Vodafone, Liberty Dutch Deal Positive, Moody's Say

February 22 2016 - 9:07AM

Dow Jones News

LONDON--Vodafone Group PLC (VOD.LN) and Liberty Global PLC's (

LBTYA) joint venture in the Netherlands is credit positive for both

companies because it will boost their competitiveness by creating

the second-largest integrated player in the Dutch

telecommunications market, Moody's Investors Service said

Monday.

"The creation of a second integrated player will increase

competitive pressure on smaller mobile-centric players in the Dutch

market," said analyst Ivan Palacios in a statement.

Mr. Palacios also said savings arising from the deal are at the

higher end of the range when compared with other similar

fixed-to-mobile deals in Europe.

Last week, Vodafone, the world's second-largest mobile operator

by subscribers after China Mobile Ltd. (0941.HK), said it would pay

EUR1 billion ($1.1 billion) to Europe-focused Liberty Global as

part of the deal to combine their businesses in the

Netherlands.

Liberty said the 50-50 joint venture would be valued at roughly

€3.5 billion in terms of combined revenue and capital expenditure,

after integration costs.

At 1335 GMT, Vodafone shares rose 1.2% to 216 pence, valuing the

company at GBP56.6 billion ($79.8 billion).

--Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

February 22, 2016 08:52 ET (13:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

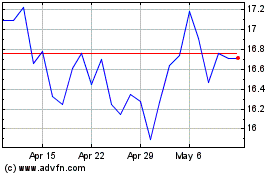

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

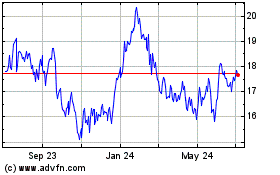

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024