Current Report Filing (8-k)

May 13 2015 - 8:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities and Exchange Act of 1934

Date of report (Date of earliest event reported): May 13, 2015

JDS UNIPHASE CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

000-22874 |

|

94-2579683 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

|

| 430 North McCarthy Boulevard, Milpitas, CA |

|

95035 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(408) 546-5000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Reporting)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

On May 13, 2015, JDS Uniphase Corporation (the “Company”) issued a press release announcing that the Company entered into a Securities Purchase

Agreement pursuant to which it will sell to Amada Holdings Co., Ltd. of Japan, up to $40 million of preferred stock of a subsidiary of Lumentum Holdings Inc., the publicly-traded company that will result from the planned spin-off of the CCOP

business unit from the Company. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference in its entirety herein.

The information in this Item 7.01 of this Form 8-K, including Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release entitled “Amada Signs Definitive Agreement to Purchase Preferred Stock of Subsidiary of Lumentum Holdings Inc. once JDSU Separation is Complete” dated May 13, 2015. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

| JDS Uniphase Corporation |

|

|

| By: |

|

/s/ Kevin Siebert |

| Kevin Siebert |

| Vice President, General Counsel and Secretary |

May 13, 2015

Exhibit 99.1

|

|

|

| NEWS RELEASE |

|

|

Amada Signs Definitive Agreement to Purchase Preferred Stock of Subsidiary of Lumentum Holdings Inc. once

JDSU Separation is Complete

Milpitas, Calif., May 13, 2015 – JDSU (NASDAQ: JDSU) announced today that it has signed a definitive

agreement with Amada Holdings Co., Ltd. of Japan, a manufacturer of machine tools for metal fabrication, to purchase up to $40 million of preferred stock of a subsidiary of Lumentum Holdings Inc., the publicly-traded company that will result from

the planned spin-off of the CCOP business unit from JDSU. The spin-off is expected to happen in the third calendar quarter of 2015 and the final amount of Amada’s investment will be determined based on initial trading of Lumentum Holdings Inc.

common stock.

“We are honored that Amada has committed to invest in our business as we progress towards becoming our own publicly-traded

company,” said Alan Lowe, president of CCOP at JDSU and CEO-designate of Lumentum.

“We look forward to continued collaboration as we have for

more than eight years,” said Mitsuo Okamoto, president and CEO of Amada.

About the Agreement

Upon initial trading of Lumentum Holdings Inc. common stock, Amada will purchase from JDSU Series A Preferred Stock in a wholly-owned subsidiary of Lumentum

Holdings Inc. The preferred stock may be converted into shares of common stock of Lumentum Holdings Inc. commencing on the second anniversary of the closing of the stock purchase (absent a change of control or similar event in Lumentum Holdings

Inc.) using a conversion price calculated based on a 125 percent of the volume weighted average price per share of Lumentum Holdings Inc.’s common stock in the five trading days following the spin-off. Cumulative dividends will accrue at

the annual rate of 2.5 percent, but will be paid only when and if declared by the Board of Lumentum Holdings Inc. The investment is contingent upon the consummation of the spin-off and is also subject to other customary closing conditions. No

preferred stock will be offered to other parties, including the public. The transaction is expected to close in the second week following the spin-off, which JDSU has previously announced it intends to effect in the third calendar quarter of

2015. Further terms of the proposed transaction are set forth in a stock purchase agreement that will be filed as an exhibit to Lumentum Holdings Inc.’s Registration Statement on Form 10 with the U.S. Securities and Exchange Commission.

JDSU News Release

To stay updated on the company separation, please visit the “Separation Updates” page on

jdsu.com.

Forward Looking Statements

This press

release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include any guidance as to the proposed spin-off of

JDSU’s CCOP business into a separate publicly traded company called Lumentum Holdings Inc, the timing and terms of the proposed spin-off transaction and Amada’s anticipated purchase of the Series A Preferred Stock. These forward-looking

statements involve risks and uncertainties that could cause actual events and terms to differ materially from those set forth herein. Risks related to the proposed separation include the requirement to obtain certain approvals, the ability to retain

key employees, the ability to recognize anticipated cost savings, the ability of each company to function successfully as a stand-alone entity, potential business disruption caused by separation preparations, customer retention and financing risks.

In addition, completion of the separation will be subject to certain conditions, such as approval by our Board of Directors, receipt of tax opinions, effectiveness of a registration statement and foreign regulatory requirements. For more information

on the risks related to the proposed spin-off, please refer to the “Risk Factors” section included in Lumentum Holdings Inc.’s Registration Statement on Form 10 as amended and filed with the Securities and Exchange Commission on

April 23, 2015, and as may be amended from time to time in the future. The forward-looking statements contained in this press release are made as of the date thereof and the Company assumes no obligation to update such statements.

About JDSU

JDSU (NASDAQ: JDSU) innovates and

collaborates with customers to build and operate the highest-performing and highest-value networks in the world. Our diverse technology portfolio also fights counterfeiting and enables high-powered commercial lasers for a range of applications.

Learn more about JDSU at www.jdsu.com and follow us on JDSU Perspectives, Twitter, Facebook and YouTube.

Contact Information

| Press: |

Noel Bilodeau, 408-546-4567 or noel.bilodeau@jdsu.com |

| Investors: |

Bill Ong, 408-546-4521 or bill.ong@jdsu.com |

###

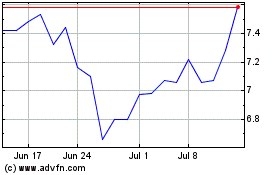

Viavi Solutions (NASDAQ:VIAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

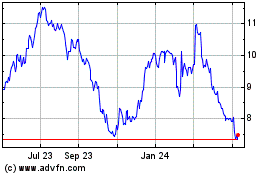

Viavi Solutions (NASDAQ:VIAV)

Historical Stock Chart

From Apr 2023 to Apr 2024