Malone's Liberty Global in Talks to Buy Cable & Wireless

October 22 2015 - 12:40PM

Dow Jones News

Cable tycoon John Malone's Liberty Global PLC is in talks to

acquire Cable & Wireless Communications PLC, according to

people familiar with the matter, in a deal that could be worth more

than $5 billion and widen the acquisitive company's presence in the

Caribbean and elsewhere.

A takeover deal between the companies could be reached before

they report their respective results in early November, one of the

people said. As ever with mergers and acquisitions, it is possible

the talks will fall apart before an agreement is reached.

Cable & Wireless released a statement confirming the

companies are in talks about a possible cash and stock deal after

The Wall Street Journal reported the news.

Cable & Wireless had a market value of about GBP 2.6 billion

($4 billion) on Thursday in London, where it trades. With Cable

& Wireless debt, a deal could be valued at roughly $8

billion.

Mr. Malone is Liberty Global's chairman and largest voting

shareholder, with a 25% stake as of April. The deal would come less

than a year after Cable & Wireless paid about $1.9 billion in

cash and stock for Columbus International Inc., in which Mr. Malone

owned a stake. That deal handed him a 13% voting stake in Cable

& Wireless. Mr. Malone has recused himself from the

conversations between Liberty Global and Cable & Wireless as a

result, one of the people said.

Cable & Wireless, which has more than 6 million subscribers,

offers pay television, Internet, landline phone and wireless

service—the so-called "quad play"—in the Caribbean, Panama, Monaco

and the Seychelles, according to its website.

Liberty Global has been focused on the need to offer a "quad

play" eventually in all its territories, which span Europe, the

Caribbean and Latin America. It doesn't have a mobile operator in

the Caribbean.

Liberty Global already offers cable service today in Puerto Rico

and Chile and recently created a separate stock dubbed LiLAC to

track its Latin American and Caribbean holdings. The stock has

dropped since its debut this summer. Still, Liberty Global

executives have touted the region as ripe for growth. In August,

the company said the region's revenue was up 7%, excluding

acquisitions and foreign-exchange impact.

"That region as a whole requires massive consolidation," Liberty

Global Chief Executive Mike Fries said at a September investor

conference. "It is fragmented. It is underpenetrated. It is

inefficient. If there was ever a part of the world that would

benefit from the kind of things we do in terms of bringing rational

consolidation to these broadband connectivity platforms, we think

this is."

It is likely Cable & Wireless would be housed with LiLAC if

the deal is consummated, one of the people said.

Cable & Wireless was created in 2010 when a British

telecommunications stalwart of the same name with roots back to

1852 separated its U.K. and Caribbean operations. The U.K.

operations were then purchased by Vodafone Group PLC for about GBP1

billion in 2012.

Liberty Global is a sprawling international basket of cable

operators that has scooped up assets across the globe as it looks

to position itself as a media and content-distribution giant. A

series of large acquisitions in recent years, including a deal to

buy the U.K.'s Virgin Media Inc. and Dutch cable operators Ziggo NV

have made Liberty Global the largest international cable operator

with 27 million customers across 14 countries.

It has been on a buying spree in content over the last year,

agreeing to acquire Irish broadcaster TV3 and taking stakes in

production house All3Media and British broadcaster ITV. At the same

time, it has been bulking up with telecom deals, including with the

purchase of Belgian mobile-phone operator BASE Company NV, agreed

to in April.

Liberty Global is separate from Mr. Malone's Liberty Broadband

Corp., which backs U.S.-based Charter Communications Inc., the

company buying Time Warner Cable Inc. and Bright House

Networks.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com,

David Benoit at david.benoit@wsj.com and Dana Mattioli at

dana.mattioli@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 22, 2015 12:25 ET (16:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

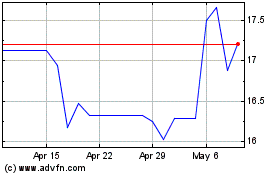

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

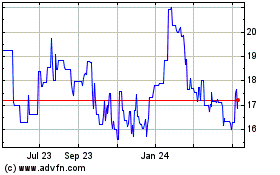

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Apr 2023 to Apr 2024