FORM

6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a–16 OR 15d–16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2015

Commission File Number: 001-33178

MELCO CROWN ENTERTAINMENT LIMITED

36th Floor, The Centrium

60 Wyndham Street

Central

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20–F or Form 40–F. Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3–2(b) under the Securities Exchange Act of

1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3–2(b): 82– N/A

MELCO CROWN ENTERTAINMENT LIMITED

Form 6–K

TABLE OF

CONTENTS

Signature

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| MELCO CROWN ENTERTAINMENT LIMITED |

|

|

| By: |

|

/s/ Geoffrey Davis |

| Name: |

|

Geoffrey Davis, CFA |

| Title: |

|

Chief Financial Officer |

Date: November 5, 2015

3

EXHIBIT INDEX

|

|

|

|

|

| Exhibit No. |

|

|

|

Description |

|

|

|

| Exhibit 99.1 |

|

|

|

Unaudited Results for Third Quarter of 2015 and Quarterly Dividend Declaration |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Melco Crown Entertainment Announces Unaudited Third Quarter 2015 Earnings and Declares Quarterly Dividend

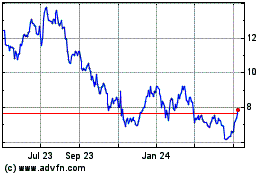

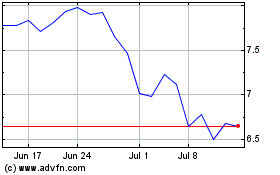

Macau, Thursday, November 5, 2015 – Melco Crown Entertainment Limited (Nasdaq: MPEL) (“Melco Crown Entertainment” or the

“Company” or “we”), a developer, owner and operator of casino gaming and entertainment resort facilities in Asia, today reported its unaudited financial results for the third quarter of 2015.

Net revenue for the third quarter of 2015 was US$945.7 million, representing a decrease of approximately 16% from US$1,124.1 million for the comparable period

in 2014. The decline in net revenue was primarily attributable to lower rolling chip revenues and mass market table games revenues in Macau, partially offset by the net revenue generated by City of Dreams Manila, which started operations in December

2014.

Adjusted property EBITDA(1) was US$237.3 million for the third quarter of 2015, as compared to

Adjusted property EBITDA of US$305.7 million in the third quarter of 2014. The 22% year-over-year decline in Adjusted property EBITDA was attributable to lower contribution from the group-wide rolling chip segment and mass market table games

segment.

On a U.S. GAAP basis, net income attributable to Melco Crown Entertainment for the third quarter of 2015 was US$33.2 million, or US$0.06 per

ADS, compared with net income attributable to Melco Crown Entertainment of US$132.2 million, or US$0.24 per ADS, in the third quarter of 2014. The net loss attributable to noncontrolling interests during the third quarter of 2015 of US$34.1 million

was related to Studio City and City of Dreams Manila.

1

Mr. Lawrence Ho, Co-Chairman and Chief Executive Officer of Melco Crown Entertainment, commented, “Our

results in the third quarter of 2015 were impressive, particularly given the challenging demand backdrop in Macau, with our Macau Property EBITDA expanding over 10% sequentially. This performance highlights our world-class gaming and non-gaming

amenities and market-leading, premium-positioned flagship integrated resort, City of Dreams, together with our ongoing commitment to managing costs.

“Our ability to compete strongly in the mass segment in a disciplined manner and our strict approach to cost management, particularly in marketing,

player reinvestment and payroll expenses, is demonstrated by a greater than 200 basis point increase in our Macau Property EBITDA margins during the recent quarter.

“I am delighted to announce the recent successful opening of our highly anticipated integrated resort in Macau, Studio City, which brings to Macau the

most diversified entertainment-focused property ever contemplated in Macau. Our newest large-scale property represents a major milestone for our Company that enables us to further diversify our offering of entertainment-focused non-gaming

attractions, which are unrivalled in Macau.

“Studio City features a wide array of entertainment options for visitors of all ages to enjoy. The

art-deco inspired façade houses the iconic Golden Reel – the world’s only figure-8 Ferris wheel, as well as a 4D flight simulation ride, Batman Dark Flight; a 40,000-square-foot family entertainment center, Warner Bros. Fun Zone; an

incredible live magical experience showcasing the world’s greatest magicians, The House of Magic; Macau’s first-ever Ibiza-style nightclub, Pacha Macau; and a 5,000-seat multi-purpose entertainment center, Studio City Event Center, hosting

exciting live concerts, theatrical and top sports offerings in addition to award shows and other special feature events.

“The property also delivers

world-class accommodation at the approximately 1,600-room Studio City Hotel, and a diverse range of international restaurants, cafes and relaxed bars and lounges. Studio City also significantly expands our Company’s retail capacity in Macau

with over 35,000 square meters of distinctive retail showcasing sophisticated and prestigious fashion brands.

“Studio City’s location directly

adjacent to the Lotus Bridge immigration point, which connects with Hengqin Island, and a future station-point for the Macau Light Rapid Transit, provides a strategic location in Cotai, enabling the property to enjoy ideal access to visitors from

the fast growing and increasingly important Hengqin Island.

“We anticipate that Studio City will provide a strong complement to our current

operating assets in Macau, allowing us to deepen our customer mix. The opening of Studio City highlights our Company’s commitment to help evolve and greatly enhance Macau’s non-gaming entertainment proposition, which in turn supports

Macau’s evolution into a multi-faceted entertainment destination. Studio City also deepens our investment in the local community by offering unique and rewarding career opportunities not currently available in Macau.

“We thank the Macau and Central governments for their support and recognition of our Company’s contribution to the true diversification of Macau

into a world leading leisure and tourism destination.

“In Manila, City of Dreams delivered 93% sequential growth in Property EBITDA, as a result of

strong traction in the rolling chip segment and further expansion of its mass table and slot machine revenue. Hotel occupancy was maintained at a high 88% for the quarter. City of Dreams Manila maintained strong visitation statistics, leading all

other integrated resorts in Manila, as its unique array of gaming and entertainment offerings continued to captivate patrons, both domestic and international. We believe that City of Dreams Manila is well positioned for long term success as Manila

transforms into an exciting and diverse tourism destination for the region.”

2

City of Dreams Third Quarter Results

For the quarter ended September 30, 2015, net revenue at City of Dreams was US$665.6 million compared to US$911.6 million in the third quarter of 2014.

City of Dreams generated Adjusted EBITDA of US$191.5 million in the third quarter of 2015, representing a decrease of 31% compared to US$276.0 million in the comparable period of 2014. The decline in Adjusted EBITDA was primarily a result of lower

rolling chip revenues and mass market table games revenues.

Rolling chip volume totaled US$9.3 billion for the third quarter of 2015 versus US$17.3

billion in the third quarter of 2014. The rolling chip win rate was 2.9% in the third quarter of 2015 versus 2.7% in the third quarter of 2014. The expected rolling chip win rate range is 2.7%-3.0%.

Mass market table games drop decreased to US$1,190.3 million compared with US$1,340.4 million in the third quarter of 2014. The mass market table games hold

percentage was 35.1% in the third quarter of 2015 compared to 38.9% in the third quarter of 2014.

Gaming machine handle for the third quarter of 2015 was

US$1,211.3 million, compared with US$1,551.7 million in the third quarter of 2014.

Total non-gaming revenue at City of Dreams in the third quarter of

2015 was US$66.8 million, compared with US$74.2 million in the third quarter of 2014.

Altira Macau Third Quarter Results

For the quarter ended September 30, 2015, net revenue at Altira Macau was US$140.3 million compared to US$160.4 million in the third quarter of 2014.

Altira Macau generated Adjusted EBITDA of US$13.3 million in the third quarter of 2015 compared with Adjusted EBITDA of US$20.3 million in the third quarter of 2014. The year-over-year decrease in Adjusted EBITDA was primarily a result of lower

rolling chip revenues.

Rolling chip volume totaled US$5.2 billion in the third quarter of 2015 versus US$7.2 billion in the third quarter of 2014. The

rolling chip win rate was 3.0% in the third quarter of 2015 versus 2.7% in the third quarter of 2014. The expected rolling chip win rate range is 2.7%-3.0%.

In the mass market table games segment, drop totaled US$156.7 million in the third quarter of 2015, a decrease from US$181.4 million generated in the

comparable period in 2014. The mass market table games hold percentage was 19.4% in the third quarter of 2015 compared with 16.2% in the third quarter of 2014.

Gaming machine handle for the third quarter of 2015 was US$11.2 million.

Total non-gaming revenue at Altira Macau in the third quarter of 2015 was US$8.1 million compared with US$9.0 million in the third quarter of 2014.

3

Mocha Clubs Third Quarter Results

Net revenue from Mocha Clubs totaled US$36.1 million in the third quarter of 2015 as compared to US$38.5 million in the third quarter of 2014. Mocha Clubs

generated US$8.5 million of Adjusted EBITDA in the third quarter of 2015 compared with US$9.9 million in the same period in 2014.

The number of

gaming machines in operation at Mocha Clubs averaged approximately 1,200 in the third quarter of 2015, compared to approximately 1,300 in the comparable period in 2014. The reduction in gaming machines reported by Mocha Clubs was primarily due to

the transfer of the reporting of one club to Altira Macau in 2015. The net win per gaming machine per day was US$318 in the third quarter of 2015, as compared with US$306 in the comparable period in 2014.

City of Dreams Manila Third Quarter Results

For the

third quarter of 2015, net revenue at City of Dreams Manila was US$91.7 million. City of Dreams Manila generated Adjusted EBITDA of US$24.4 million in the third quarter of 2015.

Rolling chip volume totaled US$1.2 billion for the third quarter of 2015. The rolling chip win rate was 2.9% in the third quarter of 2015. The expected

rolling chip win rate range is 2.7%-3.0%.

Mass market table games drop was US$116.7 million and the mass market table games hold percentage was 27.0% in

the third quarter of 2015.

Gaming machine handle for the third quarter of 2015 was US$508.4 million. The number of gaming machines in operation at City

of Dreams Manila averaged approximately 1,700 in the third quarter of 2015. The net win per gaming machine per day was US$184 for the third quarter of 2015.

Total non-gaming revenue at City of Dreams Manila in the third quarter of 2015 was US$26.4 million.

Other Factors Affecting Earnings

Total net non-operating

expenses for the third quarter of 2015 were US$34.6 million, which mainly included interest income of US$4.2 million and interest expenses, net of capitalized interest, of US$23.2 million, US$9.5 million of other finance costs and US$6.5

million of net foreign exchange loss. We recorded US$40.3 million of capitalized interest during the third quarter of 2015, primarily relating to Studio City and the fifth hotel tower at City of Dreams.

The year-on-year decrease of US$4.2 million in net non-operating expenses was primarily due to higher capitalized interest in the current quarter, partially

offset by higher interest expenses resulted from the drawdown of the Studio City US$1.3 billion term loan facility in late July 2014.

Depreciation and

amortization costs of US$114.3 million were recorded in the third quarter of 2015, of which US$14.3 million was related to the amortization of our gaming subconcession and US$16.1 million was related to the amortization of land use rights.

4

Financial Position and Capital Expenditure

Total cash and bank balances as of September 30, 2015 totaled US$2.8 billion, including US$0.7 billion of bank deposits with original maturity over three

months and US$1.0 billion of restricted cash, primarily related to Studio City. Total debt at the end of the third quarter of 2015 was US$4.0 billion.

Capital expenditure for the third quarter of 2015 were US$400.6 million, which predominantly related to Studio City and various projects at City of Dreams,

including the fifth hotel tower.

Our Studio City borrowing group issued a letter requesting, among other things, approvals from the lenders of the Studio

City US$1.4 billion term loan and revolving credit facility to amend the loan documentation. The proposed amendments include changing the Studio City project opening date condition from 400 to 250 tables, consequential adjustments to the

financial covenants, and rescheduling the commencement of financial covenant testing.

Other Information

The proceeding in Taiwan against our subsidiary’s Taiwan branch office (“Taiwan Branch”) is on-going. In early October, the first

instance court rendered a not guilty verdict on all charges in favour of our Taiwan Branch. With respect to the frozen bank account with a balance of approximately New Taiwan dollar 2.98 billion (equivalent to $102.2 million) at the time it was

frozen, such court ordered the cancellation of the prosecutor’s freeze order (“Unfreeze Order”). The prosecutor filed a notice of appeal of the not guilty verdict but did not oppose the Unfreeze Order. However, the prosecutor

may at any time apply to the appellate court for a new freeze order over the bank account. Our Taiwan Branch will continue to vigorously defend this case during the appeal process.

Dividend Declaration

On November 5, 2015, our Board

considered and approved the declaration and payment of a quarterly dividend of US$0.0061 per share (equivalent to US$0.0183 per ADS) for the third quarter of 2015 (the “Quarterly Dividend”). The Quarterly Dividend will be paid on or

about Friday, December 4, 2015 to our shareholders whose names appear on the register of members of the Company at the close of business on Tuesday, November 17, 2015, being the record date for determination of entitlements to the

Quarterly Dividend.

5

Community Support and Investment

As a company with a strong and deep heritage in Macau, we have always maintained a steadfast commitment to the long term development of our employees and

support of the local community. This is highlighted by the following initiatives we have recently instituted or expanded:

| |

• |

|

In September 2015, we announced “MCE YOU-niversity”, a unique approach that adds to the Melco Crown Entertainment’s whole person development strategy for employees who have yet to achieve a university

degree. The first bachelor’s degree program, Bachelor of Arts in International Business Practice offered by Edinburgh Napier University as part of “MCE YOU-niversity”, will be launched in 2016 with possible support from a local Macau

educational institute to help co-teach the program. |

| |

• |

|

In October 2015, we invited 40 students and their teachers from Luso-Chinese Technical and Vocational Middle School on a backstage tour at the Dancing Water Theater. The tour aimed to prepare these students to start

planning for their undergraduate programs and future career paths, potentially to become a part of the award-winning production. |

| |

• |

|

To celebrate the launch of the new cinematically-themed resort Studio City with the Macau community, we organized daily charity groups to experience the world-class attractions and entertainment. The participating

groups included Fu Hong Macau Association, Sheng Kung Hui “Star of Hope” Youth Home, Holy House of Mercy, Macau True Goodwill Friendship Association, Macau Deaf Association and a cancer patient group in association with Junior Chamber

International Macau. It is an ongoing program that continues to serve different charity groups and organizations. |

Furthermore, from October 28 to December 6, we will donate 300 tickets per weekday and 400 tickets per weekend, of The House of Magic,

Macau’s first theater hosting resident magic show, to the community, with priority to be given to the under-resourced.

6

Studio City – Asia’s Entertainment Capital

Situated in the heart of Cotai and adjacent to the Lotus Bridge immigration point and directly connected to the light rail system, Studio City combines

Macau’s most diversified mix of entertainment with an exciting array of accommodation, regional and international dining and designer brand shopping, as well as a spacious and contemporary casino.

Entertainment:

| |

• |

|

Golden Reel – The world’s first truly iconic figure-8 Ferris wheel 130 meters high, between Studio City’s stunning, Art Deco-inspired twin hotel towers. The ride features 17

“Steampunk”-themed cabins, each comfortably seating up to 10 guests. |

| |

• |

|

Batman Dark Flight – An immersive ‘flying theater’ 4D motion ride based on an action-packed, digitally animated Batman storyline. This flight simulation ride can accommodate up to 72 guests at a

time. |

| |

• |

|

Warner Bros. Fun Zone – The 40,000-square-foot fun-filled indoor play center is packed with rides and interactive fun zones themed around your favorite Warner Bros., DC Comics, Hanna-Barbera Productions and

Looney Tunes characters. |

| |

• |

|

The House of Magic – A one-of-a-kind multi-theater featuring leading magicians from around the world. The House of Magic is set to become the premier performance venue for magicians globally.

|

| |

• |

|

Studio City Event Center – A 5,000-seat multi-purpose arena representing the centerpiece of Studio City’s live entertainment offerings. It is the ideal venue for hosting the biggest international and

regional concert tours, leading theatrical productions, top sporting events, award shows and other world-class events. |

| |

• |

|

Studio 8 – The only TV Studio facility in Macau to provide open access ‘plug in and play’ facilities to create a fully operational television recording and broadcast studio. |

| |

• |

|

Pacha Macau – One of the world’s biggest names in nightclubs, Pacha will bring Ibiza-style nightlife to Macau and Greater China for the very first time. |

| |

• |

|

RiverScape – A jungle river-themed water ride on the Podium Deck. |

Accommodation:

The Studio City Hotel will offer approximately 1,600 guest rooms catering to leisure destination seekers from across Asia and around the world.

Dining: Studio City will offer a diverse range of world-class restaurants, cafes and a number of relaxed bars and lounges. Over 30 food and

beverage venues will be located throughout the property. The stunning Cosmos Food Station takes visitors on a Space Station-themed dining experience with holographic projection technology creating ‘out-of-this-world’ deep space

visages.

Retail: Merchandised, marketed and managed by Taubman Asia, The Boulevard at Studio City is a 35,000-square-meter

‘immersive’ retail entertainment experience showcasing sophisticated and prestigious fashion brands.

Studio City – This is Entertainment.

7

Conference Call Information

Melco Crown Entertainment will hold a conference call to discuss its third quarter 2015 financial results on Thursday, November 5, 2015 at 8:30 a.m.

Eastern Time (9:30 p.m. Hong Kong Time). To join the conference call, please use the dial-in details below:

|

|

|

| US Toll Free |

|

1 866 519 4004 |

| US Toll/International |

|

1 845 675 0437 |

| HK Toll |

|

852 3018 6771 |

| HK Toll Free |

|

800 906 601 |

| UK Toll Free |

|

080 823 46646 |

| Australia Toll Free |

|

1 800 457 076 |

| Philippines Toll Free

Passcode |

|

1 800 165 10607

MPEL |

An audio webcast will also be available at www.melco-crown.com.

To access the replay, please use the dial-in details below:

|

|

|

| US Toll Free |

|

1 855 452 5696 |

| US Toll/International |

|

1 646 254 3697 |

| HK Toll Free |

|

800 963 117 |

| Philippines Toll Free |

|

1 800 161 20166 |

|

|

| Conference ID |

|

58999742 |

Safe Harbor Statement

This press release contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press

releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors include,

but are not limited to, (i) growth of the gaming market and visitation in Macau and the Philippines, (ii) capital and credit market volatility, (iii) local and global economic conditions, (iv) our anticipated growth strategies,

and (v) our future business development, results of operations and financial condition. In some cases, forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”,

“anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/are likely to” or other similar expressions.

Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company undertakes

no duty to update such information, except as required under applicable law.

8

Non-GAAP Financial Measures

| (1) |

“Adjusted EBITDA” is earnings before interest, taxes, depreciation, amortization, pre-opening costs, development costs, property charges and others, share-based compensation, payments to the Philippine parties

under the cooperative arrangement (the “Philippine Parties”), land rent to Belle Corporation, gain on disposal of assets held for sale and other non-operating income and expenses. “Adjusted property EBITDA” is earnings

before interest, taxes, depreciation, amortization, pre-opening costs, development costs, property charges and others, share-based compensation, payments to the Philippine Parties, land rent to Belle Corporation, gain on disposal of assets held for

sale, corporate and others expenses and other non-operating income and expenses. Adjusted EBITDA and adjusted property EBITDA are presented exclusively as a supplemental disclosure because management believes that they are widely used to measure the

performance, and as a basis for valuation, of gaming companies. Management uses adjusted EBITDA and adjusted property EBITDA as measures of the operating performance of its segments and to compare the operating performance of its properties with

those of its competitors. The Company also presents adjusted EBITDA and adjusted property EBITDA because they are used by some investors as ways to measure a company’s ability to incur and service debt, make capital expenditures, and meet

working capital requirements. Gaming companies have historically reported adjusted EBITDA and adjusted property EBITDA as supplements to financial measures in accordance with U.S. GAAP. However, adjusted EBITDA and adjusted property EBITDA should

not be considered as alternatives to operating income as indicators of the Company’s performance, as alternatives to cash flows from operating activities as measures of liquidity, or as alternatives to any other measure determined in accordance

with U.S. GAAP. Unlike net income, adjusted EBITDA and adjusted property EBITDA do not include depreciation and amortization or interest expense and therefore do not reflect current or future capital expenditures or the cost of capital. The Company

compensates for these limitations by using adjusted EBITDA and adjusted property EBITDA as only two of several comparative tools, together with U.S. GAAP measurements, to assist in the evaluation of operating performance. |

Such U.S. GAAP measurements include operating income, net income, cash flows from operations and cash flow data. The Company has significant

uses of cash flows, including capital expenditures, interest payments, debt principal repayments, taxes and other recurring and nonrecurring charges, which are not reflected in adjusted EBITDA or adjusted property EBITDA. Also, the Company’s

calculation of adjusted EBITDA and adjusted property EBITDA may be different from the calculation methods used by other companies and, therefore, comparability may be limited. Reconciliations of adjusted EBITDA and adjusted property EBITDA with the

most comparable financial measures calculated and presented in accordance with U.S. GAAP are provided herein immediately following the financial statements included in this press release.

| (2) |

“Adjusted net income” is net income before pre-opening costs, development costs, property charges and others, loss on extinguishment of debt and costs associated with debt modification. Adjusted net income

attributable to Melco Crown Entertainment and adjusted net income attributable to Melco Crown Entertainment per share (“EPS”) are presented as supplemental disclosures because management believes that they are widely used to measure

the performance, and as a basis for valuation, of gaming companies. These measures are used by management and/or evaluated by some investors, in addition to income and EPS computed in accordance with U.S. GAAP, as an additional basis for assessing

period-to-period results of our business. Adjusted net income attributable to Melco Crown Entertainment and adjusted net income attributable to Melco Crown Entertainment per share may be different from the calculation methods used by other companies

and, therefore, comparability may be limited. Reconciliations of adjusted net income attributable to Melco Crown Entertainment with the most comparable financial measures calculated and presented in accordance with U.S. GAAP are provided herein

immediately following the financial statements included in this press release. |

9

About Melco Crown Entertainment Limited

Melco Crown Entertainment, with its American depositary shares listed on the NASDAQ Global Select Market (NASDAQ: MPEL), is a developer, owner and operator of

casino gaming and entertainment casino resort facilities in Asia. Melco Crown Entertainment currently operates Altira Macau (www.altiramacau.com), a casino hotel located at Taipa, Macau and City of Dreams (www.cityofdreamsmacau.com),

an integrated urban casino resort located in Cotai, Macau. Melco Crown Entertainment’s business also includes the Mocha Clubs (www.mochaclubs.com), which comprise the largest non-casino based operations of electronic gaming machines in

Macau. The Company also majority owns and operates Studio City (www.studiocity-macau.com), a cinematically-themed integrated entertainment, retail and gaming resort in Cotai, Macau. In the Philippines, Melco Crown (Philippines) Resorts

Corporation’s subsidiary, MCE Leisure (Philippines) Corporation, currently operates and manages City of Dreams Manila (www.cityofdreams.com.ph), a casino, hotel, retail and entertainment integrated resort in the Entertainment City

complex in Manila. For more information about Melco Crown Entertainment, please visit www.melco-crown.com.

Melco Crown Entertainment has strong

support from both of its major shareholders, Melco International Development Limited (“Melco”) and Crown Resorts Limited (“Crown”). Melco is a listed company on the Main Board of The Stock Exchange of Hong Kong

Limited and is substantially owned and led by Mr. Lawrence Ho, who is Co-Chairman, an Executive Director and the Chief Executive Officer of Melco Crown Entertainment. Crown is a top-50 company listed on the Australian Securities Exchange and

led by Mr. James Packer, who is also Co-Chairman and a Non-executive Director of Melco Crown Entertainment.

For investment community, please

contact:

Ross Dunwoody

Vice President, Investor

Relations

Tel: +853 8868 7575 or +852 2598 3689

Email:

rossdunwoody@melco-crown.com

For media enquiry, please contact:

Maggie Ma

Senior Vice President, Corporate Communications and

Public Relations

Tel: +853 8868 3767 or +852 3151 3767

Email:maggiema@melco-crown.com

10

Melco Crown Entertainment Limited and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| OPERATING REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Casino |

|

$ |

900,468 |

|

|

$ |

1,083,955 |

|

|

$ |

2,786,170 |

|

|

$ |

3,569,443 |

|

| Rooms |

|

|

45,577 |

|

|

|

33,901 |

|

|

|

138,591 |

|

|

|

100,900 |

|

| Food and beverage |

|

|

30,324 |

|

|

|

20,931 |

|

|

|

89,213 |

|

|

|

61,564 |

|

| Entertainment, retail and others |

|

|

28,360 |

|

|

|

30,178 |

|

|

|

76,063 |

|

|

|

83,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross revenues |

|

|

1,004,729 |

|

|

|

1,168,965 |

|

|

|

3,090,037 |

|

|

|

3,815,076 |

|

| Less: promotional allowances |

|

|

(58,999 |

) |

|

|

(44,895 |

) |

|

|

(173,267 |

) |

|

|

(134,152 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

|

945,730 |

|

|

|

1,124,070 |

|

|

|

2,916,770 |

|

|

|

3,680,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Casino |

|

|

(621,333 |

) |

|

|

(740,925 |

) |

|

|

(1,962,154 |

) |

|

|

(2,478,005 |

) |

| Rooms |

|

|

(5,475 |

) |

|

|

(3,148 |

) |

|

|

(15,341 |

) |

|

|

(9,290 |

) |

| Food and beverage |

|

|

(8,339 |

) |

|

|

(6,603 |

) |

|

|

(24,024 |

) |

|

|

(17,062 |

) |

| Entertainment, retail and others |

|

|

(18,237 |

) |

|

|

(17,372 |

) |

|

|

(51,528 |

) |

|

|

(46,809 |

) |

| General and administrative |

|

|

(91,373 |

) |

|

|

(84,717 |

) |

|

|

(273,733 |

) |

|

|

(224,783 |

) |

| Payments to the Philippine Parties |

|

|

(4,721 |

) |

|

|

— |

|

|

|

(11,994 |

) |

|

|

— |

|

| Pre-opening costs |

|

|

(46,388 |

) |

|

|

(28,589 |

) |

|

|

(115,671 |

) |

|

|

(57,183 |

) |

| Development costs |

|

|

(36 |

) |

|

|

(2,154 |

) |

|

|

(57 |

) |

|

|

(8,454 |

) |

| Amortization of gaming subconcession |

|

|

(14,309 |

) |

|

|

(14,309 |

) |

|

|

(42,928 |

) |

|

|

(42,928 |

) |

| Amortization of land use rights |

|

|

(16,117 |

) |

|

|

(16,117 |

) |

|

|

(48,353 |

) |

|

|

(48,353 |

) |

| Depreciation and amortization |

|

|

(83,833 |

) |

|

|

(58,707 |

) |

|

|

(249,400 |

) |

|

|

(184,378 |

) |

| Property charges and others |

|

|

(1,500 |

) |

|

|

(3,742 |

) |

|

|

(5,339 |

) |

|

|

(5,689 |

) |

| Gain on disposal of assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

(911,661 |

) |

|

|

(976,383 |

) |

|

|

(2,800,522 |

) |

|

|

(3,100,862 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

34,069 |

|

|

|

147,687 |

|

|

|

116,248 |

|

|

|

580,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-OPERATING INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

4,237 |

|

|

|

6,098 |

|

|

|

10,771 |

|

|

|

13,750 |

|

| Interest expenses, net of capitalized interest |

|

|

(23,244 |

) |

|

|

(34,146 |

) |

|

|

(74,214 |

) |

|

|

(94,539 |

) |

| Other finance costs |

|

|

(9,547 |

) |

|

|

(11,330 |

) |

|

|

(31,839 |

) |

|

|

(35,198 |

) |

| Foreign exchange (loss) gain, net |

|

|

(6,456 |

) |

|

|

71 |

|

|

|

(3,537 |

) |

|

|

(1,680 |

) |

| Other income, net |

|

|

501 |

|

|

|

549 |

|

|

|

1,582 |

|

|

|

1,765 |

|

| Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(481 |

) |

|

|

— |

|

| Costs associated with debt modification |

|

|

(47 |

) |

|

|

— |

|

|

|

(592 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-operating expenses, net |

|

|

(34,556 |

) |

|

|

(38,758 |

) |

|

|

(98,310 |

) |

|

|

(115,902 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (LOSS) INCOME BEFORE INCOME TAX |

|

|

(487 |

) |

|

|

108,929 |

|

|

|

17,938 |

|

|

|

464,160 |

|

| INCOME TAX EXPENSE |

|

|

(387 |

) |

|

|

(379 |

) |

|

|

(765 |

) |

|

|

(3,372 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (LOSS) INCOME |

|

|

(874 |

) |

|

|

108,550 |

|

|

|

17,173 |

|

|

|

460,788 |

|

| NET LOSS ATTRIBUTABLE TO NONCONTROLLING

INTERESTS |

|

|

34,077 |

|

|

|

23,605 |

|

|

|

100,913 |

|

|

|

54,548 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO MELCO CROWN

ENTERTAINMENT LIMITED |

|

$ |

33,203 |

|

|

$ |

132,155 |

|

|

$ |

118,086 |

|

|

$ |

515,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO MELCO CROWN

ENTERTAINMENT LIMITED PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.021 |

|

|

$ |

0.080 |

|

|

$ |

0.073 |

|

|

$ |

0.312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.020 |

|

|

$ |

0.079 |

|

|

$ |

0.073 |

|

|

$ |

0.309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO MELCO CROWN

ENTERTAINMENT LIMITED PER ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.062 |

|

|

$ |

0.240 |

|

|

$ |

0.219 |

|

|

$ |

0.936 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.061 |

|

|

$ |

0.238 |

|

|

$ |

0.218 |

|

|

$ |

0.928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES USED IN NET INCOME

ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT

LIMITED PER SHARE CALCULATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1,617,905,348 |

|

|

|

1,652,484,854 |

|

|

|

1,617,033,893 |

|

|

|

1,652,090,303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

1,627,096,350 |

|

|

|

1,664,642,439 |

|

|

|

1,627,249,911 |

|

|

|

1,665,490,874 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

Melco Crown Entertainment Limited and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,141,684 |

|

|

$ |

1,597,655 |

|

| Bank deposits with original maturity over three months |

|

|

707,704 |

|

|

|

110,616 |

|

| Restricted cash |

|

|

611,178 |

|

|

|

1,447,034 |

|

| Accounts receivable, net |

|

|

280,002 |

|

|

|

253,665 |

|

| Amounts due from affiliated companies |

|

|

135 |

|

|

|

1,079 |

|

| Deferred tax assets |

|

|

— |

|

|

|

532 |

|

| Income tax receivable |

|

|

1 |

|

|

|

15 |

|

| Inventories |

|

|

26,136 |

|

|

|

23,111 |

|

| Prepaid expenses and other current assets |

|

|

90,023 |

|

|

|

69,254 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

2,856,863 |

|

|

|

3,502,961 |

|

|

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT, NET |

|

|

5,672,113 |

|

|

|

4,696,391 |

|

| GAMING SUBCONCESSION, NET |

|

|

384,866 |

|

|

|

427,794 |

|

| INTANGIBLE ASSETS, NET |

|

|

4,220 |

|

|

|

4,220 |

|

| GOODWILL |

|

|

81,915 |

|

|

|

81,915 |

|

| LONG-TERM PREPAYMENTS, DEPOSITS AND OTHER ASSETS |

|

|

170,312 |

|

|

|

287,558 |

|

| RESTRICTED CASH |

|

|

350,607 |

|

|

|

369,549 |

|

| DEFERRED TAX ASSETS |

|

|

108 |

|

|

|

115 |

|

| DEFERRED FINANCING COSTS, NET |

|

|

188,259 |

|

|

|

174,872 |

|

| LAND USE RIGHTS, NET |

|

|

838,835 |

|

|

|

887,188 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

10,548,098 |

|

|

$ |

10,432,563 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

18,038 |

|

|

$ |

14,428 |

|

| Accrued expenses and other current liabilities |

|

|

1,099,256 |

|

|

|

1,005,720 |

|

| Income tax payable |

|

|

5,630 |

|

|

|

6,621 |

|

| Capital lease obligations, due within one year |

|

|

28,500 |

|

|

|

23,512 |

|

| Current portion of long-term debt |

|

|

17,445 |

|

|

|

262,750 |

|

| Amounts due to affiliated companies |

|

|

1,522 |

|

|

|

3,626 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,170,391 |

|

|

|

1,316,657 |

|

|

|

|

|

|

|

|

|

|

| LONG-TERM DEBT |

|

|

3,948,411 |

|

|

|

3,640,031 |

|

| OTHER LONG-TERM LIABILITIES |

|

|

88,349 |

|

|

|

93,441 |

|

| DEFERRED TAX LIABILITIES |

|

|

55,853 |

|

|

|

58,949 |

|

| CAPITAL LEASE OBLIGATIONS, DUE AFTER ONE YEAR |

|

|

269,909 |

|

|

|

278,027 |

|

| LAND USE RIGHTS PAYABLE |

|

|

— |

|

|

|

3,788 |

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Ordinary shares |

|

|

16,309 |

|

|

|

16,337 |

|

| Treasury shares |

|

|

(276 |

) |

|

|

(33,167 |

) |

| Additional paid-in capital |

|

|

3,074,622 |

|

|

|

3,092,943 |

|

| Accumulated other comprehensive losses |

|

|

(21,555 |

) |

|

|

(17,149 |

) |

| Retained earnings |

|

|

1,292,283 |

|

|

|

1,227,177 |

|

|

|

|

|

|

|

|

|

|

| Total Melco Crown Entertainment Limited shareholders’ equity |

|

|

4,361,383 |

|

|

|

4,286,141 |

|

| Noncontrolling interests |

|

|

653,802 |

|

|

|

755,529 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

5,015,185 |

|

|

|

5,041,670 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND EQUITY |

|

$ |

10,548,098 |

|

|

$ |

10,432,563 |

|

|

|

|

|

|

|

|

|

|

12

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Net Income Attributable to Melco Crown Entertainment Limited to

Adjusted Net Income Attributable to Melco Crown Entertainment Limited

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Net Income Attributable to Melco Crown Entertainment Limited |

|

$ |

33,203 |

|

|

$ |

132,155 |

|

|

$ |

118,086 |

|

|

$ |

515,336 |

|

| Pre-opening Costs, Net |

|

|

25,629 |

|

|

|

19,925 |

|

|

|

67,203 |

|

|

|

41,516 |

|

| Development Costs, Net |

|

|

36 |

|

|

|

2,154 |

|

|

|

57 |

|

|

|

8,454 |

|

| Property Charges and Others, Net |

|

|

1,094 |

|

|

|

2,666 |

|

|

|

4,933 |

|

|

|

4,613 |

|

| Loss on Extinguishment of Debt, Net |

|

|

— |

|

|

|

— |

|

|

|

481 |

|

|

|

— |

|

| Costs Associated with Debt Modification, Net |

|

|

47 |

|

|

|

— |

|

|

|

592 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Net Income Attributable to Melco Crown Entertainment Limited |

|

$ |

60,009 |

|

|

$ |

156,900 |

|

|

$ |

191,352 |

|

|

$ |

569,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ADJUSTED NET INCOME ATTRIBUTABLE TO

MELCO CROWN ENTERTAINMENT

LIMITED PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.037 |

|

|

$ |

0.095 |

|

|

$ |

0.118 |

|

|

$ |

0.345 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.037 |

|

|

$ |

0.094 |

|

|

$ |

0.118 |

|

|

$ |

0.342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ADJUSTED NET INCOME ATTRIBUTABLE TO

MELCO CROWN ENTERTAINMENT

LIMITED PER ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.111 |

|

|

$ |

0.285 |

|

|

$ |

0.355 |

|

|

$ |

1.035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.111 |

|

|

$ |

0.283 |

|

|

$ |

0.353 |

|

|

$ |

1.027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES USED IN

ADJUSTED NET INCOME ATTRIBUTABLE

TO MELCO CROWN ENTERTAINMENT

LIMITED PER SHARE

CALCULATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1,617,905,348 |

|

|

|

1,652,484,854 |

|

|

|

1,617,033,893 |

|

|

|

1,652,090,303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

1,627,096,350 |

|

|

|

1,664,642,439 |

|

|

|

1,627,249,911 |

|

|

|

1,665,490,874 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Operating Income (Loss) to

Adjusted EBITDA and Adjusted Property EBITDA

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, 2015 |

|

| |

|

Altira Macau |

|

|

Mocha |

|

|

City of

Dreams |

|

|

Studio

City |

|

|

City of

Dreams

Manila |

|

|

Corporate

and Others |

|

|

Total |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Operating Income (Loss) |

|

$ |

5,654 |

|

|

$ |

5,423 |

|

|

$ |

139,444 |

|

|

$ |

(57,785 |

) |

|

$ |

(7,129 |

) |

|

$ |

(51,538 |

) |

|

$ |

34,069 |

|

|

|

|

|

|

|

|

|

| Payments to the Philippine Parties |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,721 |

|

|

|

— |

|

|

|

4,721 |

|

| Land Rent to Belle Corporation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

854 |

|

|

|

— |

|

|

|

854 |

|

| Pre-opening Costs |

|

|

— |

|

|

|

— |

|

|

|

9 |

|

|

|

45,395 |

|

|

|

(145 |

) |

|

|

1,129 |

|

|

|

46,388 |

|

| Development Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

36 |

|

|

|

36 |

|

| Depreciation and Amortization |

|

|

7,608 |

|

|

|

3,036 |

|

|

|

51,491 |

|

|

|

10,946 |

|

|

|

24,173 |

|

|

|

17,005 |

|

|

|

114,259 |

|

| Share-based Compensation |

|

|

29 |

|

|

|

22 |

|

|

|

546 |

|

|

|

101 |

|

|

|

1,900 |

|

|

|

3,245 |

|

|

|

5,843 |

|

| Property Charges and Others |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,016 |

|

|

|

— |

|

|

|

484 |

|

|

|

1,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

13,291 |

|

|

|

8,481 |

|

|

|

191,490 |

|

|

|

(327 |

) |

|

|

24,374 |

|

|

|

(29,639 |

) |

|

|

207,670 |

|

| Corporate and Others Expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

29,639 |

|

|

|

29,639 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Property EBITDA |

|

$ |

13,291 |

|

|

$ |

8,481 |

|

|

$ |

191,490 |

|

|

$ |

(327 |

) |

|

$ |

24,374 |

|

|

$ |

— |

|

|

$ |

237,309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, 2014 |

|

| |

|

Altira Macau |

|

|

Mocha |

|

|

City of

Dreams |

|

|

Studio

City |

|

|

City of

Dreams

Manila |

|

|

Corporate

and Others |

|

|

Total |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Operating Income (Loss) |

|

$ |

14,155 |

|

|

$ |

6,646 |

|

|

$ |

222,298 |

|

|

$ |

(15,024 |

) |

|

$ |

(29,812 |

) |

|

$ |

(50,576 |

) |

|

$ |

147,687 |

|

|

|

|

|

|

|

|

|

| Land Rent to Belle Corporation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

901 |

|

|

|

— |

|

|

|

901 |

|

| Pre-opening Costs |

|

|

— |

|

|

|

4 |

|

|

|

1,584 |

|

|

|

3,609 |

|

|

|

22,491 |

|

|

|

— |

|

|

|

27,688 |

|

| Development Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,154 |

|

|

|

2,154 |

|

| Depreciation and Amortization |

|

|

6,097 |

|

|

|

3,184 |

|

|

|

51,842 |

|

|

|

10,897 |

|

|

|

872 |

|

|

|

16,241 |

|

|

|

89,133 |

|

| Share-based Compensation |

|

|

11 |

|

|

|

29 |

|

|

|

324 |

|

|

|

21 |

|

|

|

2,124 |

|

|

|

2,943 |

|

|

|

5,452 |

|

| Property Charges and Others |

|

|

— |

|

|

|

41 |

|

|

|

— |

|

|

|

— |

|

|

|

3,451 |

|

|

|

250 |

|

|

|

3,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

20,263 |

|

|

|

9,904 |

|

|

|

276,048 |

|

|

|

(497 |

) |

|

|

27 |

|

|

|

(28,988 |

) |

|

|

276,757 |

|

| Corporate and Others Expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28,988 |

|

|

|

28,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Property EBITDA |

|

$ |

20,263 |

|

|

$ |

9,904 |

|

|

$ |

276,048 |

|

|

$ |

(497 |

) |

|

$ |

27 |

|

|

$ |

— |

|

|

$ |

305,745 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Adjusted EBITDA and Adjusted Property EBITDA to

Net Income Attributable to Melco Crown Entertainment Limited

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| Adjusted Property EBITDA |

|

$ |

237,309 |

|

|

$ |

305,745 |

|

| Corporate and Others Expenses |

|

|

(29,639 |

) |

|

|

(28,988 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

207,670 |

|

|

|

276,757 |

|

| Payments to the Philippine Parties |

|

|

(4,721 |

) |

|

|

— |

|

| Land Rent to Belle Corporation |

|

|

(854 |

) |

|

|

(901 |

) |

| Pre-opening Costs |

|

|

(46,388 |

) |

|

|

(27,688 |

) |

| Development Costs |

|

|

(36 |

) |

|

|

(2,154 |

) |

| Depreciation and Amortization |

|

|

(114,259 |

) |

|

|

(89,133 |

) |

| Share-based Compensation |

|

|

(5,843 |

) |

|

|

(5,452 |

) |

| Property Charges and Others |

|

|

(1,500 |

) |

|

|

(3,742 |

) |

| Interest and Other Non-Operating Expenses, Net |

|

|

(34,556 |

) |

|

|

(38,758 |

) |

| Income Tax Expense |

|

|

(387 |

) |

|

|

(379 |

) |

|

|

|

|

|

|

|

|

|

| Net (Loss) Income |

|

|

(874 |

) |

|

|

108,550 |

|

| Net Loss Attributable to Noncontrolling Interests |

|

|

34,077 |

|

|

|

23,605 |

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable to Melco Crown Entertainment Limited |

|

$ |

33,203 |

|

|

$ |

132,155 |

|

|

|

|

|

|

|

|

|

|

15

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Operating Income (Loss) to

Adjusted EBITDA and Adjusted Property EBITDA

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, 2015 |

|

| |

|

Altira Macau |

|

|

Mocha |

|

|

City of

Dreams |

|

|

Studio

City |

|

|

City of

Dreams

Manila |

|

|

Corporate

and Others |

|

|

Total |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Operating Income (Loss) |

|

$ |

4,308 |

|

|

$ |

14,474 |

|

|

$ |

448,937 |

|

|

$ |

(114,284 |

) |

|

$ |

(78,826 |

) |

|

$ |

(158,361 |

) |

|

$ |

116,248 |

|

|

|

|

|

|

|

|

|

| Payments to the Philippine Parties |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,994 |

|

|

|

— |

|

|

|

11,994 |

|

| Land Rent to Belle Corporation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,634 |

|

|

|

— |

|

|

|

2,634 |

|

| Pre-opening Costs |

|

|

— |

|

|

|

— |

|

|

|

388 |

|

|

|

79,285 |

|

|

|

27,907 |

|

|

|

8,091 |

|

|

|

115,671 |

|

| Development Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

57 |

|

|

|

57 |

|

| Depreciation and Amortization |

|

|

22,196 |

|

|

|

9,312 |

|

|

|

155,232 |

|

|

|

32,738 |

|

|

|

70,893 |

|

|

|

50,310 |

|

|

|

340,681 |

|

| Share-based Compensation |

|

|

88 |

|

|

|

64 |

|

|

|

1,414 |

|

|

|

203 |

|

|

|

5,284 |

|

|

|

8,571 |

|

|

|

15,624 |

|

| Property Charges and Others |

|

|

— |

|

|

|

— |

|

|

|

301 |

|

|

|

1,016 |

|

|

|

— |

|

|

|

4,022 |

|

|

|

5,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

26,592 |

|

|

|

23,850 |

|

|

|

606,272 |

|

|

|

(1,042 |

) |

|

|

39,886 |

|

|

|

(87,310 |

) |

|

|

608,248 |

|

| Corporate and Others Expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

87,310 |

|

|

|

87,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Property EBITDA |

|

$ |

26,592 |

|

|

$ |

23,850 |

|

|

$ |

606,272 |

|

|

$ |

(1,042 |

) |

|

$ |

39,886 |

|

|

$ |

— |

|

|

$ |

695,558 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended September 30, 2014 |

|

| |

|

Altira Macau |

|

|

Mocha |

|

|

City of

Dreams |

|

|

Studio

City |

|

|

City of

Dreams

Manila |

|

|

Corporate

and Others |

|

|

Total |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Operating Income (Loss) |

|

$ |

49,921 |

|

|

$ |

18,443 |

|

|

$ |

739,455 |

|

|

$ |

(42,435 |

) |

|

$ |

(55,554 |

) |

|

$ |

(129,768 |

) |

|

$ |

580,062 |

|

|

|

|

|

|

|

|

|

| Land Rent to Belle Corporation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,678 |

|

|

|

— |

|

|

|

2,678 |

|

| Pre-opening Costs |

|

|

— |

|

|

|

1,082 |

|

|

|

3,315 |

|

|

|

8,657 |

|

|

|

41,451 |

|

|

|

— |

|

|

|

54,505 |

|

| Development Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,454 |

|

|

|

8,454 |

|

| Depreciation and Amortization |

|

|

20,596 |

|

|

|

8,963 |

|

|

|

163,218 |

|

|

|

32,665 |

|

|

|

1,971 |

|

|

|

48,246 |

|

|

|

275,659 |

|

| Share-based Compensation |

|

|

77 |

|

|

|

113 |

|

|

|

902 |

|

|

|

28 |

|

|

|

5,902 |

|

|

|

8,347 |

|

|

|

15,369 |

|

| Property Charges and Others |

|

|

— |

|

|

|

1,231 |

|

|

|

757 |

|

|

|

— |

|

|

|

3,451 |

|

|

|

250 |

|

|

|

5,689 |

|

| Gain on Disposal of Assets Held For Sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(22,072 |

) |

|

|

(22,072 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

70,594 |

|

|

|

29,832 |

|

|

|

907,647 |

|

|

|

(1,085 |

) |

|

|

(101 |

) |

|

|

(86,543 |

) |

|

|

920,344 |

|

| Corporate and Others Expenses |

|

|

— |

|

|

|

— |

|

|

|

— |