UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 6, 2015

LAMAR ADVERTISING COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-36756 |

|

72-1449411 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5321 Corporate Boulevard, Baton Rouge, Louisiana 70808

(Address of principal executive offices and zip code)

(225) 926-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2015, Lamar Advertising Company announced via press release its results for the quarter ended March 31, 2015. A copy of Lamar’s press

release is hereby furnished to the Commission and incorporated by reference herein as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of Lamar Advertising Company, dated May 6, 2015, reporting Lamar’s financial results for the quarter ended March 31, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: May 6, 2015 |

|

|

|

LAMAR ADVERTISING COMPANY |

|

|

|

|

|

|

|

|

By: |

|

/s/ Keith A. Istre |

|

|

|

|

|

|

Keith A. Istre |

|

|

|

|

|

|

Treasurer and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of Lamar Advertising Company, dated May 6, 2015, reporting Lamar’s financial results for the quarter ended March 31, 2015. |

Exhibit 99.1

5321 Corporate Boulevard

Baton Rouge, LA 70808

Lamar Advertising Company Announces

First Quarter 2015 Operating Results

Three Month Results

| |

• |

|

Net revenue increased 6.2% to $302.5 million |

| |

• |

|

Adjusted EBITDA increased 13.6% to $118.5 million |

Three Month Pro Forma Results

| |

• |

|

Pro forma adjusted net revenue increased 5.2% |

| |

• |

|

Pro forma adjusted EBITDA increased 12.3% |

Baton Rouge, LA – May 6, 2015 - Lamar Advertising Company

(Nasdaq: LAMR), a leading owner and operator of outdoor advertising and logo sign displays, announces the Company’s operating results for the first quarter ended March 31, 2015.

“We are encouraged by our first quarter results, which have us tracking to the high end of our previously provided full-year goals for sales and

AFFO,” said Lamar chief executive, Sean Reilly. “We were able to build on the sales momentum we saw at the end of 2014 while limiting expense growth. In particular, I am pleased by the continued growth in our local billboard sales.”

First Quarter Highlights

| |

• |

|

Local revenue on billboards increased 6.7% |

| |

• |

|

National revenue on billboards increased 2.5% |

| |

• |

|

Pro forma analog bulletin revenue grew 3.5% |

| |

• |

|

Pro forma consolidated expense growth held to 1.0% |

First Quarter Results

Lamar reported net revenues of $302.5 million for the first quarter of 2015 versus $284.9 million for the first quarter of 2014, a 6.2% increase. Operating

income for the first quarter of 2015 was $67.3 million as compared to $31.1 million for the same period in 2014. Lamar recognized net income of $40.7 million for the first quarter of 2015 compared to a net loss of $4.8 million for same period in

2014. Net income (loss) per basic and diluted share was $0.42 per share and $(0.05) per share for the three months ended March 31, 2015 and 2014, respectively.

Adjusted EBITDA for the first quarter of 2015 was $118.5 million versus $104.4 million for the first quarter of 2014, a 13.6% increase.

Free Cash Flow for the first quarter of 2015 was $62.9 million as compared to $51.1 million for the same period in 2014, a 23.1% increase.

For the first quarter of 2015, Funds From Operations, or FFO, was $84.6 million versus $60.4 million for the same period in 2014, an increase of 40.0%.

Adjusted Funds From Operations, or AFFO, for first quarter of 2015 was $78.9 million compared to $58.8 million for the same period in 2014, a 34.1% increase. Diluted AFFO per share was $0.82 per share and $0.62 per share for the three months ended

March 31, 2015 and 2014, respectively.

1

Q1 Pro Forma Results

Pro forma adjusted net revenue for the first quarter of 2015 increased 5.2% over pro forma adjusted net revenue for the first quarter of 2014. Pro forma

adjusted EBITDA increased 12.3% as compared to pro forma adjusted EBITDA for the first quarter of 2014. Pro forma adjusted net revenue and pro forma adjusted EBITDA include adjustments to the 2014 period for acquisitions and divestitures for the

same time frame as actually owned in the 2015 period. See “Reconciliation of Reported Basis to Pro Forma Basis”, which provides reconciliations to GAAP for adjusted and pro forma measures included in this release.

Liquidity

As of March 31, 2015, Lamar had

$303.7 million in total liquidity that consisted of $271.2 million available for borrowing under its revolving senior credit facility and approximately $32.5 million in cash and cash equivalents.

Forward Looking Statements

This

press release contains forward-looking statements, including statements regarding guidance for fiscal year 2015 and sales trends. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those

projected in these forward-looking statements. These risks and uncertainties include, among others: (1) our significant indebtedness; (2) the state of the economy and financial markets generally and the effect of the broader economy on the

demand for advertising; (3) the continued popularity of outdoor advertising as an advertising medium; (4) our need for and ability to obtain additional funding for operations, debt refinancing or acquisitions; (5) our ability to

continue to qualify as a REIT and maintain our status as a REIT; (6) the regulation of the outdoor advertising industry by federal, state and local governments; (7) the integration of companies that we acquire and our ability to recognize

cost savings or operating efficiencies as a result of these acquisitions; (8) changes in accounting principles, policies or guidelines; (9) changes in tax laws applicable to REITs or in the interpretation of those laws; (10) our

ability to renew expiring contracts at favorable rates; (11) our ability to successfully implement our digital deployment strategy; and (12) the market for our Class A common stock. For additional information regarding factors that

may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2014, as

supplemented by any risk factors contained in our Quarterly Reports on Form 10-Q. We caution investors not to place undue reliance on the forward-looking statements contained in this document. These statements speak only as of the date of this

document, and we undertake no obligation to update or revise the statements, except as may be required by law.

Use of Non-GAAP Financial Measures

The Company has presented the following measures that are not measures of performance under accounting principles generally accepted in the United

States of America (GAAP): Adjusted EBITDA, Free Cash Flow, Funds From Operations, Adjusted Funds From Operations, (AFFO), Diluted AFFO per share, adjusted pro forma results and outdoor operating income. Adjusted EBITDA is defined as net income

before income tax expense (benefit), interest expense (income), gain (loss) on extinguishment of debt and investments, stock-based compensation, depreciation and amortization and gain or loss on disposition of assets and investments. Free Cash Flow

is defined as Adjusted EBITDA less interest, net of interest income and amortization of financing costs, current taxes, preferred stock dividends and total capital expenditures. Funds From Operations is defined as net income before real estate

depreciation and amortization, gains or loss from disposition of real estate assets and investments and an adjustment to eliminate non-controlling interest, which is the definition used by the National

Association of Real Estate Investment Trusts (NAREIT). Adjusted Funds From Operations is defined as Funds From Operations adjusted for straight-line (revenue) expense,

stock-based compensation expense, non-cash tax expense (benefit), non-real estate related depreciation and amortization,

amortization of deferred financing and debt issuance costs, loss on extinguishment of debt, non-recurring, infrequent or unusual losses (gains), less maintenance capital expenditures and an adjustment for

non-controlling interest. Diluted AFFO per share is defined as AFFO divided by the weighted average diluted common shares outstanding. Outdoor operating income is defined as operating income before corporate

expenses, stock-based compensation, depreciation and amortization and gain on disposition of assets. These measures are not intended to replace financial performance measures determined in accordance with GAAP and should not be considered

alternatives to operating income, net income, cash flows from operating activities, or other GAAP figures as indicators of the Company’s financial performance or liquidity. The Company’s management believes that Adjusted EBITDA, Free Cash

Flow, Funds From Operations, Adjusted Funds From Operations, Diluted AFFO per share, adjusted pro forma results and outdoor operating income are useful in evaluating the Company’s performance and provide investors and financial analysts a

better understanding of the Company’s core operating results. The pro forma acquisition adjustments are intended to provide information that may be useful for investors when assessing period to period results. Our presentation of these non-GAAP

measures, including AFFO and FFO, may not be comparable to similarly titled measures used by similarly situated companies. See “Supplemental

2

Schedules—Unaudited Reconciliation of Non-GAAP Measures” and “Supplemental Schedules—Unaudited REIT Measures and Reconciliations to GAAP Measures”, which provides a

reconciliation of each of these measures to the most directly comparable GAAP measure.

Conference Call Information

A conference call will be held to discuss the Company’s operating results on Wednesday, May 6, 2015 at 8:00 a.m. central time. Instructions for the

conference call and Webcast are provided below:

Conference Call

|

|

|

| All Callers: |

|

1-334-323-0520 or 1-334-323-9871 |

| Pass Code: |

|

Lamar |

|

|

| Replay: |

|

1-334-323-0140 or 1-877-919-4059 |

| Pass Code: |

|

13746130 |

|

|

Available through Wednesday, May 13, 2015 at 11:59 p.m. eastern time |

|

|

| Live Webcast: |

|

www.lamar.com |

|

|

| Webcast Replay: |

|

www.lamar.com |

|

|

Available through Wednesday, May 13, 2015 at 11:59 p.m. eastern time |

|

|

| Company Contact: |

|

Buster Kantrow |

|

|

Director of Investor Relations |

|

|

(225) 926-1000 |

|

|

bkantrow@lamar.com |

General Information

Lamar Advertising Company is a leading outdoor advertising company currently operating over 150 outdoor advertising companies in 44 states, Canada and Puerto

Rico, logo businesses in 23 states and the province of Ontario, Canada and approximately 70 transit advertising franchises in the United States, Canada and Puerto Rico.

3

LAMAR ADVERTISING COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(IN THOUSANDS, EXCEPT

SHARE AND PER SHARE DATA)

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Net revenues |

|

$ |

302,477 |

|

|

$ |

284,933 |

|

|

|

|

|

|

|

|

|

|

| Operating expenses (income) |

|

|

|

|

|

|

|

|

| Direct advertising expenses |

|

|

113,232 |

|

|

|

111,508 |

|

| General and administrative expenses |

|

|

56,527 |

|

|

|

54,949 |

|

| Corporate expenses |

|

|

14,169 |

|

|

|

14,100 |

|

| Stock-based compensation |

|

|

3,901 |

|

|

|

3,912 |

|

| Depreciation and amortization |

|

|

49,230 |

|

|

|

69,526 |

|

| Gain on disposition of assets |

|

|

(1,836 |

) |

|

|

(206 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

235,223 |

|

|

|

253,789 |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

67,254 |

|

|

|

31,144 |

|

|

|

|

| Other expense (income) |

|

|

|

|

|

|

|

|

| Interest income |

|

|

(2 |

) |

|

|

(45 |

) |

| Loss on extinguishment of debt |

|

|

— |

|

|

|

5,176 |

|

| Other-than-temporary impairment of investment |

|

|

— |

|

|

|

4,069 |

|

| Interest expense |

|

|

24,532 |

|

|

|

30,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

24,530 |

|

|

|

39,468 |

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income tax expense (benefit) |

|

|

42,724 |

|

|

|

(8,324 |

) |

| Income tax expense (benefit) |

|

|

2,008 |

|

|

|

(3,487 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

40,716 |

|

|

|

(4,837 |

) |

| Preferred stock dividends |

|

|

91 |

|

|

|

91 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) applicable to common stock |

|

$ |

40,625 |

|

|

$ |

(4,928 |

) |

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per share |

|

$ |

0.42 |

|

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per share |

|

$ |

0.42 |

|

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

| - basic |

|

|

95,704,850 |

|

|

|

94,906,018 |

|

| - diluted |

|

|

95,742,148 |

|

|

|

95,368,995 |

|

| OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow Computation: |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

118,549 |

|

|

$ |

104,376 |

|

| Interest, net |

|

|

(23,372 |

) |

|

|

(28,940 |

) |

| Current tax expense |

|

|

(3,195 |

) |

|

|

(1,878 |

) |

| Preferred stock dividends |

|

|

(91 |

) |

|

|

(91 |

) |

| Total capital expenditures |

|

|

(29,041 |

) |

|

|

(22,398 |

) |

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

62,850 |

|

|

$ |

51,069 |

|

|

|

|

|

|

|

|

|

|

4

OTHER DATA (continued):

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| Selected Balance Sheet Data: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

32,546 |

|

|

$ |

26,035 |

|

| Working capital |

|

$ |

103,708 |

|

|

$ |

47,803 |

|

| Total assets |

|

$ |

3,355,224 |

|

|

$ |

3,318,818 |

|

| Total debt (including current maturities) |

|

$ |

1,953,171 |

|

|

$ |

1,899,895 |

|

| Total stockholders’ equity |

|

$ |

981,188 |

|

|

$ |

981,466 |

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Selected Cash Flow Data: |

|

|

|

|

|

|

|

|

| Cash flows provided by operating activities |

|

$ |

54,731 |

|

|

$ |

62,584 |

|

| Cash flows used in investing activities |

|

$ |

(44,270 |

) |

|

$ |

(25,772 |

) |

| Cash flows used in financing activities |

|

$ |

(2,819 |

) |

|

$ |

(637 |

) |

5

SUPPLEMENTAL SCHEDULES

UNAUDITED RECONCILIATIONS OF NON-GAAP MEASURES

(IN THOUSANDS)

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Reconciliation of Free Cash Flow to Cash Flows Provided by Operating Activities: |

|

|

|

|

|

|

|

|

| Cash flows provided by operating activities |

|

$ |

54,731 |

|

|

$ |

62,584 |

|

| Changes in operating assets and liabilities |

|

|

38,923 |

|

|

|

12,574 |

|

| Total capital expenditures |

|

|

(29,041 |

) |

|

|

(22,398 |

) |

| Preferred stock dividends |

|

|

(91 |

) |

|

|

(91 |

) |

| Other |

|

|

(1,672 |

) |

|

|

(1,600 |

) |

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

62,850 |

|

|

$ |

51,069 |

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted EBITDA to Net Income (Loss): |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

118,549 |

|

|

$ |

104,376 |

|

| Less: |

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

3,901 |

|

|

|

3,912 |

|

| Depreciation and amortization |

|

|

49,230 |

|

|

|

69,526 |

|

| Gain on disposition of assets |

|

|

(1,836 |

) |

|

|

(206 |

) |

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

67,254 |

|

|

|

31,144 |

|

|

|

|

| Less: |

|

|

|

|

|

|

|

|

| Interest income |

|

|

(2 |

) |

|

|

(45 |

) |

| Loss on extinguishment of debt |

|

|

— |

|

|

|

5,176 |

|

| Other-than-temporary impairment of investment |

|

|

— |

|

|

|

4,069 |

|

| Interest expense |

|

|

24,532 |

|

|

|

30,268 |

|

| Income tax expense (benefit) |

|

|

2,008 |

|

|

|

(3,487 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

40,716 |

|

|

$ |

(4,837 |

) |

|

|

|

|

|

|

|

|

|

| Capital expenditure detail by category: |

|

|

|

|

|

|

|

|

| Billboards - traditional |

|

$ |

5,809 |

|

|

$ |

4,618 |

|

| Billboards - digital |

|

|

14,262 |

|

|

|

9,798 |

|

| Logo |

|

|

2,942 |

|

|

|

1,868 |

|

| Transit |

|

|

130 |

|

|

|

90 |

|

| Land and buildings |

|

|

3,171 |

|

|

|

3,301 |

|

| Operating equipment |

|

|

2,727 |

|

|

|

2,723 |

|

|

|

|

|

|

|

|

|

|

| Total capital expenditures |

|

$ |

29,041 |

|

|

$ |

22,398 |

|

|

|

|

|

|

|

|

|

|

6

SUPPLEMENTAL SCHEDULES

UNAUDITED RECONCILIATIONS OF NON-GAAP MEASURES

(IN THOUSANDS)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

% Change |

|

| Reconciliation of Reported Basis to Pro Forma(a) Basis: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

$ |

302,477 |

|

|

$ |

284,933 |

|

|

|

6.2 |

% |

| Acquisitions and divestitures |

|

|

— |

|

|

|

2,722 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pro forma adjusted net revenue |

|

$ |

302,477 |

|

|

$ |

287,655 |

|

|

|

5.2 |

% |

|

|

|

|

| Reported direct advertising and G&A expenses |

|

$ |

169,759 |

|

|

$ |

166,457 |

|

|

|

2.0 |

% |

| Acquisitions and divestitures |

|

|

— |

|

|

|

1,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pro forma direct advertising and G&A expenses |

|

$ |

169,759 |

|

|

$ |

168,009 |

|

|

|

1.0 |

% |

|

|

|

|

| Outdoor operating income |

|

$ |

132,718 |

|

|

$ |

118,476 |

|

|

|

12.0 |

% |

| Acquisitions and divestitures |

|

|

— |

|

|

|

1,170 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pro forma adjusted outdoor operating income |

|

$ |

132,718 |

|

|

$ |

119,646 |

|

|

|

10.9 |

% |

|

|

|

|

| Reported corporate expenses |

|

$ |

14,169 |

|

|

$ |

14,100 |

|

|

|

0.5 |

% |

| Acquisitions and divestitures |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pro forma corporate expenses |

|

$ |

14,169 |

|

|

$ |

14,100 |

|

|

|

0.5 |

% |

|

|

|

|

| Adjusted EBITDA |

|

$ |

118,549 |

|

|

$ |

104,376 |

|

|

|

13.6 |

% |

| Acquisitions and divestitures |

|

|

— |

|

|

|

1,170 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pro forma adjusted EBITDA |

|

$ |

118,549 |

|

|

$ |

105,546 |

|

|

|

12.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Pro forma adjusted net revenue, direct advertising and general and administrative expenses, outdoor operating income, corporate expenses and Adjusted EBITDA include adjustments to 2014 for acquisitions and divestitures

for the same time frame as actually owned in 2015. |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Reconciliation of Outdoor Operating Income to Operating Income: |

|

|

|

|

|

|

|

|

| Outdoor operating income |

|

$ |

132,718 |

|

|

$ |

118,476 |

|

| Less: Corporate expenses |

|

|

14,169 |

|

|

|

14,100 |

|

| Stock-based compensation |

|

|

3,901 |

|

|

|

3,912 |

|

| Depreciation and amortization |

|

|

49,230 |

|

|

|

69,526 |

|

| Plus: Gain on disposition of assets |

|

|

1,836 |

|

|

|

206 |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

67,254 |

|

|

$ |

31,144 |

|

|

|

|

|

|

|

|

|

|

7

SUPPLEMENTAL SCHEDULES

UNAUDITED REIT MEASURES

AND

RECONCILIATIONS TO GAAP MEASURES

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

Adjusted Funds From Operations:

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Net income (loss) |

|

$ |

40,716 |

|

|

$ |

(4,837 |

) |

| Depreciation and amortization related to advertising structures |

|

|

45,414 |

|

|

|

65,175 |

|

| Gain from disposition of real estate assets |

|

|

(1,742 |

) |

|

|

(24 |

) |

| Adjustment for minority interest – consolidated affiliates |

|

|

167 |

|

|

|

77 |

|

|

|

|

|

|

|

|

|

|

| Funds From Operations |

|

$ |

84,555 |

|

|

$ |

60,391 |

|

|

|

|

|

|

|

|

|

|

| Straight-line expense |

|

|

(36 |

) |

|

|

(52 |

) |

| Stock-based compensation expense |

|

|

3,901 |

|

|

|

3,912 |

|

| Non-cash tax benefit |

|

|

(1,187 |

) |

|

|

(5,365 |

) |

| Non-real estate related depreciation and amortization |

|

|

3,816 |

|

|

|

4,351 |

|

| Amortization of deferred financing and debt issuance costs |

|

|

1,158 |

|

|

|

1,283 |

|

| Loss on extinguishment of debt |

|

|

— |

|

|

|

5,176 |

|

| Loss from other-than-temporary impairment of investment |

|

|

— |

|

|

|

4,069 |

|

| Capitalized expenditures-maintenance |

|

|

(13,156 |

) |

|

|

(14,874 |

) |

| Adjustment for minority interest–consolidated affiliates |

|

|

(167 |

) |

|

|

(77 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations |

|

$ |

78,884 |

|

|

$ |

58,814 |

|

|

|

|

|

|

|

|

|

|

| Divided by weighted average diluted shares outstanding |

|

|

95,742,148 |

|

|

|

95,368,995 |

|

|

|

|

|

|

|

|

|

|

| Diluted AFFO per share |

|

$ |

0.82 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

|

|

8

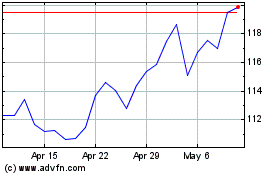

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

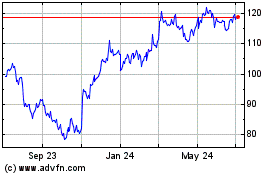

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Apr 2023 to Apr 2024