Announces $50 Million Share Repurchase

Authorization

Itron, Inc. (NASDAQ:ITRI) announced today financial results for

its fourth quarter and full year ended Dec. 31, 2016. Highlights

include:

- Quarterly and full year revenues of

$495.7 million and $2.0 billion;

- Quarterly and full year gross margin of

31.6 percent and 32.8 percent;

- Quarterly and full year GAAP net income

of $11.6 million and $31.8 million;

- Quarterly and full year GAAP diluted

earnings per share of 30 cents and 82 cents; and

- Quarterly and full year non-GAAP

diluted earnings per share of 68 cents and $2.54.

“Itron’s fourth quarter results reflect a strong finish to a

year of significant improvement in financial and operational

performance,” said Philip Mezey, Itron’s president and chief

executive officer. “Highlights from the quarter include

improved earnings and robust revenue growth in the Electricity

segment driven by growth in smart solutions. Adjusted EBITDA

increased by more than 50 percent to $54 million driven by our

focus on predictability, profitability and growth. This level of

EBITDA equates to 11 percent of revenues, demonstrating that we are

making progress toward our mid-teens goal. In addition, the board's

authorization of a new share repurchase program reflects confidence

in Itron’s profitable growth initiatives, financial flexibility and

long-term business outlook."

Summary of Fourth Quarter Consolidated Financial

Results(All comparisons made are against the prior year period

unless otherwise noted)

Revenue

Total revenue was $495.7 million in the fourth quarter of 2016

compared with $496.4 million in the fourth quarter of 2015. Foreign

currency exchange rates unfavorably affected revenue by $7 million

compared with the prior year. In addition, strong revenue growth in

the Electricity segment, which grew 13 percent, offset decreases in

the Gas and Water segments.

Gross Margin

Gross margin was 31.6 percent compared with the prior year

period margin of 30.7 percent. The improvement in gross margin was

driven by favorable product mix and reduced warranty expense,

partially offset by increased variable compensation.

Operating Expenses

Operating expenses were $125.9 million compared with $136.0

million in 2015. The decrease was due primarily to lower legal

costs and reduced headcount in general and administrative

departments, which was partially offset by higher variable

compensation and restructuring costs.

Operating Income, Net Income, Earnings per

Share

Operating income improved to $30.8 million compared with

operating income of $16.4 million in 2015. Non-GAAP operating

income improved to $44.7 million compared with $25.9 million in

2015.

Net income for the quarter was $11.6 million, or 30 cents per

diluted share, compared with net income of $9.0 million, or 23

cents per diluted share, in 2015. Non-GAAP net income for the

quarter was $26.4 million, or 68 cents per diluted share, compared

with $17.4 million, or 45 cents per diluted share, in 2015.

The increases in GAAP and non-GAAP operating income were driven

by improved gross margin and lower operating expenses. GAAP and

non-GAAP net income and earnings per share reflect the company’s

increased operating income partially offset by a higher effective

tax rate. The increased tax rate was due to the mix of taxable

income by jurisdiction and discrete items.

Fourth Quarter and Full Year Cash

Flow

Cash provided by operating activities was $34.0 million in the

fourth quarter of 2016 compared with $53.2 million in 2015.

Non-GAAP free cash flow was $21.0 million in the fourth quarter

compared with $42.6 million in the prior year. The decreases in

quarterly cash from operations and free cash flow over the prior

year were primarily driven by timing of accounts payable, timing of

remittances on certain large contracts and a $2.4 million increase

in capital expenditures.

For the full year, cash from operating activities totaled $115.8

million in 2016 compared with $73.4 million in 2015. Free cash flow

was $72.3 million in 2016 compared with $29.4 million in 2015. The

increases in cash from operations and free cash flow over the prior

year were primarily driven by increased profitability and reduced

inventory, partially offset by the timing of remittances on certain

large contracts. Capital expenditures were flat year-over-year at

approximately $44 million.

Other Measures

Bookings in the quarter totaled $653 million. Total backlog was

$1.7 billion and 12-month backlog was $761 million at 2016 year

end, compared with $1.6 billion and $836 million at 2015 year end,

respectively.

Share Repurchase Program

On Feb. 23, 2017, the board of directors authorized a new

program to repurchase up to $50 million of Itron common stock over

a 12-month period beginning Feb. 23, 2017. Repurchases under the

program will be made in the open market in accordance with

applicable securities laws.

Financial Guidance – Full Year 2017

Itron’s guidance for the full year 2017 is as follows:

- Revenue between $1.9 and $2.0

billion

- Non-GAAP diluted EPS between $2.80 and

$3.10

This guidance assumes foreign currency exchange rates remain

consistent with current levels on average in 2017, average fully

diluted shares outstanding of approximately 39.5 million for the

year and a non-GAAP effective tax rate for the year of

approximately 35 percent. A reconciliation of forward-looking

non-GAAP diluted EPS to the GAAP diluted EPS has not been provided

because we are unable to predict with reasonable certainty the

potential amount or timing of restructuring and acquisition-related

expenses and their related tax effects without unreasonable effort.

These items are uncertain, depend on various factors, and could

have a material impact on GAAP results for the guidance period.

Earnings Conference Call

Itron will host a conference call to discuss the financial

results and guidance contained in this release at 5 p.m. EST on

Feb. 28, 2017. The call will be webcast in a listen-only mode.

Webcast information and conference call materials will be made

available 10 minutes before the start of the call and will be

accessible on Itron’s website at

http://investors.itron.com/events.cfm. A replay of the audio

webcast will be made available for one year at

http://investors.itron.com/events.cfm. A telephone replay of the

conference call will be available through March 5, 2017. To access

the telephone replay, dial 888-203-1112 (Domestic) or 719-457-0820

(International) and enter passcode 8093200.

About Itron

Itron is a world-leading technology and services company

dedicated to the resourceful use of energy and water. We provide

comprehensive solutions that measure, manage and analyze energy and

water. Our broad product portfolio includes electricity, gas, water

and thermal energy measurement devices and control technology;

communications systems; software; as well as managed and consulting

services. With thousands of employees supporting nearly 8,000

customers in more than 100 countries, Itron applies knowledge and

technology to better manage energy and water resources. Together,

we can create a more resourceful world. Join us: www.itron.com.

Itron® is a registered trademark of Itron, Inc. All third party

trademarks are property of their respective owners and any usage

herein does not suggest or imply any relationship between Itron and

the third party unless expressly stated.

Forward Looking Statements

This release contains forward-looking statements within in the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements relate to our expectations about revenues,

operations, financial performance, earnings, earnings per share,

cash flows and restructuring activities including headcount

reductions and other cost savings initiatives. Although we believe

the estimates and assumptions upon which these forward-looking

statements are based are reasonable, any of these estimates or

assumptions could prove to be inaccurate and the forward-looking

statements based on these estimates and assumptions could be

incorrect. Our operations involve risks and uncertainties, many of

which are outside our control, and any one of which, or a

combination of which, could materially affect our results of

operations and whether the forward-looking statements ultimately

prove to be correct. Actual results and trends in the future may

differ materially from those suggested or implied by the

forward-looking statements depending on a variety of factors. Some

of the factors that we believe could affect our results include our

ability to execute on our restructuring plan, our ability to

achieve estimated cost savings, the rate and timing of customer

demand for our products, rescheduling of current customer orders,

changes in estimated liabilities for product warranties, adverse

impacts of litigation, changes in laws and regulations, our

dependence on new product development and intellectual property,

future acquisitions, changes in estimates for stock-based and bonus

compensation, increasing volatility in foreign exchange rates,

international business risks and other factors that are more fully

described in our Annual Report on Form 10-K for the year ended

December 31, 2015 and other reports on file with the Securities and

Exchange Commission. Itron undertakes no obligation to update or

revise any information in this press release.

Non-GAAP Financial Information

To supplement our consolidated financial statements presented in

accordance with GAAP, we use certain non-GAAP financial measures,

including non-GAAP operating expense, non-GAAP operating income,

non-GAAP net income, non-GAAP diluted EPS, adjusted EBITDA,

adjusted EBITDA margin, constant currency and free cash flow. We

provide these non-GAAP financial measures because we believe they

provide greater transparency and represent supplemental information

used by management in its financial and operational decision

making. We exclude certain costs in our non-GAAP financial measures

as we believe the net result is a measure of our core business. The

company believes these measures facilitate operating performance

comparisons from period to period by eliminating potential

differences caused by the existence and timing of certain expense

items that would not otherwise be apparent on a GAAP basis.

Non-GAAP performance measures should be considered in addition to,

and not as a substitute for, results prepared in accordance with

GAAP. Our non-GAAP financial measures may be different from those

reported by other companies. A more detailed discussion of why we

use non-GAAP financial measures, the limitations of using such

measures, and reconciliations between non-GAAP and the nearest GAAP

financial measures are included in this press release.

Statements of operations, segment information, balance sheets,

cash flow statements and reconciliations of non-GAAP financial

measures to the most directly comparable GAAP financial measures

follow.

ITRON, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited, in

thousands, except per share data)

Three Months Ended December

31, Twelve Months Ended December 31,

2016 2015 2016

2015 Revenues $ 495,713 $ 496,448 $

2,013,186 $ 1,883,533 Cost of revenues 339,050

344,029 1,352,866 1,326,848

Gross profit 156,663 152,419 660,320 556,685 Operating

expenses Sales and marketing 39,846 38,078 158,883 161,380 Product

development 40,123 35,935 168,209 162,334 General and

administrative 32,034 52,520 162,815 155,715 Amortization of

intangible assets 6,110 7,943 25,112 31,673 Restructuring

7,796 1,565 49,090 (7,263

) Total operating expenses 125,909 136,041

564,109 503,839 Operating

income 30,754 16,378 96,211 52,846 Other income (expense) Interest

income 271 321 865 761 Interest expense (2,604 ) (2,953 ) (10,948 )

(12,289 ) Other income (expense), net (427 ) (1,213 )

(1,501 ) (4,216 ) Total other income (expense)

(2,760 ) (3,845 ) (11,584 ) (15,744 )

Income before income taxes 27,994 12,533 84,627 37,102 Income tax

provision (15,325 ) (3,039 ) (49,574 )

(22,099 ) Net income 12,669 9,494 35,053 15,003 Net income

attributable to noncontrolling interests 1,020

508 3,283 2,325 Net income

attributable to Itron, Inc. $ 11,649 $ 8,986 $ 31,770

$ 12,678 Earnings per common share -

Basic $ 0.30 $ 0.23 $ 0.83 $ 0.33

Earnings per common share - Diluted $ 0.30 $ 0.23 $

0.82 $ 0.33 Weighted average common

shares outstanding - Basic 38,283 37,912 38,207 38,224 Weighted

average common shares outstanding - Diluted 39,028 38,256 38,643

38,506

ITRON, INC. SEGMENT INFORMATION

(Unaudited, in thousands)

Three Months

Ended December 31, Twelve Months Ended December 31,

2016 2015

2016 2015 Revenues

Electricity $ 245,589 $ 217,307 $ 938,374 $ 820,306 Gas 135,769

142,706 569,476 543,805 Water 114,355 136,435

505,336 519,422 Total Company $

495,713 $ 496,448 $ 2,013,186 $ 1,883,533

Gross profit Electricity $ 71,837 $ 62,116 $

282,677 $ 225,446 Gas 46,907 50,705 205,063 185,559 Water

37,919 39,598 172,580

145,680 Total Company $ 156,663 $ 152,419 $

660,320 $ 556,685

Operating income

(loss) Electricity $ 17,195 $ 16,146 $ 68,287 $ 31,104 Gas

18,002 22,485 66,813 67,471 Water 8,559 8,449 37,266 19,864

Corporate unallocated (13,002 ) (30,702 )

(76,155 ) (65,593 ) Total Company $ 30,754 $ 16,378

$ 96,211 $ 52,846

METER AND

MODULE SUMMARY (Units in thousands)

Three Months

Ended December 31, Twelve Months Ended December 31,

2016 2015

2016 2015 Meters Standard

3,520 4,020 15,540 17,560 Advanced and Smart 2,440

1,960 9,340 7,290 Total

meters 5,960 5,980 24,880

24,850

Stand-alone communication

modules Advanced and Smart 1,510 1,590

5,980 5,840

ITRON, INC. CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands)

December 31, 2016

December 31, 2015 ASSETS Current assets Cash and cash

equivalents $ 133,565 $ 131,018 Accounts receivable, net 351,506

330,895 Inventories 163,049 190,465 Other current assets

84,346 106,562 Total current assets 732,466

758,940 Property, plant, and equipment, net 176,458 190,256

Deferred tax assets noncurrent, net 94,113 109,387 Other long-term

assets 50,129 51,679 Intangible assets, net 72,151 101,932 Goodwill

452,494 468,122 Total assets $

1,577,811 $ 1,680,316

LIABILITIES AND

EQUITY Current liabilities Accounts payable $ 172,711 $ 185,827

Other current liabilities 43,625 78,630 Wages and benefits payable

82,346 76,980 Taxes payable 10,451 14,859 Current portion of debt

14,063 11,250 Current portion of warranty 24,874 36,927 Unearned

revenue 64,976 73,301 Total current

liabilities 413,046 477,774 Long-term debt 290,460 358,915

Long-term warranty 18,428 17,585 Pension benefit obligation 84,498

85,971 Deferred tax liabilities noncurrent, net 3,073 1,723 Other

long-term obligations 117,953 115,645

Total liabilities 927,458 1,057,613 Equity Preferred stock -

- Common stock 1,270,467 1,246,671 Accumulated other comprehensive

loss, net (229,327 ) (200,607 ) Accumulated deficit (409,536

) (441,306 ) Total Itron, Inc. shareholders' equity 631,604

604,758 Noncontrolling interests 18,749 17,945

Total equity 650,353 622,703

Total liabilities and equity $ 1,577,811 $ 1,680,316

ITRON, INC. CONSOLIDATED STATEMENTS OF CASH

FLOWS (Unaudited, in thousands)

Twelve

Months Ended December 31, 2016

2015 Operating activities Net income $ 35,053 $

15,003 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 68,318 75,993

Stock-based compensation 18,035 14,089 Amortization of prepaid debt

fees 1,076 2,128 Deferred taxes, net 13,790 1,488 Restructuring,

non-cash 7,188 976 Other adjustments, net 4,309 2,003 Changes in

operating assets and liabilities: Accounts receivable (27,162 )

(9,009 ) Inventories 22,343 (52,737 ) Other current assets 20,705

12,512 Other long-term assets (339 ) (3,721 ) Accounts payable,

other current liabilities, and taxes payable (37,312 ) (7,060 )

Wages and benefits payable 7,808 (10,866 ) Unearned revenue (25,810

) 11,943 Warranty (10,246 ) 20,161 Other operating, net

18,086 447 Net cash provided by operating

activities 115,842 73,350 Investing activities Acquisitions

of property, plant, and equipment (43,543 ) (43,918 ) Business

acquisitions, net of cash equivalents acquired (951 ) (5,754 )

Other investing, net (3,034 ) 721 Net cash

used in investing activities (47,528 ) (48,951 ) Financing

activities Proceeds from borrowings 15,877 113,467 Payments on debt

(79,119 ) (62,998 ) Issuance of common stock 2,891 2,663 Repurchase

of common stock - (38,283 ) Other financing, net (2,672 )

(7,109 ) Net cash provided by (used in) financing activities

(63,023 ) 7,740 Effect of foreign exchange rate changes on

cash and cash equivalents (2,744 ) (13,492 ) Increase

in cash and cash equivalents 2,547 18,647 Cash and cash equivalents

at beginning of period 131,018 112,371

Cash and cash equivalents at end of period $ 133,565 $

131,018

Itron, Inc.About Non-GAAP Financial

Measures

The accompanying press release contains non-GAAP financial

measures. To supplement our consolidated financial statements,

which are prepared and presented in accordance with GAAP, we use

certain non-GAAP financial measures, including non-GAAP operating

expense, non-GAAP operating income, non-GAAP net income, non-GAAP

diluted EPS, adjusted EBITDA, constant currency and free cash flow.

The presentation of this financial information is not intended to

be considered in isolation or as a substitute for, or superior to,

the financial information prepared and presented in accordance with

GAAP. For more information on these non-GAAP financial measures

please see the table captioned “Reconciliations of Non-GAAP

Financial Measures to Most Directly Comparable GAAP Financial

Measures.”

We use these non-GAAP financial measures for financial and

operational decision making and/or as a means for determining

executive compensation. Management believes that these non-GAAP

financial measures provide meaningful supplemental information

regarding our performance and ability to service debt by excluding

certain expenses that may not be indicative of our recurring core

operating results. These non-GAAP financial measures facilitate

management’s internal comparisons to our historical performance as

well as comparisons to our competitors’ operating results. In

addition, management analyzes revenue growth and operational

results on a constant currency basis to assess how our business

performed excluding the effect of foreign currency rate

fluctuations. Our executive compensation plans exclude non-cash

charges related to amortization of intangibles and certain discrete

cash and non-cash charges such as purchase accounting adjustments,

restructuring charges or goodwill impairment charges. We believe

that both management and investors benefit from referring to these

non-GAAP financial measures in assessing our performance and when

planning, forecasting and analyzing future periods. We believe

these non-GAAP financial measures are useful to investors because

they provide greater transparency with respect to key metrics used

by management in its financial and operational decision making and

because they are used by our institutional investors and the

analyst community to analyze the health of our business.

Non-GAAP operating expenses and non-GAAP operating income – We

define non-GAAP operating expenses as operating expenses excluding

certain expenses related to the amortization of intangible assets,

restructuring, acquisitions and goodwill impairment. We define

non-GAAP operating income as operating income excluding the

expenses related to the amortization of intangible assets,

restructuring, acquisitions and goodwill impairment. We consider

these non-GAAP financial measures to be useful metrics for

management and investors because they exclude the effect of

expenses that are related to previous acquisitions and

restructuring projects. By excluding these expenses, we believe

that it is easier for management and investors to compare our

financial results over multiple periods and analyze trends in our

operations. For example, in certain periods expenses related to

amortization of intangible assets may decrease, which would improve

GAAP operating margins, yet the improvement in GAAP operating

margins due to this lower expense is not necessarily reflective of

an improvement in our core business. There are some limitations

related to the use of non-GAAP operating expense and non-GAAP

operating income versus operating expense and operating income

calculated in accordance with GAAP. Additionally, the expenses that

we exclude in our calculation of non-GAAP operating expense and

non-GAAP operating income may differ from the expenses that our

peer companies exclude when they report the results of their

operations. We compensate for these limitations by providing

specific information about the GAAP amounts we have excluded from

our non-GAAP operating expense and non-GAAP operating income and

evaluating non-GAAP operating expense and non-GAAP operating income

together with GAAP operating expense and GAAP operating income.

Non-GAAP net income and non-GAAP diluted EPS – We define

non-GAAP net income (loss) attributable to Itron, Inc. as income

excluding the expenses associated with amortization of intangible

assets, restructuring, acquisitions, goodwill impairment,

amortization of debt placement fees and the tax effect of excluding

these expenses. We define non-GAAP diluted EPS as non-GAAP net

income divided by the weighted average shares, on a diluted basis,

outstanding during each period. We consider these financial

measures to be useful metrics for management and investors for the

same reasons that we use non-GAAP operating income. The same

limitations described above regarding our use of non-GAAP operating

income apply to our use of non-GAAP net income and non-GAAP diluted

EPS. We compensate for these limitations by providing specific

information regarding the GAAP amounts excluded from these non-GAAP

measures and evaluating non-GAAP net income and non-GAAP diluted

EPS together with GAAP net income (loss) attributable to Itron,

Inc. and GAAP diluted EPS.

Adjusted EBITDA – We define adjusted EBITDA as net income (a)

minus interest income, (b) plus interest expense, depreciation and

amortization of intangible assets, restructuring, acquisition

related expense, goodwill impairment and (c) excluding the tax

expense or benefit. Management uses adjusted EBITDA as a

performance measure for executive compensation. A limitation to

using adjusted EBITDA is that it does not represent the total

increase or decrease in the cash balance for the period and the

measure includes some non-cash items and excludes other non-cash

items. Additionally, the items that we exclude in our calculation

of adjusted EBITDA may differ from the items that our peer

companies exclude when they report their results. We compensate for

these limitations by providing a reconciliation of this measure to

GAAP net income.

Free cash flow – We define free cash flow as net cash provided

by operating activities less cash used for acquisitions of

property, plant and equipment. We believe free cash flow provides

investors with a relevant measure of liquidity and a useful basis

for assessing our ability to fund our operations and repay our

debt. The same limitations described above regarding our use of

adjusted EBITDA apply to our use of free cash flow. We compensate

for these limitations by providing specific information regarding

the GAAP amounts and reconciling to free cash flow.

Constant currency - We may refer to the impact of foreign

currency exchange rate fluctuations in our discussions of financial

results, which references the differences between the foreign

currency exchange rates used to translate operating results from

local currencies into U.S. dollars for financial reporting

purposes. We also use the term “constant currency,” which

represents financial results adjusted to exclude changes in foreign

currency exchange rates as compared with the rates in the

comparable prior year period. We calculate the constant currency

change as the difference between the current period results and the

comparable prior period’s results restated using current period

currency exchange rates.

The accompanying tables have more detail on the GAAP financial

measures that are most directly comparable to the non-GAAP

financial measures and the related reconciliations between these

financial measures.

ITRON, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASURES (Unaudited, in

thousands, except per share data)

TOTAL COMPANY

RECONCILIATIONS Three Months Ended December 31,

Twelve Months Ended December 31, 2016

2015 2016

2015 NON-GAAP NET INCOME & DILUTED EPS

GAAP net income attributable to Itron, Inc. $ 11,649 $ 8,986 $

31,770 $ 12,678 Amortization of intangible assets 6,110 7,943

25,112 31,673 Amortization of debt placement fees 245 248 987 2,021

Restructuring 7,796 1,565 49,090 (7,263 ) Acquisition-related

expense (recovery) 5 16 (197 ) (5,538 ) Income tax effect of

non-GAAP adjustments 608 (1,392 )

(8,478 ) (5,590 ) Non-GAAP net income attributable to Itron,

Inc. $ 26,413 $ 17,366 $ 98,284 $ 27,981

Non-GAAP diluted EPS $ 0.68 $ 0.45 $

2.54 $ 0.73 Weighted average common shares

outstanding - Diluted 39,028 38,256

38,643 38,506

ADJUSTED

EBITDA GAAP net income attributable to Itron, Inc. $ 11,649 $

8,986 $ 31,770 $ 12,678 Interest income (271 ) (321 ) (865 ) (761 )

Interest expense 2,604 2,953 10,948 12,289 Income tax provision

15,325 3,039 49,574 22,099 Depreciation and amortization 16,755

18,203 68,318 75,993 Restructuring 7,796 1,565 49,090 (7,263 )

Acquisition-related expense (recovery) 5 16

(197 ) (5,538 ) Adjusted EBITDA $ 53,863

$ 34,441 $ 208,638 $ 109,497

FREE CASH FLOW Net cash provided by operating activities $

33,961 $ 53,196 $ 115,842 $ 73,350 Acquisitions of property, plant,

and equipment (12,980 ) (10,594 ) (43,543 )

(43,918 ) Free Cash Flow $ 20,981 $ 42,602 $

72,299 $ 29,432

NON-GAAP OPERATING

INCOME GAAP operating income $ 30,754 $ 16,378 $ 96,211 $

52,846 Amortization of intangible assets 6,110 7,943 25,112 31,673

Restructuring 7,796 1,565 49,090 (7,263 ) Acquisition-related

expense (recovery) 5 16 (197 )

(5,538 ) Non-GAAP operating income $ 44,665 $ 25,902

$ 170,216 $ 71,718

NON-GAAP

OPERATING EXPENSE GAAP operating expense $ 125,909 $ 136,041 $

564,109 $ 503,839 Amortization of intangible assets (6,110 ) (7,943

) (25,112 ) (31,673 ) Restructuring (7,796 ) (1,565 ) (49,090 )

7,263 Acquisition-related recovery (expense) (5 ) (16

) 197 5,538 Non-GAAP operating expense

$ 111,998 $ 126,517 $ 490,104 $ 484,967

ITRON, INC. RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES TO THE MOST DIRECTLY COMPARABLE GAAP

FINANCIAL MEASURES

(Unaudited, in thousands)

SEGMENT RECONCILIATIONS

Three Months Ended December 31, Twelve Months

Ended December 31, 2016 2015

2016 2015

NON-GAAP OPERATING INCOME - ELECTRICITY Electricity - GAAP

operating income $ 17,195 $ 16,146 $ 68,287 $ 31,104 Amortization

of intangible assets 3,223 4,367 13,273 17,663 Restructuring 2,283

(110 ) 7,694 (7,253 ) Acquisition-related expense (recovery)

5 18 (197 ) (5,655 ) Electricity

- Non-GAAP operating income $ 22,706 $ 20,421 $

89,057 $ 35,859

NON-GAAP OPERATING INCOME -

GAS Gas - GAAP operating income $ 18,002 $ 22,485 $ 66,813 $

67,471 Amortization of intangible assets 1,568 1,922 6,456 7,787

Restructuring 3,754 614 25,744

(287 ) Gas - Non-GAAP operating income $ 23,324

$ 25,021 $ 99,013 $ 74,971

NON-GAAP OPERATING INCOME - WATER Water - GAAP operating

income $ 8,559 $ 8,449 $ 37,266 $ 19,864 Amortization of intangible

assets 1,319 1,654 5,383 6,223 Restructuring 651 232 13,116 778

Acquisition-related expense - -

- 104 Water - Non-GAAP operating income $

10,529 $ 10,335 $ 55,765 $ 26,969

NON-GAAP OPERATING INCOME - CORPORATE UNALLOCATED

Corporate unallocated - GAAP operating loss $ (13,002 ) $ (30,702 )

$ (76,155 ) $ (65,593 ) Restructuring 1,108 829 2,536 (501 )

Acquisition-related expense (recovery) - (2 )

- 13 Corporate unallocated - Non-GAAP

operating loss $ (11,894 ) $ (29,875 ) $ (73,619 ) $ (66,081 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170228006627/en/

Itron, Inc.Barbara DoyleVice President, Investor

Relations509-891-3443orRebecca HusseyProgram Manager, Investor

Relations509-891-3574

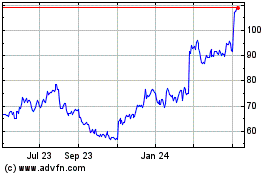

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Apr 2023 to Apr 2024