UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

M/A-COM

Technology Solutions Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35451 |

|

27-0306875 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 100 Chelmsford Street

Lowell, Massachusetts |

|

01851 |

| (Address of principal executive offices) |

|

(Zip Code) |

John Croteau

President and Chief Executive Officer

M/A-COM Technology Solutions Holdings, Inc.

(978) 656-2500

(Name and

telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to

indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1—Conflict Minerals Disclosure

| Item 1.01. |

Conflict Minerals Disclosure and Report. |

Conflict Minerals Disclosure

This Form SD is filed by M/A-COM Technology Solutions Holdings, Inc. (the “Company”) pursuant to Rule 13p-1 promulgated under the Securities Exchange

Act of 1934, as amended, for the reporting period from January 1, 2014 to December 31, 2014.

A copy of the Company’s Conflict Minerals

Report is provided as Exhibit 1.01 to this Form SD, and is publicly available at http://www.macom.com/about/sustainability-quality--reliabil.

As specified in Section 2, Item 2.01 of this Form SD, the Company is hereby filing

its Conflict Minerals Report as Exhibit 1.01 to this report.

Section 2—Exhibits

The following exhibit is filed as part of this report.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 1.01 |

|

Conflict Minerals Report of M/A-COM Technology Solutions Holdings, Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by duly authorized

undersigned.

|

|

|

|

|

|

|

|

|

|

|

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC. |

|

|

|

|

| Dated: May 29, 2015 |

|

|

|

By: |

|

/s/ John Croteau |

|

|

|

|

|

|

John Croteau |

|

|

|

|

|

|

President and Chief Executive Officer |

Exhibit 1.01

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

Conflict Minerals Report

For the

reporting period from January 1, 2014 to December 31, 2014 (the “Reporting Period”).

This Conflict Minerals Report (the

“Report”) of M/A-COM Technology Solutions Holdings, Inc. (“we,” “us,” or the “Company”) has been prepared pursuant to Rule 13p-1 and Form SD (the “Conflict Minerals Rule” or simply “the

Rule”) promulgated by the Securities and Exchange Commission, or “SEC,” under the Securities Exchange Act of 1934, as amended, for the reporting period January 1, 2014 to December 31, 2014.

The Conflict Minerals Rule requires disclosure of certain information when a company manufactures, or contracts to manufacture, products for which the

minerals specified in the Rule are necessary to the functionality or production of those products. The specified minerals are gold, columbite-tantalite (coltan), cassiterite and wolframite, including their derivatives tantalum, tin and tungsten

(“3TG”). The “Covered Countries” for the purposes of the Conflict Minerals Rule are the Democratic Republic of the Congo, the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania,

Zambia and Angola. As described in this Report, certain of the Company’s operations manufacture, or contract to manufacture, products for which 3TG are necessary to their functionality or production.

| I. |

Description of the Company’s Products Covered by this Report |

We design, develop and manufacture,

or contract for the manufacture of, high-performance analog RF, microwave, millimeter wave and photonic semiconductor products. At December 31, 2014, we offered more than 3,500 individual standard and custom products including integrated

circuits (IC), multi-chip modules, power pallets and transistors, diodes, switches and switch limiters, passive and active components, Indium Phosphide (InP) high-performance laser semiconductors and complete subsystems, across 43 product lines.

Although a number of acquisitions and divestitures in 2014 resulted in the addition of some product

families1 and the subtraction of others, we believe that substantially all of our products contain one or more of the 3TG, and that those 3TGs are in most cases necessary to their functionality.

| II. |

Summary Results of our Reasonable Country of Origin Inquiry and Due Diligence |

The Company has worked to

identify the 3TGs necessary to the functionality of its products and has developed a process to help identify relevant suppliers and smelters. We have created a Conflict Minerals vendor database to ensure relevant vendors are identified, and we

assess supplier data to ensure traceability throughout the supply chain, so that mineral origin and smelters can be identified. However, our supply chain is complex; we do not purchase 3TG

| 1 |

Pursuant to the Rule, this Report does not cover products from certain companies that we acquired during the last eight months of 2014. |

directly from mines, smelters or refiners, and there are many intervening steps in our supply chain between the original sources of these minerals and our receipt of the materials we use to

manufacture our covered products. We must therefore rely on our suppliers, and their respective suppliers further upstream to provide information regarding the origin of 3TG that are included in our products and engage directly with them in this

regard. We have relied on the EICC-GeSI Conflict Free Sourcing Initiative (or “CFSI”) audits. Based on the results of our inquiries and the EICC-GeSI CFSI audits, we formed a reasonable belief as to certain countries of origin and certain

smelters that are sources of 3TG included in our covered products. This information is set forth in Appendix A to this Conflict Minerals Report.

The

Company utilized the measures discussed below to exercise due diligence on the source and chain of custody of any 3TG used by it for the Reporting Period, which it believes conform to the Due Diligence Guidance for Responsible Supply Chains of

Minerals from Conflict-Affected and High-Risk Areas, or “Due Diligence Guidelines,” of the Organization for Economic Co-operation and Development, or “OECD” (collectively, its “RCOI Analysis”). Despite these efforts, we

were unable to obtain responses sufficient to form the basis for a reasonable belief either that none of the necessary 3TG included in our covered products originated in a Covered Country, or that all such necessary 3TG were from recycled or scrap

sources.

Our due diligence efforts fell into the following categories described in the OECD Due Diligence Guidelines:

Step I: Establish strong management systems;

Step II: Assess risk in the supply chain;

Step III: Design and implement a strategy to respond to identified risk; and

Step IV: Report on supply chain due diligence.

After exercising this due diligence, as described more fully below, we were unable to determine whether any of our covered products qualify as “DRC

conflict free,” or “not DRC conflict free,” as defined under the Conflict Minerals Rule. Accordingly, we concluded that, based on the information currently available to us, each of our covered products manufactured or contracted to be

manufactured in 2014 is “DRC conflict undeterminable.”

| III. |

Our Due Diligence Efforts |

| |

1. |

Establishing a strong Company Management System |

MACOM’s Conflict Minerals Management System has

been designed to incorporate the recommendations made by the OECD guidance as described more particularly below.

Adopt a company policy.

The Company adopted a Conflict Minerals Policy, which is posted on its website http://www.macom.com/about/sustainability-quality--reliabil. This policy

is available to its customers and to the general public.

Structure internal management to support supply chain due diligence.

Senior members of the Company’s management team have been assigned the authority and the responsibility to oversee the Conflict Minerals program and

resources have been made available to implement, support and monitor the operation of the program.

Establish a system of controls and transparency

over the mineral supply chain

The Company developed its Conflict Minerals program to facilitate transparency in its supply chain and ensure adequate

controls over the data returning from the supply chain. We actively review and update our Conflict Minerals data referencing the compliant smelter and refiner lists, as well as the active smelter and refiner lists. We use data obtained through the

CFSI, have systems in place to obtain data from our supply chain and maintain all relevant documents and data for five (5) years.

Strengthen

company engagement with suppliers

Contract language mandating the flow-down of Conflict Minerals-related requirements has been incorporated into our

contract templates for vendor and supplier agreements. We continue to refine our Conflict Minerals training material and reporting requirements. We created and use a dedicated email address to manage all Conflict Minerals supply chain communication.

Conflict Minerals team members interact with our supply chain to ensure the quality of conflict mineral data is continuously improving.

Grievance

Mechanism

Any interested party may use the dedicated Conflict Minerals email address to voice concerns regarding mineral sourcing. Our Conflict

Minerals teams proactively engage when concerns are voiced.

| |

2. |

Identify and assess risk in the supply chain |

As discussed above in Section II, the Company’s

complex supply chain requires that it rely on its suppliers and their respective suppliers further upstream to provide information regarding the origin of 3TG that are included in its products and engage directly with them in this regard. In certain

cases, however, such information was either not forthcoming or appeared to us to be inaccurate or incomplete, and we therefore relied on the EICC-GeSI Conflict Free Sourcing Initiative audits. Based on the results of our inquiries and the EICC-GeSI

CFSI audits, we formed a reasonable belief as to certain countries of origin and certain smelters that are sources of 3TG included in our covered products, which is summarized in Appendix A to this Conflict Minerals Report.

| |

3. |

Design and implement a strategy to respond to identified risks |

Conflict Minerals program findings are

periodically reported to supply chain management and senior management responsible for the oversight of the program. A risk rating system has been developed and each vendor has been assigned a rating dependent on the quality of the data provided. A

risk rating report is communicated to our senior management and to supply chain management with recommended actions. Continuous monitoring of supplier’s Conflict Minerals data and continuous communication with our supply chain allows us to

respond and mitigate risk.

| |

4. |

Report publically on due diligence |

The Company’s Conflict Minerals Policy is reviewed on an annual

basis and made available on the Company’s corporate Internet website. The Company also provides its customers and others with its corporate Conflict Minerals report, along with customer and product-specific reports. As with the instant report,

the Company prepares and submits its Conflict Minerals Report on an annual basis, according to Rule 13p-1 and Form SD, promulgated by the SEC under the Securities Exchange Act of 1934.

| IV. |

Measures to improve our future due diligence |

We expect to take the following steps, among others, to

improve our due diligence measures and to further mitigate the risk that 3TG contained in our products finance or benefit armed groups in the Covered Countries:

| • |

|

Continue to engage with suppliers to obtain current, accurate and complete information about the supply chain; |

| • |

|

Include Conflict Minerals content in supply chain audit procedures; |

| • |

|

Consider the need to encourage suppliers to implement responsible sourcing and to have them encourage smelters and refiners to obtain a “conflict-free” designation from an independent, third-party auditor; and

|

| • |

|

Consider enhancing the integration of our Conflict Minerals policy into our ERP system. |

APPENDIX A

Certain Identified Facilities and Countries of Origin

Based on the results of our due diligence inquiries, we identified certain smelters and countries of origin that we believe are sources of 3TGs included in

our covered products. This information is set forth in the table below.

|

|

|

|

|

| Metal (*) |

|

Smelter Reference List (*) |

|

Smelter Country (*) |

| Gold |

|

Allgemeine Gold-und Silberscheideanstalt A.G. |

|

GERMANY |

| Gold |

|

AngloGold Ashanti Mineração Ltda |

|

BRAZIL |

| Gold |

|

Argor-Heraeus SA |

|

SWITZERLAND |

| Gold |

|

Asahi Pretec Corporation |

|

JAPAN |

| Gold |

|

Aurubis AG |

|

GERMANY |

| Gold |

|

Boliden AB |

|

SWEDEN |

| Gold |

|

Xstrata Canada Corporation |

|

CANADA |

| Gold |

|

Chimet S.p.A. |

|

ITALY |

| Gold |

|

Dowa |

|

JAPAN |

| Gold |

|

Eco-System Recycling Co., Ltd. |

|

JAPAN |

| Gold |

|

Heimerle + Meule GmbH |

|

GERMANY |

| Gold |

|

Heraeus Ltd. Hong Kong |

|

HONG KONG |

| Gold |

|

Heraeus Precious Metals GmbH & Co. KG |

|

GERMANY |

| Gold |

|

Ishifuku Metal Industry Co., Ltd. |

|

JAPAN |

| Gold |

|

Istanbul Gold Refinery |

|

TURKEY |

| Gold |

|

Japan Mint |

|

JAPAN |

| Gold |

|

JM USA |

|

UNITED STATES |

| Gold |

|

Johnson Matthey Canada |

|

CANADA |

| Gold |

|

JX Nippon Mining & Metals Co., Ltd. |

|

JAPAN |

| Gold |

|

Kazzinc Ltd |

|

KAZAKHSTAN |

| Gold |

|

Kennecott Utah Copper LLC |

|

UNITED STATES |

| Gold |

|

Kojima Chemicals Co., Ltd |

|

JAPAN |

| Gold |

|

LS-NIKKO Copper Inc. |

|

KOREA, REPUBLIC OF |

| Gold |

|

Materion |

|

UNITED STATES |

| Gold |

|

Matsuda Sangyo Co., Ltd. |

|

JAPAN |

| Gold |

|

Metalor Technologies (Hong Kong) Ltd |

|

HONG KONG |

| Gold |

|

Metalor Technologies (Singapore) Pte. Ltd. |

|

SINGAPORE |

| Gold |

|

Metalor Switzerland |

|

SWITZERLAND |

| Gold |

|

Metalor USA Refining Corporation |

|

UNITED STATES |

| Gold |

|

Met-Mex Peñoles, S.A. |

|

MEXICO |

| Gold |

|

Mitsubishi Materials Corporation |

|

JAPAN |

| Gold |

|

Mitsui Mining and Smelting Co., Ltd. |

|

JAPAN |

| Gold |

|

Nadir Metal Rafineri San. Ve Tic. A.Ş. |

|

TURKEY |

| Gold |

|

Nihon Material Co. LTD |

|

JAPAN |

| Gold |

|

Ohio Precious Metals, LLC |

|

UNITED STATES |

| Gold |

|

Ohura Precious Metal Industry Co., Ltd |

|

JAPAN |

| Gold |

|

OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” (OJSC Krastvetmet) |

|

RUSSIAN FEDERATION |

| Gold |

|

PAMP SA |

|

SWITZERLAND |

| Gold |

|

PX Précinox SA |

|

SWITZERLAND |

| Gold |

|

Rand Refinery (Pty) Ltd |

|

SOUTH AFRICA |

| Gold |

|

Royal Canadian Mint |

|

CANADA |

| Gold |

|

Schone Edelmetaal |

|

NETHERLANDS |

| Gold |

|

SEMPSA Joyería Platería SA |

|

SPAIN |

| Gold |

|

Solar Applied Materials Technology Corp. |

|

TAIWAN |

| Gold |

|

Sumitomo Metal Mining Co., Ltd. |

|

JAPAN |

| Gold |

|

Tanaka Kikinzoku Kogyo K.K. |

|

JAPAN |

|

|

|

|

|

| Gold |

|

Tokuriki Honten Co., Ltd |

|

JAPAN |

| Gold |

|

Umicore Brasil Ltda |

|

BRAZIL |

| Gold |

|

Umicore SA Business Unit Precious Metals Refining |

|

BELGIUM |

| Gold |

|

United Precious Metal Refining, Inc. |

|

UNITED STATES |

| Gold |

|

Valcambi SA |

|

SWITZERLAND |

| Gold |

|

Western Australian Mint trading as The Perth Mint |

|

AUSTRALIA |

| Gold |

|

C. Hafner GmbH + Co. KG |

|

GERMANY |

| Gold |

|

Shandong Zhaojin Gold & Silver Refinery Co. Ltd |

|

CHINA |

| Gold |

|

YAMAMOTO PRECIOUS METAL CO., LTD. |

|

JAPAN |

| Gold |

|

Yokohama Metal Co Ltd |

|

JAPAN |

| Gold |

|

Almalyk Mining and Metallurgical Complex (AMMC) |

|

UZBEKISTAN |

| Gold |

|

Atasay Kuyumculuk Sanayi Ve Ticaret A.S. |

|

TURKEY |

| Gold |

|

Central Bank of the Philippines Gold Refinery & Mint |

|

PHILIPPINES |

| Gold |

|

Cendres & Métaux SA |

|

SWITZERLAND |

| Gold |

|

FSE Novosibirsk Refinery |

|

RUSSIAN FEDERATION |

| Gold |

|

Inner Mongolia Qiankun Gold and Silver Refinery Share Company Limited |

|

CHINA |

| Gold |

|

Jiangxi Copper Company Limited |

|

CHINA |

| Gold |

|

JSC Ekaterinburg Non-Ferrous Metal Processing Plant |

|

RUSSIAN FEDERATION |

| Gold |

|

JSC Uralectromed |

|

RUSSIAN FEDERATION |

| Gold |

|

Kyrgyzaltyn JSC |

|

KYRGYZSTAN |

| Gold |

|

Moscow Special Alloys Processing Plant |

|

RUSSIAN FEDERATION |

| Gold |

|

OJSC Kolyma Refinery |

|

RUSSIAN FEDERATION |

| Gold |

|

Prioksky Plant of Non-Ferrous Metals |

|

RUSSIAN FEDERATION |

| Gold |

|

PT Aneka Tambang (Persero) Tbk |

|

INDONESIA |

| Gold |

|

SOE Shyolkovsky Factory of Secondary Precious Metals |

|

RUSSIAN FEDERATION |

| Gold |

|

The Great Wall Gold and Silver Refinery of China |

|

CHINA |

| Gold |

|

The Refinery of Shandong Gold Mining Co. Ltd |

|

CHINA |

| Gold |

|

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

|

CHINA |

| Gold |

|

Zijin Mining Group Co. Ltd |

|

CHINA |

| Gold |

|

Asaka Riken Co Ltd |

|

JAPAN |

| Gold |

|

Advanced Chemical Company |

|

UNITED STATES |

| Gold |

|

Aida Chemical Industries Co. Ltd. |

|

JAPAN |

| Gold |

|

Caridad |

|

MEXICO |

| Gold |

|

Chugai Mining |

|

JAPAN |

| Gold |

|

Daejin Indus Co. Ltd |

|

KOREA, REPUBLIC OF |

| Gold |

|

Do Sung Corporation |

|

KOREA, REPUBLIC OF |

| Gold |

|

FAGGI ENRICO SPA |

|

ITALY |

| Gold |

|

Hwasung CJ Co. Ltd |

|

KOREA, REPUBLIC OF |

| Gold |

|

Korea Metal Co. Ltd |

|

KOREA, REPUBLIC OF |

| Gold |

|

Lingbao Jinyuan Tonghui Refinery Co. Ltd. |

|

CHINA |

| Gold |

|

Navoi Mining and Metallurgical Combinat |

|

UZBEKISTAN |

| Gold |

|

Sabin Metal Corp. |

|

UNITED STATES |

| Gold |

|

SAMWON METALS Corp. |

|

KOREA, REPUBLIC OF |

| Gold |

|

Torecom |

|

KOREA, REPUBLIC OF |

| Tantalum |

|

Changsha South Tantalum Niobium Co., Ltd. |

|

CHINA |

| Tantalum |

|

Douluoshan Sapphire Rare Metal Co Ltd |

|

CHINA |

| Tantalum |

|

Exotech Inc. |

|

UNITED STATES |

|

|

|

|

|

| Tantalum |

|

F&X Electro-Materials Ltd. |

|

CHINA |

| Tantalum |

|

Global Advanced Metals |

|

UNITED STATES |

| Tantalum |

|

Global Advanced Metals Boyertown |

|

UNITED STATES |

| Tantalum |

|

Guangdong Zhiyuan New Material Co., Ltd. |

|

CHINA |

| Tantalum |

|

H.C. Starck Co., Ltd. |

|

THAILAND |

| Tantalum |

|

H.C. Starck GmbH Goslar |

|

GERMANY |

| Tantalum |

|

H.C. Starck GmbH Laufenburg |

|

GERMANY |

| Tantalum |

|

H.C. Starck Hermsdorf GmbH |

|

GERMANY |

| Tantalum |

|

H.C. Starck Inc. |

|

UNITED STATES |

| Tantalum |

|

H.C. Starck Ltd. |

|

JAPAN |

| Tantalum |

|

H.C. Starck Smelting GmbH & Co.KG |

|

GERMANY |

| Tantalum |

|

Hengyang King Xing Lifeng New Materials Co., Ltd. |

|

CHINA |

| Tantalum |

|

Hi-Temp |

|

UNITED STATES |

| Tantalum |

|

JiuJiang JinXin Nonferrous Metals Co. Ltd. |

|

CHINA |

| Tantalum |

|

Jiujiang Tanbre Co., Ltd. |

|

CHINA |

| Tantalum |

|

Kemet Blue Powder |

|

UNITED STATES |

| Tantalum |

|

LSM Brasil S.A. |

|

BRAZIL |

| Tantalum |

|

Metallurgical Products India (Pvt.) Ltd. |

|

INDIA |

| Tantalum |

|

Mineração Taboca S.A. |

|

BRAZIL |

| Tantalum |

|

Mitsui Mining & Smelting |

|

JAPAN |

| Tantalum |

|

Molycorp Silmet |

|

ESTONIA |

| Tantalum |

|

Ningxia Orient Tantalum Industry Co., Ltd. |

|

CHINA |

| Tantalum |

|

Plansee |

|

AUSTRIA |

| Tantalum |

|

Plansee SE Liezen |

|

AUSTRIA |

| Tantalum |

|

RFH |

|

CHINA |

| Tantalum |

|

Solikamsk Metal Works |

|

RUSSIAN FEDERATION |

| Tantalum |

|

Taki Chemicals |

|

JAPAN |

| Tantalum |

|

Telex |

|

UNITED STATES |

| Tantalum |

|

Ulba |

|

KAZAKHSTAN |

| Tantalum |

|

Zhuzhou Cement Carbide |

|

CHINA |

| Tin |

|

Alpha |

|

UNITED STATES |

| Tin |

|

CV United Smelting |

|

INDONESIA |

| Tin |

|

Gejiu Non-Ferrous Metal Processing Co. Ltd. |

|

CHINA |

| Tin |

|

Magnu’s Minerais Metais e Ligas LTDA |

|

BRAZIL |

| Tin |

|

Malaysia Smelting Corp |

|

MALAYSIA |

| Tin |

|

Mineração Taboca S.A. |

|

BRAZIL |

| Tin |

|

Minsur |

|

PERU |

| Tin |

|

Mitsubishi Materials Corporation |

|

JAPAN |

| Tin |

|

OMSA |

|

BOLIVIA |

| Tin |

|

PT Babel Inti Perkasa |

|

INDONESIA |

| Tin |

|

PT Bangka Putra Karya |

|

INDONESIA |

| Tin |

|

PT Bangka Tin Industry |

|

INDONESIA |

| Tin |

|

PT Bukit Timah |

|

INDONESIA |

| Tin |

|

PT DS Jaya Abadi |

|

INDONESIA |

| Tin |

|

PT Eunindo Usaha Mandiri |

|

INDONESIA |

| Tin |

|

PT Refined Bangka TIN (RBT) |

|

INDONESIA |

| Tin |

|

PT Sariwiguna Binasentosa |

|

INDONESIA |

|

|

|

|

|

| Tin |

|

PT Stanindo Inti Perkasa |

|

INDONESIA |

| Tin |

|

PT Tambang Timah |

|

INDONESIA |

| Tin |

|

Thailand Smelting and Refining Co. Ltd. |

|

THAILAND |

| Tin |

|

White Solder Metalurgia e Mineração Ltda. |

|

BRAZIL |

| Tin |

|

Yunnan Tin Company, Ltd. |

|

CHINA |

| Tin |

|

Best Metais |

|

BRAZIL |

| Tin |

|

Liuzhou China Tin |

|

CHINA |

| Tin |

|

Cooper Santa |

|

BRAZIL |

| Tin |

|

CV Serumpun Sebalai |

|

INDONESIA |

| Tin |

|

EM Vinto |

|

BOLIVIA |

| Tin |

|

Fenix Metals |

|

POLAND |

| Tin |

|

PT Alam Lestari Kencana |

|

INDONESIA |

| Tin |

|

PT Bangka Kudai Tin |

|

INDONESIA |

| Tin |

|

PT Bangka Timah Utama Sejahtera |

|

INDONESIA |

| Tin |

|

PT Karimun Mining |

|

INDONESIA |

| Tin |

|

PT Mitra Stania Prima |

|

INDONESIA |

| Tin |

|

PT Prima Timah Utama |

|

INDONESIA |

| Tin |

|

PT Tinindo Inter Nusa |

|

INDONESIA |

| Tin |

|

Rui Da Hung |

|

TAIWAN |

| Tin |

|

Soft Metais, Ltda. |

|

BRAZIL |

| Tin |

|

Yunnan Chengfeng Non-ferrous Metals Co.,Ltd. |

|

CHINA |

| Tin |

|

Jean Goldschmidt International |

|

BELGIUM |

| Tin |

|

CNMC (Guangxi) PGMA Co. Ltd. |

|

CHINA |

| Tin |

|

CV Nurjanah |

|

INDONESIA |

| Tin |

|

Gejiu Zi-Li |

|

CHINA |

| Tin |

|

Huichang Jinshunda Tin Co. Ltd |

|

CHINA |

| Tin |

|

Smelter Not Listed |

|

BRAZIL |

| Tin |

|

Kai Unita Trade Limited Liability Company |

|

CHINA |

| Tin |

|

Linwu Xianggui Smelter Co |

|

CHINA |

| Tin |

|

Lübeck GmbH |

|

GERMANY |

| Tin |

|

Metallo Chimique |

|

BELGIUM |

| Tin |

|

Novosibirsk Integrated Tin Works |

|

RUSSIAN FEDERATION |

| Tin |

|

O.M. Manufacturing (Thailand) Co., Ltd. |

|

THAILAND |

| Tin |

|

PT Artha Cipta Langgeng |

|

INDONESIA |

| Tin |

|

PT Babel Surya Alam Lestari |

|

INDONESIA |

| Tin |

|

PT Belitung Industri Sejahtera |

|

INDONESIA |

| Tin |

|

PT BilliTin Makmur Lestari |

|

INDONESIA |

| Tin |

|

PT Fang Di Mul Tindo |

|

INDONESIA |

| Tin |

|

PT HP Metals Indonesia |

|

INDONESIA |

| Tin |

|

PT Koba Tin |

|

INDONESIA |

| Tin |

|

PT Pelat Timah Nusantara Tbk |

|

INDONESIA |

| Tin |

|

PT Sumber Jaya Indah |

|

INDONESIA |

| Tin |

|

PT Yinchendo Mining Industry |

|

INDONESIA |

| Tungsten |

|

Ganzhou Huaxing Tungsten Products Co., Ltd. |

|

CHINA |

| Tungsten |

|

Ganzhou Jiangwu Ferrotungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

Ganzhou Seadragon W & Mo Co., Ltd. |

|

CHINA |

| Tungsten |

|

GTP |

|

UNITED STATES |

|

|

|

|

|

| Tungsten |

|

Hunan Chun-Chang Nonferrous Smelting & Concentrating Co., Ltd. |

|

CHINA |

| Tungsten |

|

Japan New Metals Co Ltd |

|

JAPAN |

| Tungsten |

|

Malipo Haiyu Tungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

Xiamen Tungsten (H.C.) Co., Ltd. |

|

CHINA |

| Tungsten |

|

Xiamen Tungsten Co., Ltd |

|

CHINA |

| Tungsten |

|

Ganzhou Non-ferrous Metals Smelting Co., Ltd. |

|

CHINA |

| Tungsten |

|

H.C. Starck GmbH |

|

GERMANY |

| Tungsten |

|

Kennametal Fallon |

|

UNITED STATES |

| Tungsten |

|

Kennametal Huntsville |

|

UNITED STATES |

| Tungsten |

|

Wolfram Company CJSC |

|

RUSSIAN FEDERATION |

| Tungsten |

|

Chenzhou Diamond Tungsten Products Co., Ltd. |

|

CHINA |

| Tungsten |

|

Dayu Weiliang Tungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

Fujian Jinxin Tungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

Guangdong Xianglu Tungsten Industry Co., Ltd. |

|

CHINA |

| Tungsten |

|

Hunan Chenzhou Mining Group Co |

|

CHINA |

| Tungsten |

|

Tejing (Vietnam) Tungsten Co., Ltd. |

|

VIET NAM |

| Tungsten |

|

A.L.M.T. Corp. |

|

JAPAN |

| Tungsten |

|

Chongyi Zhangyuan Tungsten Co Ltd |

|

CHINA |

| Tungsten |

|

Conghua Tantalum and Niobium Smeltry |

|

CHINA |

| Tungsten |

|

Ganzhou Grand Sea W and Mo Company |

|

CHINA |

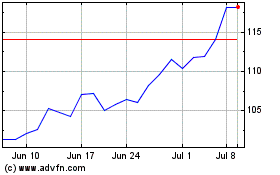

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

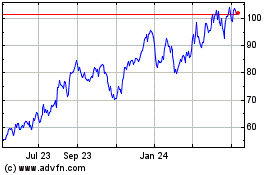

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024