UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 29, 2015

JDS UNIPHASE CORPORATION

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

000-22874 |

|

94-2579683 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

|

430 North McCarthy Boulevard, Milpitas, CA |

|

95035 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(408) 546-5000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On January 29, 2015, JDS Uniphase Corporation (the “Company”) reported its results for its fiscal second quarter ended December 27, 2014. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K, including Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press release entitled “JDSU Announces Fiscal Second Quarter 2015 Results” dated January 29, 2015. |

2

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

JDS Uniphase Corporation |

|

|

|

|

|

/s/ Rex S. Jackson |

|

|

Rex S. Jackson |

|

|

Executive Vice President, Chief Financial Officer |

|

|

|

|

|

|

|

January 29, 2015 |

|

3

Exhibit 99.1

JDSU ANNOUNCES FISCAL SECOND QUARTER 2015 RESULTS

· GAAP and Non-GAAP Net Revenue of $437.1 million

· GAAP Gross margin of 45.9%; Non-GAAP Gross margin of 49.1%

· GAAP EPS of $(0.11); Non-GAAP EPS of $0.15

· Expect completion of separation into two publicly traded companies by the calendar third quarter of 2015

Milpitas, California, January 29, 2015 — JDSU (NASDAQ: JDSU) today reported results for its fiscal second quarter ended December 27, 2014.

GAAP net revenue was $437.1 million, with net loss of $(25.1) million, or $(0.11) per share. Prior quarter net revenue was $433.6 million, with net loss of $(9.7) million, or $(0.04) per share. Net revenue for fiscal second quarter 2014 was $447.6 million, with GAAP net income of $8.8 million, or $0.04 per share.

Non-GAAP net revenue was $437.1 million, with non-GAAP net income of $35.4 million, or $0.15 per share. Prior quarter non-GAAP net revenue was $433.6 million, with non-GAAP net income of $33.8 million, or $0.14 per share. Non-GAAP net revenue for fiscal second quarter 2014 was $447.6 million, with net income of $45.3 million, or $0.19 per share.

“We continue to experience the benefits of diversification and product differentiation, which drove strength in both gross margin and operating margin at the higher end of the guidance range even as U.S. carrier spend impacted revenue in the second quarter,” said Tom Waechter, JDSU’s president and chief executive officer. “We are pleased with our progress toward the planned separation of SpinCo (CCOP) and NewCo (NE/SE/OSP) and currently expect to complete the transaction by the calendar third quarter of this year.”

Financial Overview — Second Quarter Ended December 27, 2014

The tables below (in millions, except percentage data) provide comparisons of quarterly results to prior periods, including sequential quarterly and year-over-year changes. A reconciliation between GAAP and non-GAAP measures is contained in this release under the section titled “Use of Non-GAAP (Adjusted) Financial Measures.”

|

|

|

GAAP Results |

|

|

|

|

Q2 |

|

Q1 |

|

Q2 |

|

Change |

|

|

|

|

FY 2015 |

|

FY 2015 |

|

FY 2014 |

|

Q/Q |

|

Y/Y |

|

|

Net revenue |

|

$ |

437.1 |

|

|

$ |

433.6 |

|

|

$ |

447.6 |

|

|

0.8% |

|

(2.3)% |

|

|

Gross margin |

|

45.9% |

|

46.0% |

|

45.8% |

|

(10) bps |

|

10 bps |

|

|

Operating margin |

|

(1.9)% |

|

1.0% |

|

4.4% |

|

(290) bps |

|

(630) bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Results |

|

|

|

|

Q2 |

|

Q1 |

|

Q2 |

|

Change |

|

|

|

|

FY 2015 |

|

FY 2015 |

|

FY 2014 |

|

Q/Q |

|

Y/Y |

|

|

Net revenue |

|

$ |

437.1 |

|

|

$ |

433.6 |

|

|

$ |

447.6 |

|

|

0.8% |

|

(2.3)% |

|

|

Adj. Gross margin |

|

49.1% |

|

49.0% |

|

48.5% |

|

10 bps |

|

60 bps |

|

|

Adj. Operating margin |

|

9.9% |

|

9.1% |

|

11.0% |

|

80 bps |

|

(110) bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenue by Segment |

|

|

|

|

Q2 |

|

% of |

|

Q1 |

|

Q2 |

|

Change |

|

|

|

|

FY 2015 |

|

Net Revenue |

|

FY 2015 |

|

FY 2014 |

|

Q/Q |

|

Y/Y |

|

|

Network Enablement |

|

$ |

133.7 |

|

|

30.5% |

|

$ |

132.8 |

|

|

$ |

155.8 |

|

|

0.7% |

|

(14.2)% |

|

|

Service Enablement |

|

45.7 |

|

10.5 |

|

48.2 |

|

39.2 |

|

(5.2) |

|

16.6 |

|

|

Communications and Commercial Optical Products: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Optical Communications |

|

167.1 |

|

|

|

167.1 |

|

174.5 |

|

— |

|

(4.2) |

|

|

Lasers |

|

40.0 |

|

|

|

42.2 |

|

23.5 |

|

(5.2) |

|

70.2 |

|

|

Communications and Commercial Optical Products |

|

207.1 |

|

47.4 |

|

209.3 |

|

198.0 |

|

(1.1) |

|

4.6 |

|

|

Optical Security and Performance Products |

|

50.6 |

|

11.6 |

|

43.3 |

|

54.6 |

|

16.9 |

|

(7.3) |

|

|

Total |

|

$ |

437.1 |

|

|

100.0% |

|

$ |

433.6 |

|

|

$ |

447.6 |

|

|

0.8% |

|

(2.3)% |

|

1

· Americas, EMEA and Asia-Pacific customers represented 43.3 %, 22.4 % and 34.3 %, respectively, of total net revenue for the quarter.

· The Company held $867.6 million in total cash and investments and generated $16.6 million of cash from operations for the quarter.

Business Outlook

For the fiscal third quarter ending March 28, 2015, the Company expects non-GAAP net revenue to be $418 million +/-10 million and non-GAAP earnings per share to be $0.09 +/-0.02.

Conference Call

The Company will discuss these results and other related matters at 2:00 p.m. Pacific Time on January 29, 2015 in a live webcast, which will also be archived for replay on the Company’s website at www.jdsu.com/investors. The Company will post supporting slides outlining the Company’s latest financial results on www.jdsu.com/investors under the “Quarterly Results” section concurrently with this earnings press release. This press release is being furnished as a Current Report on Form 8-K with the Securities and Exchange Commission, and will be available at www.sec.gov.

About JDSU

JDSU (NASDAQ: JDSU) innovates and collaborates with customers to build and operate the highest-performing and highest-value networks in the world. Our diverse technology portfolio also fights counterfeiting and enables high-powered commercial lasers for a range of applications. Learn more about JDSU at www.jdsu.com and follow us on JDSU Perspectives, Twitter, Facebook and YouTube.

On September 10, 2014, the Company announced plans to separate into two publicly traded companies to be named at a later date: an optical components and commercial lasers company consisting of JDSU’s current Communications and Commercial Optical Products (“CCOP”) segment, and a network and service enablement company consisting of JDSU’s current Network Enablement (“NE”), Service Enablement (“SE”) and Optical Security and Performance Products (“OSP”) segments. The separation is expected to occur through a tax-free pro rata spinoff of CCOP to JDSU shareholders, though the structure is subject to change based upon various tax and regulatory factors. The Company expects to complete the separation by the calendar third quarter of 2015.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include any anticipation or guidance as to future financial performance, including future revenue, gross margin, operating expense, operating margin, cash flow and other financial metrics, as well as the impact and duration of certain market conditions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected. In particular, the Company’s ability to predict future financial performance continues to be difficult due to, among other things: (a) continuing general limited visibility across many of our product lines; (b) quarter-over-quarter product mix fluctuations, which can materially impact profitability measures due to the broad gross margin range across our portfolio; (c) consolidations in our customer base and customer purchasing delays as they assess or transition to new technologies and/or new architectures, which limit near-term demand visibility, and could negatively impact potential revenue; (d) continued decline of average selling prices across our businesses; (e) notable seasonality and a significant level of in-quarter book-and-ship business, particularly in our NE and SE segments; (f) various product and manufacturing transfers, site consolidations and product discontinuances that have caused and may cause short-term disruptions; (g) the ability of our suppliers and contract manufacturers to meet production and delivery requirements to our forecasted demand; and (h) inherent uncertainty related to global markets and the effect of such markets on demand for our products. Additionally, these statements include (i) information and guidance about the Company’s plans to separate the business into two independent, publicly traded companies, (ii) the composition of those companies, (iii) the anticipated benefits, timing, savings, costs and other impacts of the separation, and (iv) the plan to achieve the separation through a tax-free spinoff. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected. Risks related to the proposed separation include the requirement to obtain certain approvals, the ability to retain key employees, the ability to recognize anticipated cost savings, the ability of each company to function successfully as a stand-alone entity, potential business disruption caused by separation preparations, customer retention and financing risks. In addition, completion of the separation will be subject to certain conditions, such as approval by our Board of Directors, receipt of tax opinions, effectiveness of a registration statement and foreign regulatory requirements. For more information on the risks related to the operation of Company’s existing business segments, please refer to the “Risk Factors” section included in the Company’s Annual Report on Form 10-K for the

2

fiscal year ended June 28, 2014 and the Company’s Quarterly Report on Form 10-Q for the fiscal first quarter ended September 27, 2014 filed with the Securities and Exchange Commission. The forward-looking statements contained in this press release are made as of the date hereof and the Company assumes no obligation to update such statements.

Contact Information

Investors: Bill Ong, 408-546-4521, or bill.ong@jdsu.com

Press: Jim Monroe, 240-404-1922, or jim.monroe@jdsu.com

The following financial tables are presented in accordance with GAAP, unless otherwise specified.

-SELECTED FINANCIAL DATA -

3

JDS UNIPHASE CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

December 27, |

|

December 28, |

|

December 27, |

|

December 28, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Net revenue |

|

$ |

437.1 |

|

$ |

447.6 |

|

$ |

870.7 |

|

$ |

876.6 |

|

|

Cost of sales |

|

225.5 |

|

232.8 |

|

449.8 |

|

465.2 |

|

|

Amortization of acquired technologies |

|

11.1 |

|

9.9 |

|

21.1 |

|

21.3 |

|

|

Gross profit |

|

200.5 |

|

204.9 |

|

399.8 |

|

390.1 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

79.2 |

|

72.3 |

|

155.6 |

|

141.9 |

|

|

Selling, general and administrative |

|

114.8 |

|

109.0 |

|

225.5 |

|

216.1 |

|

|

Amortization of other intangibles |

|

5.0 |

|

2.8 |

|

10.1 |

|

5.5 |

|

|

Restructuring and related charges |

|

9.7 |

|

1.0 |

|

12.6 |

|

0.2 |

|

|

Total operating expenses |

|

208.7 |

|

185.1 |

|

403.8 |

|

363.7 |

|

|

(Loss) income from operations |

|

(8.2 |

) |

19.8 |

|

(4.0 |

) |

26.4 |

|

|

Interest and other income (expense), net |

|

0.4 |

|

0.4 |

|

0.9 |

|

(0.2 |

) |

|

Interest expense |

|

(8.5 |

) |

(8.4 |

) |

(16.8 |

) |

(13.6 |

) |

|

(Loss) income before income taxes |

|

(16.3 |

) |

11.8 |

|

(19.9 |

) |

12.6 |

|

|

Provision for income taxes |

|

8.8 |

|

3.0 |

|

14.9 |

|

3.5 |

|

|

Net (loss) income |

|

$ |

(25.1 |

) |

$ |

8.8 |

|

$ |

(34.8 |

) |

$ |

9.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share from: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.11 |

) |

$ |

0.04 |

|

$ |

(0.15 |

) |

$ |

0.04 |

|

|

Diluted |

|

$ |

(0.11 |

) |

$ |

0.04 |

|

$ |

(0.15 |

) |

$ |

0.04 |

|

|

Shares used in per share calculation: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

232.1 |

|

233.0 |

|

231.5 |

|

234.2 |

|

|

Diluted |

|

232.1 |

|

235.8 |

|

231.5 |

|

237.8 |

|

4

JDS UNIPHASE CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, unaudited)

|

|

|

December 27, |

|

June 28, |

|

|

|

|

2014 |

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

293.6 |

|

$ |

297.2 |

|

|

Short-term investments |

|

545.1 |

|

552.2 |

|

|

Restricted cash |

|

28.9 |

|

31.9 |

|

|

Accounts receivable, net |

|

317.4 |

|

296.2 |

|

|

Inventories, net |

|

153.1 |

|

153.3 |

|

|

Prepayments and other current assets |

|

78.9 |

|

78.7 |

|

|

Total current assets |

|

1,417.0 |

|

1,409.5 |

|

|

Property, plant and equipment, net |

|

285.0 |

|

288.8 |

|

|

Goodwill |

|

261.3 |

|

267.0 |

|

|

Intangibles, net |

|

141.9 |

|

177.8 |

|

|

Deferred income taxes |

|

166.2 |

|

183.3 |

|

|

Other non-current assets |

|

24.2 |

|

25.5 |

|

|

Total assets |

|

$ |

2,295.6 |

|

$ |

2,351.9 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

128.9 |

|

$ |

137.1 |

|

|

Accrued payroll and related expenses |

|

84.0 |

|

79.9 |

|

|

Deferred revenue |

|

76.1 |

|

77.5 |

|

|

Accrued expenses |

|

37.6 |

|

34.8 |

|

|

Other current liabilities |

|

76.1 |

|

79.1 |

|

|

Total current liabilities |

|

402.7 |

|

408.4 |

|

|

Long-term debt |

|

548.8 |

|

536.3 |

|

|

Other non-current liabilities |

|

206.3 |

|

219.5 |

|

|

Total stockholders’ equity |

|

1,137.8 |

|

1,187.7 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,295.6 |

|

$ |

2,351.9 |

|

JDS UNIPHASE CORPORATION

REPORTABLE SEGMENT INFORMATION

(in millions, unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

December 27, |

|

December 28, |

|

December 27, |

|

December 28, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Net revenue: |

|

|

|

|

|

|

|

|

|

|

Network Enablement |

|

$ |

133.7 |

|

$ |

155.8 |

|

$ |

266.5 |

|

$ |

300.9 |

|

|

Service Enablement |

|

45.7 |

|

39.2 |

|

93.9 |

|

66.0 |

|

|

Communications and Commercial Optical Products |

|

207.1 |

|

198.0 |

|

416.4 |

|

402.6 |

|

|

Optical Security and Performance Products |

|

50.6 |

|

54.6 |

|

93.9 |

|

107.1 |

|

|

Net revenue |

|

$ |

437.1 |

|

$ |

447.6 |

|

$ |

870.7 |

|

$ |

876.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

Network Enablement |

|

$ |

22.5 |

|

$ |

30.9 |

|

$ |

42.6 |

|

$ |

53.4 |

|

|

Service Enablement |

|

(2.5 |

) |

(2.2 |

) |

(1.7 |

) |

(12.1 |

) |

|

Communications and Commercial Optical Products |

|

26.6 |

|

23.9 |

|

51.7 |

|

51.1 |

|

|

Optical Security and Performance Products |

|

18.8 |

|

20.5 |

|

34.7 |

|

39.6 |

|

|

Corporate |

|

(22.3 |

) |

(23.9 |

) |

(44.7 |

) |

(47.4 |

) |

|

Total segment operating income |

|

43.1 |

|

49.2 |

|

82.6 |

|

84.6 |

|

|

Unallocated amounts: |

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

(15.0 |

) |

(15.7 |

) |

(30.7 |

) |

(31.4 |

) |

|

Amortization of intangibles |

|

(16.1 |

) |

(12.7 |

) |

(31.2 |

) |

(26.8 |

) |

|

Gain on disposal of long-lived assets |

|

— |

|

0.5 |

|

— |

|

0.2 |

|

|

Restructuring and related charges (1) |

|

(9.7 |

) |

(1.0 |

) |

(12.6 |

) |

(0.2 |

) |

|

Other charges related to non-recurring activities (1) |

|

(10.5 |

) |

(0.5 |

) |

(12.1 |

) |

— |

|

|

Interest and other income (expense), net |

|

0.4 |

|

0.4 |

|

0.9 |

|

(0.2 |

) |

|

Interest expense |

|

(8.5 |

) |

(8.4 |

) |

(16.8 |

) |

(13.6 |

) |

|

(Loss) income from operations before income taxes |

|

$ |

(16.3 |

) |

$ |

11.8 |

|

$ |

(19.9 |

) |

$ |

12.6 |

|

(1) During the three months and six months ended December 27, 2014, the Company incurred incremental expenses of $16.3 million and $16.7 million, respectively to effect the Company’s plan to separate into two separate public companies. These incremental expenses included (a) restructuring charges, (b) accounting, legal, and professional fees, (c) and cost of additional labor dedicated to affect the separation and/or to enable SpinCo to operate successfully immediately following the split.

Use of Non-GAAP (Adjusted) Financial Measures

The Company provides non-GAAP net revenue, non-GAAP net income (loss), non-GAAP net income (loss) per share, EBITDA and adjusted EBITDA financial measures as supplemental information regarding the Company’s operational performance. The Company uses the measures disclosed in this release to evaluate the Company’s historical and prospective financial performance, as well as its performance relative to its competitors. Specifically, management uses these items to further its own understanding of the Company’s core operating performance, which the Company believes represent its performance in the ordinary, ongoing and customary course of its operations. Accordingly, management excludes from core operating performance items such as those relating to amortization of acquisition-related intangibles, stock-based compensation, restructuring, separation costs, and certain investing expenses and non-cash activities that management believes are not reflective of such ordinary, ongoing and customary course activities.

The Company believes providing this additional information allows investors to see Company results through the eyes of management. The Company further believes that providing this information allows investors to better understand the Company’s financial performance and, importantly, to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance.

The non-GAAP adjustments described in this release have historically been excluded by the Company from its non-GAAP financial measures. The non-GAAP adjustments, and the basis for excluding them, are outlined below.

Cost of sales, costs of research and development and costs of selling, general and administrative: The Company’s GAAP presentation of gross margin and operating expenses may include (i) additional depreciation and amortization from changes in estimated useful life and the write-down of certain property, equipment and intangibles that have been identified for disposal but remained in use until the date of disposal, (ii) workforce related charges such as severance, retention bonuses and employee relocation costs related to formal restructuring plans (iii) costs for facilities not required for ongoing operations, and costs related to the relocation of certain equipment from these facilities and/or contract manufacturer facilities, (iv) stock-based compensation, (v) other non-recurring charges comprising mainly of one-time acquisition, integration, litigation and other costs and contingencies unrelated to current and future operations, including separation costs incurred to effect the Company’s plan to separate into two separate public companies, such as restructuring, accounting, legal, and professional fees and related non-recurring costs, (vi) product-line termination costs such as the write-off of inventory no longer being sold, and (vii) impairment charges resulting from a write-down or write-off of the carrying value of intangible assets assessed in accordance with authoritative guidance. The Company excludes these items in calculating non-GAAP gross margin, non-GAAP operating income, non-GAAP net income (loss), non-GAAP net income (loss) per share, EBITDA and adjusted EBITDA. The Company believes excluding these items enables investors to evaluate more clearly and consistently the Company’s core operational performance.

Amortization of intangibles from acquisitions: The Company includes amortization expense related to intangibles from acquisitions in its GAAP presentation of cost of sales and operating expense. The Company excludes these significant non-cash items in calculating non-GAAP gross margin, non-GAAP operating income, non-GAAP net income (loss), non-GAAP net income (loss) per share, EBITDA and adjusted EBITDA, because it believes doing so provides investors a clearer and more consistent view of the Company’s core operating performance in terms of cost of sales and operating expenses.

Other income (loss), net and non-cash interest expense: The Company incurred non-cash interest expense accretion of the debt discount on its convertible debt instruments and a one-time write-off of unamortized issuance cost related to its revolving credit facility upon termination of the facility. The Company eliminates these items in calculating non-GAAP net income (loss), non-GAAP net income (loss) per share, EBITDA and adjusted EBITDA, because it believes that in so doing, it can provide investors a clearer and more consistent view of the Company’s core operating performance.

Gain or loss on sale of available for-sale investments: The Company has sold investments or adjusted the value of investments from time to time based on market conditions, and includes the impact of these activities in its GAAP presentation of net income (loss) and net income (loss) per share. The Company’s core business does not include making financial investments in third parties. Moreover, the amount and timing of gains and losses and adjustments to the value of investments are unpredictable. Consequently, the Company excludes these items in calculating non-GAAP net income (loss), non-GAAP net income (loss) per share, EBITDA and adjusted EBITDA because it believes gains or losses on these sales and adjustments to the value of investments are not related to the Company’s ongoing core business and operating performance.

Income tax expense or benefit: The Company excludes non-cash tax expense related to the utilization of net operating losses where valuation allowances were released and non-cash income tax intraperiod tax allocation benefit. The Company believes excluding these items enables investors to evaluate more clearly and consistently the Company’s core operational performance.

Interest, taxes, depreciation, amortization and other adjustments: The Company’s EBITDA calculation primarily excludes interest, taxes, depreciation and amortization, and other items that are not part of its core operating performance described above. The Company’s adjusted EBITDA excludes items in addition to the items excluded from the EBITDA calculation such as stock-based compensation and restructuring and related charges (benefits), and other charges related to non-recurring activities that are not part of its core operating performance described above. Management believes adjusted EBITDA is a good indicator of the Company’s core operational cash flow.

Non-GAAP financial measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The GAAP measure most directly comparable to non-GAAP net income (loss) is net income (loss). The GAAP measure most directly comparable to non-GAAP net income (loss) per share is net income (loss) per share. The Company believes these GAAP measures alone are not indicative of its core operating expenses and performance.

The following tables reconcile GAAP measures to non-GAAP measures:

JDS UNIPHASE CORPORATION

RECONCILIATION OF GAAP MEASURES TO NON-GAAP MEASURES

(in millions, except per share data)

(unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

December 27, |

|

December 28, |

|

December 27, |

|

December 28, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

Net

income

(loss) |

|

Diluted

EPS |

|

Net

income

(loss) |

|

Diluted

EPS |

|

Net

income

(loss) |

|

Diluted

EPS |

|

Net

income

(loss) |

|

Diluted

EPS |

|

|

GAAP measures |

|

$ |

(25.1 |

) |

$ |

(0.11 |

) |

$ |

8.8 |

|

$ |

0.04 |

|

$ |

(34.8 |

) |

$ |

(0.15 |

) |

$ |

9.1 |

|

$ |

0.04 |

|

|

Items reconciling GAAP net (loss) income and EPS to non-GAAP net income and EPS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Related to cost of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

2.3 |

|

0.01 |

|

2.6 |

|

0.01 |

|

4.7 |

|

0.02 |

|

5.0 |

|

0.02 |

|

|

Other charges related to non-recurring activities |

|

0.8 |

|

— |

|

(0.2 |

) |

— |

|

1.6 |

|

0.01 |

|

(0.7 |

) |

— |

|

|

Amortization of acquired developed technologies |

|

11.1 |

|

0.05 |

|

9.9 |

|

0.04 |

|

21.1 |

|

0.09 |

|

21.3 |

|

0.09 |

|

|

Total related to gross profit |

|

14.2 |

|

0.06 |

|

12.3 |

|

0.05 |

|

27.4 |

|

0.12 |

|

25.6 |

|

0.11 |

|

|

Related to operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

3.7 |

|

0.02 |

|

3.9 |

|

0.02 |

|

7.6 |

|

0.03 |

|

7.6 |

|

0.03 |

|

|

Other charges related to non-recurring activities |

|

2.1 |

|

0.01 |

|

— |

|

0.04 |

|

2.0 |

|

0.01 |

|

— |

|

0.04 |

|

|

Selling, general and administrative: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

9.0 |

|

0.04 |

|

9.2 |

|

0.04 |

|

18.4 |

|

0.08 |

|

18.8 |

|

0.08 |

|

|

Other charges related to non-recurring activities (1) |

|

7.6 |

|

0.03 |

|

0.7 |

|

— |

|

8.5 |

|

0.04 |

|

0.7 |

|

— |

|

|

Amortization of intangibles |

|

5.0 |

|

0.02 |

|

2.8 |

|

0.01 |

|

10.1 |

|

0.04 |

|

5.5 |

|

0.02 |

|

|

Loss (gain) on disposal of long-lived assets |

|

— |

|

— |

|

(0.5 |

) |

— |

|

— |

|

— |

|

(0.2 |

) |

— |

|

|

Restructuring and related charges (1) |

|

9.7 |

|

0.04 |

|

1.0 |

|

— |

|

12.6 |

|

0.05 |

|

0.2 |

|

— |

|

|

Total related to operating expenses |

|

37.1 |

|

0.16 |

|

17.1 |

|

0.07 |

|

59.2 |

|

0.25 |

|

32.6 |

|

0.14 |

|

|

Non-cash interest expense |

|

6.3 |

|

0.03 |

|

6.0 |

|

0.03 |

|

12.4 |

|

0.05 |

|

9.8 |

|

0.04 |

|

|

Gain on sale of investments |

|

— |

|

— |

|

(0.2 |

) |

— |

|

— |

|

— |

|

(0.2 |

) |

— |

|

|

Income tax expense |

|

2.9 |

|

0.01 |

|

1.3 |

|

0.01 |

|

5.0 |

|

0.02 |

|

(1.4 |

) |

(0.01 |

) |

|

Total related to net income & EPS |

|

60.5 |

|

0.26 |

|

36.5 |

|

0.15 |

|

104.0 |

|

0.44 |

|

66.4 |

|

0.28 |

|

|

Non-GAAP measures |

|

$ |

35.4 |

|

$ |

0.15 |

|

$ |

45.3 |

|

$ |

0.19 |

|

$ |

69.2 |

|

$ |

0.29 |

|

$ |

75.5 |

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in per share calculation for Non-GAAP EPS |

|

|

|

235.2 |

|

|

|

235.8 |

|

|

|

234.6 |

|

|

|

237.8 |

|

Note: Certain totals may not add due to rounding

(1) During the three months and six months ended December 27, 2014, the Company incurred incremental expenses of $16.3 million and $16.7 million, respectively to effect the Company’s plan to separate into two separate public companies. These incremental expenses included (a) restructuring charges, (b) accounting, legal, and professional fees, (c) and cost of additional labor dedicated to affect the separation and/or to enable SpinCo to operate successfully immediately following the split.

JDS UNIPHASE CORPORATION

RECONCILIATION OF GAAP NET (LOSS) INCOME TO ADJUSTED EBITDA

(in millions, unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

December

27, |

|

December

28, |

|

December

27, |

|

December

28, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

GAAP net (loss) income from continuing operations |

|

$ |

(25.1 |

) |

$ |

8.8 |

|

$ |

(34.8 |

) |

$ |

9.1 |

|

|

Interest and other income (expense), net |

|

(0.4 |

) |

(0.4 |

) |

(0.9 |

) |

0.2 |

|

|

Interest expense |

|

8.5 |

|

8.4 |

|

16.8 |

|

13.6 |

|

|

Provision for income taxes |

|

8.8 |

|

3.0 |

|

14.9 |

|

3.5 |

|

|

Depreciation |

|

20.6 |

|

17.8 |

|

40.2 |

|

35.6 |

|

|

Amortization |

|

16.1 |

|

12.7 |

|

31.2 |

|

26.8 |

|

|

EBITDA |

|

28.5 |

|

50.3 |

|

67.4 |

|

88.8 |

|

|

Costs related to restructuring and related charges (1) |

|

9.7 |

|

1.0 |

|

12.6 |

|

0.2 |

|

|

Costs related to stock based compensation |

|

15.0 |

|

15.7 |

|

30.7 |

|

31.4 |

|

|

Costs related to other non-recurring activities (1) |

|

10.5 |

|

0.5 |

|

12.1 |

|

— |

|

|

Loss (gain) on disposal of long-lived assets |

|

— |

|

(0.5 |

) |

— |

|

(0.2 |

) |

|

Adjusted EBITDA |

|

$ |

63.7 |

|

$ |

67.0 |

|

$ |

122.8 |

|

$ |

120.2 |

|

(1) During the three months and six months ended December 27, 2014, the Company incurred incremental expenses of $16.3 million and $16.7 million, respectively to effect the Company’s plan to separate into two separate public companies. These incremental expenses included (a) restructuring charges, (b) accounting, legal, and professional fees, (c) and cost of additional labor dedicated to affect the separation and/or to enable SpinCo to operate successfully immediately following the split.

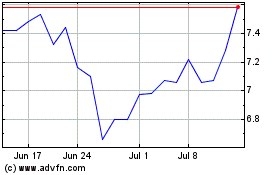

Viavi Solutions (NASDAQ:VIAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

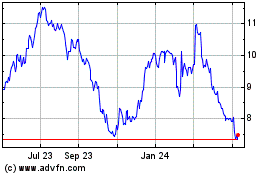

Viavi Solutions (NASDAQ:VIAV)

Historical Stock Chart

From Apr 2023 to Apr 2024