UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): April 19, 2015

Liberty Global plc

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

England and Wales | | 001-35961 | | 98-1112770 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification #) |

38 Hans Crescent, London, England

SW1X 0LZ

(Address of Principal Executive Office)

+44.20.7190.6449 or 303.220.6600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On April 19, 2015, Liberty Global plc announced that its subsidiary Telenet Telenet Group Holding NV ("Telenet") has entered into a definitive agreement to acquire BASE Company NV ("BASE Company"), the third-largest mobile network operator in Belgium in an all cash transaction.

A copy of the press release is included herein as Exhibit 99.1. The press release is incorporated herein by reference and the foregoing description of such transaction is qualified in its entirety by reference to such press release.

As noted in the press release, Telenet will host a conference call for investors and analysts on April 20, 2015 at 7:30am CET. The dial-in details for this call are: Phone number: +1 646 254 3362 (US), +44(0)20 3427 1909 (UK) or +32(0)2 404 0660 (Belgium), Dial-in ID: 9329880. It is anticipated that the webcast will be archived on the Telenet website for at least 75 days. In addition, Telenet will make available on its website certain investor information related to the transaction.

This Current Report on Form 8-K and the information contained in the Press Release attached hereto as Exhibit 99.1 are being

furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| LIBERTY GLOBAL PLC |

| |

| By: | /s/ RANDY L. LAZZELL |

| | Randy L. Lazzell |

| | Vice President |

Date: April 20, 2015

Liberty Global’s Subsidiary Telenet to Acquire BASE

Unique opportunity to drive mobile services on attractive financial terms

Denver, Colorado - April 19, 2015:

Liberty Global plc (“Liberty Global”) (NASDAQ: LBTYA, LBTYB and LBTYK) today announced that its subsidiary Telenet Group Holding NV (“Telenet”) has entered into a definitive agreement to acquire BASE Company NV (“BASE Company”), the third-largest mobile network operator in Belgium in an all cash transaction valuing BASE Company at €1.325 billion. This represents a purchase price multiple of 4.2x BASE Company’s estimated 2015 OCF1, as adjusted for approximately €145 million of projected annual run-rate opex synergies2. When the enterprise value is increased to include approximately €240 million of projected one-off investments and integration costs, the synergy adjusted multiple increases to 5.0x3. This acquisition will enable Telenet to compete more effectively in a mobile market with significant growth opportunities, while offering a full range of fixed and mobile services to the benefit of consumers and businesses in Belgium.

Mike Fries, CEO of Liberty Global, stated, “We fully support Telenet’s acquisition of Base, which represents a cost-effective and unique opportunity to expand Telenet’s mobile and fixed business in Belgium. Not surprisingly, the synergies are substantial and the price at 4.2x OCF is highly accretive to shareholders. Given Telenet’s scale in Belgium it can absorb the smaller Base business quickly and efficiently. Elsewhere in Europe we will continue to focus primarily on our existing MVNO arrangements and rapidly developing WiFi networks to provide seamless mobile voice and data services to our customers.”

Telenet has been an active player in Belgium's mobile market through an MVNO since 2006, and has grown its mobile subscriber base to 895,000 at year-end 2014 on the back of its success with its revolutionary King and Kong offerings. The acquisition of BASE Company, with nearly 3.3 million mobile subscribers4 and adjusted revenue of €690 million5 for 2014, fits very well in Liberty Global’s mobile strategy in Belgium, because this would allow Telenet to continue to provide ubiquitous connectivity for its and BASE Company’s customers. This transaction represents a unique opportunity to secure ownership of mobile capacity at an attractive price together with an efficient financing structure. As noted above, Telenet expects to make expenditures totaling approximately €240 million to upgrade the capacity and quality of BASE Company’s mobile network and support systems and to integrate BASE Company with Telenet’s operations, most of which will occur over the next few years.

Telenet intends to finance the acquisition of BASE Company through a combination of €1.0 billion of new debt facilities and existing liquidity. Giving pro-forma effect to the transaction and the completion of the intended financings, we estimate that Telenet’s net leverage6 ratio under its existing bank facility, excluding synergies, would have been approximately 4.45x at December 31, 2014. The acquisition of BASE Company is subject to customary closing conditions, including merger approval from the relevant competition authorities.

Telenet will host a conference call for investors and analysts on April 20, 2015 at 7:30am CET. The dial-in details for this call are: Phone number: +1 646 254 3362 (US), +44(0)20 3427 1909 (UK) or +32(0)2 404 0660 (Belgium), Dial-in ID: 9329880. It is anticipated that the webcast will be archived on the Telenet website for at least 75 days. Telenet’s press release announcing the acquisition of BASE Company is attached as Annex A to this release.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements regarding our expectations with respect to BASE Company’s 2015 OCF, the costs, benefits and impacts of the proposed acquisition, including annual run-rate synergies, one-off investments and integration costs, our mobile strategy, the impact of the transaction on Telenet’s operations, financial performance and leverage ratios, and other information and statements that are not historical fact. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties include the receipt and timing of necessary regulatory approvals to complete the acquisition, BASE Company’s ability to continue financial and operational growth at historic levels, continued use by customers and potential customers of BASE Company’s services, our and Telenet’s ability to achieve expected operational efficiencies, synergies and economies of scale, as well as other factors detailed from time to time in our filings with the Securities and Exchange Commission including our most recently filed Form 10-K. These forward-looking statements speak only as of the date of this release. Liberty Global expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty Global’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

About Liberty Global

Liberty Global is the largest international cable company with operations in 14 countries. We connect people to

the digital world and enable them to discover and experience its endless possibilities. Our market-leading triple-play services are provided through next-generation networks and innovative technology platforms that connected 27 million customers subscribing to 56 million television, broadband internet and telephony services at December 31, 2014. In addition, we served 5 million mobile subscribers across nine countries at year-end 2014. Liberty Global's consumer brands include Virgin Media, UPC, Ziggo, Unitymedia, Telenet and VTR. Our operations also include Liberty Global Business Services, our commercial division, and Liberty Global Ventures, our investment fund. For more information, please visit www.libertyglobal.com or contact:

|

| | | |

Investor Relations: | | Corporate Communications: |

Oskar Nooij | +1 303 220 4218 | Marcus Smith | +44 20 7190 6374 |

Christian Fangmann | +49 221 84 62 5151 | Bert Holtkamp | +31 20 778 9800 |

John Rea | +1 303 220 4238 | Hanne Wolf | +1 303 220 6678 |

____________________________________

| |

1 | OCF represents operating cash flow as customarily defined by Liberty Global. Liberty Global’s OCF performance metric is comparable to the Adjusted EBITDA performance metric used by Telenet. For purposes of the multiple calculation, we use Telenet management’s estimate of BASE Company’s FY 2015 EBITDA of €165 million, as adjusted by Telenet to exclude BASE Company’s discontinued operations and estimated reorganization costs. The Adjusted EBITDA figure is based on International Financial Reporting Standards, as adopted by the European Union (“EU-IFRS”). |

| |

2 | The annual run-rate opex savings of €145 million are based on Telenet management’s assumptions including estimated annual run-rate savings on FY 2017 MVNO-related expenses and other estimated annual run-rate opex savings to be achieved by FY 2019. |

| |

3 | This multiple calculation adds €240 million of projected one-off investments in BASE Company’s network and integration costs to the enterprise value. |

| |

4 | The reported BASE Company mobile subscribers of 3.3 million consist of approximately 2.2 million subscribers under prepaid arrangements and approximately 1.0 million subscribers under postpaid arrangements. Mobile subscribers that are served through third-party MVNO wholesale relationships are included in the mobile subscriber count. The prepaid subscribers reported by BASE Company include subscribers that have been inactive for 12 months or less. The presentation of subscribers under BASE Company’s subscriber counting policies may differ from Telenet’s and Liberty Global’s treatment, including the presentation of subscribers under MVNO wholesale arrangements and inactive prepaid subscribers. |

| |

5 | BASE Company’s reported FY 2014revenue of €711 million under EU-IFRS has been adjusted to exclude BASE Company’s discontinued operations. |

| |

6 | The pro-forma net leverage ratio is calculated pursuant to the provisions of Telenet’s 2010 Amended Senior Credit Facility definition, using pro-forma net total debt, excluding (a) subordinated shareholder loans, (b) capitalized elements of indebtedness under the Clientele and Annuity Fees, (c) any finance leases entered into on or prior to August 1, 2007, and (d) any indebtedness incurred under the network lease entered into with the pure intermunicipalities up to a maximum aggregate amount of €195 million, divided by last two quarters’ annualized combined EBITDA (under EU-IFRS, as defined under the indentures) as adjusted to add back the full-year negative impact of BASE Company’s discontinued operations and excluding synergies. |

The enclosed information constitutes regulated information as defined in the Royal Decree of 14 November 2007

regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. Annex A

Telenet to acquire BASE Company for €1.325 billion to secure its future as a leading integrated communications provider

Mechelen, 20 April 2015 - Telenet Group Holding NV (Euronext Brussels: TNET) has entered into a definitive agreement to acquire BASE Company NV for €1.325 billion. This acquisition would provide Telenet long-term mobile access to effectively compete for future growth opportunities in the mobile market. As a result of the acquisition, Telenet would be able to meet the rising demand from both residential and business customers for the full range of fixed and mobile services, and to continue providing an amazing customer experience.

Key Highlights

| |

• | Telenet announces that it has signed a definitive agreement to acquire BASE Company for €1.325 billion |

| |

• | The acquisition values BASE Company at a multiple of 8.0x BASE Company’s 2015E EBITDA as adjusted by Telenet ("Adjusted EBITDA")1 and 5.0x Adjusted EBITDA, as adjusted for projected annual run-rate synergies and one-off investments2 |

| |

• | The combination of Telenet and BASE Company will create a leading integrated communications provider in Belgium with combined3 2014 adjusted revenue of €2.4 billion and Adjusted EBITDA of €1.1 billion |

| |

• | In order to fully compete for the future growth opportunity of mobile data and to be able to provide an amazing customer experience on mobile comparable to Telenet’s demonstrated track record in fixed and mobile to date, Telenet will make expenditures of around €240 million, including targeted investments in BASE Company’s mobile network and integration costs, most of which will occur over the next few years. This considerable investment will complement the earlier announced €500 million investment in Telenet’s HFC network as part of the “De Grote Netwerf” program, providing a strong impetus to the Belgian digital economy |

| |

• | Telenet expects to achieve combined annual run-rate opex and capex synergies of approximately €150 million4, driven in large part by the migration of Telenet’s mobile telephony subscriber base to the BASE Company network |

| |

• | Telenet intends to finance the acquisition through a combination of €1.0 billion of new debt facilities and existing liquidity |

| |

• | On a pro-forma basis and excluding synergies, Telenet’s net leverage5ratio as of December 31, 2014 would have been approximately 4.45x compared to 3.7x on a reported basis, which is well within Telenet’s long-term target range and financial covenants |

| |

• | The transaction is subject to the approval from the relevant competition authorities |

John Porter, CEO of Telenet: “We are very pleased with this important strategic and complementary acquisition and the benefits that it will deliver to all stakeholders, including an enhanced customer experience for both our and BASE Company’s mobile subscribers, resulting in an improved long-term growth profile for the combined company. Mid-2012, we rejuvenated the Belgian market with the launch of our simple and transparent “King” and “Kong” mobile offers, underpinning the innovative spirit that we carry in our corporate DNA. And more recently, we also launched our “Family Deal” packages, offering a recurring monthly discount on multiple SIMs in the home for both existing and new triple-play subscribers. Through the acquisition of BASE Company we have made a significant step to secure long-term mobile access conditions, ensuring we are well positioned to effectively compete for the future growth opportunity of mobile data.”

Overview of BASE Company

BASE Company is the third-largest mobile network operator in Belgium with 2014 adjusted revenue of €690 million6 and Adjusted EBITDA of €171 million6, nearly 3.3 million mobile subscribers7 and a mobile service revenue market share of approximately 21%. BASE Company is active under the brand names BASE, BASE Business and Ortel Mobile, among others, and is an important provider of wholesale services through several MVNO agreements.

Telenet looks forward to continuing BASE Company’s wholesale partnerships. As such this transaction will not affect the agreements BASE Company has today with MVNO partners and branded resellers.

Investor & Analyst call: Telenet will host a conference call for institutional investors and analysts today at 7:30am CET. Please participate using the following dial-in details:

Phone: UK: +44(0)20 3427 1909

USA: +1646 254 3362

France: +33(0)1 76 77 22 27

Belgium: +32(0)2 404 0660

Dial-in ID: 9329880

Press conference: A press conference hosted by our CEO Mr. John Porter is scheduled today at 10.30 am CET at Telenet, Liersesteenweg 4, 2800 Mechelen.

Key data BASE Company

|

| | | | | |

BASE Company financials for the year ended Dec 2014 | € in millions |

|

| | | |

Revenue as reported by KPN | | | 711 |

|

Adjustment for discontinued operations | | | (21 | ) |

Adjusted revenue | | | 690 |

|

| | | |

EBITDA as reported by KPN | | | 149 |

|

Adjustment for discontinued operations and reorganisation costs | | 22 |

|

Adjusted EBITDA | | | 171 |

|

| | | |

Capex as reported by KPN | | | (173 | ) |

Adjustment for discontinued operations | | | 11 |

|

Adjustment for RTU licenses fees paid to BIPT | | | (3 | ) |

Adjusted Capex | | | (164 | ) |

| | | |

BASE Company Key Facts (2014) | | | |

Number of mobile subscribers at year end (k)7 | | | 3,261 |

|

Blended ARPU (€/month) | | | € | 15 |

|

Mobile service revenue market share | | | c. 21% |

|

Number of sales outlets at year end (#) | | | 115 |

|

| | | |

Own Brands | BASE, BASE Business, Ortel Mobile and others |

Partner Brands | Turk Telekom Mobile, Allo RTL, JIM Mobile, Contact Mobile, Sudpress Mobile, ALDI Talk and others |

MVNO Brands | Mobile Vikings, Carrefour Mobile and others |

Reconciliation between Adjusted EBITDA and total profit for the period

|

| | | | | | | | |

| For the year ended December 31, 2014 |

| | | | | |

(€ in millions) | TELENET | | BASE Company | | COMBINED |

| | | | | |

Adjusted EBITDA | 900.0 |

| | 170.9 |

| | 1,070.9 |

|

Adjusted EBITDA margin | 52.7 | % | | 24.8 | % | | 44.7 | % |

| | | | | |

Share based compensation | (8.3 | ) | | — |

| | |

Operating charges related to acquisitions or divestitures | (2.1 | ) | | — |

| | |

Discontinued operations and reorganisation costs | (1.9 | ) | | (21.9 | ) | | |

| | | | | |

EBITDA | 887.6 |

| | 149.0 |

| | |

| | | | | |

Depreciation, amortization and impairment | (355.5 | ) | | (166.1 | ) | | |

| | | | | |

Operating profit | 532.1 |

| | (17.1 | ) | | |

| | | | | |

Net finance income/(expense) | (331.6 | ) | | 0.3 |

| | |

Other income | 0.4 |

| | 0.0 |

| | |

Income tax benefit (expense) | (91.7 | ) | | (2.0 | ) | | |

Share of the result from associates and JVs | — |

| | (0.4 | ) | | |

| | | | | |

Profit (loss) for the period | 109.3 |

| | (19.2 | ) | | |

Goldman Sachs International is acting as financial adviser to Telenet in connection with the transaction and Freshfields is acting as legal adviser.

For more information, please contact:

Press

Stefan Coenjaerts

stefan.coenjaerts@staff.telenet.be

Tel: +32 15 33 55 44

Investor Relations

Rob Goyens

rob.goyens@staff.telenet.be

Tel: +32 15 33 30 54

Thomas Deschepper

thomas.deschepper@staff.telenet.be

Tel: +32 15 36 66 45

About Telenet

Telenet is a leading provider of media and telecommunication services. The company focuses on providing cable television, high-speed internet and fixed and mobile telephony services to mainly residential customers in Flanders and Brussels. Telenet also provides services to businesses in Belgium and Luxembourg. Telenet is listed on Euronext Brussels under ticker symbol TNET. For more information, please go to www.telenet.be

___________________________________

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995 - This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our expectations with respect to BASE Company’s 2015 Adjusted EBITDA, the costs, benefits and impacts of the proposed acquisition, including annual run-rate synergies, one-off investments and integration costs, our mobile strategy,

_________________________________________________________________________________________________

the impact of the transaction on our operations, financial performance and leverage ratios, and other information and statements that are not historical fact. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties include the receipt and timing of necessary regulatory approvals to complete the acquisition, BASE Company’s ability to continue financial and operational growth at historic levels, continued use by customers and potential customers of BASE Company’s services, our ability to achieve expected operational efficiencies, synergies and economies of scale, as well as other factors detailed from time to time in our publicly available reports including our most recently published annual report. These forward-looking statements speak only as of the date of this release. We expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Notes

| |

1 | The estimated FY 2015 Adjusted EBITDA of €165 million under EU-IFRS is based on Telenet management’s assumptions and is adjusted to exclude BASE Company’s discontinued operations and reorganisation costs. |

| |

2 | Based on Telenet management’s assumptions including estimated annual run-rate savings on FY 2017 MVNO-related expenses and other estimated annual run-rate opex savings to be achieved by FY 2019. In addition, for purposes of computing the acquisition multiples, the enterprise value was increased by approximately €240 million of projected one-off investments in BASE Company’s network and integration costs. |

| |

3 | Telenet financial information has been derived from quarterly results releases previously published by Telenet for the 12 months ended 31 December 2014. BASE Company financial information has been derived from quarterly results releases previously published by Koninklijke KPN N.V. under KPN’s accounting and reporting policies for the 12 months ended 31 December 2014 including certain adjustments. The financial information of Telenet and BASE Company was prepared under International Financial Reporting Standards, as adopted by the European Union (“EU-IFRS”). The combined Telenet/BASE Company amounts are not necessarily indicative of the amounts that would have occurred if the proposed Telenet/BASE Company transaction had occurred on the date assumed for the purpose of calculating the combined results or the revenue or Adjusted EBITDA that might occur in the future. The combined revenue of €2.4 billion is based on Telenet’s FY 2014 reported revenue of €1.7 billion and BASE Company’s FY 2014 adjusted revenue of €0.7 billion. The combined EBITDA of €1.1 billion is based on Telenet’s 2014 Adjusted EBITDA of €0.9 billion and BASE Company’s FY 2014 Adjusted EBITDA of €0.2 billion. For the nature of the adjustments to BASE Company’s revenue and EBITDA, see note 6 and the reconciliations under “Key data BASE Company”. |

| |

4 | Based on Telenet management’s assumptions including estimated annual run-rate savings on FY 2017 MVNO-related expenses, other estimated annual run-rate opex savings to be achieved by FY 2019 and approximately €5 million of estimated annual run-rate capex synergies. |

| |

5 | The pro-forma net leverage ratio is calculated as per the 2010 Amended Senior Credit Facility definition, using pro-forma net total debt, excluding (a) subordinated shareholder loans, (b) capitalised elements of indebtedness under the Clientele and Annuity Fees, (c) any finance leases entered into on or prior to August 1, 2007, and (d) any indebtedness incurred under the network lease entered into with the pure intermunicipalities up to a maximum aggregate amount of €195 million, divided by last two quarters’ annualised combined EBITDA (under EU-IFRS, as defined under the indentures) as adjusted to add back the full-year €19 million negative impact of discontinued operations and excluding synergies. |

| |

6 | BASE Company’s reported FY 2014 revenue of €711 million under EU-IFRS has been adjusted to exclude discontinued operations. Reported FY 2014 EBITDA of €149 million has been adjusted to exclude discontinued operations and reorganisation costs. See reconciliation between reported and adjusted amounts and reconciliations to the nearest EU-IFRS measure under “Reconciliation between adjusted EBITDA and total profit for the period”. |

| |

7 | The reported BASE Company mobile subscribers of 3.3 million mobile subscribers consist of approximately 2.2 million subscribers under prepaid arrangements and approximately 1.0 million subscribers under postpaid arrangements. Mobile subscribers that are served through third-party MVNO wholesale relationships are included in the mobile subscriber count. The prepaid subscribers reported by BASE Company include subscribers that have been inactive for 12 months or less. The presentation of subscribers under BASE Company’s subscriber counting policies may differ from Telenet’s and Liberty Global’s treatment, including the presentation of subscribers under MVNO wholesale arrangements and inactive prepaid subscribers. |

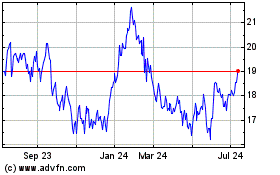

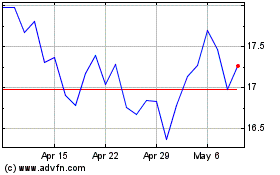

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Apr 2023 to Apr 2024