UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 30, 2015

Lakeland Bancorp, Inc.

(Exact name of registrant as specified in its charter)

| New Jersey |

000-17820 |

22-2953275 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 250 Oak Ridge Road, Oak Ridge, New Jersey |

07438 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code: (973) 697-2000

________________________________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On January 30, 2015, Lakeland Bancorp, Inc. ("Company") disseminated a press release reporting fourth quarter results for the period ended December 31, 2014. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 8.01. Other Events.

In the press release referred to in Item 2.02, the Company reported the following events. On January 27, 2015, the Company declared a $0.075 cash dividend per common share payable on February 17, 2015 to shareholders of record at the close of business February 10, 2015.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit 99.1 Press Release, dated January 30, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Lakeland Bancorp, Inc.

(Registrant)

|

January 30, 2015

(Date) |

|

/s/ THOMAS J. SHARA

Thomas J. Shara

President and Chief Executive Officer |

EXHIBIT 99.1

Lakeland Bancorp Reports Record Full Year Results

OAK RIDGE, N.J., Jan. 30, 2015 (GLOBE NEWSWIRE) -- Lakeland Bancorp, Inc. (Nasdaq:LBAI) (the "Company") reported the following results for the fourth quarter of 2014 and for the year ended December 31, 2014:

-

Net Income for the fourth quarter of 2014 was $7.9 million, an 8% increase compared to $7.3 million for the fourth quarter of 2013. Earnings per diluted share in the fourth quarter of 2014 were $0.21, compared to $0.19 in the fourth quarter of 2013. Annualized Return on Average Assets was 0.90%, Annualized Return on Average Common Equity was 8.35%, and Annualized Return on Average Tangible Common Equity was 11.87%. Tangible book value per common share at December 31, 2014 was $7.06, an increase of 12% compared to year-end 2013.

-

Net Income for the year ended December 31, 2014 was $31.1 million, or $0.82 per diluted share, compared to $25.0 million, or $0.71 per diluted share, for 2013. Excluding pre-tax merger related expenses of $2.8 million in 2013, Net Income was $27.1 million or $0.77 per diluted share. For 2014, Return on Average Assets was 0.92%, the Return on Average Common Equity was 8.48%, and the Return on Average Tangible Common Equity was 12.21%.

-

Fourth quarter 2014 results included approximately $0.5 million in pretax, one-time expenses relating to the decision to close three (3) branch offices in early 2015 and the termination of a pension plan.

-

At December 31, 2014, loans totaled $2.66 billion, an increase of $42.2 million, or 2%, from September 30, 2014, and $185.3 million, or 8%, compared to December 31, 2013. The overall increase was primarily in total commercial loans, which increased by $175.2 million, or 11%, in 2014.

-

Total deposits were $2.79 billion at December 31, 2014, an increase of $81.6 million, or 3%, from 2013. Non-interest-bearing demand deposits, which totaled $646.1 million at year-end 2014, increased by $45.4 million, or 8%, from December 31, 2013. Non-interest-bearing demand deposits represented 23% of total deposits at year-end 2014.

-

Net Interest Margin ("NIM") in the fourth quarter of 2014 was 3.58%, which equaled NIM for the third quarter of 2014. For the full year 2014, NIM was 3.64%, a five basis point decrease from 2013.

-

The Provision for Loan and Lease Losses in the fourth quarter of 2014 was $1.6 million compared to $1.7 million for the same period in 2013. For the full year 2014, the provision totaled $5.9 million, which was 37% lower than the $9.3 million reported for 2013. Net charge-offs at $5.0 million (0.19% of average loans) for the full year 2014 were 41% lower than the $8.5 million (0.36% of average loans) for 2013.

-

On January 27, 2015, the Company declared a quarterly cash dividend of $0.075 per common share, payable on February 17, 2015 to holders of record as of the close of business on February 10, 2015.

Thomas J. Shara, Lakeland Bancorp's President and CEO said, "We are very pleased to report strong fourth quarter earnings, as well as record Net Income for the full year 2014, which increased by 15% compared to 2013 results, excluding merger related expenses. This improvement resulted from strong commercial loan growth, a stable Net Interest Margin as compared to the third quarter of 2014, and controlled noninterest expenses."

Earnings

As previously noted, the Company acquired Somerset Hills Bancorp ("Somerset Hills"), which had total assets of $355.9 million at the time of acquisition, on May 31, 2013. The Company's financial statements reflect the impact of the merger from the date of acquisition, which should be considered when comparing the full year results of 2014 and 2013.

Net Interest Income

Net interest income for the fourth quarter of 2014 was $28.9 million, as compared to $28.0 million for the same period in 2013, an increase of 3%. In the fourth quarter of 2014, Net Interest Margin ("NIM") was 3.58%, which equaled the NIM of the third quarter of 2014, and compared to 3.70% in the fourth quarter of 2013. The decrease in NIM in the fourth quarter of 2014 as compared to the similar period in 2013 was primarily due to a decrease in the yield on interest-earning assets. The annualized yield on interest-earning assets declined 12 basis points from 3.99% in the fourth quarter of 2013 to 3.87% for the fourth quarter of 2014. This decrease was primarily due to a 19 basis point decrease in the yield on average loans, as loans originated and refinanced in 2014 were made at lower rates in the current interest rate environment. The annualized cost of interest-bearing liabilities increased one basis point from 0.38% in the fourth quarter of 2013 to 0.39% in the fourth quarter of 2014, as liability costs have remained fairly stable.

For the year ended December 31, 2014, net interest income at $113.6 million compared to $104.5 million reported for 2013, an increase of $9.0 million, or 9%. NIM was 3.64% for 2014 compared to 3.69% for 2013. The Company's yield on interest-earning assets decreased 11 basis points from 4.03% for the year-ended December 31, 2013 to 3.92% for 2014. The Company's cost of interest-bearing liabilities decreased six basis points from 0.44% for 2013 to 0.38% for 2014.

Noninterest Income

Noninterest income totaled $4.5 million for the fourth quarter of 2014, as compared to $5.5 million for the same period in 2013. Included in noninterest income in the fourth quarter of 2013 were $0.3 million in gains on sales of investment securities and a $0.6 million gain on the sale of an OREO property. Excluding these items, noninterest income in the fourth quarter of 2014 at $4.5 million was equivalent to the total for the same period in 2013. Service charges on deposit accounts totaling $2.6 million decreased 6% from the fourth quarter of 2013, primarily due to a decline in overdraft fees, while commissions and fees totaling $1.2 million increased by 7% primarily due to increased investment commission income. Other income at $0.3 million was $0.6 million lower than the total for the fourth quarter of 2013, reflecting the aforementioned gain on sale of OREO.

Noninterest income totaled $17.7 million for the year-ended December 31, 2014 compared to $21.0 million for 2013. Included in noninterest income in 2013 were $0.8 million in gains on sales of investment securities, a $1.2 million gain on debt extinguishment, and the gain on sale of OREO. Excluding these items, noninterest income for 2014 at $17.7 million compared to $18.3 million in 2013. Service charges on deposit accounts at $10.5 million decreased by 3%, while commissions and fees at $4.6 million was equivalent to the total in 2013. Other income at $1.1 million decreased by $1.0 million primarily due to the OREO gain in 2013, as well as reductions in both gains on sales of mortgage loans and loan swap income in 2014.

Noninterest Expense

Noninterest expense for the fourth quarter of 2014 was $20.2 million compared to $20.7 million for the same period in 2013. Included in the fourth quarter 2014 totals were $0.3 million in costs associated with the termination of a pension plan and $0.2 million in expenses relating to anticipated branch closures in 2015, while fourth quarter 2013 totals included $0.7 million in long-term debt prepayment fees and $0.6 million in additional audit fees. Excluding these items, noninterest expense in the fourth quarter of 2014 at $19.7 million compared to $19.4 for the same period in 2013. Salary and benefit expense at $11.8 million, which included the $0.3 million benefit plan termination cost, increased by $1.1 million from the same period last year. Net occupancy, furniture and equipment expenses at $3.8 million were equivalent to last year's fourth quarter total. Other expenses at $2.6 million were $1.0 million lower than last year's fourth quarter total, primarily due to increased audit fees. The efficiency ratio for the fourth quarter of 2014 was 59.9%.

Noninterest expense for the full year 2014 at $79.1 million compared to $78.7 million for 2013. Included in the total for 2014 was $0.5 million in non-recurring items described in the fourth quarter noninterest expense analysis. Included in the 2013 total were $2.8 million in merger related costs, $1.2 million in long-term debt prepayment fees, and $0.6 million in audit fees. Excluding these items, noninterest expense for 2014 totaled $78.6 million compared to $74.1 million in 2013, an increase of 6%. Noninterest expense in 2013 only included Somerset Hills' expenses from the May 31, 2013 merger date. Salary and benefit expense at $45.2 million increased by 8%, partially due to increased staffing due to the Somerset Hills merger. Net occupancy, furniture and equipment expenses at $15.5 million were $1.2 million higher than 2013 primarily due to expenses relating to the six new branches acquired in the Somerset Hills merger, as well as a $0.4 million increase in snow removal costs in the first quarter of 2014. Other expenses totaling $11.4 million were $0.2 million lower than the total for 2013.

Financial Condition

At December 31, 2014, total assets were $3.54 billion, an increase of $220.5 million, or 7%, from December 31, 2013. As previously mentioned, total loans were $2.66 billion, an increase of $185.3 million, or 8%, in 2014. Total deposits were $2.79 billion as of December 31, 2014, an increase of $81.6 million from December 31, 2013. Noninterest demand deposits at $646.1 million increased by $45.4 million, or 8%, in 2014, while interest-bearing deposits at $2.1 billion increased by 2%.

Asset Quality

At December 31, 2014, non-performing assets totaled $21.7 million (0.61% of total assets) compared to $17.5 million (0.53% of total assets) at December 31, 2013. The Allowance for Loan and Lease Losses totaled $30.7 million at December 31, 2014 and represented 1.16% of total loans. In the fourth quarter of 2014, the Company had net charge offs totaling $1.0 million compared to $1.6 million in the fourth quarter of 2013. For the year ended December 31, 2014, the Company had net charge-offs of $5.0 million (0.19% of average loans), as compared to $8.5 million (0.36% of average loans) for 2013. The provision for loan and lease losses in the fourth quarter of 2014 was $1.6 million, compared to $1.7 million for the same period of 2013, and was $5.9 million for 2014, compared to $9.3 million for 2013.

Capital

At December 31, 2014, stockholders' equity was $379.4 million. Book value per common share was $10.01 and tangible book value was $7.06, an increase of 12% from December 31, 2013. As of December 31, 2014, the Company's leverage ratio was 9.08%. Tier I and total risk based capital ratios were 11.76% and 12.98%, respectively. The Tangible Common Equity ratio was 7.81%, an increase from 7.46% reported at December 31, 2013. These regulatory capital ratios exceed those necessary to be considered a well-capitalized institution under Federal guidelines.

Forward-Looking Statements

The information disclosed in this document includes various forward-looking statements (with respect to corporate objectives, trends, and other financial and business matters) that are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words "anticipates", "projects", "intends", "estimates", "expects", "believes", "plans", "may", "will", "should", "could", and other similar expressions are intended to identify such forward-looking statements. Lakeland cautions that these forward-looking statements are necessarily speculative and speak only as of the date made, and are subject to numerous assumptions, risks and uncertainties, all of which may change over time. Actual results could differ materially from such forward-looking statements. The following factors, among others, could cause actual results to differ materially and adversely from such forward-looking statements: changes in the financial services industry and the U.S. and global capital markets, changes in economic conditions nationally, regionally and in the Company's markets, the nature and timing of actions of the Federal Reserve Board and other regulators, the nature and timing of legislation affecting the financial services industry, government intervention in the U.S. financial system, changes in levels of market interest rates, pricing pressures on loan and deposit products, credit risks of the Company's lending and leasing activities, customers' acceptance of the Company's products and services, and competition. Any statements made by Lakeland that are not historical facts should be considered to be forward-looking statements. Lakeland is not obligated to update and does not undertake to update any of its forward-looking statements made herein.

EXPLANATION OF NON-GAAP FINANCIAL MEASURES

Reported amounts are presented in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The Company's management believes that the supplemental non-GAAP information, which consists of measurements and ratios based on tangible equity and tangible assets, is utilized by regulators and market analysts to evaluate a company's financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures which may be presented by other companies.

The Company also uses an efficiency ratio that is a non-GAAP financial measure. The ratio that the Company uses excludes amortization of core deposit intangibles, expenses on other real estate owned and other repossessed assets, provision for unfunded lending commitments and, where applicable, long-term debt prepayment fees and merger related expenses. Income for the non-GAAP ratio is increased by the favorable effect of tax-exempt income and excludes securities gains and losses and gain on debt extinguishment, which can vary from period to period. The Company uses this ratio because it believes the ratio provides a better comparison of period to period operating performance.

About Lakeland Bank

Lakeland Bancorp, the holding company for Lakeland Bank, has $3.5 billion in total assets with 51 offices spanning eight northern New Jersey counties: Bergen, Essex, Morris, Passaic, Somerset, Sussex, Union and Warren. Lakeland Bank is the second largest commercial bank headquartered in the state and offers an extensive array of consumer and commercial products and services, including online and mobile banking, localized commercial lending teams, and 24-hour or less turnaround time on consumer loan applications. For more information about the full line of products and services, visit LakelandBank.com.

|

|

|

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

Year Ended December 31, |

|

|

|

|

|

|

|

|

2014 |

2013 |

2014 |

2013 |

|

|

(Dollars in thousands except per share amounts) |

|

INCOME STATEMENT |

|

|

|

|

|

Net Interest Income |

$ 28,850 |

$ 27,973 |

$ 113,566 |

$ 104,542 |

|

Provision for Loan and Lease Losses |

(1,589) |

(1,687) |

(5,865) |

(9,343) |

|

Noninterest Income: |

|

|

|

|

|

Other Noninterest Income |

4,469 |

5,139 |

17,720 |

18,925 |

|

Gains on investment securities |

-- |

333 |

2 |

839 |

|

Gain on debt extinguishment |

-- |

-- |

-- |

1,197 |

|

Long-term debt prepayment fee |

-- |

(683) |

-- |

(1,209) |

|

Merger related expenses |

-- |

(7) |

-- |

(2,834) |

|

Noninterest Expense |

(20,178) |

(20,024) |

(79,135) |

(74,698) |

|

Pretax Income |

11,552 |

11,044 |

46,288 |

37,419 |

|

Tax Expense |

(3,613) |

(3,703) |

(15,159) |

(12,450) |

|

Net Income |

$ 7,939 |

$ 7,341 |

$ 31,129 |

$ 24,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings Per Common Share (1) |

$ 0.21 |

$ 0.19 |

$ 0.82 |

$ 0.71 |

|

Diluted Earnings Per Common Share (1) |

$ 0.21 |

$ 0.19 |

$ 0.82 |

$ 0.71 |

|

Dividends per Common Share (1) |

$ 0.075 |

$ 0.071 |

$ 0.293 |

$ 0.271 |

|

Weighted Average Shares - Basic (1) |

37,765 |

37,436 |

37,749 |

34,742 |

|

Weighted Average Shares - Diluted (1) |

37,920 |

37,649 |

37,869 |

34,902 |

|

|

|

|

|

|

|

SELECTED OPERATING RATIOS |

|

|

|

|

|

Annualized Return on Average Assets |

0.90% |

0.88% |

0.92% |

0.80% |

|

Annualized Return on Average Common Equity |

8.35% |

8.30% |

8.48% |

7.78% |

|

Annualized Return on Average Tangible Common Equity (2) |

11.87% |

12.23% |

12.21% |

11.42% |

|

Annualized Return on Interest Earning Assets |

3.87% |

3.99% |

3.92% |

4.03% |

|

Annualized Cost of Interest Bearing Liabilities |

0.39% |

0.38% |

0.38% |

0.44% |

|

Annualized Net Interest Spread |

3.48% |

3.61% |

3.54% |

3.59% |

|

Annualized Net Interest Margin |

3.58% |

3.70% |

3.64% |

3.69% |

|

Efficiency ratio (2) |

59.87% |

59.44% |

59.35% |

59.74% |

|

Stockholders' equity to total assets |

|

|

10.72% |

10.59% |

|

Book value per common share (1) |

|

|

$ 10.01 |

$ 9.28 |

|

Tangible book value per common share (1) (2) |

|

|

$ 7.06 |

$ 6.31 |

|

Tangible common equity to tangible assets (1) (2) |

|

|

7.81% |

7.46% |

|

|

|

|

|

|

|

ASSET QUALITY RATIOS |

|

|

12/31/2014 |

12/31/2013 |

|

Ratio of allowance for loan and lease losses to total loans |

|

1.16% |

1.21% |

|

Non-accruing loans to total loans |

|

|

0.78% |

0.69% |

|

Non-performing assets to total assets |

|

|

0.61% |

0.53% |

|

Annualized net charge-offs to average loans |

|

|

0.19% |

0.36% |

|

|

|

|

|

|

|

SELECTED BALANCE SHEET DATA AT PERIOD-END |

|

12/31/2014 |

12/31/2013 |

|

Loans and Leases |

|

|

$ 2,655,614 |

$ 2,470,289 |

|

Allowance for Loan and Lease Losses |

|

|

(30,684) |

(29,821) |

|

Investment Securities |

|

|

575,271 |

540,788 |

|

Total Assets |

|

|

3,538,325 |

3,317,791 |

|

Total Deposits |

|

|

2,790,819 |

2,709,205 |

|

Short-Term Borrowings |

|

|

108,935 |

81,991 |

|

Other Borrowings |

|

|

243,736 |

160,238 |

|

Stockholders' Equity |

|

|

379,438 |

351,424 |

|

|

|

|

|

|

|

SELECTED AVERAGE BALANCE SHEET DATA |

For the Three Months Ended |

For the Year Ended |

|

|

12/31/2014 |

12/31/2013 |

12/31/2014 |

12/31/2013 |

|

Loans and Leases, net |

$ 2,622,602 |

$ 2,427,505 |

$ 2,568,056 |

$ 2,317,158 |

|

Investment Securities |

566,039 |

535,210 |

543,806 |

497,017 |

|

Interest-Earning Assets |

3,227,390 |

3,023,256 |

3,147,266 |

2,856,045 |

|

Total Assets |

3,483,162 |

3,291,865 |

3,400,461 |

3,102,860 |

|

Non Interest-Bearing Demand Deposits |

679,796 |

638,016 |

652,685 |

576,421 |

|

Savings Deposits |

384,064 |

382,062 |

384,715 |

370,980 |

|

Interest-Bearing Transaction Accounts |

1,487,492 |

1,450,055 |

1,454,967 |

1,341,691 |

|

Time Deposits |

277,930 |

301,640 |

283,905 |

309,384 |

|

Total Deposits |

2,829,282 |

2,771,773 |

2,776,272 |

2,598,476 |

|

Short-Term Borrowings |

38,653 |

36,928 |

55,798 |

45,701 |

|

Other Borrowings |

221,848 |

117,353 |

186,022 |

123,347 |

|

Total Interest-Bearing Liabilities |

2,409,988 |

2,288,039 |

2,365,407 |

2,191,103 |

|

Stockholders' Equity |

377,379 |

351,067 |

367,210 |

320,823 |

|

|

|

|

|

|

|

(1) Adjusted for 5% stock dividend paid on June 17, 2014 to shareholders of record June 3, 2014 |

|

(2) See supplemental information - non-GAAP financial measures |

|

|

|

|

|

Lakeland Bancorp, Inc. and Subsidiaries |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

Year Ended December 31, |

|

|

2014 |

2013 |

2014 |

2013 |

|

(dollars in thousands, except per share amounts) |

|

|

|

|

|

INTEREST INCOME |

|

|

|

|

|

Loans and fees |

$ 28,182 |

$ 27,207 |

$ 110,587 |

$ 104,329 |

|

Federal funds sold and interest bearing deposits with banks |

25 |

36 |

71 |

93 |

|

Taxable investment securities and other |

2,592 |

2,441 |

10,040 |

7,985 |

|

Tax exempt investment securities |

429 |

461 |

1,805 |

1,792 |

|

TOTAL INTEREST INCOME |

31,228 |

30,145 |

122,503 |

114,199 |

|

INTEREST EXPENSE |

|

|

|

|

|

Deposits |

1,302 |

1,349 |

5,064 |

6,089 |

|

Federal funds purchased and securities sold under agreements to repurchase |

9 |

3 |

78 |

39 |

|

Other borrowings |

1,067 |

820 |

3,795 |

3,529 |

|

TOTAL INTEREST EXPENSE |

2,378 |

2,172 |

8,937 |

9,657 |

|

NET INTEREST INCOME |

28,850 |

27,973 |

113,566 |

104,542 |

|

Provision for loan and lease losses |

1,589 |

1,687 |

5,865 |

9,343 |

|

NET INTEREST INCOME AFTER PROVISION FOR |

|

|

|

|

|

LOAN AND LEASE LOSSES |

27,261 |

26,286 |

107,701 |

95,199 |

|

NONINTEREST INCOME |

|

|

|

|

|

Service charges on deposit accounts |

2,612 |

2,785 |

10,523 |

10,837 |

|

Commissions and fees |

1,168 |

1,090 |

4,634 |

4,585 |

|

Gains on sales and calls of investment securities |

-- |

333 |

2 |

839 |

|

Gain on debt extinguishment |

-- |

-- |

-- |

1,197 |

|

Income on bank owned life insurance |

363 |

374 |

1,453 |

1,410 |

|

Other income |

326 |

890 |

1,110 |

2,093 |

|

TOTAL NONINTEREST INCOME |

4,469 |

5,472 |

17,722 |

20,961 |

|

NONINTEREST EXPENSE |

|

|

|

|

|

Salaries and employee benefits |

11,827 |

10,766 |

45,167 |

41,871 |

|

Net occupancy expense |

2,190 |

2,153 |

8,865 |

8,074 |

|

Furniture and equipment |

1,647 |

1,689 |

6,605 |

6,181 |

|

Stationery, supplies and postage |

347 |

396 |

1,403 |

1,482 |

|

Marketing expense |

534 |

650 |

2,025 |

2,088 |

|

FDIC insurance expense |

518 |

509 |

2,019 |

2,014 |

|

Legal expense |

309 |

98 |

945 |

1,032 |

|

Other real estate owned and other repossessed assets expense |

69 |

9 |

234 |

24 |

|

Long-term debt prepayment fee |

-- |

683 |

-- |

1,209 |

|

Merger related expenses |

-- |

7 |

-- |

2,834 |

|

Core deposit intangible amortization |

111 |

124 |

464 |

288 |

|

Other expenses |

2,626 |

3,630 |

11,408 |

11,644 |

|

TOTAL NONINTEREST EXPENSE |

20,178 |

20,714 |

79,135 |

78,741 |

|

INCOME BEFORE PROVISION FOR INCOME TAXES |

11,552 |

11,044 |

46,288 |

37,419 |

|

Provision for income taxes |

3,613 |

3,703 |

15,159 |

12,450 |

|

NET INCOME |

$ 7,939 |

$ 7,341 |

$ 31,129 |

$ 24,969 |

|

EARNINGS PER COMMON SHARE (1) |

|

|

|

|

|

Basic |

$ 0.21 |

$ 0.19 |

$ 0.82 |

$ 0.71 |

|

Diluted |

$ 0.21 |

$ 0.19 |

$ 0.82 |

$ 0.71 |

|

DIVIDENDS PER COMMON SHARE (1) |

$ 0.075 |

$ 0.071 |

$ 0.293 |

$ 0.271 |

|

|

|

|

|

|

|

(1) Adjusted for 5% stock dividend paid on June 17, 2014 to shareholders of record June 3, 2014 |

|

|

|

|

|

Lakeland Bancorp, Inc. and Subsidiaries |

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

December 31, |

December 31, |

|

ASSETS |

2014 |

2013 |

|

(dollars in thousands) |

(Unaudited) |

|

|

Cash and due from banks |

$ 102,549 |

$ 94,205 |

|

Federal funds sold and interest-bearing deposits due from banks |

6,767 |

8,516 |

|

Total cash and cash equivalents |

109,316 |

102,721 |

|

|

|

|

|

Investment securities available for sale, at fair value |

457,449 |

431,106 |

|

Investment securities held to maturity; fair value of $109,030 in 2014 and $100,394 in 2013 |

107,976 |

101,744 |

|

Federal Home Loan Bank and other membership stocks, at cost |

9,846 |

7,938 |

|

Loans held for sale |

592 |

1,206 |

|

Loans: |

|

|

|

Commercial, secured by real estate |

1,593,781 |

1,442,980 |

|

Commercial, industrial and other |

238,252 |

213,808 |

|

Leases |

54,749 |

41,332 |

|

Residential mortgages |

431,190 |

432,831 |

|

Consumer and home equity |

337,642 |

339,338 |

|

Total loans |

2,655,614 |

2,470,289 |

|

Net deferred costs |

(1,788) |

(1,273) |

|

Allowance for loan and lease losses |

(30,684) |

(29,821) |

|

Net loans |

2,623,142 |

2,439,195 |

|

Premises and equipment, net |

35,675 |

37,148 |

|

Accrued interest receivable |

8,896 |

8,603 |

|

Goodwill |

109,974 |

109,974 |

|

Other identifiable intangible assets |

1,960 |

2,424 |

|

Bank owned life insurance |

57,476 |

55,968 |

|

Other assets |

16,023 |

19,764 |

|

TOTAL ASSETS |

$ 3,538,325 |

$ 3,317,791 |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

LIABILITIES: |

|

|

|

Deposits: |

|

|

|

Noninterest bearing |

$ 646,052 |

$ 600,652 |

|

Savings and interest-bearing transaction accounts |

1,864,805 |

1,812,467 |

|

Time deposits under $100,000 |

165,625 |

180,859 |

|

Time deposits $100,000 and over |

114,337 |

115,227 |

|

Total deposits |

2,790,819 |

2,709,205 |

|

Federal funds purchased and securities sold under agreements to repurchase |

108,935 |

81,991 |

|

Other borrowings |

202,498 |

119,000 |

|

Subordinated debentures |

41,238 |

41,238 |

|

Other liabilities |

15,397 |

14,933 |

|

TOTAL LIABILITIES |

3,158,887 |

2,966,367 |

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

Common stock, no par value; authorized 70,000,000 shares; issued 37,910,840 shares at December 31, 2014 and 37,873,800 shares at December 31, 2013 |

384,095 |

364,637 |

|

Accumulated Deficit |

(6,180) |

(8,538) |

|

|

|

|

|

Treasury shares, at cost, no shares at December 31, 2014 and December 31, 2013 |

-- |

-- |

|

Accumulated other comprehensive gain (loss) |

1,523 |

(4,675) |

|

TOTAL STOCKHOLDERS' EQUITY |

379,438 |

351,424 |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

$ 3,538,325 |

$ 3,317,791 |

|

|

|

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

Dec 31, |

Sept 30, |

Jun 30, |

Mar 31, |

Dec 31, |

|

(dollars in thousands, except per share data) |

2014 |

2014 |

2014 |

2014 |

2013 |

|

INCOME STATEMENT |

|

|

Net Interest Income |

$ 28,850 |

$ 28,452 |

$ 28,419 |

$ 27,845 |

$ 27,973 |

|

Provision for Loan and Lease Losses |

(1,589) |

(1,194) |

(1,593) |

(1,489) |

(1,687) |

|

Noninterest Income: |

|

|

|

|

|

|

Other Noninterest Income |

4,469 |

4,809 |

4,371 |

4,071 |

5,139 |

|

Gains on Investment Securities |

-- |

-- |

-- |

2 |

333 |

|

Long-term Debt Prepayment Fee |

-- |

-- |

-- |

-- |

(683) |

|

Other Noninterest Expense |

(20,178) |

(19,685) |

(19,530) |

(19,742) |

(20,031) |

|

Pretax Income |

11,552 |

12,382 |

11,667 |

10,687 |

11,044 |

|

Tax Expense |

(3,613) |

(4,136) |

(3,886) |

(3,524) |

(3,703) |

|

Net Income |

$ 7,939 |

$ 8,246 |

$ 7,781 |

$ 7,163 |

$ 7,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings Per Common Share (1) |

$ 0.21 |

$ 0.22 |

$ 0.20 |

$ 0.19 |

$ 0.19 |

|

Diluted Earnings Per Common Share (1) |

$ 0.21 |

$ 0.22 |

$ 0.20 |

$ 0.19 |

$ 0.19 |

|

Dividends Per Common Share (1) |

$ 0.075 |

$ 0.075 |

$ 0.071 |

$ 0.071 |

$ 0.071 |

|

Dividends Paid |

$ 2,853 |

$ 2,853 |

$ 2,717 |

$ 2,705 |

$ 2,688 |

|

Weighted Average Shares - Basic (1) |

37,765 |

37,738 |

37,740 |

37,683 |

37,436 |

|

Weighted Average Shares - Diluted (1) |

37,920 |

37,862 |

37,850 |

37,806 |

37,649 |

|

|

|

|

|

|

|

|

SELECTED OPERATING RATIOS |

|

|

|

|

|

|

Annualized Return on Average Assets |

0.90% |

0.95% |

0.93% |

0.88% |

0.88% |

|

Annualized Return on Average Common Equity |

8.35% |

8.83% |

8.58% |

8.14% |

8.30% |

|

Annualized Return on Tangible Common Equity (2) |

11.87% |

12.66% |

12.41% |

11.88% |

12.23% |

|

Annualized Net Interest Margin |

3.58% |

3.58% |

3.69% |

3.72% |

3.70% |

|

Efficiency ratio (2) |

59.87% |

57.97% |

58.73% |

60.90% |

59.44% |

|

Common stockholders' equity to total assets |

10.72% |

10.65% |

10.57% |

10.62% |

10.59% |

|

Tangible common equity to tangible assets (2) |

7.81% |

7.69% |

7.59% |

7.55% |

7.46% |

|

Tier 1 risk-based ratio |

11.76% |

11.75% |

11.54% |

11.76% |

11.73% |

|

Total risk-based ratio |

12.98% |

12.97% |

12.75% |

13.01% |

12.98% |

|

Tier 1 leverage ratio |

9.08% |

9.02% |

9.06% |

9.01% |

8.90% |

|

Book value per common share (1) |

$ 10.01 |

$ 9.83 |

$ 9.70 |

$ 9.48 |

$ 9.28 |

|

Tangible book value per common share (1) (2) |

$ 7.06 |

$ 6.87 |

$ 6.74 |

$ 6.52 |

$ 6.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted for 5% stock dividend paid on June 17, 2014 to shareholders of record June 3, 2014 |

|

(2) See Supplemental Information - Non - GAAP financial measures |

|

|

|

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

Dec 31, |

Sept 30, |

Jun 30, |

Mar 31, |

Dec 31, |

|

(dollars in thousands) |

2014 |

2014 |

2014 |

2014 |

2013 |

|

|

|

|

SELECTED BALANCE SHEET DATA AT PERIOD-END |

|

|

|

|

|

Loans and Leases |

$ 2,655,614 |

$ 2,613,404 |

$ 2,610,198 |

$ 2,504,626 |

$ 2,470,289 |

|

Allowance for Loan and Lease Losses |

(30,684) |

(30,047) |

(29,866) |

(29,520) |

(29,821) |

|

Investment Securities |

575,271 |

558,032 |

530,934 |

533,165 |

540,788 |

|

Total Assets |

3,538,325 |

3,498,905 |

3,479,548 |

3,386,720 |

3,317,791 |

|

Total Deposits |

2,790,819 |

2,776,931 |

2,726,850 |

2,736,733 |

2,709,205 |

|

Short-Term Borrowings |

108,935 |

112,796 |

156,511 |

115,952 |

81,991 |

|

Other Borrowings |

243,736 |

220,938 |

215,238 |

160,238 |

160,238 |

|

Stockholders' Equity |

379,438 |

372,539 |

367,833 |

359,539 |

351,424 |

|

|

|

|

|

|

|

|

Loans and Leases |

|

|

|

|

|

|

Commercial real estate |

$ 1,593,781 |

$ 1,557,168 |

$ 1,551,071 |

$ 1,486,274 |

$ 1,442,980 |

|

Commercial, industrial and other |

238,252 |

231,961 |

237,071 |

208,056 |

213,808 |

|

Leases |

54,749 |

52,285 |

50,191 |

43,720 |

41,332 |

|

Residential mortgages |

431,190 |

431,477 |

433,634 |

430,559 |

432,831 |

|

Consumer and Home Equity |

337,642 |

340,513 |

338,231 |

336,017 |

339,338 |

|

Total loans |

$ 2,655,614 |

$ 2,613,404 |

$ 2,610,198 |

$ 2,504,626 |

$ 2,470,289 |

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

Noninterest bearing |

$ 646,052 |

$ 674,933 |

$ 649,186 |

$ 630,499 |

$ 600,652 |

|

Savings and interest-bearing transaction accounts |

1,864,805 |

1,820,657 |

1,797,358 |

1,816,084 |

1,812,467 |

|

Time deposits under $100,000 |

165,625 |

168,391 |

169,655 |

177,284 |

180,859 |

|

Time deposits $100,000 and over |

114,337 |

112,950 |

110,651 |

112,866 |

115,227 |

|

Total deposits |

$ 2,790,819 |

$ 2,776,931 |

$ 2,726,850 |

$ 2,736,733 |

$ 2,709,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED AVERAGE BALANCE SHEET DATA |

|

|

|

|

|

Loans and Leases, net |

$ 2,622,602 |

$ 2,608,687 |

$ 2,552,010 |

$ 2,486,990 |

$ 2,427,505 |

|

Investment Securities |

566,039 |

529,379 |

537,974 |

541,721 |

535,210 |

|

Interest-Earning Assets |

3,227,390 |

3,183,361 |

3,114,539 |

3,061,555 |

3,023,256 |

|

Total Assets |

3,483,162 |

3,443,946 |

3,360,289 |

3,312,709 |

3,291,865 |

|

Non Interest-Bearing Demand Deposits |

679,796 |

671,049 |

640,080 |

618,944 |

638,016 |

|

Savings Deposits |

384,064 |

382,642 |

387,179 |

385,007 |

382,062 |

|

Interest-Bearing Transaction Accounts |

1,487,492 |

1,457,680 |

1,433,382 |

1,440,770 |

1,450,055 |

|

Time Deposits |

277,930 |

280,200 |

284,475 |

293,225 |

301,640 |

|

Total Deposits |

2,829,282 |

2,791,571 |

2,745,116 |

2,737,946 |

2,771,773 |

|

Short-Term Borrowings |

38,653 |

49,725 |

78,475 |

56,602 |

36,928 |

|

Other Borrowings |

221,848 |

217,049 |

158,432 |

145,580 |

117,353 |

|

Total Interest-Bearing Liabilities |

2,409,988 |

2,387,295 |

2,341,944 |

2,321,184 |

2,288,039 |

|

Stockholders' Equity |

377,379 |

370,448 |

363,802 |

356,951 |

351,067 |

|

|

|

|

|

Lakeland Bancorp, Inc. |

|

Financial Highlights |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

Dec 31, |

Sept 30, |

Jun 30, |

Mar 31, |

Dec 31, |

|

(dollars in thousands) |

2014 |

2014 |

2014 |

2014 |

2013 |

|

|

|

|

AVERAGE ANNUALIZED YIELDS (taxable equivalent basis) |

|

|

|

|

|

Assets: |

|

|

|

|

|

|

Loans and leases |

4.26% |

4.25% |

4.33% |

4.39% |

4.45% |

|

Taxable investment securities and other |

2.09% |

2.08% |

2.18% |

2.19% |

2.12% |

|

Tax-exempt securities |

3.75% |

3.79% |

3.74% |

3.80% |

3.83% |

|

Federal funds sold and interest-bearing cash accounts |

0.26% |

0.21% |

0.15% |

0.16% |

0.24% |

|

Total interest-earning assets |

3.87% |

3.87% |

3.97% |

3.99% |

3.99% |

|

Liabilities: |

|

|

|

|

|

|

Savings accounts |

0.05% |

0.05% |

0.05% |

0.05% |

0.05% |

|

Interest-bearing transaction accounts |

0.23% |

0.23% |

0.23% |

0.23% |

0.23% |

|

Time deposits |

0.54% |

0.49% |

0.51% |

0.56% |

0.60% |

|

Borrowings |

1.65% |

1.63% |

1.50% |

1.63% |

2.13% |

|

Total interest-bearing liabilities |

0.39% |

0.39% |

0.36% |

0.36% |

0.38% |

|

Net interest spread (taxable equivalent basis) |

3.48% |

3.48% |

3.60% |

3.63% |

3.61% |

|

Annualized Net Interest Margin (taxable equivalent basis) |

3.58% |

3.58% |

3.69% |

3.72% |

3.70% |

|

Annualized Cost of Deposits |

0.18% |

0.18% |

0.18% |

0.19% |

0.19% |

|

|

|

|

|

|

|

|

ASSET QUALITY DATA |

|

|

|

|

|

|

Allowance for Loan and Lease Losses |

|

|

|

|

|

|

Balance at beginning of period |

$ 30,047 |

$ 29,866 |

$ 29,520 |

$ 29,821 |

$ 29,757 |

|

Provision for loan losses |

1,589 |

1,194 |

1,593 |

1,489 |

1,687 |

|

Net Charge-offs |

(952) |

(1,013) |

(1,247) |

(1,790) |

(1,623) |

|

Balance at end of period |

$ 30,684 |

$ 30,047 |

$ 29,866 |

$ 29,520 |

$ 29,821 |

|

|

|

|

|

|

|

|

Net Loan Charge-offs (Recoveries) |

|

|

|

|

|

|

Commercial real estate |

$ (287) |

$ 28 |

$ (152) |

$ 1,613 |

$ 928 |

|

Commercial, industrial and other |

99 |

(71) |

511 |

(578) |

100 |

|

Leases |

185 |

229 |

126 |

39 |

(2) |

|

Home equity and consumer |

860 |

638 |

411 |

567 |

244 |

|

Real estate - mortgage |

95 |

189 |

351 |

149 |

353 |

|

Net charge-offs |

$ 952 |

$ 1,013 |

$ 1,247 |

$ 1,790 |

$ 1,623 |

|

|

|

|

|

|

|

|

Nonperforming Assets |

|

|

|

|

|

|

Commercial real estate |

$ 7,612 |

$ 8,549 |

$ 9,647 |

$ 12,279 |

$ 8,528 |

|

Commercial, industrial and other |

308 |

599 |

700 |

246 |

88 |

|

Leases |

88 |

141 |

61 |

143 |

-- |

|

Home equity and consumer |

3,415 |

2,114 |

2,251 |

2,431 |

2,175 |

|

Real estate - mortgage |

9,246 |

7,221 |

6,730 |

6,875 |

6,141 |

|

Total non-accruing loans |

20,669 |

18,624 |

19,389 |

21,974 |

16,932 |

|

Property acquired through foreclosure or repossession |

1,026 |

982 |

850 |

698 |

520 |

|

Total non-performing assets |

$ 21,695 |

$ 19,606 |

$ 20,239 |

$ 22,672 |

$ 17,452 |

|

|

|

|

|

|

|

|

Loans past due 90 days or more and still accruing |

$ 66 |

$ 429 |

$ 286 |

$ 451 |

$ 1,997 |

|

Loans restructured and still accruing |

$ 10,579 |

$ 7,957 |

$ 6,818 |

$ 6,086 |

$ 10,289 |

|

|

|

|

|

|

|

|

Ratio of allowance for loan and lease losses to total loans |

1.16% |

1.15% |

1.14% |

1.18% |

1.21% |

|

Non-performing loans to total loans |

0.78% |

0.71% |

0.74% |

0.88% |

0.69% |

|

Non-performing assets to total assets |

0.61% |

0.56% |

0.58% |

0.67% |

0.53% |

|

Annualized net charge-offs to average loans |

0.15% |

0.16% |

0.20% |

0.29% |

0.27% |

|

|

|

|

|

Lakeland Bancorp, Inc. |

|

Supplemental Information - Non-GAAP Financial Measures |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the Quarter Ended, |

|

|

Dec 31, |

Sept 30, |

Jun 30, |

Mar 31, |

Dec 31, |

|

(dollars in thousands, except per share amounts) |

2014 |

2014 |

2014 |

2014 |

2013 |

|

Calculation of tangible book value per common share |

|

|

|

|

|

|

Total common stockholders' equity at end of period - GAAP |

$ 379,438 |

$ 372,539 |

$ 367,833 |

$ 359,539 |

$ 351,424 |

|

Less: |

|

|

|

|

|

|

Goodwill |

109,974 |

109,974 |

109,974 |

109,974 |

109,974 |

|

Other identifiable intangible assets, net |

1,960 |

2,071 |

2,182 |

2,301 |

2,424 |

|

Total tangible common stockholders' equity at end of period - Non- GAAP |

$ 267,504 |

$ 260,494 |

$ 255,677 |

$ 247,264 |

$ 239,026 |

|

|

|

|

|

|

|

|

Shares outstanding at end of period (1) |

37,911 |

37,910 |

37,914 |

37,912 |

37,874 |

|

|

|

|

|

|

|

|

Book value per share - GAAP (1) |

$ 10.01 |

$ 9.83 |

$ 9.70 |

$ 9.48 |

$ 9.28 |

|

|

|

|

|

|

|

|

Tangible book value per share - Non-GAAP (1) |

$ 7.06 |

$ 6.87 |

$ 6.74 |

$ 6.52 |

$ 6.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of tangible common equity to tangible assets |

|

|

|

|

|

|

Total tangible common stockholders' equity at end of period - Non- GAAP |

$ 267,504 |

$ 260,494 |

$ 255,677 |

$ 247,264 |

$ 239,026 |

|

|

|

|

|

|

|

|

Total assets at end of period |

$ 3,538,325 |

$ 3,498,905 |

$ 3,479,548 |

$ 3,386,720 |

$ 3,317,791 |

|

Less: |

|

|

|

|

|

|

Goodwill |

109,974 |

109,974 |

109,974 |

109,974 |

109,974 |

|

Other identifiable intangible assets, net |

1,960 |

2,071 |

2,182 |

2,301 |

2,424 |

|

Total tangible assets at end of period - Non-GAAP |

$ 3,426,391 |

$ 3,386,860 |

$ 3,367,392 |

$ 3,274,445 |

$ 3,205,393 |

|

|

|

|

|

|

|

|

Common equity to assets - GAAP |

10.72% |

10.65% |

10.57% |

10.62% |

10.59% |

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets - Non-GAAP |

7.81% |

7.69% |

7.59% |

7.55% |

7.46% |

|

|

|

|

|

|

|

|

Calculation of return on average tangible common equity |

|

|

|

|

|

|

Net income - GAAP |

$ 7,939 |

$ 8,246 |

$ 7,781 |

$ 7,163 |

$ 7,341 |

|

|

|

|

|

|

|

|

Total average common stockholders' equity |

377,379 |

370,448 |

363,802 |

356,951 |

351,067 |

|

Less: |

|

|

|

|

|

|

Average goodwill |

109,974 |

109,974 |

109,974 |

109,974 |

110,376 |

|

Average other identifiable intangible assets, net |

2,028 |

2,141 |

2,256 |

2,379 |

2,496 |

|

Total average tangible common stockholders' equity - Non - GAAP |

$ 265,377 |

$ 258,333 |

$ 251,572 |

$ 244,598 |

$ 238,195 |

|

|

|

|

|

|

|

|

Return on average common stockholders' equity - GAAP |

8.35% |

8.83% |

8.58% |

8.14% |

8.30% |

|

|

|

|

|

|

|

|

Return on average tangible common stockholders' equity - Non-GAAP |

11.87% |

12.66% |

12.41% |

11.88% |

12.23% |

|

|

|

|

|

|

|

|

Calculation of efficiency ratio |

|

|

|

|

|

|

Total non-interest expense |

$ 20,178 |

$ 19,685 |

$ 19,530 |

$ 19,742 |

$ 20,714 |

|

Less: |

|

|

|

|

|

|

Amortization of core deposit intangibles |

(111) |

(111) |

(119) |

(123) |

(124) |

|

Other real estate owned and other repossessed asset (expense) income |

(69) |

(50) |

(100) |

(15) |

(9) |

|

Long-term debt prepayment fee |

-- |

-- |

-- |

-- |

(683) |

|

Merger related expenses |

-- |

-- |

-- |

-- |

(7) |

|

Provision for unfunded lending commitments, net |

89 |

(106) |

93 |

(11) |

(63) |

|

Non-interest expense, as adjusted |

$ 20,087 |

$ 19,418 |

$ 19,404 |

$ 19,593 |

$ 19,828 |

|

|

|

|

|

|

|

|

Net interest income |

$ 28,850 |

$ 28,452 |

$ 28,419 |

$ 27,845 |

$ 27,973 |

|

Total noninterest income |

4,469 |

4,809 |

4,371 |

4,073 |

5,472 |

|

Total revenue |

33,319 |

33,261 |

32,790 |

31,918 |

33,445 |

|

Plus: Tax-equivalent adjustment on municipal securities |

231 |

235 |

251 |

255 |

248 |

|

Less: |

|

|

|

|

|

|

Gains on debt extinguishment |

-- |

-- |

-- |

-- |

-- |

|

Gains on sales investment securities |

-- |

-- |

-- |

(2) |

(333) |

|

Total revenue, as adjusted |

$ 33,550 |

$ 33,496 |

$ 33,041 |

$ 32,171 |

$ 33,360 |

|

|

|

|

|

|

|

|

Efficiency ratio - Non-GAAP |

59.87% |

57.97% |

58.73% |

60.90% |

59.44% |

|

|

|

|

|

|

|

|

(1) Adjusted for 5% stock dividend paid on June 17, 2014 to shareholders of record June 3, 2014 |

|

|

|

|

|

|

|

Lakeland Bancorp, Inc. |

|

Supplemental Information - Non-GAAP Financial Measures |

|

(Unaudited) |

|

|

|

|

|

|

For the Year Ended, |

|

|

December 31, |

December 31, |

|

(dollars in thousands, except per share amounts) |

2014 |

2013 |

|

Calculation of return on average tangible common equity |

|

|

|

Net income - GAAP |

$ 31,129 |

$ 24,969 |

|

|

|

|

|

Total average common stockholders' equity |

$ 367,210 |

$ 320,823 |

|

Less: |

|

|

|

Average goodwill |

109,974 |

100,753 |

|

Average other identifiable intangible assets, net |

2,200 |

1,513 |

|

Total average tangible common stockholders' equity - Non GAAP |

$ 255,036 |

$ 218,557 |

|

|

|

|

|

Return on average common stockholders' equity - GAAP |

8.48% |

7.78% |

|

|

|

|

|

Return on average tangible common stockholders' equity - Non-GAAP |

12.21% |

11.42% |

|

|

|

|

|

Calculation of efficiency ratio |

|

|

|

Total non-interest expense |

$ 79,135 |

$ 78,741 |

|

Less: |

|

|

|

Amortization of core deposit intangibles |

(464) |

(288) |

|

Other real estate owned and other repossessed asset expense |

(234) |

(24) |

|

Long-term debt prepayment fee |

-- |

(1,209) |

|

Merger related expenses |

-- |

(2,834) |

|

Provision for unfunded lending commitments |

65 |

(55) |

|

Non-interest expense, as adjusted |

$ 78,502 |

$ 74,331 |

|

|

|

|

|

Net interest income |

$ 113,566 |

$ 104,542 |

|

Noninterest income |

17,722 |

20,961 |

|

Total revenue |

131,288 |

125,503 |

|

Plus: Tax-equivalent adjustment on municipal securities |

972 |

965 |

|

Less: |

|

|

|

Gains on investment securities |

(2) |

(839) |

|

Gains on extinguishment of debt |

-- |

(1,197) |

|

Total revenue, as adjusted |

$ 132,258 |

$ 124,432 |

|

|

|

|

|

Efficiency ratio - Non - GAAP |

59.35% |

59.74% |

CONTACT: Thomas J. Shara

President & CEO

Joseph F. Hurley

EVP & CFO

973-697-2000

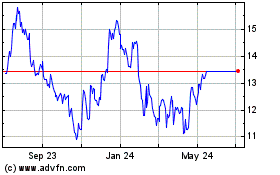

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lakeland Bancorp (NASDAQ:LBAI)

Historical Stock Chart

From Apr 2023 to Apr 2024