Additional Proxy Soliciting Materials (definitive) (defa14a)

August 22 2016 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

ý

Filed by a Party other than the Registrant

o

Check the appropriate box:

o

Preliminary Proxy Statement

o

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o

Definitive Proxy Statement

ý

Definitive Additional Materials

o

Soliciting Material Pursuant to §240.14a-12

LOGITECH INTERNATIONAL S.A.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

No fee required

|

|

o

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5) Total fee paid:

|

|

|

|

|

|

|

|

|

o

Fee paid previously with preliminary materials

|

|

o

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No:

|

|

|

|

|

|

|

|

|

(3) Filing party:

|

|

|

|

|

|

|

|

|

(4) Date filed:

|

|

|

|

SUPPLEMENT TO THE

PROXY STATEMENT DATED JULY 22, 2016

FOR THE

ANNUAL GENERAL MEETING

TO BE HELD ON SEPTEMBER 7, 2016

August 22, 2016

On or about July 22, 2016, Logitech International S.A. (the “Company”) made available a proxy statement (the “Proxy Statement”) to its shareholders describing the matters to be voted on at the Company’s 2016 Annual General Meeting to be held on September 7, 2016 (the “Annual General Meeting”), including a proposal (“Proposal 4”) to approve the amendment and restatement of the Company’s 2006 Stock Incentive Plan (the “Plan”) to authorize five million seven hundred fifty thousand (5,750,000) additional shares for issuance under the Plan, to improve the Company’s corporate governance practices, and to implement other best practices.

Subsequent to making available and mailing the Proxy Statement, the Company has determined that it is appropriate to clarify and correct the section under Proposal 4 entitled “Awards Outstanding under the Plan as of June 1, 2016” to make it clear that that section included information about employee equity compensation awards (including options, restricted stock units (“RSUs”) and performance-based restricted stock units (“PRSUs”)) under both of the Company’s current employee equity compensation plans (the Company’s 2012 Stock Inducement Equity Plan as well as the Plan) rather than just the Plan. This change affects only the information supplied under the section “Awards Outstanding under the Plan as of June 1, 2016” in support of Proposal 4; it does not affect Proposal 4, any other section of Proposal 4, or the amended and restated Plan for shareholder approval attached to the Proxy Statement as Appendix A.

With regard to Proposal 4, to the extent that the information in this Supplement differs from, updates or conflicts with the information contained in the Proxy Statement, the information in this Supplement shall amend and supersede the information in the Proxy Statement. Except as so amended or superseded, all information set forth in the Proxy Statement, including with respect to Proposal 4, remains unchanged. We urge you to read this Supplement carefully and in its entirety together with the Proxy Statement.

If you have already voted your shares with respect to the Annual General Meeting, you do not need to resubmit your vote or to complete a new response coupon or proxy card. Any shareholder who desires to revoke or change a previously executed proxy, based on the information set forth in this Supplement or otherwise, may do so in the manner described in the Proxy Statement.

The revised section “Awards Outstanding under the Plan as of June 1, 2016” of Proposal 4 now reads in full as follows:

Awards Outstanding under the Company’s Employee Equity Compensation Plans as of June 1, 2016

As of June 1, 2016, 5,065,253 shares were issuable upon exercise of stock options outstanding under our employee equity compensation plans with a weighted average exercise price of USD 17.90 per share and a weighted average remaining term of 3.97 years, and an aggregate of 6,972,012 shares were subject to RSUs and PRSUs outstanding under our employee equity compensation plans with no exercise price. These plans consist of the 2006 Stock Incentive Plan and the 2012 Stock Inducement Equity Plan. There are no stock options or other awards outstanding under our 1996 Stock Plan as of June 1, 2016. In addition as of June 1, 2016, there were 5,011,170 shares available for grant under the 2006 Stock Incentive Plan, no shares available for grant under the 2012 Stock Inducement Equity Plan and no shares available for grant under the 1996 Stock Plan.

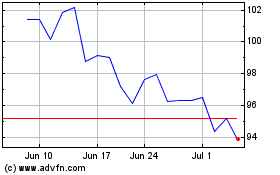

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

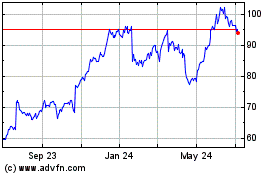

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Apr 2023 to Apr 2024