UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 12, 2015

KENTUCKY

FIRST FEDERAL BANCORP

(Exact Name of Registrant as Specified in

Its Charter)

| United States |

0-51176 |

61-1484858 |

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

|

|

| 479 Main Street, Hazard, Kentucky |

41702 |

| (Address of principal executive offices) |

(Zip Code) |

(502) 223-1638

(Registrant’s telephone number, including

area code)

Not

Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

On May 12, 2015, Kentucky

First Federal Bancorp (the “Company”) announced its unaudited financial results for the nine and three months ended

March 31, 2015. For more information, see the Company’s press release dated May 12, 2015, which is filed as Exhibit 99.1

hereto and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits |

The

following exhibit is filed herewith:

| 99.1 | Press Release dated May 12, 2015 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

KENTUCKY

FIRST FEDERAL BANCORP |

| |

|

| |

|

| Date: May

13, 2015 |

By: |

/s/ Don D. Jennings |

| |

|

Don D. Jennings

President and Chief Operating

Officer |

EXHIBIT 99.1

Kentucky First Federal Bancorp

Hazard, Frankfort, Danville, and Lancaster, Kentucky

For Immediate Release May 12, 2015

| Contact: | Kentucky First Federal Bancorp |

Don Jennings,

President

Clay

Hulette, Vice President

(502)

223-1638

Kentucky First Federal Bancorp Releases

Earnings

Kentucky First Federal Bancorp (Nasdaq:

KFFB), the holding company for First Federal Savings and Loan Association of Hazard and First Federal Savings Bank of Frankfort,

Kentucky, announced net earnings of $539,000 or $0.06 diluted earnings per share for the three months ended March 31, 2015, compared

to net earnings of $491,000 or $0.06 diluted earnings per share for the three months ended March 31, 2014, an increase of $48,000

or 9.8%. Net earnings were $1.5 million or $0.18 diluted earnings per share for the nine months ended March 31, 2015 and 2014.

The increase in net earnings on a quarter-to-quarter

basis was primarily attributable to lower non-interest expense and a decrease in provision for loan losses. Non-interest expense

decreased $122,000 or 5.8% and totaled $2.0 million for the three months ended March 31, 2015, due primarily to lower employee

compensation and benefits costs. Changes in pension laws, which temporarily reduce funding requirements for the Company’s

multiple-employer pension plan, resulted in lower costs for the period. Provision for losses on loans decreased $42,000 to $36,000

for the recently-ended quarter compared to a provision of $78,000 in the prior year period. Somewhat offsetting the lower non-interest

expense and decrease in provision for loan losses were decreases in net interest income and non-interest income. Net interest income

decreased $114,000 or 4.0% to $2.8 million for the quarter ended March 31, 2015, primarily because interest income decreased at

a faster pace than interest expense. Interest income decreased $118,000 or 3.6% to $3.1 million for the recently ended quarter,

while interest expense decreased only $4,000 or 1.1% to 373,000 for the period. Noninterest income totaled $68,000 for the three

months ended March 31, 2015, a decrease of $39,000 from the same period in 2014, primarily due to net losses on sale of other real

estate.

Net earnings increased $22,000 or 1.5% totaling

$1.5 million for both nine month periods ended March 31, 2015 and 2014. The increase in net earnings was due primarily to lower

provision for loan losses, higher non-interest income and decreased non-interest expense. Provision for loan losses decreased $229,000

or 43.1% to $302,000 for the nine months recently ended. Non-interest income totaled $396,000 for the nine months ended March 31,

2015, an increase of $77,000 or 24.1% from the same period in 2014, primarily due to gains on sale of other real estate. Noninterest

expense decreased $26,000 or 0.4% to $6.1 million for the recent nine-month period due primarily to lower employee compensation

and benefits charges.

At March 31, 2015, the Company’s assets

totaled $294.5 million, a decrease of $5.2 million or 1.7% compared to assets of $299.7 million at June 30, 2014. The decrease

was attributed primarily to decreases in loans, cash and cash equivalents and investment securities. Total liabilities decreased

$5.0 million or 2.1% to $227.5 million at March 31, 2015, as deposits decreased $11.0 million or 5.1% to $202.2 million at March

31, 2015, while FHLB advances increased $5.4 million or 31.7% to $22.6 million.

At March 31, 2015, the Company reported

its book value per share as $7.94.

This press release may contain statements

that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange

Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe

harbors created thereby. All forward-looking statements are based on current expectations regarding important risk factors including,

but not limited to, real estate values, the impact of interest rates on financing, changes in general economic conditions, legislative

and regulatory changes that adversely affect the business of the Company, changes in the securities markets and the Risk Factors

described in Item 1A of the Company’s Annual Report on Form 10-K for the year ended June 30, 2014. Accordingly, actual results

may differ from those expressed in the forward-looking statements, and the making of such statements should not be regarded as

a representation by the Company or any other person that results expressed therein will be achieved.

Kentucky First Federal Bancorp is the parent

company of First Federal Savings and Loan Association, which operates one banking office in Hazard, Kentucky, and First Federal

Savings Bank, which operates six banking offices in Kentucky, including three in Frankfort, two in Danville, and one in Lancaster.

Kentucky First Federal Bancorp shares are traded on the Nasdaq National Market under the symbol KFFB. At March 31, 2015, the Company

had approximately 8,439,515 shares outstanding of which approximately 56.0% was held by First Federal MHC.

SUMMARY OF FINANCIAL HIGHLIGHTS

Condensed Consolidated Balance Sheets

| | |

March 31,

2015 | | |

June 30,

2014 | |

| | |

(In thousands, except share data) | |

| | |

(Unaudited) | |

| Assets | |

| | | |

| | |

| Cash and Cash Equivalents | |

$ | 9,833 | | |

$ | 11,511 | |

| Investment Securities | |

| 7,857 | | |

| 9,265 | |

| Loans Held for Sale | |

| -- | | |

| -- | |

| Loans, net | |

| 244,533 | | |

| 246,788 | |

| Real estate owned, net | |

| 2,285 | | |

| 1,846 | |

| Other Assets | |

| 29,992 | | |

| 30,245 | |

| Total Assets | |

$ | 294,500 | | |

$ | 299,655 | |

| Liabilities | |

| | | |

| | |

| Deposits | |

$ | 202,173 | | |

$ | 213,142 | |

| FHLB Advances | |

| 22,644 | | |

| 17,200 | |

| Deferred revenue | |

| 614 | | |

| 631 | |

| Other Liabilities | |

| 2,025 | | |

| 1,477 | |

| Total Liabilities | |

| 227,456 | | |

| 232,450 | |

| Shareholders' Equity | |

| 67,044 | | |

| 67,205 | |

| Total Liabilities and Equity | |

$ | 294,500 | | |

$ | 299,655 | |

| Book Value Per Share | |

$ | 7.94 | | |

$ | 7.88 | |

Condensed Consolidated Statements of Income

(In thousands, except share data)

| | |

Nine months ended March 31, | | |

Three months ended March 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Interest Income | |

$ | 9,391 | | |

$ | 9,880 | | |

$ | 3,136 | | |

$ | 3,254 | |

| Interest Expense | |

| 1,078 | | |

| 1,258 | | |

| 373 | | |

| 377 | |

| Net Interest Income | |

| 8,313 | | |

| 8,622 | | |

| 2,763 | | |

| 2,877 | |

| Provision for Losses on Loans | |

| 302 | | |

| 531 | | |

| 36 | | |

| 78 | |

| Non-interest Income | |

| 396 | | |

| 319 | | |

| 68 | | |

| 107 | |

| Non-interest Expense | |

| 6,117 | | |

| 6,143 | | |

| 1,990 | | |

| 2,112 | |

| Income Before Income Taxes | |

| 2,290 | | |

| 2,267 | | |

| 805 | | |

| 794 | |

| Income Taxes | |

| 756 | | |

| 755 | | |

| 266 | | |

| 303 | |

| Net Income | |

$ | 1,534 | | |

$ | 1,512 | | |

$ | 539 | | |

$ | 491 | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 0.18 | | |

$ | 0.18 | | |

$ | 0.06 | | |

$ | 0.06 | |

| Weighted average outstanding shares: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 8,360,824 | | |

| 8,373,329 | | |

| 8,317,518 | | |

| 8,376,353 | |

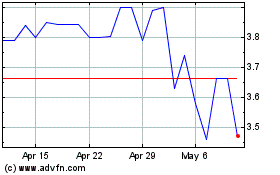

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Mar 2024 to Apr 2024

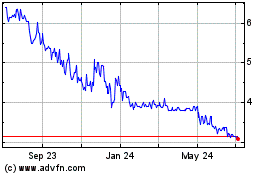

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Apr 2023 to Apr 2024