FORM

6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a–16 OR 15d–16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2015

Commission File Number: 001-33178

MELCO CROWN ENTERTAINMENT LIMITED

36th Floor, The Centrium

60 Wyndham Street

Central

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20–F or Form 40–F. Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3–2(b) under the Securities Exchange Act of

1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3–2(b): 82– N/A

MELCO CROWN ENTERTAINMENT LIMITED

Form 6–K

TABLE OF

CONTENTS

Signature

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| MELCO CROWN ENTERTAINMENT LIMITED |

|

|

| By: |

|

/s/ Geoffrey Davis |

| Name: |

|

Geoffrey Davis, CFA |

| Title: |

|

Chief Financial Officer |

Date: August 28, 2015

3

EXHIBIT INDEX

|

|

|

|

|

| Exhibit No. |

|

|

|

Description |

|

|

|

| Exhibit 99.1 |

|

|

|

Quarterly Report of Studio City Finance Limited |

Exhibit 99.1

EXPLANATORY NOTE

Studio City Finance Limited’s Quarterly Report

for the Three and Six Months Ended June 30, 2015

This quarterly report serves to provide holders of Studio City Finance Limited’s US$825,000,000 8.50% senior notes due 2020 (the

“Studio City Notes”) with Studio City Finance Limited’s unaudited condensed consolidated financial statements, comprising condensed consolidated balance sheets, condensed consolidated statements of operations and condensed

consolidated statements of cash flows, for the three and six months ended June 30, 2015, together with the related information, pursuant to the terms of the indenture, dated November 26, 2012, relating to the Studio City Notes. Studio City

Finance Limited is a 60% owned subsidiary of Melco Crown Entertainment Limited.

Studio City Finance Limited

Report for the Second Quarter of 2015

TABLE OF CONTENTS

|

|

|

|

|

| INTRODUCTION |

|

|

1 |

|

|

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

|

3 |

|

|

|

| EXCHANGE RATE INFORMATION |

|

|

4 |

|

|

|

| FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

|

5 |

|

|

|

| INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

|

|

F-1 |

|

INTRODUCTION

In this quarterly report, unless otherwise indicated:

| • |

|

“Additional Development” refers to the additional second phase development project on the Studio City site, which is expected to include an additional luxury hotel and related facilities, retail, entertainment

and gaming expansion capacity; |

| • |

|

“Cotai” refers to an area of reclaimed land located between the islands of Taipa and Coloane in Macau; |

| • |

|

“HK$” and “H.K. dollars” refer to the legal currency of Hong Kong; |

| • |

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the PRC; |

| • |

|

“Macau” refers to the Macau Special Administrative Region of the PRC; |

| • |

|

“MCE” refers to Melco Crown Entertainment Limited, a company incorporated in the Cayman Islands with its American depository shares listed on the NASDAQ Global Select Market, and which, through its subsidiary

MCE Cotai, owns a 60% interest in SCI; |

| • |

|

“MCE Cotai” refers to MCE Cotai Investments Limited, a subsidiary of MCE and a shareholder of SCI; |

| • |

|

“New Cotai” refers to New Cotai, LLC, a Delaware limited liability company owned by New Cotai Holdings; |

| • |

|

“New Cotai Holdings” refers to New Cotai Holdings, LLC, a Delaware limited liability company, formed on March 24, 2006 under the laws of the U.S. state of Delaware, primarily owned by U.S. investment

funds managed by Silver Point Capital, L.P. and Oaktree Capital Management, L.P.; |

| • |

|

“Patacas” and “MOP” refer to the legal currency of Macau; |

| • |

|

“PRC” refers to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan from a geographical point of view; |

| • |

|

“Project Costs” refers to the construction and development costs and other project costs, including licensing, financing, interest, fees and pre-opening costs, of the Studio City Project, as subsequently

amended in accordance with the Studio City Project Facility; |

| • |

|

“SCI” refers to Studio City International Holdings Limited (formerly known as Cyber One Agents Limited), a company incorporated in the British Virgin Islands with limited liability, and an indirect parent of

our company; |

1

| • |

|

“Shareholders Agreement” refers to the shareholders agreement dated July 27, 2011, by and among MCE Cotai, New Cotai, MCE and SCI (as amended from time to time); |

| • |

|

“Studio City” refers to a cinematically-themed integrated entertainment, retail and gaming resort in Cotai, Macau to be developed, consisting of the Studio City Project and the Additional Development;

|

| • |

|

“Studio City Holdings” refers to Studio City Holdings Limited, a company incorporated in the British Virgin Islands and our immediate holding company; |

| • |

|

“Studio City Project” or the “Project” refers to the first phase of our project to develop the Studio City site into a large-scale integrated leisure resort called “Studio City” combining

luxury hotel and related facilities, gaming capacity, retail, attractions and entertainment venues (including a multipurpose entertainment studio); |

| • |

|

“Studio City Project Facility” refers to the senior secured project facility agreement, dated January 28, 2013, entered into between, among others, Studio City Company Limited as borrower and certain of

its subsidiaries as guarantors, pursuant to which a term loan facility of HK$10,080,460,000 (equivalent to approximately US$1.3 billion) and revolving credit facility of HK$775,420,000 (equivalent to approximately US$100.0 million) were made

available; |

| • |

|

“US$” and “U.S. dollars” refer to the legal currency of the United States; |

| • |

|

“U.S. GAAP” refers to the accounting principles generally accepted in the United States; and |

| • |

|

“we”, “us”, “our” and “our company” refer to Studio City Finance Limited and, as the context requires, its predecessor entities and its consolidated subsidiaries.

|

This quarterly report includes our unaudited condensed consolidated financial statements for the three and six months ended

June 30, 2015.

Any discrepancies in any table between totals and sums of amounts listed therein are due to rounding. Accordingly,

figures shown as totals in certain tables may not be an arithmetic aggregation of the figures preceding them.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains forward-looking statements that relate to future events, including our future operating results and conditions,

our prospects and our future financial performance and condition, all of which are largely based on our current expectations and projections. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or

achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Moreover, because we operate in a heavily regulated and evolving industry, we may become highly

leveraged. We also operate in Macau, a market with intense competition, and therefore new risk factors may emerge from time to time. It is not possible for our management to predict all risk factors, nor can we assess the impact of these factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those expressed or implied in any forward-looking statement. Forward-looking statements involve inherent risks and

uncertainties, and a number of factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors include, but are not limited to, (i) growth of the gaming market and visitation in

Macau, (ii) capital and credit market volatility, (iii) local and global economic conditions, (iv) our anticipated growth strategies, (v) the number of gaming tables ultimately allocated to be operated at Studio City by the

applicable regulators, (vi) gaming authority and other governmental approvals and regulations, and (vii) our future business development, results of operations and financial condition. In some cases, forward-looking statements can be identified

by words or phrases such as “may”, “will”, “expect”, “anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”, “on track”, “believe”,

“potential”, “continue”, “is/are likely to” or other similar expressions.

The forward-looking statements

made in this quarterly report relate only to events or information as of the date on which the statements are made in this quarterly report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this quarterly report with the understanding that

our actual future results may be materially different from what we expect.

3

EXCHANGE RATE INFORMATION

Although we will have certain expenses and revenues denominated in Patacas, our revenues and expenses will be denominated predominantly in

H.K. dollars and, in connection with a portion of our indebtedness and certain expenses, U.S. dollars. Unless otherwise noted, all translations from H.K. dollars to U.S. dollars and from U.S. dollars to H.K. dollars in this quarterly report were

made at a rate of HK$7.78 to US$1.00.

The H.K. dollar is freely convertible into other currencies (including the U.S. dollar). Since

October 17, 1983, the H.K. dollar has been officially linked to the U.S. dollar at the rate of HK$7.80 to US$1.00. The market exchange rate has not deviated materially from the level of HK$7.80 to US$1.00 since the peg was first established.

However, in May 2005, the Hong Kong Monetary Authority broadened the trading band from the original rate of HK$7.80 per U.S. dollar to a rate range of HK$7.75 to HK$7.85 per U.S. dollar. The Hong Kong government has stated its intention to maintain

the link at that rate, and it, acting through the Hong Kong Monetary Authority, has a number of means by which it may act to maintain exchange rate stability. However, no assurance can be given that the Hong Kong government will maintain the link at

HK$7.75 to HK$7.85 per U.S. dollar or at all.

The noon buying rate on June 30, 2015 in New York City for cable transfers in H.K.

dollar per U.S. dollar, as certified for customs purposes by the H.10 weekly statistical release of the Federal Reserve Board of the United States, or the Federal Reserve Board, was HK$7.7513 to US$1.00. On August 14, 2015, the noon buying rate

was HK$7.7554 to US$1.00. We make no representation that any H.K. dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or H.K. dollars, as the case may be, at any particular rate or at all.

The Pataca is pegged to the H.K. dollar at a rate of HK$1.00 = MOP1.03. All translations from Patacas to U.S. dollars in this quarterly report

were made at the exchange rate of MOP8.0134 = US$1.00. The Federal Reserve Board does not certify for customs purposes a noon buying rate for cable transfers in Patacas.

4

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in connection with our unaudited condensed consolidated financial statements included elsewhere in

this quarterly report. Our unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP. The accompanying unaudited condensed consolidated financial statements should be read in conjunction with our audited

consolidated financial statements for the year ended December 31, 2014. The historical results are not necessarily indicative of the results of operations to be expected in the future. Certain statements in this “Financial Condition and

Results of Operations” are forward-looking statements.

Results of Operations

We are currently developing the Studio City Project which is on track to open on October 27, 2015. As of the date of this report, no

revenue or cash were provided by our intended operations during the periods reported. Accordingly, the activities reflected in our unaudited condensed consolidated statements of operations mainly relate to general and administrative expenses,

amortization of land use right, pre-opening costs, interest expenses and other finance costs. Consequently, we have incurred losses to date and expect these losses to continue to increase until we commence commercial operations.

Three Months Ended June 30, 2015 Compared to Three Months Ended June 30, 2014

For the second quarter of 2015, we had a net loss of US$35.3 million, an increase of US$21.0 million from a net loss of US$14.3 million for the

second quarter of 2014, primarily due to an increase in pre-opening costs.

Amortization of land use right expenses for the second quarter

of 2015 were US$3.0 million, in-line with the same period in 2014.

Pre-opening costs for the second quarter of 2015 were US$30.0 million,

compared to US$4.2 million incurred for the second quarter of 2014. The increase in pre-opening costs of US$25.9 million was primarily due to an increase in payroll costs and administrative costs in connection with the start-up operations of Studio

City incurred for the second quarter of 2015.

Interest expenses (net of capitalized interest of US$32.9 million) for the second quarter

of 2015 were nil, compared to US$35,000 (net of capitalized interest of US$18.1 million) for the second quarter of 2014. The decrease in interest expenses (net of capitalized interest) of US$35,000 was primarily due to a higher interest

capitalization of US$14.8 million associated with the Studio City construction and development projects and lower interest expenses on the Studio City land use right payable of US$0.6 million, partially offset by an increase in interest expenses of

US$15.3 million upon our drawdown in full of the term loan facility under the Studio City Project Facility in July 2014.

Other finance

costs for the second quarter of 2015 of US$3.4 million, included US$3.0 million of amortization of deferred financing costs (net of capitalization of US$2.9 million) associated with the drawdown in full in July 2014 of the term loan facility under

the Studio City Project Facility and the Studio City Notes issued in November 2012 as well as the loan commitment fees of US$0.4 million associated with the Studio City Project Facility which were payable from January 2013. Other finance costs for

the second quarter of 2014 of US$6.4 million, included US$0.1 million of amortization of deferred financing costs (net of capitalization of US$0.3 million) associated with the Studio City Notes and loan commitment fees of US$6.3 million associated

with the Studio City Project Facility. The increase in the amortization of deferred financing costs and decrease in loan commitment fees resulted from the drawdown in full of the term loan facility under the Studio City Project Facility in July

2014.

5

Six Months Ended June 30, 2015 Compared to Six Months Ended June 30, 2014

For the six months ended June 30, 2015, we had a net loss of US$64.2 million, an increase of US$36.4 million from a net loss of US$27.8

million for the six months ended June 30, 2014, primarily due to an increase in pre-opening costs, higher interest expenses and amortizations of deferred financing costs arising from the drawdown in full of the term loan facility under the

Studio City Project Facility on July 28, 2014, partially offset by higher interest capitalization upon our continuous development on Studio City and lower loan commitment fees.

Amortization of land use right expenses for the six months ended June 30, 2015 were US$6.1 million, in-line with the same period in 2014.

Pre-opening costs for the six months ended June 30, 2015 were US$47.3 million, compared to US$5.0 million incurred for the six

months ended June 30, 2014. The increase in pre-opening costs of US$42.3 million was primarily due to an increase in payroll costs and administrative costs in connection with the start-up operations of Studio City incurred for the six months

ended June 30, 2015.

Interest expenses (net of capitalized interest of US$64.3 million) for the six months ended June 30, 2015

were US$1.4 million, compared to US$2.3 million (net of capitalized interest of US$34.1 million) for the six months ended June 30, 2014. The decrease in interest expenses (net of capitalized interest) of US$0.9 million was primarily due to a

higher interest capitalization of US$30.2 million associated with the Studio City construction and development projects and lower interest expenses on the Studio City land use right payable of US$1.2 million, partially offset by an increase in

interest expenses of US$30.5 million upon our drawdown in full of the term loan facility under the Studio City Project Facility in July 2014.

Other finance costs for the six months ended June 30, 2015 of US$10.6 million, included US$9.7 million of amortization of deferred

financing costs (net of capitalization of US$2.9 million) associated with the term loan facility under the Studio City Project Facility drew in July 2014 and the Studio City Notes issued in November 2012 as well as the loan commitment fees of US$0.9

million associated with the Studio City Project Facility which were payable from January 2013. Other finance costs for the six months ended June 30, 2014 of US$13.1 million, included US$0.6 million of amortization of deferred financing costs

(net of capitalization of US$0.3 million) associated with the Studio City Notes and loan commitment fees of US$12.5 million associated with the Studio City Project Facility. The increase in the amortization of deferred financing costs and decrease

in loan commitment fees resulted from the drawdown in full of the term loan facility under the Studio City Project Facility in July 2014.

Liquidity

and Capital Resources

We have relied on shareholder equity contributions and/or subordinated loans from our shareholders, net proceeds

from the Studio City Notes and a portion of the Studio City Project Facility to meet our development project needs through the opening of the Studio City Project. As a result, our working capital balance may be negative from time to time as the

source of funds will be from long-term debt while our liabilities are current. In addition, we expect our cash outflow to increase as we will have substantial payment obligations relating to various development capital expenditure, pre-opening and

working capital expenses and debt financing obligations during the construction period.

As of June 30, 2015, a total of US$1,280.0

million, representing all of the capital contribution required under the Shareholders Agreement, has been funded by MCE Cotai and New Cotai to SCI. The Shareholders Agreement does not require MCE Cotai or New Cotai to make any additional capital

contributions to SCI.

6

Cash Flows

The following table sets forth a summary of our cash flows for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(In thousands of US$) |

|

| Net cash provided by (used in) operating activities |

|

$ |

1,898 |

|

|

$ |

(12,029 |

) |

|

$ |

(18,416 |

) |

|

$ |

(19,285 |

) |

| Net cash provided by investing activities |

|

|

10,606 |

|

|

|

15,247 |

|

|

|

32,105 |

|

|

|

23,444 |

|

| Net cash used in financing activities |

|

|

(25 |

) |

|

|

(3,218 |

) |

|

|

(334 |

) |

|

|

(4,159 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

12,479 |

|

|

|

— |

|

|

|

13,355 |

|

|

|

— |

|

| Cash and cash equivalents at beginning of period |

|

|

4,037 |

|

|

|

— |

|

|

|

3,161 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

16,516 |

|

|

$ |

— |

|

|

$ |

16,516 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities

We are currently developing the Studio City Project and therefore there was no revenue or cash generated from our intended operations during

the periods reported herein. Net cash provided by (used in) operating activities during the presented periods in this quarterly report mainly represents general and administrative expenses, pre-opening costs, loan commitment fees associated with

Studio City Project Facility paid and the working capital changes during the periods. For the three months ended June 30, 2015, net cash provided by operating activities were US$1.9 million. For the three months ended June 30, 2014, net

cash used in operating activities were US$12.0 million. While for the six months ended June 30, 2015 and 2014, net cash used in operating activities were US$18.4 million and US$19.3 million, respectively. The change for the three and six months

ended June 30, 2015 compared to the same periods in 2014 was primarily due to the decreased working capital partially offset by the increase in pre-opening costs paid during the periods.

The Studio City Project is on track to open on October 27, 2015. Our financial condition and ability to generate cash flow after the

opening of the Studio City Project will depend to a large extent on the Studio City gaming revenue, which will be affected by, among other things, the number of gaming tables allocated by the Macau government for the Studio City Project and we

remain concerned about receiving materially fewer tables than we intend to request for Studio City. We continue to monitor news reports and the Macau government’s policies relating to gaming table allocations in Macau and understand that a

Macau gaming operator received an allocation of only 150 tables in May 2015. Because of the possibility that the table allocation for Studio City’s gaming area may be lower than anticipated, SCI has engaged Kirkland & Ellis LLP as its

counsel and Moelis & Company LLC as its investment banker to assist it with contingency planning ahead of any table allocation decision for Studio City. In the event that the Studio City Project is allocated fewer than 400 tables, we may

not be able to meet certain conditions and requirements of the Studio City Project Facility. In addition, an allocation of fewer than 400 tables could have a material adverse effect on our cash flow, results of operations and financial condition. As

of the date of this report, no application has been submitted to the Macau government for the gaming table allocation for Studio City.

Notwithstanding this concern, we believe Studio City’s unique and diversified offerings will make it a unique asset built consistent with

the Macau government’s objective of delivering world class entertainment.

7

Investing Activities

Net cash provided by investing activities was US$10.6 million for the three months ended June 30, 2015 as compared to US$15.2 million

provided by investing activities for the three months ended June 30, 2014. The decrease was primarily due to the increased capital expenditure payments, advance to an affiliated company and prepayment for other long-term assets, partially

offset by the decrease in restricted cash. Net cash provided by investing activities for the three months ended June 30, 2015 included a decrease in restricted cash of US$318.7 million, partially offset by capital expenditure payments of

US$264.0 million, prepayment for other long-term assets of US$24.2 million, advance to an affiliated company of US$10.9 million and advance payments and deposits for acquisition of property and equipment of US$9.0 million.

Net cash provided by investing activities was US$15.2 million for the three months ended June 30, 2014, primarily due to a decrease in

restricted cash of US$147.0 million, partially offset by capital expenditure payments of US$122.1 million and advance payments and deposits for acquisition of property and equipment of US$9.6 million.

The decrease in restricted cash of US$318.7 million and US$147.0 million during the three months ended June 30, 2015 and 2014,

respectively, was primarily due to withdrawal and payment of Studio City Project Costs from bank accounts that are restricted for Studio City Project Costs in accordance with the terms of Studio City Notes and Studio City Project Facility.

Net cash provided by investing activities was US$32.1 million for the six months ended June 30, 2015, as compared to US$23.4 million

provided by investing activities for the six months ended June 30, 2014. The increase was primarily due to the decrease in restricted cash, partially offset by increased capital expenditure payments. Net cash provided by investing activities

for the six months ended June 30, 2015 included a decrease in restricted cash of US$582.2 million, partially offset by capital expenditure payments of US$475.4 million, land use right payment of US$24.4 million, prepayment for other long-term

assets of US$24.2 million, advance payments and deposits for acquisition of property and equipment of US$15.2 million and advance to an affiliated company of US$10.9 million.

Net cash provided by investing activities was US$23.4 million for the six months ended June 30, 2014, primarily due to a decrease in

restricted cash of US$281.3 million, partially offset by capital expenditure payments of US$201.8 million, advance payments and deposits for acquisition of property and equipment of US$32.8 million and land use right payment of US$23.2 million.

The decrease in restricted cash of US$582.2 million and US$281.3 million during the six months ended June 30, 2015 and 2014,

respectively, was primarily due to withdrawal and payment of Studio City Project Costs from bank accounts that are restricted for Studio City Project Costs in accordance with the terms of the Studio City Notes and Studio City Project Facility.

Financing Activities

Net cash

used in financing activities was US$25,000 for the three months ended June 30, 2015, primarily due to the payment of debt issuance costs of US$25,000 associated with the Studio City Project Facility.

Net cash used in financing activities was US$3.2 million for the three months ended June 30, 2014, primarily due to prepaid debt issuance

costs of US$3.2 million associated with the Studio City Project Facility.

Net cash used in financing activities was US$0.3 million for

the six months ended June 30, 2015, primarily due to the payment of debt issuance costs of US$0.3 million associated with the Studio City Project Facility.

Net cash used in financing activities was US$4.2 million for the six months ended June 30, 2014, primarily due to prepaid debt issuance

costs of US$4.2 million associated with the Studio City Project Facility.

8

Indebtedness and Capital Contributions

The following table presents a summary of our indebtedness as of June 30, 2015:

|

|

|

|

|

| |

|

As of June 30,

2015

(In thousands of US$) |

|

| Studio City Project Facility |

|

$ |

1,295,689 |

|

| Studio City Notes |

|

|

825,000 |

|

|

|

|

|

|

|

|

$ |

2,120,689 |

|

|

|

|

|

|

There was no change in our indebtedness as of June 30, 2015 compared to March 31, 2015.

Under the Studio City Project Facility, a five-year HK$10,080,460,000 (equivalent to approximately US$1.3 billion) term loan facility and a

HK$775,420,000 (equivalent to approximately US$100.0 million) revolving credit facility were made available. On July 28, 2014, we drew down the entire term loan facility under the Studio City Project Facility, while the revolving credit

facility under the Studio City Project Facility remains available for future drawdown, subject to satisfaction of certain conditions precedent. Certain proceeds of the term loan facility (which has been fully drawn) have been placed in a

disbursement account, which is secured in favor of the security agent for the facility, and may be withdrawn to pay Project Costs, subject to the satisfaction of certain conditions and requirements pursuant to an agreed term loan facility

disbursement agreement. Certain proceeds of the Studio City Notes have also been placed in reserved accounts, which are secured in favor of the collateral agent for the Studio City Notes, and may be withdrawn to pay the interest payable under the

Studio City Notes, subject to the satisfaction of the conditions and requirements as specified by the relevant security documents.

For

the purpose of financing the Studio City Project, we issued the US$825.0 million Studio City Notes and drew down the term loan facility of HK$10,080,460,000 (equivalent to approximately US$1.3 billion) under the Studio City Project Facility, in

November 2012 and July 2014, respectively. As of the date of this report, MCE Cotai and New Cotai, the shareholders of SCI, had contributed an aggregate amount of US$1,250.0 million (which amount includes the completion guarantee support cash of

US$225.0 million provided under the Studio City Project Facility) to the Studio City Project and US$30.0 million for the Additional Development.

9

Studio City Finance Limited

Index To Unaudited Condensed Consolidated Financial Statements

For the Three and Six Months Ended June 30, 2015

|

|

|

|

|

| |

|

Page |

|

|

|

| Unaudited Condensed Consolidated Balance Sheets |

|

|

F-2 |

|

|

|

| Unaudited Condensed Consolidated Statements of Operations |

|

|

F-3 |

|

|

|

| Unaudited Condensed Consolidated Statements of Cash Flows |

|

|

F-4 |

|

F-1

Studio City Finance Limited

Condensed Consolidated Balance Sheets

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2015 |

|

|

December 31,

2014 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

16,516 |

|

|

$ |

3,161 |

|

| Restricted cash |

|

|

801,200 |

|

|

|

1,368,390 |

|

| Amounts due from affiliated companies |

|

|

7,266 |

|

|

|

3,874 |

|

| Amount due from an intermediate holding company |

|

|

82 |

|

|

|

82 |

|

| Prepaid expenses and other current assets |

|

|

5,091 |

|

|

|

2,999 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

830,155 |

|

|

|

1,378,506 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT, NET |

|

|

2,182,731 |

|

|

|

1,629,803 |

|

| LONG-TERM PREPAYMENTS, DEPOSITS AND OTHER ASSETS |

|

|

52,140 |

|

|

|

80,687 |

|

| RESTRICTED CASH |

|

|

35,066 |

|

|

|

50,064 |

|

| DEFERRED FINANCING COSTS, NET |

|

|

72,635 |

|

|

|

85,195 |

|

| LAND USE RIGHT, NET |

|

|

136,175 |

|

|

|

142,227 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

3,308,902 |

|

|

$ |

3,366,482 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDER’S EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accrued expenses and other current liabilities |

|

$ |

143,469 |

|

|

$ |

139,223 |

|

| Current portion of long-term debt |

|

|

38,871 |

|

|

|

— |

|

| Amounts due to affiliated companies |

|

|

16,173 |

|

|

|

3,730 |

|

| Amount due to ultimate holding company |

|

|

917 |

|

|

|

337 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

199,430 |

|

|

|

143,290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LONG-TERM DEBT |

|

|

2,081,818 |

|

|

|

2,120,689 |

|

| ADVANCE FROM IMMEDIATE HOLDING COMPANY |

|

|

942,779 |

|

|

|

942,779 |

|

| OTHER LONG-TERM LIABILITIES |

|

|

47,218 |

|

|

|

57,846 |

|

|

|

|

| SHAREHOLDER’S EQUITY |

|

|

|

|

|

|

|

|

| Ordinary shares(1) |

|

|

— |

|

|

|

— |

|

| Additional paid-in capital |

|

|

298,596 |

|

|

|

298,596 |

|

| Accumulated other comprehensive losses |

|

|

(102 |

) |

|

|

(84 |

) |

| Accumulated losses |

|

|

(260,837 |

) |

|

|

(196,634 |

) |

|

|

|

|

|

|

|

|

|

| Total shareholder’s equity |

|

|

37,657 |

|

|

|

101,878 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDER’S EQUITY |

|

$ |

3,308,902 |

|

|

$ |

3,366,482 |

|

|

|

|

|

|

|

|

|

|

| (1) |

The authorized share capital of Studio City Finance Limited was 50,000 shares of US$1 par value per share, as of June 30, 2015 and December 31, 2014, 1 share of US$1 par value per share was issued and fully

paid. |

F-2

Studio City Finance Limited

Condensed Consolidated Statements of Operations (Unaudited)

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

| OPERATING REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other revenue |

|

$ |

265 |

|

|

$ |

652 |

|

|

$ |

696 |

|

|

$ |

934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative |

|

|

(512 |

) |

|

|

(934 |

) |

|

|

(1,398 |

) |

|

|

(1,511 |

) |

| Amortization of land use right |

|

|

(3,026 |

) |

|

|

(3,026 |

) |

|

|

(6,052 |

) |

|

|

(6,052 |

) |

| Depreciation and amortization |

|

|

(15 |

) |

|

|

(2 |

) |

|

|

(25 |

) |

|

|

(2 |

) |

| Pre-opening costs |

|

|

(30,013 |

) |

|

|

(4,163 |

) |

|

|

(47,315 |

) |

|

|

(5,019 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

(33,566 |

) |

|

|

(8,125 |

) |

|

|

(54,790 |

) |

|

|

(12,584 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING LOSS |

|

|

(33,301 |

) |

|

|

(7,473 |

) |

|

|

(54,094 |

) |

|

|

(11,650 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-OPERATING INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

1,263 |

|

|

|

14 |

|

|

|

1,720 |

|

|

|

32 |

|

| Interest expenses, net of capitalized interest |

|

|

— |

|

|

|

(35 |

) |

|

|

(1,356 |

) |

|

|

(2,261 |

) |

| Other finance costs |

|

|

(3,401 |

) |

|

|

(6,397 |

) |

|

|

(10,596 |

) |

|

|

(13,064 |

) |

| Foreign exchange gain (loss), net |

|

|

131 |

|

|

|

(442 |

) |

|

|

123 |

|

|

|

(855 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-operating expenses, net |

|

|

(2,007 |

) |

|

|

(6,860 |

) |

|

|

(10,109 |

) |

|

|

(16,148 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(35,308 |

) |

|

$ |

(14,333 |

) |

|

$ |

(64,203 |

) |

|

$ |

(27,798 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-3

Studio City Finance Limited

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

|

$ |

1,898 |

|

|

$ |

(12,029 |

) |

|

$ |

(18,416 |

) |

|

$ |

(19,285 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payment for acquisition of property and equipment |

|

|

(263,997 |

) |

|

|

(122,115 |

) |

|

|

(475,352 |

) |

|

|

(201,764 |

) |

| Payment for land use right |

|

|

— |

|

|

|

— |

|

|

|

(24,376 |

) |

|

|

(23,201 |

) |

| Prepayment for other long-term assets |

|

|

(24,205 |

) |

|

|

— |

|

|

|

(24,205 |

) |

|

|

— |

|

| Advance payments and deposits for acquisition of property and equipment |

|

|

(9,008 |

) |

|

|

(9,600 |

) |

|

|

(15,232 |

) |

|

|

(32,842 |

) |

| Advance to an affiliated company |

|

|

(10,923 |

) |

|

|

— |

|

|

|

(10,923 |

) |

|

|

— |

|

| Changes in restricted cash |

|

|

318,739 |

|

|

|

146,962 |

|

|

|

582,193 |

|

|

|

281,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by investing activities |

|

|

10,606 |

|

|

|

15,247 |

|

|

|

32,105 |

|

|

|

23,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payment of deferred financing costs |

|

|

(25 |

) |

|

|

— |

|

|

|

(334 |

) |

|

|

— |

|

| Prepayment of deferred financing costs |

|

|

— |

|

|

|

(3,218 |

) |

|

|

— |

|

|

|

(4,162 |

) |

| Advance from immediate holding company |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(25 |

) |

|

|

(3,218 |

) |

|

|

(334 |

) |

|

|

(4,159 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCREASE IN CASH AND CASH EQUIVALENTS |

|

|

12,479 |

|

|

|

— |

|

|

|

13,355 |

|

|

|

— |

|

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD |

|

|

4,037 |

|

|

|

— |

|

|

|

3,161 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS AT END OF PERIOD |

|

$ |

16,516 |

|

|

$ |

— |

|

|

$ |

16,516 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURES OF CASH FLOWS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash paid for interest (net of capitalized interest) |

|

$ |

(5,844 |

) |

|

$ |

(5,844 |

) |

|

$ |

(5,844 |

) |

|

$ |

(5,844 |

) |

|

|

|

|

|

| NON-CASH INVESTING ACTIVITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Construction costs and property and equipment funded through accrued expenses and other current liabilities and other long-term

liabilities |

|

|

(8,616 |

) |

|

|

16,317 |

|

|

|

53,538 |

|

|

|

71,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-4

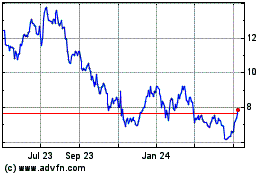

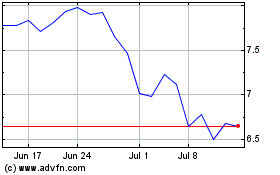

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Apr 2023 to Apr 2024