China's Tsinghua Discloses Investment in Marvell Technology

May 13 2016 - 4:40PM

Dow Jones News

China's Tsinghua Holdings Co. has disclosed an unspecified

investment in Marvell Technology Group Ltd., a Silicon Valley chip

maker that recently replaced its leadership team in the wake of an

accounting investigation and other problems.

Tsinghua Holdings reported the investment in a terse filing with

the Federal Trade Commission, which is required under antitrust

laws for transactions beyond a certain size. The FTC's threshold

for reporting proposed mergers and acquisitions subject to

antitrust enforcement is $78.2 million.

Companies that acquire a stake of more than 5% in publicly

traded U.S. companies are required to file a disclosure with the

Securities and Exchange Commission. Tsinghua Holdings has not done

so; its representatives could not be reached.

A spokesman for Marvell said it did not know the size of the

Tsinghua Holdings investment. "As far as we are concerned, they are

a shareholder for investment purposes," he said, declining

additional comment.

The FTC filing is the latest sign of interest in the U.S.

semiconductor industry by investors in China, where government

officials have been prodding companies to build a domestic industry

to reduce a reliance on foreign-made chips.

Tsinghua Holdings, a Chinese state-owned company affiliated with

Tsinghua University, has been among the most active investors. One

of the company's affiliates, Tsinghua Unigroup Ltd., according to

people familiar with the matter, last summer considered a $23

billion deal to buy Micron Technology Inc. but decided not to

proceed amid signs that the deal would be blocked by U.S.

regulators.

In February, a Tsinghua Unigroup unit backed out of a $3.78

billion deal to purchase 15% of disk drive maker Western Digital

Corp., citing a decision by an intergovernmental group called the

Committee on Foreign Investment in the U.S., or called CFIUS, to

investigate the transaction on national security grounds.

In April, Tsinghua Unigroup disclosed a 6% stake in Lattice

Semiconductor Corp. that it said it acquired in open-market stock

transactions for investment purposes only. It has increased that

stake to 8.65%, according to a May 6 filing with the Securities and

Exchange Commission.

Lawyers who have worked with CFIUS say it typically does not

review transactions that do not result in an investor gaining a

board seat or otherwise take a controlling position in a target

company. Lattice representatives have declined to comment.

Marvell, based in Santa Clara, Calif., is a 20-year-old company

known for chips used in disk drives and networking. In early April,

the company's board fired Chief Executive Sehat Sutardja and

President Weili Dai, the husband-and-wife team that founded the

company.

Timothy Arcuri, an analyst with Cowen & Co., has predicted

that a management change would pave the way for a sale of some or

all Marvell. He expressed doubts in an interview on Friday that

U.S. regulators would approve the Chinese purchase of all of

Marvell, but a partial sale might be allowed.

"This thing is absolutely ripe for China to come in," he

said.

The firing of Marvell's longtime leaders, who remain directors,

followed an accounting investigation by a board audit committee

that identified "tone at the top" problems, including significant

management pressure on sales and finance personnel to meet revenue

targets.

Marvell later named a slate of new directors backed by activist

investor Starboard Value LP, which took a 6.7% stake in Marvell.

Richard Hill, an industry veteran who is former chief executive of

Novellus Systems Inc., was named chairman. The company has launched

a search for a permanent chief executive.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

May 13, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

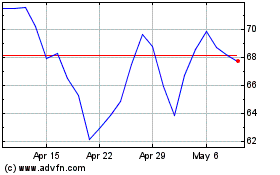

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Apr 2023 to Apr 2024