EU Opens Probe Into Liberty Global-BASE Deal

October 05 2015 - 1:30PM

Dow Jones News

BRUSSELS—European Union antitrust regulators have launched an

investigation into Liberty Global PLC's latest €1.3 billion ($1.4

Billion) consolidation move in Europe, three days after EU

antitrust chief Margrethe Vestager warned that some

telecommunications mergers in the region could face a rough ride

from her agency.

The European Commission, the bloc's top antitrust regulator,

said on Monday it was concerned that the planned purchase of

Belgian mobile-phone operator BASE Company NV by Liberty Global's

Telenet Group Holding NV could lead to higher prices and less

choice for Belgian consumers.

The deal, announced in April, is expected to make Telenet's

mobile business more competitive and boost its presence in Belgium,

where Liberty Global has eyed growth.

BASE is the third-largest mobile network operator in Belgium

with 3.3 million mobile subscribers and adjusted revenue of €690

million last year. Its current owner is Dutch telecommunications

company Royal KPN NV.

In a statement, the commission said the deal "may reduce

competition in the retail mobile telephony market in Belgium, where

Telenet and BASE currently compete against each other."

"We want to make sure that consumers in Belgium do not suffer

higher prices and less choice as a result of this proposed

takeover," Ms. Vestager said.

A spokesman for Liberty Global said the company would continue

to work with antitrust authorities, and remains "confident that the

proposed transaction will be cleared."

A spokesman for BASE said the company is aware of the EU's

decision to open an investigation, but declined to comment

further.

The commission now has until Feb. 18, 2016 to investigate the

proposed acquisition and to decide whether to approve the deal or

ask the companies for concessions to ease its concerns. If it fails

to reach an agreement on how to bring the acquisition in line with

EU competition rules, the commission can also decide to block the

merger.

Telenet offers fixed-line services such as TV and broadband in

Flanders and parts of Brussels, as well as mobile services as a

so-called virtual operator. Such operators don't own their own

mobile networks but piggyback on those of others.

The EU said it had concerns that the merger "would significantly

reduce the incentives for BASE to offer virtual operators access to

its mobile network."

Once the deal is completed, Belgium's mobile phone market will

be divided across three large operators: Telenet and Mobistar SA,

with a market share of around 30% each, and Belgacom SA, with a

market share of around 40%.

Ms. Vestager has been vocal in recent weeks in warning against

mobile-phone mergers that reduce the number of operators in a given

country from four to three.

"Research seems to suggest that a reduction of the number of

players from four-to-three in a national mobile market in the EU

can lead to higher prices for consumers…but not that it leads to

more investment per subscriber," Ms. Vestager said in a speech in

New York on Friday.

Scandinavian telecom operators Telenor ASA and TeliaSonera AB in

September abandoned plans to merge their Danish businesses into a

joint venture after failing to secure EU antitrust approval.

Spun off from Liberty Media Corp., media mogul John Malone's

Liberty Global is the largest international cable company, with

operations in 14 countries. The London company has been shifting

focus to Europe, with a series of large acquisitions, including

U.K.'s Virgin Media Inc. and Dutch cable operator Ziggo NV, seeking

to profit from rising demand for bundles of television, broadband

and telephone and mobile services.

Write to Tom Fairless at tom.fairless@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 05, 2015 13:15 ET (17:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

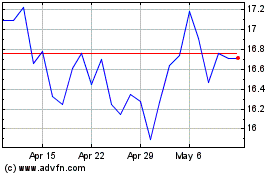

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

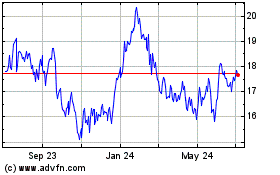

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024