SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 9, 2015

ISIS PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

000-19125

|

|

33-0336973

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

2855 Gazelle Court

Carlsbad, CA 92010

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (760) 931-9200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| £ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| £ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| £ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| £ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 9, 2015, Isis Pharmaceuticals, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended September 30, 2015. In addition to disclosing results that are determined in accordance with Generally Accepted Accounting Principles (GAAP), the Company also discloses pro forma or non-GAAP results of operations, which are adjusted from GAAP to exclude non-cash compensation related to equity awards. The Company is presenting pro forma information excluding the effects of the non-cash compensation because the Company believes it is useful for investors in assessing the Company’s operating results compared to the prior year. A copy of the release is furnished with this report as an exhibit pursuant to “Item 2.02. Results of Operations and Financial Condition” of Form 8-K in accordance with SEC Release Nos. 33-8216 and 34-47583.

The information in this Current Report on Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

|

99.1 |

Press Release dated November 9, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Isis Pharmaceuticals, Inc.

|

| |

|

|

Dated: November 9, 2015

|

By:

|

/s/ B. Lynne Parshall

|

| |

|

B. Lynne Parshall

|

| |

|

Chief Operating Officer

|

INDEX TO EXHIBITS

|

99.1 |

Press Release dated November 9, 2015. |

ISIS REPORTS FINANCIAL RESULTS AND HIGHLIGHTS

FOR THIRD QUARTER 2015

| · |

2015 Pro Forma Net Income of $25 Million Significantly Increased Over 2014 |

| · |

Conference Call Webcast Monday, November 9, 11:30 a.m. ET at www.isispharm.com |

CARLSBAD, Calif., November 9, 2015 – Isis Pharmaceuticals, Inc. (Nasdaq: ISIS) today reported consolidated financial results for the third quarter of 2015 and highlighted recent progress in advancing its pipeline.

“Our drugs in development have the potential to make fundamental changes in the way diseases are treated. Our pipeline is large, with numerous late-stage programs that represent potential near term commercial opportunities. We are conducting four Phase 3 studies which should complete enrollment in the next several months. And, we believe these programs have each been substantially de-risked by positive data from Phase 2 studies. Just last week, we reported encouraging data from two Phase 2 studies of ISIS-TTRRx, which support the potential benefit of ISIS-TTRRx for patients with familial amyloid polyneuropathy, FAP, and TTR amyloid cardiomyopathy. Together with our partner, GSK, we are conducting a broad Phase 3 program evaluating ISIS-TTRRx in all forms of TTR amyloidosis. As part of this program, GSK plans to initiate a Phase 3 study of ISIS-TTRRx in patients with TTR amyloid cardiomyopathy, both familial and wild type, early next year. Further, we expect to complete enrollment in our Phase 3 study of ISIS-TTRRx in patients with FAP by year end,” said B. Lynne Parshall, chief operating officer at Isis Pharmaceuticals. “Our other Phase 3 programs are also progressing well. We expect to complete enrollment in both of our Phase 3 studies of nusinersen, the generic name for ISIS-SMNRx, in infants and in children with spinal muscular atrophy by early next year. In addition, we and Akcea plan to complete enrollment in the Phase 3 study of volanesorsen in patients with familial chylomicronemia syndrome this year. We also plan to begin dosing patients in our Phase 3 study of volanesorsen in patients with familial partial lipodystrophy by the end of the year. As enrollment nears completion for the ongoing Phase 3 studies for ISIS-TTRRx, nusinersen and volanesorsen, we and our partners are working closely together to prepare for regulatory filings and to prepare the drugs for the market.”

“Yesterday, we reported positive clinical data on our APO(a) LICA program, showing that our LICA technology can create drugs that are 30-fold more potent in humans than our generation 2.0+ antisense drugs. The increase in potency of our LICA drugs could translate into a small and convenient dose that patients could administer weekly, monthly, quarterly or even less frequently. This, obviously, has implications for uptake, adherence and compliance and opens up broader patient populations for all of our LICA drugs. Importantly, the significantly improved potency from our LICA technology represents a major advancement in our pipeline. We currently have eight LICA drugs in development and plan to report clinical data on several of these drugs next year,” continued Ms. Parshall. “Given the attractive profile of ISIS-APO(a)-LRx, together with Akcea, we plan to aggressively develop this drug to maximize its value with near, mid and long-term opportunities in patients who are at significant cardiovascular risk due to high Lp(a) levels.”

The full list of Corporate and Drug Development Highlights can be found at the end of this press release prior to the financial tables.

Exhibit 99.1

Financial Results

“We ended the third quarter with pro forma operating income of $29 million and pro forma net income of $25 million both of which reflect a significant increase over the same period last year. In addition, our operating loss of $13 million and net loss of $17 million, both according to GAAP, were significantly improved over last year. Our continued strong financial performance reflects the successes of the drugs in our pipeline. As our drugs successfully advance, we generate cash and revenue from our partners. During the first nine months of the year, we earned over $230 million of revenue including nearly $90 million in revenue from milestone payments. Our revenue for the first nine months also included more than $90 million we earned from our license of ISIS-FXIRx to Bayer. We ended the third quarter with more than $800 million of cash as a result of the more than $300 million we received from our partners during the first nine months of 2015. Because of our financial performance so far this year, we expect to improve upon our revised financial guidance of a pro forma NOL in the low $30 million range and more than $750 million in cash,” said Elizabeth L. Hougen, chief financial officer of Isis Pharmaceuticals.

All pro forma amounts referred to in this press release exclude non-cash compensation expense related to equity awards. Please refer to the reconciliation of pro forma and GAAP measures, which is provided later in this release.

Revenue

Revenue for the three and nine months ended September 30, 2015 was $49.1 million and $232.1 million, respectively, compared to $44.1 million and $129.3 million for the same periods in 2014. Isis’ revenue in the nine months ended September 30, 2015 consisted of the following:

|

· |

$91.2 million from Bayer in connection with its exclusive license of ISIS-FXIRx; |

|

· |

$51.7 million from Biogen for advancing ISIS-SMNRx in late-stage clinical development, advancing ISIS-BIIB4Rx into development and validating two new undisclosed targets for neurological disorders; |

|

· |

$22 million from Roche for initiating a Phase 1/2 study of ISIS-HTTRx; |

|

· |

$15 million from GSK for advancing the Phase 3 study of ISIS-TTRRx; and |

|

· |

$49.5 million from the amortization of upfront fees and manufacturing services performed for its partners. |

Already in the fourth quarter of 2015, Isis has earned $16 million in milestone payments from Biogen and GSK.

Isis’ revenue fluctuates based on the nature and timing of payments under agreements with its partners and consists primarily of revenue from the amortization of upfront fees, milestone payments and license fees.

Operating Expenses

Isis is conducting more later-stage clinical trials in 2015 than it did in 2014. As such, Isis' pro forma operating expenses of $82.3 million and $203.0 million for the three and nine months ended September 30, 2015, respectively, were higher than the $57.4 million and $164.2 million in the same periods in 2014. On a GAAP basis, Isis' operating expenses for the three and nine months ended September 30, 2015 were $97.3 million and $245.0 million, respectively, compared to $65.6 million and $187.1 million for the same periods in 2014. Isis' operating expenses on a GAAP basis included non-cash compensation expense related to equity awards, which increased due to the increase in the Company’s stock price in January 2015 compared to January 2014.

Exhibit 99.1

Gain on Investment in Regulus Therapeutics Inc.

In the third quarter of 2015, Isis received nearly $26 million of cash and recorded a $20.2 million gain on its sale of a portion of the Regulus common stock it owns. Regulus is a satellite company partner that Isis co-founded to discover and develop antisense drugs targeting microRNAs. In total, Isis has received nearly $50 million since 2014 from its sale of Regulus’ common stock demonstrating the success of Isis’ satellite company strategy. Isis now owns approximately 2.8 million shares, or approximately 5%, of Regulus' common stock.

Net Loss

Isis reported a net loss of $35.8 million and $16.8 million for the three and nine months ended September 30, 2015, respectively, compared to a net loss of $26.7 million and $70.0 million for the same periods in 2014. Basic and diluted net loss per share for the three and nine months ended September 30, 2015 was $0.30 and $0.14, respectively, compared to $0.23 and $0.60 for the same periods in 2014. Isis significantly improved its net loss for the first nine months of 2015 compared to the same period in 2014 primarily due to the revenue the Company earned from its exclusive license agreement with Bayer for ISIS-FXIRx, an increase in milestone payments earned from its partners and the gain from its investment in Regulus. The increase in operating expenses associated with the Company’s maturing pipeline of drugs and Akcea’s activities to prepare for the launch and commercialization of volanesorsen partially offset the Company’s increase in revenue.

Balance Sheet

As of September 30, 2015, Isis had cash, cash equivalents and short-term investments of $812.2 million compared to $728.8 million at December 31, 2014. Isis’ working capital was $746.1 million at September 30, 2015 compared to $721.3 million at December 31, 2014. The increase in the Company’s cash and working capital primarily relates to the nearly $300 million the Company has received from its partners through the end of September 2015.

Conference Call

At 11:30 a.m. Eastern Time today, November 9, 2015, Isis will conduct a live webcast conference call to discuss this earnings release and related activities. Interested parties may listen to the call by dialing 877-443-5662 or access the webcast at www.isispharm.com. A webcast replay will be available for a limited time at the same address.

ABOUT ISIS PHARMACEUTICALS, INC.

Isis is the leading company in RNA-targeted drug discovery and development focused on developing drugs for patients who have the highest unmet medical needs, such as those patients with severe and rare diseases. Using its proprietary antisense technology, Isis has created a large pipeline of first-in-class or best-in-class drugs, with over a dozen drugs in mid- to late-stage development. Drugs currently in Phase 3 development include volanesorsen, a drug Isis is developing and plans to commercialize through its wholly owned subsidiary, Akcea Therapeutics, to treat patients with familial chylomicronemia syndrome and familial partial lipodystrophy; ISIS-TTRRx, a drug Isis is developing with GSK to treat patients with all forms of TTR amyloidosis; and ISIS-SMNRx, a drug Isis is developing with Biogen to treat infants and children with spinal muscular atrophy. Isis’ patents provide strong and extensive protection for its drugs and technology. Additional information about Isis is available at www.isispharm.com.

FORWARD-LOOKING STATEMENT

This press release includes forward-looking statements regarding Isis Pharmaceuticals’ financial position and outlook, Isis’ business, the business of Akcea Therapeutics, Inc., a subsidiary of Isis Pharmaceuticals, and the therapeutic and commercial potential of Isis’ technologies and products in development, including ISIS-SMNRx, ISIS-TTRRx and volanesorsen. Any statement describing Isis’ goals, expectations, financial or other projections, intentions or beliefs is a forward-looking statement and should be considered an at-risk statement. Such statements are subject to certain risks and uncertainties, particularly those inherent in the process of discovering, developing and commercializing drugs that are safe and effective for use as human therapeutics, and in the endeavor of building a business around such drugs. Isis’ forward-looking statements also involve assumptions that, if they never materialize or prove correct, could cause its results to differ materially from those expressed or implied by such forward-looking statements. Although Isis’ forward-looking statements reflect the good faith judgment of its management, these statements are based only on facts and factors currently known by Isis. As a result, you are cautioned not to rely on these forward-looking statements. These and other risks concerning Isis’ programs are described in additional detail in Isis’ annual report on Form 10-K for the year ended December 31, 2014, and its most recent quarterly report on Form 10-Q, which are on file with the SEC.

Exhibit 99.1

Copies of this and other documents are available from the Company.

In this press release, unless the context requires otherwise, “Isis,” “Company,” “we,” “our,” and “us” refers to Isis Pharmaceuticals and its subsidiaries.

Isis Pharmaceuticals® is a registered trademark of Isis Pharmaceuticals, Inc. Akcea Therapeutics™ is a trademark of Isis Pharmaceuticals, Inc. Regulus Therapeutics™ is a trademark of Regulus Therapeutics Inc.

Isis Pharmaceuticals’ Contacts:

|

D. Wade Walke, Ph.D.

|

Amy Williford, Ph.D.

|

|

Vice President, Corporate Communications and Investor Relations

|

Associate Director, Corporate Communications

|

|

760-603-2741

|

760-603-2772

|

Exhibit 99.1

Isis Pharmaceuticals’ Corporate and Drug Development Highlights

(2015 third quarter and subsequent activities)

Corporate Highlights

| · |

Isis and AstraZeneca formed a strategic collaboration to discover and develop antisense therapies for treating cardiovascular and metabolic diseases, primarily focused on targets in the kidney, and renal diseases. The collaboration enables Isis to broaden the application of its antisense technology to targets in the kidney. |

|

o |

In total, Isis has the potential to earn up to more than $4 billion in license fees and milestone payments. |

|

· |

Isis received a $65 million upfront payment from AstraZeneca and is eligible to earn substantial development and regulatory milestone payments and license fees. Isis is eligible to earn a payment of $25 million under this collaboration upon identification of the first drug candidate to move into development. |

|

· |

Isis is also eligible to earn tiered double-digit royalties on annual net sales for each of the programs. |

Drug Development Highlights

| · |

Isis reported positive clinical results from ISIS-APO(a)Rx and ISIS-APO(a)-LRx, ISIS-TTRRx and KYNAMRO. These data exemplify the broad applicability and potential for antisense drugs to provide therapeutic benefit for many different diseases. |

|

o |

Isis and its subsidiary, Akcea Therapeutics, reported results from a Phase 2 study of ISIS-APO(a)Rx in patients with high lipoprotein(a), or Lp(a), a known driver of cardiovascular disease. In the Phase 2 study patients treated with ISIS-APO(a)Rx achieved reductions in Lp(a) of up to 94 percent. Data from this study were presented at the American Heart Association Scientific Sessions. |

|

o |

Isis and Akcea reported results from a Phase 1/2a, study of ISIS-APO(a)-LRx, a LIgand Conjugated Antisense (LICA) version of ISIS-APO(a)Rx, in subjects with elevated Lp(a). In the Phase 1 study, subjects (with Lp(a) greater than 30 mg/dL) who received a single, low volume, subcutaneous injection of ISIS-APO(a)-LRx, achieved dose-dependent reductions in Lp(a) of up to 97 percent. Subjects who received multiple doses of ISIS-APO(a)-LRx achieved up to 99 percent reduction in Lp(a) levels. In addition, ISIS-APO(a)-LRx demonstrated the potential for a variety of convenient dose schedules - weekly, monthly, quarterly or less frequent dosing. This is the first clinical data from Isis’ LICA program and represents a greater than 30-fold increase in potency over ISIS-APO(a)Rx, the non-LICA Lp(a) drug. These data significantly exceeded the potency and duration expectations predicted by preclinical experiments. Data from this study were presented at the American Heart Association Scientific Sessions. |

|

o |

Dr. Merrill Benson reported positive preliminary results from an ongoing Phase 2 study in patients with familial amyloid cardiomyopathy (FAC) and patients with wild-type transthyretin amyloidosis (wt-TTR amyloidosis, previously referred to as senile systemic amyloidosis, or SSA). In this open-label, investigator initiated study, after six and 12 months of treatment with ISIS-TTRRx, Dr. Benson observed: |

|

· |

Evidence of disease stabilization. These observations compare favorably to those from Benson’s previously published natural history data, in which disease progression was observed at 12 months. |

|

· |

Sustained reductions in TTR compared to baseline. |

|

o

|

Isis reported positive results from an ongoing open-label extension study (OLE) of ISIS-TTRRx in patients with familial amyloid polyneuropathy (FAP). An analysis conducted on the first 38 patients to reach at least three months of treatment in the OLE study showed a maximum reduction in TTR protein levels of up to 92 percent with a mean maximum (nadir) reduction of 76 percent as compared to patients’ TTR levels at entry into the Phase 3 study.

|

Exhibit 99.1

|

o |

Isis reported that the FOCUS FH study evaluating KYNAMRO in patients with severe heterozygous familial hypercholesterolemia met its primary efficacy endpoint with a statistically significant reduction of LDL-Cholesterol. Genzyme and Isis plan to report the full data from this study at an upcoming medical meeting.

|

| · |

Isis and Akcea published clinical data from two novel lipid drugs, volanesorsen and ISIS-APO(a)Rx, in the New England Journal of Medicine and The Lancet, respectively. These data highlight the significant interest from the medical community in Isis’ and Akcea’s lipid drugs and the medical importance of the clinical data from these programs. |

| · |

Volanesorsen was granted orphan drug designation from the US FDA for the treatment of patients with familial chylomicronemia syndrome. |

| · |

Isis continued to advance its pipeline of drugs: |

|

o |

Akcea and Isis initiated a Phase 3 study of volanesorsen in patients with familial partial lipodystrophy. This study is designed to support regulatory filing for volanesorsen in this patient population. |

|

o |

Isis initiated a Phase 2 study of ISIS-FXIRx in patients who have compromised renal function. These data will be important to form the basis for Bayer’s first Phase 3 study. |

|

o |

Isis initiated a Phase 2 dose-optimization study of ISIS-GCGRRx in patients with type 2 diabetes. |

|

o |

Isis initiated a Phase 1/2 study of ISIS-HTTRx in patients with Huntington’s disease (HD). ISIS-HTTRx was granted orphan drug designation by the European Medicines Agency for the treatment of patients with HD. |

|

o |

Isis initiated a Phase 2 study to evaluate the safety and activity of ISIS-FGFR4Rx in obese patients. |

|

o |

Isis initiated Phase 1 studies of ISIS-DGAT2Rx and ISIS-GSK4-LRx in healthy volunteers. |

Exhibit 99.1

ISIS PHARMACEUTICALS, INC.

SELECTED FINANCIAL INFORMATION

Condensed Consolidated Statements of Operations

(In Thousands, Except Per Share Data)

| |

|

Three months ended,

September 30,

|

|

|

Nine months ended,

September 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Revenue:

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Research and development revenue under collaborative agreements

|

|

$

|

48,918

|

|

|

$

|

43,798

|

|

|

$

|

230,469

|

|

|

$

|

119,975

|

|

|

Licensing and royalty revenue

|

|

|

203

|

|

|

|

265

|

|

|

|

1,664

|

|

|

|

9,325

|

|

|

Total revenue

|

|

|

49,121

|

|

|

|

44,063

|

|

|

|

232,133

|

|

|

|

129,300

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research, development and patent expenses

|

|

|

88,508

|

|

|

|

61,086

|

|

|

|

220,962

|

|

|

|

173,798

|

|

|

General and administrative

|

|

|

8,751

|

|

|

|

4,470

|

|

|

|

23,992

|

|

|

|

13,313

|

|

|

Total operating expenses

|

|

|

97,259

|

|

|

|

65,556

|

|

|

|

244,954

|

|

|

|

187,111

|

|

|

Loss from operations

|

|

|

(48,138

|

)

|

|

|

(21,493

|

)

|

|

|

(12,821

|

)

|

|

|

(57,811

|

)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income

|

|

|

1,185

|

|

|

|

675

|

|

|

|

2,946

|

|

|

|

2,003

|

|

|

Interest expense

|

|

|

(9,233

|

)

|

|

|

(4,998

|

)

|

|

|

(27,381

|

)

|

|

|

(14,902

|

)

|

|

Gain on investments, net

|

|

|

199

|

|

|

|

3

|

|

|

|

200

|

|

|

|

140

|

|

|

Gain on investment in Regulus Therapeutics, Inc.

|

|

|

20,211

|

|

|

|

535

|

|

|

|

20,211

|

|

|

|

535

|

|

|

Loss before income tax benefit (expense)

|

|

|

(35,776

|

)

|

|

|

(25,278

|

)

|

|

|

(16,845

|

)

|

|

|

(70,035

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

-

|

|

|

|

(1,398

|

)

|

|

|

-

|

|

|

|

(2

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(35,776

|

)

|

|

$

|

(26,676

|

)

|

|

$

|

(16,845

|

)

|

|

$

|

(70,037

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$

|

(0.30

|

)

|

|

$

|

(0.23

|

)

|

|

$

|

(0.14

|

)

|

|

$

|

(0.60

|

)

|

|

Shares used in computing basic and diluted net loss per share

|

|

|

119,979

|

|

|

|

117,811

|

|

|

|

119,560

|

|

|

|

117,511

|

|

Exhibit 99.1

Isis Pharmaceuticals, Inc.

Reconciliation of GAAP to Pro Forma Basis:

Condensed Consolidated Operating Expenses, Loss From Operations, and Net Loss

(In Thousands)

| |

|

Three months ended,

September 30,

|

|

|

Nine months ended,

September 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

As reported operating expenses according to GAAP

|

|

$

|

97,259

|

|

|

$

|

65,556

|

|

|

$

|

244,954

|

|

|

$

|

187,111

|

|

|

Excluding compensation expense related to equity awards

|

|

|

(14,997

|

)

|

|

|

(8,118

|

)

|

|

|

(41,907

|

)

|

|

|

(22,894

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma operating expenses

|

|

$

|

82,262

|

|

|

$

|

57,438

|

|

|

$

|

203,047

|

|

|

$

|

164,217

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As reported income (loss) from operations according to GAAP

|

|

$

|

(48,138

|

)

|

|

$

|

(21,493

|

)

|

|

$

|

(12,821

|

)

|

|

$

|

(57,811

|

)

|

|

Excluding compensation expense related to equity awards

|

|

|

(14,997

|

)

|

|

|

(8,118

|

)

|

|

|

(41,907

|

)

|

|

|

(22,894

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma income (loss) from operations

|

|

$

|

(33,141

|

)

|

|

$

|

(13,375

|

)

|

|

$

|

29,086

|

|

|

$

|

(34,917

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As reported net loss according to GAAP

|

|

$

|

(35,776

|

)

|

|

$

|

(26,676

|

)

|

|

$

|

(16,845

|

)

|

|

$

|

(70,037

|

)

|

|

Excluding compensation expense related to equity awards

|

|

|

(14,997

|

)

|

|

|

(8,118

|

)

|

|

|

(41,907

|

)

|

|

|

(22,894

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma net income (loss)

|

|

$

|

(20,779

|

)

|

|

$

|

(18,558

|

)

|

|

$

|

25,062

|

|

|

$

|

(47,143

|

)

|

Reconciliation of GAAP to Pro Forma Basis

As illustrated in the Selected Financial Information in this press release, pro forma operating expenses, pro forma income (loss) from operations, and pro forma net income (loss) were adjusted from GAAP to exclude compensation expense related to equity awards, which are non-cash. Isis has regularly reported non-GAAP measures for operating results as pro forma results. These measures are provided as supplementary information and are not a substitute for financial measures calculated in accordance with GAAP. Isis reports these pro forma results to better enable financial statement users to assess and compare its historical performance and project its future operating results and cash flows. Further, the presentation of Isis' pro forma results is consistent with how Isis' management internally evaluates the performance of its operations.

Exhibit 99.1

Isis Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(In Thousands)

| |

|

September 30,

2015

|

|

|

December 31,

2014

|

|

| |

|

(unaudited)

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments

|

|

$

|

812,192

|

|

|

$

|

728,832

|

|

|

Investment in Regulus Therapeutics Inc.

|

|

|

18,594

|

|

|

|

81,881

|

|

|

Other current assets

|

|

|

37,475

|

|

|

|

25,884

|

|

|

Property, plant and equipment, net

|

|

|

89,243

|

|

|

|

88,958

|

|

|

Other assets

|

|

|

30,501

|

|

|

|

30,254

|

|

|

Total assets

|

|

$

|

988,005

|

|

|

$

|

955,809

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Other current liabilities

|

|

$

|

54,062

|

|

|

$

|

63,619

|

|

|

Current portion of deferred contract revenue

|

|

|

68,136

|

|

|

|

51,713

|

|

|

1% convertible senior notes

|

|

|

342,136

|

|

|

|

327,486

|

|

|

2 3/4% convertible senior notes

|

|

|

49,754

|

|

|

|

48,014

|

|

|

Long-term obligations, less current portion

|

|

|

79,403

|

|

|

|

79,400

|

|

|

Long-term deferred contract revenue

|

|

|

149,100

|

|

|

|

127,797

|

|

|

Stockholders’ equity

|

|

|

245,414

|

|

|

|

257,780

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

988,005

|

|

|

$

|

955,809

|

|

###

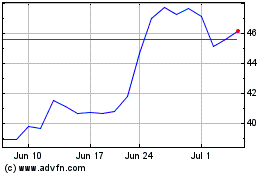

Ionis Pharmaceuticals (NASDAQ:IONS)

Historical Stock Chart

From Mar 2024 to Apr 2024

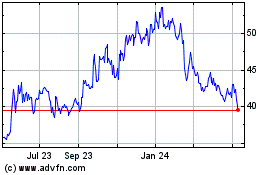

Ionis Pharmaceuticals (NASDAQ:IONS)

Historical Stock Chart

From Apr 2023 to Apr 2024