UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 18, 2015

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

0-1402

(Commission

File

Number)

|

|

|

| Ohio |

|

34-1860551 |

| (State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

22801 St Clair Avenue

Cleveland, Ohio 44117

(Address of principal executive offices, with zip code)

(216) 481-8100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On August 18, 2015, The Lincoln Electric Company (the

“Company”), a wholly-owned subsidiary of Lincoln Electric Holdings, Inc., entered into an agreement to purchase a group annuity contract from The Principal Financial Group (“The Principal”) to settle $425 million of the

Company’s approximate $900 million in outstanding U.S. pension obligations under The Lincoln Electric Company Retirement Annuity Program (the “Pension Plan”). In connection with the agreement, The Principal will assume the obligation

to pay future pension benefits starting November 1, 2015 for specified U.S. retirees and surviving beneficiaries who retired on or before June 1, 2015 and are currently receiving payments from the Pension Plan. The Principal was selected

by the Pension Plan’s fiduciary, with the advice of an independent expert.

A copy of the press release issued by the Company related

to the purchase of the group annuity contract is attached hereto as Exhibit 99.1. The press release is also available on Lincoln Electric’s website at www.lincolnelectric.com.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

|

|

| 99.1 |

|

The Company’s press release dated August 19, 2015 announcing the purchase of a group annuity contract. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

LINCOLN ELECTRIC HOLDINGS, INC. |

|

|

|

|

| Date: August 24, 2015 |

|

|

|

By: |

|

/s/ Vincent K. Petrella |

|

|

|

|

|

|

Vincent K. Petrella, Executive Vice President, CFO & Treasurer |

LINCOLN ELECTRIC HOLDINGS, INC.

INDEX TO EXHIBITS

|

|

|

| Exhibit No. |

|

Exhibit |

|

|

| 99.1 |

|

The Company’s press release dated August 19, 2015 announcing the purchase of a group annuity contract. |

Exhibit 99.1

LINCOLN ELECTRIC TO PURCHASE GROUP ANNUITY CONTRACT FOR

RETIREE PENSION BENEFITS

Reduces U.S. Pension Plan Obligations by 47%

Cleveland, OH, Wednesday, August 19, 2015 – The Lincoln Electric Company (“Lincoln Electric,” “Company”), a

subsidiary of Lincoln Electric Holdings, Inc. (NASDAQ: LECO), today announced that it has entered into an agreement to purchase a group annuity contract from The Principal Financial Group (“The Principal”) to settle $425 million of Lincoln

Electric’s approximate $900 million in outstanding U.S. pension obligations. Under the agreement, The Principal will assume the obligation to pay future pension benefits starting November 1, 2015, for specified U.S. retirees and surviving

beneficiaries who retired on or before June 1, 2015 and are currently receiving payments from Lincoln Electric’s U.S. Retirement Annuity Program (RAP).

Lincoln Electric has been committed to meeting its pension obligation responsibly. The Company has contributed $375 million to its pension

plans over the last ten years and its U.S. pension plans are fully funded. The purchase of this group annuity contract allows the Company to secure pension benefits for its approximate 1,900 retirees, reduce volatility in pension costs and funding

requirements, while maintaining a fully-funded plan for the remaining retiree obligations. The Principal was chosen by the RAP fiduciary with the advice of an independent expert after a rigorous evaluation process that reviewed several factors

including financial strength, rating of the insurance company, plan administration and customer service capabilities.

The annuity

purchase will not impact the monthly pension benefits Lincoln Electric retirees and surviving beneficiaries receive today. The group annuity contract includes an irrevocable commitment by The Principal to make annuity payments to affected retirees

covered under the contract. Lincoln Electric is notifying by mail those individuals who are affected by the forthcoming change and will provide a customer service number to address any questions that affected retirees may have.

Once finalized, this annuity purchase is expected to reduce Lincoln Electric’s U.S. pension obligation by approximately $425 million, or

47 percent. The purchase will be funded by existing plan assets and requires no cash contribution. The Company expects to incur a non-cash pension settlement charge of approximately $132 million in the third quarter.

About The Principal Financial Group

The Principal Financial Group® (The Principal®)1 is a global investment management leader offering retirement services, insurance solutions and asset management. The Principal offers

businesses, individuals and institutional clients a wide range of financial products and services, including

1

retirement, asset management and insurance through its diverse family of financial services companies. Founded in 1879 and

a member of the FORTUNE 500®, the Principal Financial Group has $539.9 billion in assets under management2 and serves some

20.1 million customers worldwide from offices in Asia, Australia, Europe, Latin America and the United States. Principal Financial Group, Inc. is traded on the New York Stock Exchange under the ticker symbol PFG. For more information, visit

www.principal.com.

| [1] |

“The Principal Financial Group” and “The Principal” are registered service marks of Principal Financial Services, Inc., a member of the Principal Financial Group. |

About Lincoln Electric

Lincoln Electric is the world leader in the design, development and manufacture of arc welding products, robotic arc welding

systems, plasma and oxy-fuel cutting equipment and has a leading global position in the brazing and soldering alloys market. Headquartered in Cleveland, Ohio, Lincoln has 47 manufacturing locations, including operations and joint ventures in 19

countries and a worldwide network of distributors and sales offices covering more than 160 countries. For more information about Lincoln Electric and its products and services, visit the Company’s website at www.lincolnelectric.com.

Forward Looking Statements

The

Company’s expectations and beliefs concerning the future contained in this news release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect management’s

current expectations and involve a number of risks and uncertainties. Forward-looking statements generally can be identified by the use of words such as “may,” “will,” “expect,” “intend,” “estimate,”

“anticipate,” “believe,” “forecast,” “guidance” or words of similar meaning. Actual results may differ materially from such statements due to a variety of factors that could adversely affect the Company’s

operating results. The factors include, but are not limited to: general economic and market conditions; uncertainties inherent in regulatory reviews; and other factors that could affect the timing or the ability of the parties to close the

transactions referenced in this release. For additional discussion, see “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K.

Contacts

Lincoln Electric

Amanda Butler

Director, Investor Relations

Tel: 216.383.2534

Email: Amanda_Butler@lincolnelectric.com

The Principal Financial Group

Jaime Naig

Tel: 515.247.0798

Email: naig.jaime@principal.com

2

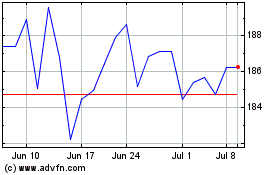

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

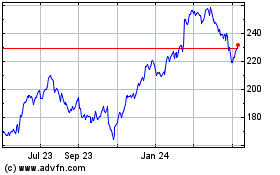

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Apr 2023 to Apr 2024