FORM 6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a–16 OR 15d–16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2015

Commission File Number: 001-33178

MELCO CROWN

ENTERTAINMENT LIMITED

36th Floor, The Centrium

60 Wyndham Street

Central

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20–F or Form 40–F. Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7): ¨

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3–2(b) under the Securities Exchange Act of

1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3–2(b): 82– N/A

MELCO CROWN ENTERTAINMENT LIMITED

Form 6–K

TABLE OF CONTENTS

Signature

|

|

|

|

|

| Exhibit 99.1 |

|

|

|

Circular and Proxy Form of Extraordinary General Meeting to be despatched on and dated March 4, 2015 |

|

|

|

| Exhibit 99.2 |

|

|

|

Timetable for Proposed Voluntary Withdrawal of Listing on the Stock Exchange of

HongKong Limited |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

| MELCO CROWN ENTERTAINMENT LIMITED |

|

|

| By: |

|

/s/ Geoffrey Davis |

| Name: |

|

Geoffrey Davis, CFA |

| Title: |

|

Chief Financial Officer |

Date: March 3, 2015

3

EXHIBIT INDEX

|

|

|

|

|

| Exhibit No. |

|

|

|

Description |

|

|

|

| Exhibit 99.1 |

|

|

|

Circular and Proxy Form of Extraordinary General Meeting to be despatched on and dated March 4, 2015 |

|

|

|

| Exhibit 99.2 |

|

|

|

Timetable for Proposed Voluntary Withdrawal of Listing on the Stock Exchange of HongKong Limited |

Exhibit 99.1

THIS CIRCULAR IS IMPORTANT AND

REQUIRES YOUR IMMEDIATE ATTENTION

If

you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser.

If you have sold or transferred all your shares in Melco Crown Entertainment Limited, you should at once hand this circular, together with the

enclosed proxy form, to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee.

Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited, Hong Kong Securities Clearing Company Limited and NASDAQ Global Select

Market take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part

of the contents of this circular.

(Incorporated in the Cayman Islands with limited liability)

(SEHK Stock Code: 6883)

PROPOSED VOLUNTARY WITHDRAWAL OF LISTING ON

THE STOCK EXCHANGE OF HONG KONG LIMITED AND

PROPOSED AMENDMENTS TO CONSTITUTIONAL DOCUMENTS

A notice convening an extraordinary general

meeting (the “EGM”) of Melco Crown Entertainment Limited (the “Company”) to be held at Salon VI, Level 2, Grand Hyatt Macau, City of Dreams, Estrada do Istmo, Cotai, Macau on Wednesday, March 25, 2015 at 2:00

p.m. (Hong Kong time) is set out on pages 50 and 51 of this circular. A proxy form for use at the EGM and at any adjournment thereof is enclosed with this circular. Such proxy form is also published on the website of Hong Kong Exchanges and Clearing

Limited (www.hkexnews.hk) and the Company (www.melco-crown.com).

Whether or not you are able to attend such meeting, please complete and

return the accompanying proxy form in accordance with the instructions printed thereon to the Company’s share registrar in Hong Kong, Computershare Hong Kong Investor Services Limited, at 17M Floor, Hopewell Centre, 183 Queen’s Road East,

Wanchai, Hong Kong, as soon as possible and in any event not less than 48 hours before the time appointed for holding the meeting or any adjournment thereof. Completion and return of the form of proxy will not preclude Shareholders from attending

and voting in person at the meeting or any adjournment thereof (as the case may be) should you wish.

March 4, 2015

CONTENTS

|

|

|

|

|

| Clause |

|

Page |

|

|

|

| Indicative Timetable |

|

|

ii |

|

|

|

| Definitions |

|

|

1 |

|

|

|

| Letter from the Board |

|

|

5 |

|

|

|

| Proposed De-Listing |

|

|

5 |

|

|

|

| Introduction |

|

|

5 |

|

|

|

| Reasons for the Proposed De-Listing |

|

|

6 |

|

|

|

| Conditions of the Proposed De-Listing |

|

|

7 |

|

|

|

| Effects of the Proposed De-Listing |

|

|

7 |

|

|

|

| Tradability of our Shares |

|

|

7 |

|

|

|

| Actions to be taken by Shareholders and ADS Holders |

|

|

8 |

|

|

|

| Adoption of the Proposed Articles |

|

|

9 |

|

|

|

| Amendments to the MCE SIP and MCP SIP |

|

|

10 |

|

|

|

| General |

|

|

11 |

|

|

|

| Recommendation |

|

|

11 |

|

|

|

| Responsibility Statement |

|

|

11 |

|

|

|

| Appendix I Arrangements for deposit into and withdrawal from the ADS Program |

|

|

12 |

|

|

|

| Appendix II Proposed Articles |

|

|

17 |

|

|

|

| Notice of Extraordinary General Meeting |

|

|

50 |

|

— i —

INDICATIVE TIMETABLE

|

|

|

|

|

2015 |

|

|

|

|

Hong Kong time |

|

|

| Latest time for Shareholders lodging forms of proxy for the EGM |

|

2:00p.m on Monday, March 23 |

|

|

| Latest time for Shareholders lodging all transfer forms for attending the EGM |

|

4:30p.m on Monday, March 23 |

|

|

| Hong Kong Record Date |

|

Monday, March 23 |

|

|

| EGM |

|

2:00p.m. on Wednesday, March 25 |

|

|

| Announcement of results of the EGM and notice of the withdrawal of listing |

|

Wednesday, March 25 |

|

|

| Announcement of: |

|

|

|

|

| (1) satisfaction of conditions; |

|

|

|

|

| (2) last day of dealings; and |

|

|

|

|

| (3) date of withdrawal of listing on the Stock Exchange |

|

Friday, June 26 |

|

|

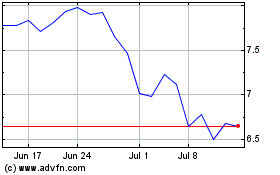

| Last day of dealings in Shares on the Stock Exchange (the “Last Dealing Date”) |

|

Monday, June 29 |

|

|

| First day for depositing the Shares with the Depositary |

|

Tuesday, June 30 |

|

|

| Withdrawal of listing on the Stock Exchange |

|

Friday, July 3 |

|

|

| Closure of Hong Kong Register and transfer of Shares to Cayman Principal Register |

|

Friday, July 17 |

|

|

| Last day for depositing the Shares with the Depositary without cost to the Shareholders (Note 1) |

|

Friday, August 28 |

Note:

| 1. |

The Company will, for a period of 60 days following the Last Dealing Date, bear the costs of the Shareholders for their deposit of the Shares with the Depositary and the corresponding issuance of ADSs. After that

period, all costs attributable to the transfer of the Shares to effect the deposit of the Shares with, or withdrawal of the Shares from, the Depositary shall be borne by the Shareholder requesting the transfer. |

— ii —

DEFINITIONS

Unless the context requires otherwise, the following capitalized terms shall have the meanings set opposite them below:

|

|

|

| “ADR(s)” |

|

the certificate(s) issued by the Depositary evidencing the ADSs issued under the terms of the Deposit Agreement, as such receipts may be amended from time to time in accordance with the provisions of the Deposit Agreement, and

includes physical certificated receipts as well as ADSs issued through any book entry system |

|

|

| “ADS(s)” |

|

American depositary shares of the Company, each of which represents three Shares |

|

|

| “ADS Deposit Process” |

|

the process of depositing Shares with the Depositary for the issuance of ADSs, as more particularly set out in Appendix I to this circular |

|

|

| “ADS Program” |

|

the Company’s American depositary share program administered by the Depositary |

|

|

| “ADS Withdrawal Process” |

|

the process of surrendering ADRs to the Depositary and withdraw the underlying Shares, as more particularly set out in Appendix I to this circular |

|

|

| “Articles” |

|

the Company’s memorandum and articles of association (as amended, supplemented and/or restated and in effect from time to time) |

|

|

| “Board” |

|

our board of Directors |

|

|

| “Cayman Islands Principal Registrar” |

|

Intertrust Corporate Services (Cayman) Limited, whose address is 190 Elgin Avenue, George Town, Grand Cayman, KY1-9005, Cayman Islands |

|

|

| “Cayman Principal Register” |

|

the principal register of members maintained by the Cayman Islands Principal Registrar |

|

|

| “CCASS” |

|

the Central Clearing and Settlement System established and operated by HKSCC |

|

|

| “Companies Law” |

|

the Companies Law (2013 Revision) of the Cayman Islands (as amended) |

|

|

| “Company”,

“Melco Crown Entertainment”,

“we” and “us” |

|

Melco Crown Entertainment Limited (Stock Code: 6883, NASDAQ: MPEL), a company incorporated in the Cayman Islands as an exempted company with limited liability, the Shares of which are listed on the Stock Exchange and the ADSs of

which are listed on the NASDAQ Global Select Market and, where the context so permits, “we”, “us” or “our” shall mean or refer to the Company and the Group |

— 1 —

DEFINITIONS

|

|

|

|

|

| “Crown” |

|

Crown Resorts Limited, a company incorporated under the laws of Victoria, Australia, and a controlling shareholder of the Company through Crown Entertainment Group Holdings Pty, Ltd. and Crown Asia Investments Pty, Ltd., with its

shares listed on Australian Securities Exchange |

|

|

| “Depositary” |

|

Deutsche Bank Trust Company Americas, the depositary bank for the ADS Program |

|

|

| “Deposit Agreement” |

|

the deposit agreement, as amended and restated from time to time, relating to the ADS Program among the Company, the Depositary and the holders and beneficial owners of ADRs from time to time |

|

|

| “Director(s)” |

|

director(s) of the Company |

|

|

| “EGM” |

|

an extraordinary general meeting of the Company to be convened for the purpose of considering and approving, amongst other matters, the Proposed De-Listing and adoption of the Proposed Articles, as set out in the notice thereof

in this circular |

|

|

| “Group” |

|

the Company and its subsidiaries |

|

|

| “HKSCC” |

|

Hong Kong Securities Clearing Company Limited |

|

|

| “Hong Kong” |

|

the Hong Kong Special Administrative Region of the People’s Republic of China |

|

|

| “Hong Kong Branch Registrar” |

|

Computershare Hong Kong Investor Services Limited, of 17M Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong |

|

|

| “Hong Kong Record Date” |

|

Monday, March 23, 2015, being the record date for the purpose of determining Shareholders entitled to attend and vote at the EGM |

|

|

| “Hong Kong Register” |

|

the Hong Kong register of members maintained by the Hong Kong Branch Registrar |

|

|

| “Introduction” |

|

the listing of our Shares on the Stock Exchange by way of introduction on December 7, 2011 |

|

|

| “Last Dealing Date” |

|

the last day of dealings in the Shares on the Stock Exchange |

|

|

| “Latest Practicable Date” |

|

Thursday, February 26, 2015, being the latest practicable date prior to the printing of this circular for ascertaining certain information contained herein |

|

|

| “Listing Committee” |

|

the listing sub-committee of the board of directors of the Stock Exchange |

— 2 —

DEFINITIONS

|

|

|

|

|

| “Listing Rules” |

|

the Rules Governing the Listing of Securities on the Stock Exchange (as amended from time to time) |

|

|

| “Macau” |

|

the Macau Special Administrative Region of the People’s Republic of China |

|

|

| “Main Board” |

|

the Main Board of the Stock Exchange |

|

|

| “MCE SIP” |

|

our 2011 share incentive plan as adopted by the Company pursuant to a resolution passed by the Shareholders at an extraordinary general meeting held on October 6, 2011 and became effective on December 7, 2011, which aims to

provide incentives in the form of awards to members of the Board, employees and consultants of the Company, any parent or subsidiary of the Company, with the view of promoting further success of the Company |

|

|

| “MCP” |

|

Melco Crown (Philippines) Resorts Corporation, a company formed under the laws of the Philippines, the shares of which are listed on the Philippine Stock Exchange, and a subsidiary of the Company |

|

|

| “MCP SIP” |

|

a share incentive plan as adopted by MCP pursuant to a resolution passed by the MCP shareholders at the special stockholders meeting held on February 19, 2013, as amended pursuant to a resolution passed by the MCP shareholders at

its annual stock holders meeting held on June 6, 2013 and a resolution passed by the Shareholder at an extraordinary general meeting of the Company held on June 21, 2013, and became effective on June 24, 2013, upon the Philippines Securities and

Exchange Commission’s approval of the same |

|

|

| “Melco” |

|

Melco International Development Limited, a company incorporated under the laws of Hong Kong with limited liability, whose shares are listed on the Stock Exchange, and a controlling shareholder of the Company through Melco Leisure

and Entertainment Group Limited |

|

|

| “NASDAQ” |

|

the National Association of Securities Dealers Automated Quotation System |

|

|

| “Proposed Articles” |

|

the amended and restated memorandum and articles of association of the Company proposed for adoption at the EGM, and set out in Appendix II to this circular |

|

|

| “Proposed De-Listing” |

|

the proposed voluntary withdrawal of the listing of our Shares on the Main Board of the Stock Exchange |

|

|

| “SEC” |

|

the U.S. Securities and Exchange Commission |

|

|

| “Share(s)” |

|

ordinary share(s) of the Company with a par value of US$0.01 each |

— 3 —

DEFINITIONS

|

|

|

|

|

| “Shareholders” |

|

registered holder(s) of our Shares |

|

|

| “Stock Exchange” |

|

The Stock Exchange of Hong Kong Limited |

|

|

| “United States” or “U.S.” |

|

the United States of America |

— 4 —

LETTER FROM THE BOARD

(Incorporated in the Cayman Islands with limited liability)

(SEHK Stock Code: 6883)

|

|

|

| Executive Director: |

|

Registered Office: |

| Mr. Lawrence Yau Lung Ho |

|

190 Elgin Avenue |

| (Co-Chairman and Chief Executive Officer) |

|

George Town |

|

|

Grand Cayman KY1-9005 |

| Non-executive Directors: |

|

Cayman Islands |

| Mr. James Douglas Packer (Co-Chairman) |

|

|

| Mr. John Peter Ben Wang |

|

Principal place of business and |

| Mr. Clarence Yuk Man Chung |

|

head office in Macau: |

| Mr. William Todd Nisbet |

|

22/F, Golden Dragon Centre |

| Mr. Rowen Bruce Craigie |

|

Avenida Xian Xing Hai |

|

|

Macau |

| Independent Non-executive Directors: |

|

|

| Mr. James Andrew Charles MacKenzie |

|

Place of business in Hong Kong: |

| Mr. Thomas Jefferson Wu |

|

36/F, The Centrium |

| Mr. Alec Yiu Wa Tsui |

|

60 Wyndham Street |

| Mr. Robert Wason Mactier |

|

Central |

|

|

Hong Kong |

March 4, 2015

To the shareholders of the Company

Dear Sir or Madam,

PROPOSED VOLUNTARY WITHDRAWAL OF LISTING ON

THE STOCK EXCHANGE OF HONG KONG LIMITED AND

PROPOSED AMENDMENTS TO CONSTITUTIONAL DOCUMENTS

PROPOSED DE-LISTING

Introduction

Our ADSs were listed on the NASDAQ Global Market in December 2006 and were upgraded to be traded on the NASDAQ Global Select Market in January

2009. Each ADS represents three Shares. On December 7, 2011, we completed a dual primary listing in Hong Kong and listed its Shares on the Main Board of the Stock Exchange by way of Introduction.

— 5 —

LETTER FROM THE BOARD

On January 2, 2015, we submitted an application to the Stock Exchange for the voluntary

withdrawal of the listing of the Shares on the Main Board of the Stock Exchange subject to the conditions set out in the paragraphs headed “Conditions of the Proposed De-Listing” below.

We intend to retain the primary listing of ADSs on NASDAQ following the Proposed De-Listing.

After the Proposed De-Listing, Shareholders will have the option of either (i) holding the Shares (which will not be listed or traded on

the Stock Exchange after the Last Dealing Date), or (ii) subject to depositing their Shares with the Depositary and complying with the requisite procedures and U.S. securities laws, holding their interest in the form of ADSs, which are listed

and can be traded on NASDAQ.

Actions to be taken by the Shareholders to proceed with either of the options set out above are provided in

the section below headed “Actions to be taken by Shareholders and ADS Holders”.

As at the close of business on the Latest

Practicable Date, based on reports from the Depositary and our Hong Kong Branch Registrar, we had issued a total of 1,629,984,104 Shares, comprising:

| |

(i) |

487,283,159 Shares (approximately 29.9% of the Shares in issue) deposited for ADSs for trading on NASDAQ; |

| |

(ii) |

19,407,157 Shares (approximately 1.2% of the Shares in issue) held by our directors and senior officers in the form of restricted ADSs and held as treasury shares for fulfilling the vesting of awards granted under our

share incentive plans; |

| |

(iii) |

559,229,043 Shares (approximately 34.3% of the Shares in issue) held by Melco through its subsidiary; |

| |

(iv) |

559,229,043 Shares (approximately 34.3% of the Shares in issue) held by Crown through its subsidiary; and |

| |

(v) |

4,835,702 Shares (approximately 0.3% of the Shares in issue) trading on the Stock Exchange. |

Reasons for

the Proposed De-Listing

The principal reasons for the Proposed De-Listing are:

| |

(i) |

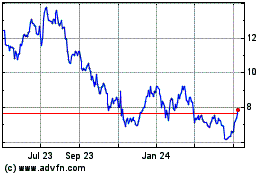

since the Introduction, appropriate opportunities to raise additional equity in Hong Kong have not arisen, and the volume of trading in the Shares on the Stock Exchange remains very limited. From the Introduction to

December 31, 2014, trading of the Shares on NASDAQ in the form of ADSs represented approximately 99.75% of the total trading volume of Shares (including Shares traded in the form of ADSs) on both the Stock Exchange and NASDAQ;

|

| |

(ii) |

since the Introduction, we have not had the appropriate opportunity to take advantage of the Stock Exchange platform for any equity fund raising activities; and |

| |

(iii) |

maintaining the listing of the Shares on the Stock Exchange requires additional and duplicative ongoing regulatory compliance obligations and such requirements involve significant additional costs and administrative

burden. |

For the reasons stated above, the Directors believe that the Proposed De-Listing is in the best interests of

Shareholders and the Company as a whole.

— 6 —

LETTER FROM THE BOARD

Conditions of the Proposed De-Listing

Pursuant to Listing Rule 6.11, the Proposed De-Listing is conditional upon:

| |

(i) |

the approval of the Shareholders by way of an ordinary resolution at an EGM; |

| |

(ii) |

the approval of the Listing Committee; and |

| |

(iii) |

the Company having given its Shareholders at least three months’ notice of the Proposed De- Listing commencing on the date of Shareholders’ approval of the Proposed De-Listing. |

For condition (i), the EGM will be convened on Wednesday, March 25, 2015. A notice of the EGM is set out on pages 50 and 51 of this

circular. No Shareholder is required to abstain from voting at the EGM. As regards condition (ii), we applied for the relevant approval on January 2, 2015 as noted in the section above headed “Introduction”. For condition (iii),

subject to the approval of the Proposed De-Listing by the Shareholders at the EGM, three months’ notice of the Proposed De-Listing is expected to be given to the Shareholders on the date set out in the indicative timetable on page ii of this

circular.

Pursuant to the Listing Rules, approval of the Proposed De-Listing by way of an ordinary resolution at the EGM shall be decided

on a poll. No Shareholder is required to abstain from voting with respect to this resolution at the EGM.

Shareholders should note that

the Proposed De-Listing is subject to, inter alia, the conditions set out above being fulfilled, including approval by the Listing Committee and by Shareholders. None of these conditions can be waived. Accordingly, the Proposed

De-Listing may or may not become effective. Shareholders should exercise caution when dealing in the Shares.

Effects of the Proposed De-Listing

The Directors do not expect that the implementation of the Proposed De-Listing will cause any diminution in the net asset value or

earnings per Share of the Company or adversely affect the business of the Group, but expect that it will enable the Company to effect cost savings.

Tradability of our Shares

All

Shareholders and investors should note that after the Last Dealing Date,

| |

(a) |

the Shares will not be listed on, and will cease to be tradeable on, the Stock Exchange; |

| |

(b) |

the Shares (except those represented by ADSs) will be transferred to the Cayman Islands principal register of members, and will not be tradeable on any stock exchange; and |

| |

(c) |

the Shares could only be traded in the form of ADSs on NASDAQ, upon completion of the ADS Deposit Process. |

In order to continuously trade our Shares (in the form of ADSs), you must cause the Shares to be deposited with the Depositary and, upon such

deposit, issued in the form of ADSs by completing the ADS Deposit Process. To facilitate the ADS Deposit Process, the Company will, for a period of 60 days following the Last Dealing Date, bear the costs of the Shareholders for their deposit of the

Shares with the Depositary and the corresponding issuance of ADSs. After that period, all costs, fees and expenses attributable to the transfer of the Shares to effect a deposit of the Shares with, or withdrawal of the Shares from, the Depositary

shall be borne by the Shareholder requesting the transfer. Additionally, Shareholders and investors should note that there are other fees and charges associated with the trading of ADSs.

— 7 —

LETTER FROM THE BOARD

Following the effectiveness of the Proposed De-Listing, the Hong Kong Register will be closed

(currently expected to occur on July 17, 2015, Hong Kong time), and the names of the Shareholders appearing on the Hong Kong Register will ultimately be transferred to the Cayman Principal Register.

Actions to be taken by Shareholders and ADS Holders

You should read this section in conjunction with Appendix I to this circular before you take any action about the Shares in relation to the

Proposed De-Listing.

If you are a Shareholder

If Shares held by you are registered in your name and entered into the Hong Kong Register and you wish to continue trading your Shares in the

form of ADSs on NASDAQ, you must cause such Shares to be deposited with the Depositary and, upon such deposit, issued in the form of ADSs by completing the physical delivery option under the ADS Deposit Process. Please refer to Appendix I to this

circular for details of the ADS Deposit Process and information on the 60-day fee waiver and the costs of trading ADSs and other fees.

If

you do not take the above action, your Shares will be placed on the Cayman Principal Register following the effectiveness of the Proposed De-Listing and will not be tradeable on the Stock Exchange.

If you hold shares through CCASS

If Shares held by you are registered in the name of HKSCC, whether directly or through a broker or custodian bank or other intermediary, and

you wish to continue trading your Shares in the form of ADSs on NASDAQ, then before the Last Dealing Date, you may either (a) contact HKSCC or your broker or custodian bank or intermediary, as the case may be, and cause such Shares to be

withdrawn from CCASS and re-registered in the name of the Depositary to be deposited into the ADS Program and, upon such deposit, issued in the form of ADSs by completing the physical delivery option under the ADS Deposit Process; or

(b) contact HKSCC or your broker or custodian bank or intermediary, as the case may be, and cause such Shares to be deposited with the Depositary and, upon such deposit, issued in the form of ADSs by completing the electronic delivery option

under the ADS Deposit Process. Please refer to Appendix I to this circular for the details of the ADS Deposit Process and information on the 60-day fee waiver and the costs of trading ADSs and other fees.

If you do not take the above action before the Last Dealing Date, Shares held by you registered in the name of HKSCC Nominees Limited would be

transferred to the Cayman Principal Register and registered in the name of HKSCC Nominees Limited, and will not be tradeable on the Stock Exchange.

However, at any time after the Last Dealing Date, if you wish to enable your Shares to be deposited for ADSs for trading on NASDAQ, you may

contact HKSCC through your broker or custodian bank or intermediary, as the case may be, and cause such Shares to be withdrawn from CCASS and re-registered in the name of the Depositary to be deposited into the ADS Program and, upon such deposit,

issued in the form of ADSs by completing the physical delivery option under the ADS Deposit Process. Please refer to Appendix I to this circular for the details of the ADS Deposit Process and information on the 60-day fee waiver and the costs of

trading ADSs and other fees.

— 8 —

LETTER FROM THE BOARD

If you are an ADS holder

If you are an ADS holder, you are not required to take any action, should you wish to continue holding the ADSs. You may instruct the

Depositary to exercise the voting rights attached to the Shares represented by your ADSs, including voting at the EGM.

If you wish to

withdraw your Shares from the ADS Program, please refer to the ADS Withdrawal Process as set out in Appendix I to this circular which sets out the actions you should take. However, please note that, upon the Proposed De-Listing becoming effective,

the Shares will not be listed on, and will cease to be tradeable on, the Stock Exchange after the Last Dealing Date.

ADOPTION OF THE PROPOSED ARTICLES

In conjunction with the Proposed De-Listing, the Board recommends that the Proposed Articles be adopted at the EGM, conditionally upon

the Proposed De-Listing, if approved, becoming effective. The Proposed De-Listing is currently expected to become effective on July 3, 2015. The Board recommends that the Proposed Articles be adopted in order to amend and restate the Articles

previously adopted in May 2012.

The Proposed Articles remove provisions that were inserted solely for compliance with the Listing Rules

for the Introduction. These include in respect of the provision of financial assistance in connection with the purchase of shares or warrants, untraceable members, document destruction, retirement of directors and the use of a subscription rights

reserve. In addition, the Proposed Articles include amendments to reflect provisions that were previously removed for compliance with the Listing Rules for the Introduction, as well as introducing new provisions including in respect of treasury

shares. The Proposed Articles also rectify certain minor textual inconsistencies as well as incorporating updates including in respect of the registered office of the Company. The major changes reflected in the Proposed Articles are summarised

below:

Provisions removed from the Proposed Articles that appear in the Memorandum and Articles of Association of the Company adopted on 23 May

2012, as currently in effect

| |

• |

|

Requirements where financial assistance is to be given in connection with the purchase of shares or warrants in the Company. (Current Article 9) |

| |

• |

|

Renunciation of allotment of shares prior to registration. (Current Article 10) |

| |

• |

|

Treatment of untraceable members. (Current Article 52) |

| |

• |

|

Requirements applicable to the destruction of certain documents by the Company. (Current Articles 53 and 54) |

| |

• |

|

Retirement of one third of the directors at each annual meeting and requirements for rotation of directors. (Current Article 108) |

| |

• |

|

Restriction on interested directors voting, and being counted in the quorum, in respect of resolutions to be passed by the Directors except in certain circumstances. (Current Article 117) |

| |

• |

|

Restrictions of the company making loans to directors. (Current Article 122) |

— 9 —

LETTER FROM THE BOARD

| |

• |

|

Use of a subscription rights reserve in connection with any warrants issued by the Company. (Current Article 172) |

Provisions reinstated in the Proposed Articles from the Memorandum and Articles of Association of the Company adopted on 19 May 2009, prior to the

Introduction

| |

• |

|

Change in the period for which the register of members may be closed for transfers to 40 days. (New Article 58 replacing current Article 66) |

| |

• |

|

Reduction in the notice period for general meetings of shareholders to at least 7 days. (New Article 64 replacing current Article 72) |

| |

• |

|

Votes at meetings of shareholders to be decided on a show of hands unless a poll is demanded. (New Article 76 replacing current Article 86) |

| |

• |

|

Ability for interested directors to vote where such interest is disclosed prior. (New Article 114) |

| |

• |

|

Presumption of assent in respect of proceedings at meetings of the directors. (New Article 125) |

New

provisions in the Proposed Articles

| |

• |

|

Ability for the Company to hold shares in treasury upon the Company purchasing, redeeming or acquiring the same. (New Articles 56 and 57) |

| |

• |

|

Amendment to the matters not constituting special business at a meeting of shareholders. (New Article 68 replacing current Article 78) |

For further details of the Proposed Articles, please refer to Appendix II to this circular, which sets out the Proposed Articles in full.

From the date of the withdrawal of listing on the Stock Exchange, the rights of the Shareholders will be governed by the Proposed Articles and

Cayman Islands law.

Pursuant to the Articles and the Listing Rules, adoption of the Proposed Articles by way of a special resolution at

the EGM shall be decided on a poll. No Shareholder is required to abstain from voting with respect to this resolution at the EGM.

AMENDMENTS TO THE

MCE SIP AND MCP SIP

In light of the Proposed De-Listing, we intend to make certain amendments to the MCE SIP and MCP SIP, including

removing references to, and provisions required by Hong Kong laws and Listing Rules, and modifying and updating certain provisions and will seek Shareholders’ approval for such amendments in the upcoming annual general meeting of the Company to

be held in May 2015. We do not expect such amendments to adversely affect the rights of MCE SIP and MCP SIP participants.

— 10 —

LETTER FROM THE BOARD

GENERAL

All registered holders of Shares as at the close of business on the Hong Kong Record Date will be entitled to vote at the EGM on the basis of

one vote for each Share held.

Please review the information set out in the appendices to this circular and the notice of EGM that is also

contained in this circular, before considering whether to vote for or against the resolutions to be proposed at the EGM.

The electronic

version of this circular will be published on the website of Hong Kong Exchanges and Clearing Limited (http://www.hkexnews.hk) and on the website of the Company (http://www.melco-crown.com). This circular will be attached to a current

report on Form 6-K to be submitted to the SEC (the “Form 6-K”). The Form 6-K will also be available to the public from the SEC’s website at http://www.sec.gov. Copies of this circular will also be available at the EGM.

A proxy form for use by the Shareholders at the EGM is enclosed with this circular. Whether or not you are able to attend the EGM in

person, you are requested to complete the proxy form and return it in accordance with the instructions printed thereon to the Company’s Hong Kong Branch Registrar, Computershare Hong Kong Investor Services Limited, at 17M Floor, Hopewell

Centre, 183 Queen’s Road East, Wanchai, Hong Kong, as soon as possible and in any event not less than 48 hours before the time fixed for the EGM or any adjournment thereof (as the case may be). Completion and return of the proxy form will not

preclude you from attending and voting in person at the EGM and any adjournment meeting (as the case may be) should you so wish.

RECOMMENDATION

The Board believes that approving the Proposed De-Listing and adopting the Proposed Articles are in the best interests of the Company

and the Shareholders as a whole. Accordingly, the Board recommends the Shareholders to vote in favor of the relevant resolutions to be proposed at the EGM.

RESPONSIBILITY STATEMENT

This circular,

for which the Directors collectively and individually accept full responsibility, includes particulars given in compliance with the Listing Rules for the purpose of giving information with regard to the Company. The Directors, having made all

reasonable enquiries, confirm that to the best of their knowledge and belief the information contained in this circular is accurate and complete in all material respects and not misleading or deceptive and there are no other matters the omission of

which would make any statement herein or this circular misleading.

|

| Yours faithfully, |

| By Order of the Board |

| Melco Crown Entertainment Limited |

| Stephanie Cheung |

| Company Secretary |

— 11 —

|

|

|

| APPENDIX I |

|

ARRANGEMENTS

FOR DEPOSIT INTO AND |

| |

|

WITHDRAWAL FROM THE ADS PROGRAM

|

| 1. |

INFORMATION REGARDING THE ADS PROGRAM |

| 1.1 |

Listing on the NASDAQ |

The Company’s ADSs are listed and traded on the NASDAQ

Global Select Market, which is part of the NASDAQ Stock Market under the symbol “MPEL.” The NASDAQ Stock Market is a securities market in the United States.

The Cayman Principal Register is currently maintained by the Cayman Islands

Principal Registrar, Intertrust Corporate Services (Cayman) Limited. The Company has established the Hong Kong Register since the Introduction which is maintained by the Hong Kong Branch Registrar. Please note that, following the effectiveness of

the Proposed De-Listing, the Hong Kong Register will be closed (currently expected to occur on July 17, 2015, Hong Kong time), and the names of the Shareholders appearing on the Hong Kong Register will ultimately be transferred to the Cayman

Principal Register maintained by the Cayman Islands Principal Registrar.

The Depositary is Deutsche Bank Trust Company Americas. The registered

office of the Depositary is located at 60 Wall Street, New York, NY 10005, United States of America and the principal executive office of the Depositary is located at 60 Wall Street, New York NY 10005, United States of America. The Depositary

operates under the laws and jurisdiction of the State of New York.

Each ADS represents an ownership interest in three ordinary shares

deposited with the custodian under the Deposit Agreement among the Company, the Depositary and ADS holders. Each ADS will also represent any securities, cash or other property deposited with the Depositary but which it has not distributed directly

to ADS holders. ADSs will be evidenced by what are known as American depositary receipts, or ADRs. The custodian under the Deposit Agreement is currently Deutsche Bank AG, Hong Kong Branch (the “Custodian”), with its principal

office at 57/F International Commerce Centre, 1 Austin Road West, Kowloon, Hong Kong.

ADSs must be held electronically in book-entry form

through the Depositary in the ADS holder’s name or indirectly through such holder’s broker or other financial institution. If the ADSs are held indirectly, such holder must rely on the procedures of the relevant broker or other financial

institution to assert the rights of ADS holders under the Deposit Agreement. ADS holders should consult their broker or financial institution to ascertain those procedures.

The Company will not treat an ADS holder as one of its shareholders and ADS holders will not have shareholder rights. Cayman Islands law

governs shareholder rights. The Depositary will be the holder of the shares underlying the ADSs. Holders of ADSs become a party to the Deposit Agreement and therefore are bound by its terms and by the terms of the ADR that represents the ADSs. As a

holder of ADRs, ADS holders will have ADR holder rights. The Deposit Agreement sets out ADR holder rights, representations and warranties as well as the rights and obligations of the Depositary. New York law governs the Deposit Agreement and the

ADRs. However, the Company’s obligations to the holders of ordinary shares are governed by Cayman Islands law, which may be different from the laws in the United States.

— 12 —

|

|

|

| APPENDIX I |

|

ARRANGEMENTS FOR DEPOSIT INTO AND

WITHDRAWAL FROM THE ADS PROGRAM |

| 2. |

ARRANGEMENTS FOR DEPOSIT INTO AND WITHDRAWAL FROM THE ADS PROGRAM |

ADSs are listed for trading on the NASDAQ. The Depositary will

deliver ADSs if a holder of ordinary shares or such holder’s broker deposits shares with the Custodian. Shares deposited with the Custodian must be accompanied by documents, including instruments showing that those shares have been properly

transferred or endorsed to the person on whose behalf the deposit is being made. A deposit of the Shares into the ADS Program involves the following procedures:

Physical delivery option

| |

(a) |

The Shareholder shall complete a Share transfer form which is on the back of the Share certificate or available from the Hong Kong Branch Registrar or the Cayman Islands Principal Registrar, as applicable, and submit

the same together with the Share certificate(s) for the transfer of Shares into the name of the Depositary to the Hong Kong Branch Registrar or the Cayman Islands Principal Registrar, as applicable. If the Shares have been deposited with CCASS, the

Shareholder must first withdraw such Shares from his investor participant stock account with CCASS or from the stock account of his designated CCASS Participant and then submit the relevant Share transfer form(s) executed by HKSCC Nominees Limited,

together with the relevant Share certificate(s), and any other duly completed Share transfer form necessary for the transfer of the Shares into the name of the Depositary to the Hong Kong Branch Registrar or the Cayman Islands Principal Registrar,

as applicable. |

| |

(b) |

Upon receipt of the Share transfer forms, including where appropriate the completed share transfer form(s) executed by HKSCC Nominees Limited, together with the relevant Share certificate(s), the Hong Kong Branch

Registrar or the Cayman Islands Principal Registrar, as applicable, shall take all actions necessary to effect the transfer of the Shares into the name of the Depositary on the Hong Kong Register and/or the principal register of members in the

Cayman Islands, as applicable. |

| |

(c) |

Upon completion of the transfer on the Hong Kong Register, the Hong Kong Branch Registrar shall issue the relevant Share certificate(s) and deliver the share certificate(s), along with the required letter of

transmittal, to Deutsche Bank AG, as the Custodian; or |

Upon completion of the transfer on the Cayman Principal Register, the

Cayman Islands Principal Registrar shall prepare the relevant Share certificate(s) for the Company to issue and deliver to Deutsche Bank AG, as the Custodian.

| |

(d) |

Upon each deposit of shares, receipt of related delivery documentation and compliance with the other provisions of the Deposit Agreement, including the payment of the fees and charges of, and expenses incurred by, the

Depositary and of any taxes or charges, such as stamp taxes or share transfer taxes or fees, the Depositary will issue an ADR or ADRs in the name of the person entitled thereto evidencing the number of ADSs to which that person is entitled.

|

Note: Under normal circumstances, steps (a) to (d) generally require six to ten business days to complete. The letter of

transmittal must be provided to the Custodian before 12 pm Hong Kong time of the day on which the deposit is to be effected.

— 13 —

|

|

|

| APPENDIX I |

|

ARRANGEMENTS FOR DEPOSIT INTO AND

WITHDRAWAL FROM THE ADS PROGRAM |

Electronic delivery option (must be completed prior to the Proposed De-Listing becoming

effective by beneficial owners/CCASS Investor Participants whose Shares have been deposited with CCASS)

| |

(a) |

If the Shares have been deposited with CCASS, (i) the beneficial owner shall contact his broker or other financial institution as appropriate to liaise with Deutsche Bank AG, as the Custodian, or (ii) the

CCASS Investor Participant shall contact and liaise directly with Deutsche Bank AG, as the Custodian (the Custodian will require a letter of transmittal with respect to any deposit of Shares). |

| |

(b) |

Thereafter, Deutsche Bank AG, as the Custodian, and the broker or other financial institution as appropriate or the CCASS Investor Participant, as applicable, shall take all actions necessary to effect the transfer of

Shares into the name of the Depositary. |

| |

(c) |

Upon each deposit of shares, receipt of related delivery documentation and compliance with the other provisions of the Deposit Agreement, including the payment of the fees and charges of, and expenses incurred by, the

Depositary and of any taxes or charges, such as stamp taxes or share transfer taxes or fees, the Depositary will issue an ADR or ADRs in the name of the person entitled thereto evidencing the number of ADSs to which that person is entitled.

|

Note: Under normal circumstances, steps (a) to (c) generally require one to two business days to complete. The letter of

transmittal must be provided to the Custodian before 12 pm Hong Kong time of the day on which the deposit is to be effected.

In

addition, every deposit of shares must be accompanied by the following: (A)(i) in the case of Shares issued in registered form, appropriate instruments of transfer or endorsement, in a form satisfactory to the Custodian, (ii) in the case of

Shares issued in bearer form, such Shares or the certificates representing such Shares and (iii) in the case of Shares delivered by book-entry transfer, confirmation of such book- entry transfer to the Custodian or that irrevocable instructions

have been given to cause such Shares to be so transferred, (B) such certifications and payments (including, without limitation, the Depositary’s fees and related charges) and evidence of such payments (including, without limitation,

stamping or otherwise marking such Shares by way of receipt) as may be required by the Depositary or the Custodian in accordance with the provisions of the Deposit Agreement, (C) if the Depositary so requires, a written order directing the

Depositary to execute and deliver to, or upon the written order of, the person or persons stated in such order a Receipt or Receipts for the number of ADSs representing the Shares so deposited, (D) evidence satisfactory to the Depositary (which

may include an opinion of counsel reasonably satisfactory to the Depositary provided at the cost of the person seeking to deposit Shares) that all conditions to such deposit have been met and all necessary approvals have been granted by, and there

has been compliance with the rules and regulations of, any applicable governmental agency in the Cayman Islands and/or Hong Kong, and (E) if the Depositary so requires, (i) an agreement, assignment or instrument satisfactory to the

Depositary or the Custodian which provides for the prompt transfer by any person in whose name the Shares are or have been recorded to the Custodian of any distribution, or right to subscribe for additional Shares or to receive other property in

respect of any such deposited Shares and (ii) if the Shares are registered in the name of the person on whose behalf they are presented for deposit, a proxy or proxies entitling the Custodian to exercise voting rights in respect of the Shares

for any and all purposes until the Shares so deposited are registered in the name of the Depositary, the Custodian or any nominee.

— 14 —

|

|

|

| APPENDIX I |

|

ARRANGEMENTS FOR DEPOSIT INTO AND

WITHDRAWAL FROM THE ADS PROGRAM |

No Share shall be accepted for deposit unless accompanied by confirmation or such additional

evidence, if any, as required by the Depositary, that is reasonably satisfactory to the Depositary or the Custodian that all conditions to such deposit have been satisfied by the person depositing such Shares under the laws and regulations of the

Cayman Islands and/or Hong Kong.

Shares deposited (whether through the physical delivery option or the electronic delivery option) for

execution and delivery of ADSs must be freely transferable. The Company and its affiliates may not deposit Shares unless those Shares are registered under, or exempted from, the registration requirements of the U.S. Securities Act of 1933, as

amended.

| 2.2 |

ADS Withdrawal Process |

An ADS holder may surrender the ADR through instructions

provided to the holder’s broker. Upon payment of: (a) fees and charges of, and expenses incurred by, the Depositary; and (b) any taxes or charges, such as stamp taxes or share transfer taxes or fees, the Depositary will deliver the

shares and any other deposited securities underlying the ADR to the holder or a designated person by the holder at the office of the Custodian. Alternatively, at the holder’s request, risk and expense, the Depositary will deliver the deposited

securities at its principal New York office or any other location that it may designate as its transfer office, if feasible.

ADS holders

have the right to cancel the ADSs and withdraw the underlying ordinary shares at any time subject only to (a) temporary delays caused by closing the Company’s or the Depositary’s transfer books or the deposit of the ordinary shares in

connection with voting at a shareholders’ meeting or the payment of dividends; (b) the payment of fees, taxes and similar charges; or (c) compliance with any U.S. or foreign laws or governmental regulations relating to the ADRs or to

the withdrawal of the deposited securities. U.S. securities laws provide that this right of withdrawal may not be limited by any other provision of the Deposit Agreement.

| 2.3 |

Charges of Depositary |

The Depositary may charge the following fees for the services

performed under the terms of the Deposit Agreement:

| |

(a) |

to any person to whom ADSs are issued or to any person to whom a distribution is made in respect of ADS distributions pursuant to stock dividends or other free distributions of stock, bonus distributions, stock splits

or other distributions (except where converted to cash), a fee not in excess of U.S.$5.00 per 100 ADSs (or fraction thereof) so issued under the terms of the Deposit Agreement to be determined by the Depositary; |

| |

(b) |

to any person surrendering ADSs for cancellation and withdrawal of deposited securities including, inter alia, cash distributions made pursuant to a cancellation or withdrawal, a fee not in excess of U.S.$5.00 per 100

ADSs (or fraction thereof) so surrendered; |

| |

(c) |

to any holder of ADSs, a fee not in excess of U.S.$5.00 per 100 ADSs held for the distribution of cash proceeds, including cash dividends or sale of rights and other entitlements, not made pursuant to a cancellation or

withdrawal; |

| |

(d) |

to any holder of ADSs, a fee not in excess of U.S.$5.00 per 100 ADSs (or portion thereof) issued upon the exercise of rights; and |

— 15 —

|

|

|

| APPENDIX I |

|

ARRANGEMENTS FOR DEPOSIT INTO AND

WITHDRAWAL FROM THE ADS PROGRAM |

| |

(e) |

for the operation and maintenance costs in administering the ADSs, an annual fee not in excess of U.S.$5.00 per 100 ADSs, such fee to be assessed against holders of ADSs of record as of the date or dates set by the

Depositary as it sees fit and collected at the sole discretion of the Depositary by billing such holders for such fee or by deducting such fee from one or more cash dividends or other cash distributions. |

In addition, holders of ADSs, beneficial owners of the ADSs, persons delivering Shares for deposit and persons surrendering ADSs for

cancellation and withdrawal of the deposited Shares will be required to pay the following charges:

| |

(a) |

taxes (including applicable interest and penalties) and other governmental charges; |

| |

(b) |

such registration fees as may from time to time be in effect for the registration of Shares or other deposited securities with the Cayman Islands Principal Registrar and applicable to transfers of Shares or other

deposited securities to or from the name of the Custodian, the Depositary or any nominees upon the making of deposits and withdrawals, respectively; |

| |

(c) |

such cable, telex, facsimile and electronic transmission and delivery expenses as are expressly provided in the Deposit Agreement to be at the expense of the person depositing or withdrawing Shares or holders and

beneficial owners of ADSs; |

| |

(d) |

the expenses and charges incurred by the Depositary in the conversion of foreign currency; |

| |

(e) |

such fees and expenses as are incurred by the Depositary in connection with compliance with exchange control regulations and other regulatory requirements applicable to Shares, deposited securities and ADSs;

|

| |

(f) |

the fees and expenses incurred by the Depositary in connection with the delivery of deposited securities, including any fees of a central depository for securities in the local market, where applicable; and

|

| |

(g) |

any additional fees, charges, costs or expenses that may be incurred by the Depositary from time to time. |

| |

(h) |

Any other charges and expenses of the Depositary under the Deposit Agreement will be paid by the Company upon agreement between the Depositary and the Company. All fees and charges may, at any time and from time to

time, be changed by agreement between the Depositary and Company but, in the case of fees and charges payable by holders or beneficial owners of ADSs, only in the manner as set forth in the Deposit Agreement. |

| 2.4 |

For the sixty day period following the Last Dealing Date, the Company will bear the fees charged by the Depositary for the deposit of Shares and correspondingly issuance and delivery of ADRs. |

| 3. |

TERMS OF THE DEPOSIT AGREEMENT |

For the terms of the Deposit Agreement, you should read

the form of amended and restated Deposit Agreement and the form of ADR which are attached as Exhibit (a) of Amendment No. 1 to the Company’s registration statement on Form F-6 (File No. 333-139159) filed with the SEC on

November 29, 2011.

— 16 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

THE COMPANIES LAW (AS AMENDED)

OF THE CAYMAN ISLANDS

COMPANY LIMITED BY SHARES

AMENDED AND RESTATED

MEMORANDUM OF ASSOCIATION

OF

MELCO CROWN

ENTERTAINMENT LIMITED

(ADOPTED BY SPECIAL RESOLUTION PASSED ON

[—])1

| 1. |

The English name of the Company is Melco Crown Entertainment Limited and the Chinese name of the Company is

.

. |

| 2. |

The registered office of the Company will be situated at the offices of Intertrust Corporate Services (Cayman) Limited, 190 Elgin Avenue, George Town, Grand Cayman KY1-9005, Cayman Islands or at such other

location as the Directors may from time to time determine. |

| 3. |

The objects for which the Company is established are unrestricted and the Company shall have full power and authority to carry out any object not prohibited by any law as provided by Section 7(4) of the Companies

Law of the Cayman Islands (as amended) (the “Law”). |

| 4. |

The Company shall have and be capable of exercising all the functions of a natural person of full capacity irrespective of any question of corporate benefit as provided by Section 27(2) of the Law.

|

| 5. |

The Company will not trade in the Cayman Islands with any person, firm or corporation except in furtherance of the business of the Company carried on outside the Cayman Islands; provided that nothing in this section

shall be construed as to prevent the Company effecting and concluding contracts in the Cayman Islands, and exercising in the Cayman Islands all of its powers necessary for the carrying on of its business outside the Cayman Islands.

|

| 6. |

The liability of the shareholders of the Company is limited to the amount, if any, unpaid on the shares respectively held by them. |

| 7. |

The authorised share capital of the Company is US$73,000,000 divided into 7,300,000,000 shares of a nominal or par value of US$0.01 each provided always that subject to the provisions of the Law and

the Articles, the Company shall have power to redeem or purchase any of its shares and to sub- divide or consolidate the said shares or any of them and to issue all or any part of its capital whether original, redeemed, increased or reduced with or

without any preference, priority, special privilege or other rights or subject to any postponement of rights or to any conditions or restrictions whatsoever and so that unless the conditions of issue shall otherwise expressly provide every issue of

shares whether stated to be ordinary, preference or otherwise shall be subject to the powers on the part of the Company hereinbefore provided. |

| 8. |

The Company may exercise the power contained in Section 206 of the Law to deregister in the Cayman Islands and be registered by way of continuation in some other jurisdiction. |

| 1 |

The adoption of this Amended and Restated Memorandum of Association was conditional upon, and took effect upon, the withdrawal of the listing of the ordinary shares of the Company on the Main

Board of The Stock Exchange of Hong Kong Limited on [—] 2015. |

— 17 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

THE COMPANIES LAW (AS AMENDED)

OF THE CAYMAN ISLANDS

COMPANY LIMITED BY SHARES

AMENDED AND RESTATED

ARTICLES OF ASSOCIATION

OF

MELCO CROWN

ENTERTAINMENT LIMITED

(ADOPTED BY SPECIAL RESOLUTION PASSED ON

[—])2

TABLE

A

The Regulations contained or incorporated in Table “A” in the First Schedule of the Law shall not apply to the Company

and the following Articles shall comprise the Articles of Association of the Company:

INTERPRETATION

| 1. |

In these Articles, the following defined terms will have the meanings ascribed to them, if not inconsistent with the subject or context: |

“ADS” means an American Depositary Share, each representing 3 ordinary shares;

“Affiliate” means a Person who, directly or indirectly, through one or more intermediaries, controls, is controlled by or is

under common control with, a specified Person. For the purpose of Article

160, “control”, “controlled

by” and “under common control with” means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting shares, by

agreement, contract, or otherwise;

“Affiliated Companies” means those partnerships, corporations, limited liability

companies, trusts or other entities that are Affiliates of the Company, including, without limitation, subsidiaries, holding companies and intermediary companies (as those and similar terms are defined in the Gaming Laws of the applicable Gaming

Jurisdictions) that are registered or licensed under applicable Gaming Laws;

“Articles” means these articles of

association of the Company as amended or substituted from time to time;

“Branch Register” means any branch Register of

such category or categories of Members as the Company may from time to time determine;

“capital” means the share capital

from time to time of the Company;

| 2 |

The adoption of these Amended and Restated Articles of Association was conditional upon, and took effect upon, the withdrawal of the listing of the ordinary shares of the Company on the Main

Board of The Stock Exchange of Hong Kong Limited on [—] 2015. |

— 18 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

“clear days” means in relation to the period of a notice that period

excluding the day when the notice is given or deemed to be given and the day for which it is given or on which it is to take effect;

“clearing house” means a clearing house recognised by the laws of the jurisdiction in which the shares of the Company are

listed or quoted on a stock exchange in such jurisdiction;

“Commission” means Securities and Exchange Commission of the

United States of America or any other federal agency for the time being administering the Securities Act;

“Company” means

Melco Crown Entertainment Limited

, a Cayman Islands exempted company;

, a Cayman Islands exempted company;

“Company’s Website” means the website of the

Company;

“Directors” and “Board of Directors” and “Board” means the Directors of the

Company for the time being, or as the case may be, the Directors assembled as a Board or as a committee thereof;

“electronic” shall have the meaning given to it in the Electronic Transactions Law (as amended) of the Cayman Islands;

“electronic communication” means electronic posting to the Company’s Website, transmission to any number, address or

internet website or other electronic delivery methods as otherwise decided and approved by not less than two-thirds of the vote of the Board;

“Gaming Activities” mean the conduct of gaming and gambling activities by the Company or its Affiliated Companies, or the use

of gaming devices, equipment and supplies in the operation of a casino or other enterprise by the Company or its Affiliated Companies;

“Gaming Authority” means any regulatory and licensing body or agency with authority over gaming including, but not limited to,

the conduct of Gaming Activities;

“Gaming Jurisdiction” means all jurisdictions, including their political subdivisions,

in which Gaming Activities are lawfully conducted;

“Gaming Laws” means all laws, statutes, ordinances and regulations

pursuant to which any Gaming Authority possesses regulatory and licensing authority over Gaming Activities within any Gaming Jurisdiction, and all orders, decrees, rules and regulations promulgated by such Gaming Authority thereunder;

“Gaming Licenses” means all licenses, permits, approvals, authorizations, registrations, findings of suitability, franchises,

concessions and entitlements issued by a Gaming Authority necessary for or relating to the conduct of Gaming Activities;

“Independent Director” means a Director who is an independent director as defined in the Nasdaq Rules as amended from time to

time;

“Law” means the Companies Law (as amended) of the Cayman Islands;

“Member” means a person whose name is entered in the Register as the holder of a share or shares;

— 19 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

“Memorandum of Association” means the Memorandum of Association of the

Company, as amended and restated from time to time;

“month” means a calendar month;

“Nasdaq” means the Nasdaq Stock Market in the United States;

“Nasdaq Rules” means the relevant code, rules and regulations, as amended, from time to time, applicable as a result of the

original and continued quotation of any shares or ADSs on Nasdaq, including without limitation, the Nasdaq Stock Market Rules;

“Office” means the registered office of the Company as required by the Law;

“Ordinary Resolution” means a resolution:

| |

(a) |

passed by a simple majority of such Members as, being entitled to do so, vote in person or, in the case of such Members being corporations, by their duly authorised representatives or, where proxies are allowed, by

proxy at a general meeting of the Company of which notice has been duly given in accordance with these Articles and where a poll is taken regard shall be had in computing a majority to the number of votes to which each Member is entitled; or

|

| |

(b) |

approved in writing by all of the Members entitled to vote at a general meeting of the Company in one or more instruments each signed by one or more of the Members and the effective date of the resolution so adopted

shall be the date on which the instrument, or the last of such instruments if more than one, is executed; |

“Own”, “Ownership” or “Control” mean ownership of record, beneficial ownership or the

possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person or the disposition of shares, by agreement, contract, agency or other manner;

“paid up” means paid up as to the par value in respect of the issue of any shares and includes credited as paid up;

“Person” means an individual, partnership, corporation, limited liability company, trust or any other entity;

“Principal Register”, where the Company has established one or more Branch Registers pursuant to the Law and these Articles,

means the Register maintained by the Company pursuant to the Law and these Articles that is not designated by the Directors as a Branch Register;

“Redemption Date” means the date specified in the Redemption Notice as the date on which the shares Owned or Controlled by an

Unsuitable Person or an Affiliate of an Unsuitable Person are to be redeemed by the Company;

“Redemption Notice” means

that notice of redemption given by the Company to an Unsuitable Person or an Affiliate of an Unsuitable Person pursuant to Article 160. Each Redemption Notice shall set forth (i) the Redemption Date, (ii) the number and type of shares to

be redeemed, (iii) the Redemption Price and the manner of payment therefor, (iv) the place where any certificates, if any, for such shares shall be surrendered for payment, and (v) any other requirements of surrender of the

certificates;

— 20 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

“Redemption Price” means the price to be paid by the Company for the shares

to be redeemed pursuant to Article 160, which shall be that price (if any) required to be paid by the Gaming Authority making the finding of Unsuitability, or if such Gaming Authority does not require a certain price to be paid, that amount

determined by the Board of Directors to be the fair value of the shares to be redeemed; provided, however, that the price per share represented by the Redemption Price shall in no event be in excess of the closing sales price per share

on the principal national securities exchange on which such shares are then listed on the trading date immediately before the Redemption Notice is deemed given by the Company to the Unsuitable Person. The Redemption Price shall be paid in cash, by

promissory note, or both, as required by the applicable Gaming Authority and, if not so required, as the Board of Directors otherwise determines;

“Register” means the register of members of the Company required to be kept pursuant to the Law and includes any Branch

Register(s) established by the Company in accordance with the Law;

“Seal” means the common seal of the Company (if

adopted) including any facsimile thereof;

“Securities Act” means the Securities Act of 1933 of the United States of

America, as amended, or any similar federal statute and the rules and regulations of the Commission thereunder, all as the same shall be in effect at the time;

“share” means a share in the capital of the Company of any or all classes including a fraction of a share;

“Shareholder” or “Member” means a person who is registered as the holder of shares in the Register and

includes each subscriber to the Memorandum of Association pending entry in the Register of such subscriber;

“signed”

means a signature or representation of a signature affixed by mechanical means;

“Special Resolution” means a special

resolution passed in accordance with the Law, being a resolution:

| |

(a) |

passed by a majority of not less than two-thirds of such Members as, being entitled to do so, vote in person or, in the case of such Members being corporations, by their respective duly authorised representatives or,

where proxies are allowed, by proxy at a general meeting of the Company of which notice specifying the intention to propose the resolution as a Special Resolution has been duly given in accordance with these Articles and where a poll is taken regard

shall be had in computing a majority to the number of votes to which each Member is entitled, or |

| |

(b) |

approved in writing by all of the Members entitled to vote at a general meeting of the Company in one or more instruments each signed by one or more of the Members and the effective date of the Special Resolution so

adopted shall be the date on which the instrument or the last of such instruments if more than one, is executed; |

“Treasury Shares” means shares that were previously issued but were purchased, redeemed, surrendered or otherwise acquired by

the Company and not cancelled;

“Unsuitable Person” means a Person who (i) is determined by a Gaming Authority to be

Unsuitable to Own or Control any shares in the Company, whether directly or indirectly, or (ii) causes the Company or any Affiliated Company to lose or to be threatened by a Gaming Authority with the loss of any Gaming License, or (iii) in

the sole discretion of the Board of Directors of the Company, is deemed likely to jeopardize the Company’s or any Affiliated Company’s application for, receipt of approval for, right to the use of, or entitlement to, any Gaming Licence,

and “Unsuitability” and “Unsuitable” shall be construed accordingly; and

— 21 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

“year” means a calendar year.

| 2. |

In these Articles, save where the context requires otherwise: |

| |

(a) |

words importing the singular number shall include the plural number and vice versa; |

| |

(b) |

words importing the masculine gender only shall include the feminine gender; |

| |

(c) |

words importing persons only shall include companies or associations or bodies of persons, whether corporate or not; |

| |

(d) |

the word “may” shall be construed as permissive and the word “shall” shall be construed as imperative; |

| |

(e) |

expressions referring to writing shall, unless the contrary intention appears, be construed as including printing, lithography, photography and other modes of representing words or figures in a visible form, and

including where the representation takes the form of electronic display, provided that both the mode of service of the relevant document or notice and the Member’s election comply with all applicable law, rules and regulations;

|

| |

(f) |

references to a document being executed include references to it being executed under hand or under seal or by electronic signature or by any other method and references to a notice or document include a notice or

document recorded or stored in any digital, electronic, electrical, magnetic or other retrievable form or medium and information in visible form whether having physical substance or not; |

| |

(g) |

reference to “US$” is a reference to dollars of the United States of America; |

| |

(h) |

reference to a statutory enactment shall include reference to any amendment or re-enactment thereof for the time being in force; |

| |

(i) |

any phrase introduced by the terms “including”, “include”, “in particular” or any similar expression shall be construed as illustrative and shall not limit the sense of the words preceding

those terms; |

| |

(j) |

reference to any determination by the Directors shall be construed as a determination by the Directors in their sole and absolute discretion and shall be applicable either generally or in any particular case; and

|

| |

(k) |

reference to “in writing” shall be construed as written or represented by any means reproducible in writing, including any form of print, lithograph, email, facsimile, photograph or telex or represented by any

other substitute or format for storage or transmission for writing or partly one and partly another. |

— 22 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

| 3. |

Subject to the last two preceding Articles, any words defined in the Law shall, if not inconsistent with the subject or context, bear the same meaning in these Articles. |

PRELIMINARY

| 4. |

The Office shall be at such address in the Cayman Islands as the Directors may from time to time determine. The Company may in addition establish and maintain such other offices and places of business and agencies in

such places as the Directors may from time to time determine. |

| 5. |

The expenses incurred in the formation of the Company shall be paid by the Company. Such expenses may be amortised over such period as the Directors may determine and the amount so paid shall be charged against income

and/or capital in the accounts of the Company as the Directors shall determine. |

| 6. |

The Directors shall keep, or cause to be kept, the Register at such place or (subject to compliance with the Law and these Articles) places as the Directors may from time to time determine. In the absence of any such

determination, the Register shall be kept at the Office. The Directors may keep, or cause to be kept, one or more Branch Registers as well as the Principal Register in accordance with the Law, provided always that a duplicate of such Branch

Register(s) shall be maintained with the Principal Register in accordance with the Law. |

SHARE CAPITAL

| 7. |

The authorised share capital of the Company at the date on which these Articles come into effect is US$73,000,000 divided into 7,300,000,000 shares of a nominal or par value of US$0.01 each. |

ISSUE OF SHARES

| 8. |

Subject to these Articles, the Law, any direction that may be given by the Company in general meeting and without prejudice to any special rights or restrictions for the time being attached to any shares or any class of

shares, all shares for the time being unissued shall be under the control of the Directors who may: |

| |

(a) |

designate, re-designate, offer, issue, allot and dispose of the same to such persons, in such manner, on such terms and having such rights and being subject to such restrictions as they may from time to time determine

but so that no shares shall be issued at a discount; and |

| |

(b) |

grant options with respect to such shares and issue warrants, convertible securities or securities of similar nature conferring the right upon the holders thereof to subscribe for any class of shares or securities in

the capital of the Company on such terms as they may from time to time determine; |

and, for such purposes, the Directors may

reserve an appropriate number of shares for the time being unissued.

| 9. |

No share shall be issued to bearer. |

| 10. |

Subject to the provisions of the Law, the Memorandum of Association and these Articles, and to any special rights conferred on the holders of any shares or class of shares, any share in the Company may be issued with or

have attached thereto such rights or restrictions whether in regard to dividend, voting, return of capital or otherwise as the Company may by Ordinary Resolution determine or, if there has not been any such determination or so far as the same shall

not make specific provision, as the Board of Directors may determine. |

— 23 —

|

|

|

| APPENDIX II |

|

PROPOSED ARTICLES |

REGISTER OF MEMBERS AND SHARE CERTIFICATES

| 11. |

The Company shall maintain a Register of its Members and every person whose name is entered as a member in the Register shall, without payment, be entitled to a certificate within two months after allotment or lodgement