BT 2Q Profit Beats Forecasts

October 29 2015 - 4:05AM

Dow Jones News

By Simon Zekaria

LONDON--BT Group PLC (BT.A.LN) Thursday lauded its strategic

direction as the U.K.-based telecommunications group recorded a

forecast-beating rise in quarterly profit, with demand for its

fiber-optic Internet broadband and sports television channels

boosting business.

The U.K. group's net profit in its second quarter, ended Sept.

30, rose to 525 million pounds ($801 million), compared with a

market consensus forecast of GBP481 million, up from GBP446 million

in the same period a year earlier.

BT's closely-watched earnings before interest, taxes,

depreciation and amortization on an adjusted basis fell 1%

year-over-year to GBP1.44 billion, hit by spending on its sports TV

business.

Revenue in the second quarter on an adjusted basis was unchanged

at GBP4.38 billion, higher than a consensus market forecast of

GBP4.33 billion. Excluding exceptional items, foreign exchange

movements and acquisitions or disposals, as well as transit costs,

revenue rose 2%.

"Our strategy is delivering and our results show we're on track

to achieve our outlook for the year," said Chief Executive Gavin

Patterson.

The telecom company competes with rivals such as Sky PLC and

Liberty Global PLC's Virgin Media for subscribers in the U.K.'s

competitive telephony and media services market. To attract

broadband users, BT has spent billions of dollars on premium sports

content.

The group recommended an interim dividend of 4.4 pence, up

13%.

BT shares closed Wednesday at 469 pence, valuing the company at

GBP39.2 billion.

Write to Simon Zekaria at simon.zekaria@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 03:50 ET (07:50 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

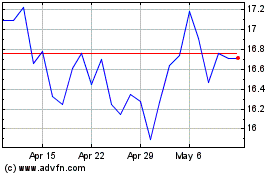

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

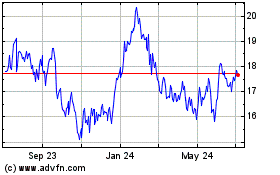

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024