Liberty Global Swings to a Loss

November 03 2016 - 9:30PM

Dow Jones News

Telecommunications company Liberty Global PLC swung into the red

during the third-quarter on trading losses.

The London-based company, controlled by American media mogul

John Malone, was formed by the 2005 merger of Europe's then-largest

cable operator, UnitedGlobalCom, and Mr. Malone's Liberty Media

International. Its operations include some of Europe's largest

markets, such as Germany and the U.K., where it owns Virgin Media,

as well as cable services in the Caribbean and Latin America. But

the expansion push, including Liberty Global's recent bid for

Polish cable giant Multimedia Polska SA, has come at a price: more

than $40 billion in debt and a string of losses.

Over all, Liberty Global reported a loss of $249.5 million,

driven by more than $436 million in losses on derivatives, compared

with a year-earlier profit of $133.3 million that had benefited

from a $742 million gain from derivatives.

Revenue rose 13% to $5.21 billion, above analysts' projections,

while operating expenses rose 6% to $4.3 billion.

It added 293,700 million subscribers during the quarter,

compared with 323,100 a year earlier. Excluding the effect of

acquisitions, the net increase was 283,700, compared with 277,000

in the previous quarter and 319,000 a year earlier.

Shares, inactive in after-hours trading, closed Thursday at

$31.43, down 15% this year.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 03, 2016 21:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

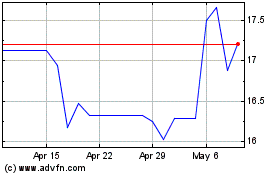

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

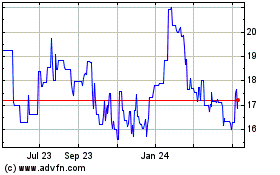

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Apr 2023 to Apr 2024