UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 15, 2015

LAM RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-12933 |

|

94-2634797 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

4650 Cushing Parkway

Fremont, California 94538

(Address of principal executive offices including zip code)

(510) 572-0200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Table of Contents

| Item 7.01. |

Regulation FD Disclosure. |

On September 15, 2015, Lam Research Corporation (the

“Company”) distributed (i) a Notice of Adjustment of Conversion Rate pursuant to the Indenture, dated as of May 11, 2011, by and between the Company, and The Bank of New York Mellon Trust Company, N.A, as Trustee, with respect to

the 0.50% Convertible Senior Notes due 2016 (the “2016 Notes”) to holders of the 2016 Notes, a copy of which is attached as Exhibit 99.1 to this report, (ii) a Notice of Adjustment of Conversion Rate pursuant to the Indenture, dated

as of May 11, 2011, by and between the Company, and The Bank of New York Mellon Trust Company, N.A, as Trustee, with respect to the 1.25% Convertible Senior Notes due 2018 (the “2018 Notes”) to holders of the 2018 Notes, a copy of

which is attached as Exhibit 99.2 to this report and (iii) a Notice of Adjustment of Conversion Rate pursuant to the Indenture, dated as of May 10, 2011, by and between Novellus Systems, Inc., as Issuer, and The Bank of New York Mellon

Trust Company, N.A, as Trustee, with respect to the 2.625% Senior Convertible Notes due 2041 (the “2041 Notes”) to holders of the 2041 Notes, a copy of which is attached as Exhibit 99.3 to this report.

The information in this Form 8-K, including Exhibits 99.1, 99.2 and 99.3 attached hereto, is being furnished under Item 7.01 and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall it be deemed incorporated by reference in any

filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

|

|

| 99.1 |

|

Notice of Adjustment of Conversion Rate of the Convertible Senior Notes Due 2016 |

|

|

| 99.2 |

|

Notice of Adjustment of Conversion Rate of the Convertible Senior Notes Due 2018 |

|

|

| 99.3 |

|

Notice of Adjustment of Conversion Rate of the Senior Convertible Notes Due 2041 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: September 15, 2015

|

|

|

| LAM RESEARCH CORPORATION |

|

|

| By: |

|

/s/ Douglas R. Bettinger |

|

|

Douglas R. Bettinger |

|

|

Executive Vice President and Chief Financial Officer |

3

EXHIBIT INDEX

|

|

|

| 99.1 |

|

Notice of Adjustment of Conversion Rate of the Convertible Senior Notes Due 2016 |

|

|

| 99.2 |

|

Notice of Adjustment of Conversion Rate of the Convertible Senior Notes Due 2018 |

|

|

| 99.3 |

|

Notice of Adjustment of Conversion Rate of the Senior Convertible Notes Due 2041 |

4

Exhibit 99.1

NOTICE TO HOLDERS OF

ANY AND ALL OUTSTANDING

0.50% CONVERTIBLE SENIOR NOTES DUE 2016

OF

LAM RESEARCH

CORPORATION

WITH CUSIP NUMBER 512807 AJ7

Pursuant to Section 14.04(l) of the Indenture, dated as of May 11, 2011 (the “Indenture”), between Lam Research

Corporation, as Issuer (the “Company”), and The Bank of New York Mellon Trust Company, N.A., as Trustee, governing the issuance of the 0.50% Convertible Senior Notes due 2016 of the Company with CUSIP number 512807 AJ7 (the

“Notes”), the Company is hereby delivering this notice to all holders of the Notes. This notice is being given to inform you of an adjustment to the Conversion Rate (as defined in the Indenture).

As previously announced, the Company’s board of directors has declared a quarterly cash dividend payment of $0.30 per share on the

Company’s common stock. Section 14.04(d) of the Indenture provides for an increase in the Conversion Rate (as defined in the Indenture) in connection with this dividend. The Conversion Rate relating to the Notes, previously equal to

16.0806 shares of Common Stock per $1,000 principal amount of Notes, was increased to 16.1481 shares of Common Stock per $1,000 principal amount of Notes in accordance with Section 14.04(d) of the Indenture as a result of the upcoming payment

by the Company of the cash dividend scheduled for September 30, 2015. The adjustment to the Conversion Rate was effective immediately after 9:00 a.m., New York City time, on September 4, 2015, the ex-dividend date for the dividend. The

adjustment to the Conversion Rate was calculated in accordance with Section 14.04(d), as set forth on Schedule 1.

If the

dividend is not paid, the Conversion Rate shall be decreased, effective as of the date the Company’s board of directors determines not to pay such dividend, to the Conversion Rate that would then be in effect if such dividend had not been

declared.

If you have any questions, please contact Investor Relations at (510) 572-0200.

|

|

|

| Very truly yours, |

|

| LAM RESEARCH CORPORATION |

|

|

| By: |

|

/s/ Douglas R. Bettinger |

|

|

|

| Name: |

|

Douglas R. Bettinger |

| Title: |

|

Executive Vice President and Chief Financial Officer |

Dated: September 15, 2015

Schedule 1

Conversion Rate Formula Adjustment per Section 14.04(d)

|

|

|

|

|

| CR' |

|

= |

|

CR0 x ((SP0) / (SP0 - C)) |

|

|

|

| CR0 |

|

= |

|

the Conversion Rate in effect immediately prior to the open of business on the Ex-Dividend Date for such dividend or distribution; |

| CR' |

|

= |

|

the Conversion Rate in effect immediately after the open of business on the Ex-Dividend Date for such dividend or distribution; |

| SP0 |

|

= |

|

the Last Reported Sale Price of the Common Stock on the Trading Day immediately preceding the Ex-Dividend Date for such dividend or distribution; and |

| C |

|

= |

|

the amount in cash per share the Company distributes to holders of its Common Stock. |

CR0 = 16.0806

CR' = 16.1481

SP0 = $71.75

C = $0.30

16.1481 = 16.0806 x (($71.75) / ($ 71.75-$0.30))

Exhibit 99.2

NOTICE TO HOLDERS OF

ANY AND ALL OUTSTANDING

1.25% CONVERTIBLE SENIOR NOTES DUE 2018

OF

LAM RESEARCH

CORPORATION

WITH CUSIP NUMBER 512807 AL2

Pursuant to Section 14.04(l) of the Indenture, dated as of May 11, 2011 (the “Indenture”), between Lam Research

Corporation, as Issuer (the “Company”), and The Bank of New York Mellon Trust Company, N.A., as Trustee, governing the issuance of the 1.25% Convertible Senior Notes due 2018 of the Company with CUSIP number 512807 AL2 (the

“Notes”), the Company is hereby delivering this notice to all holders of the Notes. This notice is being given to inform you of an adjustment to the Conversion Rate (as defined in the Indenture) effective today.

As previously announced, the Company’s board of directors has declared a quarterly cash dividend payment of $0.30 per share on the

Company’s common stock. Section 14.04(d) of the Indenture provides for an increase in the Conversion Rate (as defined in the Indenture) in connection with this dividend. The Conversion Rate relating to the Notes, previously equal to

16.0806 shares of Common Stock per $1,000 principal amount of Notes, was increased to 16.1481 shares of Common Stock per $1,000 principal amount of Notes in accordance with Section 14.04(d) of the Indenture as a result of the upcoming payment

by the Company of the cash dividend scheduled for September 30, 2015. The adjustment to the Conversion Rate was effective immediately after 9:00 a.m., New York City time, on September 4, 2015, the ex-dividend date for the dividend. The

adjustment to the Conversion Rate was calculated in accordance with Section 14.04(d), as set forth on Schedule 1.

If the

dividend is not paid, the Conversion Rate shall be decreased, effective as of the date the Company’s board of directors determines not to pay such dividend, to the Conversion Rate that would then be in effect if such dividend had not been

declared.

If you have any questions, please contact Investor Relations at (510) 572-0200.

|

|

|

| Very truly yours, |

|

| LAM RESEARCH CORPORATION |

|

|

| By: |

|

/s/ Douglas R. Bettinger |

|

|

|

| Name: |

|

Douglas R. Bettinger |

| Title: |

|

Executive Vice President and Chief Financial Officer |

Dated: September 15, 2015

Schedule 1

Conversion Rate Formula Adjustment per Section 14.04(d)

|

|

|

|

|

| CR' |

|

= |

|

CR0 x ((SP0) / (SP0 - C)) |

|

|

|

| CR0 |

|

= |

|

the Conversion Rate in effect immediately prior to the open of business on the Ex-Dividend Date for such dividend or distribution; |

| CR' |

|

= |

|

the Conversion Rate in effect immediately after the open of business on the Ex-Dividend Date for such dividend or distribution; |

| SP0 |

|

= |

|

the Last Reported Sale Price of the Common Stock on the Trading Day immediately preceding the Ex-Dividend Date for such dividend or distribution; and |

| C |

|

= |

|

the amount in cash per share the Company distributes to holders of its Common Stock. |

CR0 = 16.0806

CR' = 16.1481

SP0 = $71.75

C = $0.30

16.1481 = 16.0806 x (($71.75) / ($ 71.75-$0.30))

Exhibit 99.3

NOTICE TO HOLDERS OF

ANY AND ALL OUTSTANDING

2.625% SENIOR CONVERTIBLE NOTES DUE 2041

OF

NOVELLUS SYSTEMS,

INC.

WITH CUSIP NUMBER 670008 AD3

Pursuant to Section 8.03(l) of the Indenture, dated as of May 10, 2011 (the “Indenture”) between Novellus Systems,

Inc., a California corporation, as Issuer (the “Company”), and The Bank of New York Mellon Trust Company, N.A., as Trustee (the “Trustee”), as supplemented by the First Supplemental Indenture, dated as of

June 4, 2012 among the Company, as Issuer, Lam Research Corporation, a Delaware corporation, as Guarantor (“Parent”), and the Trustee, governing the issuance of the 2.625% Senior Convertible Notes due 2041 of the Company with

CUSIP number 670008 AD3 (the “Notes”), the Company is hereby delivering this notice to all holders of the Notes. This notice is being given to inform you of an adjustment to the Conversion Rate (as defined in the Indenture).

As previously announced, the Parent’s board of directors has declared a quarterly cash dividend payment of $0.30 per share on the

Parent’s common stock. Section 8.03(d) of the Indenture provides for an increase in the Conversion Rate (as defined in the Indenture) in connection with this dividend. The Conversion Rate relating to the Notes, previously equal to 28.8585

shares of Common Stock per $1,000 principal amount of Notes, was increased to 28.9797 shares of Common Stock per $1,000 principal amount of Notes in accordance with Section 8.03(d) of the Indenture as a result of the upcoming payment by the

Parent of the cash dividend scheduled for September 30, 2015. The adjustment to the Conversion Rate was effective immediately after 9:00 a.m., New York City time, on September 4, 2015, the ex-dividend date for the dividend. The adjustment

to the Conversion Rate was calculated in accordance with Section 8.03(d), as set forth on Schedule 1.

If the dividend is not

paid, the Conversion Rate shall be decreased, effective as of the date the Parent’s board of directors determines not to pay such dividend, to the Conversion Rate that would then be in effect if such dividend had not been declared.

If you have any questions, please contact Investor Relations at (510) 572-0200.

|

|

|

| Very truly yours, |

|

| LAM RESEARCH CORPORATION |

|

|

| By: |

|

/s/ Douglas R. Bettinger |

|

|

|

| Name: |

|

Douglas R. Bettinger |

| Title: |

|

Executive Vice President and Chief Financial

Chief Financial Officer |

Dated: September 15, 2015

Schedule 1

Conversion Rate Formula Adjustment per Section 8.03(d)

|

|

|

|

|

| CR1 |

|

= |

|

CR0 x ((SP0) / (SP0 - C)) |

|

|

|

| CR0 |

|

= |

|

the Conversion Rate in effect immediately prior to the open of business on the Ex-Dividend Date for such dividend or distribution; |

| CR1 |

|

= |

|

the Conversion Rate in effect immediately after the open of business on the Ex-Dividend Date for such dividend or distribution; |

| SP0 |

|

= |

|

the Last Reported Sale Price of the Common Stock on the Trading Day immediately preceding the Ex-Dividend Date for such dividend or distribution; and |

| C |

|

= |

|

the amount in cash per share the Parent distributes to holders of its Common Stock. |

CR0 = 28.8585

CR1 = 28.9797

SP0 = $71.75

C = $0.30

28.9797 = 28.8585 x (($71.75) / ($ 71.75-$0.30))

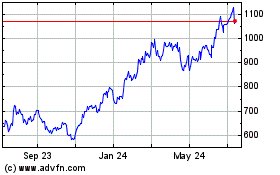

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

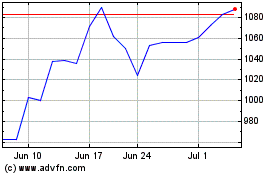

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024