Current Report Filing (8-k)

August 31 2016 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 31, 2016

MACOM Technology Solutions Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35451

|

|

27-0306875

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

100 Chelmsford Street

Lowell, Massachusetts

|

|

01851

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (978) 656-2500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

On August 31, 2016, MACOM Technology Solutions Holdings, Inc. (the “

Company

”) entered into an amendment (the “

Incremental Term Loan Amendment

”) to its credit agreement dated as of May 8, 2014 (as previously amended, restated, supplemented or modified from time to time, the “

Credit Agreement

”), by and among the Company, Goldman Sachs Bank USA, as the administrative agent, and the lender party thereto, which provides for incremental term loans in an aggregate principal amount of $250.0 million, which mature on May 8, 2021 (the “

Incremental Term Loans

”).

The terms of the Incremental Term Loans are identical to the terms of the initial term loans under the Credit Agreement (the “

Initial Term Loans

”), other than with respect to upfront fees, original issue discount and arrangement, structuring or similar fees payable in connection therewith.

The Incremental Term Loans were issued with an original issue discount of 0.95%, which is being amortized over the term of the Incremental Term Loans using the effective interest rate method. Interest on these Incremental Term Loans is payable quarterly at: (i) for LIBOR loans for any interest period, a rate per annum equal to the LIBOR rate as determined by the administrative agent (but not less than 0.75%), plus an applicable margin of 3.75%, and (ii) for base rate loans, a rate per annum equal to the greater of (x) the prime rate quoted in the print edition of the Wall Street Journal, Money Rates Section, (y) the federal funds rate plus one-half of 1.00%, and (z) the LIBOR rate applicable to a one-month interest period plus 1.00% (but, in each case, not less than 1.75%), plus an applicable margin of 2.75%.

The Incremental Term Loans and the Initial Term Loans are payable in quarterly principal installments of $1,512,755 on the last business day of each calendar quarter, beginning on the last business day of September 2016, with the remainder due on the maturity date.

The Incremental Term Loans and the Initial Term Loans are subject to a 1.00% prepayment premium to the extent the Incremental Term Loans or the Initial Term Loans are refinanced, or the terms thereof are amended, in either case, for the purpose of reducing the applicable yield with respect thereto, in each case on or prior to February 28, 2017.

The Credit Agreement, as amended by the Incremental Term Loan Amendment (the “

Amended Credit Agreement

”), contains customary events of default. If an event of default occurs and is continuing, then the lenders may declare any outstanding obligations under the Amended Credit Agreement immediately due and payable and the lenders will have the right to terminate the Amended Credit Agreement.

The foregoing description of the Incremental Term Loan Amendment does not purport to be complete and is qualified in its entirety by reference to the complete text of the Incremental Term Loan Amendment, which is filed herewith.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

Incremental Term Loan Amendment, dated August 31, 2016, by and among MACOM Technology Solutions Holdings, Inc., Goldman Sachs Bank USA, as the administrative agent, and the lender party thereto.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MACOM TECHNOLOGY SOLUTIONS

HOLDINGS, INC.

|

|

|

|

|

|

|

Dated: August 31, 2016

|

|

|

|

By:

|

|

/s/ Robert J. McMullan

|

|

|

|

|

|

|

|

Robert J. McMullan

|

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

Incremental Term Loan Amendment, dated August 31, 2016, by and among MACOM Technology Solutions Holdings, Inc., Goldman Sachs Bank USA, as the administrative agent, and the lender party thereto.

|

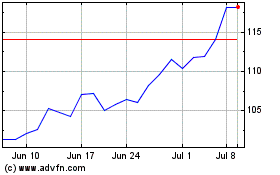

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

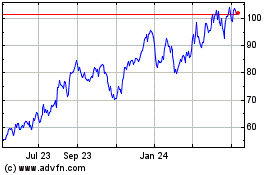

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024