Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

January 25 2016 - 4:48PM

Edgar (US Regulatory)

Lam Research + KLA-Tencor: Integration

Update January 2016 Filed by Lam Research Corporation Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-6 under the Securities Exchange Act of 1934 Subject Company: KLA-Tencor Corporation Registration

Statement Number: 333-208356

Increase value with natural market

complement Deliver more together than is possible as standalone companies Enable innovation across logic, memory, foundry, and packaging areas Accelerate our capability to address the most difficult challenges Better support customer technology and

economic roadmaps Lam and KLA-Tencor: Creating Unmatched Capability The combination of our capabilities in process and process control will enhance our ability to partner with the industry

We are anticipating a mid 2016 close

Regulatory approvals are in process – thank you for your support in this area We expect to hold shareholder meetings in the first quarter of 2016 We have begun integration planning with representation from both companies We will continue the

existing KLA-Tencor supply and support relationships Across the ecosystem of suppliers, including competitors We are committed to protect confidential information and IP for the benefit of customers and suppliers Until close, we will remain as

separate independent companies Lam and KLA-Tencor Integration Update We look forward to working with you through the integration process

Cautions Regarding Forward-Looking

Statements All statements included or incorporated by reference in this document, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Lam Research Corporation’s (“Lam”) and KLA-Tencor Corporation’s

(“KLA”) current expectations, estimates and projections about its respective business and industry, management’s beliefs, and certain assumptions made by Lam and KLA, all of which are subject to change. Forward-looking statements

can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,”

“will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. Examples of such

forward-looking statements include, but are not limited to: (1) references to the anticipated benefits of the proposed transaction; (2) the expected industry leadership, future technical capabilities and served markets of the individual and/or

combined companies; (3) each individual company’s or the combined company’s ability to deliver value, partner and collaborate with customers, address technical and economic challenges, and enable innovation; (4) market expansion

opportunities and systems and products that may benefit from sales growth as a result of changes in market share or existing markets; (5) technological achievements that may be realized by the combined company; (6) the combined company’s

success in achieving integration; and (7) the companies’ ability to achieve the closing conditions, including holding shareholder meetings and achieving regulatory approvals, and the expected date of closing of the transaction. These

forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those expressed in any forward-looking statement.

Important risk factors that may cause such a difference in connection with the proposed transaction include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied,

including the risk that required approvals for the transaction from governmental authorities or the stockholders of KLA or Lam are not obtained; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of

the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of KLA or Lam; (5) the ability of KLA and Lam to retain and hire key personnel; (6)

competitive responses to the proposed transaction and the impact of competitive products; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from

the announcement or completion of the transaction; (9) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the

combined companies’ existing businesses; (10) the terms and availability of the indebtedness planned to be incurred in connection with the transaction; and (11) legislative, regulatory and economic developments, including changing business

conditions in the semiconductor industry and overall economy as well as the financial performance and expectations of Lam’s and KLA’s existing and prospective customers. These risks, as well as other risks associated with the proposed

transaction, are more fully discussed in the Registration Statement on Form S-4, which includes the joint proxy statement of Lam and KLA, also constitutes a prospectus of Lam, and was filed with the Securities and Exchange Commission

(“SEC”) on December 7, 2015, amended on January 12, 2016 and declared effective on January 13, 2016. Each of Lam and KLA provided a definitive joint proxy statement/prospectus to their respective stockholders on or about January 19,

2016. Investors and potential investors are urged not to place undue reliance on forward-looking statements in this document, which speak only as of this date. Neither Lam nor KLA undertakes any obligation to revise or update publicly any

forward-looking statement to reflect future events or circumstances. Nothing contained herein constitutes or will be deemed to constitute a forecast, projection or estimate of the future financial performance of Lam, KLA, or the merged company,

whether following the implementation of the proposed transaction or otherwise. In addition, actual results are subject to other risks and uncertainties that relate more broadly to Lam’s overall business, including those more fully

described in Lam’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended June 28, 2015 and its quarterly report on Form 10-Q for the fiscal quarter ended September 27, 2015, and KLA’s overall business

and financial condition, including those more fully described in KLA’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended June 30, 2015 and its quarterly report on Form 10-Q for the fiscal quarter ended

September 30, 2015.

Additional Information and Where to Find

It; Participants in the Solicitation Additional Information and Where to Find It: This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be

any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed transaction will be submitted to the

stockholders of each of Lam and KLA for their consideration. On December 7, 2015, Lam and KLA filed with the SEC a Registration Statement on Form S-4 which was amended on January 12, 2016 and declared effective by the SEC on January 13, 2016. The

Registration Statement includes a joint proxy statement of Lam and KLA and a prospectus of Lam, which was mailed by Lam and KLA to their respective stockholders on or about January 19, 2016. Lam and KLA also plan to file other documents with the SEC

regarding the proposed transaction. This document is not a substitute for any prospectus, proxy statement or any other document that Lam or KLA may file with the SEC in connection with the proposed transaction. Investors and security holders of Lam

and KLA are urged to read the definitive joint proxy statement/prospectus and any other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they contain, or will contain, important

information about the proposed transaction. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and stockholders are able to obtain

free copies of the joint proxy statement/prospectus and other documents filed with the SEC by Lam on Lam’s Investor Relations website (investor.lamresearch.com) or by writing to Lam Research Corporation, Investor Relations, 4650 Cushing

Parkway, Fremont, CA 94538-6401 (for documents filed with the SEC by Lam), or by KLA on KLA’s Investor Relations website (ir.kla-tencor.com) or by writing to KLA-Tencor Corporation, Investor Relations, One Technology Drive, Milpitas,

California 95035 (for documents filed with the SEC by KLA). Participants in the Solicitation: Lam, KLA, their respective directors, and certain of their respective executive officers, other members of management and employees, may, under SEC rules,

be deemed to be participants in the solicitation of proxies from Lam and KLA stockholders in connection with the proposed transaction. Information regarding the persons who, under SEC rules, are or may be deemed to be participants in the

solicitation of Lam and KLA stockholders in connection with the proposed transaction is set forth in the definitive joint proxy statement/prospectus that was filed with the SEC on January 13, 2016.

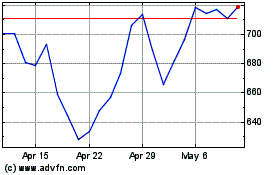

KLA (NASDAQ:KLAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

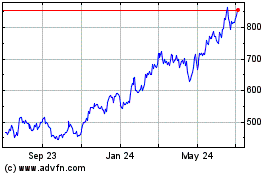

KLA (NASDAQ:KLAC)

Historical Stock Chart

From Apr 2023 to Apr 2024