Logitech Shares Plummet After Profit Warning

April 01 2011 - 7:45AM

Dow Jones News

Shares in Logitech International SA (LOGN.VX) nosedived Friday,

losing almost 20% in value after the Swiss technology firm warned

its profits would be much lower than previously expected.

Investors dumped shares in the Swiss company, which has

developed set-top box hardware for Google Inc.'s (GOOG) Google TV

product, after it lowered its full year operating profit and sales

outlook Thursday.

At 1050 GMT, Logitech shares were traded down 3.22 Swiss francs,

or 19.5%, at CHF13.32, while the benchmark SMI traded up 0.5%.

The drop wiped nearly CHF500 million from the company's market

capitalization, and contributed to a drop of 25% so far in

2011.

It came after Morges, Switzerland-based Logitech lowered its

outlook for its financial year which ends on March 31.

Logitech said late Thursday that it now expects fiscal year 2011

sales in the range of $2.35 billion to $2.37 billion, down from the

previous range of $2.4 billion to $2.42 billion.

It now expects 2011 fiscal operating income to be in the range

of $140 million to $150 million, down from the previous range of

$170 million to $180 million.

The company, which reports fiscal 2011 results April 27, blamed

weakness in its European, Middle East and Africa sales region,

where it said it has experienced lower than expected demand for its

retail products from both distributors and retailers.

Europe is Logitech's largest market, responsible for around 36%

of the company's sales.

Logitech's retail products include Internet video cameras, input

and pointing devices and optical trackballs and keyboards.

It didn't specify which products had been particularly affected

by the downturn. Logitech declined to comment further Friday.

In January, the company reported its fiscal third-quarter profit

for the period ended Dec. 31 had jumped 14% as sales and margins

grew.

Analysts were surprised by the profit warning, and reduced their

price targets in response.

"Although recent consumer electronics data has been weak, the

profit warning comes as a surprise as we had assumed that most of

the weakness in retail was coming from the TV side," said Stefan

Gaechter at Swiss brokerage Helvea.

"While the stock has arguably priced out a boost from Google TV

and even if we assume the Japan quake impact has been priced in, we

still think the stock will disappoint on a 12 month view," said

Citigroup analyst Tim Shaw. He said he was unconvinced by the

company's mid-teens medium term sales growth target, and kept his

sell rating on the stock.

In January, Logitech Chief Executive Gerald Quindlen told Dow

Jones Newswires that he expected the Google TV deal to contribute

around $40 million in sales for the fiscal year ended March 31. He

conceded at the time that he had been slightly disappointed with

the uptake for the product in the U.S., but that demand had picked

up in the last few weeks before Christmas.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

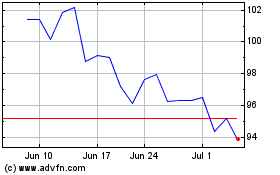

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

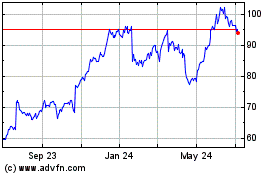

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Apr 2023 to Apr 2024