UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| þ |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

LAM RESEARCH CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| þ |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

September 21, 2015

Dear Lam Research

Stockholders,

We cordially invite you to attend, in person or by proxy, the Lam Research Corporation 2015 Annual Meeting of Stockholders. The annual meeting will be

held on Wednesday, November 4, 2015, at 9:30 a.m. Pacific Standard Time in the Building CA1 Auditorium at the principal executive offices of Lam Research Corporation, which is located at 4650 Cushing Parkway, Fremont, California 94538.

At this year’s annual meeting, stockholders will be asked to elect the nine nominees named in the attached proxy statement as directors to serve for the

ensuing year, and until their respective successors are elected and qualified; to cast an advisory vote to approve the compensation of our named executive officers, or “Say on Pay”; to approve the Lam 2004 Executive Incentive Plan, as

amended and restated; to approve the adoption of the Lam 2015 Stock Incentive Plan; and to ratify the appointment of the independent registered public accounting firm for fiscal year 2016. The Board of Directors recommends that you vote in favor of

all five proposals. Management will not provide a business update during this meeting; please refer to our latest quarterly earnings report for our current outlook.

Please refer to the proxy statement for detailed information about the annual meeting and each of the proposals, as well as voting instructions. Your vote is

important, and we strongly urge you to cast your vote by the internet, phone or mail even if you plan to attend the meeting in person.

Sincerely yours,

Lam Research Corporation

Stephen G. Newberry

Chairman of the Board

|

|

|

|

|

Notice of 2015 Annual Meeting

of Stockholders |

4650 Cushing Parkway

Fremont, California 94538

Telephone: 510-572-0200

|

|

|

| Date and Time |

|

Wednesday, November 4, 2015 |

|

|

9:30 a.m. Pacific Standard Time |

|

|

| Place |

|

Lam Research Corporation |

|

|

Building CA1 Auditorium |

|

|

4650 Cushing Parkway |

|

|

Fremont, California 94538 |

Items of Business

| |

1. |

Election of nine directors to serve for the ensuing year, and until their respective successors are elected and qualified |

| |

2. |

Advisory vote to approve the compensation of our named executive officers, or “Say on Pay” |

| |

3. |

Approval of the Lam 2004 Executive Incentive Plan, as amended and restated |

| |

4. |

Approval of the adoption of the Lam 2015 Stock Incentive Plan |

| |

5. |

Ratification of the appointment of independent registered public accounting firm for fiscal year 2016 |

| |

6. |

Transact such other business that may properly come before the annual meeting (including any adjournment or postponement thereof) |

Record Date

Only stockholders of record at the close of business on

September 8, 2015, the “Record Date,” are entitled to notice of and to vote at the annual meeting.

Voting

Please vote as soon as possible, even if you plan to attend the annual meeting in person. You have three options for submitting your vote before the annual meeting: by

the internet, phone or mail. The proxy statement and the accompanying proxy card provide detailed voting instructions.

Internet Availability of Proxy Materials

Our Notice of 2015 Annual Meeting of Stockholders, Proxy Statement and Annual Report to Stockholders are available on the Lam Research website at

http://investor.lamresearch.com and at www.proxyvote.com.

By Order of the Board of Directors

Sarah A. O’Dowd

Secretary

This proxy statement is first being made available and/or mailed to our stockholders on or about September 21, 2015.

LAM RESEARCH CORPORATION

Proxy Statement for 2015 Annual Meeting of Stockholders

TABLE OF CONTENTS

To assist you in reviewing the proposals to be acted upon at the annual meeting we call your attention to the following information about the proposals and voting

recommendations, the Company’s director nominees and highlights of the Company’s corporate governance, executive compensation and 2015 Stock Incentive Plan. The following description is only a summary. For more complete information about

these topics, please review the complete proxy statement.

We use the terms “Lam Research,” “Lam,” the “Company,” “we,”

“our,” and “us” in this proxy statement to refer to Lam Research Corporation, a Delaware corporation.

Figure 1. Proposals and Voting Recommendations

|

|

|

|

|

| Voting Matters |

|

Board Vote Recommendation |

|

| Proposal 1 – Election of Nine Nominees Named Herein as Directors |

|

|

FOR each nominee |

|

| Proposal 2 – Advisory Vote to Approve the Compensation of Our Named Executive Officers, or “Say on Pay” |

|

|

FOR |

|

| Proposal 3 – Approval of the Lam 2004 Executive Incentive Plan, as Amended and Restated |

|

|

FOR |

|

| Proposal 4 – Approval of the Adoption of the Lam 2015 Stock Incentive Plan |

|

|

FOR |

|

| Proposal 5 – Ratification of the Appointment of the Independent Registered Public Accounting Firm for Fiscal Year 2016 |

|

|

FOR |

|

Figure 2. Summary Information Regarding Director Nominees

You are being asked to vote on the election of these nine directors. The following table provides summary information about each director nominee as of September 2015,

and their biographical information is contained in the “Voting Proposals – Proposal No. 1: Election of Directors – 2015 Nominees for Director” section below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Director |

|

Committee

Membership |

|

Other Current Public

Boards |

| Name |

|

Age |

|

Since |

|

Independent (1) |

|

AC |

|

CC |

|

NGC |

|

| Martin B. Anstice |

|

48 |

|

2012 |

|

No |

|

|

|

|

|

|

|

|

| Eric K. Brandt |

|

53 |

|

2010 |

|

Yes |

|

C/FE |

|

|

|

|

|

Dentsply International |

| Michael R. Cannon |

|

62 |

|

2011 |

|

Yes |

|

M |

|

|

|

M |

|

Adobe Systems, Seagate Technology, Dialog Semiconductor |

| Youssef A. El-Mansy |

|

70 |

|

2012 |

|

Yes |

|

|

|

M |

|

|

|

|

| Christine A. Heckart |

|

49 |

|

2011 |

|

Yes |

|

M |

|

|

|

|

|

|

| Catherine P. Lego |

|

58 |

|

2006 |

|

Yes |

|

|

|

C |

|

M |

|

SanDisk, Fairchild Semiconductor International |

| Stephen G. Newberry |

|

61 |

|

2005 |

|

No |

|

|

|

|

|

|

|

Splunk |

| Krishna C. Saraswat |

|

68 |

|

2012 |

|

Yes |

|

|

|

|

|

|

|

|

| Abhijit Y. Talwalkar |

|

51 |

|

2011 |

|

Yes

(Lead Independent Director) |

|

|

|

M |

|

C |

|

|

|

|

|

| (1) Independence determined based on NASDAQ

rules. |

| AC – Audit committee |

|

C – Chairperson |

| CC – Compensation committee |

|

M – Member |

| NGC – Nominating and governance committee |

|

FE – Audit committee financial expert (as determined based on SEC rules) |

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

1 |

Figure 3. Corporate Governance Highlights

|

|

|

|

|

| Board and Other Governance Information (1) |

|

As of September 2015 |

|

| Size of Board as Nominated |

|

|

9 |

|

| Average Age of Director Nominees |

|

|

57.8 |

|

| Average Tenure of Director Nominees |

|

|

5.4 |

|

| Number of Independent Nominated Directors |

|

|

7 |

|

| Number of Nominated Directors Who Attended ³75% of Meetings |

|

|

8 |

(2) |

| Number of Nominated Directors on More Than Four Public Company Boards |

|

|

0 |

|

| Directors Subject to Stock Ownership Guidelines |

|

|

Yes |

|

| Annual Election of Directors |

|

|

Yes |

|

| Voting Standard |

|

|

Majority |

|

| Plurality Voting Carveout for Contested Elections |

|

|

Yes |

|

| Separate Chairman and CEO |

|

|

Yes |

|

| Lead Independent Director |

|

|

Yes |

|

| Independent Directors Meet Without Management Present |

|

|

Yes |

|

| Board (Including Individual Director) and Committee Self-Evaluations |

|

|

Yes |

|

| Annual Independent Director Evaluation of CEO |

|

|

Yes |

|

| Risk Oversight by Full Board and Committees |

|

|

Yes |

|

| Commitment to Board Refreshment and Diversity |

|

|

Yes |

|

| Robust Director Nomination Process |

|

|

Yes |

|

| Board Orientation/Education Program |

|

|

Yes |

|

| Code of Ethics Applicable to Directors |

|

|

Yes |

|

| Stockholder Ability to Act by Written Consent |

|

|

Yes |

|

| Poison Pill |

|

|

No |

|

| Publication of Corporate Social Responsibility Report on Our Website |

|

|

Yes |

|

| (1) |

The nine directors to be elected is fewer than the eleven members as of the proxy statement filing date, and the board has reduced the size of the board to nine, effective immediately prior to the time of this

year’s annual meeting of stockholders. |

| (2) |

For additional information regarding meeting attendance see “Governance Matters – Corporate Governance – Meeting Attendance” below. |

2

Figure 4. Executive Compensation Highlights

|

| What We Do |

| Pay for Performance (Pages 15-18, 21, 24-25) – Our executive compensation program is designed to pay for performance with 100% of the short-term incentive program tied to company

financial, strategic and operational performance metrics, 50% of the long-term incentive program tied to total shareholder return, or “TSR,” performance, and 50% of the long-term incentive program awarded in stock options and restricted

stock units, or “RSUs.” |

| Three-Year Performance Period for Our 2015 Long-Term Incentive Program (Pages 24-26) – Our current long-term incentive program is designed to pay for performance over a period of

three years. |

| Absolute and Relative Performance Metrics (Pages 21-23, 24-26) – Our annual and long-term incentive programs for executive officers include the use of absolute and relative

performance factors. |

| Balance of Annual and Long-Term Incentives – Our incentive programs provide a balance of annual and longer-term incentives. |

| Different Performance Metrics for Annual and Long-Term Incentive Programs (Pages 21-23, 24-26) – Our annual and long-term incentive programs use different performance

metrics. |

| Capped Amounts (Pages 21-22, 25-26) – Amounts that can be earned under the annual and long-term incentive programs are capped. |

| Compensation Recovery/Clawback Policy (Page 18) – We have a policy in which we can recover the excess amount of cash incentive-based compensation granted and paid to our officers

who are covered by Section 16 of the Exchange Act. |

| Prohibit Option Repricing – Our stock incentive plans prohibit option repricing without stockholder approval (excluding adjustments due to specified corporate transactions and

changes in capitalization). |

| Hedging and Pledging Policy (Page 8) – We have a policy applicable to our Named Executive Officers, or “NEOs,” and directors that prohibits pledging and hedging.

|

| Stock Ownership Guidelines (Page 18) – We have stock ownership guidelines for each of our executive officers and certain other senior executives; each of our NEOs has met his or

her individual ownership level under the current program or has a period of time remaining under the guidelines to do so. |

| Independent Compensation Advisor (Page 19) – The compensation committee benefits from its utilization of an independent compensation advisor retained directly by the committee that

provides no other services to the Company. |

| Stockholder Engagement – We engage with stockholders and stockholder advisory firms to obtain

feedback concerning our compensation program. |

| What We Don’t Do |

| Tax “Gross-Ups” for Perquisites, for Other Benefits or upon a Change in Control (Pages 29-32, 36-38) – Our executive officers do not receive tax “gross-ups” for

perquisites, for other benefits or upon a change in control.(1) |

| Single-Trigger Change in Control Provisions (Pages 28, 36-38) – None of our executive officers have single-trigger change in control agreements. |

| (1) |

Our executive officers may receive tax gross-ups in connection with relocation benefits that are widely available to all of our employees. |

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

3 |

Figure 5. 2015 Stock Incentive Plan Highlights

|

| What The Plan Includes |

| Share Reserve (Page 58) – 18 million shares shall be available for issuance under the 2015 Stock Incentive Plan, or the “2015 Plan.” In addition, the shares that

remain available for grants under the 2007 Stock Incentive Plan, or the “2007 Plan,” as of the date of the 2015 Annual Meeting of Stockholders and any shares that would otherwise return to the 2007 Plan as a result of the forfeiture,

termination or expiration of awards previously granted under the 2007 Plan shall also be available for issuance under the 2015 Plan in addition to the 18 million shares. |

| Award Type Flexibility (Page 57) – The 2015 Plan provides for incentive stock options, non-qualified stock options, restricted stock, restricted stock units, stock appreciation

rights, or “SARs,” and other awards (including, but not limited to, purchase rights for shares, bonus shares, deferred shares, performance shares and phantom shares). |

| Fungible Share Ratio (Page 58) – Awards other than stock options and SARs count against the share reserve at a 2:1 ratio (i.e., will count as two shares against the share reserve

for every one share subject to such award). |

| Grant Limits (Page 58) – Grantees may not be granted more than 1,000,000 stock options and SARs during a fiscal year (2,000,000 for new hires). Restricted stock, restricted stock

units and other awards intended to be performance-based compensation are limited at 600,000 shares during a fiscal year. Non-employee director awards are limited to 80,000 shares regardless of award type. |

| Minimum Vesting Periods (Page 59) – Awards may not vest sooner than the one year anniversary of the date of grant (except with respect to 5% of the maximum number of shares that

may be issued under the 2015 Plan). Awards may provide for earlier vesting in certain circumstances (e.g., death, disability and in certain corporate transactions). |

| Recoupment/Clawback (Page 60) – Awards under the 2015 Plan are subject to any applicable recoupment provision that we may adopt with respect to equity awards made after such

adoption. |

| Plan Term (Page 59) – The 2015 Plan terminates 10 years from its effective date, though awards granted before termination will survive in accordance with their terms. |

| Shares Available for Awards Provisions (Page 59) –

• Shares covered by an award which is forfeited, canceled or which expires before the

shares are issued shall be available for future issuance under the 2015 Plan. • Shares

that have been issued (e.g., restricted stock) shall not be returned to the 2015 Plan except where unvested shares are forfeited or repurchased by the Company at the lower of their original purchase price or their fair market value.

• Shares tendered or withheld in payment of an option or SAR exercise price or withheld to

pay any option or SAR tax withholding obligation shall not be returned to the 2015 Plan.

• Shares tendered or withheld in payment of any tax withholding obligation for an award

other than an option or SAR shall be returned to the 2015 Plan and available for future issuance. |

| What The Plan Does Not Include |

| Repricing Without Stockholder Approval (Page 59) – Stockholder approval must be obtained prior to the reduction of the exercise price of any option or SAR or the cancellation of

an option or SAR when its exercise price exceeds the fair market value of the shares in exchange for cash, another award, or an option or SAR with a lower exercise price (excluding adjustments due to specified corporate transactions and changes in

capitalization). |

4

Security Ownership of Certain Beneficial Owners and Management

The table below sets forth the beneficial ownership of shares of Lam common stock by: (i) each person or entity who we

believe based on our review of filings made with the United States Securities and Exchange Commission, or the “SEC,” beneficially owned as of September 8, 2015, more than 5% of Lam’s common stock on the date set forth below;

(ii) each current director of the Company; (iii) each NEO identified below in the “Compensation Matters – Executive Compensation and Other Information – Compensation Discussion and Analysis” section; and

(iv) all current directors and current

executive officers as a group. With the exception of 5% owners, and unless otherwise noted, the information below reflects holdings as of September 8, 2015, which is the Record Date for the

2015 annual meeting and the most recent practicable date for determining ownership. For 5% owners, holdings are as of the dates of their most recent ownership reports filed with the SEC, which are the most practicable dates for determining their

holdings. The percentage of the class owned is calculated using 158,498,813 as the number of shares of Lam common stock outstanding on September 8, 2015.

Figure 6. Beneficial

Ownership Table

|

|

|

|

|

|

|

|

|

| Name of Person or Identity of Group |

|

Shares Beneficially Owned

(#) (1) |

|

|

Percentage

of Class |

|

| 5% Stockholders |

|

|

|

|

|

|

|

|

| JPMorgan Chase & Co.

270 Park Avenue New York, NY 10017 |

|

|

20,041,020 |

(2) |

|

|

12.6 |

% |

| Ameriprise Financial, Inc.

145 Ameriprise Financial Center Minneapolis, MN

55474 Columbia Management Investment Advisers, LLC

225 Franklin St. Boston, MA 02110 |

|

|

14,784,854 |

(3) |

|

|

9.3 |

% |

| The Vanguard Group, Inc.

100 Vanguard Boulevard Malvern, PA

19355 |

|

|

12,200,295 |

(4) |

|

|

7.7 |

% |

| BlackRock Inc.

55 East 52nd Street New York, NY 10022 |

|

|

9,099,499 |

(5) |

|

|

5.7 |

% |

| Directors |

|

|

|

|

|

|

|

|

| Martin B. Anstice (also a Named Executive Officer) |

|

|

53,261 |

|

|

|

* |

|

| Eric K. Brandt |

|

|

24,230 |

|

|

|

* |

|

| Michael R. Cannon |

|

|

20,530 |

|

|

|

* |

|

| Youssef A. El-Mansy |

|

|

22,133 |

|

|

|

* |

|

| Christine A. Heckart |

|

|

15,030 |

|

|

|

* |

|

| Grant M. Inman |

|

|

90,038 |

|

|

|

* |

|

| Catherine P. Lego |

|

|

46,038 |

|

|

|

* |

|

| Stephen G. Newberry |

|

|

32,640 |

|

|

|

* |

|

| Krishna C. Saraswat |

|

|

23,696 |

|

|

|

* |

|

| William R. Spivey |

|

|

62,416 |

|

|

|

* |

|

| Abhijit Y. Talwalkar |

|

|

21,130 |

|

|

|

* |

|

| Named Executive Officers (“NEOs”) |

|

|

|

|

|

|

|

|

| Timothy M. Archer |

|

|

139,556 |

(6) |

|

|

* |

|

| Douglas R. Bettinger |

|

|

10,811 |

|

|

|

* |

|

| Richard A. Gottscho |

|

|

67,191 |

|

|

|

* |

|

| Sarah A. O’Dowd |

|

|

49,797 |

|

|

|

* |

|

| All current directors and executive officers as a group (15 people) |

|

|

678,497 |

(6) |

|

|

* |

|

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

5 |

| (1) |

Includes shares subject to outstanding stock options that are now exercisable or will become exercisable within 60 days after September 8, 2015, as well as restricted stock units, or “RSUs,” that will

vest within that time period, as follows: |

|

|

|

|

|

| |

|

Shares |

|

| Martin B. Anstice |

|

|

— |

|

| Eric K. Brandt |

|

|

2,400 |

|

| Michael R. Cannon |

|

|

2,400 |

|

| Youssef A. El-Mansy |

|

|

2,400 |

|

| Christine A. Heckart |

|

|

2,400 |

|

| Grant M. Inman |

|

|

2,400 |

|

| Catherine P. Lego |

|

|

2,400 |

|

| Stephen G. Newberry |

|

|

2,400 |

|

| Krishna C. Saraswat |

|

|

2,400 |

|

| William R. Spivey |

|

|

2,400 |

|

| Abhijit Y. Talwalkar |

|

|

2,400 |

|

| Timothy M. Archer |

|

|

— |

|

| Douglas R. Bettinger |

|

|

— |

|

| Richard A. Gottscho |

|

|

— |

|

| Sarah A. O’Dowd |

|

|

— |

|

| All current directors and executive officers as a group (15 people) |

|

|

24,000 |

|

| |

As discussed in “Director Compensation” below, the non-employee directors receive an annual equity grant as part of their compensation. These grants generally vest on October 31, 2015, subject to

continued service on the board as of that date, with immediate delivery of the shares upon vesting. For 2015, Drs. El-Mansy, Saraswat and Spivey; Messrs. Brandt, Cannon, Inman, Newberry and Talwalkar; and Mses. Heckart and Lego each received grants

of 2,400 RSUs. These RSUs are included in the tables above. |

| (2) |

All information regarding JPMorgan Chase & Co., or “JPMorgan Chase,” is based solely on information disclosed in amendment number six to Schedule 13G filed by JPMorgan Chase with the SEC on

January 15, 2015 as a parent holding company on behalf of JPMorgan Chase and its wholly-owned subsidiaries: JPMorgan Chase Bank, National Association; J.P. Morgan Investment Management Inc.; JPMorgan Asset Management (UK) Ltd.; J.P. Morgan

Trust Company of Delaware; and JPMorgan Asset Management (Canada) Inc. According to the Schedule 13G/A filing, of the 20,041,020 shares of Lam common stock reported as beneficially owned by JPMorgan Chase as of December 31, 2014, JPMorgan Chase

had sole voting power with respect to 17,836,175 shares, had shared voting power with respect to 257,237 shares, had sole dispositive power with respect to 19,726,354 shares and shared dispositive power with respect to 313,701 shares of Lam common

stock reported as beneficially owned by JPMorgan Chase as of that date. |

| (3) |

All information regarding Ameriprise Financial, Inc., or “Ameriprise,” and Columbia Management Investment Advisers, LLC, or “Columbia,” is based solely on information disclosed in amendment number

two to Schedule 13G filed by Ameriprise and Columbia with the SEC on February 17, 2015. According to the Schedule 13G filing, of the 14,784,854 shares of Lam common stock reported as beneficially owned by Ameriprise and Columbia as of

December 31, 2014, Ameriprise and Columbia did not have sole voting power with respect to any shares, and had shared voting power with respect to 1,262,004 shares, did not have sole dispositive power with respect to any other shares and shared

dispositive power with respect to 14,784,854 shares of Lam common stock reported as beneficially owned by Ameriprise and Columbia as of that date. According to the Schedule 13G filing, Ameriprise, as the parent company of Columbia, may be deemed to

beneficially own the shares reported by Columbia in the Schedule 13G filing. Accordingly, the shares reported by Ameriprise in the Schedule 13G filing include those shares separately reported therein by Columbia. |

| (4) |

All information regarding The Vanguard Group, Inc., or “Vanguard,” is based solely on information disclosed in amendment number two to Schedule 13G filed by Vanguard with the SEC on February 10, 2015.

According to the Schedule 13G filing, of the 12,200,295 shares of Lam common stock reported as beneficially owned by Vanguard as of December 31, 2014, Vanguard had sole voting power with respect to 267,722 shares, did not have shared voting

power with respect to any other shares, had sole dispositive power with respect to 11,938,873 shares and shared dispositive power with respect to 261,422 shares of Lam common stock reported as beneficially owned by Vanguard as of that date. The

12,200,295 shares of Lam common stock reported as beneficially owned by Vanguard include 217,422 shares beneficially owned by Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, as a result of it serving as investment manager of

collective trust accounts, and 103,300 shares beneficially owned by Vanguard Investments Australia, Ltd., a wholly–owned subsidiary of Vanguard, as a result of it serving as investment manager of Australian investment offerings.

|

| (5) |

All information regarding BlackRock Inc., or “BlackRock,” is based solely on information disclosed in amendment number seven to Schedule 13G filed by

BlackRock with the SEC on February 2, 2015 on behalf of BlackRock and its subsidiaries: BlackRock (Luxembourg) S.A.; BlackRock (Netherlands) B.V.; BlackRock Advisors (UK) Limited; BlackRock Advisors, LLC; BlackRock Asset Management Canada

Limited; BlackRock Asset Management Deutschland AG; BlackRock Asset Management Ireland Limited; BlackRock Asset Management North Asia Limited; BlackRock Financial Management, Inc.; BlackRock Fund Management Ireland Limited; BlackRock Fund Managers

Ltd; BlackRock Institutional Trust Company, N.A.; BlackRock International Limited; BlackRock Investment Management (Australia) Limited; BlackRock Investment Management (UK) Ltd; BlackRock Investment Management, LLC; BlackRock Japan Co Ltd; and

BlackRock Life Limited. According to the Schedule 13G filing, of the 9,099,499 shares of Lam common stock reported as beneficially owned by BlackRock as of December 31, 2014, BlackRock had sole voting power with respect to 7,649,071 shares, did

not have shared voting power with respect to any other shares, |

6

| |

had sole dispositive power with respect to 9,099,499 shares and did not have shared dispositive power with respect to any other shares of Lam common stock reported as beneficially owned by BlackRock as of that date.

|

| (6) |

Includes 4,284 shares of common stock held indirectly in a 401(k) plan and 506 shares of common stock held by Mr. Archer’s spouse in her 401(k) plan over which he may be deemed to have beneficial ownership.

|

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors, and people who own more than 10% of a

registered class of our equity securities to file an initial report of ownership (on a Form 3) and reports on subsequent changes in ownership (on Forms 4 or 5) with the SEC by specified due dates. Our executive officers, directors, and

greater-than-10% stockholders are also required by SEC rules

to furnish us with copies of all Section 16(a) forms they file. We are required to disclose in this proxy statement any failure to file any of these reports on a timely basis. Based solely

on our review of the copies of the forms that we received from the filers, and on written representations from certain reporting persons, we believe that all of these requirements were satisfied during fiscal year 2015.

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

7 |

Corporate Governance

Our board of directors and members of management are committed to responsible corporate governance to manage the Company

for the long-term benefit of its stockholders. To that end, the board and management periodically review and update, as appropriate, the Company’s corporate governance policies and practices. As part of that process, the board and management

consider the requirements of federal and state law, including rules and regulations of the SEC; the listing standards for the NASDAQ Global Select Market, or “NASDAQ;” published guidelines and recommendations of proxy advisory firms;

published guidelines of other selected public companies; and any feedback we receive from our stockholders. A list of key corporate governance practices is provided in the “Proxy Statement Summary” above.

Corporate Governance Policies

We have instituted a variety of policies and procedures to foster and maintain responsible corporate governance, including the following:

Board committee charters. Each of the board’s audit, compensation and

nominating and governance committees has a written charter adopted by the board that establishes practices and procedures for the committee in accordance with applicable corporate governance rules and regulations. Each committee reviews its charter

annually and recommends changes to the board, as appropriate. Each committee charter is available on the investors’ page of our web site at http://investor.lamresearch.com/corporate-governance.cfm. Also refer to “Board

Committees” below, for additional information regarding these board committees.

Corporate

governance guidelines. We adhere to written corporate governance guidelines, adopted by the board and reviewed annually by the nominating and governance committee and the board. Selected provisions of the

guidelines are discussed below, including in the “Board Nomination Policies and Procedures,” “Director Independence Policies” and “Other Governance Practices” sections below. The corporate

governance guidelines are available on the investors’ page of our web site at http://investor.lamresearch.com/corporate-governance.cfm.

Corporate code of ethics. We maintain a code of ethics that applies to all employees, officers, and members of the board. The code of ethics establishes

standards reasonably necessary to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, and full, fair, accurate, timely, and understandable

disclosure in the periodic

reports we file with the SEC and in other public communications. We will promptly disclose to the public any amendments to, or waivers from, any provision of the code of ethics to the extent

required by applicable laws. We intend to make this public disclosure by posting the relevant material on our web site, to the extent permitted by applicable laws. A copy of the code of ethics is available on the investors’ page of our web site

at http://investor.lamresearch.com/corporate-governance.cfm.

Global standards of business conduct

policy. We maintain written standards of appropriate conduct in a variety of business situations that apply to our worldwide workforce. Among other things, these global standards of business conduct address

relationships with one another, relationships with Lam (including conflicts of interest, safeguarding of Company assets and protection of confidential information) and relationships with other companies and stakeholders (including anti-corruption).

Insider trading policy. Our insider trading policy restricts

the trading of Company stock by our directors, officers, and employees, and includes provisions addressing insider blackout periods and prohibiting hedges and pledges of Company stock.

Board Nomination Policies and Procedures

Board membership criteria. Under our corporate governance guidelines, the

nominating and governance committee is responsible for assessing the appropriate balance of experience, skills and characteristics required for the board and for recommending director nominees to the independent directors.

The guidelines direct the committee to consider all factors it considers appropriate. The committee need not consider all of the same factors for every candidate.

Factors to be considered may include, but are not limited to: experience; business acumen; wisdom; integrity; judgment; the ability to make independent analytical inquiries; the ability to understand the Company’s business environment; the

candidate’s willingness and ability to devote adequate time to board duties; specific skills, background or experience considered necessary or desirable for board or committee service; specific experiences with other businesses or organizations

that may be relevant to the Company or its industry; diversity with respect to any attribute(s) the board considers appropriate, including geographic, gender, age and ethnic diversity; and the interplay of a candidate’s experiences and skills

with those of other board members.

8

The board and the nominating and governance committee regard board refreshment as important, and strive to maintain an

appropriate balance of tenure, turnover, diversity and skills on the board. The board believes that new perspectives and ideas are important to a forward-looking and strategic board as is the ability to benefit from the valuable experience and

familiarity of longer-serving directors.

Prior to recommending that an incumbent non-employee director be nominated for reelection to the board, the committee

reviews the experiences, skills and qualifications of the directors to assess the continuing relevance of the directors’ experiences, skills and qualifications to those considered necessary or desirable for the board at that time. Board members

may not serve on more than four boards of public companies (including service on the Company’s board).

To be nominated, a new or incumbent candidate must

provide an irrevocable conditional resignation that will be effective upon (i) the director’s failure to receive the required majority vote at an annual meeting at which the nominee faces re-election and (ii) the board’s

acceptance of such resignation. In addition, no director, after having attained the age of 75 years, may be nominated for re-election or reappointment to the board.

Nomination procedure. The nominating and governance committee identifies,

screens, evaluates and recommends qualified candidates for appointment or election to the board based on the board’s needs and desires at that time as developed through their self-evaluation process. The committee considers recommendations from

a variety of sources, including search firms, board members, executive officers and stockholders. Nominations for election by the stockholders are made by the independent members of the board.

Certain provisions of our bylaws apply to the nomination or recommendation of candidates by a stockholder. Information regarding the nomination procedure is provided in

the “Voting and Meeting Information – Other Meeting Information – Stockholder-Initiated Proposals and Nominations for 2015 Annual Meeting” section below.

Director Independence Policies

Board independence requirements. Our corporate governance guidelines require

that at least a majority of the board members be independent. No director will qualify as “independent” unless the board affirmatively determines that the director qualifies as independent under the NASDAQ rules and has no relationship

that would interfere with the exercise of independent judgment as a director. In addition, no non-employee director may serve as a consultant or service provider to the Company without the approval of a majority of the independent directors (and any

such director’s independence must be reassessed by the full board following such approval).

Board member independence.

The board has determined that all current directors, other than Messrs. Anstice and Newberry, are independent in accordance with NASDAQ criteria for director independence.

Board committee independence. All members of the board’s audit,

compensation, and nominating and governance committees must be non-employee or outside directors and independent in accordance with applicable NASDAQ criteria as well as, in the case of the compensation committee, applicable rules under section

162(m) of the Internal Revenue Code of 1986, as amended, or the “Code,” and Rule 16b-3 of the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” See “Board Committees” below for additional

information regarding these board committees.

Lead independent director. Our corporate governance guidelines authorize the board to designate a lead independent director from among the independent board members. The lead independent director is responsible for coordinating the activities of the

independent directors; consulting with the chairman regarding matters such as schedules of and agendas for board meetings; the quality, quantity and timeliness of the flow of information from management; the retention of consultants who report

directly to the board; and developing the agenda for and moderating executive sessions of the board’s independent directors. Mr. Talwalkar was appointed the lead independent director, effective August 27, 2015, succeeding

Mr. Inman, who is retiring effective as of November 2, 2015 and had served as the lead independent director from his reelection at the 2012 annual meeting through August 26, 2015.

Executive sessions of independent directors. The board and its audit,

compensation, and nominating and governance committees hold meetings of the independent directors and committee members, without management present, as part of each regularly scheduled meeting and at any other time at the discretion of the board or

committee, as applicable.

Board access to independent advisors.

The board as a whole, and each of the board standing committees separately, has the complete authority to retain, at the Company’s expense, and terminate, in their discretion, any independent consultants, counselors, or advisors as they deem

necessary or appropriate to fulfill their responsibilities.

Board education program. Our corporate governance guidelines provide that directors are expected to participate in educational activities sufficient to maintain their understanding of their duties as directors and to enhance their ability to

fulfill their responsibilities. In addition to any external educations that the directors find useful, the Company and the board leadership are expected to facilitate such participation by arranging for appropriate educational content to be

incorporated into regular meetings of the board and committees.

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

9 |

Leadership Structure of the Board

The current leadership structure of the board consists of a chairman and a lead independent director. The chairman, Mr. Newberry, served as chief executive officer

of the Company from June 2005 to January 2012. The board believes that this is the appropriate board leadership structure at this time. Lam and its stockholders benefit from having Mr. Newberry as its chairman, as he brings to bear his

experience as CEO as well as his other qualifications in carrying out his responsibilities as chairman, which include (i) preparing the agenda for the board meetings; (ii) upon invitation, attending meetings of any of the board committees

on which he is not a member; (iii) if not also the CEO, conveying to the CEO, together with the chair of the compensation committee, the results of the CEO’s performance evaluation; (iv) reviewing proposals submitted by stockholders

for action at meetings of stockholders and, depending on the subject matter, determining the appropriate body, among the board or any of the board committees, to evaluate each proposal and making recommendations to the board regarding action to be

taken in response to such proposal; (v) performing such other duties as the board may reasonably request from time to time; and (vi) performing such duties as the CEO may reasonably request from time to time for the purpose of enhancing

the chairman’s familiarity with the Company and its executives, such as attending the annual Executive Strategic Planning Conference as a representative of the board, and by meeting with the members of management at the request of the CEO or

COO. The Company and its stockholders also benefit from having a lead independent director to provide independent board leadership. See “Director Independence Policies – Lead Independent Director” for additional information

regarding the responsibilities of the lead independent director.

Other Governance Practices

In addition to the principal policies and procedures described above, we have established a variety of other practices to enhance our corporate governance, including the

following:

Board and committee assessments. At least once every two

years, the board conducts a self-evaluation of the board, its committees, and the individual directors, overseen by the nominating and governance committee.

Director resignation or notification of change in executive officer status. Under our corporate governance guidelines, any director who is also an executive

officer of the Company must offer to submit his or her resignation as a director to the board if the director ceases to be an executive officer of the Company. The board may accept or decline the offer, in its discretion. The corporate governance

guidelines also require a non-employee director to notify the nominating and governance committee if the director changes or retires from his or her executive position at another company. The nominating and governance committee reviews the

appropriateness of the director’s continuing board membership under the circumstances, and the director is expected to act in accordance with

the nominating and governance committee’s recommendations.

Director and executive stock ownership. Under the corporate governance

guidelines, each director is expected to own at least the lesser of five times the value of the annual cash retainer (not including any committee chair or other supplemental retainers for directors) or 5,000 shares of Lam common stock, by the fifth

anniversary of his or her initial election to the board. Guidelines for stock ownership by designated members of the executive management team are described below under “Compensation Matters – Executive Compensation and Other

Information – Compensation Discussion and Analysis.” All of our directors and designated members of our executive management team were in compliance with the Company’s applicable stock ownership guidelines at the end of fiscal

year 2015 or have a period of time remaining under the program to do so.

Communications with board

members. Any stockholder who wishes to communicate directly with the board of directors, with any board committee or with any individual director regarding the Company may write to the board, the committee

or the director c/o Secretary, Lam Research Corporation, 4650 Cushing Parkway, Fremont, California 94538. The secretary will forward all such communications to the appropriate director(s).

Any stockholder, employee, or other person may communicate any complaint regarding any accounting, internal accounting control, or audit matter to the attention of the

board’s audit committee by sending written correspondence by mail (to Lam Research Corporation, Attention: Board Audit Committee, P.O. Box 5010, Fremont, California 94537-5010) or by phone (855-208-8578) or internet (through the Company’s

third party provider web site at www.lamhelpline.ethicspoint.com). The audit committee has established procedures to ensure that employee complaints or concerns regarding audit or accounting matters will be received and treated anonymously

(if the complaint or concern is submitted anonymously and permitted under applicable law).

Meeting Attendance

All of the directors attended at least 75% of the aggregate number of board meetings and meetings of board committees on which they served during their

board tenure in fiscal year 2015, with the exception of Dr. El-Mansy, who attended 100% of all such meetings in all prior years of service and 70% in fiscal year 2015. Dr. El-Mansy was unable to attend one board and two compensation

committee meetings scheduled within a two week period in fiscal year 2015 due to a serious family medical situation. Our board of directors held a total of five meetings during fiscal year 2015.

We expect our directors to attend the annual meeting of stockholders each year. All individuals who were directors as of the 2014 annual meeting of stockholders attended

the 2014 annual meeting of stockholders.

10

Board Committees

The board of directors has three standing committees: an audit committee, a compensation committee, and a nominating and governance committee. The purpose, membership and

charter of each are described below.

Figure 7. Committee Membership

|

|

|

|

|

|

|

| Current Committee Memberships |

| Name |

|

Audit |

|

Compensation |

|

Nominating

and

Governance |

| Eric K. Brandt |

|

Chair |

|

|

|

|

| Michael R. Cannon |

|

x |

|

|

|

x |

| Youssef A. El-Mansy |

|

|

|

x |

|

|

| Christine A. Heckart |

|

x (1) |

|

|

|

|

| Grant M. Inman |

|

|

|

x |

|

x (2) |

| Catherine P. Lego |

|

|

|

Chair (3) |

|

x |

| William R. Spivey |

|

x |

|

|

|

|

| Abhijit Y. Talwalkar |

|

|

|

x (4) |

|

Chair (5) |

| Total Number of Meetings Held in FY2015 |

|

8 |

|

5 |

|

4 |

| (1) |

Ms. Heckart was appointed as a member of the audit committee effective August 27, 2015. Until that time, she served as a member of the compensation committee. |

| (2) |

Mr. Inman served as chair of the nominating and governance committee through August 26, 2015, remaining thereafter as a member of the committee. |

| (3) |

Ms. Lego was appointed as chair of the compensation committee effective August 27, 2015. Until that time, she served as a member of the audit committee. |

| (4) |

Mr. Talwalkar served as chair of the compensation committee through August 26, 2015, remaining thereafter as a member of the committee. |

| (5) |

Mr. Talwalkar was appointed as a member of the nominating and governance committee effective May 14, 2015 and as chair of the nominating and governance committee effective August 27, 2015.

|

Audit committee. The purpose of the audit committee is

to oversee the Company’s accounting and financial reporting processes and the audits of our financial statements, including the system of internal controls. As part of its responsibilities, the audit committee reviews and oversees potential

conflict of interest situations, transactions required to be disclosed pursuant to Item 404 of Regulation S-K of the SEC and any other transaction involving an executive or board member. A copy of the audit committee charter is available on the

investors’ page of our web site at http://investor.lamresearch.com/corporate-governance.cfm.

The board concluded that all audit committee members are non-employee directors who are independent in accordance with the

NASDAQ listing standards and SEC rules for audit committee member independence and that each audit committee member is able to read and understand fundamental financial statements as required by the NASDAQ listing standards. The board also

determined that Mr. Brandt, the chair of the committee, is an “audit committee financial expert” as defined in the SEC rules.

Compensation committee. The purpose of the compensation committee is to discharge certain responsibilities of the board relating to executive compensation; to

oversee incentive, equity-based plans and other compensatory plans in which the Company’s executive officers and/or directors participate; and to produce an annual report on executive compensation for inclusion as required in the Company’s

annual proxy statement. The compensation committee is authorized to perform the responsibilities of the committee referenced above and described in the charter. A copy of the compensation committee charter is available on the investors’ page of

our web site at http://investor.lamresearch.com/corporate-governance.cfm.

The board concluded that all members of the compensation committee are

non-employee directors who are independent in accordance with Rule 16b-3 of the Exchange Act and the NASDAQ criteria for director and compensation committee member independence and who are outside directors for purposes of section 162(m) of the

Code.

Nominating and governance committee. The purpose of the

nominating and governance committee is to identify individuals qualified to serve as members of the board of the Company, to recommend nominees for election as directors of the Company, to oversee self-evaluations of the board’s performance, to

develop and recommend corporate governance guidelines to the board, and to provide oversight with respect to corporate governance. A copy of the nominating and governance committee charter is available on the investors’ page of our web

site at http://investor.lamresearch.com/corporate-governance.cfm.

The board concluded that all nominating and governance committee members are

non-employee directors who are independent in accordance with the NASDAQ criteria for director independence.

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

11 |

The nominating and governance committee will consider for nomination persons properly nominated by stockholders in

accordance with the Company’s bylaws and other procedures described in the “Voting and Meeting Information – Other Meeting Information – Stockholder-Initiated Proposals and Nominations for 2015 Annual Meeting” section

below. Subject to then-applicable law, stockholder nominations for director will be evaluated by the Company’s nominating and governance committee in accordance with the same criteria as is applied to candidates identified by the nominating and

governance committee or other sources.

Board’s Role in Risk Oversight

The board is actively engaged in risk oversight. Management regularly reports to the board on its risk assessments and risk mitigation strategies for the major risks of

our business. Generally the board exercises its oversight responsibility

directly; however, in specific cases, such responsibility has been delegated to board committees. Committees that have been charged with risk oversight regularly report to the board on those risk

matters within their areas of responsibility. Risk oversight responsibility has been delegated to board committees as follows:

| |

• |

|

Our audit committee oversees risks related to the Company’s accounting and financial reporting, internal controls, and the auditing of our annual financial statements. The audit committee also oversees risks

related to our independent registered public accounting firm and our internal audit function. |

| |

• |

|

Our compensation committee oversees risks related to the Company’s equity, and executive compensation programs and plans. |

| |

• |

|

Our nominating and governance committee oversees risks related to director independence, board and board committee composition and CEO succession planning.

|

Director Compensation

Our director compensation is designed to attract and retain high caliber directors and to align director interests with

those of stockholders. Director compensation is reviewed and determined annually by the board (in the case of Messrs. Newberry and Anstice, by the independent members of the board), upon recommendation from the compensation committee. Non-employee

director compensation (including the compensation of Mr. Newberry, who is currently our non-employee chairman and was previously an employee chairman for a portion of fiscal year 2015) is described below. Mr. Anstice, whose compensation as

CEO is described below under “Compensation Matters – Executive Compensation and Other Information – Compensation Discussion and Analysis,” does not receive additional compensation for his service on the board.

Non-employee director compensation. Non-employee directors receive annual cash retainers and equity awards.

The chairman of the board, committee chairs, the lead independent director and committee members receive additional cash retainers. Non-employee directors who join the board or a committee midyear receive prorated cash retainers and equity awards,

as applicable. Our non-employee director compensation plans are based on service during the calendar year; however, SEC rules require us to report compensation in this proxy statement on a fiscal-year basis. Cash compensation paid to non-employee

directors for the fiscal year ended June 28, 2015 is shown in the table below, together with the annual cash compensation program components in effect for calendar years 2014 and 2015.

Figure 8. Director Annual Retainers

|

|

|

|

|

|

|

|

|

|

|

|

|

| Annual Retainers |

|

Calendar

Year 2015

($) |

|

|

Calendar

Year 2014

($) |

|

|

Fiscal

Year 2015

($) |

|

| Non-employee Director |

|

|

60,000 |

|

|

|

60,000 |

|

|

|

60,000 |

|

| Lead Independent Director |

|

|

20,000 |

|

|

|

20,000 |

|

|

|

20,000 |

|

| Chairman (1) |

|

|

280,000 |

|

|

|

— |

|

|

|

280,000 |

|

| Audit Committee – Chair |

|

|

25,000 |

|

|

|

25,000 |

|

|

|

25,000 |

|

| Audit Committee – Member |

|

|

12,500 |

|

|

|

12,500 |

|

|

|

12,500 |

|

| Compensation Committee – Chair |

|

|

20,000 |

|

|

|

20,000 |

|

|

|

20,000 |

|

| Compensation Committee – Member |

|

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

| Nominating and Governance Committee – Chair |

|

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

| Nominating and Governance Committee – Member |

|

|

5,000 |

|

|

|

5,000 |

|

|

|

5,000 |

|

| (1) |

The supplemental retainer for the chairman of the board became effective as of January 1, 2015 and was paid in its entirety in February 2015. The amount and timing of cash received by the chairman in calendar year

2014 to supplement the amount of his cash retainer paid on the same terms as the annual cash retainer for all non-employee directors is described below under “Chairman compensation.”

|

12

Each non-employee director also receives an annual equity grant on the first Friday following the annual meeting (or, if

the designated date falls within a blackout window under applicable Company policies, on the first business day such grant is permissible under those policies) with a targeted grant date value equal to $190,000 (the number of RSUs subject to the

award is determined by dividing $190,000 by the closing price of a share of Company common stock as of the date of grant, rounded down to the nearest 10 shares). These grants generally vest on October 31 in the year following the grant and are

subject to the terms and conditions of the Company’s 2007 Stock Incentive Plan, as amended, or the “2007 Plan,” and the applicable award agreements. These grants immediately vest in full: (i) if a non-employee director dies or

becomes subject to a “disability” (as determined pursuant to the 2007 Plan), (ii) upon the occurrence of a “Change in Control” (as defined in the 2007 Plan), or (iii) on the date of the annual meeting if the annual

meeting during the year in which the award was expected to vest occurs prior to the vest date and the non-employee director is not re-elected or retires or resigns effective immediately prior to the annual meeting. Non-employee directors who

commence service after the annual award has been granted receive a pro-rated grant based on the number of regular board meetings remaining in the year as of the date of the director’s election.

On November 7, 2014, each director other than Mr. Anstice received a grant of 2,400 RSUs for services during calendar year 2015. Unless there is an

acceleration event, these RSUs will vest in full on October 31, 2015, subject to the director’s continued service on the board.

Chairman compensation. Mr. Newberry, who served as vice-chairman from December 7, 2010 until November 1, 2012 and since such date has served as chairman, has a chairman’s

agreement documenting his responsibilities, described above under “Governance Matters – Corporate Governance – Leadership Structure of the Board,” and compensation. Mr. Newberry entered into a chairman’s

agreement with the Company commencing on January 1, 2015 and expiring on December 31, 2015, subject to the right of earlier termination in certain circumstances and a one year extension upon mutual written agreement of the parties. The

agreement provides that Mr. Newberry will serve as chairman (and not as an employee or officer) and in addition to his regular compensation as a non-employee director, he receives an additional cash retainer of $280,000.

Prior to January 1, 2015, Mr. Newberry had an employment agreement with the Company that commenced on January 1, 2012 and expired on December 31,

2014. The agreement provided for annual compensation of $500,000, subject to adjustment at the discretion of the independent members of the board. His annual compensation was adjusted to $530,000 effective March 31, 2014. His annual

compensation for calendar year 2014 was paid partly in equity and partly in cash as follows: he received an RSU grant with a targeted grant

date value of $190,000 and a $60,000 cash retainer on the same terms as non-employee directors’ annual equity grants and cash retainers, and he received the remaining $280,000 of his annual

compensation in cash. Mr. Newberry was eligible to participate in 2014 in the Company’s Elective Deferred Compensation Plan that is generally applicable to executives of the Company, subject to the general terms and conditions of such

plan. He continues to maintain a balance in the plan until he no longer performs service for the Company as a director but is no longer eligible to defer any compensation into the plan.

The following table shows compensation for fiscal year 2015 for directors other than Mr. Anstice:

Figure 9. FY2015 Director Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director Compensation for Fiscal Year 2015 |

|

| |

|

Fees

Earned

or Paid

in Cash

($) |

|

|

Stock

Awards

($) (1)(2) |

|

|

All Other

Compen-

sation

($) (3) |

|

|

Total

($) |

|

| Stephen G. Newberry |

|

|

483,231 |

(4) |

|

|

187,728 |

|

|

|

11,487 |

|

|

|

682,446 |

|

| Eric K. Brandt |

|

|

85,000 |

(5) |

|

|

187,728 |

|

|

|

— |

|

|

|

272,728 |

|

| Michael R. Cannon |

|

|

77,500 |

(6) |

|

|

187,728 |

|

|

|

— |

|

|

|

265,228 |

|

| Youssef A. El-Mansy |

|

|

70,000 |

(7) |

|

|

187,728 |

|

|

|

22,432 |

|

|

|

280,160 |

|

| Christine A. Heckart |

|

|

70,000 |

(8) |

|

|

187,728 |

|

|

|

— |

|

|

|

257,728 |

|

| Grant M. Inman |

|

|

100,000 |

(9) |

|

|

187,728 |

|

|

|

22,432 |

|

|

|

310,160 |

|

| Catherine P. Lego |

|

|

77,500 |

(10) |

|

|

187,728 |

|

|

|

21,279 |

|

|

|

286,507 |

|

| Krishna C. Saraswat |

|

|

60,000 |

(11) |

|

|

187,728 |

|

|

|

— |

|

|

|

247,728 |

|

| William R. Spivey |

|

|

72,500 |

(12) |

|

|

187,728 |

|

|

|

22,432 |

|

|

|

282,660 |

|

| Abhijit Y. Talwalkar |

|

|

80,000 |

(13) |

|

|

187,728 |

|

|

|

— |

|

|

|

267,728 |

|

| (1) |

The amounts shown in this column represent the grant date fair value of unvested RSU awards granted during fiscal year 2015 in accordance with Financial Accounting Standards Board Accounting Standards Codification 718,

Compensation – Stock Compensation, or “ASC 718.” However, pursuant to SEC rules, these values are not reduced by an estimate for the probability of forfeiture. The assumptions used to calculate the fair value of the RSUs in fiscal

year 2015 are set forth in Note 5 to the Consolidated Financial Statements of the Company’s Annual Report on Form 10-K for the fiscal year ended June 28, 2015. |

| (2) |

On November 7, 2014, each director who was on the board received an annual grant of 2,400 RSUs based on the $78.93 closing price of Lam’s common stock and the target value of $190,000, rounded down to the

nearest 10 shares. |

| (3) |

Represents the portion of medical, dental, and vision premiums paid by the Company. |

| (4) |

Mr. Newberry received $483,231, representing his $280,000 chairman retainer and $60,000 annual retainer as a director and the remainder of his annual cash compensation under his employment agreement ended

December 31, 2014. |

| (5) |

Mr. Brandt received $85,000, representing his $60,000 annual retainer and $25,000 as the chair of the audit committee. |

| (6) |

Mr. Cannon received $77,500, representing his $60,000 annual retainer, $12,500 as a member of the audit committee, and $5,000 as a member of the nominating and governance committee.

|

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

13 |

| (7) |

Dr. El-Mansy received $70,000, representing his $60,000 annual retainer and $10,000 as a member of the compensation committee. |

| (8) |

Ms. Heckart received $70,000, representing her $60,000 annual retainer and $10,000 as a member of the compensation committee. |

| (9) |

Mr. Inman received $100,000, representing his $60,000 annual retainer, $20,000 as lead independent director, $10,000 as the chair of the nominating and governance committee, and $10,000 as a member of the

compensation committee. |

| (10) |

Ms. Lego received $77,500, representing her $60,000 annual retainer, $12,500 as a member of the audit committee, and $5,000 as a member of the nominating and governance committee. |

| (11) |

Dr. Saraswat received $60,000, representing his $60,000 annual retainer. |

| (12) |

Dr. Spivey received $72,500, representing his $60,000 annual retainer and $12,500 as a member of the audit committee. |

| (13) |

Mr. Talwalkar received $80,000, representing his $60,000 annual retainer and $20,000 as chair of the compensation committee. |

Other benefits. Any members of the board enrolled in the Company’s

health plans as of or prior to December 31, 2012 can participate after retirement from the board in the Company’s Retiree Health Plans. The board eliminated this benefit for any person who became a director after December 31, 2012.

The most recent valuation of the Company’s accumulated post-retirement benefit obligation under Accounting Standards Codification 715, Compensation – Retirement Benefits, or “ASC 715,” as of

June 28, 2015, for eligible former directors and the current directors who may become eligible is shown below. Factors affecting the amount of post-retirement benefit obligation include age

at enrollment, age at retirement, coverage tier (e.g., single, plus spouse, plus family), interest rate, and length of service.

Figure 10.

FY2015 Accumulated Post-Retirement Benefit Obligations

|

|

|

|

|

| Director Compensation for Fiscal Year 2015 |

|

| Name |

|

Accumulated

Post-Retirement

Benefit Obligation,

as of June 28,

2015

($) |

|

| Stephen G. Newberry |

|

|

767,000 |

|

| Eric K. Brandt |

|

|

— |

|

| Michael R. Cannon |

|

|

— |

|

| Youssef A. El-Mansy |

|

|

500,000 |

|

| Christine A. Heckart |

|

|

— |

|

| Grant M. Inman |

|

|

391,000 |

|

| Catherine P. Lego |

|

|

435,000 |

|

| Krishna C. Saraswat |

|

|

— |

|

| William R. Spivey |

|

|

704,000 |

|

| Abhijit Y. Talwalkar |

|

|

— |

|

14

Executive Compensation and Other Information

Compensation Discussion and Analysis

This Compensation Discussion and Analysis, or “CD&A,” describes our executive compensation program. It is organized into the following four sections:

|

|

|

| I. |

|

Overview of Executive Compensation (Including Our Philosophy and Program Design) |

| II. |

|

Executive Compensation Governance and Procedures |

| III. |

|

Primary Components of Named Executive Officer Compensation; Calendar Year 2014 Compensation Payouts; Calendar Year 2015 Compensation Targets and Metrics |

| IV. |

|

Tax and Accounting Considerations |

Our CD&A discusses compensation earned by our fiscal year 2015 “Named Executive Officers,” or “NEOs,” who are as

follows:

Figure 11. FY2015 NEOs

|

|

|

| Named Executive Officer |

|

Position(s) |

| Martin B. Anstice |

|

President and Chief Executive Officer |

| Timothy M. Archer |

|

Executive Vice President and Chief Operating Officer |

| Douglas R. Bettinger |

|

Executive Vice President and Chief Financial Officer |

| Richard A. Gottscho |

|

Executive Vice President, Global Products |

| Sarah A. O’Dowd |

|

Senior Vice President, Chief Legal Officer and Secretary |

I. OVERVIEW OF EXECUTIVE COMPENSATION

To align with stockholders’ interests, our executive compensation program is designed to foster a pay-for-performance culture and achieve the executive compensation

objectives set forth in “Executive Compensation Philosophy and Program Design – Executive Compensation Philosophy” below. We have structured our compensation program and payouts to reflect these goals. Our CEO’s

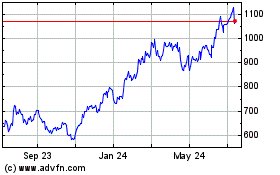

compensation in relation to our revenue and net income is shown in Figure 12 below.

Figure 12. FY2010-FY2015 CEO Pay for Performance

Continues on next page u

|

|

|

| Lam Research Corporation 2015 Proxy Statement |

|

15 |

| (1) |

“CEO Total Compensation” consists of base salary, annual incentive payments, accrued values of the cash payments under the long-term incentive program and grant date fair values of equity-based awards under

the long-term incentive program, and all other compensation as reported in the “Summary Compensation Table” below. |

| (2) |

The CEO Total Compensation for fiscal year 2012 reflects Mr. Anstice’s succession of Mr. Newberry as our President and CEO as of January 1, 2012. |

| (3) |

The CEO Total Compensation for fiscal years 2015 and 2014 reflects awards covering a three-year performance period as compared to the two-year period in all other prior fiscal years. The one-time 2014 Gap Year Award,

with a value of $3,074,271 is reflected in the “Summary Compensation Table” below, is not included in fiscal year 2014 CEO Total Compensation in order to allow readers to more easily compare compensation in prior and subsequent

periods and better reflect the compensation payable in any fiscal year following the transition. See “Long-Term Incentive Program – Design” for additional information regarding the impact of the Gap Year Award.

|

To understand our executive compensation program fully, we feel it is important to understand:

| |

• |

|

Our business, our industry environment and our financial performance; and |

| |

• |

|

Our executive compensation philosophy and program design. |

Our Business, Our Industry

Environment and Our Financial Performance

Lam Research has been an innovative supplier of wafer fabrication equipment and services to the semiconductor industry for more than 35 years. Our customers include

semiconductor manufacturers that make memory, microprocessors, and other logic integrated circuits for a wide

range of electronics; including cell phones, computers, tablets, storage devices, and networking equipment.

Our market-leading products are designed to help our customers build the smaller, faster and more powerful devices that are necessary to power the capabilities required

by end users. The process of integrated circuits fabrication consists of a complex series of process and preparation steps, and our product offerings in deposition, etch and clean address a number of the most critical steps in the fabrication

process. We leverage our expertise in semiconductor processing to develop technology and/or productivity solutions that typically benefit our customers through lower defect rates, enhanced yields, faster processing time, and reduced cost as well as

by facilitating their ability to meet more stringent performance and design standards.

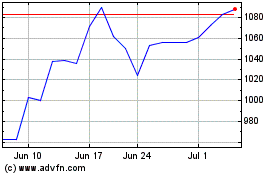

The semiconductor capital equipment industry has been highly competitive and

characterized by rapid changes in demand. Figure 13 below shows year-over-year changes in revenue growth for each of the electronics industry, the semiconductor industry, and the wafer fabrication equipment segment of the semiconductor equipment

industry from 2001 to the present. The semiconductor industry has historically been a highly cyclical industry, with fluctuations responding to changes in the demand for semiconductor devices. The wafer fabrication equipment segment in which we