Texas Instruments Gains Analog Leverage With National Semi Buy

April 05 2011 - 1:40PM

Dow Jones News

Texas Instruments Inc.'s (TXN) pricey $6.5 billion deal to buy

National Semiconductor Corp. (NSM) strengthens the company's analog

chip holdings, but questions remain as to how disruptive the merged

entity will be to the $42 billion analog market.

The deal adds 12,000 products to Texas Instruments' analog

business, which will now represent more than half of the company's

revenue. The combination of National Semiconductor will enable TI

to compete better in areas that it is currently not strong, such as

industrial power management, which comprises about half the total

analog market, according to one research firm.

"Analog and particularly analog catalog portfolios take a long

time to build," said Texas Instruments Chairman and Chief Executive

Rich Templeton. "In any given year, TI introduces about 500 new

analog products. With this acquisition, we add 12,000 products all

at once."

He said National Semiconductor's exposure to the industrial

market will benefit TI, whose power-management products are geared

more toward portable devices.

"The bottom line is that the combination of TI and National

means we can engage with customers in application segments where we

have no or minimal engagement today," Templeton said.

Analog chips--which take real-world signals, such as sound and

light, and convert them to digital signals--are used in products

ranging from cellphones to industrial equipment.

Among those power-management companies that could feel pressure

from a combined TI and National Semiconductor include Microchip

Technology Inc. (MCHP), STMicroelectronics NV (STM) and Power

Integrations Inc. (POWI). Other large analog companies like Analog

Devices Inc. (ADI), Maxim Integrated Products Inc. (MXIM) and

Linear Technology Corp. (LLTC) also could feel heighened

competition.

Texas Instruments' acquisition of National Semiconductor creates

a "analog power house" with a "substantial advantage" in the

marketplace, Cowen & Co. analyst John Barton said as he

downgraded his rating on Analog Devices and Maxim to neutral from

outperform.

However, analysts note, it is hard to displace rivals quickly in

the analog market because customers tend to have longstanding

relationships with their chip companies and usually have little

need to displace them.

TI, though, sees cost savings of $100 million on an annualized

run rate from the merger simply from consolidating the company's

sales forces and cross-selling each company's products. Also, TI

said that because the companies have parts that fit together

easily, it expects the deal to add to earnings quickly.

"The numbers work," Templeton said. "I've always said that we

would not enter into a sizeable acquisition unless it made us a

better, stronger supplier to our customers and that the numbers

made sense both near term and long term."

The deal is not expected to prompt consolidation in the analog

sector, though many stocks were getting a boost on hopes for more

merger activity. Intersil Corp. (ISIL) jumped 10%, while Semtech

Corp. (SMTC) grew 7.4%.

Because of the cyclical nature of the chip industry, and the

perennial need to invest in new equipment, semiconductor companies

tend to carry a lot of cash on their books. This forces potential

acquirers to pay a hefty premium on any deal. For example, TI's

offer price was 78% above National Semiconductor's current

valuation.

Many analog companies "are probably too well-capitalized to be

easy absorption targets," Gartner analyst Steve Ohr said.

In addition, IDC analyst Mali Venkatesan said mergers between

larger analog companies don't happen often because of the

competitive nature of the business.

"I don't think in the tech field, especially the analog or the

chip business where innovation continues to be a pretty important

factor, that there is necessarily some force of consolidation,"

Texas Instruments' Templeton said.

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

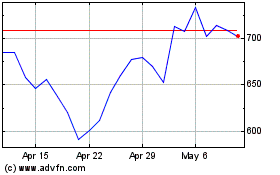

Monolithic Power Systems (NASDAQ:MPWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

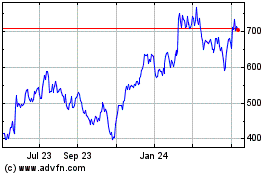

Monolithic Power Systems (NASDAQ:MPWR)

Historical Stock Chart

From Apr 2023 to Apr 2024