UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event Reported): July 16, 2015

ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-35547 |

|

36-4392754 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

| 222 Merchandise Mart Plaza, Suite 2024, Chicago, Illinois |

60654 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number, including area code: (312) 506-1200

________________________________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 16, 2015, Allscripts Healthcare Solutions, Inc. (the "Company") issued a press release regarding the Company's preliminary financial results for the second quarter ended June 30, 2015. A copy of the Company's press release is attached hereto as Exhibit 99.1.

The information contained in this Current Report on Form 8-K shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished herewith:

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release issued by Allscripts Healthcare Solutions, Inc. on July 16, 2015

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: July 16, 2015 |

ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

|

|

|

By: |

/s/ RICHARD J. POULTON

Richard J. Poulton

Chief Financial Officer |

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release issued by Allscripts Healthcare Solutions, Inc. on July 16, 2015

|

EXHIBIT 99.1

Allscripts Announces Preliminary Second Quarter 2015 Financial Results and Upcoming Investor Event

CHICAGO, July 16, 2015 (GLOBE NEWSWIRE) -- Allscripts Healthcare Solutions, Inc. (Nasdaq:MDRX) today announced its preliminary financial results for the second quarter ended June 30, 2015.

The Company expects bookings(1) in the second quarter of 2015 to be in a range of $255-$260 million, a record for the second quarter. Bookings were $233 million in the second quarter of 2014, or growth of between 9 and 12 percent year-over-year and an acceleration from the 6 percent year-over-year bookings growth reported in the first quarter of 2015.

Allscripts expects preliminary second quarter 2015 revenue to be in a range of $350-$353 million. This compares with total revenue of $351 million in the second quarter of 2014 and $335 million in the first quarter of 2015.

In addition, the Company expects second quarter 2015 Adjusted EBITDA(2) to be in a range of $59-$62 million. This compares with Adjusted EBITDA of $53 million in the second quarter of 2014 and $50 million in the first quarter of 2015.

Finally, Allscripts expects second quarter 2015 non-GAAP earnings per share(3) to be approximately $0.12 compared with $0.09 in the second quarter of 2014. Second quarter 2015 GAAP loss per share is expected to be approximately $0.01 compared with a loss per share of $0.09 in the second quarter of 2014.

Preliminary results for the second quarter of 2015 exceed First Call consensus estimates for revenue, Adjusted EBITDA and GAAP and non-GAAP earnings per share.

"Our strong preliminary results across all key financial metrics reflect continued improvement in Allscripts execution across the enterprise on behalf of our clients," said Paul M. Black, Allscripts President and Chief Executive Officer. "Sales growth in the second quarter accelerated compared with the first quarter based on improving performance within acute and international markets. Ambulatory solutions and growth in Allscripts payer and life sciences business helped drive the year-over-year bookings growth. Revenue improved on a sequential basis, driven by growth in both recurring and non-recurring revenue. We look forward to discussing our results in more detail in a few weeks."

The preliminary financial information presented in this press release is based on expectations and may be adjusted as a result of, among other things, completion of customary quarterly review and audit procedures. Management plans to discuss its complete second quarter results and outlook as scheduled after market close on Tuesday, August 4, 2015.

Details on the Second Quarter 2015 Financial Results Call

The Allscripts earnings announcement will be distributed immediately after the close of regular stock market hours on August 4, 2015. The announcement will also be available at Allscripts Investor Relations website: http://investor.allscripts.com.

To listen to the conference call, participants may log onto the Allscripts Investor Relations website. Participants also may access the conference call by dialing (855) 717-7811 or (224) 357-2059 (international) and requesting Conference ID # 82141689.

A replay of the call will be available approximately two hours after the conclusion of the call, for a period of four weeks, on the Allscripts Investor Relations website or by calling (855) 859-2056 or (404) 537-3406 - Conference ID # 82141689.

Upcoming Investor Event

2015 Allscripts Client Experience, Wednesday August 5, 2015, from 11:30am until 7:00pm ET, to be held at the Boston Convention and Exhibition Center (BCEC) and Westin Waterfront, Boston, MA. Registration information will be sent to members of the financial community shortly.

Portions of this event are expected to be recorded and/or webcasted and will be available at http://investor.allscripts.com.

About Allscripts

Allscripts (NASDAQ:MDRX) is a leader in healthcare information technology solutions that advance clinical, financial and operational results. Our innovative solutions connect people, places and data across an Open, Connected Community of Health™. Connectivity empowers caregivers to make better decisions and deliver better care for healthier populations. To learn more, visit www.allscripts.com, Twitter, YouTube and It Takes A Community: The Allscripts Blog.

© 2015 Allscripts Healthcare, LLC and/or its affiliates. All Rights Reserved.

Allscripts, the Allscripts logo, and other Allscripts marks are trademarks of Allscripts Healthcare, LLC and/or its affiliates. All other products are trademarks of their respective holders, all rights reserved. Reference to these products is not intended to imply affiliation with or sponsorship of Allscripts Healthcare, LLC and/or its affiliates.

Reconciliations and Footnotes

(1) Bookings reflect the value of executed contracts for software, hardware, other client services, remote hosting, outsourcing and subscription-based services.

(2) Allscripts estimates the preliminary Adjusted EBITDA range and reconciling items as follows:

|

|

|

Allscripts Healthcare Solutions, Inc. |

|

Condensed Non-GAAP Financial Information |

|

(In millions, except per share amounts) |

|

(Unaudited) |

|

|

Three Months Ended |

|

|

June 30, 2015 |

|

Preliminary GAAP net loss range |

$ (3) |

$ (3) |

|

|

|

|

|

Depreciation and amortization |

41 |

41 |

|

Stock-based compensation expense |

10 |

10 |

|

Non-recurring expenses and other |

8 |

5 |

|

Interest expense |

4 |

4 |

|

Income tax expense |

2 |

2 |

|

|

|

|

|

Preliminary Adjusted EBITDA Range |

$ 62 |

$ 59 |

(3) Allscripts estimates preliminary non-GAAP earnings per share and reconciling items as follows:

|

|

|

Allscripts Healthcare Solutions, Inc. |

|

Condensed Non-GAAP Financial Information |

|

(Unaudited) |

|

|

Three Months Ended |

|

|

June 30, 2015 |

|

|

|

|

Preliminary GAAP loss per share |

$ (0.01) |

|

|

|

|

Acquisition-related amortization |

0.05 |

|

Stock-based compensation expense |

0.04 |

|

Non-recurring expenses and transaction-related costs |

0.03 |

|

Other non-cash charges |

0.01 |

|

|

|

|

Preliminary non-GAAP earnings per share |

$ 0.12 |

Explanation of Non-GAAP Financial Measures

Allscripts reports its financial results in accordance with U.S. generally accepted accounting principles, or GAAP. To supplement this information, Allscripts presents non-GAAP net income on a per share basis and Adjusted EBITDA which are considered non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended.

-

Adjusted EBITDA is a non-GAAP measure and consists of GAAP net income (loss) as reported and adjusts for: tax provision (benefit); interest expense and other income, net; stock-based compensation expense; depreciation and amortization; deferred revenue and other adjustments; non-recurring and transaction-related costs; and non-cash asset impairment charges.

-

Non-GAAP net income on a per share basis consists of GAAP net income/(loss) as reported, and adds back acquisition-related amortization, stock-based compensation expense, non-recurring expenses and transaction-related costs, non-cash charges to interest expense and other, and non-cash asset impairment charges, in each case net of any related tax effects. Non-GAAP net income on a per share basis also includes a tax rate alignment adjustment.

Management believes that non-GAAP net income on a per share basis and Adjusted EBITDA provide useful supplemental information to management and investors regarding the underlying performance of Allscripts business operations. Acquisition accounting adjustments made in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments provided and discussed herein. Management also uses this information internally for forecasting and budgeting, as it believes that these measures are indicative of core operating results. In addition, management may use non-GAAP net income and/or Adjusted EBITDA to measure achievement under Allscripts stock and cash incentive compensation plans. Note, however, that non-GAAP net income on a per share basis and Adjusted EBITDA are performance measures only, and they do not provide any measure of cash flow or liquidity. Non-GAAP financial measures are not in accordance with, or an alternative for, measures of financial performance prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Allscripts results of operations as determined in accordance with GAAP.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including the preliminary financial information in this release, are based on the current beliefs and expectations of Allscripts management, only speak as of the date that they are made, and are subject to significant risks and uncertainties. Such statements can be identified by the use of words such as "future," "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "will," "would," "could," "can," "may," and similar terms. Actual results could differ from those set forth in the forward-looking statements, and reported results should not be considered an indication of future performance. Certain factors that could cause Allscripts' actual results to differ materially from those described in the forward-looking statements include, but are not limited to: Allscripts' failure to compete successfully; consolidation in Allscripts' industry; current and future laws, regulations and industry initiatives; increased government involvement in Allscripts' industry; the failure of markets in which Allscripts operates to develop as quickly as expected; Allscripts' or its customers' failure to see the benefits of government programs; changes in interoperability or other regulatory standards; the effects of the realignment of Allscripts' sales, services, and support organizations; market acceptance of Allscripts' products and services; the unpredictability of the sales and implementation cycles for Allscripts' products and services; Allscripts' ability to manage future growth; Allscripts' ability to introduce new products and services; Allscripts' ability to establish and maintain strategic relationships; risks related to the acquisition of new companies or technologies; the performance of Allscripts' products; Allscripts' ability to protect its intellectual property rights; the outcome of legal proceedings involving Allscripts; Allscripts' ability to hire, retain and motivate key personnel; performance by Allscripts' content and service providers; liability for use of content; security breaches; price reductions; Allscripts' ability to license and integrate third party technologies; Allscripts' ability to maintain or expand its business with existing customers; risks related to international operations; changes in tax rates or laws; business disruptions; Allscripts' ability to maintain proper and effective internal controls; and asset impairment charges. Additional information about these and other risks, uncertainties, and factors affecting Allscripts' business is contained in Allscripts' filings with the Securities and Exchange Commission. Allscripts does not undertake to update forward-looking statements to reflect changed assumptions, the impact of circumstances or events that may arise after the date of the forward-looking statements, or other changes in its business, financial condition, or operating results over time.

CONTACT: For more information contact:

Investors:

Seth Frank

312-506-1213

seth.frank@allscripts.com

Media:

Concetta DiFranco

312-447-2466

concetta.difranco@allscripts.com

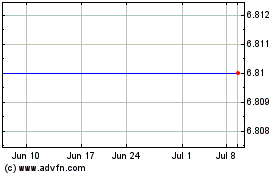

Veradigm (NASDAQ:MDRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

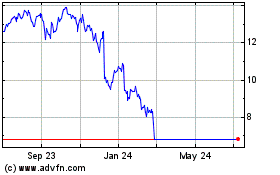

Veradigm (NASDAQ:MDRX)

Historical Stock Chart

From Apr 2023 to Apr 2024