- Highlighting the value of our

well-positioned Latin American and Caribbean operations

- Will create “pure-play” equity focused

on the region

Liberty Global plc (“Liberty Global”) (NASDAQ: LBTYA, LBTYB and

LBTYK) today reiterates its commitment to creating a tracking stock

for its operations in Latin America and the Caribbean (the “LiLAC

Group”) and urges its shareholders to vote “FOR” the tracking stock

proposals at its shareholders’ meetings on Tuesday, February 24,

2015. As previously disclosed, the LiLAC Group will initially have

attributed to it Liberty Global’s Chilean business, VTR, the

largest cable operator in Chile, and its 60% interest in the

largest cable company in Puerto Rico, Liberty Cablevision.

CEO Mike Fries commented, “Over the last ten years, we have

demonstrated a track record of substantial equity value creation,

effective and disciplined capital allocation, and M&A prowess.

We believe that the creation of LiLAC shares will represent another

positive step for us. The tracking stock proposals would create a

pure-play investment vehicle in Latin America and the Caribbean,

positioning us to enhance long-term shareholder value and create

additional strategic flexibility and optionality.”

“The underlying businesses in Chile and Puerto Rico performed

very well in 2014, as we added 130,000 RGUs and delivered 16%

rebased OCF growth on a combined basis. Looking ahead, we are

excited about our organic growth potential, and see significant

opportunity to expand in a region where broadband penetration is

just 25% and pay-TV take-up is in the low 40%’s.”

While the reasons for pursuing the tracking stock proposals,

including the benefits and advantages of such proposals, are set

forth in detail in the December 29, 2014 proxy statement/prospectus

relating to the shareholders’ meetings, today we are emphasizing

the following:

- Create a

“pure-play” cable stock for Latin America and the Caribbean,

providing greater choice for shareholders

- LiLAC shares would give investors the

ability to decide where they want to invest depending on their

investment objectives and regional focus.

- Because there are few listed Latin

American pay-TV companies, LiLAC shares would present a rare

investment opportunity for investors interested in that asset

class.

- LiLAC shares will enhance transparency

for investors regarding our regional operations, providing

increased focus and additional clarity with respect to the LiLAC

Group’s performance and outlook.

- Seize upon

significant organic growth potential

- Today, we are the number one cable

operator in each of Chile and Puerto Rico, passing 3.7 million

homes and servicing 1.5 million customers taking 3.2 million

service subscriptions, and generating $1.2 billion of revenue in

2014 on a combined basis. Within these two markets, our long-term

strategy is focused on capitalizing on our video and broadband

product leadership and our superior fixed-line network to expand

our subscriber base and drive ARPU growth.

- We believe there is ample room to drive

video (33%) and broadband (36%) penetrations1 higher from current

levels, leveraging our track record of innovation and

market-leading brands.

- In addition, there are substantial

revenue growth opportunities for us in mobile services and

business-to-business, which together accounted for less than 5% of

2014 LiLAC revenue.

- Leverage the

synergies from experience, scale and multi-layered

management

- The issuance of LiLAC shares will allow

us to retain the advantages of our global scale by sharing

technology innovation, purchasing power, best practices and

strategic and financial benefits. For example, we intend to launch

our next-generation Horizon TV platform in Chile and Puerto Rico

based on our success in Europe.

- The LiLAC Group would benefit from a

multi-layered group of highly-experienced management, including a

seasoned management team at the Liberty Global level, a dedicated

divisional management team focused on the Latin American and

Caribbean region, and our local management teams that focus

exclusively on our operations in Chile and Puerto Rico.

- Unlock M&A

and capital market opportunities supported by a strong regional

presence

- Our strong and stable Latin American

assets provide an ideal platform for consolidation in the region

and for raising capital to support our organic growth as well as

potential M&A requirements. We are confident that our extensive

M&A experience and expertise in the region will create

interesting strategic opportunities that might otherwise get

“lost,” absent a separate security tracking the value of the assets

in that region.

As a reminder, because we are a British company, all of our

shareholders (including holders of Class C shares) have an

opportunity to vote on the tracking stock proposals. This means

that we have scheduled meetings for each of our classes of ordinary

shares on February 24, 2015. While our December 29, 2014 proxy

statement/prospectus outlines, in detail, all of the matters being

presented to our shareholders, the tracking stock proposals

represent only a subset of the proposals to be voted on at the

shareholders meetings.

The following table summarizes the tracking stock proposals.

Tracking Stock Proposals

New Articles Proposal** –Proposal 1

Management PoliciesProposal – Proposal

2

Future Consolidation/Sub-DivisionProposal

– Proposal 3

General Meeting* X X X Class A Meeting X Class B Meeting X Class C

Meeting X *

Class A and Class B shareholders vote together as a class.

** For purposes of each of the class meetings, this proposal is

referred to as the “Class A Articles Proposal,” the “Class B

Articles Proposal” and the “Class C Articles Proposal,”

respectively.

We remain confident that the creation of the LiLAC Group and

issuance of the tracking stock is in the best interest of all

Liberty Global shareholders and will enhance shareholder value. Our

board of directors remains fully committed to its implementation

and strongly recommends that shareholders vote in favor of the

tracking stock proposals.

Forward Looking Statements

This press release contains forward-looking statements,

including statements regarding our growth prospects, strategy and

opportunities with respect to our operations in Latin American and

the Caribbean, the creation of LiLAC shares and the anticipated

consequences and benefits thereof and other information and

statements that are not historical fact. These forward-looking

statements involve certain risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by these statements. These risks and uncertainties include the

satisfaction of certain conditions to the creation of the tracking

stock, the continued use by subscribers and potential subscribers

of our services and their willingness to upgrade to our more

advanced offerings, our ability to meet challenges from

competition, to manage rapid technological change or to maintain or

increase rates to our subscribers or to pass through increased

costs to our subscribers, the effects of changes in laws or

regulation, general economic factors, our ability to obtain

regulatory approval and satisfy regulatory conditions associated

with acquisitions and dispositions, our ability to successfully

acquire and integrate new businesses and realize anticipated

efficiencies from businesses we acquire, the availability of

attractive programming for our digital video services and the costs

associated with such programming, our ability to achieve forecasted

financial and operating targets, the outcome of any pending or

threatened litigation, our ability to access cash of our

subsidiaries and the impact of our future financial performance, or

market conditions generally, on the availability, terms and

deployment of capital, fluctuations in currency exchange and

interest rates, the ability of vendors and suppliers to timely

deliver quality products, equipment, software and services, as well

as other factors detailed from time to time in Liberty Global’s

filings with the SEC including Liberty Global’s recently filed

registration statement on Form S-4 relating to the issuance of

LiLAC shares and Form 10-K. These forward-looking statements speak

only as of the date of this release. We expressly disclaim any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statement contained herein to reflect any

change in the expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based, except to the extent required by applicable law.

Additional Information and Where to Find It

Nothing in this press release shall constitute a solicitation to

buy or subscribe for or an offer to sell any securities of Liberty

Global, including Liberty Global’s proposed new LiLAC Group shares

or Liberty Global’s existing ordinary shares. The issuance of LiLAC

shares will only be made pursuant to an effective registration

statement. In connection with the proposed issuance of LiLAC

shares, Liberty Global has filed a registration statement on Form

S-4 with the SEC. SHAREHOLDERS OF LIBERTY GLOBAL ARE URGED TO READ

THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS

CONTAINED THEREIN (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Shareholders can obtain

a free copy of the registration statement including the proxy

statement/prospectus contained therein, as well as other filings

containing information about Liberty Global, without charge, at the

SEC's internet site (http://www.sec.gov). Copies of the

registration statement and other filings by Liberty Global with the

SEC that are incorporated by reference therein can also be

obtained, without charge, by directing a request to Liberty Global

plc, 12300 Liberty Boulevard, Englewood, CO 80112, USA, Attention:

Investor Relations.

Participants in a Solicitation

The directors and executive officers of Liberty Global and other

persons may be deemed to be participants in the solicitation of

proxies in respect of proposals relating to the approval of the

issuance of LiLAC shares. Information regarding the directors and

executive officers of Liberty Global and other participants in the

proxy solicitations and a description of their respective direct

and indirect interests, by security holdings or otherwise, is

contained in Liberty Global’s proxy statement filed with the SEC on

April 30, 2014.

About Liberty Global

Liberty Global is the largest international cable company with

operations in 14 countries. We connect people to the digital world

and enable them to discover and experience its endless

possibilities. Our market-leading triple-play services are provided

through next-generation networks and innovative technology

platforms that connected 27 million customers subscribing to 56

million television, broadband internet and telephony services at

December 31, 2014. In addition, we served 5 million mobile

subscribers across nine countries at year-end 2014.

Liberty Global's consumer brands include Virgin Media, UPC,

Ziggo, Unitymedia, Kabel BW, Telenet and VTR. Our operations also

include Liberty Global Business Services, our commercial division,

and Liberty Global Ventures, our investment fund. For more

information, please visit www.libertyglobal.com.

1 Video penetration is calculated by dividing the number of

video RGUs by total homes passed and broadband penetration is

calculated by dividing the number of internet RGUs by the number of

two-way homes passed.

Liberty Global plcInvestor

Relations:Oskar Nooij, +1 303 220 4218Christian

Fangmann, +49 221 8462 5151John Rea, +1 303 220 4238orCorporate Communications:Marcus Smith, +44

20 7190 6374Bert Holtkamp, +31 20 778 9800Hanne Wolf, +1 303 220

6678

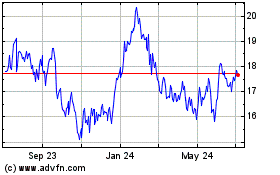

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

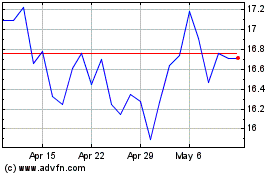

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024