Rackspace CEO Says Co Not For Sale; Shares Hit All-Time High

February 11 2011 - 12:59PM

Dow Jones News

Rackspace Hosting Inc. (RAX) Chief Executive Lanham Napier said

Friday that his company isn't for sale even as Wall Street bets the

recent wave of consolidation within the data-storage sector will

continue.

Napier's comments came after the data-center operator late

Thursday reported better-than-expected fourth-quarter revenue, due

in large part to increased demand for its hosting services. The

company's chief financial officer also announced his intent to

retire.

Rackspace shares recently rose 7.6% to $39.85 and earlier hit a

fresh all-time high at $40.62. The stock has gained nearly 35% over

the last three weeks as takeover chatter has intensified. It has

more than doubled since August. Rackspace's market capitalization

is $5 billion.

"We have not built our company to sell it," Napier said in an

interview with Dow Jones Newswires. "We feel like we have a tiger

by the tail and have an opportunity to build a web giant."

The takeover chatter follows Verizon Communications Inc.'s (VZ)

recent announcement to acquire Terremark Worldwide Inc. (TMRK) in a

$1.4 billion deal and Time Warner Cable Inc.'s (TWC) deal to

acquire NaviSite Inc. (NAVI) for about $230 million. Both deals

highlight the attractiveness of up-and-coming cloud-services

providers to larger and more established companies.

Businesses are showing a greater interest in cloud computing,

which enables companies to access computer servers and data storage

over the Internet and internal networks. This allows them to lower

data costs and move content more nimbly.

"The market is realizing cloud is a game changer," Napier said.

"Legacy telecom and cable companies are trying to buy their way

into this game."

For the fourth quarter, Rackspace reported net income of $13.5

million, or 10 cents a share, compared to $30.2 million, or 24

cents a share a year ago. Revenue rose 27% to $214.7 million.

Analysts polled by Thomson Reuters anticipated earnings of 10

cents a share on revenue of $210.1 million.

For 2011, Rackspace said it expects revenue growth will exceed

the 24% growth rate achieved last year. Analysts are expecting a

revenue increase of 25%.

Rackspace also said CFO Bruce Knooihuizen announced his

intention to retire from the company. Knooihuizen, 55, joined

Rackspace in 2008 and helped take the company public. He will

remain with the company as it conducts an internal and external

search for a replacement and will fully retire when the transition

comes to a conclusion.

On a conference call with analysts, Knooihuizen said he doesn't

have plans to join another company.

"It would be hard for me to do that right now, but at some point

in some capacity I would love to help other small companies achieve

some of the success that Rackspace has seen," he said.

JMP Securities analyst Patrick Walravens said Knooihuizen's

intent to stay with Rackspace through the transition should

eliminate any concern regarding his pending departure.

"The main investor issue with this story is likely to be the

capital-intensive nature of the model," he said, as the company's

capex guidance is up 41% from a year ago, more than the company's

likely revenue trajectory.

As for takeover rumors, Napier insisted he is intent on keeping

Rackspace a long-term independent player and isn't worried about

recent consolidation. He pointed out the managed hosting market

went through a wave of consolidation 10 years ago that didn't end

too well.

"Those deals, from my perspective, did not fulfill the synergies

and promise that the buyers wanted to have," he said on the call.

"Whenever a big deal happens, the selling company gets distracted.

The new company comes in and changes everything, and so frankly I

think it puts their entire customer base up for grabs."

He said Rackspace will continue to be an organic-based growth

company that will focus on small acquisitions in the future.

"The competitive landscape can change, but we're going to be a

focused standalone player because we believe we have an incredible

opportunity to build a new web giant," Napier said.

Napier's comments contrast remarks made earlier this week from

Jim Ousley, the chief executive of rival Savvis Inc. (SVVS), who

acknowledged he has had more strategic discussions than usual with

bankers and inquiring partners. But he insisted he isn't feeling

pressure to act in the short term.

"We have strategic discussions with people all the time," Ousley

said in an interview on Wednesday. "Sure there are more people

calling us now, but we don't have to do anything. If the right

situation came about, our board would consider it."

-By Steven Russolillo, Dow Jones Newswires; 212-416-2180;

steven.russolillo@dowjones.com

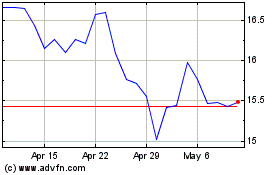

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024