Rackspace Insists It Will Stay Independent Amid Takeover Talk

April 01 2011 - 11:44AM

Dow Jones News

Rackspace Hosting Inc. (RAX) Chief Executive Lanham Napier

insists his company is focused on remaining a stand-alone player

even as deal chatter within the data-storage sector

intensifies.

Rackspace, a data-center operator in the hosting and so-called

cloud computing industry, has seen its share price soar 45% since

January amid strong revenue growth and continued takeover

speculation. The stock, which has nearly tripled in price from a

year ago, hit a fresh all-time high Friday as Wall Street continues

to bet Rackspace is an attractive candidate to be acquired.

But Napier maintained he is focused on keeping Rackspace

independent and will continue to explore partnerships and small

acquisitions.

"I think the merger-and-acquisition speculation is a massive

distraction," Napier said in an interview with Dow Jones Newswires.

"We love our business, and we are an organic-growth company. We're

looking at start ups that share our values and believe in our

mission of being a leader in service cloud computing."

Rackspace, Dell Inc. (DELL) and Equinix Inc. (EQIX) said earlier

this week that they have collaborated to develop an open-source

cloud-computing platform--dubbed OpenStack--which is aimed to

compete against Amazon Inc.'s (AMZN) Web Services. Rackspace late

last year said it acquired Cloudkick, a web-application provider

that helps to manage servers. Napier said these are examples of the

strategic roadmap Rackspace wants to keep pursing in the

future.

The takeover chatter surrounding Rackspace, Savvis Inc. (SVVS)

and other cloud-service providers follows Verizon Communications

Inc.'s (VZ) recent announcement to acquire Terremark Worldwide Inc.

(TMRK) in a $1.4 billion deal and Time Warner Cable Inc.'s (TWC)

deal to take over NaviSite Inc. (NAVI) for about $230 million. Both

deals earlier this year highlight the attractiveness of

up-and-coming cloud-services providers to larger and more

established companies.

Businesses are showing a greater interest in cloud computing,

which enables more cost-efficient access to computer servers and

data storage over the Internet and internal networks. Data tracker

In-Stat LLC has said U.S. spending on cloud computing and managed

hosting should surpass $13 billion in 2014, up from less than $3

billion in 2010.

"The cloud-computing category is white hot," Napier said. "And

now you have tech incumbents with cash that are trying to buy their

way in."

Business spending is starting to pick up again coming out of the

recession. Companies are slowly becoming more comfortable investing

in technology now that sales and profits have not only stabilized

but are expanding.

"If I was to say a year ago I was cautiously optimistic about

business spending, then this year in general I'd say the caution is

down and the optimism is up," Napier said. "But do not infer things

are ripping, and we're back off to the bucking-bronco days because

we're not."

Rackspace last month reported better-than-anticipated

fourth-quarter revenue, due in large part to increased demand for

its hosting services. For 2011, Rackspace said it expects revenue

growth to exceed the 24% growth rate achieved last year.

But analysts have questioned the capital-intensive nature of

Rackspace's business model, especially because the company's

capital-expenditure guidance will likely be higher than its revenue

trajectory for 2011.

"Our business will always be relatively capital intensive," he

said, largely because the company regularly has to upgrade its

infrastructure. "The magic is in the margin of service layer we add

on top of that infrastructure. We're making investments to continue

to make the business more capital efficient, but we have more work

to do on it."

Napier's insistence on keeping Rackspace independent contrasts

with recent remarks from competitor Savvis CEO Jim Ousley. He has

acknowledged that he has had more strategic discussions than usual

with bankers and inquiring partners. But Napier said he remains

focused on growing his company as a stand-alone player.

"I absolutely have a fiduciary obligation, and I work for the

stockholders," he said. "But we're trying to build something great,

and greatness isn't achieved overnight. We're just getting going.

When I think about the market opportunity to build the service

leader in cloud computing, I think little old Rackspace will win

that one."

-By Steven Russolillo, Dow Jones Newswires; 212-416-2180;

steven.russolillo@dowjones.com

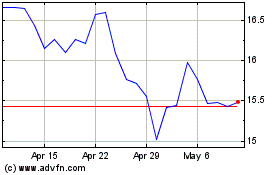

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024