Filed by Lam Research Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: KLA-Tencor Corporation

Commission File No.: 000-09992

Mad Money

CNBC

Host: Jim Cramer

Guest: Martin Anstice, Lam Research (LRCX) President & CEO

November 6, 2015

Jim Cramer: Lam Research

recently joined the acquisition spree in the semiconductor space. I’m sitting down with the CEO to hear what’s next for the company. He’s a real smart fella.

—

Less than three weeks ago back on October 21, we

learned that Lam Research, the extremely well-run semiconductor capital equipment maker is buying competitor – well, not really, same industry guy – KLA-Tencor for $10.6B in cash and stock. It looks to me like a terrific deal. This

transaction will create a company with greater scale, one that’s big enough to rival Applied Materials, the industry’s top dog. According to Lam’s management, this acquisition should produce $250M in annualized cost synergies, $600M

in incremental annual revenue, best of all it’s expected to be added to the company’s earnings and free cash flow during the first 12 months after the deal closes. That’s extremely early for these big transactions. No wonder

Lam’s stock has rallied just under ten percent since the announcement, though it helps that the company also reported a pretty darn strong quarter the other day. And it wouldn’t be surprising to me if this stock has a lot more room to run,

so let’s check in with Martin Anstice, the President and CEO of Lam Research, find out more about this KLA-Tencor deal and what it means for the future of his company. Mr. Anstice, welcome back to Mad Money.

Martin Anstice: Jim, thank you very much for inviting me to be on your show today. Nice to be back.

JC: Alright Martin, there was a transaction that occurred that was aborted, and that’s the Tokyo Electron-Applied Materials, and that’s

because the customers didn’t like it. When I look at this Lam tie-up with KLA, I think it’s exactly what the customers would want and I don’t expect any anti-trust issues. Am I right?

MA: Yeah, I think that certainly there is zero product overlap between Lam Research and KLA-Tencor, and one of the most fundamental anti-trust

tests is product overlap. And as I’ve said many, many times, our approach to non-organic as well as organic investment is to preserve the substance of competitiveness in our industry and create situations where we can innovate better and more

for the success of our customers. And I think… I spent a lot of time in the last 4-5 years dialoguing with customers to better understand their critical needs, and I’ve had an opportunity in the last ten days to visit with most of our key

customers around the world, and so far I’m very pleased with the response from them, and also pleased with the response from employees. I’ve been in front of about 6,000 employees of the combined company since announcement and I think

there’s a lot of excitement about the opportunity for us to make an impact here.

JC: Now, when you speak to those employees, I’m

curious. You’ve got some pretty aggressive synergies that could go on. Are people worried that they will not be necessary in the combined institution?

MA: You know, I think you can position a combination of this nature in one of two ways. You can define a vision focused on eliminating costs and tax or

financial reengineering and that is not our story. Our story is a growth trajectory. We have a wonderful platform with Lam Research, a technology inflections outperformance of the last several years, and that will run for a number of years still

ahead of us. So we’re building upon that platform of growth and we’re creating a situation where the combination of

two companies creates growth opportunities, new vehicles for delivering value to our customers over time that were not available to the companies on a stand-alone basis. And so, that’s the

reason why I think for most people, this is a story of optimism and opportunity. And as we demonstrated, I think, with the Novellus transaction, we know how to bring two companies together. That is a foundational strength of operational excellence,

not just in our company but I think also in KLA-Tencor. And we’ve got a great platform here, so I’m excited for that opportunity.

JC:

When some of these big semiconductor companies – they get cheered these days when they talk about cutting back on capital expenditures. But is it really possible for them to cut back for too long?

MA: Well I think one of the things that’s transitioned through a consolidation, not just in our industry but also in our customer’s industry,

and this scale of technical and economic challenges is a statement on discipline. There’s a tremendous discipline today associated with capital spending environments, and that leads to less cyclicality and more predictability in results. One of

the strengths that I’m really interested in seeing play out here between KLA-Tencor and Lam Research is the relative strength of Lam in memory and the relative strength of KLA-Tencor in logic. That complement is about as perfect a complement as

we could get relative to exposure in segments and customers specifically and their spending in years to come.

JC: One of the things I did not know

until I read the documents about your deal is when you’re just a standalone like Lam, you’re not really privy to a lot of the test and measurement stuff from the other guys, from KLA. And yet I would think that the customers really would

like you to know how that’s going so you can switch your line to get faster yields for people.

MA: Yeah, there’s a lot of complexity

relative to the exchange of information in our industry and at the end of the day, I think every one of us is invested in protecting confidential information and we’re invested in creating situations where collaboration can create enhanced

value. One of the platforms of Lam Research is a platform of customer trust. Our most important objective is to be number one in customer trust in our industry and we pursue that each and every day, and that creates situations where the exchange of

information allows us to enhance our ability to deliver enabling technology and also trusted productivity, on time, to our customers.

JC: Alright

Martin, I want in the time remaining, for people who are not familiar with the semiconductor business, people keep saying – like I’m wearing an Apple watch right now – people keep saying, “You know what, how can they

shrink things, shrink things, shrink things?” The reason why they can continue to shrink things is because of what you make, right? It’s not necessarily what Intel produces or what a customer produces, but because of your calibrations;

that’s why things keep getting smaller but have more brain power.

MA: Yeah no question, we’re in this thing together, and the equipment

industry and Lam Research is an enabler of the technology road maps that you’ve just described. We do that in partnership with key customers around the world. We can’t do this without them and they can’t do this without us. It’s

that partnership and collaboration that creates the continuity of Moore’s Law and performance and cost scaling generally that I think is a tremendous opportunity in the years to come. You look at IoT roadmaps, and cloud and mobility generally,

you look at wearables and automotive, I mean there are some really interesting demand drivers showing up for this industry. Ultimately that translates itself into leading and trailing edge demand for ICs and also for silicon wafers, which in turn

leads to our marketplace and the opportunity we have to contribute, so I think this is the right deal at the right time for our industry.

JC: Well you’ve made a ton of money for our viewers who own Novellus and you’ve been a terrific

steward of Lam, and I think this deal is fantastic. Martin Anstice, President and CEO of Lam Research, always great to see you, sir.

MA: Thank you

very much, Jim, thank you.

JC: If you’re looking for a technology leader, it’s going to be this combination, which is terrific. Lam

Research.

***

Forward Looking

Statements

All statements included or incorporated by reference in this document, other than statements or characterizations of historical fact, are

forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are

based on Lam Research Corporation’s (“Lam”) and KLA-Tencor Corporation’s (“KLA-Tencor”) current expectations, estimates and projections about its respective business and industry, management’s beliefs, and certain

assumptions made by Lam and KLA-Tencor, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,”

“predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,”

similar expressions, and variations or negatives of these words. Examples of such forward-looking statements include, but are not limited to: (1) references to the anticipated benefits of the proposed transaction; (2) the expected industry

leadership, future technical capabilities and served markets of the individual and/or combined companies; (3) projections of pro forma revenue, cost synergies, revenue synergies, cash flow, market share and other metrics, whether by specific market

segment, or as a whole, and whether for each individual company or the combined company; (4) market expansion opportunities and systems and products that may benefit from sales growth as a result of changes in market share or existing markets; (5)

technological achievements that may be realized by the combined company, (6) the allocation of merger consideration in the transactions; (7) the financing components of the proposed transaction; (8) potential financing opportunities, together with

sources and uses of cash; (9) potential dividend growth rates; and (10) the companies’ ability to achieve the closing conditions and the expected date of closing of the transaction.

These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results

to differ materially and adversely from those expressed in any forward-looking statement. Important risk factors that may cause such a difference in connection with the proposed transaction include, but are not limited to, the following factors: (1)

the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals for the transaction from governmental authorities or the stockholders of KLA-Tencor or Lam are not obtained; (2) litigation

relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the proposed transaction disrupts the current plans and operations of

KLA-Tencor or Lam; (5) the ability of KLA-Tencor and Lam to retain and hire key personnel; (6) competitive

responses to the proposed transaction and the impact of competitive products; (7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes

to business relationships resulting from the announcement or completion of the transaction; (9) the combined companies’ ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and

expenses associated with integrating the combined companies’ existing businesses; (10) the terms and availability of the indebtedness planned to be incurred in connection with the transaction; and (11) legislative, regulatory and economic

developments, including changing business conditions in the semiconductor industry and overall economy as well as the financial performance and expectations of Lam’s and KLA-Tencor’s existing and prospective customers. These risks, as well

as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that Lam will file with the Securities and Exchange

Commission (“SEC”) in connection with the proposed transaction. Investors and potential investors are urged not to place undue reliance on forward-looking statements in this document, which speak only as of this date. Neither Lam nor

KLA-Tencor undertakes any obligation to revise or update publicly any forward-looking statement to reflect future events or circumstances. Nothing contained herein constitutes or will be deemed to constitute a forecast, projection or estimate of the

future financial performance of Lam, KLA-Tencor, or the merged company, whether following the implementation of the proposed transaction or otherwise.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to Lam’s overall business, including those more fully

described in Lam’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended June 28, 2015, and KLA-Tencor’s overall business and financial condition, including those more fully described in

KLA-Tencor’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended June 30, 2015.

Additional Information and

Where to Find It

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed

transaction will be submitted to the stockholders of each of Lam and KLA-Tencor for their consideration. Lam intends to file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement/prospectus of Lam and

KLA-Tencor. Each of Lam and KLA-Tencor will provide the joint proxy statement/prospectus to their respective stockholders. Lam and KLA-Tencor also plan to file other documents with the SEC regarding the proposed transaction. This document is not

a substitute for any prospectus, proxy statement or any other document that Lam or KLA-Tencor may file with the SEC in connection with the proposed transaction. Investors and security holders of Lam and KLA-Tencor are urged to read the joint proxy

statement/prospectus and any other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed transaction. You may obtain

copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and stockholders will be able to obtain free copies of the joint proxy statement/prospectus and

other documents filed with the SEC by Lam on Lam’s Investor Relations website (investor.lamresearch.com) or by writing to Lam Research Corporation, Investor Relations, 4650 Cushing Parkway, Fremont, CA 94538-6401 (for documents filed with the

SEC by Lam), or by KLA-Tencor on KLA-Tencor’s Investor Relations website (ir.kla-tencor.com) or by writing to KLA-Tencor-Tencor Corporation, Investor Relations, One Technology Drive, Milpitas,

California 95035 (for documents filed with the SEC by KLA-Tencor).

Participants in the Solicitation

Lam, KLA-Tencor, their respective directors, and certain of their respective executive officers, other members of management and employees, may, under SEC

rules, be deemed to be participants in the solicitation of proxies from Lam and KLA-Tencor stockholders in connection with the proposed transaction. Information regarding the persons who, under SEC rules, are or may be deemed to be participants in

the solicitation of Lam and KLA-Tencor stockholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find more detailed information about Lam’s

executive officers and directors in its definitive proxy statement filed with the SEC on September 21, 2015. You can find more detailed information about KLA-Tencor’s executive officers and directors in its definitive proxy statement filed with

the SEC on September 24, 2015. Additional information about Lam’s executive officers and directors and KLA-Tencor’s executive officers and directors will be provided in the above-referenced Registration Statement on Form S-4 when it

becomes available.

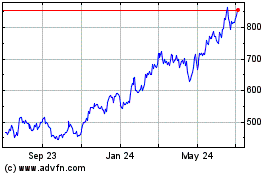

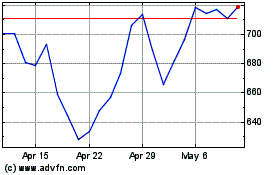

KLA (NASDAQ:KLAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

KLA (NASDAQ:KLAC)

Historical Stock Chart

From Apr 2023 to Apr 2024