LONDON—BT Group PLC on Tuesday rejected a call from the U.K.'s

communications regulator for the carrier to run its lucrative

infrastructure arm as a legally separate company within the

firm.

The rejection puts the company and the regulator on a potential

collision course amid mounting tensions across the British

telecommunications industry.

BT, a 170-year-old former state-run monopoly known as British

Telecom, lays down most of the U.K.'s telecoms lines and makes a

hefty chunk of its revenue through its Openreach division by

connecting up the country's copper wire and high-speed fiber-optic

cable network.

For years, BT has faced calls for increased regulatory pressure

on the division by rival operators which lease the network on a

wholesale basis to reach their own customers.

While the U.K.'s Office of Communications, or Ofcom, stopped

short of calling for Openreach to be spun off entirely, it said the

business should be a "distinct company" in BT, with its own

independent board.

Also, under the plans, Openreach would be obliged to consult

with customers such as Sky PLC and TalkTalk Telecom Group PLC on

"large-scale" investments.

Ofcom says Openreach, which recorded 40% of BT's operating

profit in the year to end of March 2015, needs to take its own

decisions on budget, investment and strategy. Openreach provides

financial power to BT as the group's largest contributor of free

cash flow.

Responding to concerns over competition, investment and service

across the network, Ofcom said BT must allow easier access to its

cables for other operators to build up their own fiber networks. BT

competes with companies such as Vodafone Group PLC, Sky and Liberty

Global PLC's Virgin Media in the rapidly-developing market for

combined telephony, Internet broadband and media services.

Ofcom announced last year that it was considering whether BT

should be split up, based on promoting benefits to consumers and

businesses. While rivals called for the telecoms giant to be broken

up, BT said its ownership of Openreach is key to network investment

across the U.K.

Still, Ofcom said on Tuesday its plan would avoid "costs and

disruption" resulting from separating off the division

entirely.

"We're pressing ahead with the biggest shake-up of telecoms in a

decade," said Chief Executive Sharon White, who joined the

regulator last year.

In response, BT said it would make "significant governance

changes" to Openreach, including forming a new board and greater

budget independence.

But it said legal separation would be step too far. And it also

disagrees with Ofcom's proposals for Openreach to have its own

network assets and staff.

"We believe our proposals are a bold and appropriate response,"

said BT Chief Executive Gavin Patterson, who said the company would

make changes within six months.

"We think we have gone almost as far as we can go," added a BT

spokesman.

As well as receiving criticism from regulators and rivals, BT

has also faced calls from U.K. lawmakers to reform its

business.

The U.K. government has called for the country's homes and

businesses to have universal access to fast Internet broadband. And

last week, a government committee said BT's lack of investment

could total hundreds of millions of pounds a year.

Addressing spending criticisms, Mr. Patterson said BT would

invest a further £ 6 million ($7.9 million) over the next three

years.

BT shares rose nearly 5% in early deals, as investors reacted

warmly to Ofcom's not immediately forcing a structural breakup of

BT.

"Avoidance of the worst-case outcome may be a relief for

investors," said UBS analyst Polo Tang.

Still, others said the result may only be temporary.

"This move is clearly the first in a multi-stage process toward

severing Openreach from the BT group," said Cable.co's Dan Howdle.

"Full separation is now inevitable."

On Tuesday, Ms. White warned that Ofcom could still force a full

split of BT and Openreach if the telecoms group doesn't act on the

regulator's plans.

"We have the powers [to enforce the proposals]," Ms. White told

the British Broadcasting Corp. earlier.

Ofcom said it will seek views on its plans until Oct. 4.

The rising pressure on BT follows wider discussions about the

U.K.'s telecoms and media market, which has been roiled by a frenzy

of deal-making activity in recent years.

In the U.K, as elsewhere in Europe's consolidating telecoms and

cable markets, operators are battling for subscribers in an

intensified media services fight as they bundle together fixed

telephony, mobile, broadband Internet and pay-TV.

BT has spent heavily on a range of sports channels and sports

rights to develop its TV service and last year moved to acquire

mobile operator EE in a multibillion-dollar deal, which has raised

the stakes in the industry.

Rory Gallivan contributed to this article.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

July 26, 2016 06:55 ET (10:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

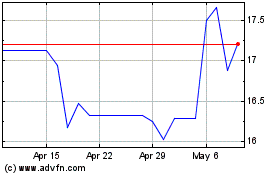

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

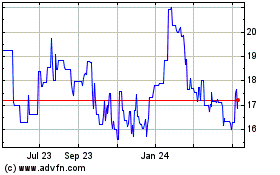

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Apr 2023 to Apr 2024