Vodafone, Liberty Discuss Netherlands Joint Venture -- Update

February 02 2016 - 10:59AM

Dow Jones News

(Rewrites, adds detail.)

By Simon Zekaria and Razak Musah Baba

LONDON--British telecommunications giant Vodafone Group PLC

(VOD.LN) Tuesday said it was in talks with U.S. peer Liberty Global

PLC (LBTYA) to create a joint venture in the Netherlands, four

months after talks between the firms collapsed.

In a statement, Vodafone, based in Newbury, England, said the

venture would incorporate both companies' operating businesses in

the Netherlands. It said discussions were ongoing and didn't extend

beyond the Dutch venture, adding that there was no certainty of any

agreement.

Vodafine's statement didn't provide financial details, further

details on the structure of the venture or a timeline for

negotiations. Liberty Global wasn't immediately available for

comment.

At 1439 GMT, Vodafone shares had fallen 1.4% to 222 pence,

valuing the company at 59.9 billion pounds ($86.3 billion).

Vodafone has a 39% share of core mobile revenue in the

Netherlands, and at the end of last year it began legal action

against competitor Royal KPN NV (KKPNY), alleging its Dutch rival

delayed the introduction of Vodafone's competing suite of

television, fixed-line broadband and fixed-line telephone services

in the Netherlands by three years. Liberty, which is based in the

U.S. but focused on Europe, acquired KPN's Dutch cable rival Ziggo

for nearly $10 billion in 2014.

Last September Vodafone terminated talks with Liberty regarding

a possible exchange of selected assets between the two companies,

without disclosing the types of assets under consideration or

geographic locality. Vodafone had confirmed early-stage talks in

June 2015, but ruled out any discussions over a full-blown

merger.

In May 2015, Liberty Global Chairman John Malone signalled his

company's interest in a deal with Vodafone, saying the U.K.

telecoms firm, which is the largest global mobile operator after

China Mobile Ltd., would be a "great fit" with his cable operator,

which is the largest in Europe by number of subscribers.

Liberty, with headquarters in both Englewood, Colo., and London,

operates in some of Europe's biggest markets, including Germany,

the Netherlands and the U.K., where it owns Virgin Media Inc.

Liberty has been on the acquisition hunt in recent years to snap up

cable operators in Europe, where it has the majority of its

broadband networks.

Vodafone, meanwhile, has also been looking at European

acquisitions. Indeed it has purchased fixed-line assets in Germany

and Spain to shore up its flagging mobile business in Europe and

bolster its position as a unified media player in a

rapidly-evolving market of bundled services.

Like Liberty, Vodafone derives the majority of its profit and

sales from the continent, with a focus on Germany, Italy and

Spain.

The talks between Liberty and Vodafone are part of a recent

frenzy of European television and communications deal-making in

recent years, with telecom and cable operators eager to benefit

from the so-called "quadruple-play" -offering services that

encompass fixed telephony, mobile, Internet broadband and

pay-television. The packaged offerings are aimed at boosting

subscriber revenue and winning consumer loyalty.

Over-the-top streaming platforms such as Netflix Inc. have also

started to eat into their potential market, adding pressure to bulk

up. The continent's telecom players have suffered in recent years

from fragmented markets across Europe and slow growth, which hasn't

picked up much since the depths of the global economic crisis and

Europe's painful recession.

Write to Simon Zekaria at simon.zekaria@wsj.com and Razak Musah

Baba at razak.baba@wsj.com

(END) Dow Jones Newswires

February 02, 2016 10:44 ET (15:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

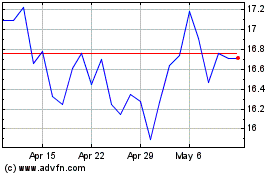

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

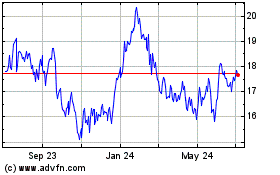

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024