Navient cautions borrowers about student loan "debt relief" companies

April 15 2015 - 9:00AM

In recognition of Financial Literacy Month, Navient, the nation's

leading loan management, servicing and asset recovery company, is

warning Americans to beware of supposed "student debt relief"

companies.

These so-called debt relief companies typically try to take

advantage of student loan borrowers lured by promises of student

loan cancellation, forgiveness, credit repair, or dramatically

lowered payments. But, they charge fees for services Navient and

other federal loan servicers offer for free.

To avoid getting taken advantage of by one of these companies,

Navient recommends borrowers follow these simple precautions:

1. Contact your loan

servicer. Contact your student loan servicer with any

questions regarding your loans. Navient is committed to helping our

student loan customers achieve successful loan repayment. If you

are having trouble managing your student loans, contact us. We can

help you review your repayment plan options, which may include

income-driven plans.

2. Protect your personal

information. Don't share personal financial or sensitive

information about your federal student aid, such as your Personal

Identification Number (PIN).

3. Don't pay for what is

available for free. There are no fees to enroll in

Income-Based Repayment, Pay As You Earn or other repayment options

based on your income.

Here are a few signs to watch out for:

- You are asked to pay high fees in advance;

- Your request for a company name, mailing address or phone

number is refused;

- You feel high pressure to make a decision immediately; or,

- You are asked to sign paperwork giving the third-party company

"Power of Attorney" or legal authority to negotiate on your behalf

and you're told not to contact your servicer after you complete the

paperwork.

If you've already signed a contract, seek advice to learn about

your options. You can file a complaint with the consumer protection

division of your State's Attorney General. At the federal level,

the Federal Trade Commission has the authority to act against

companies that engage in deceptive or unfair practices.

More information about how to protect yourself from fraud is

available at navient.com.

Connect with @Navient on Facebook, Twitter and LinkedIn.

About Navient

As the nation's leading loan management, servicing and asset

recovery company, Navient (Nasdaq:NAVI) helps customers navigate

the path to financial success. Servicing more than $300 billion in

student loans, the company supports the educational and economic

achievements of more than 12 million Americans. A growing number of

government and higher education clients rely on Navient for proven

solutions to meet their financial goals. Learn more at navient.com.

Navient began trading on Nasdaq as an independent company on May 1,

2014.

CONTACT: Media: Nikki Lavoie, nikki.lavoie@navient.com, 302-283-4057

Customers: 888-272-5543

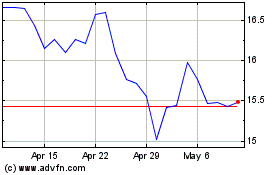

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

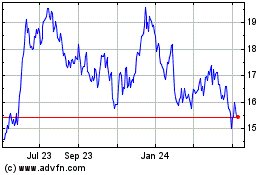

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024