Bidders Circle Formula One

July 29 2016 - 6:30PM

Dow Jones News

The long-awaited sale of the Formula One may finally be nearing

the finish line.

A number of bidders including British broadcaster Sky PLC are

circling Formula One and a winner of the auction could emerge in

the next few weeks, according to people familiar with the matter. A

deal could value the racing series at around $8 billion or

more.

Other possible buyers participating in the process include a

team of Discovery Communications Inc. and John Malone's Liberty

Global PLC, the people said.

Should there be a deal, it isn't clear how much of the famed

motor-racing company would be sold.

Formula One holds the eponymous races in cities around the

world, from Monte Carlo to Kuala Lumpur. The auto-racing franchise

markets lucrative television rights and sponsorships for the

popular races and negotiates contracts with venues and teams, among

other functions. In 2006, private-equity firm CVC Capital Partners

bought majority control of Formula One. It has since reduced its

stake to around 35%.

CVC has flirted with the possibility of selling its stake for

years but for various reasons hasn't struck a deal.

One complication was a trial Formula One's colorful founder

Bernie Ecclestone faced in Germany related to charges of bribery

and fraud. A court in 2014 dropped the case against Mr. Ecclestone,

who is known as "Supremo" in Formula One circles, in return for a

payment of $100 million.

Mr. Ecclestone is a former used-car salesman who built the race

into a powerful marketing force in the late 1970s. The octogenarian

remains chief executive of the company. Today, the stars in the

sport include Lewis Hamilton and Sebastian Vettel.

Rights to show popular sporting events are considered

increasingly valuable for channel distributors and advertisers amid

a rise in ad-skipping technology and web-based entertainment.

Sky has a vast pay-TV business, with more than 20 million

customers in Italy, Germany, Austria, the U.K. and Ireland. It is a

big investor in television content too, with a programming budget

of more than £ 4.6 billion ($6.1 billion), according to the

company's website. Its market value currently stands at nearly £ 16

billion.

21st Century Fox Inc., which holds a 39% stake in Sky, shares

common ownership with News Corp, the owner of The Wall Street

Journal.

Discovery, whose properties include Discovery Channel, TLC and

Animal Planet, has been trying to build its sports-content holdings

abroad, buying control of European sports entertainment group

Eurosport International in 2014.

Liberty Global is a global media and content-distribution giant.

It has struck a number of content deals in recent years, including

one for the U.K.'s All3Media, together with Discovery.

Mr. Malone, Liberty Global's chairman, has a big stake in

Discovery Communications.

Amol Sharma and Craig Karmin contributed to this article.

Write to Dana Mattioli at dana.mattioli@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

July 29, 2016 18:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

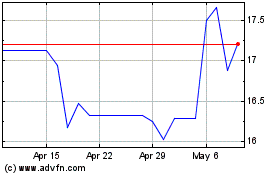

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

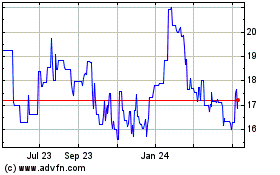

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Apr 2023 to Apr 2024