Rebased Revenue Growth of 4% in Q4, and 3% for the Full

Year

Rebased OCF Growth of 6% in Q4, and 4% for the Full

Year

Free Cash Flow1 of $2.5 billion in 2015,

exceeding guidance

Repurchased $2.3 Billion of Equity, including ~$900 million

in Q4

Vodafone JV in the Netherlands to Create National

Powerhouse

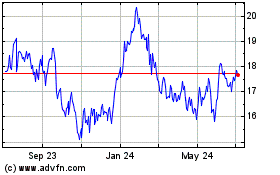

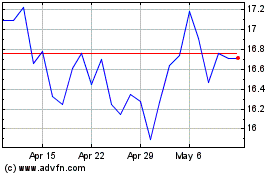

Liberty Global plc ("Liberty Global") (NASDAQ: LBTYA, LBTYB,

LBTYK, LILA and LILAK), today announces financial and operating

results2 for the three months ("Q4") and year ended December 31,

2015 for the Liberty Global Group3 and the LiLAC Group3.

Key highlights for the consolidated operations of Liberty

Global plc for full-year 2015

- Organic RGU4 additions of 870,000,

including 344,000 in Q4, the best quarter of the year

- Broadband net adds of 734,000, fueled

by speed leadership

- Video attrition improved materially in

H2, as compared to the first half of 2015

- Revenue of $18.3 billion, representing

3% rebased5 growth, including 4% rebased growth in Q4

- Full-year rebased revenue growth

improvements in the U.K. and Belgium

- Rebased OCF6 growth of 4% in 2015,

reaching $8.7 billion

- Full-year result driven by 6% rebased

OCF growth in Q4 2015

- Excluding our Dutch business, rebased

OCF growth would have been 5% in 2015

- Operating income of $2.3 billion, up 5%

year-over-year

- Adjusted Free Cash Flow ("FCF")1,7

growth of over 20% in '15, exceeding our financial guidance

- Repurchased $2.3 billion of equity in

2015, including approximately $900 million in Q4

Operating and financial highlights for the Liberty Global

Group, our European business

- Q4 2015 organic RGU additions of

336,000, including 208,000 broadband additions

- Led by 126,000 RGU additions in the

U.K. and 94,000 in Germany

- U.K. new build on track, added over

250,000 Project Lightning premises in 2015

- Investment supported record customer

growth in the U.K. of 55,000 in Q4

- New build programs to target over 1.5

million homes in 2016

- Continued investment in cutting-edge

technologies and product innovation

- Added record 1.5 million

next-generation8 video subscribers in 2015

- Q4 '15 rebased OCF growth increased to

6%, led by Switzerland/Austria, Germany & U.K./Ireland

- Q4 rebased revenue growth of 3.5%,

including 6% in both the U.K. and Germany

- Full-year 2015 revenue growth of 3% and

rebased OCF growth of 3.5%

- Completed Ziggo reorganization in

December; synergies backed 2% rebased OCF growth in Q4

- Enhanced customer experience with

Replay TV, 4G mobile and Ziggo Sport in H2 2015

- Quality program setting the stage for

stabilized revenue performance in 2016

- Balance sheet remains strong

- Average debt tenor over seven years

with net leverage9 of 4.9x at year end

- Nearly $4.4 billion in total

liquidity10 and only 11% of our debt due before 2021

2015 Operating and financial highlights for the LiLAC

Group

- Organic RGU additions of 110,000, a

fifth straight year of over 100,000 new subscribers

- Strongest annual broadband subscriber

gain in Chile in eight years

- Delivered customer growth in every

quarter, totaling 40,000 additions in 2015

- Recently raised top speeds to 200 Mbps

in Puerto Rico and 160 Mbps in Chile

- Full-year rebased revenue growth of 7%

powered robust financial results across the board

- 2015 OCF of $491 million, representing

8% rebased growth

- Delivered $87 million in FCF, up 25%

year-over-year

- Finished 2015 with net leverage of 3.9x

and minimal debt maturities prior to 2022

- Decreased fully-swapped borrowing

cost11 by 320 bps in 2015 to 6.0% following a series of

transactions in H2 2015 relating to a re-strike of our CLP

derivative position

CEO Mike Fries stated, "The core drivers of value creation and

opportunity in our business have never been better than today.

Financial and operating growth in the second half of 2015 was

stronger than our first six months of the year across the board,

and we are guiding towards even higher growth for 2016 and beyond.

These trends are supported by our Liberty 3.012 blueprint, which

will enhance revenue and operating cash flow by focusing on B2B13,

mobile, network expansion and cost controls over the next three

years."

"Europe is a rapidly converging market for fixed and mobile

services, and in addition to the completion of our BASE mobile

acquisition in Belgium, we are excited to announce today a new

50-50 joint venture with Vodafone in the Netherlands. By combining

our best-in-class broadband and video network in the Netherlands

with Vodafone's market-leading 4G wireless platform, we are

creating a new national champion for Dutch consumers that has the

opportunity to realize synergies valued at €3.5 billion14. This is

a terrific transaction for Liberty Global shareholders. We valued

Ziggo at €14 billion or approximately 11 times 2015 OCF15 and will

continue to benefit from 50% of the synergies and free cash flow of

the combined businesses. Together with expected proceeds from

additional leverage and the pre-closing cash generated by Ziggo, we

also expect to generate between €2.5 and €3 billion16 of cash at

closing."

"On the operating front in Europe, we reported 3% rebased

revenue growth and 4% rebased OCF growth for 2015. Our revenue

ramped in the second half of the year, in large part driven by

Virgin Media in the U.K. and Unitymedia in Germany, with both

markets delivering 6% rebased top-line growth in Q4. Underpinned by

the continued success of our pricing strategy, footprint expansion

and the strong demand for our increasingly converged products, we

expect to deliver 5% to 7% rebased OCF growth in Europe in 2016,

excluding our Dutch business Ziggo and the recently acquired BASE,

and we also plan to deliver over $2 billion of FCF17. Over the next

three years, we are targeting rebased OCF growth of between 7% and

9%18, as we execute our ambitious Liberty 3.0 plans."

"Our Latin American and Caribbean platform also had an eventful

year, as we launched our LiLAC tracking stock in July and announced

the Cable & Wireless transaction in November. Cable &

Wireless will add substantial scale and unlock significant

synergies over the next several years and will enhance the already

strong growth prospects for a region that is characterized by low

broadband and pay-TV penetration. In 2015, LiLAC achieved strong

subscriber growth and delivered robust rebased OCF growth of 8%,

above our mid-single-digit OCF guidance for the year. Looking

ahead, we expect to deliver 5% to 7% rebased OCF growth and limited

FCF at LiLAC in 2016, excluding Cable & Wireless."

"Our balance sheet remains in great shape, with $4.9 billion of

total liquidity, an average tenor of over seven years, and a record

low cost of debt of 4.9%. We generated $2.5 billion of FCF in 2015,

an adjusted year-over-year improvement of over 20%1, which exceeded

our guidance of mid-teens growth. This strong FCF generation

underpinned a record $2.3 billion of stock repurchases last year,

and we are pleased to announce an increase to our buyback target of

$2.4 billion, upping our remaining amount authorized for

repurchases to $4.0 billion by year-end 2017.”

Strategic combination of Ziggo and Vodafone

Netherlands

Powerful combination of the best fixed and mobile networks in

the Netherlands

Liberty Global and Vodafone Group Plc today announced an

agreement to merge their operating businesses in the Netherlands to

form a 50:50 joint venture (the “JV”), creating a nationwide

integrated communications provider with over 15 million

subscribers19. By combining Ziggo’s market-leading Horizon TV

product suite, 200 Mbps nationwide broadband internet and extensive

Wi-Fi network, together with Vodafone’s market-leading, data-rich

4G mobile propositions, Dutch consumers will enjoy an amazing

customer experience with superior connectivity and entertainment

both in and outside the home. In addition, the JV will become a

leading national enterprise business that will ensure sustainable

competition in the small, medium and large business segments across

the Netherlands, which will benefit the overall Dutch economy. The

transaction is expected to close around the end of 2016 and is

subject to regulatory approvals and consultations with the Works

Councils.

We expect this highly complementary combination to enhance the

long-term equity value for Liberty Global Group for the following

reasons:

- Total cost, capex and revenue synergies

with an NPV of ~€3.5 billion14 after integration costs

- We valued our Ziggo operations at an

enterprise value of €14 billion or a premium multiple of ~11x 2015

OCF15

- Vodafone will make a cash payment to

Liberty Global of €1 billion to equalize ownership in JV

- New joint venture will target leverage

of 4.5-5.0x covenant EBITDA20

- Continue to benefit from 50% of growth,

synergies, free cash flow21 and recapitalizing proceeds

Subscriber Statistics - Liberty Global Group (Europe)

At the end of Q4 2015, we provided our 25.8 million unique

customers with 53.6 million subscription services ("RGUs") across

our footprint of 49.2 million homes passed in Europe. On a product

level, our RGU base for the Liberty Global Group consisted of 22.8

million video, 16.8 million broadband internet and 14.0 million

telephony subscriptions. As compared to December 31, 2014, we

increased our total RGU base by 2%, or 840,000 RGUs, primarily

driven by our 760,000 organic RGU additions and, to a lesser

extent, various small in-market acquisitions. We ended the year

with a bundling ratio of 2.08 RGUs per customer, as 45% of our

customers subscribed to a triple-play product, 17% subscribed to a

double-play product and 38% subscribed to a single-play product,

offering continued up-sell opportunity within our existing customer

base.

Geographically, our 2015 organic additions consisted of 412,000

RGUs in Western Europe and 349,000 in Central and Eastern Europe

("CEE"). From a country perspective, our results were again led by

our German operations, where we added 316,000 RGUs in 2015, as we

successfully balanced subscriber volumes and price increases.

Meanwhile, Virgin Media in the U.K. delivered a solid 2015

performance with a total of 219,000 RGU additions, including

126,000 RGUs added in Q4, a quarterly record since we assumed

ownership in June 2013. This result was powered by continued strong

demand for high broadband speeds and the early benefits from

Project Lightning. Moving to Belgium, Telenet added 80,000 RGUs in

2015, driven by the continued traction of its leading "Whop" and

"Whoppa" bundles.

Turning to the Netherlands, Ziggo experienced RGU attrition of

203,000 during 2015, including 52,000 in Q4, which was mainly the

result of lower sales and higher churn. This decline is due in part

to aggressive competition, operational challenges associated with

our network and product harmonization and integration work, as well

as price increases we initiated across our existing customer base

during the year. We believe that our continued focus on video

quality and the customer experience, together with the launch of

the Ziggo Sport channel in Q4, will put us in a better competitive

position in 2016. Rounding out our top five markets, we lost 12,000

RGUs in Switzerland during the year, partly driven by lower sales

and elevated churn following our announced average price increase

of 3.5% per customer that became effective January 1, 2016. This

price increase was supported by continued network investments and

product enhancements, such as more HD channels in our basic digital

offer, the doubling of broadband speeds for existing subscribers

and the expansion of our Replay TV functionality.

From a product perspective, our organic subscriber growth was

fueled by 646,000 broadband RGU additions in 2015. During the year,

we expanded our speed leadership strategy and launched new top

speeds, including up to 500 Mbps in several markets. In the U.K.,

Virgin Media posted a particularly robust result, delivering

158,000 broadband additions during the year, a 12% year-over-year

improvement, due primarily to fall and winter marketing campaigns,

the recent launch of its 200 Mbps service and the start of the

Project Lightning new build program. Our German operation added

210,000 broadband subscribers, representing lower RGU volume growth

as compared to 2014, due largely to the impacts of broadband price

increases and higher priced portfolios that were implemented during

2015. Our CEE businesses added 136,000 broadband RGUs during 2015,

partially related to a network expansion completed in the second

half of 2015. Turning to fixed-line telephony, we added 515,000

subscribers in 2015 organically, slightly below the 566,000 total

posted in 2014, as improvements in Romania, the U.K. and

Switzerland were more than offset by lower additions in Germany,

the Netherlands and Ireland.

On the video front, we lost 400,000 subscribers in 2015. In the

CEE region, we saw improved video performance, with a gain of

51,000 RGUs, but this result was more than offset by weaker trends

in our Western European markets, in particular the Netherlands

where we lost over 200,000 video RGUs. At the same time, we

successfully migrated 1.5 million of our legacy video subscribers

to one of our next-generation TV platforms in 2015. More

specifically, we increased our Horizon TV subscriber base by over

800,000, added over 350,000 TiVo subscribers in the U.K. and nearly

140,000 Digital TV subscribers in Belgium with a Horizon-like user

interface, and upgraded over 170,000 legacy boxes to our

"Horizon-light" platform in the Czech Republic. There were a number

of video innovation milestones that we achieved in 2015, including

the successful launch of Replay TV in the Netherlands, Switzerland

and Ireland, the expansion of our multi-screen TV viewing services

across all 12 of our European markets and the enhancement of

out-of-home video capabilities. As of the end of 2015, 29% of our

total video base subscribed to one of our next-generation

platforms, an increase from 22% at the end of 2014. At December 31,

2015, we had 14.2 million enhanced video subscribers22,

representing enhanced video penetration23 of 65%, and 7.7 million

basic video subscribers.

With respect to our wireless business in Europe, we finished

2015 with 4.7 million mobile subscribers24. During 2015, we added

425,000 total postpaid subscribers, partially offset by a loss of

188,000 low-ARPU25 prepaid subscribers. This net growth of 237,000

mobile subscribers was led by our Western European operations,

which added 218,000 subscribers. At Telenet, we added 107,000

mobile subscribers during the year, eclipsing the one million mark

during Q4, primarily as a result of our "Family Deal" proposition

launched in April 2015 and the initiation of split-contracts26 in

Q3. In the Netherlands, Germany and Switzerland we added 57,000,

46,000 and 24,000 total mobile subscribers, respectively. In the

U.K., we lost 37,000 mobile subscribers during the year, as our

postpaid gains of 151,000 were less than the aforementioned prepaid

subscriber losses. Our postpaid result in this market was driven by

the popularity of our SIM-only contracts and Freestyle mobile

proposition in the U.K. From an innovation standpoint, we

successfully launched our 4G services in Switzerland and the

Netherlands in September and October, respectively, along with a

full-MVNO launch in Ireland in October. During 2016, we expect to

deploy 4G services in additional markets and, in combination with a

targeted fixed-mobile convergence strategy, we see ample

opportunity for mobile growth ahead of us.

Revenue - Liberty Global Group (Europe)

Revenue attributed to the Liberty Global Group for the three

months and year ended December 31, 2015 remained relatively flat at

$4.3 billion and $17.1 billion, respectively, as compared to the

corresponding prior year periods. For both periods, our reported

results were primarily driven by the contribution from Ziggo and,

to a lesser extent, our organic revenue growth. These positive

factors were nearly offset by negative foreign currency ("FX")

movements related to the strengthening of the U.S. dollar against

all of our functional currencies. When adjusting to neutralize the

impact of acquisitions, dispositions and FX, our operations

attributed to the Liberty Global Group achieved year-over-year

rebased revenue growth of 3.5% and 3% during the Q4 and full-year

2015 periods, respectively.

Our Q4 and full-year 2015 rebased growth rates both included the

net effects of certain non-recurring and non-operational items, the

most significant of which were: (i) the net positive impacts of $32

million and $116 million, respectively, from the upfront

recognition of mobile handset revenue in connection with our

split-contract26 programs in the U.K. and Belgium, (ii) the

negative impacts of $19 million and $101 million, respectively, of

increased VAT obligations, composed of $15 million and $85 million,

respectively, in the U.K. and $4 million and $16 million,

respectively, at our direct-to-home ("DTH") business, (iii) the

favorable impacts of $5 million and $23 million, respectively, of

higher amortization of deferred upfront fees on B2B contracts in

the U.K., (iv) increases in revenue due to an $18 million benefit

recorded in the U.K. during the fourth quarter of 2015 related to

the settlement of disputes with mobile operators over amounts

charged for voice traffic, including $16 million related to years

prior to 2015 and (v) the $12 million negative impact of a Q1 2014

favorable revenue settlement in Germany impacting the full-year

comparison.

In terms of our products, the success of broadband internet

continued to fuel our overall rebased revenue results throughout

2015. Other key areas of growth came from B2B (including SOHO) and

mobile (including interconnect and handset sales), delivering

improved 2015 rebased revenue growth rates of 9% and 15%27,

respectively, as compared to 2014. These growing business lines

represented 11% and 8% of our total 2015 revenue, respectively.

Geographically, we generated 3% rebased revenue growth in

Western Europe in 2015, while our CEE operations delivered 1%

rebased revenue growth in each of the Q4 and full-year 2015

periods. The rebased results of CEE for both periods were similar

to last year's results, led by Romania, Hungary and Poland, and

were mainly driven by volume gains across the region, partially

offset by declines in ARPU.

Turning back to Western Europe, which represents over 90% of

Liberty Global Group's revenue, our 2015 top-line rebased growth of

3% was led by Belgium and Germany, each delivering 6% rebased

revenue growth. As compared to 2014, Belgian rebased revenue growth

improved by two percentage points, primarily due to an increase in

subscribers, higher ARPU per RGU and growth in our mobile and B2B

businesses. Germany repeated its 2014 performance with 6% rebased

revenue growth, although in 2015 our growth was more balanced

between price and volume. Moving to our largest operation, Virgin

Media in the U.K. and Ireland produced 4% revenue growth on a

rebased basis for the year ended December 31, 2015. Of particular

note, the U.K. delivered 6% rebased revenue growth in Q4 2015, its

third consecutive quarter of improved growth and our best quarterly

rebased result since we acquired the business in 2013. The growth

in the U.K. for Q4 and the full-year was fueled by higher cable

subscription revenue from subscriber growth and ARPU per RGU

improvements, the net benefit from higher mobile handset sales and

higher B2B revenues.

Our Swiss/Austrian operation delivered 3% rebased revenue growth

during 2015, driven by an increase in cable subscription revenue

and increasing momentum in our B2B and mobile businesses. Finally,

our rebased revenue growth in Europe was negatively impacted by our

operations in the Netherlands, especially in the second half of

2015. For full-year 2015, Ziggo experienced a 2% rebased revenue

decline, primarily due to the previously-mentioned challenges in

the Dutch market. While Ziggo reported a year-over-year Q4 rebased

revenue contraction of 3%, Q4 local currency revenue stabilized

relative to Q3 2015. Looking forward to 2016, we expect that our

continued investment in our product suite, enhanced customer

service and positive momentum in our mobile and B2B operations will

stabilize our top-line in the Netherlands.

Operating Cash Flow - Liberty Global Group (Europe)

For the three months and year ended December 31, 2015, our

reported OCF increased 3% to $2.1 billion and 2% to $8.2 billion,

respectively, as compared to the corresponding prior-year periods.

Our reported Q4 increase was primarily driven by the net effect of

organic OCF growth, the inclusion of Ziggo and the negative effects

of FX movements. With respect to the full-year 2015 period, the

principal OCF contributors were acquisitions, mainly Ziggo, and

organic OCF growth. This result was partially offset by negative FX

headwinds during the period. From a rebased perspective, the

operations attributed to the Liberty Global Group reported 6% and

3.5% OCF growth, respectively, for the three months and full year

ended December 31, 2015.

Our full-year rebased OCF growth included the net positive

impact of the aforementioned revenue items and the net negative

impact of certain items that impacted our expenses, the most

significant of which were: (i) $28 million of additional

integration-related expenses, primarily in the Netherlands and

Belgium and (ii) $20 million of Liberty 3.0 program costs within

our corporate category. In terms of our Q4 rebased OCF performance,

our growth rate included the aforementioned net favorable revenue

items, the positive impact of synergies related to our Ziggo

integration and the adverse impacts of $5 million in integration

costs related to the acquisition of BASE Company ("BASE") and $3

million in incremental costs related to our Liberty 3.0

program.

From a geographic perspective, our Western European operations

reported 5% rebased OCF growth for full-year 2015, including

rebased OCF growth of 7% in Q4. Our full-year growth in Western

Europe was partially offset by a 3% rebased OCF contraction in the

CEE region and higher year-over-year central and other costs. Our

CEE performance was negatively affected by the recurring $16

million increase in annual VAT payments related to our

Luxembourg-based DTH operation that took effect on January 1,

2015.

In Western Europe, our 2015 performance was led by our operation

in Germany, which generated 7% rebased OCF growth in 2015,

including 11% in Q4 2015. This performance was primarily driven by

the aforementioned revenue growth, while Q4 also benefited from a

decrease in sales and marketing costs. In the U.K./Ireland, we

delivered 6% rebased OCF growth in 2015, including 7% in Q4 2015.

These results were primarily driven by U.K. top-line growth, cost

savings and efficiencies. These positive factors were partially

offset by increases in certain operating costs, including

programming and mobile handset costs. With respect to our

operations in Switzerland/Austria and Belgium, our full-year 2015

rebased OCF growth of 6% for both segments was delivered largely

through the aforementioned revenue drivers. Of note, our

Switzerland/Austria operation delivered 13% rebased OCF growth in

Q4 2015. This growth was driven by revenue increases, lower

staff-related costs, lower network-related costs, lower marketing

spend related to the impact of higher spend in Q4 2014 associated

with our MyPrime and mobile campaigns and lower rent expense due to

the impact of costs incurred in Q4 2014 associated with the

relocation of our Swiss office.

Rounding out Western Europe, Ziggo reported an increase in

rebased OCF of 2% in Q4 and a decline of 2% during 2015. The

full-year 2015 decline is primarily due to the aforementioned

revenue contraction. Our Segment OCF in the Netherlands during Q4

was $10 million higher than the third quarter of 2015 and the

highest of any quarter during 2015, mainly as a result of cost

controls and delivery on the synergy plan. For the year ended

December 31, 2015, we incurred $29 million of integration related

costs, but these expenses were more than offset by synergy

benefits, which were primarily driven by FTE savings.

The Liberty Global Group reported OCF margins28 of 48.2% and

47.9%, respectively, for the three months and year ended December

31, 2015. These represent margin improvements of 160 and 70 basis

points, respectively, compared to the 46.6% and 47.2% margins we

reported for the corresponding prior year periods.

Property and Equipment Additions - Liberty Global Group

(Europe)

The Liberty Global Group reported property and equipment

("P&E") additions29 of $3,910 million or 22.9% of revenue in

2015, as compared to $3,653 million or 21.4% of revenue in 2014.

The increase in absolute P&E additions was due principally to

an increase associated with the acquisition of Ziggo as well as

higher spend for line extensions, new builds and upgrade projects.

These increases were partially offset by the impact of the

strengthening of the U.S. dollar against all of our European

currencies. In terms of our 2015 P&E additions by category, 47%

pertained to line extensions, upgrade and rebuild and scalable

infrastructure, 27% was related to customer premises equipment

("CPE") and 26% was related to support capital.

For 2016, we expect our property and equipment additions as a

percentage of our revenue will range from 25% to 27%. As part of

our Liberty 3.0 program, we are planning to build over 1.5 million

homes in 2016, including the U.K. (over 500,000), Germany (over

200,000), and the CEE region (over 600,000).

Free Cash Flow - Liberty Global Group (Europe)

We reported Free Cash Flow attributable to the Liberty Global

Group of $2.4 billion, a 16% year-over-year increase, as compared

to the $2.1 billion we reported in 2014. This improvement is

attributable to the effect of lower interest rates, our organic OCF

growth, the inclusion of Ziggo and benefits from our vendor

financing program. The impact of these increases was partially

offset by trade working capital outflows, the adverse impact of FX

and higher tax payments.

Leverage, Liquidity & Shares Outstanding - Liberty Global

Group (Europe)

We ended 2015 with attributed total third-party debt30 of $44.7

billion and cash and cash equivalents of $708 million for the

Liberty Global Group. As compared to the previous quarter, our

reported long-term debt balance remained flat.

Excluding $2.4 billion of debt backed by shares we hold in ITV

plc, Sumitomo Corporation and Lions Gate Entertainment Corp., the

Liberty Global Group's consolidated adjusted gross and net leverage

ratios were 5.0x and 4.9x, respectively, at December 31, 2015. The

Liberty Global Group's average tenor of third-party debt was over

seven years at the end of 2015, only 11% of which is due before

2021. At December 31, 2015, our blended fully-swapped borrowing

cost of such debt was 4.8%, a 110 basis point improvement as

compared to 5.9% at year end 2014. This reduction is mainly

attributable to over $9 billion of debt refinancings that we

undertook in 2015.

Our consolidated liquidity position at the end of 2015 was $4.4

billion, including $708 million of cash, and the aggregate maximum

undrawn commitments under our credit facilities31 of $3.7

billion.

At February 4, 2016, we had 844 million Liberty Global Group

shares outstanding, including 253 million Class A ordinary shares,

10 million Class B ordinary shares and 581 million Class C ordinary

shares.

Subscriber Statistics - LiLAC Group

At the end of Q4 2015, we provided our 1.7 million unique

customers with 3.5 million subscription services across our cable

footprint of 4.1 million homes passed within Chile and Puerto Rico.

In 2015, we continued our strong track record of customer growth,

as we added over 40,000 customers organically, a 24% increase over

2014 organic growth. In terms of RGUs, we increased our subscriber

base by 266,000 RGUs, powered by a 37% year-over-year increase in

broadband additions. This result included 156,000 RGUs from the

acquisition of Choice in Puerto Rico and 110,000 organic RGU

additions (88,000 broadband, 14,000 telephony and 8,000 video). As

a result, we finished 2015 with an RGU base consisting of 1.3

million video, 1.3 million broadband internet and 0.9 million

telephony subscriptions.

Geographically, our Chilean operation contributed 80,000 RGUs,

an increase of 7% year-over-year, fueled by strong broadband

additions. We added 71,000 broadband RGUs in 2015, our strongest in

eight years, due in part to the introduction of our popular “Vive

Más” bundles, featuring rich HD channel line-ups and market-leading

broadband speeds. Further extending our competitive advantage, we

recently boosted our Vive Más speeds to 80 Mbps (December 2015) and

top broadband speed to 160 Mbps (February 2016). Rounding out our

triple-play products in Chile, we added 13,000 video RGUs and lost

4,000 telephony RGUs in 2015. On the video front, we added video

subscribers for the eleventh year in a row. We expanded our HD

line-up early in 2015 and in the fourth quarter we selectively

introduced our next-generation video-on-demand user interface,

which we are targeting to be fully rolled-out by the middle of

2016. Additionally, we will begin deploying Horizon TV during 2016

and we expect to continue to invest in product innovation to

enhance the customer experience.

Turning to Puerto Rico, we added 30,000 RGUs in 2015, including

8,000 in Q4. From a product perspective, we added 17,000 RGUs in

each of broadband and telephony, while losing 5,000 video

subscribers during 2015. Our RGU growth was driven in part by our

strategy to drive bundled services to our customer base, including

our newly acquired Choice customers, which have been historically

more focused on single-play broadband services. Similar to our

Chilean operation, we are excited about our product portfolio and

the competitive advantage that we expect to have in the

marketplace. During 2016, we plan to significantly increase

customer broadband speeds, with a new top speed of 200 Mbps, as

well as expand the HD line-up and implement harmonized product

portfolios across our entire footprint.

In addition to our residential triple-play business, we

continued to grow our mobile subscriber base in 2015, adding 22,000

mobile subscribers during the year in Chile. This year-over-year

increase consisted of a 30,000 postpaid subscriber gain and a loss

of 9,000 prepaid subscribers. During Q4, we lost 2,000 mobile

subscribers, bringing our total mobile subscribers at year end to

132,000. The competitive landscape in the second half of 2015

intensified with the emergence of an aggressive, low-priced

competitor. We expect that the Chilean mobile market will remain

highly competitive in 2016.

Revenue - LiLAC Group

The LiLAC Group reported revenue of $309 million and $1.2

billion for the three months and year ended December 31, 2015,

respectively. This represents increases of 4% in Q4 and 1% for the

twelve-month period, as compared to the corresponding prior-year

periods. Our reported increases for both the Q4 and full-year 2015

periods include the positive impacts of organic revenue growth and

the inclusion of Choice in Puerto Rico. These increases were offset

by the negative impact of FX movements related to declines of the

Chilean peso against the U.S. dollar of 17% and 15%, respectively.

When adjusting to neutralize for the impact of the Choice

acquisition and FX, the businesses attributed to the LiLAC Group

delivered year-over-year rebased revenue growth of 7% in both the

Q4 and full-year 2015 periods.

Our Chilean operation reported rebased revenue growth of 7% for

full-year 2015, including 8% in Q4, our strongest quarterly result

in over two years. Our rebased performance in both periods was

driven by cable subscription and mobile revenue growth, resulting

from a combination of volume growth and improved ARPU per RGU. Of

note, the revenue increase during the 2015 period is net of

adjustments to reflect the retroactive application of proposed

tariff reductions on ancillary services and fixed-line termination

rates. These adjustments reduced our full-year 2015 revenue at VTR

by approximately $6 million.

In Puerto Rico, we ended the year with revenue growth of 6% on a

rebased basis, including 5% growth in Q4. The principal growth

drivers for both periods include the net impact of our subscriber

gains, ARPU declines and the robust growth in our B2B business

(including SOHO), which generated rebased revenue growth in excess

of 20% in 2015.

Operating Cash Flow - LiLAC Group

For the three months and year ended December 31, 2015, the

operations attributed to the LiLAC Group reported OCF decreases of

1% to $127 million and an OCF increase of 3% to $491 million,

respectively, as compared to the corresponding prior year periods.

The LiLAC Group's reported Q4 and full-year OCF growth was

primarily driven by organic growth and the Choice acquisition.

These results were partially offset by the aforementioned negative

impact of FX and the adjustments related to the tariff reductions

noted above. On a rebased basis, we delivered 2% year-over-year OCF

growth in Q4 and 8% year-over-year OCF growth for full-year

2015.

From a country perspective, Chile reported 7% rebased OCF growth

for the year ended December 31, 2015, including flat performance in

Q4. Our rebased results for both Q4 and the full-year were

adversely impacted by the $5.7 million (CLP 3.4 billion)

unfavorable impact of a nonrecurring adjustment recorded in Q4 2014

related to the reassessment of certain accrued liabilities, as well

as the negative impacts of costs denominated in U.S. dollars. We

estimate that the impact of this non-functional currency spend

reduced our OCF on a year-over-year basis by approximately $3

million and $8 million for the three months and year ended December

31, 2015.

Rounding out our LiLAC Group operations, Puerto Rico generated

rebased OCF growth of 10% in 2015, including 7% in Q4, driven in

part by the aforementioned revenue growth and disciplined cost

controls.

On a year-over-year basis, the LiLAC Group's reported OCF margin

decreased by 200 basis points to 41.2% in Q4 and increased 70 basis

points to 40.3% for full-year 2015. The full-year improvement is

supported by revenue growth and improved operational leverage,

while the Q4 decrease is largely attributable to the aforementioned

Q4 2014 nonrecurring adjustment.

Property and Equipment Additions - LiLAC Group

For fiscal 2015, operations attributed to the LiLAC Group

reported P&E additions of $227 million or 19% of revenue, as

compared to $256 million or 21% of revenue in 2014. The decrease in

absolute P&E additions was primarily related to the

depreciation of the Chilean peso against the U.S. dollar and lower

spend on support capital, scalable infrastructure and CPE. The

inclusion of our Choice acquisition in Puerto Rico for seven months

in 2015 partially offset this decline. In terms of our 2015 capital

allocation, 49% of our full-year spend was related to CPE, 33% to

scalable infrastructure, line extensions and upgrade/rebuild

activity and 18% to support capital, including IT upgrades and

general support systems.

Looking ahead to 2016, we expect our property and equipment

additions as a percentage of revenue to range from 21% to 23%, an

increase over the prior year that is mainly due to our plans to

substantially increase our new build and upgrade program. In this

regard, we are currently targeting over 150,000 homes to be

connected to our networks or to be upgraded to two-way service in

2016, a near doubling from 2015. We believe this higher level of

investment will drive future growth and generate attractive returns

to our shareholders.

Free Cash Flow - LiLAC Group

On a reported basis, we generated $87 million of FCF in 2015 for

the operations attributed to the LiLAC Group, as compared to $70

million in 2014, representing a 25% year-over-year improvement. The

positive variance was mainly attributable to organic OCF growth and

trade working capital improvement. This result was partially offset

by higher interest and related derivative payments. The higher

payments were directly attributable to interest and related

derivative payments of approximately $67 million in January 2015 on

the $1.4 billion in bonds at VTR Finance B.V., as similar payments

were not required to be made in the corresponding Q1 2014

period.

Leverage, Liquidity & Shares Outstanding - LiLAC

Group

At December 31, 2015, we had total third-party debt attributed

to the LiLAC Group of $2.3 billion and cash and cash equivalents of

$275 million. As compared to September 30, 2015, the carrying value

of our debt attributed to the LiLAC Group was largely unchanged,

while the cash balance attributed to the LiLAC Group improved by

$36 million.

The average tenor of our third-party debt attributed to the

LiLAC Group at the end of Q4 2015 was over seven years, with

minimal maturities prior to 2022, and our blended fully-swapped

borrowing cost of such debt was 6.0%, as compared to 9.2% at the

end of 2014. This substantial decrease was directly attributable to

a re-striking of all of the derivatives associated with VTR's $1.4

billion principal amount of senior secured notes during the second

half of 2015. The net impact of these transactions resulted in a

reduction in the annual swapped coupon that we pay going forward,

with the notional amount of our leverage on a swapped basis at the

Chilean credit pool increasing from CLP 760 billion to CLP 951

billion. The gross and net leverage ratios associated with the debt

attributed to the LiLAC Group were 4.5x and 3.9x, respectively, at

the end of 2015.

At February 4, 2016, we had 44 million LiLAC shares outstanding,

including 13 million Class A ordinary shares, 0.5 million Class B

ordinary shares and 31 million Class C ordinary shares.

Profit Forecast for Liberty Global for the Year ending

December 31, 2016

Liberty Global is currently in an offer period (as defined in

the City Code on Takeovers and Mergers (the “Code”)) with respect

to Cable & Wireless Communications Plc ("Cable &

Wireless"). Accordingly, pursuant to the requirements of Rule 28 of

the Code, by publishing an ordinary course "profit forecast" in

this release Liberty Global is required to include a statement by

the Directors that such profit forecast is valid. In addition, we

must include in this release a confirmation by our Directors that

the profit forecast has been properly compiled on the basis of the

assumptions stated and that the basis of accounting used is

consistent with Liberty Global’s accounting policies.

As noted in the release, Liberty Global today is providing

full-year 2016 financial guidance targets, which includes the

following statements:

- Full-year guidance of 5% to 7% rebased

OCF growth, for Liberty Global Group, excluding the Netherlands and

BASE

- Full-year guidance of 5% to 7% rebased

OCF growth for LiLAC Group, excluding Cable & Wireless

While our OCF measure should not be considered a measurement of

profit, the above statements for the year ending December 31, 2016,

constitute "profit forecasts" for the purposes of the Code (the

“Liberty Global Profit Forecast”). Please see pages 17 and 20 for

our Operating Cash Flow (“OCF”) definition and the required

reconciliation and how we calculate rebased growth rates.

The Liberty Global Profit Forecast has been prepared on a basis

consistent with the accounting policies for Liberty Global, which

are in accordance with generally accepted accounting standards in

the U.S. and those which Liberty Global anticipates will be

applicable for the full year ending December 31, 2016. Liberty

Global has prepared the Liberty Global Profit Forecast based on

audited financial results for the year ended December 31, 2015, and

an internal management forecast to December 31, 2016.

In accordance with Rule 28.4(a) of the Code, the principal

assumptions upon which the profit forecast is based are included

below. Our 2016 guidance for Liberty Global Group mentioned above

excludes our Dutch business Ziggo and the recently acquired BASE in

Belgium, whereas the 2016 guidance for LiLAC Group excludes Cable

& Wireless. In accordance with Rule 28.4(c) of the Code, there

is a clear distinction made between assumptions which the Directors

of Liberty Global (or other members of Liberty Global’s management)

can influence and those which they cannot influence.

Factors outside the influence or control of Liberty Global and

its Directors:

- economic and business conditions and

industry trends in the countries in which we operate;

- the competitive environment in the

industries in the countries in which we operate, including

competitor responses to our products and services;

- fluctuations in currency exchange rates

and interest rates;

- instability in global financial

markets, including sovereign debt issues and related fiscal

reforms;

- consumer disposable income and spending

levels, including the availability and amount of individual

consumer debt;

- changes in consumer television viewing

preferences and habits;

- consumer acceptance of our existing

service offerings, including our digital video, broadband internet,

fixed-line telephony, mobile and business service offerings, and of

new technology, programming alternatives and other products and

services that we may offer in the future;

- changes in laws or treaties relating to

taxation, or the interpretation thereof, in the U.K., U.S. or in

other countries in which we operate;

- changes in laws and government

regulations that may impact the availability and cost of capital

and the derivative instruments that hedge certain of our financial

risks;

- the ability of suppliers and vendors

(including our third-party wireless network providers under our

MVNO arrangements) to timely deliver quality products, equipment,

software, services and access; and

- events that are outside of our control,

such as political unrest in international markets, terrorist

attacks, malicious human acts, natural disasters, pandemics and

other similar events.

Factors within the influence or control of Liberty Global and

its Directors:

- our ability to maintain or increase the

number of subscriptions to our digital video, broadband internet,

fixed-line telephony and mobile service offerings and our average

revenue per household;

- our ability to maintain or increase

rates to our subscribers or to pass through increased costs to our

subscribers;

- there will be no material change in the

present management or control of Liberty Global or its existing

operational strategy; and

- Liberty Global’s accounting policies

will be consistently applied in the financial year to December 31,

2016.

The Directors of Liberty Global have considered the Liberty

Global Profit Forecast and confirm that it is valid as at the date

of this document and has been properly compiled on the basis of the

assumptions set out above and that the basis of the accounting used

is consistent with Liberty Global’s accounting policies.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding our operations, strategies,

future growth prospects and opportunities (in particular with

respect to upselling and bundling of products); our expected OCF

growth and FCF in the future; property and equipment additions as a

percentage of revenue, including the expected increase in such

percentages as a result of new build opportunities; Liberty 3.0,

including plans and expectations with respect to new build and

network extensions; the pending acquisition of Cable & Wireless

and joint venture in the Netherlands and the anticipated benefits,

costs and synergies in connection therewith; the timing of proposed

transactions; the development, enhancement and expansion of our

superior networks and innovative and advanced products and

services, including higher broadband speed rollouts, expansion and

launches of next-generation video services and new channels; our

mobile and B2B strategies; our expectations with respect to

improved performance in the Netherlands and the anticipated drivers

thereof; the strength of our balance sheet and tenor of our

third-party debt; expectations with respect to our share buyback

program; and other information and statements that are not

historical fact. These forward-looking statements involve certain

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by these statements.

These risks and uncertainties include the continued use by

subscribers and potential subscribers of our services and their

willingness to upgrade to our more advanced offerings; our ability

to meet challenges from competition, to manage rapid technological

change or to maintain or increase rates to our subscribers or to

pass through increased costs to our subscribers; the effects of

changes in laws or regulation; general economic factors; our

ability to obtain regulatory approval and satisfy regulatory

conditions associated with acquisitions and dispositions; our

ability to successfully acquire and integrate new businesses and

realize anticipated efficiencies from businesses we acquire; the

availability of attractive programming for our digital video

services and the costs associated with such programming; our

ability to achieve forecasted financial and operating targets; the

outcome of any pending or threatened litigation; our ability to

access cash of our subsidiaries and the impact of our future

financial performance, or market conditions generally, on the

availability, terms and deployment of capital, fluctuations in

currency exchange and interest rates; the ability of suppliers and

vendors (including our third-party wireless network providers under

our MVNO arrangements) to timely deliver quality products,

equipment, software, services and access; our ability to adequately

forecast and plan future network requirements including the costs

and benefits associated with network extension; and other factors

detailed from time to time in our filings with the Securities and

Exchange Commission, including our most recently filed Form 10-K

and Form 10-Qs. These forward-looking statements speak only as of

the date of this release. We expressly disclaim any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

our expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is

based.

About Liberty Global

Liberty Global is the largest international cable company with

operations in 14 countries. We connect people to the digital world

and enable them to discover and experience its endless

possibilities. Our market-leading products are provided through

next-generation networks and innovative technology platforms that

connected 27 million customers subscribing to 57 million

television, broadband internet and telephony services at December

31, 2015. In addition, we served five million mobile subscribers

and offered WiFi service across six million access points.

Liberty Global’s businesses are currently attributed to two

tracking stock groups: the Liberty Global Group (NASDAQ: LBTYA,

LBTYB and LBTYK), which primarily comprises our European

operations, and the LiLAC Group (NASDAQ: LILA and LILAK, OTC Link:

LILAB), which comprises our operations in Latin America and the

Caribbean.

Liberty Global's consumer brands are Virgin Media, Ziggo,

Unitymedia, Telenet, UPC, VTR and Liberty. Our operations also

include Liberty Global Business Services and Liberty Global

Ventures. For more information, please visit

www.libertyglobal.com.

_______________________________________

1 The adjusted growth rate for our FCF is based on (i) our

reported 2014 FCF plus the pre-acquisition FCF of Ziggo, with the

combined amount further adjusted to reflect the new Ziggo capital

structure and the change in our FCF definition, and (ii) our

reported 2015 FCF, adjusted to reflect the FX rates that were in

effect when we provided our 2015 FCF guidance. 2 We sold

substantially all of our legacy content business on January 31,

2014 (the "Chellomedia Sale"). Accordingly, we have presented the

disposed business as a discontinued operation for the year ended

December 31, 2014. 3 On July 1, 2015, Liberty Global completed the

"LiLAC Transaction" pursuant to which each holder of Liberty

Global’s then-outstanding ordinary shares remained a holder of the

same amount and class of new Liberty Global ordinary shares and

received one share of the corresponding class of LiLAC ordinary

shares for each 20 then-outstanding Liberty Global ordinary shares

held as of the record date for such distribution, with cash issued

in lieu of fractional LiLAC ordinary shares. The Liberty Global

ordinary shares following the LiLAC Transaction and the LiLAC

ordinary shares are tracking shares. Tracking shares are intended

by the issuing company to reflect or “track” the economic

performance of a particular business or “group,” rather than the

economic performance of the company as a whole. The Liberty Global

ordinary shares and the LiLAC ordinary shares are intended to

reflect or “track” the economic performance of the Liberty Global

Group and the LiLAC Group (each as defined and described below),

respectively. For more information regarding the tracking shares,

see note 1 to our consolidated financial statements included in our

annual report on Form 10-K filed on February 12, 2016 (the "10-K").

“Liberty Global Group” does not represent a separate legal entity,

rather it represents those businesses, assets and liabilities that

have been attributed to that group. The Liberty Global Group

comprises our businesses, assets and liabilities not attributed to

the LiLAC Group, including Virgin Media, Unitymedia, UPC Holding

BV, Telenet and Ziggo Group Holding. “LiLAC Group” does not

represent a separate legal entity, rather it represents those

businesses, assets and liabilities that have been attributed to

that group. The LiLAC Group comprises our operations in Latin

America and the Caribbean and has attributed to it VTR and Liberty

Puerto Rico. 4 Please see page 29 for the definition of RGUs.

Organic figures exclude RGUs of acquired entities at the date of

acquisition, but include the impact of changes in RGUs from the

date of acquisition. All subscriber/RGU additions or losses refer

to net organic changes, unless otherwise noted. 5 Please see page

17 for information on rebased growth. 6 Please see page 20 for our

Operating Cash Flow ("OCF") definition and the required

reconciliation. 7 Please see page 23 for information on Free Cash

Flow (“FCF”) and the required reconciliations. 8 Our

next-generation video base consists of Horizon TV, TiVo (in the

U.K.), Digital TV with Horizon-like user interface (in Belgium) as

well as Horizon Light set-top boxes. 9 Our gross and net debt

ratios are defined as total debt and net debt to annualized OCF of

the latest quarter. Net debt is defined as total debt less cash and

cash equivalents. For purposes of these calculations, debt is

measured using swapped foreign currency rates, consistent with the

covenant calculation requirements of our subsidiary debt

agreements, and, in the case of the Liberty Global Group, excludes

the loans backed by the shares we hold in Sumitomo Corp., ITV plc

and Lions Gate Entertainment Corp. 10 Liquidity refers to cash and

cash equivalents plus the maximum undrawn commitments under

subsidiary borrowing facilities, without regard to covenant

compliance calculations. 11 Our blended fully-swapped debt

borrowing cost represents the weighted average interest rate on our

aggregate variable- and fixed-rate indebtedness (excluding capital

lease obligations), including the effects of derivative

instruments, original issue premiums or discounts and commitment

fees, but excluding the impact of financing costs. 12 During 2015,

we initiated our “Liberty 3.0” program, which is a comprehensive

plan to drive top-line growth while maintaining tight cost

controls. The Liberty 3.0 program seeks to capitalize on revenue

opportunities associated with extensions of our network, mobile and

B2B, together with the realization of greater efficiencies by

leveraging our scale more effectively. Underpinning this program is

a commitment to customer centricity, which we believe is key to

succeeding in an ever more demanding consumer market. We expect

this transformation to occur over the next several years and, as

with any program of this magnitude, the benefits are expected to

materialize over time. We believe that the successful

implementation of Liberty 3.0 will, beginning in 2017, lead to

consolidated organic growth rates for revenue and OCF that are

meaningfully higher than our recent consolidated organic growth

rates. 13 Total B2B includes subscription (SOHO) and

non-subscription revenue. Non-subscription revenue includes the

amortization of deferred upfront installation fees and deferred

non-recurring fees received on B2B contracts where we maintain

ownership of the installed equipment. Most of this deferred revenue

relates to Virgin Media's B2B contracts, and in connection with the

application of the Virgin Media acquisition accounting, we

eliminated all of Virgin Media's B2B deferred revenue as of the

June 7, 2013 acquisition date. Due primarily to this acquisition

accounting, the amortization of Virgin Media's deferred revenue is

accounting for $5 million and $23 million of the increases in

Liberty Global Group's total B2B revenue for the three months and

year ended December 31, 2015, respectively. 14

The total NPV of synergies of €3.5 billion

is calculated after considering integration costs and includes

revenue synergies with an estimated net present value (“NPV") of

€1.0 billion and operating and capital cost synergies with an

estimated NPV of €2.5 billion. The full annual run-rate amount for

the operating and capital cost synergies of €280 million (including

at least €240 million of operating cost synergies) is expected to

be achieved during the fifth full year after closing. To achieve

these synergies, the JV expects to incur approximately €350 million

of integration costs, most of which will be incurred in the first

three years post completion.

15

The multiple is calculated by dividing a

pre-synergy enterprise value for Ziggo of €14 billion by the

adjusted segment OCF of Ziggo and Sport1 for the year ended

December 31, 2015 of €1,272 million. The adjusted Segment OCF of

Ziggo and Sport1 was calculated by deducting (i) estimated

recharges from Liberty Global to the Joint Venture of €81 million

from (ii) the actual combined segment OCF of Ziggo and Sport1 of

€1,352 million for the year ended December 31, 2015.

16

The range of cash to be received at

closing of €2.5 billion to €3.0 billion includes the €1.0 billion

estimated equalization payment from Vodafone and the assumed

combined proceeds of €1.5 billion to €2.0 billion from pre-closing

cash generated by Ziggo and our share of the proceeds from

additional joint venture leverage. The actual proceeds from

additional leverage will depend on the actual pre-closing

performance of the businesses to be contributed to the joint

venture and capital market conditions at closing. The assumed

proceeds from the pre-closing cash to be generated by Ziggo is

based on budgeted cash flows for Ziggo and assumes that the

transaction will close at or around December 31, 2016.

17

Our FCF guidance for 2016, which includes

the Netherlands, but excludes BASE and Cable & Wireless, is

based on FX rates at the date of this release.

18

Our three-year OCF guidance of 7% to 9%

growth excludes Ziggo, Cable & Wireless and BASE and is

intended to be calculated as a compound annual growth rate in 2018

with 2015 as the base year, after adjusting for acquisitions,

dispositions, FX and other factors that may affect the

comparability of 2018 and 2015 results.

19 Represents combined revenue generating units of Liberty Global

and Vodafone (as defined by each) as at December 31, 2015. 20

Covenant EBITDA is calculated in accordance with Ziggo’s

third-party debt agreements. 21

The JV agreement provides for the equal

distribution of all available cash, subject to minimum cash

balance, between Vodafone and Liberty Global

22 Enhanced Video Subscriber - please see page 29 for our Enhanced

Video Subscriber definition. 23 Enhanced video penetration is

calculated by dividing the number of enhanced video RGUs by the

total number of basic and enhanced video RGUs. 24 Our mobile

subscriber count represents the number of active subscriber

identification module (“SIM”) cards in service rather than services

provided. For example, if a mobile subscriber has both a data and

voice plan on a smartphone this would equate to one mobile

subscriber. Alternatively, a subscriber who has a voice and data

plan for a mobile handset and a data plan for a laptop (via a

dongle) would be counted as two mobile subscribers. Customers who

do not pay a recurring monthly fee are excluded from our mobile

telephony subscriber counts after periods of inactivity ranging

from 30 to 90 days, based on industry standards within the

respective country. 25 Average Revenue Per Unit (“ARPU”) refers to

the average monthly subscription revenue per average customer

relationship and is calculated by dividing the average monthly

subscription revenue (excluding mobile services, B2B services,

interconnect, channel carriage fees, mobile handset sales and

installation fees) for the indicated period, by the average of the

opening and closing balances for customer relationships for the

period. Customer relationships of entities acquired during the

period are normalized. Unless otherwise indicated, ARPU per

customer relationship for the Liberty Global Group and LiLAC Group

are not adjusted for currency impacts. ARPU per RGU refers to

average monthly subscription revenue per average RGU, which is

calculated by dividing the average monthly subscription revenue

(excluding mobile services, B2B services, interconnect, channel

carriage fees, mobile handset sales and installation fees) for the

indicated period, by the average of the opening and closing

balances of RGUs for the period. Unless otherwise noted, ARPU in

this release is considered to be ARPU per average customer

relationship. 26 In the U.K. and Belgium, we now offer our

customers the option to purchase a mobile handset pursuant to a

contract that is independent of a mobile airtime services contract

("split-contract programs"). Revenue associated with handsets sold

under our split-contract programs is recognized upfront and

included in other non-subscription revenue. We generally recognize

the full sales price for the mobile handset upon delivery,

regardless of whether the sales price is received upfront or in

installments. Revenue associated with the airtime services is

recognized as mobile subscription revenue over the contractual term

of the airtime services contract. Prior to our split-contract

programs, all revenue from handset sales that was contingent upon

delivering future airtime services was recognized over the life of

the customer contract as part of the monthly fee and included in

mobile subscription revenue. 27 Liberty Global Group's 11.5% and

15% rebased mobile revenue growth for Q4 and the full-year 2015,

respectively includes the positive impact of our split-contract

programs in the U.K. and Belgium, as further described in footnote

26. Our split-contract programs in the U.K. and Belgium had a net

positive effect on our mobile subscription and handset revenue of

$31.6 million in Q4 2015 and $115.5 million in full-year 2015. The

net positive effect of the split-contract programs is comprised of

(i) increases to handset revenue of $42.5 million and $157.1

million and (ii) decreases to mobile subscription revenue of $10.9

million and $41.6 million during Q4 2015 and the full-year 2015,

respectively. 28 OCF margin is calculated by dividing OCF by total

revenue for the applicable period. 29 Our property and equipment

additions include our capital expenditures on an accrual basis and

amounts financed under vendor financing or capital lease

arrangements. 30 Total debt includes capital lease obligations. 31

Our aggregate unused borrowing capacity of $3.9 billion represents

the maximum undrawn commitments under our subsidiaries' applicable

facilities without regard to covenant compliance calculations. This

consists of $3.7 billion attributed to the Liberty Global Group and

$231 million attributed to LiLAC Group. Upon completion of the

relevant December 31, 2015 compliance reporting requirements for

our credit facilities, and assuming no further changes from

quarter-end borrowing levels, we anticipate that our subsidiaries'

borrowing capacity would be $3.5 billion. This consists of $3.3

billion attributed to the Liberty Global Group and $231 million

attributed to the LiLAC Group.

Balance Sheets, Statements of Operations and Statements of

Cash Flows

The consolidated balance sheets, statements of operations and

statements of cash flows of Liberty Global are included in our

10-K. For attributed financial information of the Liberty Global

Group and the LiLAC Group, see Exhibit 99.1 to our 10-K.

Revenue and Operating Cash Flow

In the following tables, we present revenue and operating cash

flow by reportable segment of our continuing operations for the

three months and year ended December 31, 2015, as compared to the

corresponding prior-year periods. All of our reportable segments

derive their revenue primarily from broadband communications

services, including video, broadband internet and fixed-line

telephony services. Most of our reportable segments also provide

B2B and mobile services. For detailed information regarding the

composition of our reportable segments, including information

regarding a change to our reportable segments that we made during

the second quarter of 2015, see note 18 to our consolidated

financial statements included in our 10-K.

For purposes of calculating rebased growth rates on a comparable

basis for all businesses that we owned during 2015, we have

adjusted our historical revenue and OCF for the three months and

year ended December 31, 2014 to (i) include the pre-acquisition

revenue and OCF of certain entities acquired during 2014 and 2015

in our rebased amounts for the three months and year ended December

31, 2014 to the same extent that the revenue and OCF of such

entities are included in our results for the three months and year

ended December 31, 2015, (ii) remove intercompany eliminations for

the applicable periods in 2014 to conform to the presentation

during the 2015 periods following the disposal of the Chellomedia

operations, which resulted in previously eliminated intercompany

costs becoming third-party costs, (iii) exclude the pre-disposition

revenue and OCF of "offnet" subscribers in the U.K. that were

disposed in the fourth quarter of 2014 and the first half of 2015

from our rebased amounts for the three months and year ended

December 31, 2014 to the same extent that the revenue and OCF of

these disposed subscribers is excluded from our results for the

three months and year ended December 31, 2015, (iv) exclude the

revenue and OCF related to a partner network agreement that was

terminated shortly after the Ziggo acquisition from our rebased

amounts for the three months and year ended December 31, 2014 to

the same extent that the revenue and OCF from this partner network

is excluded from our results for the three months and year ended

December 31, 2015, (v) exclude the pre-disposition revenue, OCF and

associated intercompany eliminations of Film1, which was disposed

in the third quarter of 2015, from our rebased amounts for the

three months and year ended December 31, 2014 to the same extent

that the revenue, OCF and associated intercompany eliminations are

excluded from our results for the three months and year ended

December 31, 2015 and (vi) reflect the translation of our rebased

amounts for the three months and year ended December 31, 2014 at

the applicable average foreign currency exchange rates that were

used to translate our results for the three months and year ended

December 31, 2015. We have included Ziggo, Choice and two small

entities in whole or in part in the determination of our rebased

revenue and OCF for the three months ended December 31, 2014. We

have included Ziggo, Choice and four small entities in whole or in

part in the determination of our rebased revenue and OCF for the

year ended December 31, 2014. We have reflected the revenue and OCF

of the acquired entities in our 2014 rebased amounts based on what

we believe to be the most reliable information that is currently

available to us (generally pre-acquisition financial statements),

as adjusted for the estimated effects of (a) any significant

differences between Generally Accepted Accounting Principles in the

United States (“GAAP”) and local generally accepted accounting

principles, (b) any significant effects of acquisition accounting

adjustments, (c) any significant differences between our accounting

policies and those of the acquired entities and (d) other items we

deem appropriate. We do not adjust pre-acquisition periods to

eliminate non-recurring items or to give retroactive effect to any

changes in estimates that might be implemented during

post-acquisition periods. As we did not own or operate the acquired

businesses during the pre-acquisition periods, no assurance can be

given that we have identified all adjustments necessary to present

the revenue and OCF of these entities on a basis that is comparable

to the corresponding post-acquisition amounts that are included in

our historical results or that the pre-acquisition financial

statements we have relied upon do not contain undetected errors.

The adjustments reflected in our rebased amounts have not been

prepared with a view towards complying with Article 11 of

Regulation S-X. In addition, the rebased growth percentages are not

necessarily indicative of the revenue and OCF that would have

occurred if these transactions had occurred on the dates assumed

for purposes of calculating our rebased amounts or the revenue and

OCF that will occur in the future. The rebased growth percentages

have been presented as a basis for assessing growth rates on a

comparable basis, and are not presented as a measure of our pro

forma financial performance. Therefore, we believe our rebased data

is not a non-GAAP financial measure as contemplated by Regulation G

or Item 10 of Regulation S-K.

In each case, the following tables present (i) the amounts

reported by each of our reportable segments for the comparative

periods, (ii) the U.S. dollar change and percentage change from

period to period and (iii) the percentage change from period to

period on a rebased basis:

Three months ended Increase

Increase December 31, (decrease)

(decrease) Revenue 2015 2014

$ % Rebased % in millions, except %

amounts Liberty Global Group: European Operations

Division: U.K./Ireland $ 1,804.4 $ 1,802.3 $ 2.1 0.1 5.3 The

Netherlands 672.6 562.5 110.1 19.6 (3.0 ) Germany 607.1 655.1 (48.0

) (7.3 ) 5.7 Belgium 505.5 547.1 (41.6 ) (7.6 ) 5.4

Switzerland/Austria 432.2 445.0 (12.8 ) (2.9 ) 2.1

Total Western Europe 4,021.8 4,012.0 9.8 0.2 3.5 Central and

Eastern Europe 265.0 299.1 (34.1 ) (11.4 ) 1.4 Central and other

(1.7 ) (7.6 ) 5.9 N.M. * Total European

Operations Division 4,285.1 4,303.5 (18.4 ) (0.4 ) 3.5 Corporate

and other 8.4 15.8 (7.4 ) (46.8 ) * Intersegment eliminations (3.6

) (2.4 ) (1.2 ) N.M. *

Total Liberty Global Group

4,289.9 4,316.9 (27.0 ) (0.6 ) 3.5 LiLAC

Group: Chile 204.2 219.7 (15.5 ) (7.1 ) 8.4 Puerto Rico 105.1

78.5 26.6 33.9 4.6 Total LiLAC

Group 309.3 298.2 11.1 3.7 7.1

Inter-group eliminations — 0.1 (0.1 ) N.M.

*

Total $ 4,599.2 $ 4,615.2 $ (16.0 ) (0.3 ) 3.8

* - Omitted; N.M. - Not Meaningful

Year ended Increase

Increase December 31, (decrease)

(decrease) Revenue 2015 2014

$ % Rebased % in millions, except %

amounts Liberty Global Group: European Operations

Division: U.K./Ireland $ 7,058.7 $ 7,409.9 $ (351.2 ) (4.7 ) 3.9

The Netherlands 2,745.3 1,498.5 1,246.8 83.2 (1.7 ) Germany 2,399.5

2,711.5 (312.0 ) (11.5 ) 5.9 Belgium 2,021.0 2,279.4 (258.4 ) (11.3

) 6.1 Switzerland/Austria 1,758.2 1,846.1 (87.9 )

(4.8 ) 2.9 Total Western Europe 15,982.7 15,745.4 237.3 1.5

3.4 Central and Eastern Europe 1,066.6 1,259.5 (192.9 ) (15.3 ) 1.3

Central and other (5.4 ) (7.1 ) 1.7 N.M. *

Total European Operations Division 17,043.9 16,997.8 46.1 0.3 3.2

Corporate and other 42.3 70.8 (28.5 ) (40.3 ) * Intersegment

eliminations (23.5 ) (24.9 ) 1.4 N.M. * Total

Liberty Global Group 17,062.7 17,043.7 19.0

0.1 3.2 LiLAC Group: Chile 838.1 898.5 (60.4 ) (6.7 )

6.9 Puerto Rico 379.2 306.1 73.1 23.9

6.1 Total LiLAC Group 1,217.3 1,204.6 12.7

1.1 6.6 Total $ 18,280.0 $ 18,248.3

$ 31.7 0.2 3.4

* - Omitted; N.M. - Not Meaningful

Three months ended

Increase Increase December 31,

(decrease) (decrease) OCF 2015

2014 $ % Rebased % in

millions, except % amounts Liberty Global Group:

European Operations Division: U.K./Ireland $ 816.2 $ 802.4 $ 13.8

1.7 7.1 The Netherlands 392.0 314.4 77.6 24.7 1.7 Germany 390.3

400.7 (10.4 ) (2.6 ) 11.0 Belgium 224.2 247.1 (22.9 ) (9.3 ) 3.5

Switzerland/Austria 262.0 242.2 19.8 8.2

13.3 Total Western Europe 2,084.7 2,006.8 77.9 3.9 7.1

Central and Eastern Europe 118.5 133.9 (15.4 ) (11.5 ) 0.9 Central

and other (74.6 ) (68.2 ) (6.4 ) N.M. * Total European Operations

Division 2,128.6 2,072.5 56.1 2.7 6.2 Corporate and other (62.9 )

(61.9 ) (1.0 ) (1.6 ) * Total Liberty Global Group 2,065.7

2,010.6 55.1 2.7 6.3 LiLAC Group: LiLAC

Division: Chile 82.0 95.9 (13.9 ) (14.5 ) — Puerto Rico 46.5

33.5 13.0 38.8 6.7 Total LiLAC Division 128.5

129.4 (0.9 ) (0.7 ) 2.3 Corporate and other (1.1 ) (0.7 ) (0.4 )

N.M. * Total LiLAC Group 127.4 128.7 (1.3 ) (1.0 )

2.0 Total $ 2,193.1 $ 2,139.3 $ 53.8 2.5

6.1

* - Omitted; N.M. - Not Meaningful

Year ended Increase

Increase December 31, (decrease)

(decrease) OCF 2015 2014

$ % Rebased % in millions, except %

amounts Liberty Global Group: European Operations

Division: U.K./Ireland $ 3,162.1 $ 3,235.7 $ (73.6 ) (2.3 ) 6.3 The

Netherlands 1,519.5 857.9 661.6 77.1 (2.0 ) Germany 1,502.1 1,678.2

(176.1 ) (10.5 ) 7.1 Belgium 990.3 1,125.0 (134.7 ) (12.0 ) 5.6

Switzerland/Austria 1,040.1 1,056.4 (16.3 ) (1.5 )

6.0 Total Western Europe 8,214.1 7,953.2 260.9 3.3 4.7

Central and Eastern Europe 474.0 583.0 (109.0 ) (18.7 ) (2.7 )

Central and other (289.2 ) (282.7 ) (6.5 ) N.M. *

Total European Operations Division

8,398.9 8,253.5 145.4 1.8 3.7 Corporate and other (222.6 ) (212.0 )

(10.6 ) (5.0 ) * Intersegment eliminations — 4.0 (4.0

) N.M. * Total Liberty Global Group 8,176.3

8,045.5 130.8 1.6 3.5 LiLAC Group:

LiLAC Division: Chile 328.1 351.0 (22.9 ) (6.5 ) 6.9 Puerto Rico

167.2 128.9 38.3 29.7 9.9 Total

LiLAC Division 495.3 479.9 15.4 3.2 7.9 Corporate and other (4.3 )

(3.1 ) (1.2 ) N.M. * Total LiLAC Group 491.0

476.8 14.2 3.0 7.7 Total $ 8,667.3

$ 8,522.3 $ 145.0 1.7 3.7

* - Omitted; N.M. - Not Meaningful

Operating Cash Flow Definition and Reconciliation

As used herein, OCF has the same meaning as the term "Adjusted

OIBDA" that is referenced in our 10-K. OCF is the primary measure

used by our chief operating decision maker to evaluate segment

operating performance. OCF is also a key factor that is used by our

internal decision makers to (i) determine how to allocate resources

to segments and (ii) evaluate the effectiveness of our management

for purposes of annual and other incentive compensation plans. As

we use the term, OCF is defined as operating income before

depreciation and amortization, share-based compensation, provisions

and provision releases related to significant litigation and

impairment, restructuring and other operating items. Other

operating items include (a) gains and losses on the disposition of