Starboard Says Depomed Should Consider Selling Itself

April 08 2016 - 10:50AM

Dow Jones News

Starboard Value LP said Depomed Inc. should consider selling

itself in a letter to the pharmaceutical company's board a day

after disclosing a stake in the maker of pain drugs.

The activist investor owns about 6 million shares, or about 9.8%

of Depomed's stock outstanding, when including certain financial

agreements.

"We acquired our position in Depomed because we believe that the

company is substantially undervalued and opportunities exist to

create significant value for shareholders," wrote Jeffrey Smith,

Starboard's chief executive.

Opportunities include improved capital deployment, rationalized

research and development, and a potential sale of the company, he

said.

Depomed responded Friday by saying it "welcomes open

communications with its shareholders and values constructive

input." According to the company, Starboard didn't communicate with

it before revealing its stake Thursday and "has not attempted to

hold any discussions" with Depomed.

Depomed said its board recommends shareholders take no action at

this time.

The New York hedge fund said it would nominate a slate of

candidates to the company's board. In the letter, Starboard accused

the company of suppressing shareholder rights, poor corporate

governance and mishandling the takeover offer from Horizon Pharma

PLC. The firm also called Depomed's continuing lawsuit against

Horizon ill-advised.

"These concerns lead us to believe that management and the board

may be more interested in entrenching themselves than in delivering

maximum value for all shareholders," Mr. Smith said in the letter,

which noted that Depomed's stock had fallen 56%, through Thursday,

from its high in July.

Friday, shares of Depomed rose 19% to $17.84. Depomed

specializes in products that treat pain and central nervous system

disorders.

Depomed is the latest company to come under Starboard's assault.

The hedge fund is embroiled in a proxy fight with Yahoo Inc., has

pushed Macy's Inc. to shed the retailer's real estate holdings and

has taken a stake in Marvell Technology Group Ltd. The firm also

overthrew the board at Darden Restaurants Inc.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 08, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

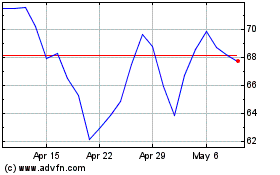

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marvell Technology (NASDAQ:MRVL)

Historical Stock Chart

From Apr 2023 to Apr 2024