Amended Current Report Filing (8-k/a)

May 25 2016 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K/A

(Amendment No. 1)

___________________

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 24, 2016

___________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAM RESEARCH CORPORATION

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Delaware

|

0-12933

|

94-2634797

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

|

4650 Cushing Parkway

Fremont, California 94538

|

|

(Address of principal executive offices including zip code)

|

|

|

(510) 572-0200

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

Not Applicable

|

|

|

|

(Former name or former address, if changed since last report)

|

|

___________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Table of Contents

|

|

|

|

|

|

|

|

|

Page

|

|

Explanatory Note

|

|

|

Item 8.01

|

Other Events

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

Signatures

|

|

|

Exhibit Index

|

|

Explanatory Note

This Amendment No. 1 to Current Report on Form 8-K/A (this “Amendment”) hereby amends and supplements the Current Report on Form 8-K of Lam Research Corporation (the “Company”) originally filed with the Securities and Exchange Commission on May 23, 2016 to provide, among other items, certain financial information with respect to pro forma financial statements combining the historical consolidated financial position and results of operation of the Company and its subsidiaries and KLA-Tencor Corporation ("KLA-Tencor") and its subsidiaries, as well as the computation of the Company’s ratio of earnings to fixed charges and the computation of the Company’s unaudited pro forma ratio of earnings to fixed charges.

Item 8.01. Other Events

In presenting the pro forma condensed combined statements of operations, the Company previously presented the reclassification of $74.1 million of other expense, net to interest expense for the nine months ended March 27, 2016, to conform to the combined presentation. The Company is filing this Amendment to supplement the prior presentation by increasing the reclassification of other expense, net to interest expense for the nine months ended March 27, 2016, to $101.3 million as compared to the $74.1 million previously presented. This supplement to the prior presentation relates to $27.2 million associated with the amortization of debt issuance costs, primarily relating to the bridge commitment letter the Company entered into in connection with the planned acquisition by the Company of KLA-Tencor, which costs are properly categorized as interest expense as compared to other expense. After giving effect to this supplement to the prior presentation, the Company’s ratio of earnings to fixed charges for the nine months ended March 27, 2016 would have been 7.6x on an actual basis, and the Company’s pro forma ratio of earnings to fixed charges (giving effect to the acquisition by the Company of KLA-Tencor and related financing transactions) for the nine months ended March 27, 2016 would have been 3.6x.

Accordingly, this Amendment provides (i) the updated computation of its ratio of earnings to fixed charges for the nine months ended March 27, 2016 and for the years ended June 28, 2015, June 29, 2014, June 30, 2013, June 24, 2012 and June 26, 2011, which is attached as Exhibit 12.1 hereto and incorporated by reference herein, and (ii) the updated computation of the Company’s pro forma ratio of earnings to fixed charges for the nine months ended March 27, 2016 and for the fiscal year ended June 30, 2015, giving effect to the acquisition by the Company of KLA-Tencor and related financing transactions, which is attached as Exhibit 12.2 hereto and incorporated by reference herein.

In addition, with regard to the stockholders’ equity portion of the pro forma combined company consolidated balance sheet as of March 27, 2016, the correct classification of the components of stockholders’ equity results in common stock of $237 and additional paid in capital of $11,308,955 (numbers in thousands), with no change to total stockholders’ equity.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

12.1

|

Computation of Ratio of Earnings to Fixed Charges for the nine months ended March 27, 2016 and the years ended June 28, 2015, June 29, 2014, June 30, 2013, June 24, 2012 and June 26, 2011

|

|

|

|

|

12.2

|

Unaudited Pro Forma Computation of Ratio of Earnings to Fixed Charges

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: May 24, 2016

|

LAM RESEARCH CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Douglas R. Bettinger

|

|

|

|

Douglas R. Bettinger

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

12.1

|

Computation of Ratio of Earnings to Fixed Charges for the nine months ended March 27, 2016 and the years ended June 28, 2015, June 29, 2014, June 30, 2013, June 24, 2012 and June 26, 2011

|

|

|

|

|

12.2

|

Unaudited Pro Forma Computation of Ratio of Earnings to Fixed Charges

|

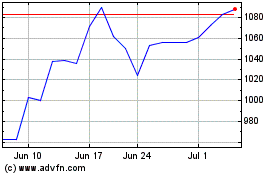

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

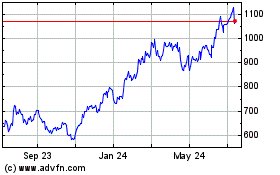

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024