Guidance for Fiscal Fourth Quarter

2015

M/A-COM Technology Solutions Holdings, Inc. (NASDAQ: MTSI)

(MACOM), a leading supplier of high-performance RF, microwave,

millimeterwave and photonic semiconductor products, today announced

it has completed the previously announced divestiture of its

Automotive business to Autoliv ASP Inc. (Autoliv) for approximately

$100 million in cash, plus the opportunity to receive up to an

additional $30 million in cash based on the achievement of

revenue-and customer order based earn-out targets through 2019.

In conjunction with closing the divestiture, MACOM announced

financial guidance for its fiscal fourth quarter ending October 2,

2015, excluding the Automotive business which is now classified as

discontinued operations. MACOM expects revenue to be in the range

of $110 to $114 million, or an increase of 1.0 percent to 4.5

percent, compared to the fiscal third quarter 2015 without

Automotive. Non-GAAP gross margin is expected to be between 56

percent and 59 percent, and non-GAAP earnings per diluted share

between $0.32 and $0.34 on an anticipated 55.5 million shares

outstanding.

Commenting on the closing, John Croteau, President and

Chief Executive Officer stated, “We are pleased to complete

the divestiture of our Automotive business, which we

believe represents a key step towards realizing our full potential

as a pure play high-performance analog semiconductor

company. Since announcing the transaction, we have

become increasingly confident in the accelerated growth

of our business, which we now

expect to replace the pre-divestiture earnings

contribution from the Auto business within a

few quarters. With our remaining business well

aligned with our high-growth, high margin model, we expect to

achieve our target of 60 percent non-GAAP gross margin in

the first half of fiscal 2016 and 30 percent

non-GAAP operating margin as we exit fiscal 2016. This

exceptional financial profile will position MACOM in the highest

performing segment of our industry and serve as a key

differentiator with both customers

and investors alike.”

MACOM expects by the end of this week to file a Current Report

on Form 8-K with the Securities and Exchange Commission (SEC),

including pro forma financial statements for its last three fiscal

years and the nine months ended July 3, 2015, adjusted to reflect

the Automotive business divestiture, and also to post to the

investor page of MACOM’s website (http://www.macom.com/) certain

comparative non-GAAP information along with a reconciliation to

GAAP.

About MACOM

MACOM (http://www.macom.com/) is a leading supplier of

high-performance analog RF, microwave, millimeterwave and photonic

semiconductor products that enable next-generation Internet and

modern battlefield applications. Recognized for its broad catalog

portfolio of technologies and products, MACOM serves diverse

markets, including high speed optical, satellite, radar, wired and

wireless networks, automotive, industrial, medical, and mobile

devices. A pillar of the semiconductor industry, we thrive on more

than 60 years of solving our customers' most complex problems,

serving as a true partner for applications ranging from RF to

Light.

Headquartered in Lowell, Massachusetts, MACOM is certified to

the ISO9001 international quality standard and ISO14001

environmental management standard. MACOM has design centers and

sales offices throughout North America, Europe, Asia and

Australia.

MACOM, M/A-COM, M/A-COM Technology Solutions, M/A-COM Tech,

Partners in RF & Microwave, Partners from RF to Light, The

First Name in Microwave and related logos are trademarks of MACOM.

All other trademarks are the property of their respective

owners.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements based on

MACOM management's beliefs and assumptions and on information

currently available to our management. Forward-looking statements

include, among others, information concerning our stated business

outlook and future results of operations, the impact of our

divestment of our Automotive business, future activities or trends,

business strategies, competitive position, industry conditions,

acquisitions and market opportunities. Forward-looking statements

include all statements that are not historical facts and generally

may be identified by terms such as "anticipates," "believes,"

"could," "estimates," "expects," "intends," "may," "plans,"

"potential," "predicts," "projects," "seeks," "should," "will,"

"would" or similar expressions and the negatives of those

terms.

Forward-looking statements contained in this press release

reflect MACOM's current views about future events and are subject

to risks, uncertainties, assumptions and changes in circumstances

that may cause those events or our actual activities or results to

differ materially from those expressed in any forward-looking

statement. Although MACOM believes that the expectations reflected

in the forward-looking statements are reasonable, it cannot and

does not guarantee future events, results, actions, levels of

activity, performance or achievements. Readers are cautioned not to

place undue reliance on these forward-looking statements. A number

of important factors could cause actual results to differ

materially from those indicated by the forward-looking statements,

including greater than expected dilutive effect on earnings of our

equity issuances, outstanding indebtedness and related interest

expense and other costs, the potential that the expected rollout of

fiber-to-the-home network technology or other new network

technology deployments in China and other geographies fails to

occur, occurs more slowly than we expect or does not result in the

amount or type of new business we anticipate, lower than expected

demand in any or all of our primary end markets or from any of our

large OEM customers based on seasonal effects, macro-economic

weakness or otherwise, indemnity claims related to or failure to

realize the projected benefits of our Automotive business

divestment, our failure to realize the expected economies of scale,

lowered production cost and other anticipated benefits of our

previously announced GaN intellectual property licensing program or

InP laser production capacity expansion program, the potential for

defense spending cuts, program delays, cancellations or

sequestration, failures or delays by any customer in winning

business or to make purchases from us in support of such business,

lack of adoption or delayed adoption by customers and industries we

serve of GaN, InP lasers or other solutions offered by us, failures

or delays in porting and qualifying GaN or InP process technology

to our Lowell, MA fabrication facility or third party facilities,

lower than expected utilization and absorption in our manufacturing

facilities, lack of success or slower than expected success in our

new product development efforts, loss of business due to

competitive factors, product or technology obsolescence, customer

program shifts or otherwise, lower than anticipated or slower than

expected customer acceptance of our new product introductions, the

potential for a shift in the mix of products sold in any period

toward lower-margin products or a shift in the geographical mix of

our revenues, the potential for increased pricing pressure based on

competitive factors, technology shifts or otherwise, the impact of

any executed or abandoned acquisition, divestiture, joint venture,

financing or restructuring activity, the impact of supply shortages

or other disruptions in our internal or outsourced supply chain,

the impact of changes in export, environmental or other laws

applicable to us, the relative success of our cost-savings

initiatives, the potential for inventory obsolescence and related

write-offs, the expense, business disruption or other impact of any

current or future investigations, administrative actions,

litigation or enforcement proceedings we may be involved in, the

potential loss of access to any in-licensed intellectual property

or inability to license technology we may require on reasonable

terms, the impact of any claims of intellectual property

infringement or misappropriation, which could require us to pay

substantial damages for infringement, expend significant resources

in prosecuting or defending such matters or developing

non-infringing technology, incur material liability for royalty or

license payments, or prevent us from selling certain of our

products, and any failure in the effectiveness of our internal

control over financial reporting or disclosure controls and

procedures, as well as those factors described in "Risk Factors" in

MACOM's filings with the SEC, including its Quarterly Report on

Form 10-Q for the fiscal quarter ended July 3, 2015 as filed with

the SEC on August 12, 2015. MACOM undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150817005854/en/

Company Contact:M/A-COM Technology Solutions Holdings,

Inc.Bob McMullan, 978-656-2753Chief Financial

Officerbob.mcmullan@macom.comorInvestor Relations

Contact:Shelton GroupLeanne K. Sievers, 949-224-3874EVPorBrett

L. Perry, 214-272-0070Managing

Directorsheltonir@sheltongroup.com

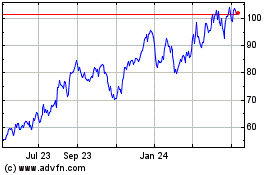

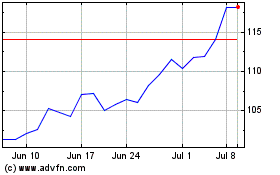

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024