Lyft Hails Deal Makers -- WSJ

June 28 2016 - 3:03AM

Dow Jones News

Banker Qatalyst Partners has begun contacting auto makers about

a deal

By Douglas MacMillan

Ride-hailing startup Lyft Inc. hired Qatalyst Partners LP, the

boutique investment bank best known for helping tech companies find

a buyer, according to people familiar with the matter.

Frank Quattrone, the founder and executive chairman of Qatalyst,

has contacted companies including large auto makers about acquiring

a stake in Lyft, the people said. It isn't clear whether Lyft is

aiming to sell itself or raise new funding.

Lyft, the largest U.S. rival to Uber Technologies Inc., has

tried to keep up with its larger competitor as both companies burn

through capital to expand their ride-hailing services. The two San

Francisco companies pour millions of dollars into subsidizing

low-price rides and giving cash bonuses to new drivers, and both

Uber and Lyft have said such spending has put them on a path to

profitability.

Lyft has raised about $2 billion in funding, or less than

one-sixth the total funds raised by Uber. Lyft was last valued at

$5.5 billion by investors including auto maker General Motors

Co.

Hiring Qatalyst, one of the most active Silicon Valley deal

makers, may signal Lyft is open to a sale. Qatalyst ranks fourth

this year among banks advising on U.S. acquisitions, working on

deals totaling $33.7 billion, according to data provider Dealogic.

Those deals include a coveted role advising LinkedIn Corp. on its

$26 billion sale to Microsoft Corp., announced two weeks ago.

One potential buyer may be General Motors, which paid $500

million for a 10% stake in Lyft earlier this year and indicated

that the ride-hailing service could be crucial to the future of

automobiles. The two companies have since agreed to develop

self-driving cars and to offer deals on rental cars to Lyft

drivers.

Technology M&A may be due for an uptick this year, as highly

valued startups find it more difficult to raise funds from venture

capitalists. Marc Andreessen, whose firm Andreessen Horowitz is an

investor in Lyft, said at the Bloomberg Technology Conference

earlier this month that more firms are considering or negotiating a

merger than any time in the past four years.

So far this year, there have been at least $260 billion of tech

deals announced globally, according to Dealogic data. That is the

second-fastest pace ever for the period, after 2000. Technology is

the busiest sector for M&A this year, as it was in 2015, the

data show.

The growing popularity of ride-hailing has attracted several of

the biggest auto makers and tech companies. In May alone, Apple

Inc. said it invested $1 billion in Chinese startup Didi Chuxing;

Volkswagen AG bet $300 million on Israeli company Gett; and Toyota

Motor Corp. made an investment in Uber. Alphabet Inc., a leader in

self-driving cars, is testing its own carpooling service with its

employees in San Francisco.

Lyft has in recent months joined with Didi Chuxing and two other

Asian ride-hailing services in an effort to help each other compete

with Uber in their respective countries. Both companies share a

common investor in Chinese internet company Alibaba Group Holding

Ltd.

Mr. Quattrone, one of the prominent IPO bankers during the

dot-com boom, started San Francisco-based Qatalyst in 2008. In

January, Mr. Quattrone stepped down from his role as chief

executive, handing that title to his longtime partner, George

Boutros.

--Maureen Farrell and Gautham Nagesh contributed to this

article.

Write to Douglas MacMillan at douglas.macmillan@wsj.com

(END) Dow Jones Newswires

June 28, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

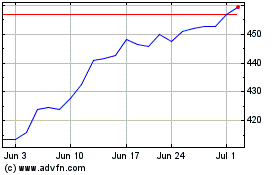

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

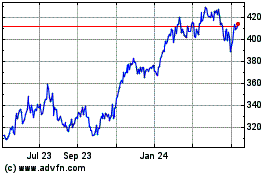

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024