MannKind Corporation Reports 2016 First Quarter Financial Results

May 09 2016 - 4:00PM

MannKind Corporation (Nasdaq:MNKD) (TASE:MNKD)

today reported financial results for the first quarter ended March

31, 2016.

For the first quarter of 2016, total operating

expenses were $20.0 million as compared to $21.7 million for the

same quarter in 2015. Research and development expenses were

$5.1 million for the first quarter of 2016, a decline of 45%,

compared to the first quarter of 2015, primarily due to the

reduction in force and closure of the Paramus, New Jersey facility

in 2015 and the transition from development to commercial

activities. General and administrative costs were $7.4 million for

the first quarter of 2016, a decline of 30%, compared to the first

quarter of 2015, mainly due to the reduction in force and closure

of the Paramus facility in 2015 in addition to reduced professional

fees related to strategic planning activities incurred in 2015 and

lower non-cash stock compensation expense. Product manufacturing

costs for the first quarter of 2016 were $7.5 million, an increase

of 300%, compared to the same quarter of 2015, due to

underutilization of the manufacturing facility and loss from

foreign currency exchange of $2.4 million related to purchase

commitments.

The Company’s portion of the loss sharing under

the Sanofi License Agreement was $5.5 million for the first quarter

of 2016. The total amount owed to Sanofi is currently $68.8

million, including accrued interest of $2.8

million.

The net loss for the first quarter of 2016 was

$24.9 million, or $0.06 per share based on 428.9 million weighted

average shares outstanding, compared to the net loss of $30.7

million, or $0.08 per share on 398.9 million weighted average

shares outstanding in the first quarter of 2015. The number of

common shares outstanding at March 31, 2016 was 429.1 million.

Cash and cash equivalents at March 31, 2016 were

$27.7 million, compared to $59.1 million at December 31, 2015. In

February 2016, an upfront fee of $250,000 was received pursuant to

the previously announced collaboration and license agreement with

Receptor Life Sciences. In addition, $467,000 was received

from exercises of stock options by employees. Currently,

$30.1 million remains available for borrowing under the amended

loan arrangement with The Mann Group. A recently filed universal

shelf registration statement became effective along with a

prospectus supplement for a $50.0 million ATM facility.

Conference Call

MannKind management will host a conference call

to discuss these results today at 5:00 p.m. Eastern Time. To

participate in the call please dial (888) 771-4371 or (847)

585-4405 and use the participant passcode: 41477569. Those

interested in listening to the conference call live via the

Internet may do so by visiting the Company's website at

http://www.mannkindcorp.com.

A telephone replay will be accessible for

approximately 14 days following completion of the call by dialing

(888) 843-7419 or (630) 652-3042 and use the participant passcode:

4147 7569#. A replay will also be available on MannKind's

website for 14 days.

About MannKind Corporation

MannKind Corporation (Nasdaq and TASE: MNKD)

focuses on the discovery, development and commercialization of

therapeutic products for patients with diseases such as diabetes.

MannKind maintains a website at http://www.mannkindcorp.com to

which MannKind regularly posts copies of its press releases as well

as additional information about MannKind. Interested persons can

subscribe on the MannKind website to e-mail alerts that are sent

automatically when MannKind issues press releases, files its

reports with the Securities and Exchange Commission or posts

certain other information to the website.

Forward-Looking Statements

This press release contains forward-looking

statements that involve risks and uncertainties, including

statements regarding MannKind’s ability to directly commercialize

pharmaceutical products. Words such as “believes”,

“anticipates”, “plans”, “expects”, “intend”, “will”, “goal",

“potential” and similar expressions are intended to identify

forward-looking statements. These forward-looking statements

are based upon the MannKind’s current expectations. Actual

results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these

risks and uncertainties, which include, without limitation, the

ability to generate significant product sales for MannKind,

difficulties or delays in obtaining regulatory feedback or

completing and analyzing the results of clinical studies,

MannKind’s ability to manage its existing cash resources or raise

additional cash resources, stock price volatility and other risks

detailed in MannKind’s filings with the Securities and Exchange

Commission, including the Annual Report on Form 10-K for the year

ended December 31, 2015 and subsequent periodic reports on Form

10-Q and current reports on Form 8-K. You are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement, and MannKind undertakes no obligation to

revise or update any forward-looking statements to reflect events

or circumstances after the date of this press release.

(Tables to follow)

| MannKind CorporationCondensed

Consolidated Statements of

Operations(Unaudited)(In thousands) |

| |

| |

Three months ended March 31,

|

|

| |

|

2016 |

|

|

2015 |

|

| Revenue |

$ |

— |

|

$ |

— |

|

| |

|

|

|

|

|

|

| Operating expenses: |

|

|

| Research and

development |

|

5,130 |

|

|

9,377 |

|

| General and

administrative |

|

7,351 |

|

|

10,479 |

|

| Product

manufacturing |

|

7,532 |

|

|

1,882 |

|

| Total

operating expenses |

|

20,013 |

|

|

21,738 |

|

| |

|

|

|

|

|

|

| Loss from

operations |

|

(20,013 |

) |

|

(21,738 |

) |

| Other income |

|

67 |

|

|

1,413 |

|

| Interest expense on note

payable to principal stockholder |

|

(721 |

) |

|

(714 |

) |

| Interest expense on

notes |

|

(4,221 |

) |

|

(9,622 |

) |

| Interest income |

|

15 |

|

|

3 |

|

| |

|

|

|

|

|

|

| Net loss |

$ |

(24,873 |

) |

$ |

(30,658 |

) |

| |

|

|

|

|

|

|

| Net loss per share — basic

and diluted |

$ |

(0.06 |

) |

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

| Shares used to compute

basic and diluted net loss per share |

|

428,858 |

|

|

398,916 |

|

| |

|

|

|

|

|

|

| MannKind CorporationCondensed Consolidated

Balance Sheet(Unaudited)(in thousands) |

| |

| |

March 31, 2016 |

December 31, 2015 |

|

|

|

|

|

Assets |

|

|

| Current assets: |

|

|

| Cash and

cash equivalents |

$ |

27,653 |

|

$ |

59,074 |

|

|

Receivables from collaboration |

|

144 |

|

|

23 |

|

| Deferred

product costs from collaboration |

|

13,539 |

|

|

13,539 |

|

| Prepaid

expenses and other current assets |

|

2,807 |

|

|

4,018 |

|

| Total current

assets |

|

44,143 |

|

|

76,654 |

|

| Property and equipment

— net |

|

48,033 |

|

|

48,749 |

|

| Other assets |

|

1,096 |

|

|

1,009 |

|

| Total |

$ |

93,272 |

|

$ |

126,412 |

|

| |

|

|

|

|

|

|

| Liabilities and

Stockholders’ Deficit |

|

|

|

|

|

|

| |

|

|

| Accounts payable |

$ |

582 |

|

$ |

15,599 |

|

| Accrued expenses and

other current liabilities |

|

8,077 |

|

|

7,929 |

|

| Facility financing

obligation |

|

75,010 |

|

|

74,582 |

|

| Deferred product sales

from collaboration |

|

17,680 |

|

|

17,503 |

|

| Purchase commitments

liabilities - current |

|

12,927 |

|

|

12,475 |

|

| Deferred payments from

collaboration |

|

134,935 |

|

|

140,231 |

|

| Current

liabilities |

|

249,211 |

|

|

268,319 |

|

| Note payable to related

party |

|

49,521 |

|

|

49,521 |

|

| Sanofi loan facility

and loss share obligation |

|

68,835 |

|

|

62,371 |

|

| Senior convertible

notes |

|

27,618 |

|

|

27,613 |

|

| Net purchase

commitments |

|

55,605 |

|

|

53,692 |

|

| Other liabilities |

|

15,946 |

|

|

15,225 |

|

| Stockholders’

deficit |

|

(373,464 |

) |

|

(350,329 |

) |

| Total |

$ |

93,272 |

|

$ |

126,412 |

|

| |

|

|

|

|

|

|

Company Contact:

Rose Alinaya

SVP, Finance

661-775-5300

ralinaya@mannkindcorp.com

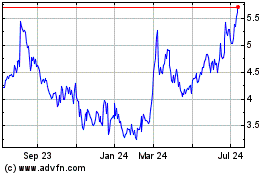

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2023 to Apr 2024