FORM

6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a–16 OR 15d–16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2015

Commission File Number: 001-33178

MELCO CROWN ENTERTAINMENT LIMITED

36th Floor, The Centrium

60 Wyndham Street

Central

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20–F or Form 40–F. Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by

furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3–2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is

marked, indicate below the file number assigned to the registrant in connection with Rule 12g3–2(b): 82– N/A

MELCO CROWN ENTERTAINMENT LIMITED

Form 6–K

TABLE OF

CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| MELCO CROWN ENTERTAINMENT LIMITED |

|

|

| By: |

|

/s/ Geoffrey Davis |

| Name: |

|

Geoffrey Davis, CFA |

| Title: |

|

Chief Financial Officer |

Date: May 20, 2015

3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Poll Results of AGM held on May 20, 2015; Retirement and Appointment of Director and Update on Delisting from HKEx. |

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

Melco Crown Entertainment Limited

(Incorporated in the Cayman Islands with limited liability)

(SEHK Stock Code: 6883)

(1) POLL RESULTS OF THE ANNUAL GENERAL MEETING

HELD ON MAY 20, 2015

(2) RETIREMENT AND APPOINTMENT

OF NON-EXECUTIVE DIRECTOR

AND

(3) UPDATE OF

PROPOSED VOLUNTARY

WITHDRAWAL OF LISTING ON

THE STOCK EXCHANGE OF HONG KONG LIMITED

The Board is pleased to announce that the resolutions as set out in the notice of the AGM dated

April 16, 2015 were duly passed by the Shareholders by way of poll at the AGM held on May 20, 2015.

The Board

also announces that Mr. Rowen Bruce Craigie retired as a non-executive Director of the Company with effect from the conclusion of the AGM and Mr. Robert John Rankin was appointed as a non-executive Director of the Company with effect from

the conclusion of the AGM.

The Board further announces that the Listing Committee of the Stock

Exchange approved the Proposed De-Listing on May 8, 2015. A further announcement will be made by the Company upon all conditions for the withdrawal of listing have been satisfied.

1

References are made to the circular and the notice of the Annual General Meeting (the “AGM”) of

Melco Crown Entertainment Limited (the “Company”) both dated April 16, 2015, and the announcements of the Company dated January 2, 2015 and March 25, 2015, and the circular of the Company dated March 4, 2015 (the

“Circular”), in relation to, among other matters, the proposed voluntary withdrawal of the listing of the Company’s shares on the Main Board of The Stock Exchange of Hong Kong Limited (the “Stock Exchange”)

(the “Proposed De-Listing”).

POLL RESULTS OF THE AGM

The board of directors of the Company (the “Board” or “Directors”) is pleased to announce that the resolutions as set out in

the notice of the AGM dated April 16, 2015 were duly passed by the shareholders of the Company (the “Shareholders”), by way of poll at the AGM held on May 20, 2015. Computershare Hong Kong Investor Services Limited, the

Hong Kong branch share registrar of the Company, was appointed as the scrutineer for the vote-taking at the AGM.

The poll results in respect of all the

resolutions proposed at the AGM are set out below:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Number of Votes (%) |

| Ordinary Resolutions |

|

|

|

For |

|

Against |

| 1. |

|

To ratify the annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, and to receive and adopt the audited consolidated financial statements and the directors’

and auditors’ reports, for the year ended December 31, 2014. |

|

|

|

1,435,287,265 (99.988%) |

|

174,885

(0.012%) |

| |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 2(A). |

|

To re-elect Mr. Lawrence Yau Lung Ho as the executive Director of the Company. |

|

|

|

1,434,748,417 (98.859%) |

|

16,552,401

(1.141%) |

| |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 2(B). |

|

To re-elect Mr. James Douglas Packer as a non-executive Director of the Company. |

|

|

|

1,439,021,344 (99.006%) |

|

14,449,122

(0.994%) |

| |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 2(C). |

|

To re-elect Mr. John Peter Ben Wang as a non-executive Director of the Company. |

|

|

|

1,438,432,821 (98.979%) |

|

14,836,252

(1.021%) |

| |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 3. |

|

To appoint Mr. Robert Rankin as a non-executive Director of the Company. |

|

|

|

1,438,505,728

(98.983%) |

|

14,781,667

(1.017%) |

| |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

2

|

|

|

|

|

|

|

|

|

| 4. |

|

To authorize the board of directors of the Company (the “Directors”) to fix the remuneration of each Director. |

|

|

|

1,444,100,051

(99.836%) |

|

2,374,008 (0.164%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 5. |

|

To ratify the appointment of and re-appoint the independent auditors of the Company, Deloitte Touche Tohmatsu, and to authorize the Directors to fix their remuneration. |

|

|

|

1,454,370,316

(99.980%) |

|

284,169

(0.020%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 6. |

|

To grant a general and unconditional mandate to the Directors to issue new shares of the Company not exceeding 20% of the issued share capital of the Company as at the date of passing this

resolution, valid for a period commencing from this resolution date until the earliest of (i) the conclusion of the next annual general meeting; (ii) the expiration of the period within which the next annual general meeting is required to be held by

Articles, Cayman Islands laws or any other applicable law; and (iii) the revocation of such mandate by shareholders (the “Relevant Period”). |

|

|

|

1,268,194,480

(87.271%) |

|

184,967,935

(12.729%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 7(A). |

|

To grant a general and unconditional mandate to the Directors to repurchase shares of the Company not exceeding 10% of the issued share capital of the Company as at the date of passing this

resolution, valid for a period commencing from this resolution date until the earliest of (i) the Relevant Period; and (ii) the effective date and time of the Proposed De-Listing. |

|

|

|

1,452,499,068

(99.946%) |

|

784,670

(0.054%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 7(B). |

|

To grant a general and unconditional mandate to the Directors to repurchase shares of the Company, valid for a period immediately following the effective date and time of the Proposed

De-Listing until the end of the Relevant Period. |

|

|

|

1,452,577,059

(99.950%) |

|

723,113

(0.050%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

3

|

|

|

|

|

|

|

|

|

| 8. |

|

To extend the general mandate granted to the Directors to issue new shares of the Company under Resolution No. 6 by the aggregate nominal amount of shares

repurchased by the Company pursuant to the general mandates granted to the Directors to repurchase shares of the Company under Resolutions 7A and 7B. |

|

|

|

1,269,200,764 (87.342%) |

|

183,938,872 (12.658%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

| 9. |

|

To (a) approve certain amendments to the Company’s 2011 Share Incentive Plan, including removing references to, and provisions required by Hong Kong laws and the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”), adding clarifications and modifying and updating certain provisions, to be implemented as of the effective date and time of the Proposed

De-Listing, and (b) authorize any one Director and officer of the Company, including the Chief Executive Officer, Chief Financial Officer, Chief Legal Officer and Company Secretary (collectively, the “Authorized Representatives”) to

execute such documents, make such applications and submissions and do all such acts, deeds or things incidental thereto or arising in connection therewith as such Authorized Representative might deem appropriate, and approve all such actions by any

Authorized Representative on behalf of the Company in connection with the foregoing resolution. |

|

|

|

1,261,373,698

(86.821%) |

|

191,469,082

(13.179%) |

| |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

4

|

|

|

|

|

|

|

|

|

| 10. |

|

To (a) approve certain amendments to the Share Incentive Plan of Melco Crown (Philippines) Resorts Corporation (“MCP”), including removing

references to Hong Kong laws and Listing Rules, adding clarifications and modifying and updating certain provisions, to be implemented upon the occurrence of the following events: (i) the effective date and time of the Proposed De-Listing; (ii) the

passing of the necessary resolutions by the directors and shareholders of MCP; and (iii) the Philippine Securities and Exchange Commission approving the amendments, and (b) authorize any one director and officer of the Company and MCP (collectively,

the “MCP Authorized Representatives”) to execute such documents, make such applications and submissions and do all such acts, deeds or things incidental thereto or arising in connection therewith as such MCP Authorized

Representative might deem appropriate, and approve all such actions by any MCP Authorized Representative on behalf of the Company in connection with the foregoing resolution. |

|

|

|

1,261,602,064 (86.826%) |

|

191,426,221 (13.174%) |

|

As more than 50% of the votes were cast in favor of the resolution, the resolution was duly passed as an ordinary

resolution. |

As of the date of the AGM, the total number of issued shares of the Company was 1,630,924,523, which was the total number of

shares entitling the Shareholders to attend and vote for or against the resolutions proposed at the AGM. There were no restrictions on any Shareholders to cast votes of the proposed resolutions at the AGM and there were no shares entitling the

Shareholders to attend and vote only against any of the proposed resolutions at the AGM. No Shareholder was required to abstain from voting at the AGM for approving the resolutions proposed at the AGM.

RETIREMENT OF NON-EXECUTIVE DIRECTOR

Mr. Rowen

Bruce Craigie (“Mr. Craigie”), the non-executive Director of the Company, did not offer himself for re-election at the AGM because Crown had nominated Crown’s new director, Mr. Robert John Rankin, in place of himself as a

Director of the Company with effect from the conclusion of the AGM. Mr. Craigie confirmed that he has no claims whatsoever against the Company for fees, compensation for loss of office, remuneration, severance payments, pension, expenses or

otherwise and there is no matter relating to his retirement that needs to be brought to the attention of the Shareholders or the Stock Exchange.

The

Board would like to take this opportunity to express its sincere thanks to Mr. Craigie for his valuable contribution to the Company during his tenure of service.

5

APPOINTMENT OF NON-EXECUTIVE DIRECTOR

Since the resolution to appoint Mr. Robert John Rankin (“Mr. Rankin”) as a non-executive Director was passed as ordinary resolution at the

AGM, Mr. Rankin was appointed as a non-executive Director with effect from the conclusion of the AGM.

Mr. Robert John Rankin, aged 51, joined

Deutsche Bank AG in June 2009 and has been a member of the Group Executive Committee since January 2011. He was the first CEO from Asia Pacific to become a member of the Group Executive Committee. Between October 2009 and June 2012, he was the Chief

Executive Officer for Deutsche Bank in the Asia Pacific (ex-Japan) region and was responsible for the Bank’s management and strategic development in the region. In June 2012, Mr. Rankin was appointed Co-Global Head of Corporate

Banking & Securities (“CB&S”) and Global Head of Corporate Finance where he was based out of London. Mr. Rankin completed Bachelor degrees in Economics and Law from the University of Sydney in 1985 and 1987

respectively before taking time off to travel through India and Southeast Asia. Upon returning to Sydney, Mr. Rankin worked as a securities and mergers and acquisitions lawyer at Blake Dawson Waldron. Whilst working at Blake Dawson Waldron,

Mr. Rankin was also a member of the Australian Stock Exchange Listing Committee.

After joining the Australian arm of the Swiss Bank Corporation

(merging to become UBS in 1998), Mr. Rankin quickly rose through the ranks in the Sydney office of UBS and relocated to Hong Kong in 2001 to be the UBS Head of Asia Pacific telecommunications, media and technology. In 2003, he was named by UBS

as Managing Director and Co-Head of Investment Banking, Asia Pacific (ex Japan), and was sole Managing Director and Head a year later. In this role, he had responsibility for corporate and government advisory engagements, debt and equity origination

and mergers and acquisitions in the region. He also served on the UBS Investment Bank Board. Mr. Rankin joined Deutsche Bank in 2009 where he immediately repeated the growth success he managed at UBS. Under his leadership, Deutsche Bank became

the No. 1 ranked investment bank for initial public offerings in the Asia region and No. 3 for overall investment banking in 2012 according to Dealogic. As Co-Head of CB&S Mr. Rankin was responsible for Deutsche Bank’s

leading global investment banking business serving institutional, corporate and sovereign clients from over 100 offices in 40 countries. As Head of Corporate Finance, he oversaw Deutsche Bank’s leading global capital markets, origination and

advisory businesses and acted as trusted advisor to many of Deutsche Bank’s most important clients. CB&S is consistently ranked as a top-tier investment bank for Corporate Finance and Sales & Trading and recognized as an industry

leader in areas including Electronic Trading, Structured Finance and Prime Finance. It has a strong global franchise across mergers and acquisitions, including advisory, debt and equity origination and issuance, and capital markets coverage of large

and medium-sized corporations. In addition to his client responsibilities, Mr. Rankin oversaw several internal CB&S programmes covering regulatory readiness, cultural change and talent development.

Save as disclosed above, Mr. Rankin has not held any directorships in other listed public companies during the past three years, does not hold any other

position with the Company or other members of the Group and does not have any other relationships with any of the other Directors, senior management, substantial shareholders or controlling shareholders of the Company.

6

As at the date of this announcement, Mr. Rankin does not have, and was not deemed to have any interests or

short positions in any Shares, underlying Shares or interests in debentures of the Company and its associated corporations within the meaning of Part XV of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong).

There is no director service contract entered into between Mr. Rankin and the Company. His directorship with the Company is not for a specific term and

he will be subject to rotation, retirement and re-election at annual general meeting pursuant to the Articles. Mr. Rankin will be entitled to share-based compensation which is determined with reference to his duties and responsibilities with

the Company, experience and abilities required of Mr. Rankin, his individual performance, the Company’s operating results and the remuneration offered for similar positions in comparable companies.

Save as disclosed above, there are no other matters concerning Mr. Rankin that need to be brought to the attention of the Shareholders in connection with

his appointment and there is no other information that should be disclosed pursuant to Rule 13.51(2)(h) to (v) of the Listing Rules.

The Board would

like to take this opportunity to extend its warm welcome to Mr. Rankin for joining the Board.

UPDATE OF PROPOSED DE-LISTING

As disclosed in the Circular, pursuant to Rule 6.11 of the Listing Rule, the Proposed De-Listing is conditional upon:

| (i) |

the approval of the Shareholders by way of an ordinary resolution at an extraordinary general meeting of the Company for considering and approving, amongst others, the Proposed De-Listing; |

| (ii) |

the approval of the listing sub-committee of the board of directors of the Stock Exchange (the “Listing Committee”); and |

| (iii) |

the Company having given its Shareholders at least three months’ notice of the Proposed De-Listing commencing on the date of Shareholders’ approval of the Proposed De-Listing. |

At the extraordinary general meeting of the Company held on March 25, 2015, the resolution to approve the Proposed De-Listing was duly passed by the

Shareholders by way of poll. The Listing Committee approved the Proposed De-Listing on May 8, 2015. Notice of Proposed De-Listing was given to the Shareholders on March 25, 2015 by way of the Company’s announcement issued on that

date, and the requisite three month notice period will complete on June 26, 2015.

7

As indicated in the timetable set out in the Circular, a further announcement will be made by the Company on

June 26, 2015 specifying (a) satisfaction of all conditions under Rule 6.11; (b) last day of dealings; and (c) date of withdrawal of listing on the Stock Exchange.

|

| By Order of the Board of |

| Melco Crown Entertainment Limited |

| Stephanie Cheung |

| Company Secretary |

Macau, May 20, 2015

As at the date of this announcement, the Board comprises one executive Director, namely Mr. Lawrence Yau Lung Ho (Co-Chairman and Chief Executive

Officer); five non-executive Directors, namely Mr. James Douglas Packer (Co-Chairman), Mr. John Peter Ben Wang, Mr. Clarence Yuk Man Chung, Mr. William Todd Nisbet, and Mr. Robert John Rankin; and four independent non-executive

Directors, namely Mr. James Andrew Charles MacKenzie, Mr. Thomas Jefferson Wu, Mr. Alec Yiu Wa Tsui, and Mr. Robert Wason Mactier.

8

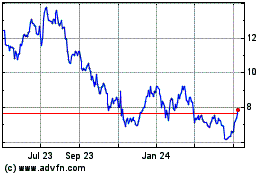

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

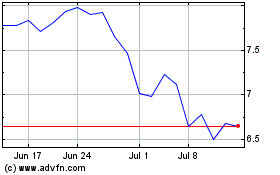

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Apr 2023 to Apr 2024