Current Report Filing (8-k)

October 03 2016 - 9:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 3, 2016

MARVELL TECHNOLOGY GROUP LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Bermuda

|

|

0-30877

|

|

77-0481679

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Canon’s Court

22 Victoria Street

Hamilton HM 12

Bermuda

(Address of principal executive offices)

(441) 296-6395

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On October 3, 2016, Marvell Technology Group Ltd. (the

“Company”) announced that David Caron has been appointed Senior Vice President, Chief Accounting Officer and Corporate Controller, effective immediately. He will serve as the Company’s principal accounting officer. For the past five

years, Mr. Caron, 56, served as Vice President, Corporate Controller and principal accounting officer at Maxim Integrated. The Company’s press release announcing Mr. Caron’s appointment is attached as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated by reference herein.

Mr. Caron has no direct or indirect material interest in any transaction

required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with his appointment, the Company entered

into a letter agreement with Mr. Caron (the “Offer Letter”) that established his compensation, as summarized below.

Salary; Annual Incentive Bonus; Sign-on Bonus

. Mr. Caron’s annual base salary will be $375,000, and he will be eligible to

participate in the Company’s Performance Rewards Program with a target annual incentive bonus of 50% of his annual base salary. Mr. Caron will be paid a sign-on bonus of $200,000 which is subject to repayment and other conditions in the

event of his resignation within twelve months of his date of employment or his termination for Cause, as further described in the Offer Letter.

Equity Awards

. Mr. Caron will receive grants of restricted stock units (“RSUs”) for the number of shares of Marvell

common stock, as follows:

|

|

1.

|

RSUs for the number of shares of common stock equal to $225,200 shall vest over three (3) years at the rate of 33% after the first anniversary of the vesting start date, 33% after the second anniversary of the

vesting start date and 34% after the third anniversary of the vesting start date.

|

|

|

2.

|

RSUs for the number of shares of common stock (at the target achievement level) equal to $168,900 shall vest based on the relative total shareholder return of Marvell’s stock as compared to the total shareholder

return of comparable companies of the Philadelphia Semiconductor Sector Index over a three-year performance period measured from August 11, 2016 through fiscal 2019, as further described in the Offer Letter.

|

|

|

3.

|

RSUs for the number of shares of common stock equal to $168,900 shall vest based on the achievement of operating performance metrics for fiscal years 2017 and 2018, as further described in the Offer Letter.

|

Buy-Out Awards

. In addition to the grants of RSUs set forth above, Mr. Caron will be granted the following

equity awards in acknowledgment of his existing unvested equity position that was forfeited upon termination of his prior employment:

|

|

1.

|

RSUs for the number of shares of common stock equal to $250,000 shall vest over three (3) years at the rate of 33% after the first anniversary of the vesting start date, 33% after the second anniversary of the

vesting start date and 34% after the third anniversary of the vesting start date. The RSUs will vest in full in the event the Company terminates Mr. Caron’s employment without Cause (as defined in the Offer Letter) within two years of

his date of employment.

|

|

|

2.

|

RSUs for the number of shares of common stock equal to $250,000 shall vest based on the relative total shareholder return of Marvell’s stock as compared to the total shareholder return of comparable companies of

the Philadelphia Semiconductor Sector Index over a three-year performance period, as further described in the Offer Letter. The RSUs vest in whole or in part as further described in the Offer Letter, in the event the Company terminates

Mr. Caron’s employment without Cause (as defined in the Offer Letter) within two years of his date of employment.

|

Change in Control.

Mr. Caron will be designated a “Tier 3” participant in

the Company’s Change in Control Severance Plan (“CIC Plan”) in the form attached as Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on June 20, 2016.

The foregoing description of the Offer Letter is qualified in its entirety by reference to the full text of the Offer Letter filed as Exhibit

10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

10.1

|

|

Offer Letter between the Company and David Caron

|

|

|

|

|

99.1

|

|

Press Release dated October 3, 2016

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

Dated: October 3, 2016

|

|

|

|

|

MARVELL TECHNOLOGY GROUP LTD.

|

|

|

|

|

By:

|

|

/s/ Mitchell Gaynor

|

|

|

|

Mitchell Gaynor

|

|

|

|

EVP, Chief Legal Officer and Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Offer Letter between the Company and David Caron

|

|

99.1

|

|

Press Release dated October 3, 2016

|

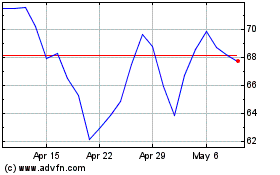

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Apr 2023 to Apr 2024