M/A-COM Technology Solutions Holdings, Inc. (NASDAQ: MTSI)

(“MACOM”), a leading supplier of high-performance analog RF,

microwave, millimeterwave and photonic semiconductor products,

today announced its financial results for its fiscal second quarter

ended April 1, 2016.

Second Quarter Fiscal Year 2016 GAAP Results

- Revenue was $133.6 million, an increase

of 15.4% percent, compared to $115.8 million in the prior fiscal

quarter and an increase of 30.4% percent compared to $102.4 million

in the previous year fiscal second quarter;

- Gross profit was $65.5 million, an

increase of 8.6% percent, compared to $60.3 million in the prior

fiscal quarter and an increase of 40.3% percent compared to $46.7

million in the previous year fiscal second quarter;

- Gross margin was 49.1 percent, compared

to 52.1 percent in the prior fiscal quarter and 45.6 percent in the

previous year fiscal second quarter;

- Operating loss was $7.2 million,

compared to income of $0.2 million in the prior fiscal quarter and

an operating loss of $2.4 million in the previous year fiscal

second quarter; and

- Net loss from continuing operations was

$12.0 million, resulting in $0.23 loss per diluted share, compared

to net loss from continuing operations of $16.8 million, or $0.32

loss per diluted share, in the prior fiscal quarter and net loss

from continuing operations of $11.2 million, or $0.22 loss per

diluted share, in the previous year fiscal second quarter.

Second Quarter Fiscal Year 2016 Adjusted Non-GAAP

Results

- Adjusted gross margin was 58.1 percent,

compared to 58.7 percent in the prior fiscal quarter and 57.6

percent in the previous year fiscal second quarter;

- Adjusted operating income was $32.4

million, or 24.3 percent of revenue, compared to $27.7 million, or

23.9 percent of revenue, in the prior fiscal quarter and $23.7

million, or 23.2 percent of revenue, in the previous year fiscal

second quarter;

- Adjusted net income was $25.7 million,

or $0.46 per diluted share, compared to adjusted net income of

$21.8 million, or $0.40 per diluted share, in the prior fiscal

quarter and adjusted net income of $16.5 million, or $0.31 per

diluted share, in the previous year fiscal second quarter; and

- Adjusted EBITDA was $39.0 million,

compared to $33.5 million for the prior fiscal quarter and $27.4

million for the previous year fiscal second quarter.

Management Commentary

John Croteau, MACOM's President and Chief Executive Officer,

stated, "I am pleased to announce another quarter of solid

execution and sequential growth. Strong demand across our end

markets enabled us to beat the top end of guidance on revenue and

earnings per share.

"Our Network markets once again delivered solid growth across

all optical markets fueled by modulator drivers in long/haul metro

as well as lasers in access, backhaul and datacenter applications.

We also continued to advance our GaN vision and remain on track

with our process qualifications. We are rapidly converging on

program wins with Tier-1 customers addressing mainstream LTE

deployments."

Mr. Croteau concluded, “As we move into the fiscal second

half of the year, we remain focused on executing on our three

secular growth drivers - Optical, GaN, and Active Antennas - as

highlighted at our recent Analyst Day.”

Business Outlook

For the fiscal third quarter ending July 1, 2016, MACOM

expects revenue to be in the range of $138.0 million to $142.0

million. Adjusted gross margin is expected to be between 57 and 59

percent, and adjusted earnings per share between $0.49 and $0.52 on

an anticipated 56.5 million diluted shares outstanding.

Conference Call

MACOM will host a conference call on Tuesday, April 26,

2016 at 5:00 p.m. Eastern Time to discuss its second fiscal quarter

financial results and business outlook. Investors and analysts may

join the conference call by dialing 1-877-837-3908 and providing

the confirmation code 84787504.

International callers may join the teleconference by dialing

+1-973-872-3000 and entering the same confirmation code at the

prompt. A telephone replay of the call will be made available

beginning two hours after the call and will remain available for 5

business days. The replay number is 1-855-859-2056 with a passcode

of 84787504. International callers should dial +1-404-537-3406 and

enter the same pass code at the prompt.

Additionally, this conference call will be broadcast live over

the Internet and can be accessed by all interested parties in the

Investors section of MACOM's website at http://www.macom.com. To listen to the live call,

please go to the Investors section of MACOM's website and click on

the conference call link at least fifteen minutes prior to the

start of the conference call. For those unable to participate

during the live broadcast, a replay will be available shortly after

the call and will remain available for approximately 30 days.

About MACOM

MACOM Technology Solutions Holdings, Inc. (www.macom.com) supplies key enabling technologies

for the Cloud Connected Apps Economy and Modern Networked

Battlefield. Recognized for its broad catalog portfolio of

technologies and products, MACOM provides high-performance analog

RF, microwave, millimeterwave and photonic semiconductor products

for diverse applications ranging from high speed optical,

satellite, wired and wireless networks to military and civil radar

systems. A pillar of the semiconductor industry, we thrive on more

than 60 years of solving our customers' most complex problems as

their trusted partner for solutions ranging from RF to Light.

Headquartered in Lowell, Massachusetts, MACOM is certified to

the ISO9001 international quality standard and ISO14001

environmental management standard. MACOM has design centers and

sales offices throughout North America, Europe, Asia and

Australia.

MACOM, M/A-COM, M/A-COM Technology Solutions, M/A-COM Tech,

Partners in RF & Microwave, The First Name in Microwave and

related logos are trademarks of MACOM. All other trademarks are the

property of their respective owners.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements based on

MACOM management's beliefs and assumptions and on information

currently available to our management. Forward-looking statements

include, among others, information concerning our stated business

outlook and future results of operations, our expectations for

execution on our three growth drivers in fiscal year 2016, on our

GaN vision and qualification, and on program wins with Tier-1

customers addressing mainstream LTE deployments and any other

statements regarding future trends, business strategies,

competitive position, industry conditions, acquisitions and market

opportunities. Forward-looking statements include all statements

that are not historical facts and generally may be identified by

terms such as "anticipates," "believes," "could," "estimates,"

"expects," "intends," "may," "plans," "potential," "predicts,"

"projects," "seeks," "should," "will," "would" or similar

expressions and the negatives of those terms.

Forward-looking statements contained in this press release

reflect MACOM's current views about future events and are subject

to risks, uncertainties, assumptions and changes in circumstances

that may cause those events or our actual activities or results to

differ materially from those expressed in any forward-looking

statement. Although MACOM believes that the expectations reflected

in the forward-looking statements are reasonable, it cannot and

does not guarantee future events, results, actions, levels of

activity, performance or achievements. Readers are cautioned not to

place undue reliance on these forward-looking statements. A number

of important factors could cause actual results to differ

materially from those indicated by the forward-looking statements,

including the potential that the expected rollout of

fiber-to-the-home network technology or other new optical or other

network technology deployments in China, Japan and other

geographies fails to occur, occurs more slowly than we expect or

does not result in the amount or type of new business we

anticipate, lower than expected demand in the optical network

infrastructure market or any or all of our primary end markets or

from Huawei or any or all of our large OEM customers based on

seasonal effects, macro-economic weakness or otherwise, the

potential for increased pricing pressure and ASP erosion based on

competitive factors, technology shifts or otherwise, the potential

for inventory obsolescence and related write-offs, the expense,

business disruption or other impact of any current or future

investigations, administrative actions, litigation or

enforcement proceedings we may be involved in, the potential loss

of access to any in-licensed intellectual property or inability to

license technology we may require on reasonable terms, the impact

of any claims of intellectual property infringement or

misappropriation, which could require us to pay substantial damages

for infringement, expend significant resources in prosecuting or

defending such matters or developing non-infringing technology,

incur material liability for royalty or license payments, or

prevent us from selling certain of our products, greater than

expected dilutive effect on earnings of our equity issuances,

outstanding indebtedness and related interest expense and other

costs, our failure to realize the expected economies of scale,

lowered production cost and other anticipated benefits of our

previously announced GaN intellectual property licensing program or

InP laser production capacity expansion program, the potential for

defense spending cuts, program delays, cancellations or

sequestration, failures or delays by any customer in winning

business or to make purchases from us in support of such business,

lack of adoption or delayed adoption by customers and industries we

serve of Active Antennas, GaN, InP lasers or other solutions

offered by us, failures or delays in porting and qualifying GaN or

InP process technology to our Lowell fabrication facility or third

party facilities, lower than expected utilization and absorption in

our manufacturing facilities, lack of success or slower than

expected success in our new product development efforts, failure of

any announced transaction to close in accordance with its terms,

failure to successfully integrate acquired companies, technologies

or products or realize synergies associated with acquisitions, the

potential that we will experience difficulties in managing the

personnel and operations associated with our acquisitions, loss of

business due to competitive factors, product or technology

obsolescence, customer program shifts or otherwise, lower than

anticipated or slower than expected customer acceptance of our new

product introductions, the potential for a shift in the mix of

products sold in any period toward lower-margin products or a shift

in the geographical mix of our revenues, the impact of any executed

or abandoned acquisition, divestiture, joint venture, financing or

restructuring activity, the impact of supply shortages or other

disruptions in our internal or outsourced supply chain, the impact

of changes in export, environmental or other laws applicable to us,

the relative success of our cost-savings initiatives, as well as

those factors described in "Risk Factors" in MACOM's filings with

the Securities and Exchange Commission (SEC), including its

Quarterly Report on Form 10-Q for the fiscal quarter ended January

1, 2016, as filed with the SEC on January 27, 2016 and its Annual

Report on Form 10-K for the fiscal year ended October 2, 2015 as

filed with the SEC on November 24, 2015. MACOM undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures

In addition to GAAP reporting, MACOM provides investors with

adjusted non-GAAP financial information. Adjusted items include

revenue, gross profit, gross margin, operating margin, operating

income, net income, earnings per share, Adjusted EBITDA and other

data calculated on a non-GAAP basis. This non-GAAP information

excludes non-consulting agreement related discontinued operations,

the impact of fair value accounting in merger and acquisitions

(M&A) of businesses, M&A costs, including acquisition and

related integration costs, certain cost savings from synergies

expected from M&A activities, income and expenses from

transition services related to M&A activities, expected

amortization of acquisition-related intangibles, share-based and

other non-cash compensation expense, certain cash compensation,

restructuring charges, impairment charges, litigation settlement

and costs, changes in the carrying values of assets and liabilities

measured at fair value, contingent consideration, amortization of

debt discounts and issuance costs, debt settlement costs, other

non-cash expenses, earn-out costs, restructuring costs and certain

income tax items. The non-GAAP information includes consulting

agreement related revenue associated with the Automotive business

divestiture. Management does not believe that the adjusted items

are reflective of MACOM's underlying performance. The adjustment of

these and other similar items from MACOM's non-GAAP presentation

should not be interpreted as implying that these items are

non-recurring, infrequent or unusual. These and other similar items

are also excluded from Adjusted EBITDA, which is non-GAAP earnings

before interest, income taxes, depreciation and amortization. MACOM

believes this adjusted non-GAAP financial information provides

additional insight into these items and MACOM's performance and

has, therefore, chosen to provide this information to investors for

a consistent basis of comparison and to help them evaluate the

results of MACOM's operations and enable more meaningful period to

period comparisons. These adjusted non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, or superior

to, measures of financial performance prepared in accordance with

GAAP. A reconciliation between GAAP and adjusted non-GAAP financial

data used in this earnings release is included in the supplemental

financial data attached to this press release.

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited and in thousands, except per

share data)

Three Months Ended Six Months Ended April

1, January 1, April 3, April

1, April 3, 2016 2016 2015

2016 2015 Revenue $ 133,579 $ 115,774 $ 102,431 $

249,353 $ 198,987 Cost of revenue 68,054 55,456

55,717 123,510 104,854 Gross profit 65,525

60,318 46,714 125,843 94,133

Operating expenses: Research and development 26,203 25,322 20,439

51,525 39,221 Selling, general and administrative 34,617 34,686

28,247 69,303 53,475 Impairment charges 11,005 — — 11,005 —

Restructuring charges 851 157 413 1,008

413 Total operating expenses 72,676 60,165

49,099 132,841 93,109 Income (loss) from

operations (7,151 ) 153 (2,385 ) (6,998 ) 1,024 Other

income (expense): Warrant liability expense (4,201 ) (14,878 )

(5,609 ) (19,079 ) (16,217 ) Interest expense, net (4,408 ) (4,346

) (4,723 ) (8,754 ) (9,446 ) Other income (expense), net (81 ) 100

(1,376 ) 19 (1,001 ) Total other income (expense)

(8,690 ) (19,124 ) (11,708 ) (27,814 ) (26,664 ) Loss before

income taxes (15,841 ) (18,971 ) (14,093 ) (34,812 ) (25,640 )

Income tax benefit (3,796 ) (2,201 ) (2,917 ) (5,997 ) (4,500 )

Loss from continuing operations (12,045 ) (16,770 ) (11,176 )

(28,815 ) (21,140 ) Income from discontinued operations 1,396

1,199 3,639 2,595 7,297 Net loss

$ (10,649 ) $ (15,571 ) $ (7,537 ) $ (26,220 ) $ (13,843 )

Net income (loss) per share: Basic: Loss from continuing

operations $ (0.23 ) $ (0.32 ) $ (0.22 ) $ (0.54 ) $ (0.43 ) Income

from discontinued operations 0.03 0.02 0.07

0.05 0.15 Loss per share - basic $ (0.20 ) $ (0.29 )

$ (0.15 ) $ (0.49 ) $ (0.28 ) Diluted: Loss from continuing

operations $ (0.23 ) $ (0.32 ) $ (0.22 ) $ (0.54 ) $ (0.43 ) Income

from discontinued operations 0.03 0.02 0.07

0.05 0.15 Loss per share - diluted $ (0.20 ) $ (0.29

) $ (0.15 ) $ (0.49 ) $ (0.28 ) Shares - Basic 53,228

53,015 50,593 53,122 49,100 Shares -

Diluted 53,228 53,015 50,593 53,122

49,100

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited and in thousands)

April 1, October 2, 2016 2015

ASSETS Current assets: Cash and cash equivalents $ 58,187 $ 122,312

Short term investments 23,632 39,557 Accounts receivable, net

91,604 83,950 Inventories 106,972 79,943 Deferred income taxes (1)

— 31,431 Income tax receivable 16,077 15,854 Prepaids and other

current assets 11,553 11,172 Total current assets 308,025

384,219 Property and equipment, net 99,637 83,759 Goodwill and

intangible assets, net 397,370 337,012 Deferred income taxes 83,909

48,239 Other long-term assets 11,457 13,022 TOTAL ASSETS $

900,398 $ 866,251 LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Current portion of debt obligations $

4,499 $ 4,058 Accounts payable, accrued liabilities and other

78,335 67,418 Total current liabilities 82,834 71,476

Long-term debt obligations, less current portion 341,396 340,504

Common stock warrant liability 40,901 21,822 Deferred income taxes

13,920 — Long-term liabilities and other 7,339 7,916 Total

liabilities 486,390 441,718 Stockholders' equity 414,008

424,533 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 900,398

$ 866,251

(1) During the second quarter of fiscal 2016, we early-adopted

Accounting Standards Update (ASU) No. 2015-17, Balance Sheet

Classification of Deferred Taxes, and applied ASU 2015-17 on a

prospective basis. This standard requires that all deferred tax

assets and liabilities, and any related valuation allowance, be

classified as noncurrent on the balance sheet. As of the second

quarter of fiscal 2016, we included $31.4 million of current

deferred income tax assets with our noncurrent deferred income tax

assets; no adjustments were made to deferred tax liabilities.

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited and in thousands)

Six Months Ended April

1, April 3, 2016 2015

CASH FLOWS FROM OPERATING ACTIVITIES: Net loss $ (26,220 ) $

(13,843 ) Adjustments to reconcile net loss to net operating cash

77,452 61,947 Change in operating assets and liabilities (16,134 )

(46,672 ) Net cash from operating activities 35,098 1,432

CASH FLOWS FROM INVESTING ACTIVITIES: Acquisition of

businesses, net (85,516 ) (208,369 ) Purchases, sales and

maturities of investments 15,596 — Gain on disposition of business

3,750 — Strategic investments — (250 ) Purchases of property and

equipment (16,962 ) (14,036 ) Acquisition of intellectual property

(777 ) (1,587 ) Net cash used in investing activities (83,909 )

(224,242 ) CASH FLOWS FROM FINANCING ACTIVITIES: Payments of notes

payable (1,750 ) (1,750 ) Proceeds from stock offering — 127,959

Payment of assumed debt (9,120 ) (1,232 ) Proceeds from stock

option exercises and employee stock purchases 3,071 2,871

Repurchase of common stock (6,152 ) (4,924 ) Borrowings on

revolving facility — 100,000 Payments on revolving facility —

(100,000 ) Other adjustments (1,195 ) (39 ) Net cash from financing

activities (15,146 ) 122,885 EFFECT OF EXCHANGE RATE CHANGES

ON CASH AND CASH EQUIVALENTS (168 ) — NET CHANGE IN CASH AND CASH

EQUIVALENTS (64,125 ) (99,925 ) CASH AND CASH EQUIVALENTS —

Beginning of period 122,312 173,895 CASH AND CASH

EQUIVALENTS — End of period $ 58,187 $ 73,970

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS,

INC.

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS

(unaudited and in thousands, except per

share data)

Three Months Ended

Six Months Ended April 1,

2016 January 1, 2016

April 3, 2015 April 1,

2016 April 3, 2015 Amount

Amount Amount

Amount Amount

Revenue - GAAP $ 133,579 $ 115,774 $ 102,431 $

249,353 $ 198,987 Adjusted Revenue (NonGAAP) $

133,579 $ 115,774 $ 102,431 $ 249,353 $

198,987

Amount % Revenue

Amount % Revenue

Amount % Revenue

Amount % Revenue Amount

% Revenue Gross Profit - GAAP $ 65,525 49.1 $ 60,318

52.1 $ 46,714 45.6 $ 125,843 50.5 $ 94,133 47.3 Intangible

amortization expense 6,642 5.0 7,167 6.2 7,347 7.2 13,809 5.5

12,706 6.4 Non-cash compensation expense 500 0.4 491 0.4 577 0.6

991 0.4 919 0.5 Equity-based compensation 191 0.1 51 — 179 0.2 242

0.1 237 0.1 Impairment charges 1,950 1.5 — — — — 1,950 0.8 — —

Acquisition FMV step-up expense (inventory/fixed assets) 2,646 2.0

(226 ) (0.2 ) 3,538 3.5 2,420 1.0 4,373 2.2 Third-party engineering

costs — — — — 305 0.3 — — 1,229 0.6 Integration costs and synergy

savings 102 0.1 158

0.1 356 0.3

260 0.1 352

0.2 Adjusted Gross Profit (NonGAAP) $ 77,556

58.1 $ 67,959 58.7

$ 59,016 57.6

$ 145,515 58.4

$ 113,949 57.3 Research and

Development - GAAP $ 26,203 19.6 $ 25,322 21.9 $ 20,439 20.0 $

51,525 20.7 $ 39,221 19.7 Non-cash compensation expense (1,742 )

(1.3 ) (2,142 ) (1.9 ) (1,563 ) (1.5 ) (3,884 ) (1.6 ) (2,568 )

(1.3 ) Equity-based compensation (1,061 ) (0.8 ) (894 ) (0.8 ) (669

) (0.7 ) (1,955 ) (0.8 ) (1,188 ) (0.6 ) Acquisition FMV step-up

expense (inventory/fixed assets) (204 ) (0.2 ) (204 ) (0.2 ) (204 )

(0.2 ) (408 ) (0.2 ) (408 ) (0.2 ) Integration costs and synergy

savings (133 ) (0.1 ) (597 ) (0.5 ) (137 ) (0.1 ) (730 ) (0.3 )

(308 ) (0.2 ) Third-party engineering costs — —

— — 305

0.3 —

— 1,229 0.6

Adjusted Research and Development (NonGAAP) $ 23,063

17.3 $ 21,485 18.6

$ 18,171 17.7

$ 44,548 17.9 $ 35,978

18.1 Selling, General and

Administrative - GAAP $ 34,617 25.9 $ 34,686 30.0 $ 28,247 27.6 $

69,303 27.8 $ 53,475 26.9 Earn-out costs (26 ) — 196 0.2 — — 170

0.1 — — Intangible amortization expense (6,304 ) (4.7 ) (4,423 )

(3.8 ) (3,096 ) (3.0 ) (10,727 ) (4.3 ) (4,149 ) (2.1 ) Non-cash

compensation expense (4,210 ) (3.2 ) (7,383 ) (6.4 ) (7,558 ) (7.4

) (11,592 ) (4.6 ) (9,953 ) (5.0 ) Equity-based compensation (705 )

(0.5 ) (462 ) (0.4 ) (501 ) (0.5 ) (1,167 ) (0.5 ) (818 ) (0.4 )

Acquisition FMV step-up expense (inventory/fixed assets) (28 ) —

(28 ) — (28 ) — (56 ) — (56 ) — Litigation related costs (232 )

(0.2 ) (108 ) (0.1 ) (206 ) (0.2 ) (340 ) (0.1 ) (766 ) (0.4 )

Transaction expenses (102 ) (0.1 ) (3,111 ) (2.7 ) 530 0.5 (3,213 )

(1.3 ) (4,106 ) (2.1 ) Integration costs and synergy savings (919 )

(0.7 ) (571 ) (0.5 ) (282

) (0.3 ) (1,491 ) (0.6 )

(578 ) (0.3 ) Adjusted Selling, General and

Administrative (NonGAAP) $ 22,091 16.5

$ 18,796 16.2 $ 17,106

16.7 $ 40,887

16.4 $ 33,049 16.6

Amount % Revenue Amount

% Revenue Amount %

Revenue Amount %

Revenue Amount % Revenue

Total operating expenses - GAAP $ 72,676 54.4 $ 60,165 52.0 $

49,099 47.9 $ 132,841 53.3 $ 93,109 46.8 Intangible amortization

expense (6,304 ) (4.7 ) (4,423 ) (3.8 ) (3,096 ) (3.0 ) (10,727 )

(4.3 ) (4,149 ) (2.1 ) Non-cash compensation expense (5,951 ) (4.5

) (9,525 ) (8.2 ) (9,121 ) (8.9 ) (15,477 ) (6.2 ) (12,521 ) (6.3 )

Equity-based compensation (1,766 ) (1.3 ) (1,356 ) (1.2 ) (1,170 )

(1.1 ) (3,122 ) (1.3 ) (2,006 ) (1.0 ) Acquisition FMV step-up

expense (inventory/fixed assets) (232 ) (0.2 ) (232 ) (0.2 ) (232 )

(0.2 ) (464 ) (0.2 ) (464 ) (0.2 ) Contingent consideration and

earn-out costs (26 ) — 196 0.2 — — 170 0.1 — — Impairment charges

(11,005 ) (8.2 ) — — — — (11,005 ) (4.4 ) — — Restructuring charges

(851 ) (0.6 ) (157 ) (0.1 ) (413 ) (0.4 ) (1,008 ) (0.4 ) (413 )

(0.2 ) Integration costs and synergy savings (1,053 ) (0.8 ) (1,168

) (1.0 ) (419 ) (0.4 ) (2,221 ) (0.9 ) (886 ) (0.4 ) Litigation

related costs (232 ) (0.2 ) (108 ) (0.1 ) (206 ) (0.2 ) (340 ) (0.1

) (766 ) (0.4 ) Transaction expenses (102 ) (0.1 ) (3,111 ) (2.7 )

530 0.5 (3,213 ) (1.3 ) (4,106 ) (2.1 ) Third-party engineering —

— — —

305 0.3

— — 1,229

0.6 Adjusted Total Operating Expenses (NonGAAP) $ 45,154

33.8 $ 40,281 34.8

$ 35,277 34.4

$ 85,434 34.3

$ 69,027 34.7 Income (loss) from

operations - GAAP $ (7,151 ) (5.4 ) $ 153 0.1 $ (2,385 ) (2.3 ) $

(6,998 ) (2.8 ) $ 1,024 0.5 Intangible amortization expense 12,946

9.7 11,590 10.0 10,446 10.2 24,536 9.8 16,858 8.5 Non-cash

compensation expense 6,452 4.8 10,016 8.7 9,698 9.5 16,468 6.6

13,440 6.8 Equity-based compensation 1,957 1.5 1,407 1.2 1,349 1.3

3,364 1.3 2,243 1.1 Contingent consideration and earn-out costs 26

— (196 ) (0.2 ) — — (170 ) (0.1 ) — — Impairment charges 12,955 9.7

— — — — 12,955 5.2 — — Restructuring charges 851 0.6 157 0.1 413

0.4 1,008 0.4 413 0.2 Acquisition FMV step-up expense

(inventory/fixed assets) 2,878 2.2 6 — 3,770 3.7 2,884 1.2 4,837

2.4 Litigation related costs 232 0.2 108 0.1 206 0.2 340 0.1 766

0.6 Transaction expenses 102 0.1 3,111 2.7 (530 ) (0.5 ) 3,213 1.3

4,106 0.4 Integration costs and synergy savings 1,154

0.9 1,326 1.1

772 0.8

2,480 1.0 1,235

2.1 Adjusted Income (Loss) from Operations (NonGAAP) $

32,402 24.3 $ 27,678

23.9 $ 23,739 23.2

$ 60,080 24.1

$ 44,922 22.6 Depreciation

expense 4,840 3.6 3,903 3.4 3,702 3.6 8,743 3.5 7,089 3.6 Other

income, net 1,792 1.3 1,954

1.7 — —

3,746 1.5

— — Adjusted EBITDA $ 39,034

29.2 $ 33,535 29.0

$ 27,441 26.8

$ 72,569 29.1 $

52,011 26.1 Interest expense- GAAP $

4,478 3.4 $ 4,475 3.9 $ 4,723 4.6 $ 8,953 3.6 $ 9,446 4.7 Non-cash

interest expense (425 ) (0.3 ) (398 )

(0.3 ) (403 ) (0.4 )

(823 ) (0.3 ) (842 ) (0.4 )

Adjusted Interest Expense (NonGAAP) $ 4,053 3.0

$ 4,077 3.5

$ 4,320 4.2 $

8,130 3.3 $ 8,604

4.3 Net income (loss) - GAAP $ (10,649 ) (8.0 ) $

(15,571 ) (13.4 ) $ (7,537 ) (7.4 ) $ (26,220 ) (10.5 ) $ (13,843 )

(7.0 ) Discontinued operations (1,396 ) (1.0 ) (1,199 ) (1.0 )

(3,639 ) (3.6 ) (2,595 ) (1.0 ) (7,297 ) (3.7 ) Intangible

amortization expense 12,946 9.7 11,590 10.0 10,446 10.2 24,536 9.8

16,858 8.5 Non-cash compensation expense 6,452 4.8 10,016 8.7 9,698

9.5 16,468 6.6 13,440 6.8 Equity-based compensation 1,957 1.5 1,407

1.2 1,349 1.3 3,364 1.3 2,243 1.1 Impairment of minority investment

— — — — 3,500 3.4 — — 3,500 1.8 Contingent consideration 26 — (196

) (0.2 ) (2,000 ) (2.0 ) (170 ) (0.1 ) (2,000 ) (1.0 ) Consulting

agreement 1,875 1.4 1,875 1.6 — — 3,750 1.5 — — Impairment charges

12,955 9.7 — — — — 12,955 5.2 — — Restructuring charges 851 0.6 157

0.1 413 0.4 1,008 0.4 413 0.2 Warrant liability (gain) expense

4,201 3.1 14,879 12.9 5,609 5.5 19,080 7.7 16,217 8.1 Non-cash

interest expense 425 0.3 398 0.3 403 0.4 823 0.3 842 0.4

Acquisition FMV step-up expense (inventory/fixed assets) 2,878 2.2

6 — 3,770 3.7 2,884 1.2 4,837 2.4 Litigation related costs 232 0.2

108 0.1 206 0.2 340 1.0 766 0.6 Integration costs and synergy

savings 1,152 0.9 1,306 1.1 772 0.8 2,457 0.1 1,235 0.4 Transaction

expenses 102 0.1 3,111 2.7 (530 ) (0.5 ) 3,213 1.3 4,106 2.1 Tax

effect of non-GAAP adjustments (8,327 ) (6.2 ) (6,054 ) (5.2 )

(5,830 ) (5.7 ) (14,381 ) (5.8 ) (9,948 ) (5.0 ) Transition

services for divested business and other — —

— — (124 )

(0.1 ) — —

(499 ) (0.3 ) Adjusted Net Income (NonGAAP) $ 25,680

19.2 $ 21,833 18.9

$ 16,506 16.1

$ 47,512 19.1

$ 30,870 15.5

Three Months Ended Six Months

Ended April 1, 2016 January 1, 2016

April 3, 2015

April 1, 2016 April 3, 2015

Net Income(Loss)

Income (loss)per

dilutedshare

Net Income(Loss)

Income (loss)per

dilutedshare

Net Income(Loss)

Income (loss)per

dilutedshare

Net Income(Loss)

Income (loss)per

dilutedshare

Net Income(Loss)

Income (loss)per

dilutedshare

GAAP $ (10,649 ) $ (0.20 ) $ (15,571 )

$ (0.29 ) $ (7,537 ) $ (0.15 )

$ (26,220 ) $ (0.49 ) $

(13,843 ) $ (0.28 ) Adjusted (NonGAAP) $ 25,680

$ 0.46 $ 21,833 $

0.40 $ 16,506 $ 0.31

$ 47,512 $ 0.86

$ 30,870 $ 0.61

Shares Shares

Shares

Shares

Shares Diluted Shares - GAAP 53,228 53,015

50,593 53,122 49,100 Incremental stock options, warrants,

restricted stock and units 2,139

1,996 1,908

2,081

1,815 Adjusted Diluted Shares (NonGAAP)

55,367 55,011

52,501

55,203 50,915

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160426006655/en/

Company Contact:M/A-COM Technology Solutions Holdings,

Inc.Robert J. McMullan, 978-656-2753Senior Vice President and Chief

Financial Officerbob.mcmullan@macom.comorInvestor Relations

Contact:Shelton GroupLeanne K. Sievers, 949-224-3874EVP,

Investor Relationslsievers@sheltongroup.com

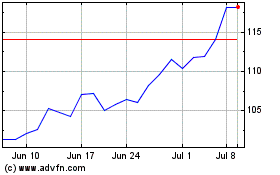

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

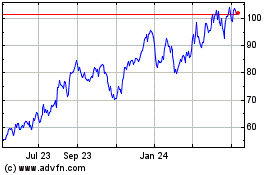

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024