UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 18, 2015

M/A-COM Technology Solutions Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35451 |

|

27-0306875 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 100 Chelmsford Street

Lowell, Massachusetts |

|

01851 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (978) 656-2500

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry Into a Material Definitive Agreement. |

On June 18, 2015, M/A-COM Technology Solutions

Holdings, Inc. (the “Company”), through its wholly-owned subsidiary, M/A-COM Technology Solutions Inc., entered into an Agreement of Purchase and Sale, dated effective June 17, 2015 (the “Purchase

Agreement”), with Cobham Properties, Inc. (“Cobham”), pursuant to which the Company agreed to purchase from Cobham the real property consisting of the Company’s headquarters and fabrication facility located at 100

Chelmsford Street, Lowell, Massachusetts 01852, including the associated land, improvements, leases and leasehold property (the “Facility”), for an aggregate purchase price of $8.25 million, subject to the adjustments,

prorations and terms set forth in the Purchase Agreement. The Purchase Agreement contains customary representations, warranties and covenants, and the closing is subject to customary closing conditions. The transaction is expected to close on or

about June 29, 2015.

The Company currently leases the Facility from Cobham pursuant to a Lease Agreement, dated October 4, 2014 (the

“Lease”). Upon closing of the purchase of the Facility, the Lease will be terminated. Other than with respect to the Purchase Agreement and the Lease, there is no material relationship among the Company or any of its affiliates and

Cobham.

The foregoing description of the Purchase Agreement does not purport to be complete and is subject to, and is qualified in its entirety by

reference to, the full text of the Purchase Agreement which is attached hereto as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 1.02. |

Termination of a Material Definitive Agreement. |

The information in Item 1.01 above is incorporated

by reference in this Item 1.02.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Agreement of Purchase and Sale, dated June 17, 2015, between Cobham Properties, Inc. and M/A-COM Technology Solutions Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC. |

|

|

|

|

|

|

Dated: June 23, 2015 |

|

By: |

|

/s/ Robert J. McMullan |

|

|

|

|

|

|

Robert J. McMullan |

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Agreement of Purchase and Sale, dated June 17, 2015, between Cobham Properties, Inc. and M/A-COM Technology Solutions Inc. |

Exhibit 10.1

AGREEMENT OF PURCHASE AND SALE

THIS AGREEMENT OF PURCHASE AND SALE (the “Agreement”) is made and entered into as of the 17th day of June, 2015 by and between COBHAM PROPERTIES, INC., a Delaware corporation (hereinafter referred to as “Seller”), and M/A-COM TECHNOLOGY SOLUTIONS INC., a

Delaware corporation (hereinafter referred to as “Purchaser”).

In consideration of the mutual promises, covenants and

agreements hereinafter set forth and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Purchaser agree as follows:

ARTICLE I.

Sale of

Property

1.1 Sale of Property. Seller hereby agrees to sell, assign and convey to Purchaser and Purchaser agrees

to purchase from Seller, all of Seller’s right, title and interest in and to, the following:

1.1.1. Land and

Improvements. The real property known and numbered as 100-144 Chelmsford Street in Lowell, Massachusetts, being more particularly described on Exhibit A attached hereto and incorporated herein by reference thereto

(collectively, the “Land”), together with the buildings and other improvements located thereon (the “Improvements”);

1.1.2. Leases. All leases, subleases, licenses and other occupancy agreements, together with any and all amendments,

modifications or supplements thereto (hereafter referred to collectively as the “Leases”, which Leases are listed on Schedule 1.1.2 attached hereto) affecting the Property, and all prepaid rent attributable to the period

following the Closing, and, subject to Section 4.2.4 below, the security deposits under such Leases (which security deposits are listed on Schedule 1.1.2) (collectively, the “Leasehold Property”);

1.1.3. Real Property. All rights, privileges and easements appurtenant to Seller’s interest in the Land and the

Improvements, if any, including, without limitation, all of Seller’s right, title and interest, if any, in and to all mineral and water rights and all easements, licenses, covenants and other rights-of-way or other appurtenances used in

connection with the beneficial use and enjoyment of the Land and the Improvements (the Land, the Improvements and all such easements and appurtenances are sometimes collectively referred to herein as the “Real Property”);

1.1.4. Personal Property. All personal property (including equipment), if any, owned by Seller and located on the Real

Property as of the date hereof, and all fixtures (if any) owned by Seller and located on the Real Property as of the date hereof (the “Personal Property”), and including, without limitation, that listed on schedule on Schedule

1.1.4 attached hereto);

1.1.5. Intangible Property. All non-exclusive trademarks and trade names, if

any, used or useful in connection with the Real Property, but only to the extent that the same are not trademarks or trade names of Seller or any of Seller’s affiliated companies (collectively, the “Trade Names”), together with

the Seller’s interest, if any, in and to any service, equipment, supply and maintenance contracts which Purchaser elects to assume by written notice to Seller prior to the end of the Feasibility Period (the “Contracts”, which

Contracts are listed on Schedule 1.1.5 attached hereto), guarantees, licenses, approvals, certificates, permits and warranties relating to the property (to the extent assignable), all plans, specifications and architectural or other drawings

related to the Property (if any) and any site plans, layout plans or other renderings related to the possible development of vacant portions of the Property by Seller (collectively, the “Intangible Property”). (The Real Property,

the Leasehold Property, the Personal Property, the Trade Names and the Intangible Property are sometimes collectively hereinafter referred to as the “Property”).

SELLER SELLS AND WILL SELL AND PURCHASER TAKES AND WILL TAKE THE PROPERTY IN “AS IS” CONDITION WITH ALL FAULTS.

ARTICLE II.

Purchase

Price

2.1 Purchase Price. The purchase price for the Property shall be Eight Million Two Hundred Fifty Thousand Dollars

($8,250,000.00) (the “Purchase Price”). The Purchase Price, as adjusted by all prorations as provided for herein, shall be paid to Seller by Purchaser at Closing, as herein defined, by wire transfer to an account designated by

Seller.

ARTICLE III.

Intentionally Omitted

ARTICLE IV.

Closing,

Prorations and Closing Costs

4.1 Closing. The Closing (hereinafter defined) shall occur on or before 10:00 a.m.

Eastern time on the date that is fifteen (15) days after the expiration of the Feasibility Period (as defined in Section 5.1 of this Agreement), but in no event any later than June 29, 2015. The Closing shall be made through a

closing escrow arrangement with the Purchaser’s title insurance company (the “Title Company”) reasonably acceptable to Seller. “Closing” shall be deemed to occur when the Title Company has been instructed by

both parties to release escrow and record the Deed. Time is hereby made of the essence. The date of Closing is referred to herein as the “Closing Date.”

4.2. Prorations. All matters involving prorations or adjustments to be made in connection with Closing and not specifically

provided for in some other provision of this Agreement shall be adjusted in accordance with this Section 4.2. Except as otherwise set forth

2

herein, all items to be prorated pursuant to this Section 4.2 shall be prorated as of midnight of the day immediately preceding the Closing Date, with Purchaser to be treated as the

owner of the Property, for purposes of prorations of income and expenses, on and after the Closing Date. The provisions of Section 4.2 (including Sections 4.2.1 through 4.2.7) shall survive the Closing.

4.2.1. Taxes. Real estate and personal property taxes and special assessments, if any, shall be prorated as of the Closing

Date. Seller shall pay at or prior to Closing all real estate and personal property taxes and special assessments attributable to the Property as of the Closing Date. If the real estate and/or personal property tax rate and assessments have not been

set for the year in which the Closing occurs, then the proration of such taxes shall be based upon the rate and assessments for the preceding tax year and such proration shall be adjusted in cash between Seller and Purchaser upon presentation of

written evidence that the actual taxes paid for the year in which the Closing occurs, differ from the amounts used in the Closing in accordance with the provisions of Section 4.2.5 hereof.

4.2.2. Insurance. There shall be no proration of Seller’s insurance premiums or assignment of Seller’s insurance

policies. Purchaser shall obtain any insurance coverage deemed necessary or appropriate by Purchaser.

4.2.3. Utilities and

Contracts. Purchaser and Seller hereby acknowledge and agree that the amounts of all telephone, electric, sewer, water and other utility bills, trash removal bills, janitorial and maintenance service bills and all other operating

expenses relating to the Property and allocable to the period prior to the Closing Date shall be determined and paid by Seller before Closing, if possible, or shall be paid thereafter by Seller or adjusted between Purchaser and Seller immediately

after the same have been determined. Seller shall attempt to have all utility meters read as of the Closing Date, and Seller shall provide written evidence reasonably satisfactory to Purchaser of the payment of the same. Purchaser shall cause all

utility services to be placed in Purchaser’s name as of the Closing Date. If permitted by the applicable utilities, all utility deposits in Seller’s name shall be assigned to Purchaser as of the Closing Date and Seller shall receive a

credit therefor at Closing.

4.2.4. Rents. Rents (including, without limitation, estimated pass-through payments,

payments for common area maintenance reconciliations and all additional charges payable by tenants under the Leases, (collectively, “Rents”)) collected by Seller prior to Closing shall be prorated as of the Closing Date. The amount

of any unapplied security deposits under the Leases in the form of cash shall be credited against the Purchase Price; accordingly, Seller shall retain the actual cash deposits. If any security deposits are in the form of a letter of credit, Seller

shall assign its interest in the letter of credit to Purchaser (to the extent assignable) and deliver the original letter of credit to Purchaser at Closing.

4.2.5. Calculations. For purposes of calculating prorations, Purchaser shall be deemed to be in title to the Property, and,

therefore entitled to the income therefrom and responsible for the expenses thereof for the entire day upon which the Closing occurs. All such prorations shall be made on the basis of the actual number of days of the month which shall have elapsed

as of the day of the Closing and based upon the actual number of days in the month and a three hundred sixty five (365) day year. The amount of such prorations shall be initially performed at Closing but shall be subject to adjustment in cash

after the Closing as and when

3

complete and accurate information becomes available, if such information is not available at the Closing. Seller and Purchaser agree to cooperate and use their best efforts to make such

adjustments no later than sixty (60) days after the Closing (or as soon thereafter as may be practicable, with respect to common area maintenance and other additional rent charges (including pass-throughs for real estate and personal property

taxes and special assessments) payable by tenants under leases). Except as set forth in this Section 4.2, all items of income and expense which accrue for the period prior to the Closing will be for the account of Seller and all items of

income and expense which accrue for the period on and after the Closing will be for the account of Purchaser.

4.2.6. Leasing

Commissions and Leasing Costs. Except as otherwise provided in Section 9.19 of the Lease Agreement between Seller as landlord and Purchaser as tenant described in Schedule 1.1.2, Seller shall be responsible for all leasing and

brokerage commissions and other leasing costs currently due and owing with respect to Leases executed prior to the Effective Date, it being acknowledged that leasing commissions and leasing costs which are attributable to existing options in the

Leases, to the extent such options are exercised after the Effective Date, shall be paid by Purchaser.

4.2.7. Prepaid

Items. Any prepaid items, including, without limitation, fees for licenses which are transferred to the Purchaser at the Closing and annual permit and inspection fees shall be apportioned between the Seller and the Purchaser at the Closing.

4.3. Closing Costs. All transfer taxes and expenses and any state, county or municipal documentary stamps or transfer taxes

on the deed shall be paid by Seller. Purchaser shall pay title examination costs, title insurance premiums (including any endorsements required by Purchaser) and all other costs associated with Purchaser’s due diligence and Purchaser’s

financing. Except as provided in Section 16.16, each party shall be responsible for its own attorney’s fees. Any title escrow fees shall be split equally by the parties.

ARTICLE V.

Purchaser’s Right of Inspection; Feasibility Period

5.1. Right to Evaluate. Commencing on the Effective Date and continuing until 5:00 p.m. Eastern time on June 28,

2015 (the “Feasibility Period”), Purchaser and its agents shall have the right (with reasonable advance notice to Seller), at Purchaser’s sole cost and expense and at Purchaser’s and its agents’ sole risk, to perform

inspections and tests of the Property and to perform such other analyses, inquiries and investigations as Purchaser shall deem necessary or appropriate. Seller shall reasonably cooperate with Buyer in connection with such review and evaluation of

the Property, provided such cooperation shall be at no out-of-pocket cost to Seller. In the event Purchaser and/or its agents is not allowed by Seller to perform any reasonable inspections as Purchaser so desires, then Purchaser may terminate this

Agreement, in which event this Agreement shall terminate and be of no further force and effect other than the Surviving Termination Obligations (as defined in Section 16.12 herein).

4

Notwithstanding anything contained in this Section 5.1 to the contrary, with respect to any

intrusive inspection or test (i.e., core sampling, soil tests, etc.) desired by Purchaser, the following terms and conditions shall apply: (a) Purchaser must obtain Seller’s prior written consent (which consent may be given, withheld or

conditioned in Seller’s sole discretion) as to the scope of the proposed inspection or test and the firm or person performing the same; (b) prior to performing any such inspection or test, Purchaser must deliver to Seller a certificate of

insurance to Seller evidencing that Purchaser and its contractors, agents and representatives have in place reasonable amounts of comprehensive general liability insurance and workers compensation insurance for their activities on the Premises upon

terms and amounts reasonably satisfactory to Seller, covering any accident arising in connection with the presence of Purchaser, its contractors, agents and representatives on the Premises, which insurance shall name Seller and such other parties as

Seller may designate as additional insureds thereunder; and (c) Purchaser shall bear the cost of all such inspections or tests and shall be responsible for and act as the generator with respect to any wastes generated by those inspections or

tests.

5.2. Seller Deliveries. Seller acknowledges that on or prior to the Effective Date, Seller has delivered to

Purchaser all of the items specified on Exhibit B, attached hereto (the “Documents”).

5.3. Termination

Right. In the event that Purchaser determines that it does not desire to acquire the Property for any reason in Purchaser’s sole discretion, Purchaser shall provide written notice to Seller before the end of the Feasibility Period,

and, subject to the Surviving Termination Obligations, this Agreement shall terminate and neither party shall have any further rights or obligations to the other hereunder.

5.4 Time of the Essence Closing. In the event that the Closing does not occur on or before June 29, 2015, this Agreement

shall be deemed terminated, and subject to the Surviving Termination Obligations, this Agreement shall terminate and neither party shall have any further rights or obligations hereunder.

ARTICLE VI.

Title

Matters

6.1. Title. At Closing, Seller shall convey to Purchaser, good and clear, insurable, record and marketable fee

simple title to the Property, free and clear of all liens and encumbrances other than any Permitted Exceptions. “Permitted Exceptions” shall consist exclusively of: (a) items 3 – 12 of the excerpt of policy of title

insurance listed on Schedule 6.1 attached hereto, (b) all non-delinquent property taxes and assessments, (c) all matters created by, through or under Purchaser, including, without limitation, any documents or instruments to be

recorded as part of any financing for the acquisition of the Property by Purchaser, and (d) local, state and federal laws, ordinances or governmental regulations, including, but not limited to, building and zoning laws, ordinances and

regulations, now or hereafter in effect relating to the Property.

6.2. Title Provisions. Notwithstanding anything herein to

the contrary, the Property will not conform with the title provisions of this agreement unless (a) all buildings, structures and improvements, and all means of access to the Property, are located completely within the boundary lines of the

Property and do not encroach upon or under the property of any other person or entity without the benefit of a perpetual appurtenant easement, (b) no building, structure or improvement of any kind belonging to another person or entity

encroaches upon or under the Property without the benefit of an appurtenant easement, and (c) the Property abuts or has indefeasible access to a public way, duly laid out or accepted as such by the municipality in which the Property is located.

5

ARTICLE VII.

Representations and Warranties of the Seller

7.1. Seller’s Representations. Seller represents and warrants that the following matters are true and correct as of

the Effective Date.

7.1.1. Authority. Seller is a corporation duly organized, validly existing and in good standing

under the laws of the State of Delaware and is qualified to conduct business in the Commonwealth of Massachusetts. This Agreement has been duly authorized, executed and delivered by Seller, is the legal, valid and binding obligation of Seller, and

does not violate any provision of any agreement or judicial order to which Seller is a party or to which Seller is subject. All documents to be executed by Seller which are to be delivered at Closing, at the time of Closing will be duly authorized,

executed and delivered by Seller, at the time of Closing will be legal, valid and binding obligations of Seller, and at the time of Closing will not violate any provision of any agreement or judicial order to which Seller is a party or to which

Seller is subject.

7.1.2. Bankruptcy or Debt of Seller. Seller has not made a general assignment for the benefit of

creditors, filed any voluntary petition in bankruptcy, admitted in writing its inability to pay its debts as they come due or made an offer of settlement, extension or composition to its creditors generally. Seller has received no written notice of

(a) the filing of an involuntary petition by Seller’s creditors, (b) the appointment of a receiver to take possession of all, or substantially all, of Seller’s assets, or (c) the attachment or other judicial seizure of all,

or substantially all, of Seller’s assets.

7.1.3. Foreign Person. Seller is not a foreign person within the

meaning of Section 1445(f) of the Internal Revenue Code, and Seller agrees to execute any and all documents necessary or required by the Internal Revenue Service or Purchaser in connection with such declaration(s).

7.1.4. Leases. Copies of the Leases delivered to Purchaser by Seller are true and complete copies of such Leases. There are no

leases, rental agreements or other rights to occupy or conduct business at the Property except under the Leases.

6

7.1.6. Litigation. There are no judgments unsatisfied against Seller or the

Property or orders, consent decrees or injunctions to which the Property is subject or to which Seller is subject that would affect Seller’s ability to convey the Property in accordance with the terms hereof and there is no litigation or

proceeding pending of which Seller has been served with pleadings or has received written notice or which has been threatened in writing against or relating to Seller or the Property.

7.1.7. Condemnation. Seller has not (i) received any written notice from any governmental authority stating that there are

any pending or contemplated condemnation, eminent domain or annexation proceedings affecting the Property or any part thereof or (ii) engaged in any discussions or negotiations with any governmental authority regarding any such proceedings or

agreements in lieu thereof.

7.1.8. Violations of Law. Seller has not received written notice of and is not aware of any

violation of or potential liability under any statute, ordinance, law, rule, regulation or code applicable or alleged to be applicable to the Property which has not been cured.

7.1.9. Contracts. Copies of the Contracts delivered to Purchaser by Seller are true and complete copies of such Contracts. There

are no service, management, equipment, supply or maintenance contracts related to the Property (a) in Seller’s possession or control, or (b) between Seller and another party other than Purchaser, in either case that have not been

delivered to Purchaser.

7.1.10. Personal Property. Seller owns the Personal Property free and clear of any liens or

encumbrances created by, through or under Seller.

7.1.11. Betterments. To the best of Seller’s knowledge, there are no

pending betterment assessments, encumbrances, and/or liens affecting the Property.

7.1.12. Environmental. Copies of the

documents listed on Schedule 7.1.12 attached hereto (the “Environmental Reports”) delivered to Purchaser by Seller are true and complete copies of such Environmental Reports. The Environmental Reports represent all of the

notices to and from government agencies, studies, sampling reports and other documents related to environmental conditions at or related to the Property in Seller’s possession or control and Seller knows of no other such environmental documents

related to the Property.

7.1.13. Purchase Option. No Tenant at the Property has been granted any right of first refusal or

other option to purchase the Property except as may be set forth in the Leases.

7.1.14. Covenants and Restrictions. Seller

has received no notice of and, to the best of Seller’s knowledge, the Property is not in violation or breach of any of the covenants, conditions, restrictions or other agreements affecting the Property.

7.2. Survival. The express representations and warranties made in this Agreement shall not merge into any instrument or

conveyance delivered at the Closing; provided, however, that any action, suit or proceeding with respect to the truth, accuracy or completeness of such

7

representations and warranties shall be commenced, if at all, on or before the date which is twelve (12) months after the date of the Closing and, if not commenced on or before such date,

thereafter such representations and warranties shall be void and of no force or effect.

ARTICLE VIII.

Representations and Warranties of Purchaser

8.1. Purchaser represents and warrants to Seller that the following matters are true and correct as of the Effective Date.

8.1.1 Authority. Purchaser is a corporation duly organized, validly existing and in good standing under the laws of the

State of Delaware and is qualified to conduct business in the Commonwealth of Massachusetts. This Agreement has been duly authorized, executed and delivered by Purchaser, is the legal, valid and binding obligation of Purchaser, and does not violate

any provision of any agreement or judicial order to which Purchaser is a party or to which Purchaser is subject. All documents to be executed by Purchaser which are to be delivered at Closing, at the time of Closing will be duly authorized, executed

and delivered by Purchaser, at the time of Closing will be legal, valid and binding obligations of Purchaser, and at the time of Closing will not violate any provision of any agreement or judicial order to which Purchaser is a party or to which

Purchaser is subject.

8.1.2. Bankruptcy or Debt of Purchaser. Purchaser has not made a general assignment for the

benefit of creditors, filed any voluntary petition in bankruptcy or suffered the filing of an involuntary petition by Purchaser’s creditors, suffered the appointment of a receiver to take possession of all, or substantially all, of

Purchaser’s assets, suffered the attachment or other judicial seizure of all, or substantially all, of Purchaser’s assets, admitted in writing its inability to pay its debts as they come due or made an offer of settlement, extension or

composition to its creditors generally.

8.2. Survival. The express representations and warranties made in this Agreement by

Purchaser shall not merge into any instrument of conveyance delivered at the Closing; provided, however, that any action, suit or proceeding with respect to the truth, accuracy or completeness of all such representations and warranties shall be

commenced, if at all, on or before the date which is twelve (12) months after the date of the Closing and, if not commenced on or before such date, thereafter shall be void and of no force or effect.

ARTICLE IX.

Seller’s Interim Operating Covenants.

9.1. Operations. Seller agrees to continue to operate, manage and maintain the Improvements through the Closing Date in the

ordinary course of Seller’s business and substantially in accordance with Seller’s present practice, subject to ordinary wear and tear and further subject to Article XII of this Agreement.

8

9.2. Maintain Insurance. Seller agrees to maintain or cause to be maintained

until the Closing Date general commercial liability and fire and extended coverage insurance on the Property which is at least equivalent in all material respects to the insurance policies covering the Real Property and the Improvements as of the

Effective Date.

9.3. Personal Property. Seller agrees not to transfer or remove any Personal Property from the

Improvements after the Effective Date except for repair or replacement thereof. Any items of Personal Property replaced after the Effective Date shall be promptly installed prior to Closing and shall be of substantially similar quality to the item

of Personal Property being replaced.

9.4. No Sales. Except for the execution of tenant Leases pursuant to

Section 9.5, Seller agrees that it shall not convey any interest in the Property to any third party.

9.5. Tenant

Leases. Seller shall not, from and after the Effective Date, without the prior written approval of Purchaser (which may be withheld in Purchaser’s sole discretion), enter into a new lease, modify an existing Lease or renew, extend

or expand an existing (an “Approved New Lease”).

9.6. Contracts. At the direction of Purchaser at any

time from and after the end of the Feasibility Period, Seller will, at Seller’s sole cost and expense, terminate any Contracts as directed by Purchaser, any such terminations to be effective as of the Closing Date. Notwithstanding the

foregoing, Seller shall, at Seller’s sole cost and expense, terminate any management and/or leasing contracts as of the Closing.

9.7. No Marketing. Seller shall not market the Property to any other party and Seller shall cause Seller’s agents to cease

all marketing of the Property.

9.8. Purchaser Approval. Seller shall obtain Purchaser’s prior written consent to any

action which would materially affect the current zoning classification, permitted uses, title, survey, governmental compliance, tax assessments, leasing or any other matter affecting the Property. Seller shall also obtain Purchaser’s prior

written consent to any filings made with any governmental authority regarding the Property’s site planning, zoning, use or any other land use approval.

ARTICLE X.

Closing

Conditions.

10.1. Conditions to Obligations of Seller. The obligations of Seller under this Agreement to sell the

Property and consummate the other transactions contemplated hereby shall be subject to the satisfaction of the following conditions on or before the Closing Date except to the extent that any of such conditions may be waived by Seller in writing at

Closing.

10.1.1. Representations, Warranties and Covenants of Purchaser. All representations and warranties of

Purchaser in this Agreement shall be true and correct in all material respects as of the Closing Date, with the same force and effect as if such representations

9

and warranties were made anew as of the Closing Date. Any changes to such representations disclosed by Purchaser pursuant to Section 11.1.6 shall be acceptable to Seller, and

Purchaser shall have performed and complied with all covenants and agreements required by this Agreement to be performed or complied with by Purchaser prior to the Closing Date.

10.1.2. No Orders. No order, writ, injunction or decree shall have been entered and be in effect by any court of competent

jurisdiction or any governmental authority, and no statute, rule, regulation or other requirement shall have been promulgated or enacted and be in effect, that restrains, enjoins or invalidates the transactions contemplated hereby.

10.1.3. No Suits. No suit or other proceeding shall be pending or threatened by any third party before any court or

governmental authority seeking to restrain or prohibit or declare illegal, or seeking substantial damages against Seller or any of its affiliates in connection with, the transactions contemplated by this Agreement.

10.2. Conditions to Obligations of Purchaser. The obligations of Purchaser under this Agreement to purchase the Property

and consummate the other transactions contemplated hereby shall be subject to the satisfaction of the following conditions on or before the Closing Date, except to the extent that any of such conditions may be waived by Purchaser in writing at

Closing.

10.2.1. Representations, Warranties and Covenants of Seller. All representations and warranties of Seller in this

Agreement shall be true and correct in all material respects as of the Closing Date, with the same force and effect as if such representations and warranties were made anew as of the Closing Date. Any changes to such representations disclosed by

Seller pursuant to Section 11.2.6 shall be acceptable to Purchaser, and Seller shall have performed and complied in all material respects with all covenants and agreement required by this Agreement to be performed or complied with by

Seller prior to the Closing Date.

10.2.2. No Orders. No order, writ, injunction or decree shall have been entered and

be in effect by any court of competent jurisdiction or any governmental authority, and no statute, rule, regulation or other requirement shall have been promulgated or enacted and be in effect, that restrains, enjoins or invalidates the transactions

contemplated hereby.

10.2.3. No Suits. No suit or other proceeding shall be pending or threatened by any third party

not affiliated with or acting at the request of Purchaser before any court or governmental authority seeking to restrain or prohibit or declare illegal, or seeking substantial damages against Purchaser in connection with, the transactions

contemplated by this Agreement.

10.2.4. Possession. Seller shall deliver exclusive possession of the Property to

Purchaser, subject to the rights of tenants under the Leases.

10.2.5. Title. Seller shall convey to Purchaser, good

and clear, insurable, record and marketable fee simple title to the Property, free and clear of all liens and encumbrances other than any Permitted Exceptions.

10

ARTICLE XI.

Closing

11.1.

Purchaser’s Closing Obligations. Purchaser, at its sole cost and expense, shall deliver or cause to be delivered to Seller at Closing the following:

11.1.1. The Purchase Price, after all adjustments are made at the Closing as herein provided, shall be received in escrow by the Title

Company at or before 10:00 a.m. Eastern time.

11.1.2. An assignment of the Leases (the “Assignment of Leases”),

duly executed by Purchaser.

11.1.3. A blanket conveyance and bill of sale (the “General Assignment”), duly

executed by Purchaser, conveying and assigning to Purchaser the Personal Property, the Leases, the Contracts and the Intangible Property.

11.1.4. Evidence reasonably satisfactory to Seller and the Title Company that the person executing the Closing documents on behalf of

Purchaser has full right, power and authority to do so.

11.1.5. Intentionally omitted.

11.1.6. A certificate indicating that the representations and warranties set forth in Section 8.1 are true and correct on

the Closing Date, or, if there have been changes, describing such changes.

11.1.7. Such other documents as may be reasonably

necessary or appropriate to effect the consummation of the transactions which are the subject of this Agreement.

11.2.

Seller’s Closing Obligations. Seller, at its sole cost and expense, shall deliver or cause to be delivered to Purchaser the following:

11.2.1. A quitclaim deed (the “Deed”) in recordable form properly executed by Seller conveying to Purchaser the Land

and Improvements described on Exhibit A in fee simple, subject only to the Permitted Exceptions.

11.2.2. The Assignment of

the Leases, duly executed by Seller.

11.2.3. The General Assignment, duly executed by Seller, conveying and assigning to Purchaser

the Personal Property, the Leases, the Contracts and the Intangible Property.

11.2.4. Intentionally omitted.

11

11.2.5. Evidence reasonably satisfactory to Purchaser and the Title Company that the

person executing the Closing documents on behalf of Seller has full right, power and authority to do so.

11.2.6. A certificate

indicating that the representations and warranties set forth in Section 7.1 are true and correct on the Closing Date, or, if there have been changes, describing such changes.

11.2.7. A certificate (the “Non-foreign Entity Certification”) certifying that Seller is not a “foreign

person” as defined in Section 1445 of the Internal Revenue Code of 1986, as amended.

11.2.8. Such other documents as may

be reasonably necessary or appropriate to effect the consummation of the transactions which are the subject of this Agreement.

ARTICLE

XII.

Risk of Loss.

12.1. Condemnation and Casualty. If, prior to the Closing Date, all or any portion of the Property is taken by condemnation

or eminent domain, or is the subject of a pending taking which has not been consummated, or is destroyed or damaged by fire or other casualty, Seller shall notify Purchaser of such fact promptly after Seller obtains knowledge thereof. If such

condemnation or casualty is “Material” (as hereinafter defined), Purchaser shall have the option to terminate this Agreement upon notice to Seller given not later than fifteen (15) days after receipt of Seller’s notice, or

the Closing Date, whichever is earlier. If this Agreement is terminated, thereafter neither Seller nor Purchaser shall have any further rights or obligations to the other hereunder except with respect to the Surviving Termination Obligations. If

this Agreement is not terminated, Seller shall not be obligated to repair any damage or destruction but (x) Seller shall assign, without recourse, and turn over to Purchaser all of the insurance proceeds or condemnation proceeds, as applicable,

net of any costs of repairs to the extent actually incurred or expended by Seller (or, if such have not been awarded, all of its right, title and interest therein) payable with respect to such fire or other casualty or condemnation including any

rent abatement insurance for such casualty or condemnation and (y) the parties shall proceed to Closing pursuant to the terms hereof without abatement of the Purchase Price except for a credit in the amount of the applicable insurance

deductible.

12.2. Condemnation Not Material. If the condemnation is not Material, then the Closing shall occur without

abatement of the Purchase Price and Seller shall assign, without recourse, all remaining awards or any rights to collect awards to Purchaser on the Closing Date.

12.3. Casualty Not Material. If the casualty is not Material, then the Closing shall occur without abatement of the

Purchase Price except for a credit in the amount of the reasonable estimate of the cost to repair the damage from the casualty (provided, however, that either Seller or Purchaser may extend the date for Closing up to thirty

(30) days in order to resolve any issues as a result of such casualty with such party’s insurer or lender, respectively.

12.4. Materiality. For purposes of this Article XII, with respect to a taking by eminent domain, the term

“Material” shall mean any taking whatsoever, regardless of the amount of the award or the amount of the Property taken, excluding, however, any taking solely of subsurface rights or takings for utility easements or right of way

easements, if the surface of the Property, after such taking, may be used in substantially the same manner as though such rights had not been taken. For purposes of this Article XII, with respect to a casualty, the term

“Material” shall mean any casualty such that the cost of repair, as reasonably estimated by Seller’s engineer, is in excess of $82,500.00.

12

ARTICLE XIII.

Default

13.1.

Default by Seller. In the event the Closing and the transactions contemplated hereby do not occur as provided herein by reason of the default of Seller, Purchaser may elect to (i) terminate this Agreement and in such event

Seller shall not have any liability whatsoever to Purchaser hereunder other than with respect to the Surviving Termination Obligations or (ii) enforce specific performance of this Agreement and of the obligations of Seller hereunder.

Notwithstanding the foregoing, nothing contained herein shall limit Purchaser’s remedies at law or in equity, as to the Surviving Termination Obligations.

13.2. Default by Purchaser. In the event the Closing and the transactions contemplated hereby do not occur as provided herein by

reason of any default of Purchaser, Purchaser and Seller agree it would be impractical and extremely difficult to fix the damages which Seller may suffer. Therefore, Purchaser and Seller hereby agree a reasonable estimate of the total net detriment

Seller would suffer in the event Purchaser defaults and fails to complete the purchase of the Property is and shall be, as Seller’s sole and exclusive remedy (whether at law or in equity), a sum equal to $82,500 (the “Liquidated Damages

Sum”). Upon such default by Purchaser, Seller shall have the right to receive the Liquidated Damages Sum from Purchaser as its sole and exclusive remedy and thereupon this Agreement shall be terminated and neither Seller nor Purchaser shall

have any further rights or obligations hereunder except with respect to the Surviving Termination Obligations. The Liquidated Damages Sum shall be the full, agreed and liquidated damages for Purchaser’s default and failure to complete the

purchase of the Property, all other claims to damages or other remedies being hereby expressly waived by Seller. Notwithstanding the foregoing, nothing contained herein shall limit Seller’s remedies at law or in equity as to the Surviving

Termination Obligations.

ARTICLE XIV.

Brokers

14.1.

Brokers. Purchaser and Seller each represents and warrants to the other that it has not dealt with any person or entity entitled to a brokerage commission, finder’s fee or other compensation with respect to the transaction

contemplated hereby other than DTZ, whose compensation shall be the sole responsibility of Purchaser, and who shall be paid only upon the Closing of the purchase and sale contemplated hereby pursuant to a separate agreement.

13

Purchaser hereby agrees to indemnify, defend, and hold Seller harmless from and against any losses, damages, costs and expenses (including, but not limited to, attorneys’ fees and costs)

incurred by Seller by reason of any breach or inaccuracy of the Purchaser’s (or its nominee’s) representations and warranties contained in this Section 14.1. Seller hereby agrees to indemnify, defend, and hold Purchaser

harmless from and against any losses, damages, costs and expenses (including, but not limited to, reasonable attorneys’ fees and costs) incurred by Purchaser by reason of any breach or inaccuracy of Seller’s representations and warranties

contained in this Section 14.1. Seller and Purchaser agree that it is their specific intent that no broker shall be a party to or a third party beneficiary of this Agreement, that no broker shall have any rights or cause of action

hereunder, and further that the consent of a broker shall not be necessary to any agreement, amendment, or document with respect to the transaction contemplated by this Agreement. The provisions of this Section 14.1 shall survive the

Closing and/or termination of this Agreement.

ARTICLE XV.

Confidentiality

15.1.

Confidentiality. Each of Purchaser and Seller expressly acknowledges and agrees that the transactions contemplated by this Agreement, the Documents that are not otherwise known by or readily available to the public and the terms,

conditions and negotiations concerning the same shall be held in the strictest confidence by Purchaser and Seller, respectively, and shall not be disclosed except (i) to each party’s respective legal counsel, lender, surveyor, title

company, broker, accountants, consultants, officers, employees, partners, directors and shareholders, as applicable (the “Authorized Representatives”), (ii) to the extent such disclosure may be required by any law, order,

subpoena, rule, regulation or securities exchange requirement, and (iii) to the extent that such disclosure may be necessary for its performance hereunder. Each of Purchaser and Seller agrees that it shall instruct each of its Authorized

Representatives to maintain the confidentiality of such information in accordance with this paragraph. The provisions of this Section 15.1 shall survive any termination of this Agreement.

ARTICLE XVI.

Miscellaneous

16.1.

Notices. Any and all notices, requests, demands or other communications hereunder shall be deemed to have been duly given if in writing and if transmitted by hand delivery with receipt therefor, by email delivery (with notice

simultaneously sent by one of the other permitted means), by overnight courier, or by registered or certified mail, return receipt requested, first class postage prepaid addressed as follows (or to such new address as the addressee of such a

communication may have notified the sender thereof). All such notices shall be deemed to have been served on the date of actual receipt or rejection thereof (in the case of hand delivery), or on the date such notice shall have been sent by email or

deposited with a reputable overnight courier, or three (3) business days after such notice shall have been deposited in the United States mails within the continental United States (in the case of mailing by registered or certified mail as

aforesaid).

14

|

|

|

| To Purchaser: |

|

M/A-COM Technology Solutions Inc. |

|

|

100 Chelmsford Street |

|

|

Lowell, MA 01851 |

|

|

Attn: Clay Simpson, VP and General Counsel |

|

|

E-mail: clay.simpson@macom.com |

|

|

| With a copy to: |

|

Langer & McLaughlin, LLP |

|

|

535 Boylston Street, 3rd Floor |

|

|

Boston, MA 02116 |

|

|

Attn: Doug McLaughlin |

|

|

E-mail: mclaughlin@relawboston.com |

|

|

| To Seller: |

|

Cobham Properties, Inc. |

|

|

10 Cobham Drive |

|

|

Orchard Park, New York 14127 |

|

|

Attn: Betty J. Bible, Treasurer |

|

|

E-mail: Betty.Bible@Cobham.com |

|

|

| With a copy to: |

|

Jaeckle Fleischmann & Mugel, LLP |

|

|

200 Delaware Avenue, Suite 900 |

|

|

Buffalo, New York 14202 |

|

|

Attn: Michael A. Piette, Esq. |

|

|

E-mail: mpiette@jaeckle.com |

16.2. Governing Law. This Agreement shall be governed by and construed in accordance with

the internal, substantive laws of the Commonwealth of Massachusetts, without regard to the conflict of laws principles thereof.

16.3.

Headings. The captions and headings herein are for convenience and reference only and in no way define or limit the scope or content of this Agreement or in any way affect its provisions.

16.4. Effective Date. This Agreement shall be effective upon delivery of this Agreement fully executed by the Seller and

Purchaser, which date shall be deemed the Effective Date hereof. Either party may request that the other party promptly execute a memorandum specifying the Effective Date.

16.5. Business Days. If any date herein set forth for the performance of any obligations of Seller or Purchaser or for the

delivery of any instrument or notice as herein provided should be on a Saturday, Sunday or legal holiday, the compliance with such obligations or delivery shall be deemed acceptable on the next business day following such Saturday, Sunday or legal

holiday. As used herein, the term “legal holiday” means any state or Federal holiday for which financial institutions or post offices are generally closed in the state where the Property is located.

15

16.6. Counterpart Copies. This Agreement may be executed in two or more

counterpart copies, all of which counterparts shall have the same force and effect as if all parties hereto had executed a single copy of this Agreement. The parties acknowledge and agree that this Agreement may be executed via .pdf format

(including computer-scanned or other electronic reproduction of the actual signatures) and that delivery of a signature by electronic or physical means shall be effective to the same extent as delivery of an original signature. Notwithstanding

the foregoing, originally signed documents shall be provided upon either party’s request.

16.7. Binding

Effect. This Agreement shall be binding upon, and inure to the benefit of, the parties hereto and their respective legal representatives, heirs, successors and assigns.

16.8. Intentionally Omitted.

16.9. Interpretation. This Agreement shall not be construed more strictly against one party than against the other merely

by virtue of the fact that it may have been prepared by counsel for one of the parties, it being recognized that both Seller and Purchaser have contributed substantially and materially to the preparation of this Agreement.

16.10. Entire Agreement. This Agreement and the Exhibits attached hereto contain the final and entire agreement between the

parties hereto with respect to the sale and purchase of the Property contemplated hereby, and are intended to be an integration of all prior negotiations and understandings between the parties hereto concerning the sale and purchase of the Property

contemplated hereby. Neither party hereto shall be bound by any terms, conditions, statements, warranties or representations made by such party hereto to the other party hereto during the negotiation of this Agreement, whether oral or written,

except to the extent they are set forth in writing herein. No change or modifications to this Agreement shall be valid unless the same is in writing and signed by the parties hereto. Each party reserves the right to waive any of the terms or

conditions of this Agreement which are for their respective benefit and to consummate the transaction contemplated by this Agreement in accordance with the terms and conditions of this Agreement which have not been so waived. Any such waiver must be

in writing signed by the party for whose benefit the provision is being waived.

16.11. Severability. If any one or

more of the provisions hereof shall for any reason be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provision hereof, and this Agreement shall be construed as

if such invalid, illegal or unenforceable provision had never been contained herein.

16.12. Survival. Except as

otherwise specifically provided for in Sections 4.2, 7.2, 8.2, 13.1, 13.2, 14.1, 15.1 and 16.16 (collectively, the “Surviving Termination Obligations”), the provisions of this

Agreement and the representations and warranties herein shall not survive after the conveyance of title and payment of the Purchase Price but be merged therein.

16.13. Exhibits and Schedules. Exhibits A and B and Schedules 1.12, 1.1.4, 1.1.5,

4.2.6 and 7.1.12 attached hereto are incorporated herein by reference.

16

16.14. Time. Time is of the essence in the performance of each of the

parties’ respective obligations contained herein.

16.15. Waiver of Trial by Jury. The respective parties hereto

shall and hereby do waive trial by jury in any action, proceeding or counterclaim brought by either of the parties hereto against the other on any matters whatsoever arising out of or in any way connected with this Agreement, or for the enforcement

of any remedy under any statute, emergency or otherwise.

16.16. Prevailing Party. Should either party employ an

attorney to enforce any of the provisions hereof (whether before or after Closing, and including any claims or actions involving amounts held in escrow), the non-prevailing party in any final judgment agrees to pay the other party’s reasonable

expenses, including reasonable attorneys’ fees and expenses in or out of litigation and, if in litigation, trial, appellate, bankruptcy or other proceedings, expended or incurred in connection therewith, as determined by a court of competent

jurisdiction. The provisions of this Section 16.16 shall survive Closing and/or any termination of this Agreement.

16.17.

Real Estate Reporting Person. Title Company is hereby designated the “real estate reporting person” for purposes of Section 6045 of Title 26 of the United States Code and Treasury Regulation 1.6045-4 and any

instructions or settlement statement prepared by Title Company shall so provide. Upon the consummation of the transaction contemplated by this Agreement, Title Company shall file Form 1099 information return and send the statement to Seller as

required under the aforementioned statute and regulation. Seller and Purchaser shall promptly furnish their federal tax identification numbers to Title Company and shall otherwise reasonably cooperate with Title Company in connection with Title

Company’s duties as real estate reporting person.

16.18. No Recording. Neither this Agreement nor any memorandum

or short form hereof shall be recorded or filed in any public land or other public records of any jurisdiction, by either party and any attempt to do so may be treated by the other party as a breach of this Agreement.

[SIGNATURES ON FOLLOWING PAGE]

17

IN WITNESS WHEREOF, the parties hereto have executed this Agreement under seal on the date

or dates set forth below.

|

|

|

| SELLER: |

|

| COBHAM PROPERTIES, INC. |

|

|

| By: |

|

/s/ Betty J. Bible |

| Name: |

|

Betty J. Bible |

| Its: |

|

Treasurer |

|

| PURCHASER: |

|

| M/A-COM TECHNOLOGY SOLUTIONS INC. |

|

|

| By: |

|

/s/ Robert J. McMullan |

| Name: |

|

Robert J. McMullan |

| Its: |

|

Senior Vice President and Chief Financial Officer |

18

LIST OF EXHIBITS AND SCHEDULES

EXHIBITS

|

|

|

| Exhibit A - |

|

Legal Description of property |

| Exhibit B - |

|

Due Diligence Documents |

SCHEDULES

|

|

|

| Schedule 1.1.2 - |

|

Leases and Security Deposits |

| Schedule 1.1.4 - |

|

Personal Property |

| Schedule 1.1.5 - |

|

Contracts |

| Schedule 6.1 - |

|

Excerpt of Policy of Title Insurance |

| Schedule 7.1.12 - |

|

Environmental Reports |

19

EXHIBIT A

Legal Description of Property

The land

situated on Chelmsford Street, in Lowell Middlesex County, Massachusetts, shown as Lots I-1B-4 and I-1B-5 on a plan entitled “Compiled Disposition Map of Lots I-1B-3, I-1B-4 & I-1B-5 in Lowell, Mass., Hale Howard Urban Renewal Area, Project

No. Mass. R-130” dated March 30, 1977, by Dana F. Perkins & Sons, Inc. Civil Engineers & Surveyors”, recorded with Middlesex North District Deeds in Plan Book 124, Plan 46, bounded and described as follows:

|

|

|

| Northeasterly |

|

by land now or formerly of the Boston & Maine Railroad Corp., as shown on said plan, by three bounds totaling 649.97 feet; |

|

|

| Southeasterly |

|

by said land of Boston & Maine Railroad Corp., as shown on said plan, 27.97 feet; |

|

|

| Northeasterly |

|

again, by said land of Boston & Mane Railroad Corp., as shown on said plan, 265.16 feet; |

|

|

| Southeasterly |

|

again, by Lot I-1B-3, as shown on said plan, 412.45 feet; |

|

|

| Southeasterly |

|

again, by said Lot I-1B-3, as shown on said plan, 277.71 feet; |

|

|

| Southwesterly |

|

by Lot I-1A, as shown on said plan, 300 feet; |

|

|

| Northwesterly |

|

by Chelmsford Street, 270 feet; and |

|

|

| Northwesterly |

|

again, by said Chelmsford Street by three courses totaling 1,042.23 feet; |

[the remainder of this page intentionally blank]

A - 1

Comprised in part by three parcels of registered land; namely,

Registered Parcel 1:

A certain parcel of land situated

in said Lowell, bounded and described as follows:

|

|

|

| Northeasterly |

|

by Howard Street, fifty-two (52) feet; |

|

|

| Southeasterly |

|

by land now or formerly of David Ziskind, one hundred twelve (112) feet; |

|

|

| Southwesterly |

|

by land now or formerly of Charles E. Jameson, fifty-two and 1/100 (52.01) feet; and |

|

|

| Northwesterly |

|

by land now or formerly of Israel Levin, one hundred thirteen and 28/100 (113.28) feet. |

All of said boundaries of said Registered Parcel 1 are determined by the Land Court to be located as shown on Plan 5672-A

entitled “Plan of Land in Lowell” drawn by Smith and Brooks, Civil Engineers, dated October 15, 1915, as approved by the Court, filed in the Land Registration Office, a copy of a portion of which is filed with Certificate of Title

No. 951 issued by Middlesex North Registry District of the Land Court.

|

|

|

| Registered Parcel 2: |

|

Specifically omitted |

|

|

| Registered Parcel 3: |

|

|

A certain parcel of land situated in said Lowell, bounded and described as follows:

|

|

|

| Northwesterly |

|

by land now or formerly of Minnie Bernstein and Mary F. Hardy, forty-six and 68/100 (46.68) feet; |

|

|

| Southeasterly |

|

by Lot 5, twenty-five and 07/100 (25.07) feet; |

|

|

| Southwesterly |

|

by Lot 6, thirty-three and 94/100 (33.94) feet. |

All of said boundaries of said Registered Parcel 3 are determined by the Land Court to be located and shown on Subdivision

Plan 6039-B entitled “Subdivision Plan of Land in Lowell” drawn by Dana F. Perkins & Sons, Inc., Surveyors, dated December 22, 1976, as approved by the Court, filed in the Land Registration Office, a copy of a portion of

which is filed with Certificate of Title No. 21963 issued by said Registry District, and said Registered Parcel 3 is shown as Lot 7 on said Plan.

A - 2

Excepting and excluding from the foregoing the following:

So much of the premises as lies within former Railroad Street as the same is now or formerly owned by Boston and Maine Corporation as set forth

in Deed from the Trustees of Boston and Maine Railroad Corporation to City Development Authority dated January 5, 1977, recorded with said Deeds, Book 2242, Page 527.

Said land being the land conveyed to Lowell Investors Associates Limited Partnership by deed of M/A Com, Inc., dated as of May 15, 1984,

recorded with said Deed in Book 2755, Page 3. (For title to said registered parcels, referenced is also made to Certificate of Title No. 25036 issued by said Registry District).

A - 3

EXHIBIT B

Due Diligence Documents

To the extent such items are in Seller’s possession or control, Seller shall deliver to Purchaser true, correct and complete copies of

the following items related to the Property:

| |

• |

|

All management, maintenance, service and other contracts; |

| |

• |

|

All leases, rental agreements and other rights to occupy, and other occupancy agreements, and any other agreements conveying an interest in or right to use the Property; |

| |

• |

|

Current title insurance policy (together with any title exception documents and any other relevant deeds, easements, encumbrances, use restrictions and plats) and survey; |

| |

• |

|

All plans, surveys and drawings (including, without limitation, site plans, floor plans, surveys, plot plans, as-built plans, structural reports, and architectural and engineering drawings); |

| |

• |

|

All studies regarding the condition of the land, including, without limitation, environmental studies; and |

| |

• |

|

Any other information regarding the Property that the Purchaser reasonably deems pertinent. |

SCHEDULE 1.1.2

Leases

That certain

Lease Agreement dated as of October 4, 2012, by and between Seller, as lessor, and Purchaser, as lessee.

Security Deposits

None.

SCHEDULE 1.1.4

Personal Property

NONE

SCHEDULE 1.1.5

Contracts

NONE

SCHEDULE 6.1

Excerpt of Policy of Title Insurance

|

|

|

| Issued By: |

|

|

|

|

| CHICAGO TITLE INSURANCE COMPANY |

|

Schedule B |

|

|

|

|

|

| OWNER’S POLICY OF TITLE INSURANCE ALTA

OWNER’S (10-17-92) |

|

No: |

|

2651-25146 |

|

| This Policy does not insure against loss or damage (and the Company will not pay costs, legal fees, or expenses) which arise by reason of the following

items, and the mortgage, if any referred to in Item 4 of Schedule A. |

|

|

|

|

|

| X |

|

1. |

|

Real estate taxes are paid through September 30, 2008. Subsequent real estate taxes are a lien not yet due or payable. |

|

|

|

| I |

|

2. |

|

Any facts that would be disclosed by an accurate survey or inspection of the land. |

|

|

|

| J |

|

3. |

|

The exact acreage or square footage being other than as stated in the description sheet annexed or the plan(s) therein referred to. |

|

|

|

| K |

|

4. |

|

Taking by City of Lowell for street and highway purposes within Chelmsford Street and Westford Street dated May 20, 1970, recorded in Book 1922, Page 281 and filed as Document No. 54519. |

|

|

|

| L |

|

5. |

|

Terms and Provisions of Urban Renewal Plan for Hale Howard Streets Area Project No. Mass. R-130 prepared by City Development Authority dated June, 1970, as amended February 16,1973, filed with the City Clerk of the City of Lowell;

as affected by Certificate of Compliance by City of Lowell recorded in Book 2586, Page 441, and filed as Document No. 95998. |

|

|

|

| M |

|

6. |

|

Grant of Easement from The City Development Authority to Massachusetts Electric Company dated March 24, 1977, recorded in Book 2241, Page 309; as affected by Easement among Allu Realty Corp., Lowell Division of Colonial Gas

Company and Massachusetts Electric Company dated July 19, 1982 recorded in Book 2547, Page 94. |

|

|

|

| N |

|

7. |

|

Easements, conditions and restrictions set forth or referred to in a deed from City Development Authority to the City of Lowell dated October 2, 1978, recorded in Book 2332, Page 534 and filed as Document No. 76121. |

|

|

|

| O |

|

8. |

|

Easements, conditions or restrictions set forth or referred to in a Deed from the City of Lowell to Wang Laboratories, Inc. dated December 31, 1980, recorded in Book 2459, Page 212 and filed as Document No. 81413. |

|

|

|

| P |

|

9. |

|

Easements, conditions or restrictions set forth or referred to in a deed from Wang Laboratories, Inc. to M/A - Com, Inc., dated January 26, 1983 recorded in Book 2586, Page 450 and filed as Document No. 96003. |

|

|

|

| Q |

|

10. |

|

Access and License Agreement between AMP Incorporated, M/A - Com, Division and L’Energia Limited Partnership dated November 17,

1997, recorded in Book 8910, Page 285; as affected by: a) Access and License Agreement

dated November 17, 1997, recorded in Book 9034, Page 184, and filed as Document No. 173809.

b.) Amendment Agreement with UAE Lowell Power, LLC as transferee of L’Energia Limited Partnership dated February 25, 1999, recorded in Book 10461,

Page 68. NOTE: The Amendment was not registered with the Land Court. |

|

|

|

| R |

|

11. |

|

Terms and provisions forth in deed from the Trustees of Boston and Maine Railroad Corporation to City Development Authority dated January 5, 1977, recorded in Book 2242, Page 527. |

|

|

|

| W |

|

12. |

|

Notice of Activity and Use Limitation and recorded in Book 21997, Page 35. |

Page B - 1

SCHEDULE 7.1.12

Environmental Reports

| 1. |

Phase I Environmental Site Assessment by EBI Consulting dated August 1, 2007, EBI Project No. 21070014 |

| 2. |

Class A Off-Site Recycling Presumptive Approval Permit |

| 3. |

BWP 1W 38 & BWP 1W 39 – Permit for Industrial Sewer Use – B10 Walker Building |

| 4. |

Transmittal Form and Permit Application for Payment – B11 Walker Building |

| 5. |

Class B4 Recycling Permit – B12 Walker Building |

| 6. |

Certificate of Accelerator Registration dated 12/18/2007 – B13 Walker Building |

| 7. |

Registration dated 07/17/07 – B9 Walker Building |

| 8. |

Hazardous Waste Generation Summary (01/01/06 to 08/31/07) |

| 9. |

6.03IT – Chelmsford Street Panels |

| 10. |

6.05 EHS – Audit Report – Walker Building |

| 11. |

Notice of Activity and Use Limitation |

| 12. |

EPCRA Section 313 TRI Submission Certification |

| 13. |

M/A-COM Semi-Annual Report of Facility Wide Emission for 2006 |

| 14. |

Wastewater Analyses – Industrial Sewer User Self-Monitoring Report Summary Sheet – June, July and August 2006 |

| 15. |

Wastewater Analyses – Industrial Sewer User Self-Monitoring Report Summary Sheet – June, July and August 2007 |

| 16. |

Wastewater Analyses – Industrial Sewer User Self-Monitoring Report Summary Sheet – December 2006, January and February 2007 |

| 17. |

Wastewater Analyses – Industrial Sewer User Self-Monitoring Report Summary Sheet – March, April and May 2007 |

| 18. |

Wastewater Analyses – Industrial Sewer User Self-Monitoring Report Summary Sheet – September, October and November 2006 |

| 19. |

Samples Results Report dated 09/13/2007 |

| 20. |

Limited Subsurface Investigation Summary Letter Report dated 10/02/2007 |

| 22. |

2010 MA DEP Walker Bldg. AUL Audit Findings |

| 23. |

Recorded AUL, recorded 03/06/2008 Book 21997 Page 35 |

| 24. |

E-mail from James Streater of ERM Consultants summarizing preliminary findings of ERM review of data room materials regarding environmental compliance and soil and ground water dated March 14, 2008 (limited to the

Walker Bldg. location). |

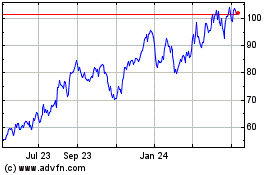

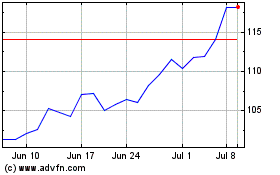

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024