Reports Cash Flow from Operations of

$150,000 for Quarter, $913,000 for Year-to-Date, increases of

approximately $950,000 and $2.5 million, respectively, from year

earlier periods

Innovative Solutions & Support, Inc. (NASDAQ: ISSC) today

announced its financial results for the third quarter of fiscal

2015 ended June 30, 2015.

For the third quarter of fiscal 2015, the Company reported

revenues of $4.9 million, compared to revenues of $10.6 million for

the third quarter of fiscal 2014. Cash provided by operating

activities was $150,000 for the quarter, a significant turnaround

from $813,000 used in operating activities in the third quarter of

fiscal 2014. The Company reported a third quarter 2015 operating

loss of $0.3 million, which included an increased investment in

internal research and development and new product development, and

a net loss of $3.5 million, or $0.21 per share, of which $3.3

million was attributable to a non-cash, valuation allowance of the

Company’s deferred tax assets.

In the third quarter of 2014, the Company reported net income of

$497,000, or $0.03 per share.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

Innovative Solutions & Support, Inc. said, “On the strength of

growing interest in our expanding portfolio of products that we

believe provide the industry's best price-for-performance, we were

able to increase our product revenues in the quarter versus the

quarter ended March 31, 2015. Gross margins in the quarter were up

from a year ago as production volume increased and development

contracts continue to wind down. We also further reduced operating

expenses in the quarter. While we reported an operating loss for

the quarter, we increased cash flow from operations by nearly a

million dollars from the third quarter of last year, adding to our

already strong balance sheet. We are focused on rebuilding our

backlog through aggressive marketing and product innovation. During

the quarter we introduced our new Integrated Global Navigation

System (IGNS) that we believe addresses the need for an economical

solution that enables aging Flight Management Systems to be updated

to today's NexGen standards without the downtime or expense of

replacing the entire system. This is just another example of

Innovative Solutions and Support's legacy of developing exciting

new technologies that provide cost effective solutions to the

military, commercial air transport, and business jet markets.”

At June 30, 2015, the Company had $15.8 million of cash on hand

and remained debt free.

New orders for the quarter were $3.4 million, and backlog at

June 30, 2015 was $4.8 million, compared to backlog of $6.3 million

at March 31, 2015. Backlog excludes potential future sole-source

production orders from products in development under the Company’s

engineering development contracts, including the Eclipse 550, the

Pilatus PC-24, and the KC-46A, all of which the Company expects to

remain in production for a decade following completion of their

development phases. The Company expects that these sole-source

contracts will add to production sales already in backlog.

Nine Months Results

Total sales for the nine months ended June 30, 2015 were $16.9

million compared to sales of $34.2 million for the nine months

ended June 30, 2014. Net loss for the nine months ended June 30,

2015 was $3.3 million, compared to net income of $2.3 million in

the comparable year earlier period. The company had a $0.20 loss

per share for the first nine months of fiscal 2015, compared to

earnings per share of $0.13 for the first nine months of fiscal

2014. Cash provided by operating activities was $913,000 for the

first nine months of fiscal 2015, up significantly from $1.6

million of cash used in operations during the first nine months of

fiscal 2014.

Shahram Askarpour, President of ISSC, commented, "Our focus is

on rebuilding backlog, particularly new production contracts, while

continuing to improve operational efficiencies. Consequently,

during the quarter we reduced total operating expenses while still

increasing our investment in internal research and development.

Those efforts yielded the rapid and timely development of our

latest new product, the IGNS. On the new business front, we are

experiencing increased activity levels in select markets, such as

Europe, where we are seeing a concerted sales and marketing effort

turn into new orders and opportunities. Our goal is to build on the

success we have achieved introducing new technologies that have

been employed by industry leaders such as Boeing, Lockheed and

others and to expand our product portfolio into new and emerging

applications that help owners and operators improve safety,

increase efficiency and reduce costs."

Conference Call

The Company will be hosting a conference call August 6, 2015 at

10:00 AM ET to discuss these results and its business outlook.

Those planning to dial in to the call should dial the following

number and register their names and company affiliations:

1-877-883-0383 and enter the PIN Number 5343401. The call will also

be carried live on the Investor Relations page of the Company web

site at www.innovative-ss.com.

About Innovative Solutions &

Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator that designs

and manufactures flight guidance and cockpit display systems for

Original Equipment Manufacturers (OEM’s) and retrofit applications.

The company supplies integrated Flight Management Systems (FMS) and

advanced GPS receivers for precision low carbon footprint

navigation.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflect management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets June 30, September

30, 2015 2014 (unaudited)

ASSETS

Current assets Cash and cash equivalents $ 15,759,516 $ 15,214,584

Accounts receivable 3,903,094 4,419,863 Unbilled receivables, net

4,865,158 7,425,728 Inventories 4,138,705 5,470,786 Deferred income

taxes 471,387 3,245,223 Prepaid expenses and other current assets

827,426 750,108 Total current assets 29,965,286

36,526,292 Property and equipment, net 7,225,633 7,467,663

Non-current deferred income taxes - 57,707 Other assets 168,949

110,848 Total assets $ 37,359,868 $ 44,162,510

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 359,498 $ 2,402,652

Accrued expenses 2,298,990 4,077,290 Deferred revenue 739,538

526,320 Total current liabilities 3,398,026 7,006,262

Deferred income taxes 139,344 132,999 Other liabilities

11,991 11,725 Total liabilities 3,549,361

7,150,986 Commitments and contingencies

- - Shareholders' equity

Preferred stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

June 30, 2015 and September 30, 2014

- -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,736,089 and 18,714,449 issued at June 30,

2015 and September 30, 2014, respectively

18,736 18,715 Additional paid-in capital 51,052,953

50,697,497 Retained earnings 3,382,580 6,684,902

Treasury stock, at cost, 1,846,451 shares

at June 30, 2015 and 1,756,807 at September 30, 2014

(20,643,762 ) (20,389,590 ) Total

shareholders' equity 33,810,507 37,011,524

Total liabilities and shareholders' equity $

37,359,868 $ 44,162,510

Innovative Solutions and Support, Inc.

Consolidated Statements of Operations (unaudited)

Three months ended Nine months ended June 30, June 30, 2015

2014 2015 2014 Net sales $ 4,919,689 $ 10,575,976 16,929,995

34,176,802 Cost of sales 2,988,044

7,413,849 10,653,149 23,449,115 Gross

profit 1,931,645 3,162,127 6,276,846 10,727,687 Operating

expenses: Research and development 799,340 647,894 2,101,812

1,935,692 Selling, general and administrative 1,397,165

1,854,332 4,911,546 5,633,832

Total operating expenses 2,196,505 2,502,226 7,013,358 7,569,524

Operating income (loss) (264,860 ) 659,901 (736,512 )

3,158,163 Interest income 6,372 5,280 18,269 16,246 Other

income 11,173 7,939 31,405

27,307 Income (loss) before income taxes (247,315 ) 673,120

(686,838 ) 3,201,716 Income tax expense 3,284,658

176,090 2,615,484 911,874

Net income (loss) $ (3,531,973 ) $ 497,030 $ (3,302,322 ) $

2,289,842 Net income (loss) per common share: Basic $ (0.21

) $ 0.03 $ (0.20 ) $ 0.14 Diluted $ (0.21 ) $ 0.03 $ (0.20 ) $ 0.13

Weighted average shares outstanding: Basic

16,910,475 16,951,360

16,930,522

16,918,423 Diluted

16,910,475

17,177,572

16,930,522 17,141,532

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150805006792/en/

Innovative Solutions & Support, Inc.Relland Winand, Chief

Financial Officer610-646-0350

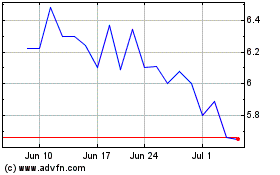

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

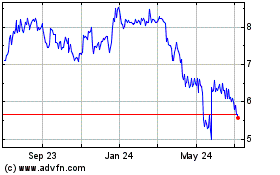

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024