UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

August 5, 2015

|

|

|

Date of Report (Date of Earliest Event Reported)

|

|

|

ITRON, INC.

|

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Washington

|

|

000-22418

|

|

91-1011792

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer

Identification No.)

|

|

2111 N. Molter Road, Liberty Lake, WA 99019

|

|

(Address of Principal Executive Offices, Zip Code)

|

|

(509) 924-9900

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 2.02

|

Results of Operations and Financial Condition.

|

|

|

|

|

|

On August 5, 2015, Itron, Inc. (the Company) issued a press release

announcing its financial results for the three and six months ended

June 30, 2015.

|

|

|

|

|

A copy of this press release and accompanying financial statements

are attached as Exhibit 99.1.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated August 5, 2015.

|

The information presented in this Current Report on Form 8-K may contain

forward-looking statements and certain assumptions upon which such

forward-looking statements are in part based. Numerous important

factors, including those factors identified in Itron, Inc.’s Annual

Report on Form 10-K and other of the Company’s filings with the

Securities and Exchange Commission, and the fact that the assumptions

set forth in this Current Report on Form 8-K could prove incorrect,

could cause actual results to differ materially from those contained in

such forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

ITRON, INC.

|

|

|

|

|

|

|

|

Dated:

|

August 5, 2015

|

By:

|

/s/ W. Mark Schmitz

|

|

|

|

|

|

W. Mark Schmitz

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press release dated August 5, 2015.

|

Exhibit 99.1

Itron

Announces Second Quarter 2015 Financial Results

LIBERTY LAKE, Wash.--(BUSINESS WIRE)--August 5, 2015--Itron, Inc.

(NASDAQ:ITRI) announced today financial results for its second quarter

and six months ended June 30, 2015. The financial results include:

-

Quarterly and six month revenues of $470 million and $918 million;

-

Quarterly and six month Electricity segment revenues increased 11

percent and 9 percent;

-

Quarterly and six month GAAP net loss per share of 37 cents and 24

cents;

-

Quarterly and six month non-GAAP net loss per share of 38 cents and 18

cents;

-

A previously announced warranty charge of $23.6 million in the quarter

and $26.7 million in the six month period impacted per share results

by 38 cents and 43 cents, respectively;

-

An unfavorable tax adjustment due to losses in countries with full

valuation allowances impacted per share results by approximately 18

cents in the quarter, and 21 cents in the six month period;

-

Quarterly and six month adjusted EBITDA of $4 million and $33 million;

-

Twelve-month backlog of $791 million and total backlog of $1.4 billion;

-

Quarterly bookings of $398 million.

“Revenues for the quarter increased by six percent excluding the impact

of foreign currency, however, our earnings were unacceptable,” said

Philip Mezey, Itron’s president and chief executive officer. “Strong

improvement in the Electricity business was offset by the previously

announced warranty cost in the Water segment, as well as weaker than

expected Gas gross margin in the EMEA region. In addition, tax expense

contributed to the unfavorable earnings. The higher tax rate in the

quarter was due to operating losses in countries where deferred tax

assets have been impaired. Improved profitability in these countries

should result in a lower tax rate for the balance of the year.”

“We are taking aggressive steps to strengthen our quality processes and

improve operational performance, including immediate cost control

measures to strengthen earnings in the second half of the year,”

continued Mr. Mezey. “Itron has a strong competitive position in a

growing industry. We are also on track with our restructuring

initiatives, which will deliver long-term sustainable cost savings. We

are confident that we are taking the right steps to create increased

value for shareholders in 2016 and beyond.”

Financial Results - Quarter

Revenues were $470 million for the quarter compared with $489 million in

2014. Changes in foreign currency exchange rates unfavorably impacted

revenues by approximately $50 million for the quarter. Excluding the

impact from foreign currency, revenues increased $31 million, or 6

percent, compared with the 2014 quarter. The increase in revenues was

driven by the Electricity segment, which grew 19 percent year-over-year,

on a constant currency basis.

Gross margin for the quarter was 25.2 percent compared with the prior

year period margin of 33.3 percent. Increased warranty expense,

primarily due to $23.6 million recorded in the Water segment, negatively

impacted gross margin by approximately 570 basis points. In addition,

lower volumes and an unfavorable product mix in the Gas segment

negatively impacted gross margin.

GAAP operating expenses in the quarter were $123 million compared with

$131 million in same period of 2014. Changes in foreign currency

exchange rates favorably impacted GAAP expenses by approximately $13

million in the quarter. Excluding the impact from foreign currency,

expenses in the quarter increased $4 million compared with the prior

year quarter. The increase was driven by restructuring, higher sales and

marketing expenses in Electricity and increased product development

investments in Gas and Water. These increases were partially offset by

lower general and administrative costs driven by a recovery of $4.6

million from a litigation matter associated with the 2012 SmartSynch

acquisition and lower intangible asset amortization expense.

GAAP operating loss for the quarter was $4 million compared with

operating income of $32 million in the same period of 2014. GAAP net

loss for the quarter was $14 million, or 37 cents per share, compared

with net income of $19 million, or 49 cents per diluted share. The

operating and net losses for the quarter were primarily attributable to

the Water segment warranty charge and decreased contribution from the

Gas segment. Interest expense in the quarter increased $1 million

compared with the prior year due to the write-off of unamortized debt

fees associated with the refinancing of a previous debt agreement. In

addition, despite having a pre-tax net loss, tax expense was recorded

due to valuation allowances applied to deferred tax assets in certain

jurisdictions. These valuation allowances currently restrict the ability

to recognize a tax benefit on losses in these jurisdictions.

Non-GAAP operating expenses, which exclude amortization of intangibles,

restructuring charges, acquisition related expenses and goodwill

impairment, were $123 million for the quarter compared with $128 million

in the prior year quarter. Changes in foreign currency exchange rates

favorably impacted Non-GAAP expenses by approximately $13 million in the

quarter. Excluding the foreign currency impact, expenses increased by $8

million driven by higher sales and marketing costs in Electricity,

increased product development investments in Gas and Water and higher

general and administrative expenses due to employee related benefits and

information technology support.

Non-GAAP operating loss was $5 million for the quarter compared with

operating income of $35 million in the same period in 2014. Non-GAAP net

loss for the quarter was $15 million, or 38 cents per share, compared

with net income of $21 million, or 54 cents per diluted share in the

prior year quarter. The Non-GAAP operating and net loss for the quarter

were primarily attributable to the Water segment warranty charge and

decreased contribution from the Gas segment. In addition, despite having

a pre-tax net loss, tax expense was recorded due to valuation allowances

applied to deferred tax assets in certain jurisdictions. These valuation

allowances currently restrict the ability to recognize a tax benefit on

losses in these jurisdictions.

Free cash flow was $10 million for the quarter compared with negative

$10 million in the prior year quarter. Free cash flow for the quarter

was positively impacted by timing of accounts payable disbursements,

offset by increased inventory to support future production requirements.

During the quarter, the company repurchased 188,775 shares of Itron

common stock at an average price of $36.25 per share pursuant to Board

authorization to repurchase up to $50 million of Itron common stock

during a 12-month period beginning February 2015. As of June 30, 2015,

the company had repurchased 272,775 shares of Itron common stock at an

average price of $36.30 per share, since the inception of the plan.

The company recently concluded discussions with several work councils in

Europe regarding its restructuring plans and expects the pace of

activities to accelerate. Adjustments to restructuring expense were made

during the quarter to reflect changes in estimates and assumptions

following labor negotiations. The company continues to expect annualized

savings of approximately $40 million upon completion of the

restructuring activities by the end of 2016.

Financial Results – Six Months

Revenues were $918 million for the first six months of 2015, compared

with $964 million in the 2014 period. Changes in foreign currency

exchange rates unfavorably impacted revenues by $94 million for the

first six months. Excluding the impact from foreign currency, revenues

increased $48 million, or 5 percent, compared with the 2014 period. The

increase in revenues was driven by the Electricity segment, which grew

nearly 17 percent year-over-year, on a constant currency basis.

Gross margin for the first six months of 2015 was 28.0 percent compared

with 32.9 percent in 2014. Increased warranty expenses, primarily due to

$26.7 million recorded in the Water segment, negatively impacted gross

margin by approximately 320 basis points. In addition, lower volumes and

an unfavorable product mix in the Gas segment negatively impacted gross

margin.

GAAP operating expenses for the six month period were $247 million

compared with $281 million in the prior year period. Changes in foreign

currency exchange rates favorably impacted GAAP expenses by

approximately $28 million for the six month period. Excluding the impact

from foreign currency, expenses in the six month period decreased $6

million compared with the 2014 period. The decrease was driven by lower

intangible asset amortization expense and adjustments to restructuring

reserves.

GAAP operating income for the six month period was $10 million compared

with $36 million in the 2014 period. GAAP net loss in the first six

months was $9 million, or 24 cents per share, compared with net income

of $19 million, or 48 cents per share, in the 2014 period. The decrease

in GAAP net earnings compared with the prior year period was driven by

lower gross profit in the Water and Gas segments and an increased

effective tax rate and expense as a result of valuation allowances

applied to deferred tax assets in certain jurisdictions. These valuation

allowances currently restrict the ability to recognize a tax benefit on

losses in these jurisdictions.

Non-GAAP operating expenses, which exclude amortization of intangibles,

restructuring charges, acquisition related expenses and goodwill

impairment, for the six month period were $243 million compared with

$260 million in the prior year period. Changes in foreign currency

exchange rates favorably impacted Non-GAAP expenses by approximately $25

million in the six month period. Excluding the foreign currency impact,

expenses increased due to higher sales and marketing expenses in both

the Electricity and Water segments, increased product development

investments in Gas and Water and higher general and administrative

expenses due to employee related benefits and professional services.

Non-GAAP operating income for the first six months of 2015 was $13

million compared with $58 million in 2014. Non-GAAP net loss for the

first six months of 2015 was $7 million, or 18 cents per share, compared

with non-GAAP net income of $34 million, or 85 cents per diluted share,

in 2014. The decrease in non-GAAP operating income for the six month

period was attributable to lower gross profit. Non-GAAP net income for

the year was negatively impacted by a higher effective tax rate driven

primarily by the valuation allowances applied to deferred tax assets in

certain jurisdictions. These valuation allowances currently restrict the

ability to recognize a tax benefit on losses in these jurisdictions.

During the first six months of 2015, free cash flow was negative $3

million compared with positive $48 million in 2014. The decrease over

the prior year was primarily due to lower earnings and increased

inventory levels.

Financial Guidance

Itron’s guidance for the full year 2015 is as follows:

-

Revenue between $1.85 and $1.95 billion

-

Non-GAAP diluted earnings per share between $1.00 and $1.30

The company’s guidance includes the effect of the $26.7 million Water

warranty charge recorded in the first half of the year, accounting for

43 cents of decreased earnings per share. The guidance assumes a Euro to

U.S. dollar average exchange rate of $1.12 in 2015 compared with an

average rate of $1.33 in 2014, a gross margin of approximately 30

percent and average shares outstanding of approximately 38.5 million for

the year. The company also anticipates modest upward pressure on its

previously provided guidance of 37 percent non-GAAP effective tax rate

for the full year.

The guidance reflects the company’s expectation for improvement in

results in the second half of 2015 when compared with the first half.

Earnings are expected to improve due to increased revenue supported by

contracted backlog; higher gross margin reflecting additional volumes

across all segments, product cost reductions and factory efficiencies in

Gas in the fourth quarter; immediate cost reductions in all categories

of discretionary spending; and a lower effective tax rate than realized

in the first half of the year.

Earnings Conference Call

Itron will host a conference call to discuss the financial results and

guidance contained in this release at 5:00 p.m. Eastern Daylight Time

(EDT) on Aug. 5, 2015. The call will be webcast in a listen-only mode.

Webcast information and conference call materials will be made available

10 minutes before the start of the call and will be accessible on

Itron’s website at http://investors.itron.com/events.cfm. A

replay of the audio webcast will be available within 90 minutes of the

conclusion of the live call and available for one year at http://investors.itron.com/events.cfm.

A telephone replay of the conference call will be available through Aug.

10, 2015. To access the telephone replay, dial (888) 203-1112 (Domestic)

or (719) 457-0820 (International) and enter passcode 5299205.

About Itron

Itron is a world-leading technology and services company dedicated to

the resourceful use of energy and water. We provide comprehensive

solutions that measure, manage and analyze energy and water. Our broad

product portfolio includes electricity, gas, water and thermal energy

measurement devices and control technology; communications systems;

software; as well as managed and consulting services. With thousands of

employees supporting nearly 8,000 customers in more than 100 countries,

Itron applies knowledge and technology to better manage energy and water

resources. Together, we can create a more resourceful world. Join us: www.itron.com.

Forward Looking Statements

This release contains forward-looking statements concerning our

expectations about operations, financial performance, sales, earnings

and cash flows. These statements reflect our current plans and

expectations and are based on information currently available. The

statements rely on a number of assumptions and estimates, which could be

inaccurate, and which are subject to risks and uncertainties that could

cause our actual results to vary materially from those anticipated.

Risks and uncertainties include the rate and timing of customer demand

for our products, rescheduling of current customer orders, changes in

estimated liabilities for product warranties, changes in laws and

regulations, our dependence on new product development and intellectual

property, future acquisitions, changes in estimates for stock-based and

bonus compensation, increasing volatility in foreign exchange rates,

international business risks and other factors that are more fully

described in our Annual Report on Form 10-K for the year ended December

31, 2014 and other reports on file with the Securities and Exchange

Commission. Itron undertakes no obligation to update publicly or revise

any forward-looking statements, including our business outlook.

Non-GAAP Financial Information

To supplement our consolidated financial statements presented in

accordance with GAAP, we use certain non-GAAP financial measures,

including non-GAAP operating expense, non-GAAP operating income,

non-GAAP net income, non-GAAP diluted EPS, adjusted EBITDA and free cash

flow. We provide these non-GAAP financial measures because we believe

they provide greater transparency and represent supplemental information

used by management in its financial and operational decision making.

Specifically, these non-GAAP financial measures are provided to enhance

investors’ overall understanding of our current financial performance

and our future anticipated performance by excluding infrequent or

non-cash costs, particularly those associated with acquisitions. We

exclude certain costs in our non-GAAP financial measures as we believe

the net result is a measure of our core business. Non-GAAP performance

measures should be considered in addition to, and not as a substitute

for, results prepared in accordance with GAAP. Our non-GAAP financial

measures may be different from those reported by other companies. A more

detailed discussion of why we use non-GAAP financial measures, the

limitations of using such measures, and reconciliations between non-GAAP

and the nearest GAAP financial measures are included in this press

release.

Statements of operations, segment information, balance sheets, cash flow

statements and reconciliations of non-GAAP financial measures to the

most directly comparable GAAP financial measures follow.

|

|

ITRON, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Revenues

|

|

$

|

470,103

|

|

|

$

|

489,353

|

|

|

$

|

918,350

|

|

|

$

|

964,148

|

|

|

Cost of revenues

|

|

|

351,532

|

|

|

|

326,312

|

|

|

|

661,580

|

|

|

|

646,572

|

|

|

Gross profit

|

|

|

118,571

|

|

|

|

163,041

|

|

|

|

256,770

|

|

|

|

317,576

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

43,058

|

|

|

|

46,119

|

|

|

|

84,085

|

|

|

|

93,728

|

|

|

Product development

|

|

|

43,318

|

|

|

|

43,999

|

|

|

|

84,840

|

|

|

|

88,408

|

|

|

General and administrative

|

|

|

32,492

|

|

|

|

37,680

|

|

|

|

72,077

|

|

|

|

78,087

|

|

|

Amortization of business acquisition-related intangible assets

|

|

|

7,888

|

|

|

|

11,109

|

|

|

|

15,861

|

|

|

|

22,179

|

|

|

Restructuring expense

|

|

|

(4,234

|

)

|

|

|

(7,793

|

)

|

|

|

(9,681

|

)

|

|

|

(2,269

|

)

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

977

|

|

|

Total operating expenses

|

|

|

122,522

|

|

|

|

131,114

|

|

|

|

247,182

|

|

|

|

281,110

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

(3,951

|

)

|

|

|

31,927

|

|

|

|

9,588

|

|

|

|

36,466

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

213

|

|

|

|

53

|

|

|

|

260

|

|

|

|

150

|

|

|

Interest expense

|

|

|

(3,855

|

)

|

|

|

(2,913

|

)

|

|

|

(6,537

|

)

|

|

|

(5,822

|

)

|

|

Other income (expense), net

|

|

|

(1,907

|

)

|

|

|

(1,375

|

)

|

|

|

(1,883

|

)

|

|

|

(3,873

|

)

|

|

Total other income (expense)

|

|

|

(5,549

|

)

|

|

|

(4,235

|

)

|

|

|

(8,160

|

)

|

|

|

(9,545

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

(9,500

|

)

|

|

|

27,692

|

|

|

|

1,428

|

|

|

|

26,921

|

|

|

Income tax benefit (provision)

|

|

|

(3,966

|

)

|

|

|

(7,848

|

)

|

|

|

(9,529

|

)

|

|

|

(7,195

|

)

|

|

Net income (loss)

|

|

|

(13,466

|

)

|

|

|

19,844

|

|

|

|

(8,101

|

)

|

|

|

19,726

|

|

|

Net income attributable to non-controlling interests

|

|

|

732

|

|

|

|

585

|

|

|

|

1,187

|

|

|

|

721

|

|

|

Net income (loss) attributable to Itron, Inc.

|

|

$

|

(14,198

|

)

|

|

$

|

19,259

|

|

|

$

|

(9,288

|

)

|

|

$

|

19,005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per common share - Basic

|

|

$

|

(0.37

|

)

|

|

$

|

0.49

|

|

|

$

|

(0.24

|

)

|

|

$

|

0.48

|

|

|

Earnings (loss) per common share - Diluted

|

|

$

|

(0.37

|

)

|

|

$

|

0.49

|

|

|

$

|

(0.24

|

)

|

|

$

|

0.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Basic

|

|

|

38,434

|

|

|

|

39,356

|

|

|

|

38,438

|

|

|

|

39,296

|

|

|

Weighted average common shares outstanding - Diluted

|

|

|

38,434

|

|

|

|

39,544

|

|

|

|

38,438

|

|

|

|

39,528

|

|

|

|

|

|

ITRON, INC.

SEGMENT INFORMATION

|

|

|

|

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

Electricity

|

|

$

|

203,410

|

|

|

$

|

183,755

|

|

|

$

|

397,262

|

|

|

$

|

363,973

|

|

|

Gas

|

|

|

139,386

|

|

|

|

154,322

|

|

|

|

264,475

|

|

|

|

300,431

|

|

|

Water

|

|

|

127,307

|

|

|

|

151,276

|

|

|

|

256,613

|

|

|

|

299,744

|

|

|

Total Company

|

|

$

|

470,103

|

|

|

$

|

489,353

|

|

|

$

|

918,350

|

|

|

$

|

964,148

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

|

|

|

|

|

|

|

Electricity

|

|

$

|

52,622

|

|

|

$

|

52,976

|

|

|

$

|

107,742

|

|

|

$

|

95,716

|

|

|

Gas

|

|

|

44,109

|

|

|

|

56,711

|

|

|

|

87,625

|

|

|

|

115,117

|

|

|

Water

|

|

|

21,840

|

|

|

|

53,354

|

|

|

|

61,403

|

|

|

|

106,743

|

|

|

Total Company

|

|

$

|

118,571

|

|

|

$

|

163,041

|

|

|

$

|

256,770

|

|

|

$

|

317,576

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

|

|

|

|

|

|

|

Electricity

|

|

$

|

3,904

|

|

|

$

|

(1,247

|

)

|

|

$

|

6,300

|

|

|

$

|

(24,216

|

)

|

|

Gas

|

|

|

14,742

|

|

|

|

24,329

|

|

|

|

28,334

|

|

|

|

50,053

|

|

|

Water

|

|

|

(11,511

|

)

|

|

|

20,519

|

|

|

|

(3,414

|

)

|

|

|

41,162

|

|

|

Corporate unallocated

|

|

|

(11,086

|

)

|

|

|

(11,674

|

)

|

|

|

(21,632

|

)

|

|

|

(30,533

|

)

|

|

Total Company

|

|

$

|

(3,951

|

)

|

|

$

|

31,927

|

|

|

$

|

9,588

|

|

|

$

|

36,466

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METER AND MODULE SUMMARY

|

|

|

|

|

|

|

|

|

|

|

|

(Units in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Meters

|

|

|

|

|

|

|

|

|

|

Standard

|

|

|

4,700

|

|

|

|

4,480

|

|

|

|

9,440

|

|

|

|

9,330

|

|

|

Advanced and Smart

|

|

|

1,860

|

|

|

|

1,360

|

|

|

|

3,400

|

|

|

|

2,880

|

|

|

Total meters

|

|

|

6,560

|

|

|

|

5,840

|

|

|

|

12,840

|

|

|

|

12,210

|

|

|

|

|

|

|

|

|

|

|

|

|

Stand-alone communication modules

|

|

|

|

|

|

|

|

|

|

Advanced and Smart

|

|

|

1,410

|

|

|

|

1,580

|

|

|

|

2,720

|

|

|

|

2,930

|

|

|

|

|

|

ITRON, INC.

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

June 30, 2015

|

|

December 31, 2014

|

|

ASSETS

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

128,814

|

|

|

$

|

112,371

|

|

|

Accounts receivable, net

|

|

|

338,196

|

|

|

|

348,389

|

|

|

Inventories

|

|

|

195,394

|

|

|

|

154,504

|

|

|

Deferred tax assets current, net

|

|

|

38,121

|

|

|

|

39,115

|

|

|

Other current assets

|

|

|

111,248

|

|

|

|

104,307

|

|

|

Total current assets

|

|

|

811,773

|

|

|

|

758,686

|

|

|

|

|

|

|

|

|

Property, plant, and equipment, net

|

|

|

195,510

|

|

|

|

207,789

|

|

|

Deferred tax assets noncurrent, net

|

|

|

73,861

|

|

|

|

74,598

|

|

|

Other long-term assets

|

|

|

28,741

|

|

|

|

28,503

|

|

|

Intangible assets, net

|

|

|

117,136

|

|

|

|

139,909

|

|

|

Goodwill

|

|

|

471,648

|

|

|

|

500,820

|

|

|

Total assets

|

|

$

|

1,698,669

|

|

|

$

|

1,710,305

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

Accounts payable

|

|

$

|

226,512

|

|

|

$

|

184,132

|

|

|

Other current liabilities

|

|

|

60,634

|

|

|

|

100,945

|

|

|

Wages and benefits payable

|

|

|

84,944

|

|

|

|

95,248

|

|

|

Taxes payable

|

|

|

16,435

|

|

|

|

21,951

|

|

|

Current portion of debt

|

|

|

11,250

|

|

|

|

30,000

|

|

|

Current portion of warranty

|

|

|

35,589

|

|

|

|

21,063

|

|

|

Unearned revenue

|

|

|

50,255

|

|

|

|

43,436

|

|

|

Total current liabilities

|

|

|

485,619

|

|

|

|

496,775

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

361,708

|

|

|

|

293,969

|

|

|

Long-term warranty

|

|

|

22,550

|

|

|

|

15,403

|

|

|

Pension plan benefit liability

|

|

|

93,918

|

|

|

|

101,432

|

|

|

Deferred tax liabilities noncurrent, net

|

|

|

3,247

|

|

|

|

3,808

|

|

|

Other long-term obligations

|

|

|

86,366

|

|

|

|

84,437

|

|

|

Total liabilities

|

|

|

1,053,408

|

|

|

|

995,824

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

Preferred stock

|

|

|

-

|

|

|

|

-

|

|

|

Common stock

|

|

|

1,255,154

|

|

|

|

1,270,045

|

|

|

Accumulated other comprehensive loss, net

|

|

|

(182,742

|

)

|

|

|

(136,514

|

)

|

|

Accumulated deficit

|

|

|

(445,879

|

)

|

|

|

(436,591

|

)

|

|

Total Itron, Inc. shareholders' equity

|

|

|

626,533

|

|

|

|

696,940

|

|

|

Non-controlling interests

|

|

|

18,728

|

|

|

|

17,541

|

|

|

Total equity

|

|

|

645,261

|

|

|

|

714,481

|

|

|

Total liabilities and equity

|

|

$

|

1,698,669

|

|

|

$

|

1,710,305

|

|

|

|

|

|

ITRON, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

Six Months Ended June 30,

|

|

|

|

2015

|

|

2014

|

|

Operating activities

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(8,101

|

)

|

|

$

|

19,726

|

|

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities:

|

|

|

|

|

|

Depreciation and amortization

|

|

|

38,760

|

|

|

|

50,606

|

|

|

Stock-based compensation

|

|

|

7,997

|

|

|

|

9,454

|

|

|

Amortization of prepaid debt fees

|

|

|

1,579

|

|

|

|

808

|

|

|

Deferred taxes, net

|

|

|

1,901

|

|

|

|

(8,046

|

)

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

977

|

|

|

Restructuring expense, non-cash

|

|

|

267

|

|

|

|

-

|

|

|

Other adjustments, net

|

|

|

919

|

|

|

|

85

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Accounts receivable

|

|

|

(6,849

|

)

|

|

|

(14,712

|

)

|

|

Inventories

|

|

|

(49,677

|

)

|

|

|

(16,801

|

)

|

|

Other current assets

|

|

|

(9,043

|

)

|

|

|

(9,103

|

)

|

|

Other long-term assets

|

|

|

406

|

|

|

|

312

|

|

|

Accounts payable, other current liabilities, and taxes payable

|

|

|

23,990

|

|

|

|

12,360

|

|

|

Wages and benefits payable

|

|

|

(6,276

|

)

|

|

|

4,473

|

|

|

Unearned revenue

|

|

|

7,807

|

|

|

|

16,560

|

|

|

Warranty

|

|

|

23,119

|

|

|

|

(2,864

|

)

|

|

Other operating, net

|

|

|

(9,232

|

)

|

|

|

3,356

|

|

|

Net cash provided by operating activities

|

|

|

17,567

|

|

|

|

67,191

|

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

Acquisitions of property, plant, and equipment

|

|

|

(20,992

|

)

|

|

|

(19,403

|

)

|

|

Business acquisitions, net of cash equivalents acquired

|

|

|

-

|

|

|

|

-

|

|

|

Other investing, net

|

|

|

693

|

|

|

|

56

|

|

|

Net cash provided by (used in) investing activities

|

|

|

(20,299

|

)

|

|

|

(19,347

|

)

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

Proceeds from borrowings

|

|

|

74,183

|

|

|

|

-

|

|

|

Payments on debt

|

|

|

(22,373

|

)

|

|

|

(51,250

|

)

|

|

Issuance of common stock

|

|

|

1,864

|

|

|

|

1,530

|

|

|

Repurchase of common stock

|

|

|

(23,185

|

)

|

|

|

(7,164

|

)

|

|

Other financing, net

|

|

|

(3,942

|

)

|

|

|

1,204

|

|

|

Net cash provided by (used in) financing activities

|

|

|

26,547

|

|

|

|

(55,680

|

)

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash and cash equivalents

|

|

|

(7,372

|

)

|

|

|

(2,189

|

)

|

|

Increase (decrease) in cash and cash equivalents

|

|

|

16,443

|

|

|

|

(10,025

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

112,371

|

|

|

|

124,805

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

128,814

|

|

|

$

|

114,780

|

|

|

|

Itron, Inc.

About Non-GAAP Financial Measures

The accompanying press release contains non-GAAP financial measures. To

supplement our consolidated financial statements, which are prepared and

presented in accordance with GAAP, we use certain non-GAAP financial

measures, including non-GAAP operating expense, non-GAAP operating

income, non-GAAP net income, non-GAAP diluted EPS, adjusted EBITDA and

free cash flow. The presentation of this financial information is not

intended to be considered in isolation or as a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP. For more information on these non-GAAP financial

measures please see the table captioned “Reconciliations of Non-GAAP

Financial Measures to Most Directly Comparable GAAP Financial Measures.”

We use these non-GAAP financial measures for financial and operational

decision making and as a means for determining executive compensation.

Management believes that these non-GAAP financial measures provide

meaningful supplemental information regarding our performance and

ability to service debt by excluding certain expenses that may not be

indicative of our recurring core operating results. These non-GAAP

financial measures facilitate management’s internal comparisons to our

historical performance as well as comparisons to our competitors’

operating results. Our executive compensation plans exclude non-cash

charges related to amortization of intangibles acquired through a

business acquisition and non-recurring discrete cash and non-cash

charges that are infrequent in nature such as purchase accounting

adjustments, restructuring charges or goodwill impairment charges. We

believe that both management and investors benefit from referring to

these non-GAAP financial measures in assessing our performance and when

planning, forecasting and analyzing future periods. We believe these

non-GAAP financial measures are useful to investors because they provide

greater transparency with respect to key metrics used by management in

its financial and operational decision making and because they are used

by our institutional investors and the analyst community to analyze the

health of our business.

Non-GAAP operating expense and non-GAAP operating income – We define

non-GAAP operating expense as operating expense excluding certain

expenses related to the amortization of intangible assets acquired

through a business acquisition, restructuring, acquisitions and goodwill

impairment. We define non-GAAP operating income as operating income

excluding the expenses related to the amortization of intangible assets

acquired through a business acquisition, restructuring, acquisitions and

goodwill impairment. We consider these non-GAAP financial measures to be

useful metrics for management and investors because they exclude the

effect of expenses that are related to previous acquisitions and

restructurings. By excluding these expenses, we believe that it is

easier for management and investors to compare our financial results

over multiple periods and analyze trends in our operations. For example,

in certain periods expenses related to amortization of intangible assets

may decrease, which would improve GAAP operating margins, yet the

improvement in GAAP operating margins due to this lower expense is not

necessarily reflective of an improvement in our core business. There are

some limitations related to the use of non-GAAP operating expense and

non-GAAP operating income versus operating expense and operating income

calculated in accordance with GAAP. Non-GAAP operating expense and

non-GAAP operating income exclude some costs that are recurring.

Additionally, the expenses that we exclude in our calculation of

non-GAAP operating expense and non-GAAP operating income may differ from

the expenses that our peer companies exclude when they report the

results of their operations. We compensate for these limitations by

providing specific information about the GAAP amounts we have excluded

from our non-GAAP operating expense and non-GAAP operating income and

evaluating non-GAAP operating expense and non-GAAP operating income

together with GAAP operating expense and GAAP operating income.

Non-GAAP net income and non-GAAP diluted EPS – We define non-GAAP net

income as net income excluding the expenses associated with amortization

of intangible assets acquired through a business acquisition,

restructuring, acquisitions, goodwill impairment and amortization of

debt placement fees. We define non-GAAP diluted EPS as non-GAAP net

income divided by the weighted average shares, on a diluted basis,

outstanding during each period. We consider these financial measures to

be useful metrics for management and investors for the same reasons that

we use non-GAAP operating income. The same limitations described above

regarding our use of non-GAAP operating income apply to our use of

non-GAAP net income and non-GAAP diluted EPS. We compensate for these

limitations by providing specific information regarding the GAAP amounts

excluded from these non-GAAP measures and evaluating non-GAAP net income

and non-GAAP diluted EPS together with GAAP net income and GAAP diluted

EPS.

Adjusted EBITDA – We define adjusted EBITDA as net income (a) minus

interest income, (b) plus interest expense, depreciation and

amortization of business acquisition related intangible asset expenses,

restructuring expense, acquisition related expense, goodwill impairment

and (c) exclude the tax expense or benefit. We believe that providing

this financial measure is important for management and investors to

understand our ability to service our debt as it is a measure of the

cash generated by our core business. Management uses adjusted EBITDA as

a performance measure for executive compensation. A limitation to using

adjusted EBITDA is that it does not represent the total increase or

decrease in the cash balance for the period and the measure includes

some non-cash items and excludes other non-cash items. Additionally, the

items that we exclude in our calculation of adjusted EBITDA may differ

from the items that our peer companies exclude when they report their

results. We compensate for these limitations by providing a

reconciliation of this measure to GAAP net income.

Free cash flow – We define free cash flow as net cash provided by

operating activities less cash used for acquisitions of property, plant

and equipment. We believe free cash flow provides investors with a

relevant measure of liquidity and a useful basis for assessing our

ability to fund our operations and repay our debt. The same limitations

described above regarding our use of adjusted EBITDA apply to our use of

free cash flow. We compensate for these limitations by providing

specific information regarding the GAAP amounts and reconciling to free

cash flow.

The accompanying tables have more detail on the GAAP financial measures

that are most directly comparable to the non-GAAP financial measures and

the related reconciliations between these financial measures.

|

|

ITRON, INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES

TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASURES

|

|

|

|

(Unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMPANY RECONCILIATIONS

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

NON-GAAP NET INCOME & DILUTED EPS

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss)

|

|

$

|

(14,198

|

)

|

|

$

|

19,259

|

|

|

$

|

(9,288

|

)

|

|

$

|

19,005

|

|

|

Amortization of intangible assets

|

|

|

7,888

|

|

|

|

11,109

|

|

|

|

15,861

|

|

|

|

22,179

|

|

|

Amortization of debt placement fees

|

|

|

1,164

|

|

|

|

379

|

|

|

|

1,529

|

|

|

|

758

|

|

|

Restructuring expense

|

|

|

(4,234

|

)

|

|

|

(7,793

|

)

|

|

|

(9,681

|

)

|

|

|

(2,269

|

)

|

|

Acquisition related expenses

|

|

|

(4,607

|

)

|

|

|

89

|

|

|

|

(2,283

|

)

|

|

|

578

|

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

977

|

|

|

Income tax effect of non-GAAP adjustments

|

|

|

(674

|

)

|

|

|

(1,636

|

)

|

|

|

(2,988

|

)

|

|

|

(7,578

|

)

|

|

Non-GAAP net income (loss)

|

|

$

|

(14,661

|

)

|

|

$

|

21,407

|

|

|

$

|

(6,850

|

)

|

|

$

|

33,650

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP diluted EPS

|

|

$

|

(0.38

|

)

|

|

$

|

0.54

|

|

|

$

|

(0.18

|

)

|

|

$

|

0.85

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Diluted

|

|

|

38,434

|

|

|

|

39,544

|

|

|

|

38,438

|

|

|

|

39,528

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss)

|

|

$

|

(14,198

|

)

|

|

$

|

19,259

|

|

|

$

|

(9,288

|

)

|

|

$

|

19,005

|

|

|

Interest income

|

|

|

(213

|

)

|

|

|

(53

|

)

|

|

|

(260

|

)

|

|

|

(150

|

)

|

|

Interest expense

|

|

|

3,855

|

|

|

|

2,913

|

|

|

|

6,537

|

|

|

|

5,822

|

|

|

Income tax (benefit) provision

|

|

|

3,966

|

|

|

|

7,848

|

|

|

|

9,529

|

|

|

|

7,195

|

|

|

Depreciation and amortization

|

|

|

19,421

|

|

|

|

25,014

|

|

|

|

38,760

|

|

|

|

50,606

|

|

|

Restructuring expense

|

|

|

(4,234

|

)

|

|

|

(7,793

|

)

|

|

|

(9,681

|

)

|

|

|

(2,269

|

)

|

|

Acquisition related expenses

|

|

|

(4,607

|

)

|

|

|

89

|

|

|

|

(2,283

|

)

|

|

|

578

|

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

977

|

|

|

Adjusted EBITDA

|

|

$

|

3,990

|

|

|

$

|

47,277

|

|

|

$

|

33,314

|

|

|

$

|

81,764

|

|

|

|

|

|

|

|

|

|

|

|

|

FREE CASH FLOW

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

$

|

21,522

|

|

|

$

|

430

|

|

|

$

|

17,567

|

|

|

$

|

67,191

|

|

|

Acquisitions of property, plant, and equipment

|

|

|

(11,520

|

)

|

|

|

(10,839

|

)

|

|

|

(20,992

|

)

|

|

|

(19,403

|

)

|

|

Free Cash Flow

|

|

$

|

10,002

|

|

|

$

|

(10,409

|

)

|

|

$

|

(3,425

|

)

|

|

$

|

47,788

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP OPERATING INCOME

|

|

|

|

|

|

|

|

|

|

GAAP operating income (loss)

|

|

$

|

(3,951

|

)

|

|

$

|

31,927

|

|

|

$

|

9,588

|

|

|

$

|

36,466

|

|

|

Amortization of intangible assets

|

|

|

7,888

|

|

|

|

11,109

|

|

|

|

15,861

|

|

|

|

22,179

|

|

|

Restructuring expense

|

|

|

(4,234

|

)

|

|

|

(7,793

|

)

|

|

|

(9,681

|

)

|

|

|

(2,269

|

)

|

|

Acquisition related expenses

|

|

|

(4,607

|

)

|

|

|

89

|

|

|

|

(2,283

|

)

|

|

|

578

|

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

977

|

|

|

Non-GAAP operating income (loss)

|

|

$

|

(4,904

|

)

|

|

$

|

35,332

|

|

|

$

|

13,485

|

|

|

$

|

57,931

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP OPERATING EXPENSE

|

|

|

|

|

|

|

|

|

|

GAAP operating expense

|

|

$

|

122,522

|

|

|

$

|

131,114

|

|

|

$

|

247,182

|

|

|

$

|

281,110

|

|

|

Amortization of intangible assets

|

|

|

(7,888

|

)

|

|

|

(11,109

|

)

|

|

|

(15,861

|

)

|

|

|

(22,179

|

)

|

|

Restructuring expense

|

|

|

4,234

|

|

|

|

7,793

|

|

|

|

9,681

|

|

|

|

2,269

|

|

|

Acquisition related expenses

|

|

|

4,607

|

|

|

|

(89

|

)

|

|

|

2,283

|

|

|

|

(578

|

)

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(977

|

)

|

|

Non-GAAP operating expense

|

|

$

|

123,475

|

|

|

$

|

127,709

|

|

|

$

|

243,285

|

|

|

$

|

259,645

|

|

|

|

|

|

ITRON, INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES

TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASURES

|

|

|

|

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT RECONCILIATIONS

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

NON-GAAP OPERATING INCOME - ELECTRICITY

|

|

|

|

|

|

|

|

|

|

Electricity - GAAP operating income (loss)

|

|

$

|

3,904

|

|

|

$

|

(1,247

|

)

|

|

$

|

6,300

|

|

|

$

|

(24,216

|

)

|

|

Amortization of intangible assets

|

|

|

4,428

|

|

|

|

6,189

|

|

|

|

8,883

|

|

|

|

12,344

|

|

|

Restructuring expense

|

|

|

(2,703

|

)

|

|

|

(7,925

|

)

|

|

|

(5,830

|

)

|

|

|

(8,455

|

)

|

|

Acquisition related expenses

|

|

|

(4,607

|

)

|

|

|

89

|

|

|

|

(2,283

|

)

|

|

|

531

|

|

|

Goodwill impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

977

|

|

|

Electricity - Non-GAAP operating income (loss)

|

|

$

|

1,022

|

|

|

$

|

(2,894

|

)

|

|

$

|

7,070

|

|

|

$

|

(18,819

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP OPERATING INCOME - GAS

|

|

|

|

|

|

|

|

|

|

Gas - GAAP operating income

|

|

$

|

14,742

|

|

|

$

|

24,329

|

|

|

$

|

28,334

|

|

|

$

|

50,053

|

|

|

Amortization of intangible assets

|

|

|

1,945

|

|

|

|

2,681

|

|

|

|

3,915

|

|

|

|

5,370

|

|

|

Restructuring expense

|

|

|

(1,186

|

)

|

|

|

517

|

|

|

|

(684

|

)

|

|

|

214

|

|

|

Gas - Non-GAAP operating income

|

|

$

|

15,501

|

|

|

$

|

27,527

|

|

|

$

|

31,565

|

|

|

$

|

55,637

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP OPERATING INCOME - WATER

|

|

|

|

|

|

|

|

|

|

Water - GAAP operating income (loss)

|

|

$

|

(11,511

|

)

|

|

$

|

20,519

|

|

|

$

|

(3,414

|

)

|

|

$

|

41,162

|

|

|

Amortization of intangible assets

|

|

|

1,515

|

|

|

|

2,239

|

|

|

|

3,063

|

|

|

|

4,465

|

|

|

Restructuring expense

|

|

|

156

|

|

|

|

453

|

|

|

|

273

|

|

|

|

1,010

|

|

|

Water - Non-GAAP operating income (loss)

|

|

$

|

(9,840

|

)

|

|

$

|

23,211

|

|

|

$

|

(78

|

)

|

|

$

|

46,637

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP OPERATING INCOME - CORPORATE UNALLOCATED

|

|

|

|

|

|

|

|

|

|

Corporate unallocated - GAAP operating loss

|

|

$

|

(11,086

|

)

|

|

$

|

(11,674

|

)

|

|

$

|

(21,632

|

)

|

|

$

|

(30,533

|

)

|

|

Restructuring expense

|

|

|

(501

|

)

|

|

|

(838

|

)

|

|

|

(3,440

|

)

|

|

|

4,962

|

|

|

Acquisition related expenses

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

47

|

|

|

Corporate unallocated - Non-GAAP operating loss

|

|

$

|

(11,587

|

)

|

|

$

|

(12,512

|

)

|

|

$

|

(25,072

|

)

|

|

$

|

(25,524

|

)

|

|

|

CONTACT:

Itron, Inc.

Barbara Doyle, 509-891-3443

Vice

President, Investor Relations

or

Marni Pilcher, 509-891-3847

Director,

Investor Relations

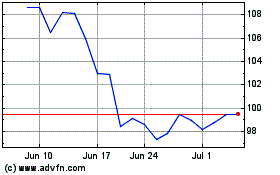

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

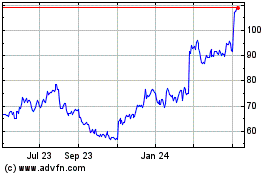

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Apr 2023 to Apr 2024