UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 22, 2015

M/A-COM Technology Solutions Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35451 |

|

27-0306875 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 100 Chelmsford Street

Lowell, Massachusetts |

|

01851 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (978) 656-2500

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On April 22, 2015, the Compensation Committee of the Board of Directors of M/A-COM Technology Solutions Holdings, Inc. (the “Company”) approved

grants of time-based restricted stock units (“RSUs”), performance-based RSUs and/or performance-based stock options to certain of the Company’s executive officers under the terms of the Company’s 2012 Omnibus Incentive Plan.

The time-based RSUs will vest and no longer be subject to forfeiture at the rate of 25% on each of May 15, 2016, May 15,

2017, May 15, 2018 and May 15, 2019, assuming continued employment with or services to the Company.

The performance-based RSUs are divided

into three equal tranches with one tranche based on the Company’s non-GAAP earnings per share (“EPS”) growth during fiscal year 2015, one tranche based on EPS growth during fiscal years 2015-2016 and one tranche based on EPS growth

during fiscal years 2015-2017. For each tranche, recipients can earn between 0% to 300% of the target number of performance-based RSUs, depending on actual performance. Once earned, the performance-based RSUs will be settled in shares of the

Company’s common stock, assuming continued employment with or services to the Company.

The performance-based stock options will vest and become

exercisable in full if certain pre-established revenue and non-GAAP gross margin targets are met or exceeded in any four consecutive fiscal quarters completed during the term of the awards. The stock options have a term of seven years, assuming

continued employment with or services to the Company, and have an exercise price equal to the closing price of the Company’s common stock on the date of grant.

Also on April 22, 2015, the Compensation Committee approved an amended and restated Change in Control Plan to exclude the performance-based stock options

granted on the same date from the terms thereof and to increase the percentage by which outstanding performance-based equity awards (other than those specifically excluded) will be deemed earned in the event of a change in control, from 100% of

“target” to 200% of “target”.

The foregoing is a summary of the terms of the equity awards granted on April 22, 2015 and the

amended and restated Change in Control Plan. The forms of award agreements for the equity awards and the amended and restated Change in Control Plan are filed herewith and are incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

|

|

| 10.1 |

|

Form of Restricted Stock Unit Award Agreement under 2012 Omnibus Incentive Plan (Time-Based and Performance-Based). |

|

|

| 10.2 |

|

Form of Nonqualified Stock Option Agreement under 2012 Omnibus Incentive Plan (Performance-Based). |

|

|

| 10.3 |

|

M/A-COM Technology Solutions Holdings, Inc. Change in Control Plan, as amended and restated on April 22, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| |

|

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC. |

|

|

|

|

|

|

|

|

| Dated: April 27, 2015 |

|

By: |

|

/s/ John Croteau |

|

|

|

|

John Croteau |

|

|

|

|

President and Chief Executive Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Form of Restricted Stock Unit Award Agreement under 2012 Omnibus Incentive Plan (Time-Based and Performance-Based). |

|

|

| 10.2 |

|

Form of Nonqualified Stock Option Agreement under 2012 Omnibus Incentive Plan (Performance-Based). |

|

|

| 10.3 |

|

M/A-COM Technology Solutions Holdings, Inc. Change in Control Plan, as amended and restated on April 22, 2015. |

Exhibit 10.1

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

RESTRICTED STOCK UNIT AWARD NOTICE

2012 OMNIBUS INCENTIVE PLAN

(Time-Based and Performance-Based)

M/A-COM Technology Solutions Holdings, Inc. (the “Company”) has granted to you a Restricted Stock Unit Award (the

“Award”). The Award is subject to all the terms and conditions set forth in this Restricted Stock Unit Award Notice (the “Award Notice”), the Restricted Stock Unit Award Agreement and the

Company’s 2012 Omnibus Incentive Plan (the “Plan”), which are either attached hereto or have been made available to you via the Company intranet at http://macomtech/finance/stock/restricted, and which are hereby

incorporated into the Award Notice in their entirety.

|

|

|

|

|

| Participant: |

|

|

|

|

|

|

|

| Grant Date: |

|

|

|

|

|

|

|

| Vesting Commencement Date: |

|

, 20 |

|

|

|

|

|

| Number of Time-Based Restricted Stock Units: |

|

|

|

|

|

|

|

| Target Number of Performance-Based

Restricted Stock Units: |

|

|

|

|

Vesting Schedule for Time-Based Restricted Stock Units: The Time-Based Restricted Stock Units will vest with respect to

the number of Units on the Vesting Dates indicated below:

|

|

|

| Vesting Date |

|

Number of Restricted Stock Units Vesting |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vesting Schedule for Performance-Based Restricted Stock Units: The number of Performance-Based Restricted Stock Units

that become earned and vested (if any) will be determined in accordance with the performance measures, targets and methodology set forth in Exhibit A attached hereto.

Additional Terms/Acknowledgement: You acknowledge receipt of, and understand and agree to, the Award Notice, the Restricted Stock Unit Award Agreement

and the Plan. You further acknowledge that as of the Grant Date, the Award Notice, the Restricted Stock Unit Award Agreement and the Plan set forth the entire understanding between Participant and the Company regarding the Award and supersede all

prior oral and written agreements on the subject.

|

|

|

|

|

| M/A-COM TECHNOLOGY SOLUTIONS

HOLDINGS, INC. |

|

PARTICIPANT |

|

|

|

|

|

| By: |

|

Name: |

|

|

| Its: |

|

Taxpayer ID: |

|

|

| Additional Documents: |

|

Address: |

|

|

| 1. Restricted Stock Unit Award Agreement |

|

|

|

|

| 2. 2012 Omnibus Incentive Plan |

|

|

|

|

| 3. Plan Summary |

|

|

|

|

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

2012 OMNIBUS INCENTIVE PLAN

RESTRICTED STOCK UNIT AWARD AGREEMENT

Pursuant to your Restricted Stock Unit Award Notice (the “Award Notice”) and this Restricted Stock Unit Award Agreement (this

“Agreement”), M/A-COM Technology Solutions Holdings, Inc. (the “Company”) has granted you a Restricted Stock Unit Award (the “Award”) under its 2012 Omnibus Incentive Plan (the

“Plan”) for the number of Time-Based Restricted Stock Units and the target number of Performance-Based Restricted Stock Units indicated in your Award Notice. Capitalized terms not explicitly defined in this Agreement but

defined in the Plan shall have the same definitions as in the Plan.

The details of the Award are as follows:

| 1. |

Vesting and Settlement |

The Award will vest and become payable according to the vesting

schedule set forth in the Award Notice and Exhibit A thereto, as applicable (the “Vesting Schedule”). One share of the Company’s Common Stock will be issuable for each Restricted Stock Unit that vests and

becomes payable. Restricted Stock Units that have vested and are no longer subject to forfeiture according to the Vesting Schedule are referred to herein as “Vested Units.” Restricted Stock Units that have not vested and

remain subject to forfeiture under the Vesting Schedule are referred to herein as “Unvested Units.” The Unvested Units will vest (and to the extent so vested cease to be Unvested Units remaining subject to forfeiture) and

become payable in accordance with the Vesting Schedule (the Unvested and Vested Units are collectively referred to herein as the “Units”). As soon as practicable, but in any event within 30 days, after Unvested Units become

Vested Units, the Company will settle the Vested Units by issuing to you one share of the Company’s Common Stock for each Vested Unit. The Award will terminate and the Units will be subject to forfeiture upon your Termination of Service as set

forth in Section 2.

| 2. |

Termination of Award upon Termination of Service |

Unless the Plan Administrator

determines otherwise prior to your Termination of Service, upon your Termination of Service any portion of the Award that has not vested as provided in Section 1 will immediately terminate and all Unvested Units shall immediately be forfeited

without payment of any further consideration to you.

| 3. |

Securities Law Compliance |

3.1 You represent and warrant that you (a) have

been furnished with a copy of the Plan and all information which you deem necessary to evaluate the merits and risks of receipt of the Award, (b) have had the opportunity to ask questions and receive answers concerning the information received

about the Award and the Company, and (c) have been given the opportunity to obtain any additional information you deem necessary to verify the accuracy of any information obtained concerning the Award and the Company.

3.2 You hereby agree that you will in no event sell or distribute all or any part of the shares of the Company’s Common Stock that

you receive pursuant to settlement of this Award (the “Shares”) unless (a) there is an effective registration statement under the Securities Act and applicable state securities laws covering any such transaction

involving the Shares or (b) the

- 2 -

Company receives an opinion of your legal counsel (concurred in by legal counsel for the Company) stating that such transaction is exempt from registration or the Company otherwise satisfies

itself that such transaction is exempt from registration. You understand that the Company has no obligation to you to maintain any registration of the Shares with the SEC and has not represented to you that it will so maintain registration of the

Shares.

3.3 You confirm that you have been advised, prior to your receipt of the Shares, that neither the offering of the Shares

nor any offering materials have been reviewed by any administrator under the Securities Act or any other applicable securities act (the “Acts”) and that the Shares cannot be resold unless they are registered under the Acts or

unless an exemption from such registration is available.

3.4 You hereby agree to indemnify the Company and hold it harmless from

and against any loss, claim or liability, including attorneys’ fees or legal expenses, incurred by the Company as a result of any breach by you of, or any inaccuracy in, any representation, warranty or statement made by you in this Agreement or

the breach by you of any terms or conditions of this Agreement.

Units shall not be sold, transferred, assigned, encumbered,

pledged or otherwise disposed of, whether voluntarily or by operation of law.

| 5. |

No Rights as Stockholder |

You shall not have voting or other rights as a stockholder of

the Common Stock with respect to the Units.

| 6. |

Independent Tax Advice |

You acknowledge that determining the actual tax consequences to

you of receiving or disposing of the Units and Shares may be complicated. These tax consequences will depend, in part, on your specific situation and may also depend on the resolution of currently uncertain tax law and other variables not within the

control of the Company. You are aware that you should consult a competent and independent tax advisor for a full understanding of the specific tax consequences to you of receiving the Units and receiving or disposing of the Shares. Prior to

executing this Agreement, you either have consulted with a competent tax advisor independent of the Company to obtain tax advice concerning the receipt of the Units and the receipt or disposition of the Shares in light of your specific situation or

you have had the opportunity to consult with such a tax advisor but chose not to do so.

You are ultimately responsible for all taxes arising in connection with

this Award (e.g., at vesting and/or upon receipt of the Shares), including any domestic or foreign tax withholding obligation required by law, whether national, federal, state or local, including FICA or any other social tax obligation (the

“Tax Withholding Obligation”), regardless of any action the Company or any Related Company takes with respect to any such Tax Withholding Obligation that arises in connection with this Award. As a condition to the issuance of

Shares pursuant to this Award, you agree to make arrangements satisfactory to the Company for the payment of the Tax Withholding Obligation that arises upon receipt of the Shares or otherwise. The Company may

- 3 -

refuse to issue any Shares to you until you satisfy the Tax Withholding Obligation. The Company may withhold from the shares otherwise payable to you with respect to your Vested Units the number

of whole shares of the Company’s common stock required to satisfy the minimum applicable Tax Withholding Obligation, the number to be determined by the Company based on the Fair Market Value of the Company’s Common Stock on the date the

Company is required to withhold. The Company may require you to satisfy your Tax Withholding Obligation by instructing and authorizing the Company and the brokerage firm determined acceptable to the Company for such purpose to sell on your behalf a

whole number of Shares from those Shares issuable to you in payment of Vested Units as the Company determines to be appropriate to generate cash proceeds sufficient to satisfy the Tax Withholding Obligation. Notwithstanding the forgoing, to the

maximum extent permitted by law, you hereby grant the Company and any Related Company the right to deduct without notice from salary or other amounts payable to you, an amount sufficient to satisfy the Tax Withholding Obligation.

8.1 Assignment. The Company may assign its forfeiture rights

at any time, whether or not such rights are then exercisable, to any person or entity selected by the Company’s Board of Directors.

8.2 No Waiver. No waiver of any provision of this Agreement will be valid unless in writing and signed by the person against whom such

waiver is sought to be enforced, nor will failure to enforce any right hereunder constitute a continuing waiver of the same or a waiver of any other right hereunder.

8.3 Undertaking. You hereby agree to take whatever additional action and execute whatever additional documents the Company may deem

necessary or advisable in order to carry out or effect one or more of the obligations or restrictions imposed on either you or the Units pursuant to the express provisions of this Agreement.

8.4 Successors and Assigns. The provisions of this Agreement will inure to the benefit of, and be binding on, the Company and its

successors and assigns and you and your legal representatives, heirs, legatees, distributees, assigns and transferees by operation of law, whether or not any such person will have become a party to this Agreement and agreed in writing to join herein

and be bound by the terms and conditions hereof.

8.5 No Employment or Service Contract. Nothing in this Agreement will affect in

any manner whatsoever the right or power of the Company, or a Related Company, to terminate your employment or services on behalf of the Company, for any reason, with or without Cause.

8.6 Relationship Between The Plan And Your Employment. Awards made under the Plan and any profits or gains made as a result of such

Awards are not pensionable under any pension arrangements of the Company or any Related Company. Participation in this Award is a matter entirely separate from any pension right or entitlement which you may have, and from your terms and conditions

of employment. Participation in the Award shall in no respects whatever affect in any way your pension rights (if any), entitlements or terms or conditions of employment, and in particular (but without limiting the generality of the foregoing words)

neither the provisions of the Award Notice, the Plan nor this Agreement shall form part of any contract of employment between you and the Company and/or any Related Company, nor shall it be taken into account for the purpose of calculating any

redundancy or unfair dismissal payment or wrongful dismissal payment, nor shall it confer on you any legal or equitable rights whatsoever against the Company or any Related Company.

- 4 -

Participation in the Plan does not impose upon the Company, any Related Company, the Committee or any of their

representatives, agents and employees any liability whatsoever (whether in contract, tort, or otherwise howsoever) in connection with:

(a) the loss of

your Award(s) under the Plan;

(b) the loss of your eligibility to be granted Award(s) under the Plan; and/or

(c) the manner in which any power or discretion under the Plan is exercised or the failure or refusal of any person to exercise any power or discretion under

the Plan.

8.7 Data Protection. By accepting this Award, you hereby consent to personal information obtained in relation to the

Plan, the Award Notice and this Agreement being handled by the Company, Related Companies and their delegates, agents or affiliates in accordance with applicable law. Information in relation to you will be held, used, disclosed and processed for the

purposes of: (a) managing and administering the Awards you hold under the Plan; (b) complying with any applicable audit, legal or regulatory obligations including, without limitation, legal obligations under company law and anti-money

laundering legislation; (c) disclosure and transfer whether in your country of residence or elsewhere (including companies situated in countries which may not have the same data protection laws as your country of residence) to third parties

including regulatory bodies, auditors and any of their respective related, associated or affiliated companies for the purposes specified above; (d) or for other legitimate business interests of the Company and Related Companies.

- 5 -

EXHIBIT A

(For Performance-Based Restricted Stock Units Granted on ,

20__)

This Exhibit A is applicable to the Performance-Based Restricted Stock Units (“PRSUs”) granted by

M/A-COM Technology Solutions Holdings, Inc. under the 2012 Omnibus Incentive Plan. Capitalized terms not explicitly defined in in this Exhibit A but defined in the Restricted Stock Unit Award Agreement to which this Exhibit A relates shall have the

same definitions as set forth therein.

The number of PRSUs that become earned and vested (if any) will be determined in accordance with

the performance measures, targets and methodology set forth herein.

- 6 -

Exhibit 10.2

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

2012 OMNIBUS INCENTIVE PLAN

STOCK OPTION GRANT NOTICE

(Nonqualified Stock Option)

(Performance-Based)

M/A-COM Technology Solutions Holdings, Inc. (the “Company”) hereby grants to you an Option (the

“Option”) to purchase shares of the Company’s Common Stock under the Company’s 2012 Omnibus Incentive Plan. The Option is subject to all the terms and conditions set forth in this Stock Option Grant Notice (this

“Grant Notice”) and in the Stock Option Agreement and the Plan, which are either attached hereto or have been made available to you via the electronic brokerage account you accessed through www.etrade.com to accept

this Option electronically, and in either case are incorporated into this Grant Notice in their entirety.

|

|

|

|

|

| Participant: |

|

|

|

|

|

|

|

| Grant Date: |

|

|

|

|

|

|

|

| Number of Shares Subject to Option: |

|

|

|

|

|

|

|

| Exercise Price (per Share): |

|

|

|

|

|

|

| Option Expiration Date: |

|

(subject to earlier termination in accordance with the terms of the Plan and the Stock Option

Agreement) |

|

|

| Type of Option: |

|

Nonqualified Stock Option |

|

|

| Vesting and Exercisability Schedule: |

|

|

Additional Terms/Acknowledgement: By accepting this Option electronically through www.etrade.com, you

acknowledge receipt of, and understand and agree to, this Grant Notice, the Stock Option Agreement and the Plan. You further acknowledge that as of the Grant Date, this Grant Notice, the Stock Option Agreement and the Plan set forth the entire

understanding between Participant and the Company regarding the Option and supersede all prior oral and written agreements on the subject. You and the Company hereby agree that your electronic acceptance of this Option through www.etrade.com

is sufficient to legally bind you to the terms set forth collectively in the Grant Notice, the Stock Option Agreement and the Plan. You further acknowledge that as of the Grant Date, this Grant Notice, the Stock Option Agreement and the Plan,

without requirement of any signature on your part.

|

|

|

|

|

|

|

|

|

| M/A-COM TECHNOLOGY SOLUTIONS

HOLDINGS, INC. |

|

|

|

PARTICIPANT |

|

|

|

|

|

|

|

|

|

Signature |

| By: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Its: |

|

|

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attachments: |

|

|

|

Address: |

|

|

|

|

|

|

| 1. Stock Option Agreement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. 2012 Omnibus Incentive Plan |

|

|

|

Tax ID: |

|

|

| 3. Plan Summary |

|

|

|

|

|

|

| 4. Exhibit A |

|

|

-1-

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

2012 OMNIBUS INCENTIVE PLAN

STOCK OPTION AGREEMENT

Pursuant to your Stock Option Grant Notice (the “Grant Notice”) and this Stock Option Agreement (this

“Agreement”), M/A-COM Technology Solutions Holdings, Inc. (the “Company”) has granted you an Option under its 2012 Omnibus Incentive Plan (the “Plan”) to purchase the number of

shares of the Company’s Common Stock indicated in your Grant Notice (the “Shares”) at the exercise price indicated in your Grant Notice. Capitalized terms not defined in this Agreement but defined in the Plan shall have

the same definitions as in the Plan. The Plan shall control in the event there is any express conflict between the Plan and the Grant Notice or this Agreement and with respect to such matters as are not expressly covered in this Agreement.

The details of the Option are as follows:

1. Vesting and Exercisability. Subject to the limitations contained herein, the Option will vest and become exercisable as provided in

your Grant Notice, except that unless otherwise provided in the Grant Notice or this Agreement, vesting will cease upon your Termination of Service and the unvested portion of the Option will terminate.

2. Securities Law Compliance. Notwithstanding any other provision of this Agreement, you may not exercise the Option unless the Shares

issuable upon exercise are registered under the Securities Act or, if such Shares are not then so registered, the Company has determined that such exercise and issuance would be exempt from the registration requirements of the Securities Act. The

exercise of the Option must also comply with other applicable laws and regulations governing the Option, and you may not exercise the Option if the Company determines that such exercise would not be in material compliance with such laws and

regulations.

3. Independent Tax Advice. You should obtain tax advice when exercising the Option and prior to the disposition of

the Shares.

4. Method of Exercise. Subject to the provisions of this Agreement, the vested portion of the Option may be exercised,

in whole or in part, at any time during the term of the Option by giving written notice of exercise to the Company on the form furnished by the Company for that purpose or, to the extent applicable, by written notice to a brokerage firm designated

or approved by the Company, specifying the number of Shares subject to the Option to be purchased, and accompanied by payment of the exercise price and any withholding taxes, or suitable arrangements for such payment satisfactory to the Company.

The exercise price for Shares to be purchased upon exercise of all or a portion of the Option shall be paid in any combination of the

following: (a) in cash, (b) by wire transfer or certified or bank check or other instrument acceptable to the Company; (c) by having the Company withhold shares of Common Stock that would otherwise be issued on exercise of the Option

that have a Fair Market Value on the date of exercise of the Option equal to the exercise

price of the Option; (d) if permitted by the Committee, by tendering shares of Common Stock you already own; and (e) if the Common Stock is registered under the Exchange Act and to the

extent permitted by law, by instructing a broker to deliver to the Company the total payment required, all in accordance with the regulations of the Federal Reserve Board; or (f) by any other method permitted by the Committee.

5. Treatment Upon Termination of Service. The unvested portion of the Option will terminate automatically and without further notice

immediately upon your Termination of Service. You may exercise the vested portion of the Option as follows:

(a) General Rule. You

must exercise the vested portion of the Option on or before the earlier of (i) three months after your Termination of Service and (ii) the Option Expiration Date;

(b) Disability. In the event of your Termination of Service due to Disability, you must exercise the vested portion of the Option on or

before the earlier of (i) one year after your Termination of Service and (ii) the Option Expiration Date.

(c) Death. In

the event of your Termination of Service due to your death, the vested portion of the Option must be exercised on or before the earlier of (i) one year after your Termination of Service and (ii) the Option Expiration Date. If you die after

your Termination of Service but while the Option is still exercisable, the vested portion of the Option may be exercised until the earlier of (x) one year after the date of death and (y) the Option Expiration Date; and

(d) Cause. The vested portion of the Option will automatically expire at the time the Company first notifies you of your Termination of

Service for Cause, unless the Committee determines otherwise. If your employment or service relationship is suspended pending an investigation of whether you will be terminated for Cause, all your rights under the Option likewise will be suspended

during the period of investigation. If any facts that would constitute termination for Cause are discovered after your Termination of Service, any Option you then hold may be immediately terminated by the Committee.

It is your responsibility to be aware of the date the Option terminates.

6. Change in Control. In the event of a Change in Control, the Option will become fully vested and exercisable immediately prior to the

Change in Control and shall terminate at the effective time of the Change in Control.

7. Limited Transferability. During your

lifetime only you can exercise the Option. The Option is not transferable except by will or by the applicable laws of descent and distribution. The Plan provides for exercise of the Option by a beneficiary designated on a Company-approved form or

the personal representative of your estate. Notwithstanding the foregoing and to the extent permitted by Section 422 of the Internal Revenue Code of 1986, the Committee, in its sole discretion, may permit you to assign or transfer the Option,

subject to such terms and conditions as specified by the Committee.

-2-

8. Withholding Taxes. As a condition to the exercise of any portion of an Option, you must

make such arrangements as the Company may require for the satisfaction of any federal, state, local or foreign tax withholding obligations that may arise in connection with such exercise.

9. Option Not an Employment or Service Contract. Nothing in the Plan or this Agreement will be deemed to constitute an employment

contract or confer or be deemed to confer any right for you to continue in the employ of, or to continue any other relationship with, the Company or any Related Company or limit in any way the right of the Company or any Related Company to terminate

your employment or other relationship at any time, with or without Cause.

10. No Right to Damages. You will have no right to bring

a claim or to receive damages if you are required to exercise the vested portion of the Option within three months (one year in the case of Disability or death) of your Termination of Service or if any portion of the Option is cancelled or expires

unexercised. The loss of existing or potential profit in the Option will not constitute an element of damages in the event of your Termination of Service for any reason even if the termination is in violation of an obligation of the Company or a

Related Company to you.

11. Binding Effect. This Agreement will inure to the benefit of the successors and assigns of the Company

and be binding upon you and your heirs, executors, administrators, successors and assigns.

12. Section 409A. Notwithstanding

any provision in the Plan or this Agreement to the contrary, the Committee may, at any time and without your consent, modify the terms of the Option as it determines appropriate to avoid the imposition of interest or penalties under

Section 409A; provided, however, that the Company makes no representations that the Option shall be exempt from or comply with Section 409A and makes no undertaking to preclude Section 409A from applying to the Option.

-3-

EXHIBIT A

-4-

Exhibit 10.3

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

CHANGE IN CONTROL PLAN

Effective as of October 3, 2014

Amended and Restated on April 22, 2015

The Plan is established by M/A-COM Technology Solutions Holdings, Inc., a Delaware corporation, to secure for the benefit of the Company the

services of the participating Employees in the event of a potential or actual Change in Control without concern for whether such Employees might be hindered in discharging their duties by the personal uncertainties and risks associated with a Change

in Control, by affording such Employees the opportunity to protect the share value they have helped create as of the date of any Change in Control and offering income protection to such Employees in the event their employment terminates

involuntarily without Cause or for Good Reason in connection with a Change in Control. All capitalized terms in the Plan have the meaning set forth in Section 2 or as defined elsewhere in the Plan.

| 1. |

Purpose, Establishment and Applicability of Plan. |

1.1 Establishment of

Plan. As of the Effective Date, the Company hereby establishes its Change in Control Plan, as set forth in this document.

1.2

Applicability of Plan. Subject to the terms of the Plan, the benefits provided by the Plan shall be available to those Employees who, on or after the Effective Date, receive a Notice of Participation, pursuant to Section 3.

1.3 Contractual Right to Benefits. The Plan and the Notice of Participation establish and vest in each Participant a contractual right

to the benefits to which he or she is entitled pursuant to the terms and conditions thereof, enforceable by the Participant against the Company.

| 2. |

Definitions and Construction. |

Whenever capitalized in the Plan, the following

terms shall have the meanings set forth below.

2.1 Administrator. “Administrator” shall mean the Board, or its

Compensation Committee or either of their designees, as shall be responsible for administering the Plan.

2.2 Base Salary.

“Base Salary” shall mean an amount equal to the sum of the Participant’s gross monthly base salary, as in effect immediately preceding the Change in Control (and as may have been increased after the date of such Change in Control).

2.3 Board. “Board” shall mean the Board of Directors of the Company.

2.4 Cause. “Cause” shall mean (a) an act of fraud by the Participant in connection with the Participant’s

responsibilities as an Employee; (b) the Participant’s conviction of, or plea of nolo contendere to, a felony, or commission of an act of moral turpitude; (c) the Participant’s gross misconduct; or (d) the Participant’s

material failure to discharge his or her employment duties after having received a written demand for performance from the Company (or notice of misconduct,

1

where applicable) specifying the breach of employment duties and the Participant’s failure to cure such breach (where such breach is curable) within 30 days of the date of such notice from

the Company.

| 2.5 |

Change in Control. “Change in Control” shall mean the occurrence of any of the following events: |

(a) An acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act) (a

“Person”) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of 50% or more of either (i) the then outstanding shares of common stock of the Company (the “Outstanding Company Common

Stock”) or (ii) the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); excluding, however, the

following acquisitions of Outstanding Company Common Stock and Outstanding Company Voting Securities: (1) any acquisition directly from the Company, other than an acquisition by virtue of the exercise of a conversion privilege unless the

security being so converted was itself acquired directly from the Company, (2) any acquisition by the Company, (3) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company, or (4) any

acquisition by any Person pursuant to a transaction that complies with clauses (i), (ii) and (iii) of Section 2.5(c); or

(b) A change in the composition of the Board such that the individuals who, as of the Effective Date, constitute the Board (the

“Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual who becomes a member of the Board subsequent to the Effective Date whose election, or nomination for election by

the Company’s stockholders, was approved by a vote of at least a majority of those individuals who are members of the Board and who were also members of the Incumbent Board (or deemed to be such pursuant to this proviso) shall be considered as

though such individual was a member of the Incumbent Board; but, provided, further, that any such individual whose initial assumption of office occurs as a result of or in connection with an actual or threatened election contest with respect to the

removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board shall not be considered a member of the Incumbent Board; or

(c) The consummation of a reorganization, merger or consolidation or sale or other disposition of all or substantially all of the assets of

the Company (“Business Combination”); excluding, however, such a Business Combination pursuant to which:

(i) all or

substantially all of the individuals and entities who are the beneficial owners, respectively, of the Outstanding Company Common Stock and Outstanding Company Voting Securities immediately prior to such Business Combination shall beneficially own,

directly or indirectly, more than 50% of, respectively, the outstanding shares of common stock, and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of

the corporation resulting from such Business Combination (including, without limitation, a corporation that as a result of such transaction owns the Company or all or substantially all of the Company’s assets) in substantially the same

proportions as their ownership, immediately prior to such Business Combination, of the Outstanding Company Common Stock and Outstanding Company Voting Securities, as the case may be,

2

(ii) no Person (other than any employee benefit plan (or related trust) sponsored or maintained

by the Company or any entity controlled by the Company or such corporation resulting from such Business Combination) shall beneficially own, directly or indirectly, 50% or more of, respectively, the outstanding shares of common stock of the

corporation resulting from such Business Combination or the combined voting power of the outstanding voting securities of such corporation entitled to vote generally in the election of directors, except to the extent that such ownership existed with

respect to the Company prior to the Business Combination, and

(iii) at least a majority of the members of the board of directors of the

corporation resulting from such Business Combination shall have been members of the Incumbent Board at the time of the execution of the initial agreement, or of the action of the Board, providing for such Business Combination.

2.6 Code. “Code” shall mean the Internal Revenue Code of 1986, as amended.

2.7 Company. “Company” shall mean M/A-COM Technology Solutions Holdings, Inc., any successor entities as provided in

Section 8 and any Section 409A Affiliates as defined in Section 10.2(b).

2.8 Disability. “Disability”

shall mean a mental or physical impairment of the Participant that is expected to result in death or that has lasted or is expected to last for a continuous period of 12 months or more and that causes the Participant to be unable to perform his or

her material duties for the Company and to be engaged in any substantial gainful activity, in each case as determined by the Administrator, whose determination shall be conclusive and binding.

2.9 Effective Date. “Effective Date” for purposes of the Plan shall mean the date stated on the first page of the Plan.

2.10 Employee. “Employee” shall mean an employee of the Company.

2.11 ERISA. “ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended.

2.12 Exchange Act. “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

2.13 Good Reason. “Good Reason” shall mean any of the following that occur without the Participant’s express written

consent and that the Company fails to cure within the time frame specified in Section 12.3: (a) the material reduction of the Participant’s authority, duties or responsibilities, or assignment to the Participant of duties, in either

case which results in a material diminution of the Participant’s authority, duties or responsibilities in effect immediately prior to such action; (b) a material reduction in the Participant’s Base Salary; (c) a material

reduction in the Participant’s “target” bonus opportunity, “target” long-term incentive opportunity, or “target” equity incentive opportunity, as determined by taking into account each opportunity in effect

immediately prior to a Change in Control (and as may have been increased after the date of a Change in Control); (d) any action or inaction by the Company that constitutes a material breach by the Company of the Plan; or (e) a change in

the Participant’s geographic work location of over 50 miles from the Participant’s geographic work location immediately prior to such change, except for required travel in furtherance of the Company’s business to the extent consistent

with the Participant’s duties.

3

2.14 Participant. “Participant” shall mean each Employee designated by the

Administrator as a Participant and who signs and returns to the Company a Notice of Participation indicating that such Employee agrees to be a Participant.

2.15 Release. “Release” means a general waiver and release of claims substantially in the form provided to the Participant

together with the Notice of Participation.

2.16 Notice of Participation. “Notice of Participation” shall mean an

individualized written notice of participation in the Plan from an authorized officer of the Company.

2.17 Plan. “Plan”

shall mean the M/A-COM Technology Solutions Holdings, Inc. Change in Control Plan, as set forth herein, together with all amendments hereto.

2.18 Severance Payments. “Severance Payments” shall mean the severance compensation and benefits as provided in

Section 4.

3.1 Release of Claims. As a condition of receiving any

payments or benefits under the Plan, a Participant must sign (and not revoke, if applicable) a Release, which Release must become effective (i.e., the Participant must sign the Release and any revocation period specified therein must have

expired without the Participant revoking the Release) no later than 60 days following the Participant’s termination of employment (or, if earlier, by the date specified in the Release). If the Release does not become effective by the deadline

specified in the immediately preceding sentence, then none of such payments or benefits shall be provided to the Participant.

3.2

Participation in Plan. Each Employee who is designated by the Administrator as a Participant and who signs and returns to the Company a Notice of Participation within the time set forth in such Notice shall be a Participant in the Plan. A

Participant shall cease to be a Participant in the Plan upon ceasing to be an Employee; provided, however, that once a Participant has become entitled to payments and benefits hereunder, he or she shall remain a Participant in the Plan until the

full amount of the payments and benefits has been delivered to the Participant.

4.1 Cash Severance Payments. If, within one year

following a Change in Control, a Participant’s employment is terminated by the Company involuntarily without Cause or by the Participant for Good Reason then, subject to Sections 3.1, 5 and 6, the Participant shall be entitled to receive the

following cash payments:

(a) the cash amount determined in accordance with the Participant’s Notice of Participation; and

(b) an amount equal to that percentage specified in a Participant’s Notice of Participation of the Participant’s annual bonus

potential at “target” rather than “maximum” level of achievement as in effect immediately prior to a Change in Control (and as may have been increased after the date of a Change in Control).

4

4.2 Treatment of Equity Awards. Notwithstanding any provision in the instrument evidencing

an equity award:

(a) If, within one year following a Change in Control, a Participant’s employment is terminated by the Company

involuntarily without Cause or by the Participant for Good Reason then, subject to Sections 3.1, 5 and 6, all then outstanding equity-based awards that become exercisable, vested or payable based solely on continued service granted to the

Participant under any applicable equity compensation plans of the Company as in effect on the date of the Change in Control, whether granted before or after the Effective Date, shall become fully vested and exercisable or payable as of the effective

date of the Participant’s termination; provided, that if an award provides deferred compensation subject to Code Section 409A, such award will be paid at the same time and in the same form as it would have been paid had no Change in

Control occurred.

(b) All outstanding equity-based awards, but excluding the stock options granted by the Company on April 29, 2014

and April 22, 2015, that are eligible to become exercisable, vested or payable (or that provide for accelerated vesting or payment) upon the attainment of specified performance goals granted to the Participant under any applicable equity

compensation plans of the Company as in effect on the date of the Change in Control, whether granted before or after the Effective Date, shall be deemed earned at 200% of “target” immediately prior to the Change in Control and shall be

converted, without proration, into that number of restricted stock units equal to the number of shares that would have been payable had the performance goals been attained at 200% of the “target” performance level, such restricted stock

units to become vested and payable upon completion of the applicable performance period and any further service-based vesting period relating to such award, subject to the Participant’s continued employment; provided, that, subject to

Sections 3.1, 5 and 6, such restricted stock units shall immediately become fully vested and payable if, within one year following a Change in Control, a Participant’s employment is terminated by the Company involuntarily without Cause or

by the Participant for Good Reason; provided further, that if an award provides deferred compensation subject to Code Section 409A, such award will be paid at the same time and in the same form as it would have been paid had no Change in

Control occurred.

(c) For the avoidance of doubt, any unvested equity-based awards shall cease vesting immediately on the date of

Participant’s termination of employment, but shall not terminate until the date on which it is determined whether the Participant is eligible to receive accelerated vesting under this Section 4.2.

4.3 Method of Payment. Any cash Severance Payment to which a Participant becomes entitled pursuant to Section 4.1 shall be paid to

the Participant in a lump sum within 10 days of the effective date of the Participant’s Release. If a Participant dies after becoming eligible for a cash Severance Payment and executing a Release but before payment of the cash Severance

Payment, the cash Severance Payment will be paid to the Participant’s estate in a lump sum within 60 days of the Participant’s death, provided that the Release becomes effective prior to such date. If a Participant dies after becoming

eligible for a cash Severance Payment but before executing a Release, the personal representative of the Participant’s estate shall be permitted to sign a Release on the Participant’s (and the Participant’s estate’s) behalf. All

payments and benefits under the Plan will be net of amounts withheld with respect to taxes, offsets or other obligations.

5

4.4 Voluntary Resignation; Termination for Cause. If (a) the Participant’s

employment terminates by reason of the Participant’s voluntary resignation after a Change in Control other than for Good Reason or (b) the Company terminates the Participant for Cause, then the Participant shall not be entitled to receive

any payments or benefits under the Plan and shall be entitled only to those payments and benefits (if any) as may be available under the Company’s then existing benefit plans and policies at the time of such termination.

4.5 Disability; Death. If the Participant’s employment terminates by reason of the Participant’s death, or in the event the

Company terminates the Participant’s employment following his or her Disability, the Participant shall not be entitled to receive any payments or benefits under the Plan and shall be entitled only to those payments and benefits (if any) as may

be available under the Company’s then existing benefits plans and policies at the time of such termination.

| 5. |

Golden Parachute Excise Tax. |

5.1 Gross-Up Payment. In the event that a

Participant becomes entitled to receive any payment or benefit under the Plan, either alone or when aggregated with any other payments or benefits received (or to be received) by a Participant from the Company (each a “Payment” and,

collectively, the “Total Payments”) and any of the Total Payments will be subject to any excise tax pursuant to Section 4999 of the Code or any similar or successor provision (the “Excise Tax”), the Company shall make an

additional lump-sum cash payment to the Participant (a “Gross-Up Payment”) in an amount such that after payment by the Participant of all taxes (including any interest or penalties imposed with respect to such taxes), including, without

limitation, any income and employment taxes (and any interest and penalties imposed with respect thereto) and Excise Tax imposed upon the Gross-Up Payment, the Participant retains an amount of the Gross-Up Payment equal to the Excise Tax imposed

upon the Total Payments.

5.2 Timing of Payment. A Gross-Up Payment, if any, shall be made by the Company to the Participant

on or within 10 business days of the date that the related Excise Tax on the Total Payments is required to be remitted to the relevant taxing authorities. Notwithstanding anything to the contrary in this Section 5, in no event will a Gross-Up

Payment be made on a day that is later than the last day of the Participant’s taxable year that immediately follows the Participant’s taxable year in which the related Excise Tax on the Total Payments is remitted to the relevant taxing

authorities.

5.3 Determination. Unless the Company and the Participant otherwise agree in writing, any determination required

under this Section 5 or the Participant’s Notice of Participation shall be made in writing by an independent accounting firm appointed by the Company (the “Accountants”), whose determination shall be conclusive and binding upon

the Participant and the Company. For purposes of making the calculations required by Section 5, the Accountants may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith

interpretations concerning the application of Code Sections 280G and 4999. The Company and the Participant shall furnish to the Accountants such information and documents as the Accountants may reasonably request in order to make a

determination under this Section 5. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations pursuant to this Section 5.

6

| 6. |

Forfeiture of Severance Payments. |

The Severance Payments are conditioned on a

Participant’s compliance with the Company’s code of conduct, code of ethics, and any restrictive covenants contained in the Participant’s Release (collectively, the “restrictive covenants”). Notwithstanding any other

provision of the Plan to the contrary, if it is determined by the Company that the Participant has violated any of the restrictive covenants, the Participant shall be required to repay to the Company an amount equal to the economic value of all

payments and benefits already paid or provided to the Participant under the Plan and the Participant (including the Participant’s estate and successors) shall forfeit all other entitlements under the Plan. Additional forfeiture provisions may

apply under the Plan or other agreements between the Participant and the Company, and any such forfeiture provisions shall remain in full force and effect.

| 7. |

Employment Status; Withholding. |

7.1 Employment Status. The Plan does not

constitute a contract of employment or impose on the Participant or the Company any obligations to retain the Participant as an Employee, to change the status of the Participant’s employment, or to change the Company’s policies regarding

termination of employment. The Participant’s employment is and shall continue to be at will, as defined under applicable law.

7.2

Tax Withholdings. All payments and benefits made or provided pursuant to the Plan shall be subject to applicable payroll and income tax withholding and other legally required deductions; provided that the amount so withheld shall not exceed

the minimum amount required to be withheld by law.

| 8. |

Successors to Company and Participants. |

8.1 Company’s Successors.

Any successor to the Company (whether direct or indirect and whether by purchase, lease, merger, consolidation, liquidation or otherwise) or acquiror of all or substantially all of the Company’s business and/or assets shall assume the

obligations under the Plan and agree expressly to perform the obligations under the Plan. For all purposes under the Plan, the term “Company” shall include any successor to the Company or acquiror of the Company’s business and/or

assets pursuant to the terms of an agreement between the Company and such successor or acquiror or by operation of law.

8.2

Participant’s Successors. All rights of the Participant hereunder shall inure to the benefit of, and be enforceable by, the Participant’s personal or legal representatives, executors, administrators, successors, heirs, distributees,

devisees and legatees.

| 9. |

Duration, Amendment and Termination. |

9.1 Duration. The Plan shall

terminate 3 years from the Effective Date, unless (a) the Plan is extended by the Administrator, (b) a Change in Control occurs while the Plan is in effect, or (c) the Administrator terminates the Plan in accordance with

Section 9.2 below. If a Change in Control occurs prior to termination of the Plan pursuant to the preceding sentence, then the Plan shall terminate upon the date that all obligations of the Company hereunder have been satisfied.

7

9.2 Amendment and Termination. The Administrator shall have the discretionary authority to

amend the Plan in any respect, including as to the removal or addition of Participants, or to terminate or suspend the Plan, by resolution adopted by a majority of the Administrator; provided, however, that with respect to any Participant that has

been designated by the Administrator as a Participant and has signed and returned to the Company a Notice of Participation indicating that such Employee has agreed to be a Participant, no such amendment, termination or suspension of the Plan shall

be effective as to such Participant unless (a) the Participant would not be adversely affected in any way by such amendment, termination or suspension or (b) the Participant consents in writing to such amendment, termination or suspension.

10.1 Power and Authority. The Administrator has all power

and authority necessary or convenient to administer the Plan, including, but not limited to, the exclusive authority and discretion: (a) to construe and interpret the Plan; (b) to decide all questions of eligibility for and the amount of

benefits under the Plan; (c) to prescribe procedures to be followed and the forms to be used by the Participants pursuant to the Plan; and (d) to request and receive from all Participants such information as the Administrator determines is

necessary for the proper administration of the Plan.

10.2 Code Section 409A. The provisions for Code Section 409A shall

be applied as follows:

(a) The Company makes no representations or warranties to any Employee with respect to any tax, economic or legal

consequences of the Plan or any payments to any Participant hereunder, including, without limitation, under Code Section 409A, and no provision of the Plan shall be interpreted or construed to transfer any liability for failure to comply with

Code Section 409A or any other applicable legal requirements from the Participant or other individual to the Company or any of its affiliates. Each Participant, by executing a Notice of Participation, shall be deemed to have waived any claim

against the Company and its affiliates with respect to any such tax, economic or legal consequences. However, the payments and benefits provided under the Plan are not intended to constitute deferred compensation that is subject to the requirements

of Code Section 409A. Rather, the Company intends that the Plan and the payments and other benefits provided hereunder be exempt from the requirements of Code Section 409A, whether pursuant to the short-term deferral exception described in

Treas. Reg. § 1.409A-1(b)(4), the involuntary separation pay plan exception described in Treas. Reg. § 1.409A-1(b)(9)(iii) or otherwise.

Notwithstanding any provision of the Plan to the contrary, the Plan shall be interpreted, operated and administered in a manner consistent with such intention;

(b) Without limiting the generality of the foregoing, and notwithstanding any other provision of the Plan to the contrary, all references

herein to a Participant’s termination of employment are intended to mean the Participant’s “separation from service” from the Company and its Section 409A Affiliates within the meaning of Code Section 409A.

“Section 409A Affiliates” means each entity that is required to be included in the Company’s controlled group of corporations within the meaning of Code Section 414(b) or (c); provided, however, that the phrase “at least 50

percent” shall be used in place of the phrase “at least 80 percent” each place it appears therein or in the regulations thereunder;

8

(c) If the Company determines that any of the payments or benefits under the Plan constitute

“deferred compensation” under Code Section 409A and the Participant is, on the date of his or her termination of employment, a “specified employee” of the Company, as such term is defined in Code

Section 409A(a)(2)(B)(i), then, solely to the extent necessary to avoid the incurrence of the adverse personal tax consequences under Code Section 409A, the timing of the payment of such pay or benefits shall be delayed until the earlier

to occur of the date that is six months and one day after the Participant’s termination of employment or the date of the Participant’s death after the Participant’s termination of employment;

(d) To the extent that any reimbursement under Section 4 is deemed to constitute taxable compensation to a Participant, such

reimbursement will be made no later than December 31 of the year following the year in which the expense was incurred. The amount of any such reimbursement provided in one year shall not affect the expenses eligible for reimbursement in any

subsequent year, and the Participant’s right to such reimbursement will not be subject to liquidation or exchange for any other benefit; and

(e) If any payments or benefits under the Plan would violate the terms of Section 16(b) of the Exchange Act or other federal securities

laws, or any other applicable law, then the payment or the provision of such payments or benefits shall be delayed until the earliest date on which making such payment or providing such benefit would not violate such law.

11.1 Claim for Benefits. A Participant (or any individual

authorized by such Participant) has the right under ERISA and the Plan to file a written claim for benefits. To file a claim, the Participant must send the written claim to the Company’s Vice President of Human Resources. If such claim is

denied in whole or in part, the Participant shall receive written notice of the decision of the Company’s Vice President of Human Resources within 90 days after the claim is received. Such written notice shall include the following information:

(a) specific reasons for the denial; (b) specific reference to pertinent Plan provisions on which the denial is based; (c) a description of any additional material or information necessary for the perfection of the claim and an

explanation of why it is needed; and (d) steps to be taken if the Participant wishes to appeal the denial of the claim, including a statement of the Participant’s right to bring a civil action under Section 502(a) of ERISA upon an

adverse decision on appeal. If the Company’s Vice President of Human Resources needs more than 90 days to make a decision, he or she shall notify the Participant in writing within the initial 90 days and explain why more time is required, and

how long is needed. If a Participant (or any individual authorized by such Participant) submits a claim according to the procedures above and does not hear from the Company’s Vice President of Human Resources within the appropriate time, the

Participant may consider the claim denied.

11.2 Appeals. The following appeal procedures give the rules for appealing a denied

claim. If a claim for benefits is denied, in whole or in part, or if the Participant believes benefits under the Plan have not been properly provided, the Participant (or any individual authorized by such Participant) may appeal this denial in

writing within 60 days after the denial is received by filing a written request for review with the Administrator. The Administrator shall conduct a

9

review and make a final decision within 60 days after receiving the Participant’s written request for review. If the Administrator needs more than 60 days to make a decision, it shall notify

the Participant in writing within the initial 60 days and explain why more time is required and the date by which the Administrator expects to render its decision. The Administrator may then take 60 more days to make a decision. If such appeal is

denied in whole or in part, the decision shall be in writing and shall include the following information: (a) specific reasons for the denial; (b) specific reference to pertinent Plan provisions on which the denial is based; (c) a

statement of the Participant’s right to access and receive copies, upon request and free of charge, of all documents and other information relevant to such claim for benefits; and (d) a statement of the Participant’s (or

representative’s) right to bring a civil action under Section 502(a) of ERISA. If the Administrator does not respond within the applicable time frame, the Participant may consider the appeal denied. If a Participant’s claim is denied,

in whole or in part, the Participant (or any individual authorized by such Participant) will be provided, upon request and free of charge, reasonable access to, and copies of, all documents, records and other information relevant (within the meaning

of 29 C.F.R. § 2560.503-1(m)(8)) to his or her claim. Likewise, a Participant (or any individual authorized by such Participant) who submits a written request to appeal a denied claim shall have the right to submit any comments, documents,

records or other information relating to the claim that he or she wishes to provide.

11.3 Limitations Period. A Participant must

pursue the claim and appeal rights described above within 365 days following the date of which the Participant knew of should have known that the benefits in dispute would not be paid under the Plan. The Participant must exhaust the claim and

appeals rights described above before seeking any other legal recourse regarding a claim for benefits. The Participant may thereafter file an action in a court of competent jurisdiction, but he or she must do so within 365 days after the date of the

notice of decision on appeal or such action will be forever barred. Any judicial review of the Administrator’s decision on a claim will be limited to whether, in the particular instance, the Administrator abused its discretion. In no event will

such judicial review be on a de novo basis, because the Administrator has discretionary authority to determine eligibility for (and the amount of) payments and benefits under the Plan and to construe and interpret the terms and provisions of the

Plan.

| 12. |

Notices and Assignment. |

12.1 General. Notices and all other

communications contemplated by the Plan shall be in writing and shall be deemed to have been duly given when personally delivered or when mailed by U.S. registered or certified mail, return receipt requested and postage prepaid. In the case of the

Participant, mailed notices shall be addressed to him or her at the home address that he or she most recently communicated to the Company in writing. In the case of the Company, mailed notices shall be addressed to its corporate headquarters, and

all notices shall be directed to the attention of its Vice President of Human Resources.

12.2 Notice of Termination by the

Company. Any termination of employment by the Company in connection with a Change in Control pursuant to the terms herein shall be communicated by a notice of termination of employment to the Participant at least five days prior to the date of

such termination (or at least 30 days prior to the date of a termination by reason of the Participant’s Disability). Such notice shall indicate the specific termination provision or provisions in the Plan relied upon (if any), shall set forth

in reasonable detail the facts and circumstances claimed to provide a basis for termination under the provision or provisions so indicated, and shall specify the termination date.

10

12.3 Notice of Good Reason Termination by the Participant. For purposes of the Plan, a

Participant’s termination of employment shall be for Good Reason only if (a) the Participant delivers written notice to the Company of the existence of the condition which the Participant believes constitutes Good Reason within

90 days of the initial existence of such condition (which notice specifically identifies such condition), (b) the Company fails to remedy such condition within 30 days after the date on which it receives such notice (the “Good

Reason Cure Period”), and (c) the Participant actually terminates employment with the Company within 90 days after the expiration of the Good Reason Cure Period. If the Company fails to remedy the condition constituting Good Reason during

the Good Reason Cure Period and the Participant decides to terminate his or her employment for Good Reason, then the Participant shall provide the Company with written notice of such intent to terminate. Subject to the first sentence of this

Section 12.3, any such termination shall be effective on the date such notice of termination is given to the Company or on such later date specified therein.

12.4 Assignment by Company. The Company may assign its rights under the Plan to an affiliate, and an affiliate may assign its rights

under the Plan to another affiliate of the Company or to the Company. In the case of any such assignment, the term “Company” when used in the Plan shall mean the entity that actually employs the Participant.

13.1 Governing Law, Jurisdiction and Venue. The Plan is

intended to be, and shall be interpreted as, an unfunded employee welfare benefit plan (within the meaning of Section 3(1) of ERISA) for a select group of management or highly compensated employees (within the meaning of 29 C.F.R.

§2520.104-24) and it shall be enforced in accordance with ERISA. Any Participant or other Person filing an action related to the Plan shall be subject to the jurisdiction and venue of the federal courts of the State of Delaware.

13.2 Employment Status. Except as may be provided under any other agreement between a Participant and the Company, the employment of

the Participant by the Company is “at will” and may be terminated by either the Participant or the Company at any time, subject to applicable law.

13.3 Indebtedness of Participant. If a Participant is indebted to the Company, the Company reserves the right to offset any Severance

Payments by the amount of such indebtedness, to the full extent permitted by applicable law; provided that such offset is structured in a manner intended to comply with Code Section 409A.

13.4 Severability. In the event any provision of the Plan shall be held illegal or invalid for any reason, the illegality or invalidity

shall not affect the remaining parts of the Plan, and the Plan shall be construed and enforced as if the illegal or invalid provision had not been included. Further, the captions of the Plan are not part of the provisions hereof and shall have no

force and effect.

13.5 Effect of Plan. The Plan, as amended, shall completely replace and supersede any prior version of the Plan

and any other verbal or written promise, agreement, document or communication concerning the payments or benefits under the Plan. Without limiting the generality of the foregoing, effective immediately upon delivery by the Participant of a signed

Notice of

11

Participation, the Participant (a) thereby waives, without need of any further agreement or action, any potential rights the Participant may have to severance pay, equity acceleration or

other benefits specifically arising from or in respect of a Change in Control occurring during the term of the Plan (including any such potential rights arising from any verbal or written promise, offer letter, employment agreement, other agreement,

document, or communication between the Participant and the Company or pre-existing practice of the Company with respect to such benefits, but expressly excluding any rights to benefits arising from the Plan), and (b) thereby agrees that, if the

Participant has an existing agreement with the Company relating to potential rights to severance pay, equity acceleration or other benefits specifically arising from or in respect of a Change in Control, those rights shall be deemed completely

replaced and superseded by the Participant’s rights under the Plan with respect to any Change in Control occurring during the term of the Plan; provided that, except as specifically modified (mutatis mutandis) by the foregoing subsection (b),

such agreement shall remain enforceable and in full force and effect. In addition, none of the payments or benefits under the Plan shall be counted as “compensation” or any equivalent term for purposes of determining benefits under other

plans, programs or practices owing to the Participant from the Company, except to the extent expressly provided therein. Except as otherwise specifically provided for in the Plan, the Participant’s rights under all such agreements, plans,

provisions and practices continue to be subject to the respective terms and conditions thereof.

12

M/A-COM TECHNOLOGY SOLUTIONS HOLDINGS, INC.

CHANGE IN CONTROL PLAN

NOTICE OF PARTICIPATION

To:

The Administrator has designated you as a Participant in the Plan, a copy of which is

attached hereto. The terms and conditions of your participation in the Plan are as set forth in the Plan and herein. The terms defined in the Plan shall have the same defined meanings in this Notice of Participation. As a condition of receiving any

payments or benefits under the Plan, you must sign (and not revoke, if applicable) a Release substantially in the form provided to you together with this Notice of Participation, which Release must become effective (i.e., you must sign the

Release and any revocation period specified therein must have expired without you revoking the Release) no later than 60 days following your termination of employment (or, if earlier, by the date specified in the Release).

As provided in Section 4.1 of the Plan, the following terms apply to your participation in the Plan:

(a) Cash Amount: (A) [12 times][6 times] your monthly Base Salary, plus (B) $[25,000][12,500].

(b) Percentage of Annual Bonus Potential at Target: [100%][50%]

If you agree to participate in the Plan on these terms and conditions, please acknowledge your acceptance by signing below. Also by signing

below, you acknowledge and agree that the payments and benefits under the Plan are subject to forfeiture or repayment in certain cases if you have violated the Company’s code of conduct or code of ethics or any restrictive covenants contained

in your Release.

Please return the signed copy of this Notice of Participation within 10 days of the date set forth above to:

|

|

|

|

|

|

|

M/A-COM Technology Solutions Holdings, Inc.

Attn: Vice President of Human Resources 100 Chelmsford Street

Lowell, MA 01851 |

|

|

Your failure to timely remit this signed Notice of Participation will result in your immediate removal from

the Plan. Please retain a copy of this Notice of Participation, along with the Plan, for your records.

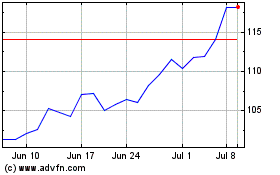

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

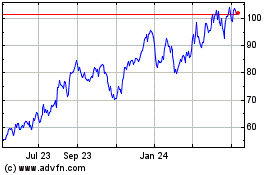

MACOM Technology Solutions (NASDAQ:MTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024