UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

August 4, 2015

|

Innospec Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

1-13879

|

98-0181725

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

8310 South Valley Highway, Suite 350, Englewood, Colorado

|

|

CO 80112

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(303) 792 5554

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On August 4, 2015, Innospec Inc. issued a press release announcing its financial results for the quarter ended June 30, 2015.

Item 9.01 Financial Statements and Exhibits.

A copy of the press release is attached as Exhibit 99.1 to this report on Form 8K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Innospec Inc.

|

|

|

|

|

|

|

|

August 4, 2015

|

|

By:

|

|

David E. Williams

|

|

|

|

|

|

|

|

|

|

|

|

Name: David E. Williams

|

|

|

|

|

|

Title: VP, General Counsel, CCO and Corporate Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated August 4, 2015 announcing Innospec Inc's results for the quarter ended June 30, 2015.

|

PRESS RELEASE

INNOSPEC REPORTS SECOND QUARTER 2015 FINANCIAL RESULTS

Operating income excluding fair value adjustments up 22 percent; EBITDA up 10 percent

Core businesses deliver strong performance; Margin improvement across all businesses

Adjusted non-GAAP EPS of $1.02

Operating cash inflows of $36.9 million in the quarter

Englewood, CO – August 4, 2015 – Innospec Inc. (NASDAQ: IOSP) today announced its financial

results for the second quarter ended June 30, 2015.

Total net sales for the quarter were $242.9 million, up 10 percent from the $221.3 million

reported in the corresponding quarter last year. Net income was $34.5 million, or $1.40 per

diluted share, compared to $18.5 million, or $0.75 per diluted share, recorded a year ago. EBITDA

(earnings before interest, taxes, depreciation, amortization, and fair value adjustments) for the

quarter was $34.7 million, a 10 percent increase from $31.6 million in 2014’s second quarter.

Results for the quarter after-tax include an adjustment to the fair value of contingent

consideration of $16.1 million, or $0.65 per diluted share; foreign currency exchange losses of

$3.5 million, or $0.14 per diluted share; and amortization of acquired intangible assets of $3.2

million, or $0.13 per diluted share. Excluding these items, adjusted non-GAAP EPS was $1.02 per

diluted share, compared to $0.88 per diluted share a year ago. Innospec closed the quarter with a

net debt position of $71.1 million, reduced from $90.4 million at the end of the first quarter

2015. Cash generation for the quarter was strong, with operating cash inflows of $36.9 million,

before capital expenditures during the quarter of $6.3 million.

EBITDA and net income excluding special items, and related per-share amounts, are non-GAAP

financial measures that are defined and reconciled with GAAP results herein and in the schedules

below.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended June 30, 2015 |

|

Quarter ended June 30, 2014 |

| |

|

Income before |

|

Net |

|

|

|

|

|

Income before |

|

Net |

|

|

| (in millions, except share and per share data) |

|

income taxes |

|

Income |

|

Diluted EPS |

|

income taxes |

|

income |

|

Diluted EPS |

Reported GAAP amounts |

|

$ |

51.8 |

|

|

$ |

34.5 |

|

|

$ |

1.40 |

|

|

$ |

23.8 |

|

|

$ |

18.5 |

|

|

$ |

0.75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment to fair value of contingent consideration |

|

|

(26.6 |

) |

|

|

(16.1 |

) |

|

|

(0.65 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Foreign currency exchange losses |

|

|

4.7 |

|

|

|

3.5 |

|

|

|

0.14 |

|

|

|

0.7 |

|

|

|

0.6 |

|

|

|

0.02 |

|

Amortization of acquired intangible assets |

|

|

4.3 |

|

|

|

3.2 |

|

|

|

0.13 |

|

|

|

3.4 |

|

|

|

2.6 |

|

|

|

0.11 |

|

|

|

|

(17.6 |

) |

|

|

(9.4 |

) |

|

|

(0.38 |

) |

|

|

4.1 |

|

|

|

3.2 |

|

|

|

0.13 |

|

Adjusted non-GAAP amounts |

|

$ |

34.2 |

|

|

$ |

25.1 |

|

|

$ |

1.02 |

|

|

$ |

27.9 |

|

|

$ |

21.7 |

|

|

$ |

0.88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the first six months of 2015, total net sales of $512.1 million increased 16 percent from

$442.0 million in the corresponding period a year ago. Net income for the first half of 2015 was

$52.4 million, or $2.12 per diluted share, up from the $35.4 million, or $1.44 per diluted share,

reported a year ago. Excluding special items, diluted earnings per share for the first six months

of 2015 was $1.93, up 26 percent from $1.53 a year ago. EBITDA for the first half of 2015 was

$71.4 million, up 22 percent from $58.7 million in last year’s first half.

Commenting on the second quarter results, Patrick S. Williams, President and Chief Executive

Officer of Innospec, said, “Overall, we had an excellent quarter, with our core businesses of Fuel

Specialties, Oilfield Specialties and Personal Care delivering significant growth in both sales and

operating income. Our Oilfield Specialties business held up well, in the face of continuing

depressed crude and gas prices and improved sequentially over the first quarter. We believe that

we have built an excellent position from which to capitalize on the upturn in the market, when it

comes.

“We are pleased to see our strategy delivering significantly improved profitability, with gross

margin up five basis points from last year’s comparable quarter and operating income up 22 percent.

This has been driven by improvements in raw material pricing, a richer sales mix and higher margin

new business wins. We are optimistic, entering the second half, as we feel that we are very

strongly positioned, both operationally and financially.

“Our core Fuel Specialties business turned in excellent results, for both sales and operating

income. A steady performance in the Americas was driven by a continuing strong economy as well as

new product launches and customer wins. The business in EMEA has been doing extremely well against

a backdrop of slow economic growth and the substantial adverse impact of foreign exchange. In

Asia-Pacific, we believe that we are on the right track for sustainable growth. As anticipated,

AvTel sales bounced back to more normal levels in the quarter.

“Despite the extremely difficult market conditions, Oilfield Specialties’ performance overall has

met our ambitious expectations. While reduced rig count continues to depress our Drilling business,

we have seen improved performance in both Frac/Stim and Production. Our recent acquisition is

performing well, and the integration remains on schedule. We feel that we are well positioned for

substantial future growth when the market recovers. We are also pleased with our improved

profitability in the period.

“Our Performance Chemicals business did well, despite reporting a 9 percent year-over-year

reduction in sales, which was primarily due to foreign exchange, as the Euro remains weak. Within

the segment, our core Personal Care business grew by 10 percent during the same period, continuing

its strong performance. We saw good growth among existing and new product lines in both the

Americas and in EMEA, and we believe that our prospects for the second half look very promising.

“As previously reported, we announced the sale of our Aroma Chemicals business during the second

quarter and closed the transaction on July 6, 2015. Strategically, we can now concentrate more

effectively in the Personal Care area, which we anticipate offers us higher sustainable growth

opportunities.”

Net sales in Fuel Specialties for the quarter were $182.3 million, a 26 percent increase from

$145.1 million in last year’s second quarter, driven by a strong contribution from the Independence

acquisition. Excluding the acquisition, volumes increased by 4 percent offset by the adverse

currency impact of 6 percent and 1 percent weaker pricing in the quarter. Excluding Oilfield

Specialties, revenues in the Americas were flat and declined 9 percent in Asia-Pacific due to

reduced volumes and foreign exchange. EMEA sales grew by 6 percent as volume growth more than

offset the adverse currency impact. Oilfield Specialties grew revenues by 2 percent sequentially

over the first quarter and as expected, AvTel sales rebounded. The segment’s gross margin rose

sharply to 37.8 percent, from 30.3 percent in last year’s quarter, benefitting from improved raw

material pricing, including the positive impact from foreign exchange and a richer sales mix of

higher margin business. Operating income for the quarter was $27.8 million, up 59 percent from

last year’s $17.5 million.

In Performance Chemicals, net sales of $54.1 million were down 9 percent from 2014’s second

quarter, driven by 5 percent weaker pricing and an adverse currency impact of 8 percent partially

offset by volume growth of 4 percent. By region, sales were slightly down by 1 percent in the

Americas but fell by 17 percent in EMEA and 11 percent in Asia-Pacific driven by adverse currency

impacts and weaker pricing. The segment’s gross margin was 27.4 percent, up 1.6 percentage points

from the year-ago period, primarily a result of increased sales of high-margin Personal Care

products in the quarter. Operating income of $7.5 million for the quarter was slightly lower than

the $7.8 million reported in 2014’s second quarter.

In Octane Additives, net sales for the quarter were $6.5 million as anticipated.

Corporate costs were $7.4 million, unchanged from a year ago, and include legal fees recovered in

the quarter. There was a quarterly pension credit of $0.1 million, compared to a charge of $0.9

million a year ago. The effective tax rate for the quarter was 33.4 percent and the full year

adjusted effective tax rate is anticipated to be 26 percent.

Net cash generated from operations was $36.9 million, compared to the $12.9 million reported a year

ago. As of June 30, 2015, Innospec had $70.9 million in cash, cash equivalents, and short-term

investments, including cash held for sale and total debt of $142.0 million. In the second quarter,

the company retired 114,064 shares at a cost of $5.1 million as part of the board-authorized share

repurchase program, and paid a first half year dividend of 30 cents per share, at a cost of $7.3

million.

Mr. Williams concluded, “We have delivered above our expectations in the second quarter, which is

particularly notable considering the challenging state of the markets in which we operate.

Moreover, our strong financial management and cost control have supported broad margin expansion

across our businesses, which we anticipate will be a good springboard for the remainder of the

year. We enter the second half of the year feeling optimistic about delivering strong full year

results.”

Use of Non-GAAP Financial Measures

The information presented in this press release includes financial measures that are not calculated

or presented in accordance with Generally Accepted Accounting Principles in the United States

(GAAP). These non-GAAP financial measures comprise EBITDA, income before income taxes excluding

special items and net income excluding special items and related per share amounts. EBITDA is net

income per our consolidated financial statements adjusted for the exclusion of charges for interest

expense, net, income taxes, depreciation, amortization and adjustment to fair value of contingent

consideration. Income before income taxes, net income and diluted EPS, excluding special items,

per our consolidated financial statements are adjusted for the exclusion of adjustment to fair

value of contingent consideration, foreign currency exchange losses and amortization of acquired

intangible assets. Reconciliations of these non-GAAP financial measures to their most directly

comparable GAAP financial measures are provided herein and in the schedules below. The Company

believes that such non-GAAP financial measures provide useful information to investors and may

assist them in evaluating the Company’s underlying performance and identifying operating trends.

In addition, management uses these non-GAAP financial measures internally to allocate resources and

evaluate the performance of the Company’s operations. While the Company believes that such

measures are useful in evaluating the Company’s performance, investors should not consider them to

be a substitute for financial measures prepared in accordance with GAAP. In addition, these

non-GAAP financial measures may differ from similarly-titled non-GAAP financial measures used by

other companies and do not provide a comparable view of the Company’s performance relative to other

companies in similar industries. Management believes the most directly comparable GAAP financial

measure is GAAP net income and has provided a reconciliation of EBITDA and net income excluding

special items, and related per share amounts, to GAAP net income herein and in the schedules below.

About Innospec Inc.

Innospec Inc. is an international specialty chemicals company with approximately 1300 employees in

20 countries. Innospec manufactures and supplies a wide range of specialty chemicals to markets in

the Americas, Europe, the Middle East, Africa and Asia-Pacific. The Fuel Specialties business

specializes in manufacturing and supplying the fuel additives that help improve fuel efficiency,

boost engine performance and reduce harmful emissions. This business also contains Oilfield

Specialties which provides specialty chemicals for oil & gas drilling and production operations.

Innospec’s Performance Chemicals business provides effective technology-based solutions for our

customers’ processes or products focused in the Personal Care and Polymers markets. Innospec’s

Octane Additives business is the world’s only producer of tetra ethyl lead.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements other than statements of historical facts

included or incorporated herein may constitute forward-looking statements. Such forward-looking

statements include statements (covered by words like “expects,” “estimates,” “anticipates,” “may,”

“believes,” “feels” or similar words or expressions), for example, which relate to earnings, growth

potential, operating performance, events or developments that we expect or anticipate will or may

occur in the future. Although forward-looking statements are believed by management to be

reasonable when made, they are subject to certain risks, uncertainties and assumptions, and our

actual performance or results may differ materially from these forward-looking statements.

Additional information regarding risks, uncertainties and assumptions relating to Innospec and

affecting our business operations and prospects are described in Innospec’s Annual Report on Form

10-K for the year ended December 31, 2014, and other reports filed with the U.S. Securities and

Exchange Commission. You are urged to review our discussion of risks and uncertainties that could

cause actual results to differ from forward-looking statements under the heading “Risk Factors” in

such reports. Innospec undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Contacts:

Brian Watt

Innospec Inc.

+44-151-356-6241

Brian.Watt@innospecinc.com

Robert D. Ferris

RF|Binder Partners

+1-212-994-7505

Robert.Ferris@RFBinder.com

Chloe Miller

RF|Binder Partners

+1-212-994-7636

Dan.Scorpio@RFBinder.com

1

Schedule 1

INNOSPEC INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except share and per share data) |

|

|

|

|

|

|

|

|

| } |

|

Three Months Ended |

|

|

|

|

|

Six Months Ended |

| } |

|

June 30 |

|

|

|

|

|

June 30 |

| |

|

2015 |

|

|

|

|

|

2014 |

|

|

|

|

|

2015 |

|

|

|

|

|

2014 |

Net sales |

|

$ |

242.9 |

|

|

|

|

|

|

$ |

221.3 |

|

|

|

|

|

|

$ |

512.1 |

|

|

|

|

|

|

$ |

442.0 |

|

Cost of goods sold |

|

|

(155.4 |

) |

|

|

|

|

|

|

(152.7 |

) |

|

|

|

|

|

|

(342.8 |

) |

|

|

|

|

|

|

(307.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

87.5 |

|

|

|

|

|

|

|

68.6 |

|

|

|

|

|

|

|

169.3 |

|

|

|

|

|

|

|

134.3 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

(50.2 |

) |

|

|

|

|

|

|

(37.7 |

) |

|

|

|

|

|

|

(98.9 |

) |

|

|

|

|

|

|

(79.7 |

) |

Research and development |

|

|

(6.5 |

) |

|

|

|

|

|

|

(5.6 |

) |

|

|

|

|

|

|

(12.7 |

) |

|

|

|

|

|

|

(11.3 |

) |

Adjustment to fair value of contingent consideration |

|

|

26.6 |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

23.1 |

|

|

|

|

|

|

|

— |

|

Total operating expenses |

|

|

(30.1 |

) |

|

|

|

|

|

|

(43.3 |

) |

|

|

|

|

|

|

(88.5 |

) |

|

|

|

|

|

|

(91.0 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

57.4 |

|

|

|

|

|

|

|

25.3 |

|

|

|

|

|

|

|

80.8 |

|

|

|

|

|

|

|

43.3 |

|

Other net (expense)/income |

|

|

(4.7 |

) |

|

|

|

|

|

|

(0.7 |

) |

|

|

|

|

|

|

(3.2 |

) |

|

|

|

|

|

|

1.2 |

|

Interest expense, net |

|

|

(0.9 |

) |

|

|

|

|

|

|

(0.8 |

) |

|

|

|

|

|

|

(1.9 |

) |

|

|

|

|

|

|

(1.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

51.8 |

|

|

|

|

|

|

|

23.8 |

|

|

|

|

|

|

|

75.7 |

|

|

|

|

|

|

|

42.8 |

|

Income taxes |

|

|

(17.3 |

) |

|

|

|

|

|

|

(5.3 |

) |

|

|

|

|

|

|

(23.3 |

) |

|

|

|

|

|

|

(7.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

34.5 |

|

|

|

|

|

|

$ |

18.5 |

|

|

|

|

|

|

$ |

52.4 |

|

|

|

|

|

|

$ |

35.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.43 |

|

|

|

|

|

|

$ |

0.76 |

|

|

|

|

|

|

$ |

2.16 |

|

|

|

|

|

|

$ |

1.45 |

|

Diluted |

|

$ |

1.40 |

|

|

|

|

|

|

$ |

0.75 |

|

|

|

|

|

|

$ |

2.12 |

|

|

|

|

|

|

$ |

1.44 |

|

Weighted average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

24,202 |

|

|

|

|

|

|

|

24,401 |

|

|

|

|

|

|

|

24,251 |

|

|

|

|

|

|

|

24,382 |

|

Diluted |

|

|

24,671 |

|

|

|

|

|

|

|

24,672 |

|

|

|

|

|

|

|

24,761 |

|

|

|

|

|

|

|

24,632 |

|

INNOSPEC INC. AND SUBSIDIARIES

Schedule 2A

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SEGMENTAL ANALYSIS OF RESULTS |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30 |

|

June 30 |

| (in millions) |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel Specialties |

|

$ |

182.3 |

|

|

$ |

145.1 |

|

|

$ |

381.7 |

|

|

$ |

309.3 |

|

Performance Chemicals |

|

|

54.1 |

|

|

|

59.4 |

|

|

|

111.7 |

|

|

|

115.5 |

|

Octane Additives |

|

|

6.5 |

|

|

|

16.8 |

|

|

|

18.7 |

|

|

|

17.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

242.9 |

|

|

|

221.3 |

|

|

|

512.1 |

|

|

|

442.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel Specialties |

|

|

68.9 |

|

|

|

43.9 |

|

|

|

130.4 |

|

|

|

95.9 |

|

Performance Chemicals |

|

|

14.8 |

|

|

|

15.3 |

|

|

|

29.3 |

|

|

|

28.9 |

|

Octane Additives |

|

|

3.8 |

|

|

|

9.4 |

|

|

|

9.6 |

|

|

|

9.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

87.5 |

|

|

|

68.6 |

|

|

|

169.3 |

|

|

|

134.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel Specialties |

|

|

27.8 |

|

|

|

17.5 |

|

|

|

51.3 |

|

|

|

43.3 |

|

Performance Chemicals |

|

|

7.5 |

|

|

|

7.8 |

|

|

|

13.9 |

|

|

|

14.3 |

|

Octane Additives |

|

|

2.8 |

|

|

|

8.3 |

|

|

|

7.9 |

|

|

|

7.1 |

|

Pension credit/(charge) |

|

|

0.1 |

|

|

|

(0.9 |

) |

|

|

0.1 |

|

|

|

(1.7 |

) |

Corporate costs |

|

|

(7.4 |

) |

|

|

(7.4 |

) |

|

|

(15.5 |

) |

|

|

(19.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.8 |

|

|

|

25.3 |

|

|

|

57.7 |

|

|

|

43.3 |

|

Adjustment to fair value of contingent consideration |

|

|

26.6 |

|

|

|

— |

|

|

|

23.1 |

|

|

|

— |

|

Total operating income |

|

$ |

57.4 |

|

|

$ |

25.3 |

|

|

$ |

80.8 |

|

|

$ |

43.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2B

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-GAAP MEASURES |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30 |

|

June 30 |

| (in millions) |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

Net income |

|

$ |

34.5 |

|

|

$ |

18.5 |

|

|

$ |

52.4 |

|

|

$ |

35.4 |

|

Interest expense, net |

|

|

0.9 |

|

|

|

0.8 |

|

|

|

1.9 |

|

|

|

1.7 |

|

Income taxes |

|

|

17.3 |

|

|

|

5.3 |

|

|

|

23.3 |

|

|

|

7.4 |

|

Depreciation and amortization |

|

|

8.6 |

|

|

|

7.0 |

|

|

|

16.9 |

|

|

|

14.2 |

|

Adjustment to fair value of contingent consideration |

|

|

(26.6 |

) |

|

|

— |

|

|

|

(23.1 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

|

34.7 |

|

|

|

31.6 |

|

|

|

71.4 |

|

|

|

58.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel Specialties |

|

|

33.0 |

|

|

|

20.6 |

|

|

|

61.6 |

|

|

|

49.8 |

|

Performance Chemicals |

|

|

9.4 |

|

|

|

10.1 |

|

|

|

17.6 |

|

|

|

18.8 |

|

Octane Additives |

|

|

2.9 |

|

|

|

8.4 |

|

|

|

8.1 |

|

|

|

7.3 |

|

Pension credit/(charge) |

|

|

0.1 |

|

|

|

(0.9 |

) |

|

|

0.1 |

|

|

|

(1.7 |

) |

Corporate costs |

|

|

(6.0 |

) |

|

|

(5.9 |

) |

|

|

(12.8 |

) |

|

|

(16.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39.4 |

|

|

|

32.3 |

|

|

|

74.6 |

|

|

|

57.5 |

|

Other net (expense)/income |

|

|

(4.7 |

) |

|

|

(0.7 |

) |

|

|

(3.2 |

) |

|

|

1.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

34.7 |

|

|

$ |

31.6 |

|

|

$ |

71.4 |

|

|

$ |

58.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

Schedule 3

INNOSPEC INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| |

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| (in millions) |

|

2015 |

|

2014 |

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

64.3 |

|

|

$ |

41.6 |

|

Short-term investments |

|

|

5.5 |

|

|

|

4.7 |

|

Trade and other accounts receivable |

|

|

131.5 |

|

|

|

164.3 |

|

Inventories |

|

|

167.5 |

|

|

|

184.9 |

|

Current portion of deferred tax assets |

|

|

8.2 |

|

|

|

8.4 |

|

Prepaid expenses |

|

|

5.2 |

|

|

|

8.3 |

|

Prepaid income taxes |

|

|

1.5 |

|

|

|

2.0 |

|

Assets held for sale |

|

|

42.7 |

|

|

|

— |

|

Total current assets |

|

|

426.4 |

|

|

|

414.2 |

|

Net property, plant and equipment |

|

|

72.5 |

|

|

|

80.8 |

|

Goodwill |

|

|

268.4 |

|

|

|

276.1 |

|

Other intangible assets |

|

|

175.9 |

|

|

|

181.1 |

|

Deferred finance costs |

|

|

0.7 |

|

|

|

1.1 |

|

Deferred tax assets, net of current portion |

|

|

0.7 |

|

|

|

0.7 |

|

Pension asset |

|

|

52.5 |

|

|

|

45.2 |

|

Other non-current assets |

|

|

1.3 |

|

|

|

0.7 |

|

Total assets |

|

$ |

998.4 |

|

|

$ |

999.9 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

67.4 |

|

|

$ |

87.6 |

|

Accrued liabilities |

|

|

69.6 |

|

|

|

77.2 |

|

Current portion of long-term debt |

|

|

— |

|

|

|

0.4 |

|

Current portion of finance leases |

|

|

0.6 |

|

|

|

0.5 |

|

Current portion of plant closure provisions |

|

|

5.1 |

|

|

|

5.7 |

|

Current portion of accrued income taxes |

|

|

3.9 |

|

|

|

5.6 |

|

Current portion of acquisition-related contingent consideration |

|

|

39.0 |

|

|

|

45.7 |

|

Current portion of deferred income |

|

|

0.2 |

|

|

|

0.2 |

|

Liabilities held for sale |

|

|

7.8 |

|

|

|

— |

|

Total current liabilities |

|

|

193.6 |

|

|

|

222.9 |

|

Long-term debt, net of current portion |

|

|

139.0 |

|

|

|

139.0 |

|

Finance leases, net of current portion |

|

|

2.4 |

|

|

|

1.7 |

|

Plant closure provisions, net of current portion |

|

|

29.9 |

|

|

|

28.4 |

|

Unrecognized tax benefits, net of current portion |

|

|

6.3 |

|

|

|

6.2 |

|

Deferred tax liabilities, net of current portion |

|

|

33.1 |

|

|

|

23.0 |

|

Pension liability |

|

|

9.8 |

|

|

|

10.4 |

|

Acquisition-related contingent consideration, net of current portion |

|

|

33.2 |

|

|

|

49.5 |

|

Deferred income, net of current portion |

|

|

0.7 |

|

|

|

0.9 |

|

Other non-current liabilities |

|

|

0.7 |

|

|

|

2.0 |

|

Equity |

|

|

549.7 |

|

|

|

515.9 |

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

998.4 |

|

|

$ |

999.9 |

|

|

|

|

|

|

|

|

|

|

3

Schedule 4

INNOSPEC INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

| |

|

June 30 |

| (in millions) |

|

2015 |

|

2014 |

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

52.4 |

|

|

$ |

35.4 |

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

17.3 |

|

|

|

14.6 |

|

Adjustment to fair value of contingent consideration |

|

|

(23.1 |

) |

|

|

— |

|

Deferred taxes |

|

|

10.5 |

|

|

|

0.8 |

|

Changes in working capital |

|

|

1.7 |

|

|

|

(15.6 |

) |

Excess tax benefit from stock-based payment arrangements |

|

|

(0.7 |

) |

|

|

(0.6 |

) |

Accrued income taxes |

|

|

0.5 |

|

|

|

6.3 |

|

Movement on plant closure provisions |

|

|

1.4 |

|

|

|

(0.8 |

) |

Cash contributions to defined benefit pension plans |

|

|

(5.2 |

) |

|

|

(5.8 |

) |

Non-cash expense of defined benefit pension plans |

|

|

0.3 |

|

|

|

2.0 |

|

Stock option compensation |

|

|

1.8 |

|

|

|

1.2 |

|

Movements on unrecognized tax benefits |

|

|

0.1 |

|

|

|

(4.0 |

) |

Movements on other non-current assets and liabilities |

|

|

(1.9 |

) |

|

|

0.3 |

|

Net cash provided by operating activities |

|

|

55.1 |

|

|

|

33.8 |

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(7.3 |

) |

|

|

(5.9 |

) |

Business combinations, net of cash acquired |

|

|

— |

|

|

|

0.3 |

|

Internally developed software |

|

|

(5.1 |

) |

|

|

(3.0 |

) |

Purchase of short-term investments |

|

|

(3.7 |

) |

|

|

(3.3 |

) |

Sale of short-term investments |

|

|

3.0 |

|

|

|

4.1 |

|

Net cash used in investing activities |

|

|

(13.1 |

) |

|

|

(7.8 |

) |

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

|

0.4 |

|

|

|

— |

|

Net repayment of revolving credit facility |

|

|

— |

|

|

|

(8.0 |

) |

Repayment of term loans |

|

|

(0.4 |

) |

|

|

(0.5 |

) |

Excess tax benefit from stock-based payment arrangements |

|

|

0.7 |

|

|

|

0.6 |

|

Dividend paid |

|

|

(7.3 |

) |

|

|

(6.6 |

) |

Issue of treasury stock |

|

|

0.7 |

|

|

|

0.4 |

|

Repurchase of common stock |

|

|

(11.4 |

) |

|

|

(0.8 |

) |

Net cash used in financing activities |

|

|

(17.3 |

) |

|

|

(14.9 |

) |

Effect of foreign currency exchange rate changes on cash |

|

|

(0.9 |

) |

|

|

0.1 |

|

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

|

23.8 |

|

|

|

11.2 |

|

Cash and cash equivalents at beginning of period |

|

|

41.6 |

|

|

|

80.2 |

|

Reclassification of cash to assets held for sale |

|

|

(1.1 |

) |

|

|

— |

|

Cash and cash equivalents at end of period |

|

$ |

64.3 |

|

|

$ |

91.4 |

|

|

|

|

|

|

|

|

|

|

Amortization of deferred finance costs of $0.4 million (2014 — $0.4 million) are included in

depreciation and amortization in the cash flow statement but in interest expense in the income

statement.

4

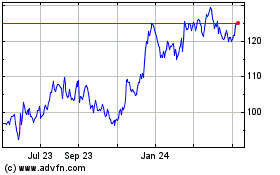

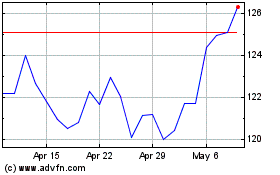

Innospec (NASDAQ:IOSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Innospec (NASDAQ:IOSP)

Historical Stock Chart

From Apr 2023 to Apr 2024