Current Report Filing (8-k)

June 16 2015 - 7:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 16, 2015

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

0-1402

(Commission File Number)

|

|

|

| Ohio |

|

34-1860551 |

| (State or Other Jurisdiction

of Incorporation) |

|

(IRS Employer

Identification No.) |

22801 St Clair Avenue

Cleveland, Ohio

44117

(Address of Principal Executive Offices, with zip code)

Registrant’s telephone number, including area code: (216) 481-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

As previously announced, members of management of Lincoln

Electric Holdings, Inc. (the “Company”) will speak at the Stifel 2015 Industrials Conference being held in New York City on Tuesday, June 16, 2015. The presentation will be webcast and can be accessed on the Company’s Investor

Relations web site at http://ir.lincolnelectric.com. A slide presentation for the conference is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed filed for purposes of Section 18 of the

Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

99.1 Stiflel Industrials Conference Presentation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

LINCOLN ELECTRIC HOLDINGS, INC. |

|

|

|

|

| Date: June 16, 2015 |

|

|

|

By: |

|

/s/ Frederick G. Stueber |

|

|

|

|

|

|

Frederick G. Stueber |

|

|

|

|

|

|

Executive Vice President, General

Counsel and Secretary |

INDEX TO EXHIBITS

|

|

|

| Exhibit

No. |

|

Exhibit Description |

|

|

| 99.1 |

|

Stiflel Industrials Conference Presentation. |

| The

Welding Experts ®

Vincent K. Petrella Executive Vice President & Chief Financial Officer Stifel 2015 Industrials Conference June 16, 2015 Exhibit 99.1 |

|

Forward-Looking Statements:

Statements made during this presentation which are not historical facts may be

considered forward-looking statements. Forward-looking statements

involve risks and uncertainties that could cause actual events or results

to differ materially from those expressed or implied. Forward-looking statements generally can be identified by the use of words such as “may,” “will,” “expect,” “intend,” “estimate,”

“anticipate,” “believe,” “forecast,”

“guidance” or words of similar meaning. For further information concerning issues that could materially affect financial performance related to forward-looking statements, please refer to Lincoln

Electric’s quarterly earnings releases and periodic filings with the Securities

and Exchange Commission, which

can be found on www.sec.gov or on www.lincolnelectric.com. Safe Harbor and Regulation G Disclosures Non-GAAP Measures: Our management uses non-GAAP financial measures in assessing and evaluating the Company’s

performance, which exclude items we consider unusual or special items. We believe the

use of such financial measures and information may be useful to

investors. Non-GAAP financial measures should be read in conjunction

with the GAAP financial measures, as non-GAAP measures are a supplement to, and not a replacement for, GAAP financial measures. Please refer to the attached schedule for a reconciliation of non-GAAP financial measures to the related GAAP financial measures. 2 |

| Pioneer

With Market-Leading Technology A global manufacturer and market leader

with 120 years of expertise. Distinguished by an unwavering commitment

to customers,

employees and shareholders.

Founded in 1895 $2.8B in revenue in 2014 Market cap of ~$5.1B HQ in Cleveland, Ohio, U.S. 47 manufacturing facilities in 19 countries Distribution to over 160 countries 10,000+ employees worldwide EQUIPMENT EQUIPMENT AUTOMATION AUTOMATION FUME CONTROL FUME CONTROL CUTTING CUTTING ACCESSORIES ACCESSORIES CONSUMABLE CONSUMABLE (filler metals) 3 |

| Investment

Highlights Predictable

model enables high dividend payout Track record of expanding margins Leader in complete solutions and application expertise Increasing cash returns to shareholders Disciplined capital deployment delivers top quartile returns 1 Refers to Operating profit margin excluding special items 4 13% CAGR 2006 - 2015 15+% Operating Margin 1 #1 Global Provider of Solutions >$485 Million in 2015 Est. (+28% vs. ‘14) 19+% ROIC (share repurchases + dividends) |

|

Diversified Products and Reach

Net Sales by Product Area ¹ Net Sales by Segment ¹ 1 FY2014 5 Consumables (filler metals) 62% Equipment 38% North America 60% South America Asia Pacific Harris Products Group Europe 15% 11% 9% 5% |

| Global

Arc Welding, Brazing & Cutting Industry

Market Share Estimates ¹ 1 Amounts based on the Company estimates of the total market and include sales of equity affiliates

2 Based on company estimates. $23B Global Arc Welding, Brazing & Cutting Industry ² LECO is one of only three global providers to offer a complete solution

Leading Provider Across Diverse End Markets

8% 8% 6% 3% 4% 3% 9% LECO Colfax ITW Big Bridge Kobelco Golden Bridge Bohler Air Liquide Kemppi Hyundai OTC Hypertherm Atlantic Fronius Panasonic Others 6 Heavy Fabrication Ship Building Automotive/ Transport General Industrial Fabrication 31% Power Generation & Process 14% Maintenance & Repair Pipe Mill Offshore Pipeline Structural 14% |

| Innovation

& Expertise Differentiate Our Value-Added Model 1920s

Motor generator- based equipment Stick electrodes 1950 - 1970s Transformer-based equipment Wire & stick-based consumables 1990 - 2005 Inverter-based equipment (digital) Proprietary wave form technologies Broader-range of consumables & alloys 2006+ Automated and semi-automated solutions Highly engineered solutions for unique applications Expanded alloys and aluminum Virtual reality training tools Laser welding, cutting and cladding solutions Productivity and quality monitoring tools Digital interfaces for

repeatability, speed and ease-of-use 70% smaller and 85% lighter 7 |

| Innovation

Drives Growth Adding MIG to existing TIG solution

Used in various oil and gas applications

Leverages a standard, installed base of

Power Wave ® equipment, unique motion control technology & new, simple interface New digital system is 75% faster; meeting the need for speed and ease-of-use R&D Investment Galvanized Steel Solution Orbital Solutions Process Z™ new custom wire

& waveform for welding zinc-coated

steels Stringent automotive requirements

driving demand for zinc-coated steels

Delivers up to 85% lower porosity levels

and higher productivity vs. alternatives

New Patents 1 1 Initial patent filings for new technologies 2 New products defined as solutions launched within the last five years 8 ~33% of 2014 sales from new products 2 (+300 bps YoY) ~44% of 2014 equipment sales from new products 2 $22 $24 $26 $27 $28 $29 $33 $37 $42 $43 67 42 22 41 50 29 52 74 110 61 - 20 40 60 80 100 120 $- $5 $10 $15 $20 $25 $30 $35 $40 $45 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 |

|

Disciplined M&A is Expanding Growth Opportunities

$489 Million Cumulative M&A Investment 2005-2014 Sales growth attributed to acquisitions (%) Expanding the market size potential for future growth ¹ $23 Billion $35 Billion Arc Welding, Brazing & Cutting + Automation + Hardfacing 1 Based on company estimates 9 3.9% average |

|

‘2020 Strategy’ Targets Best-in-Class Financial Performance

FY2014 Result 2009 to 2014 Performance 2020 Goal (2009-2020) Sales Growth -1.4% 10.2% CAGR 10% CAGR Adj Op Profit Margin 15.1% Average 11.7% Average 15.0% ROIC 19.1% Average 14.8% Average 15.0% Operating Working Capital Ratio 16.5% 670 bps improvement 15.0% BRICs Channels Salesforce Reach Attractive Sectors Automotive Energy Infrastructure Construction Heavy Fabrication Education Operational Excellence Arc Welding Automation Alloys/ Aluminum Accessories Cutting Services Leverage Core + Adjacencies Working capital initiatives Portfolio optimization Lean/Six Sigma programs 2020 2009 10 |

| Share

of World Crude Steel Production: 2014

1 1 World Steel Association. Note: U.S. steel production FY2014: +1.7%, YTD through April 2015: -8.5%

2 Markit Financial Information Services Economic Variables Impacting Our Industry 4% 4% 2% 5% 5% 7% EU-28 11 Crude Steel Production Annual Growth Trend: 2010-4/2015 1 -5% 0% 5% 10% 15% 20% 25% 2010 2011 2012 2013 2014 YTD '15 World China ROW China 50% 10% Japan USA India Russia S. Korea Ukraine ROW 11% 40 42 44 46 48 50 52 54 56 58 60 2010 2011 2012 2013 2014 2015 Global U.S. China Eurozone Manufacturing Purchasing Managers’ Indices: 2010 to April 2015 Report 2 |

|

4.2% 15.5% 6.8% -3.9% -29.8% 14.1% 14.8% 1.3% -2.7% -2.0% -0.8% 8.0% 2.9% 3.7% 7.8% -0.5% 0.4% 6.9% 1.7% 0.1% 1.8% 2.9% 7.0% 3.4% 2.0% 3.0% 3.0% 5.3% 5.8% 4.9% 3.2% 1.5% 1.8% 0.9% 1.3% 3.2% 1.9% -2.9% 2.6% -2.0% -0.6% -2.6% -4.0% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1-2015 FX Acquisition Price Volume Solid Price Performance. Volumes Impacted by Initiatives to Improve Mix and Macro’s Please refer to the appendix for reconciliation of non-GAAP measures. 20.1% 23.1% 15.7% 8.7% -30.2% 19.7% 30.2% 5.9% 0.0% -1.4% Components of Revenue Performance 12 -4.0% |

| Q2

Trending: Focused on ‘2020 Vision & Strategy’ initiatives to drive

long-term margin and earnings growth

13 Value Drivers in Q2: • Richening mix • Automation growth • Diversified end sector exposure with steady-to-modest growth in: • General Fabrication • Automotive • Shipbuilding • Pipe mills • Structural (non-res construction) • Continuous improvement programs and cost reduction initiatives • Capital allocation and share repurchases |

| Q2

Trending: Near-term trends and challenging YoY comparisons keep

us cautious on earnings performance

14 Q2 Challenges: • FX translation – mid single-digit percent decline QTD thru May • Weakening oil/gas – high teens percent decline QTD thru May • Weakening exports – over 25 percent decline QTD thru May • General economic malaise and end sector weakness in: • Energy • Heavy Fabrication (agricultural, mining and construction equipment) • Mining / Maintenance & Repair • Higher interest and pension expense • Challenging year-over-year comparisons • Prior year Q2- and Q3-2014 strengthening volume and EBIT performance in North American and European segments • $0.04 EPS contribution from Venezuela in Q2/2014 • $0.03 EPS contribution from an insurance gain in Q2/2014 |

| Focused

on Higher Margin Opportunities 1

Excludes special items. Please refer to the appendix for reconciliation of non-GAAP

measures. Operating

Profit Margin 1 vs. Net Sales 15 |

| ($ in

millions) 1

Q1/2013 dividend paid in Q4/2012

Solid Cash Flows are Funding Growth and Accelerated

Shareholder Returns 17 Capital Allocation $477 >$550 $43 $45 $47 $52 $73 $49 1 $73 $85-$90 $42 $40 $37 $81 $168 $307 $400 $72 $38 $61 $66 $53 $76 $73 $65-$75 $44 $25 $19 $66 $135 $53 $24 2008 2009 2010 2011 2012 2013 2014 2015e Acquisition Cap Ex Share Repurchase Dividend $346 $342 $221 $167 $108 $201 |

| 13.2%

CAGR 2006 - 2015 Predictable Model Enables a Growing Dividend Payout Dividend History 18 Celebrating 100 years of dividend payments $0.38 $0.44 $0.50 $0.54 $0.56 $0.62 $0.68 $0.80 $0.92 $1.16 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 |

|

Disciplined Capital Deployment Delivers Top Quartile

Returns 19 Return on Invested Capital 17.7% 19.9% 16.8% 18.8% 4.3% 10.7% 16.9% 18.7% 18.9% 19.1% 20.1% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1-2015 |

| Summary

– Positioned for Long Term Value Creation

#1 Global Provider Top Quartile ROIC $840M Returned to Shareholders 2011-2014 Top Market Position in Arc Welding • Differentiated by comprehensive equipment and consumables • Renowned Welding Experts ® with industry-leading engineers Innovative R&D and Pragmatic M&A Driving Growth • Focused investments driving higher margins and returns • 33% of sales from new products (excl. Automation) • M&A initiatives contributing 3% to 4% of annual revenue growth

Solid Execution Increasing Returns

• Operational excellence is optimizing the cost structure • Working capital efficiency supporting cash flow generation • Model driven by ROIC Predictable Model Accelerating Shareholder Returns • Business model resilient through economic cycles • 400 basis point margin expansion in 4 years on ‘2020 Strategy’ • Share repurchases up over 700% over the past 4 years 20 Driving Growth and Richening Mix |

|

Appendix Amanda Butler Director, Investor Relations Amanda_Butler@lincolnelectric.com 216.383.2534 |

| Net

Income Solid earnings performance through the cycle

($ in Millions) 2005-2014 CAGR 10.5% Net Income 1 1 Excludes special items. Please refer to the appendix for reconciliation of non-GAAP measures.

21 $125 $171 $203 $231 $73 $130 $231 $266 $313 $306 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1 2015 |

| Please

refer to the appendix for reconciliation of non-GAAP measures.

(EXCLUDING SPECIAL ITEMS)

Diluted Earnings Per Share Progression

Beginning of Upturn 22 Beginning of Recession |

|

Period Ended December 31, 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1-2015 Operating income: $149,845 $232,970 $277,632 $295,404 $92,976 $186,430 $296,680 $362,081 $406,985 $373,747 $90,499 Special items: Rationalization charges / (gains) 1,761 3,478 (188) 2,447 29,018 (384) 282 9,354 8,463 30,053 - Loss on sale of land - - - - - - - - 705 - - Impairment charges - - - 16,924 879 - - - - - - Pension settlement loss (gain) - - - - (1,543) - - - - - - Loss on sale of business 1,942 - - - - - - - - - - Gain on sale of Ireland facility - (9,006) - - - - - - - - - Venezuelan charges (gains) - - - - - 3,123 - 1,381 12,198 21,133 - Adjusted operating income: $ 153,548 $ 227,442 $ 277,444 $ 314,775 $ 121,330 $ 189,169 $ 296,962 $ 372,816 $ 428,351 $424.933 $90,499 Net sales $ 1,601,190 $ 1,971,915 $ 2,280,784 $ 2,479,131 $ 1,729,285 $ 2,070,172 $ 2,694,609 $ 2,853,367 $ 2,852,671 $ 2,813,324 $ 657,900 Op income % 9.4% 11.8% 12.2% 11.9% 5.4% 9.0% 11.0% 12.7% 14.3% 13.3% 13.8% Adjusted op income % 9.6% 11.5% 12.2% 12.7% 7.0% 9.1% 11.0% 13.1% 15.0% 15.1% 13.8% Reconciliation of Operating Income and Operating Income Margin to Non-GAAP Adjusted Operating Income and Adjusted Operating Income Margin Non-GAAP Financial Measures 23 |

|

Period Ended December 31, 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1-2015 Net income: $122,306 $175,008 $202,736 $212,286 $48,576 $130,244 $217,186 $257,411 $293,780 $254,686 $68,354 Special items: Rationalization charges / (gains) 1,303 3,478 (107) 18,313 23,789 (894) 237 7,442 7,573 30,914 - Loss on sale of land - - - - - - - - 705 - - Pension settlement loss (gain) - - - - (2,144) - - - - - - Loss (gain) on sale of business 1,678 - - - (5,667) - - - - - - Gain on sale of Ireland facility - (7,204) - - - - - - - - - Venezuelan charges (gains) - - - - - 3,560 - 906 12,198 21,133 - Non-controlling interests - - - - 601 1,782 - - (1,068) (805) - Tax audit settlements (9,857) - - - - (4,844) - - - - Tax contingency - - - - - (5,092) - - - - - Tax benefits related to Ohio tax law change (1,807) - - - - - - - - - - Gain from settlement of legal disputes (876) - - - - - - - - - - Adjusted Net Income: $ 112,747 $ 171,282 $ 202,629 $ 230,599 $ 121,330 $ 129,600 $ 212,579 $ 265,759 $ 313,188 $ 305,928 $ 68,354 Reconciliation of Net Income to Non-GAAP Adjusted Net Income Non-GAAP Financial Measures 24 |

|

Reconciliation of Diluted Earnings Per Common Share (EPS) to

Non-GAAP Diluted Adjusted Net Earnings Per Common Share (Adjusted EPS)

2008 2009 2010 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2008 2008 2008 2008 2009 2009 2009 2009 2010 2010 2010 2010 Diluted EPS: $0.62 $0.81 $0.80 $0.23 $(0.04) $0.18 $0.15 $0.29 $0.28 $0.38 $0.38 $0.49 Special items: Rationalization charges (gains) - - - 0.02 0.09 0.08 0.07 0.03 0.01 (0.04) - 0.02 Impairment charges - - - 0.19 - - - 0.01 - - - - Pension settlement gain - - - - - (0.02) - - - - - - LEIM disposal of assets (noncontrolling) - - - - - - - - - 0.02 - - Adjust. Tax contingencies (Asia Pac) - - - - - - - - - - - (0.06) Loss from Jin Tai acquisition - - - - - - 0.09 - - - - - Gain on sale of property (Turkey) - - - - - (0.07) - - - - - - Venezuela charges (gains) - - - - - - - - - 0.03 0.01 - Adjusted Diluted EPS: $0.62 $0.81 $0.80 $0.44 $0.05 $0.17 $0.32 $0.32 $0.28 $0.39 $0.39 $0.45 Non-GAAP Financial Measures 2011 2012 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2011 2011 2011 2011 2012 2012 2012 2012 2013 2013 2013 2013 Diluted EPS: $0.55 $0.68 $0.66 $0.68 $0.76 $0.79 $0.77 $0.74 $0.80 $0.87 $0.80 $1.07 Special items: Rationalization charges (gains) - - - - - 0.01 0.03 0.05 0.01 0.04 0.06 0.02 Tax audit settlements (0.06) - - - - - - - - - - - Venezuela charges (gains) - - - - - 0.01 - - 0.11 - - - Adjusted Diluted EPS: $0.49 $0.68 $0.66 $0.68 $0.76 $0.81 $0.80 $0.79 $0.92 $0.91 $0.86 $1.09 25 |

|

Reconciliation of Diluted Earnings Per Common Share (EPS) to

Non-GAAP Diluted Adjusted Net Earnings Per Common Share (Adjusted EPS)

2014 2015 2010 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2014 2014 2014 2015 2009 2009 2009 2010 2010 2010 2010 Diluted EPS: $0.69 $0.96 $0.57 $0.96 $0.89 $0.18 $0.15 $0.29 $0.28 $0.38 $0.38 $0.49 Special items: Rationalization charges (gains) - 0.01 0.37 - - 0.08 0.07 0.03 0.01 (0.04) - 0.02 Venezuela charges (gains) 0.22 0.04 - - - - - - - 0.03 0.01 - Adjusted Diluted EPS: $0.91 $1.01 $0.94 $0.96 $0.89 $0.17 $0.32 $0.32 $0.28 $0.39 $0.39 $0.45 Non-GAAP Financial Measures 26 |

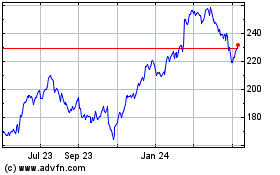

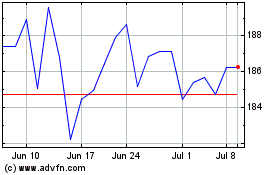

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Apr 2023 to Apr 2024